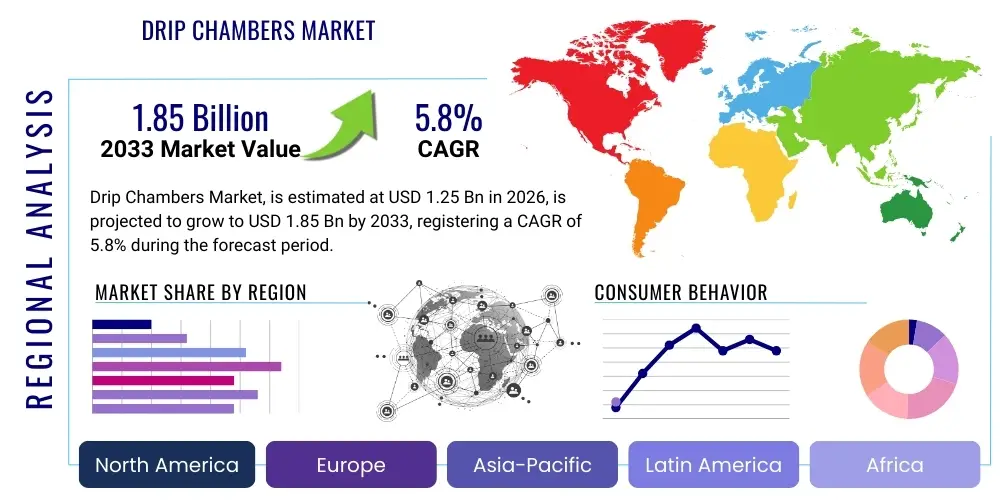

Drip Chambers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435818 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Drip Chambers Market Size

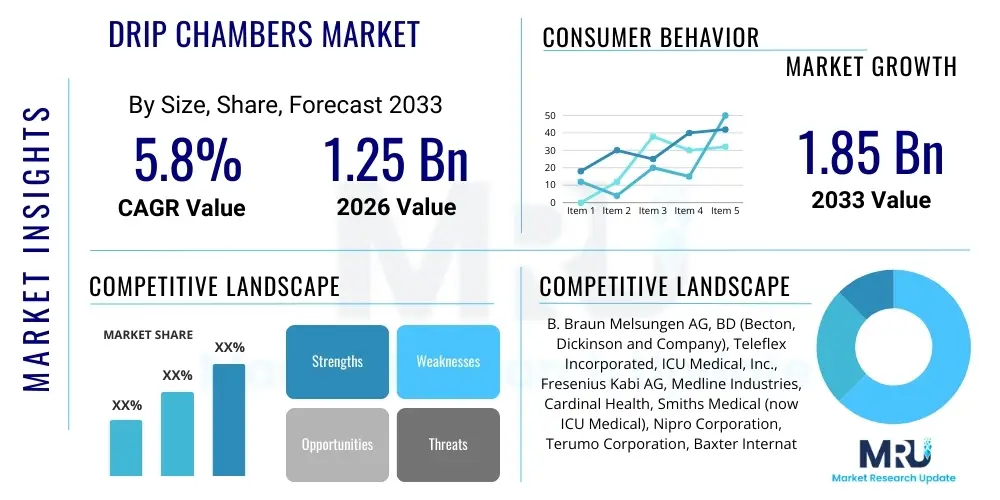

The Drip Chambers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by the rising incidence of chronic diseases globally, which necessitates frequent intravenous fluid administration, alongside continuous improvements in global healthcare infrastructure and accessibility.

Drip Chambers Market introduction

The Drip Chambers Market is defined by the manufacturing, distribution, and sale of essential components used in intravenous (IV) administration sets, blood transfusion kits, and other critical fluid delivery systems. A drip chamber is a crucial part of an IV set designed to allow the medical professional to visually monitor the flow rate of the fluid, prevent air embolisms by trapping air bubbles before they reach the patient, and ensure the precise, controlled delivery of medication or hydration. These devices are typically manufactured from medical-grade polymers such as PVC, polycarbonate, or polypropylene, adhering strictly to stringent international standards for biocompatibility and sterility.

The core product, the drip chamber itself, comes in various forms, including macro-drip (standard) and micro-drip chambers, tailored to different therapeutic requirements and patient populations, especially pediatrics and neonates who require highly precise fluid volumes. Major applications span across critical care, general surgery, oncology, and home healthcare settings. The increasing global burden of non-communicable diseases, coupled with a rapidly aging demographic requiring continuous medical support, significantly fuels the demand for high-quality, reliable fluid administration components like precision drip chambers.

Key benefits derived from advanced drip chamber designs include enhanced patient safety through air filtration and flow stability, improved ease of use for clinical staff via clearly marked volume indicators, and reduced risk of microbial contamination due to closed-system designs. Driving factors include technological advancements leading to more accurate volume calibration, the expansion of ambulatory surgical centers (ASCs) demanding sterile disposable products, and significant investments in developing nations aimed at modernizing hospital infrastructure and increasing access to sterile medical disposables.

Drip Chambers Market Executive Summary

The global Drip Chambers Market is experiencing robust expansion driven primarily by the escalating demand for single-use medical consumables across highly regulated markets such as North America and Europe, coupled with massive healthcare infrastructure development in the Asia Pacific region. Business trends are characterized by a strong focus on manufacturing efficiency, regulatory compliance (especially MDR and FDA standards), and strategic mergers and acquisitions among key players to consolidate supply chains and expand geographical footprints. Furthermore, there is a pronounced shift towards specialized drip chamber designs, including those integrated with advanced filtration mechanisms and needle-free connectors, enhancing both safety and workflow efficiency in clinical environments.

Regionally, North America maintains its dominance due to high per capita healthcare spending, the widespread adoption of advanced infusion technologies, and the presence of major industry innovators setting global quality benchmarks. However, the Asia Pacific market is poised for the highest growth rate, fueled by expanding healthcare access in countries like China and India, rising prevalence of diabetes and cardiovascular diseases requiring continuous infusion therapy, and increasing governmental initiatives promoting sterile medical practices. Europe demonstrates stable growth, mandated by rigorous EU Medical Device Regulation (MDR) standards, driving innovation toward safer, compliant materials and designs.

Segmentation trends highlight the increasing preference for Micro Drip Chambers, particularly within pediatric and neonatology applications, due to their ability to deliver precise, controlled volumes critical for sensitive patient care. The End-User segment sees hospitals remaining the largest consumer, yet the fastest growth is observed in Ambulatory Surgical Centers (ASCs) and home healthcare settings, reflecting the broader trend of shifting patient care away from traditional inpatient environments. Material innovation focuses on reducing reliance on conventional PVC, driven by environmental concerns and regulatory pressures, paving the way for advanced polymer usage offering superior biocompatibility and sustainability.

AI Impact Analysis on Drip Chambers Market

User inquiries regarding AI's influence on the Drip Chambers Market typically revolve around automation in manufacturing quality control, optimization of the sterile supply chain, and whether AI integration will lead to "smart" infusion systems rendering traditional visual monitoring obsolete. Key themes center on achieving zero-defect production through predictive maintenance and computer vision systems during the molding and assembly processes, optimizing inventory management of these high-volume consumables, and leveraging AI algorithms for predictive maintenance of infusion pumps that utilize these chambers. Users expect AI to reduce human error in production and enhance supply chain resilience, rather than directly modifying the passive function of the chamber itself. The concern is mainly focused on how AI will indirectly impact the cost, availability, and quality assurance protocols surrounding these essential disposables.

- Enhanced Manufacturing Quality Control: AI-powered computer vision systems monitor micro-defects in chamber molding and assembly lines, ensuring higher product uniformity and compliance, reducing batch rejection rates.

- Supply Chain Optimization: Machine learning algorithms predict demand fluctuations for various chamber types (macro vs. micro), optimizing inventory levels in hospitals and minimizing stockouts of critical IV components.

- Predictive Maintenance for Pumps: AI analyzes flow rate data collected via infusion pumps, potentially identifying subtle inconsistencies caused by chamber performance variations before system failure occurs.

- Automated Sterilization Tracking: AI systems integrate sterilization records and batch tracing, drastically improving traceability and compliance management for medical disposables, including drip chambers.

- R&D Acceleration: AI simulates fluid dynamics within new chamber designs, accelerating the development of more efficient and accurate drop-forming mechanisms, reducing physical prototyping cycles.

DRO & Impact Forces Of Drip Chambers Market

The Drip Chambers Market is highly influenced by a critical balance of drivers, restraints, and opportunities that collectively shape its growth trajectory, acting as significant impact forces. A primary driver is the global increase in surgical procedures and chronic disease management, which invariably rely on intravenous therapy for drug delivery and hydration. Concurrently, strict regulatory guidelines, particularly those enforced by organizations like the FDA and the European Medicines Agency (EMA), mandate the use of sterile, high-quality disposable administration sets, thereby sustaining continuous demand for certified drip chambers.

However, the market faces significant restraints, notably the intense price pressure due to the highly commoditized nature of standard IV components. Healthcare providers often prioritize cost-efficiency, forcing manufacturers to operate on thin margins, especially in emerging markets where local competition is fierce. Furthermore, the inherent environmental challenges associated with disposable medical plastics, particularly PVC, present a long-term restraint, pushing companies toward costly research and development into sustainable or non-PVC alternatives, which impacts profitability and manufacturing setup costs.

Opportunities for growth are abundant in emerging economies characterized by rapid infrastructure expansion and improving healthcare access. The shift towards specialized products, such as pediatric-specific micro-drip chambers and chambers integrated with advanced bacterial filtration membranes, offers higher margin potential and differentiation avenues. The market’s overall impact force is generally positive, driven by the non-negotiable requirement of safe fluid delivery in medical practice. Regulatory stringency acts as a dual force, restraining low-quality entrants while simultaneously driving innovation among established players committed to superior product safety and precision.

Segmentation Analysis

The Drip Chambers Market is extensively segmented based on Type, Material, Application, and End-User, reflecting the diverse clinical requirements and operational environments where these components are utilized. Understanding these segmentations is critical for market participants to tailor their manufacturing and distribution strategies, ensuring alignment with specific medical needs, such as the precision required in neonatal care versus the high volume demands of operating theaters. The segmentation reveals key trends, including the increasing market share of non-PVC materials driven by environmental and health safety concerns, and the expanding utilization across specialized applications like dialysis and chemotherapy administration.

Segmentation by Type distinguishes between macro-drip and micro-drip chambers, addressing flow rate variability requirements. Macro-drip chambers are standard in adult general infusion therapy for high-volume delivery, while micro-drip chambers (typically 60 drops/mL) are indispensable for critical and precise dosing in sensitive patient populations. Segmentation by End-User emphasizes the hospital setting as the dominant consumer base, yet rapid growth is anticipated from non-traditional settings such as home care and specialty clinics, demanding portable and easier-to-use administration sets.

The strategic importance of material segmentation is growing, with manufacturers investing heavily in alternatives like polypropylene and polycarbonate to replace conventional PVC, which can sometimes leach plasticizers (like DEHP) into fluids. This material shift not only addresses regulatory compliance but also offers enhanced material clarity and structural integrity, crucial for accurate visual monitoring of the drip rate. These detailed segment analyses provide a roadmap for innovation and investment, targeting areas of highest clinical value and regulatory demand within the broader medical disposables sector.

- By Type: Standard Drip Chambers (Macro), Micro Drip Chambers, Precision Drip Chambers.

- By Material: Polyvinyl Chloride (PVC), Polycarbonate (PC), Polypropylene (PP), Others (e.g., medical-grade elastomers).

- By Application: Infusion Therapy (General IV, Chemotherapy, Pain Management), Blood Transfusion, Dialysis, Diagnostic Procedures.

- By End-User: Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Home Healthcare Settings, Others (Blood Banks, Research Labs).

Value Chain Analysis For Drip Chambers Market

The value chain for the Drip Chambers Market begins with the upstream suppliers responsible for raw materials, primarily medical-grade polymers such as PVC, polycarbonate, and polypropylene. This initial stage is heavily dependent on petrochemical industry stability and specialized polymer compounding to meet stringent medical safety standards (USP Class VI certification). Upstream analysis reveals that raw material procurement and quality control are critical bottlenecks, as any variation in polymer consistency directly affects the clarity, biocompatibility, and sterilization capabilities of the final drip chamber product. Key upstream activities also include the production of precision molds necessary for high-volume, automated injection molding processes used in chamber manufacturing.

The midstream involves the core manufacturing process, encompassing injection molding, sterilization (usually ETO or gamma), and the assembly of the chamber into complete administration sets, often done in ISO-certified cleanroom environments. This stage is characterized by high capital expenditure in automation technology to ensure scalable, sterile production. Distribution channels form the critical link to downstream users. Direct distribution is common for large-volume contracts with major hospital groups or governmental health agencies, offering customized logistics and pricing models. Indirect distribution relies heavily on established medical device distributors and wholesalers who manage regional inventories and penetrate smaller clinics and ASCs, optimizing market reach.

Downstream analysis focuses on the end-users: hospitals, clinics, and home care providers. The final consumption stage emphasizes product reliability, ease of connection, and compatibility with various infusion pumps and fluid bags. The choice between direct and indirect channels is often driven by the geographic market size and the complexity of the sale. In highly regulated and consolidated markets like the U.S. and Western Europe, direct sales offer greater control over pricing and customer service for strategic accounts, while indirect sales are essential for navigating fragmented markets in Asia and Latin America, utilizing distributors’ established local networks and regulatory expertise.

Drip Chambers Market Potential Customers

The primary consumers in the Drip Chambers Market are institutions involved in administering intravenous fluids, medications, or blood products across various levels of care intensity. Hospitals, particularly large tertiary care centers and specialized facilities (e.g., oncology, cardiology units), represent the largest segment of end-users, given the volume and complexity of procedures performed, necessitating constant replenishment of IV sets and associated consumables. These customers demand products that comply with strict anti-kinking and high-pressure specifications, essential for continuous patient monitoring and critical care environments.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing customer base, driven by the global trend towards outpatient procedures. ASCs require high volumes of sterile, cost-effective disposable components for short-duration surgeries and diagnostics. Furthermore, the rise of home healthcare settings and infusion clinics, which manage long-term therapies such as chemotherapy or total parenteral nutrition (TPN), represents a crucial, specialized customer segment. These users prioritize ease of use, portability, and safety features suitable for non-clinical environments.

Other vital customers include blood banks and regional transfusion centers, which require specialized chambers compliant with blood product handling protocols. Moreover, medical humanitarian organizations and governmental public health agencies are significant buyers, especially in times of global health crises or vaccination drives, demanding bulk quantities of standardized, reliable IV administration components for mass treatment programs. The buying decision across all segments is a complex interplay between procurement cost, regulatory compliance, brand reliability, and clinical consensus on product efficacy and safety.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | B. Braun Melsungen AG, BD (Becton, Dickinson and Company), Teleflex Incorporated, ICU Medical, Inc., Fresenius Kabi AG, Medline Industries, Cardinal Health, Smiths Medical (now ICU Medical), Nipro Corporation, Terumo Corporation, Baxter International Inc., Qosina Corp., Shanghai Kindly Enterprise Development Group Co., Ltd., Wuxi Nest Biotechnology Co., Ltd., Allied Medical Ltd., Asahi Kasei Corporation, Angiplast Pvt. Ltd., JMS Co., Ltd., Healthium Medtech Limited, Vygon S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drip Chambers Market Key Technology Landscape

The Drip Chambers Market, while focusing on a seemingly simple device, incorporates several key technologies to ensure safety, precision, and mass-scale sterile production. The primary technology revolves around precision injection molding and extrusion processes, enabling the high-tolerance manufacturing of chambers and associated tubing. Manufacturers utilize advanced computer-aided design (CAD) and simulation software to optimize internal chamber geometry, ensuring consistent drop formation (e.g., 10, 15, or 60 drops per milliliter) and minimizing droplet adhesion to the inner walls, which could compromise volume accuracy. Automation is paramount; highly automated assembly lines operating within ISO Class 7 or 8 cleanrooms are standard, reducing human interaction and the risk of contamination, which is a critical technological necessity in disposable medical device production.

Material science is another crucial technological frontier. The industry is constantly exploring and implementing advanced medical-grade polymers, moving away from conventional plasticized PVC to non-PVC materials like specialized polyurethanes, polycarbonate, and polypropylene. This shift requires sophisticated compounding techniques to maintain material clarity, flexibility, and compatibility with a wide range of pharmaceutical compounds without leaching contaminants (like DEHP). Furthermore, surface modification technologies are sometimes employed to ensure hydrophobic properties, minimizing fluid residue and maximizing the accuracy of the delivered dose over time.

A growing technological focus is on integration and sterilization methodologies. Chambers are increasingly being integrated with sophisticated components such as integrated bacterial filters (0.22 micron or 1.2 micron pore size), anti-reflux valves, and needle-free injection ports, transforming the simple chamber into a highly functional component of a complex closed-loop infusion system. Sterilization technology is dominated by Ethylene Oxide (ETO) due to its efficacy and low material degradation, though gamma irradiation is also utilized. Ensuring the validation and control of these sterilization cycles using advanced sensor technology and process mapping is a continuous technological requirement mandated by global health regulators, driving up the technological sophistication of the overall manufacturing platform.

Regional Highlights

Geographically, the Drip Chambers Market demonstrates differential growth rates and consumption patterns heavily influenced by healthcare expenditure, regulatory environments, and the prevalence of chronic diseases across continents. North America, comprising the United States and Canada, currently holds the largest market share, predominantly due to its highly sophisticated healthcare system, high rate of technology adoption, and extensive utilization of single-use disposables. The stringent regulatory framework imposed by the FDA drives continuous innovation in safety features and quality standards, resulting in premium pricing and substantial market value, particularly for specialized and high-precision drip chamber sets used in critical care settings. Key focus areas in this region include managing supply chain resilience and transitioning to non-DEHP materials.

Europe represents a mature market characterized by stable growth, significantly influenced by the European Medical Device Regulation (MDR). The MDR mandates rigorous safety and quality assessment, compelling manufacturers to invest heavily in recertification and documentation, ensuring only the highest quality products reach the market. Western European countries, particularly Germany, the UK, and France, exhibit high consumption driven by aging populations and established universal healthcare systems providing extensive long-term care, leading to sustained demand for IV administration sets. Eastern Europe is gradually increasing its share through ongoing modernization of hospital infrastructure and increasing alignment with EU regulatory standards.

The Asia Pacific (APAC) region is projected to register the fastest growth during the forecast period. This exponential expansion is underpinned by vast populations, rising disposable incomes leading to increased private healthcare investment, and governmental initiatives aimed at improving healthcare accessibility, particularly in populous nations like China and India. The sheer volume of procedures, combined with the gradual adoption of sterile, disposable components to replace reusable systems, creates a massive market opportunity. While price sensitivity remains a factor, the demand for quality drip chambers is escalating due to rising awareness of healthcare-associated infections (HAIs). Latin America and the Middle East & Africa (MEA) are emerging markets, with growth primarily fueled by increased foreign investment in healthcare infrastructure and expanding medical tourism, though political and economic instability sometimes introduces volatility in procurement cycles.

- North America (USA, Canada): Market leader; driven by high spending and stringent FDA regulations; focus on advanced, specialized chambers and non-PVC materials.

- Europe (Germany, UK, France): Stable, high-value market; growth dictated by EU MDR compliance; high demand for standardized, certified products due to aging demographics.

- Asia Pacific (China, India, Japan): Fastest-growing region; rapid infrastructure expansion and increasing patient volume; strong local manufacturing competition focusing on cost-effective, high-volume products.

- Latin America (Brazil, Mexico): Emerging growth market; driven by expanding private healthcare sector and increasing complexity of surgical procedures.

- Middle East & Africa (UAE, South Africa): Moderate growth; substantial investment in medical tourism and modernizing hospital facilities; reliance on imports for high-end specialized products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drip Chambers Market.- B. Braun Melsungen AG

- BD (Becton, Dickinson and Company)

- Baxter International Inc.

- ICU Medical, Inc.

- Teleflex Incorporated

- Fresenius Kabi AG

- Nipro Corporation

- Terumo Corporation

- Cardinal Health

- Medline Industries

- Qosina Corp.

- Shanghai Kindly Enterprise Development Group Co., Ltd.

- Wuxi Nest Biotechnology Co., Ltd.

- JMS Co., Ltd.

- Angiplast Pvt. Ltd.

- Healthium Medtech Limited

- Vygon S.A.

- Argon Medical Devices, Inc.

- Bexen Medical

- Hospira (Acquired by Pfizer/ICU Medical)

Frequently Asked Questions

Analyze common user questions about the Drip Chambers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a micro drip chamber compared to a macro drip chamber?

The primary function difference lies in flow precision. A macro drip chamber (typically 10-20 drops/mL) is used for high-volume, standard infusions in adults. A micro drip chamber (typically 60 drops/mL) provides highly precise, controlled fluid delivery, essential for pediatrics, neonates, and administering potent medications where volume accuracy is critical.

Which materials are being adopted as alternatives to PVC in drip chamber manufacturing?

Manufacturers are increasingly adopting non-PVC materials such as Polycarbonate (PC) and Polypropylene (PP) to mitigate risks associated with plasticizers like DEHP and improve product biocompatibility. This shift is driven by stricter environmental and medical regulations globally.

How is the growth of Ambulatory Surgical Centers (ASCs) impacting the Drip Chambers Market?

The proliferation of ASCs increases the demand for single-use, cost-effective, and standardized disposable infusion sets, including drip chambers. ASCs focus on short-stay procedures, driving high-volume consumption of reliably sterile components outside the traditional hospital inpatient setting.

What are the key regulatory challenges influencing the Drip Chambers market in Europe?

The major regulatory challenge in Europe is compliance with the Medical Device Regulation (MDR). This regulation imposes heightened requirements for clinical evidence, post-market surveillance, and traceability, leading to increased compliance costs and forcing companies to ensure rigorous quality standards for all administration set components.

What technological advancement is most critical for future drip chamber design?

The most critical technological advancement is the integration of advanced anti-air embolism features and highly precise flow rate indicators, often combined with automated manufacturing processes that utilize computer vision for zero-defect quality control. This enhances both patient safety and operational efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager