Drip Irrigation Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433465 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Drip Irrigation Pipe Market Size

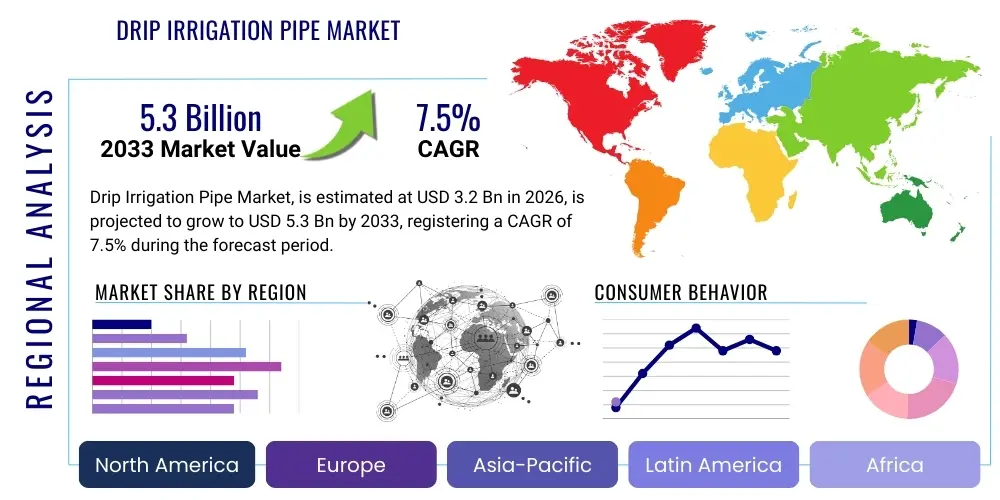

The Drip Irrigation Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.3 Billion by the end of the forecast period in 2033.

Drip Irrigation Pipe Market introduction

The Drip Irrigation Pipe Market encompasses the manufacturing, distribution, and utilization of specialized tubing designed for micro-irrigation systems. These systems deliver water and nutrients directly to the plant root zone, optimizing resource utilization and maximizing crop yield. Drip irrigation, also known as trickle irrigation or micro-irrigation, represents a highly efficient watering method critical for sustainable agriculture, especially in regions facing acute water scarcity or where high-value crops necessitate precise moisture control. Key products within this market include thick-walled tubing, thin-walled tubing (drip tape), emitters (built-in or button), and related accessories, predominantly manufactured using polyethylene (PE) or polyvinyl chloride (PVC) due to their durability and chemical resistance.

The growing global emphasis on efficient water management in agriculture acts as the primary catalyst for market expansion. Traditional flood irrigation methods result in significant water wastage through evaporation and runoff, leading to decreased yields and environmental degradation. Drip irrigation pipes mitigate these issues, offering substantial water savings, sometimes exceeding 50% compared to conventional techniques. Furthermore, the integration of fertigation (fertilizer application through irrigation) enhances nutrient delivery efficiency, reducing costs and minimizing environmental leaching. The inherent benefits of reduced labor input for watering tasks and adaptability across diverse topographic conditions further solidify drip irrigation’s indispensable role in modern farming practices across developing and developed economies alike.

Major applications span diverse agricultural sectors, including row crops (e.g., sugarcane, cotton, corn), permanent crops (e.g., orchards, vineyards), and greenhouse horticulture. Market driving factors include increasing government subsidies supporting water conservation technologies, technological advancements leading to more durable and cost-effective pipe materials, and the necessity to feed a rapidly expanding global population under constraints imposed by climate change and diminishing arable land resources. These systems are crucial not only for large commercial farms but also for smaller, resource-constrained farmers seeking sustainable methods to ensure crop viability and economic resilience.

- Product Description: Specialized tubing (PE, PVC) designed to deliver water and nutrients directly to the root zone via embedded emitters, ensuring high water use efficiency.

- Major Applications: Row crops (vegetables, grains), permanent crops (fruits, nuts, vineyards), commercial greenhouses, and landscape irrigation.

- Benefits: Significant water savings, optimized nutrient delivery (fertigation), reduced energy consumption, minimized weed growth, and maximized crop yield and quality.

- Driving Factors: Increasing global water scarcity, supportive government policies and subsidies for micro-irrigation, and the necessity for increased food production efficiency.

Drip Irrigation Pipe Market Executive Summary

The Drip Irrigation Pipe Market is witnessing robust growth, driven primarily by the transition toward precision agriculture and sustainable water practices worldwide. Business trends indicate a strong focus on material innovation, particularly in creating biodegradable or highly recyclable polyethylene pipes, and the development of pressure-compensating (PC) emitters integrated within the tubing to ensure uniform water distribution across uneven terrains and long lateral runs. Consolidation among smaller regional players by large multinational agricultural technology firms is streamlining distribution channels and enhancing market penetration, especially in high-growth regions like Asia Pacific and Latin America. Strategic partnerships between pipe manufacturers and agricultural software providers are also emerging to offer comprehensive farm management solutions that incorporate real-time irrigation scheduling and monitoring.

Regional trends highlight Asia Pacific as the dominant and fastest-growing region, fueled by large governmental initiatives in countries like India and China aimed at modernizing irrigation infrastructure and combating drought. North America and Europe demonstrate mature markets characterized by high adoption rates of advanced, automated drip systems, focusing less on basic installation and more on system optimization and replacement cycles. The Middle East and Africa (MEA) region shows accelerating potential due to critical water stress and the expansion of high-value protected cultivation (greenhouse farming), necessitating highly efficient irrigation methods to ensure profitability in arid environments. This divergence in regional maturity dictates varying demand for different pipe types, ranging from cheap, disposable drip tape in emerging economies to durable, heavy-gauge tubing in established markets.

Segmentation trends confirm that the Polyethylene (PE) segment, particularly Low-Density Polyethylene (LDPE), maintains the largest market share due to its flexibility, ease of installation, and cost-effectiveness. In terms of application, the agricultural segment significantly outweighs non-agricultural uses (like landscaping), with permanent crops showing disproportionate growth owing to the long-term investment viability of drip systems in orchards and vineyards. The thin-walled tubing (drip tape) segment, favored for seasonal row crops, is experiencing high volume growth, while thick-walled pipes dominate permanent installations. The push towards smart irrigation is driving demand for products compatible with Internet of Things (IoT) sensors and automated controls, embedding data collection capabilities within the physical infrastructure.

AI Impact Analysis on Drip Irrigation Pipe Market

User inquiries regarding Artificial Intelligence (AI) in the drip irrigation sector frequently center on how these advanced algorithms translate into tangible efficiencies for pipe infrastructure management, longevity, and optimal water delivery. Users are deeply interested in AI's role in predictive maintenance—specifically, forecasting pipe failures, clogging events, or pressure inconsistencies before they occur—and minimizing downtime. A primary theme is the integration of AI-driven decision support systems (DSS) that analyze large datasets from soil sensors, weather stations, and drone imagery to determine the precise volume and timing of irrigation cycles, directly influencing the operational efficiency of the pipes themselves. Concerns also revolve around the cost and complexity of implementing AI-compatible infrastructure upgrades, questioning whether existing pipe networks can be retrofitted effectively to leverage these intelligent technologies.

AI's influence is transforming drip irrigation from a passive delivery system into a highly responsive, dynamic network. By utilizing machine learning models, irrigation systems can now analyze complex environmental variables, including evapotranspiration rates, soil moisture profiles at different depths, and specific crop stress levels, to generate hyper-localized irrigation prescriptions. This precision dictates the exact pulse frequency and duration through the drip pipes, dramatically improving Water Use Efficiency (WUE). Furthermore, AI algorithms are vital in managing system health; they can detect minute changes in flow rate caused by partial emitter blockage or micro-leaks within the pipe network, triggering automated alerts or self-cleaning sequences, thereby extending the operational lifespan of the installed piping.

The strategic deployment of AI allows for optimization of resource allocation across vast fields, which is crucial for maximizing return on investment in the pipe infrastructure. By accurately predicting peak water demand periods and adjusting pump operations and pressure regulation across different zones, AI minimizes the strain on the piping system, reducing the likelihood of burst pipes or uneven water distribution that can occur under manual or time-based control. This transformation ensures that the physical infrastructure—the drip pipes—operates under optimal hydraulic conditions defined by real-time data analysis, making the entire irrigation investment more resilient and economically viable for modern large-scale agriculture.

- AI algorithms optimize irrigation scheduling by analyzing sensor data (soil moisture, weather), reducing water wastage.

- Predictive maintenance using AI identifies potential clogging or pipe degradation points, minimizing system failure and maximizing pipe longevity.

- Integration of AI-driven pressure monitoring ensures uniform water output across long drip lines, compensating for topographic variations.

- Automated fault detection based on flow rate anomalies enhances operational efficiency and reduces manual inspection labor.

- Machine learning models guide the selection of optimal pipe diameter and wall thickness during system design based on anticipated operational demands and hydraulic models.

DRO & Impact Forces Of Drip Irrigation Pipe Market

The Drip Irrigation Pipe Market is shaped by a strong combination of environmental and economic pressures. Drivers include the undeniable necessity for water conservation due to global climate change and increasing frequency of drought conditions, pushing governments and farmers toward high-efficiency methods. Simultaneously, the imperative to boost global food production to meet demographic demand ensures continuous investment in agricultural productivity enhancements where drip irrigation is foundational. Restraints predominantly involve the high initial capital expenditure required for system installation compared to traditional methods, especially problematic for smallholder farmers lacking access to financing. Furthermore, the issue of pipe clogging due to poor water quality (sediment, algae) and the laborious process of system cleaning and maintenance pose operational challenges that can deter adoption.

Opportunities in the market center around technological innovation and geographic expansion. The development of advanced, clog-resistant emitters (e.g., labyrinth path designs and turbulent flow technology) and biodegradable drip tapes addresses key restraints and sustainability goals. Geographically, emerging markets in Southeast Asia, Sub-Saharan Africa, and specific arid zones in Latin America present vast untapped potential as commercial farming expands and water management becomes institutionalized. The confluence of smart farming technology, allowing remote monitoring and automated control via IoT integration, further unlocks opportunities for market players to offer premium, value-added pipe solutions that simplify management and optimize performance.

The primary impact forces governing market direction include shifts in global agricultural policy (e.g., subsidies and carbon credit incentives for sustainable practices), volatility in raw material prices (polyethylene and PVC resins), and the competitive pressure to reduce the cost of installation per hectare. Economic forces dictate the material choice, often favoring cost-effective PE over alternatives. Regulatory impact forces, particularly those related to water extraction limits and mandatory irrigation efficiency standards, directly mandate the adoption of micro-irrigation systems. These combined forces compel manufacturers to focus on product durability, cost-efficiency, and seamless integration with digital agricultural platforms to maintain competitive relevance and capture market share in an increasingly sophisticated agricultural technology landscape.

Segmentation Analysis

The Drip Irrigation Pipe Market is extensively segmented based on material, component, application, and crop type, offering a granular view of demand dynamics across various agricultural practices and geographic regions. Material segmentation, particularly between Polyethylene (PE) and Polyvinyl Chloride (PVC), reflects a trade-off between flexibility/cost and durability/pressure handling capabilities. Component segmentation differentiates between integral driplines (emitters built into the pipe) and external drippers, affecting initial cost and suitability for different soil types. This granular market structure allows companies to tailor their manufacturing processes and go-to-market strategies to target specific farming needs, whether focusing on high-volume, seasonal row crops requiring drip tape or long-term, high-pressure permanent crop installations.

Application segmentation distinguishes the demand originating from agricultural versus non-agricultural (e.g., residential, commercial landscape) uses, with agriculture dominating due to the massive scale of water usage. Within agriculture, the crop type is a crucial differentiator. Row crops often utilize thin-walled, disposable or seasonal drip tape, favoring low initial cost and ease of installation and removal. Conversely, permanent crops such as orchards and vineyards require durable, thick-walled tubing capable of withstanding years of exposure and higher operational pressures, reflecting a higher average selling price per unit. The segmentation provides insights into investment cycles, with permanent crops driving stable replacement demand and row crops driving high-volume initial demand.

The analysis of these segments reveals that technological adoption rates vary significantly. The growing demand for precision irrigation has amplified the sub-segment of Pressure Compensating (PC) Drip Lines, regardless of the core material, as farmers seek uniform water distribution, which is crucial for achieving consistent yields. Furthermore, the segmentation by end-user size, separating smallholder farms from large commercial operations, often dictates the choice between low-tech, manually operated systems and fully automated, IoT-enabled networks that utilize premium pipe materials and advanced emission technologies. Understanding these segmented needs is paramount for developing targeted product portfolios and accurate demand forecasting.

- By Material:

- Polyethylene (PE) (LDPE, HDPE)

- Polyvinyl Chloride (PVC)

- Others (e.g., biodegradable polymers)

- By Component:

- Drip Emitters (Online, Inline, Pressure Compensating)

- Drip Tubes/Pipes (Thin-walled/Drip Tape, Thick-walled)

- Fittings and Accessories (Connectors, Filters, Valves)

- By Application:

- Agriculture (Row Crops, Permanent Crops, Greenhouses)

- Non-Agriculture (Landscaping, Residential, Sports Fields)

- By Flow Rate:

- Low Flow (0.5 GPH or less)

- Medium Flow (0.5 to 1.5 GPH)

- High Flow (Above 1.5 GPH)

Value Chain Analysis For Drip Irrigation Pipe Market

The value chain for the Drip Irrigation Pipe Market begins with upstream activities focused on raw material sourcing. This stage is dominated by major petrochemical companies supplying polymer resins, predominantly polyethylene (PE) and, to a lesser extent, polyvinyl chloride (PVC). The price stability and availability of these fossil fuel derivatives significantly influence manufacturing costs and, consequently, the final product pricing. Manufacturers of specialized components, such as emitter molds and filtration technology, also form a critical part of the upstream segment, providing specialized inputs that define the performance characteristics (e.g., flow uniformity, clog resistance) of the final drip pipes. Efficiency in procurement and securing long-term contracts for high-quality resins are key competitive differentiators at this initial phase.

Midstream activities involve the core manufacturing processes, including extrusion of the plastic pipes, insertion or welding of emitters (for inline drip lines), and quality control testing for wall thickness and pressure resistance. Technology and operational scale are crucial here, as manufacturers leverage high-speed extrusion lines to achieve economies of scale necessary for the low-margin, high-volume pipe segment, particularly drip tape production. The product differentiation occurs through proprietary emitter design, aimed at minimizing clogging and ensuring precise pressure compensation. Marketing and branding activities related to system durability and warranty are also established during this stage, linking product quality directly to manufacturer reputation.

Downstream analysis focuses on distribution channels and end-user installation. The distribution is bifurcated into direct sales to large commercial farming conglomerates and indirect sales through a network of specialized agricultural distributors, irrigation dealers, and system integrators. System integrators play a vital role, offering customized planning, design, and installation services that incorporate the pipes and accessories. The market features significant after-sales support requirements, including technical assistance for system maintenance, troubleshooting clogs, and seasonal pipe storage or disposal. The effectiveness of the distribution network, particularly the reach into remote agricultural areas, is paramount for market penetration, determining how efficiently the product moves from the factory floor to the specific crop row.

- Upstream Analysis: Raw material suppliers (Polymer resin manufacturers like LDPE and PVC), specialized component suppliers (Emitter molds, Filtration media).

- Downstream Analysis: Agricultural distributors, specialized irrigation dealers, system integrators, large commercial farm purchasing cooperatives.

- Distribution Channels: Direct sales (large-scale projects, government tenders), Indirect sales (retailers, e-commerce platforms, dealer networks).

- Key Value Adds: System design consultation, pipe customization (length, diameter, emitter spacing), post-installation maintenance training and support.

Drip Irrigation Pipe Market Potential Customers

The primary customers for the Drip Irrigation Pipe Market are deeply embedded within the agricultural sector, spanning various scales and types of operations. Large commercial farms and corporate agricultural holdings represent the most significant buyers, characterized by high-volume purchases of durable, thick-walled pipes and often requiring fully integrated, automated systems. These customers prioritize system efficiency, longevity, and seamless compatibility with large-scale machinery and advanced farm management software. Their purchasing decisions are driven by ROI calculations based on water savings, labor reduction, and guaranteed yield increases, making them highly receptive to premium, technologically advanced drip pipe solutions, especially those with pressure-compensating features.

A second major customer segment includes small and medium-sized farms, particularly those cultivating high-value crops (e.g., vegetables, flowers, specialty fruits) or operating in regions subject to water use restrictions. For this segment, cost-effectiveness and ease of installation are crucial factors. They often prefer thin-walled drip tapes for seasonal crops or subsidized systems provided through government programs aimed at improving farmer resilience. System simplicity and robust support from local dealers are essential to overcome the initial complexity perceived in adopting new irrigation technology. This segment's purchasing power is often leveraged through agricultural cooperatives or government grants, requiring manufacturers to maintain competitive pricing and standardized product offerings.

Beyond agriculture, the non-agricultural sector, encompassing landscape architects, urban planners, and sports facility managers, constitutes a growing customer base. These end-users utilize micro-irrigation for aesthetic landscaping, municipal water conservation mandates, and precise turf management. Their purchasing criteria often prioritize discretion (sub-surface installation), durability against vandalism or heavy use, and compatibility with sophisticated smart controllers for zone-specific watering. Municipal and government agencies are also key buyers, particularly for large-scale infrastructure projects aimed at green belt development or drought mitigation strategies, demanding compliance with strict performance and safety standards for the piping materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.3 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Netafim, Jain Irrigation Systems Ltd., The Toro Company, Lindsay Corporation, Valmont Industries, Hunter Industries, Rain Bird Corporation, Eurodrip S.A., Rivulis Irrigation, drip irrigation, T-L Irrigation Co., Kothari Group, Irritec S.p.A., Plastro Plasson Industries, Antelco, Metzer Group, EPC Industries, Elgo Irrigation Ltd., Chinadrip Irrigation Equipment, KSNM Marketing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drip Irrigation Pipe Market Key Technology Landscape

The technological landscape of the Drip Irrigation Pipe Market is defined by continuous innovation focused on optimizing water delivery, enhancing system resilience, and improving material sustainability. Key advancements center on emitter technology, which dictates the system’s performance. Pressure Compensating (PC) emitters represent a significant technological leap, utilizing internal diaphragms to regulate water pressure and ensure uniform flow rate regardless of elevation changes or line length variations. This technology is critical for large-scale, undulating terrain farms, ensuring equal water distribution that maximizes crop homogeneity and yield predictability. Furthermore, self-flushing and anti-siphon mechanisms are increasingly integrated into emitters to mitigate the perennial problem of particulate and biological clogging, thereby reducing maintenance labor and extending the effective life of the pipe network.

Material science and manufacturing techniques are also critical technological drivers. The shift towards higher-quality polyethylene resins that resist UV degradation and chemical corrosion from fertilizers and pesticides ensures that pipes remain structurally intact for longer periods, reducing replacement frequency. Co-extrusion technology allows manufacturers to produce pipes with different internal and external layers, optimizing for durability, smoothness (to reduce friction loss), and cost. Furthermore, automated, high-speed pipe manufacturing lines equipped with vision systems ensure precise emitter placement and consistent wall thickness, guaranteeing product quality necessary for high-pressure applications and adhering to stringent international standards for micro-irrigation equipment.

The convergence of physical pipe infrastructure with digital technology marks the most transformative technological shift. This includes the development of 'Smart Drip Lines' embedded with RFID tags or sensors that allow for asset tracking and integration with IoT platforms. These sensors, often connected to broader cloud-based farm management systems, monitor soil moisture, pipeline pressure, and flow rates in real-time, enabling AI-driven irrigation prescriptions. This synergy transforms the passive drip pipe into an active, data-generating component of a sophisticated agricultural ecosystem, paving the way for hyper-localized resource application and maximized Water Use Efficiency (WUE) across the entire farming operation.

- Pressure Compensating (PC) Emitters: Advanced diaphragms maintain constant flow rate regardless of pressure fluctuations, crucial for system efficiency over long distances.

- Anti-Clogging Technology: Labyrinth path designs, self-flushing mechanisms, and turbulent flow paths built into emitters to handle poor water quality.

- UV Stabilization and Material Composites: Use of specialized additives in PE and PVC to enhance resistance to UV radiation, environmental stress cracking, and chemical degradation.

- IoT and Sensor Integration: Development of drip lines compatible with wireless sensors for real-time monitoring of soil moisture, temperature, and pipe pressure for smart farming integration.

- Recyclability and Biodegradable Materials: Research into using recyclable content (post-consumer resin) and developing temporary, biodegradable drip tapes for single-season row crops to address environmental concerns.

Regional Highlights

- Asia Pacific (APAC): Dominates the market share and exhibits the highest growth rate, primarily driven by massive government investments in agricultural modernization (e.g., India's Pradhan Mantri Krishi Sinchayee Yojana) and the need to irrigate vast tracts of farmland, particularly for sugarcane, cotton, and horticulture. China and India are the primary consumers, focusing heavily on affordable, high-volume drip tape solutions.

- North America: Characterized by high technological adoption and maturity. The market here focuses on replacement and optimization of existing infrastructure, utilizing advanced, durable, and highly automated PC drip systems primarily for high-value crops (almonds, specialized vegetables) in arid regions like California and the Midwest. Water rights regulations heavily influence adoption rates.

- Europe: A mature market defined by strict environmental regulations and a focus on sustainable water use. Demand is robust in Southern Europe (Spain, Italy, Greece) for orchards and vineyards. Key trends include the integration of AI-driven irrigation controllers and a strong preference for high-quality, long-life, chemically resistant pipes.

- Middle East and Africa (MEA): Projected for substantial growth due to extreme water scarcity and rapid expansion of protected agriculture (greenhouses) and large-scale desert farming projects. The region demands robust, high-performance piping and filtration systems to cope with high temperatures and often saline or brackish water sources.

- Latin America: Experiencing rapid market expansion, particularly in Brazil, Mexico, and Chile, driven by the expansion of commodity crops (soy, corn) and high-value exports (avocados, berries). Government support and the need to increase export quality drive demand for efficient irrigation systems, favoring a mix of durable pipes for permanent crops and tape for large-scale annual cultivation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drip Irrigation Pipe Market.- Netafim

- Jain Irrigation Systems Ltd.

- The Toro Company

- Lindsay Corporation

- Valmont Industries

- Hunter Industries

- Rain Bird Corporation

- Eurodrip S.A.

- Rivulis Irrigation

- drip irrigation

- T-L Irrigation Co.

- Kothari Group

- Irritec S.p.A.

- Plastro Plasson Industries

- Antelco

- Metzer Group

- EPC Industries

- Elgo Irrigation Ltd.

- Chinadrip Irrigation Equipment

- KSNM Marketing

Frequently Asked Questions

Analyze common user questions about the Drip Irrigation Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Drip Irrigation Pipe Market?

The primary growth drivers are increasing global water scarcity, governmental policies and subsidies promoting water-efficient irrigation methods, and the necessity for farmers to maximize crop yield and quality under constrained resource conditions. Technological advancements making systems more durable and clog-resistant also bolster adoption.

What is the difference between thick-walled drip pipe and thin-walled drip tape, and which crops use them?

Thick-walled pipe (0.6mm or more) is durable, lasts several years, and is used for permanent crops like orchards and vineyards. Thin-walled drip tape (under 0.25mm) is cost-effective, typically used for seasonal row crops (e.g., vegetables, cotton) and disposed of or recycled after one or two seasons.

How does Pressure Compensating (PC) technology enhance the efficiency of drip irrigation systems?

PC technology utilizes an internal diaphragm to regulate the water pressure, ensuring a consistent and uniform flow rate from every emitter across the entire pipe length, irrespective of changes in elevation or pressure variations. This guarantees equal water and nutrient delivery to every plant, improving crop consistency.

Which region holds the largest market share for Drip Irrigation Pipes, and what contributes to its dominance?

Asia Pacific (APAC), particularly India and China, holds the largest market share due to the immense scale of agricultural activity, substantial governmental funding for modernizing outdated irrigation infrastructure, and the widespread cultivation of water-intensive crops such as sugarcane and rice.

What are the main restraints hindering the widespread adoption of drip irrigation pipes?

Key restraints include the high initial capital investment required for installing a comprehensive drip system compared to traditional methods, coupled with the persistent challenge of emitter clogging due to poor water quality, which necessitates complex filtration systems and ongoing maintenance efforts.

What are the environmental advantages of switching from flood irrigation to drip irrigation?

Drip irrigation significantly conserves water by delivering it directly to the root zone, minimizing losses through evaporation and surface runoff. It also reduces nutrient leaching into groundwater, controls weed growth by limiting surface water availability, and lowers energy consumption required for pumping less water.

How is the market leveraging smart technology and IoT in conjunction with drip irrigation pipes?

Smart technology integrates IoT sensors to monitor soil moisture, weather, and pipe pressure in real-time. This data feeds into AI-driven platforms that generate precise, hyper-localized irrigation schedules, automating the control valves and optimizing the operational performance and longevity of the physical pipe network.

What role do raw materials like Polyethylene (PE) and PVC play in the market, and which is preferred?

PE is the dominant material due to its flexibility, ease of manufacturing, and cost-effectiveness, making it ideal for both thin-walled tape and durable mainline piping. PVC is used less frequently for flexible pipes but is vital for rigid main lines and manifold systems that require higher pressure resistance and structural integrity.

What is the impact of rising raw material costs on the pricing structure of drip irrigation pipes?

As polyethylene (PE) and PVC resins are petrochemical derivatives, their price fluctuations directly impact manufacturing costs. Rising raw material costs pressure manufacturers to either increase the final product price, potentially hindering adoption by price-sensitive small farmers, or focus on optimizing production efficiency and using recyclable materials to maintain margins.

In the Value Chain, why are system integrators critical for the downstream segment of the market?

System integrators are crucial because they provide technical expertise, design customized irrigation layouts, manage complex hydraulic calculations, and ensure proper installation. They translate farmer needs into functioning systems, mitigating risks associated with improper pipe selection, emitter spacing, and filtration requirements.

What is the current trend regarding the biodegradability of drip irrigation pipes?

There is an emerging trend focusing on developing biodegradable drip tapes, particularly for use in single-season row crops. This addresses environmental concerns related to the disposal of traditional plastic tapes, offering a sustainable alternative that breaks down naturally in the field post-harvest, reducing environmental footprint and labor costs associated with plastic removal.

How does the market cater to the specific needs of permanent crops like vineyards and fruit orchards?

Permanent crops require high-durability, thick-walled PE tubing with integrated Pressure Compensating (PC) emitters to ensure the system lasts for decades and provides consistent, reliable water delivery essential for perennial plant health and sustained fruit quality. Robust UV protection is also mandatory.

What is fertigation, and how is it linked to the functionality of drip irrigation pipes?

Fertigation is the precise application of fertilizers and soil amendments through the irrigation water stream. Drip pipes are essential for this process as they deliver the nutrient solution directly to the root zone with high accuracy, minimizing nutrient runoff, reducing environmental impact, and maximizing nutrient uptake efficiency by the plant.

How do agricultural cooperatives influence the purchasing decisions of drip irrigation equipment?

Agricultural cooperatives consolidate the purchasing power of numerous small and medium-sized farmers. They negotiate bulk purchases of drip pipes and systems at lower prices, often facilitating the adoption of technology that individual farmers might not afford, thereby acting as a critical demand aggregator in emerging markets.

What impact does the need for food security have on the Drip Irrigation Pipe Market?

The global need for enhanced food security, driven by population growth and climate volatility, compels increased agricultural productivity. Drip irrigation is a proven method to consistently achieve higher yields and better quality crops, directly linking market growth to long-term global food security initiatives and investments.

What are the key technical challenges in maintaining long drip irrigation lateral lines?

The main challenges involve maintaining uniform pressure and flow rate across the entire line length, especially on sloped terrain, which is addressed using Pressure Compensating pipes. Other challenges include managing hydraulic friction losses and preventing system blockage dueating to sediment buildup or biological fouling.

How is the adoption of drip irrigation related to the market for greenhouses and protected cultivation?

Protected cultivation, such as greenhouses, demands extremely precise control over nutrient and water delivery to maximize high-value crop yields. Drip irrigation is the standard method used in these environments due to its exceptional efficiency, contributing significantly to the demand for specialized, highly accurate micro-irrigation components.

What measures are manufacturers taking to address the clogging issue in drip emitters?

Manufacturers are innovating through emitter design, incorporating features like large, turbulent flow paths to keep particles suspended, advanced self-flushing mechanisms, and high-quality filtration system compatibility. These measures are designed to ensure continuous, reliable water discharge even with moderately poor water quality.

Why is the durability and UV resistance of the pipe material crucial for the Drip Irrigation Market?

In agricultural settings, pipes are exposed to harsh sunlight, temperature extremes, and corrosive chemicals (fertilizers). High durability and UV resistance ensure the structural integrity of the pipes over multiple seasons, preventing cracking, brittleness, and premature failure, thereby protecting the farmer's long-term investment.

How does the Drip Irrigation Pipe Market contribute to climate change mitigation efforts?

By drastically reducing water consumption and enabling precise fertilizer application, drip irrigation reduces the energy needed for water pumping and minimizes the emissions associated with fertilizer production and runoff (nitrous oxide), contributing positively to overall agricultural sustainability and climate resilience.

What distinguishes Low-Density Polyethylene (LDPE) from High-Density Polyethylene (HDPE) in pipe manufacturing?

LDPE is highly flexible and commonly used for lighter, easier-to-handle secondary distribution lines. HDPE offers superior strength, rigidity, and resistance to higher pressures, making it suitable for mainlines and sub-mainlines in large, permanent irrigation infrastructure requiring robust performance.

What competitive strategies are key players adopting in the Drip Irrigation Pipe market?

Key players are focusing on vertical integration (from resin sourcing to system installation), expanding their proprietary clog-resistant emitter technology portfolios, engaging in strategic regional acquisitions to enter high-growth markets, and forming alliances with technology firms to offer integrated smart irrigation solutions.

How do government subsidies in countries like India affect the demand for drip irrigation pipes?

Government subsidies significantly lower the high initial cost barrier for farmers, rapidly accelerating the mass adoption of micro-irrigation systems. This generates massive volume demand for cost-effective drip tape and standardized pipes, driving market expansion in subsidized regions.

What factors determine the optimal pipe diameter for a specific drip irrigation system?

Optimal pipe diameter is determined by the required flow rate, the total length of the line, and the permissible friction loss. Hydraulic modeling ensures that the selected diameter minimizes pressure drop while remaining cost-effective, guaranteeing uniform water delivery to all plants.

How is the demand for drip pipes affected by the shift towards organic farming practices?

Organic farming, which often requires highly controlled water management and specialized application of non-synthetic fertilizers, benefits greatly from the precision of drip systems. This drives steady demand for highly reliable drip pipes that can handle organic matter content in the water used for fertigation without excessive clogging.

What is the typical lifespan expected for high-quality, thick-walled drip irrigation pipe?

High-quality, thick-walled polyethylene (PE) pipes, properly installed and maintained with adequate filtration, are typically expected to have an operational lifespan ranging from 10 to 20 years or more, especially in permanent crop applications where they are protected from mechanical damage and excessive chemical exposure.

What is the current regulatory environment surrounding water usage and its influence on the market?

Increasingly stringent governmental regulations concerning water extraction limits, mandatory efficiency targets, and the imposition of fines for water waste are compelling farmers globally to adopt drip irrigation systems rapidly, directly translating regulatory compliance into market demand for pipes.

How are manufacturers addressing the issue of microplastic contamination related to drip tape use?

Manufacturers are investigating material alternatives, focusing on developing drip tapes from certified recyclable polymers or creating formulations that are completely biodegradable under specific soil conditions, aiming to minimize the long-term environmental accumulation of fragmented plastic materials in agricultural fields.

What are the key differences between online emitters and inline emitters in drip pipe systems?

Inline emitters are manufactured directly into the pipe during the extrusion process, providing a fixed spacing and highly automated solution (used in drip tape). Online emitters are manually inserted into the pipe post-manufacture, offering flexibility for customized spacing adjustments suitable for irregular planting patterns or varying plant sizes.

How does the expansion of urban and commercial landscaping contribute to the drip irrigation pipe market?

Urban and commercial landscaping, driven by water conservation mandates in cities and the demand for aesthetically maintained green spaces, uses drip irrigation to ensure precise watering of shrubs, trees, and planter beds, thus contributing to the non-agricultural segment of the market, primarily through high-end micro-tubing and drippers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager