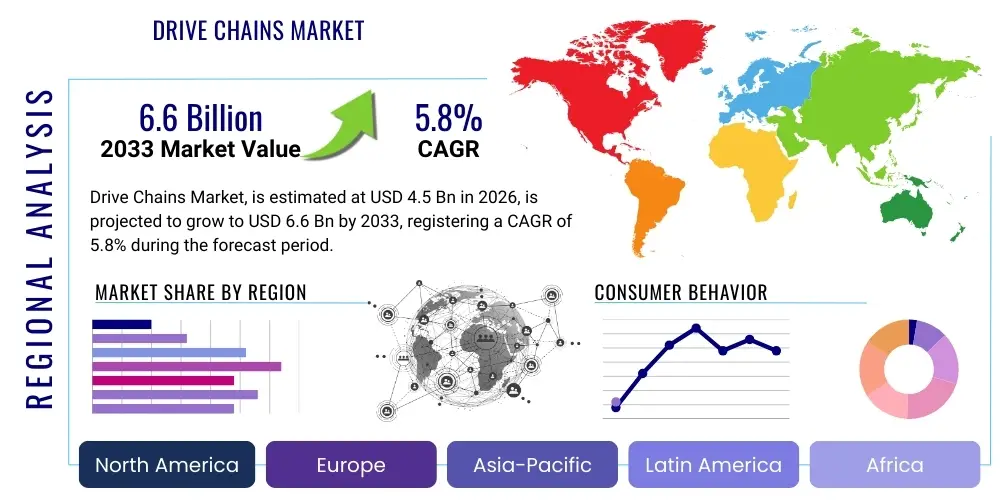

Drive Chains Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438327 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Drive Chains Market Size

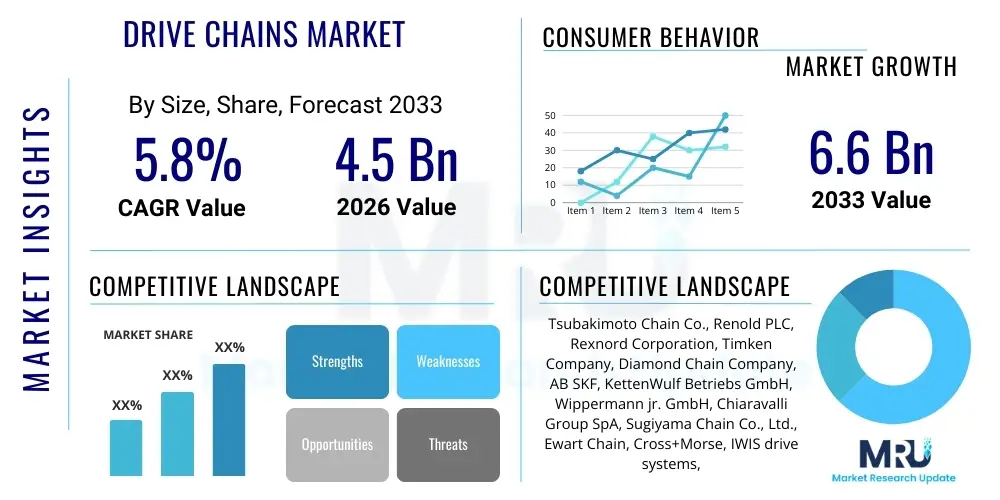

The Drive Chains Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.6 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by increasing global industrialization, rising demand for efficient power transmission solutions in manufacturing and automotive sectors, and significant capital investments in infrastructure projects worldwide. The durability, reliability, and relatively low maintenance costs associated with drive chains, particularly roller chains used across heavy-duty applications, contribute substantially to this sustained market value growth over the forecast horizon.

Drive Chains Market introduction

The Drive Chains Market encompasses the manufacturing, distribution, and utilization of chains primarily designed for mechanical power transmission across various machinery. Drive chains, essential components in mechanical engineering, transfer torque and rotational power from one shaft to another, maintaining a precise speed ratio and synchronization between the driver and driven sprockets. The primary products within this market include roller chains, silent chains, leaf chains, and specialized engineering chains, each tailored to specific operational requirements such as load capacity, speed, and environment (e.g., corrosive, high temperature). These products are critical across a diverse application landscape, ensuring the smooth and reliable operation of complex systems.

Major applications of drive chains span heavy industries, encompassing material handling equipment like forklifts and conveyors, agricultural machinery such as combines and tractors, automotive systems, and a vast array of industrial machinery including printing presses, textile manufacturing equipment, and assembly lines. The intrinsic benefits of using drive chains include superior power transmission efficiency, high tensile strength allowing for heavy load bearing, robustness in demanding environments, ease of installation, and inherent durability leading to long operational lifecycles. Furthermore, their ability to operate effectively over large center distances compared to gears or belts offers design flexibility in large-scale industrial setups.

The market expansion is fundamentally driven by the accelerated pace of global industrial automation, particularly in emerging economies where manufacturing output is rapidly increasing. The continuous necessity for upgrading aging industrial infrastructure in developed regions also fuels demand for replacement and high-performance chains. Additionally, technological advancements focusing on improving chain materials (e.g., corrosion-resistant alloys, self-lubricating designs) and enhancing operational efficiency are key factors propelling market adoption. The relentless push for higher operational uptime and reduced maintenance expenditure across key end-user sectors reinforces the market’s positive trajectory.

Drive Chains Market Executive Summary

The Drive Chains Market demonstrates robust growth, primarily driven by expanding manufacturing bases in Asia Pacific and the increasing focus on advanced material handling systems globally. Current business trends indicate a strong shift toward specialized, high-performance chains capable of enduring harsh operating conditions, high speeds, and corrosive environments, moving away from standard, generalized components. Key manufacturers are prioritizing lightweight designs and enhanced material science—particularly the use of nickel-plated and stainless steel variants—to appeal to industries like food and beverage and pharmaceuticals, which demand stringent hygiene standards and superior corrosion resistance. This innovation focus is leading to premium product offerings and higher average selling prices in certain specialized segments, balancing out the price sensitivity often observed in commodity chain segments.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, India, and Southeast Asian nations, is the dominant and fastest-growing region, characterized by massive investments in automotive production, heavy machinery manufacturing, and logistics infrastructure. Europe and North America maintain significant market shares, largely driven by the replacement and maintenance (MRO) demand within established heavy industries, including mining, forestry, and construction. Furthermore, strict safety and quality regulations in these regions necessitate the adoption of certified, high-quality drive chains, favoring established international vendors. The trend towards electric vehicles (EVs) is also indirectly influencing the market by driving demand for specialized chains in associated component manufacturing machinery.

Segment trends reveal that Roller Chains maintain the largest market share due to their versatility and cost-effectiveness across general industrial applications. However, the Silent Chains segment is witnessing accelerated adoption, especially in applications requiring minimal noise and high speed, such as high-precision printing and certain machine tools. In terms of application, Industrial Machinery remains the primary consumer, though the Agricultural Equipment sector is showing substantial growth due to the global imperative for increasing agricultural productivity through mechanization. Manufacturers are increasingly offering condition monitoring systems integrated with chains, transforming the product from a simple mechanical component into a smart, networked asset, catering to the growing demand for Industry 4.0 compliant solutions.

AI Impact Analysis on Drive Chains Market

User queries regarding the impact of Artificial Intelligence (AI) on the Drive Chains Market predominantly center around three key themes: predictive maintenance effectiveness, optimization of manufacturing processes, and supply chain transparency. Users frequently ask how AI-driven analytics can extend the operational life of a drive chain by accurately predicting failure points and optimizing lubrication schedules, minimizing costly, unplanned downtime. There is also significant interest in how AI and machine learning (ML) are being utilized by chain manufacturers to simulate material performance under various stress loads, leading to the development of lighter yet stronger alloys and optimized chain geometry. Finally, users seek clarity on the role of AI in managing the complex global supply chains for raw materials and finished components, aiming for improved lead times and inventory management across maintenance, repair, and operations (MRO) networks.

AI's influence is transforming the drive chain from a purely mechanical device into a digitally monitored asset. By integrating sensors (IoT devices) into or near the chain system, continuous data on vibration, temperature, and tension is collected. AI algorithms then analyze this massive dataset to identify subtle deviations from normal operational parameters, providing highly accurate predictions of wear and imminent failure long before traditional inspection methods would detect issues. This shift from reactive or time-based maintenance to predictive, condition-based maintenance offers substantial cost savings and drastically improves operational efficiency, setting new performance benchmarks for drive chain reliability in critical applications like mining conveyors or high-speed automation lines. The ability of AI to interpret multivariate sensor data is the central expectation users have regarding its value proposition in this sector.

Furthermore, AI-driven solutions are crucial in enhancing manufacturing precision and quality control. Machine vision systems powered by deep learning are now inspecting every link and component of a drive chain for micro-cracks or dimensional inconsistencies at high production speeds, ensuring near-perfect quality output, thereby reducing warranty claims and improving product lifespan. From a strategic perspective, AI tools are helping manufacturers optimize factory layouts, manage energy consumption during heat treatment processes, and refine scheduling, leading to reduced production costs and increased competitiveness. These optimizations, coupled with AI-enhanced design capabilities (generative design), result in chains that are perfectly engineered for their intended application, accelerating the overall product development lifecycle and enhancing market responsiveness.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by analyzing real-time sensor data (vibration, temperature) to forecast chain failure accurately.

- Manufacturing Optimization: Utilizes machine learning for quality control, defect detection via machine vision, and precise control over heat treatment processes, enhancing chain durability.

- Supply Chain Resilience: AI algorithms optimize logistics, raw material sourcing, and inventory management, ensuring faster component delivery for MRO services.

- Generative Design: AI assists engineers in simulating performance and optimizing chain geometry for maximum strength-to-weight ratio and efficiency.

- Energy Management: Optimizing energy use in forging and manufacturing through AI-based process monitoring and adjustment.

DRO & Impact Forces Of Drive Chains Market

The Drive Chains Market is significantly influenced by a set of dynamic forces encompassing Drivers, Restraints, and Opportunities (DRO). The primary drivers include the global trend toward industrial automation and the continuous expansion of the automotive and material handling sectors, requiring reliable and efficient power transmission. Concurrently, the increasing focus on the replacement market, driven by the need to upgrade existing machinery with higher-efficiency components, provides a constant demand stream. These drivers establish a foundational growth trajectory, particularly in high-growth regions like APAC where new manufacturing capacity is rapidly being established across various industries, demanding large volumes of standard and heavy-duty chains for initial equipment installations.

Restraints acting on the market primarily involve the volatility of raw material prices, specifically high-grade steel and alloys, which directly impacts production costs and profit margins for manufacturers. Furthermore, the rising technological adoption of alternative power transmission solutions, such as high-efficiency belts (synchronous belts) in certain low-load or speed-sensitive applications, presents competitive pressure, particularly where noise reduction is paramount. Regulatory hurdles concerning standardization and environmental compliance in certain regions also pose challenges for manufacturers. The necessity for precise lubrication and maintenance for optimal chain performance often acts as a restraint, as inadequate maintenance practices by end-users can lead to premature failure and increased total cost of ownership, potentially driving users toward maintenance-free alternatives.

Opportunities for growth are concentrated in the development and proliferation of specialized, maintenance-free drive chains, such as sealed O-ring and X-ring chains, and self-lubricating chains tailored for food processing and textile industries, reducing operational overhead for users. The market also benefits substantially from the integration of IoT and smart manufacturing principles, allowing for the development of smart chains with integrated sensors for condition monitoring, unlocking premium service opportunities. The expansion of infrastructure projects (e.g., railways, ports, heavy construction) globally offers a substantial long-term opportunity, demanding highly specialized and durable engineering class chains capable of handling extreme loads and environmental stress. These factors, combined with the increasing adoption of electric material handling equipment, position the market for continuous technological advancement and expansion.

Segmentation Analysis

The Drive Chains Market is comprehensively segmented based on Type, Material, Application, and End-User, reflecting the diverse operational requirements across different industries. Segmentation by Type is crucial as it dictates the chain’s performance characteristics, such as speed capability, load capacity, and noise level. Material segmentation addresses environmental factors like corrosion resistance and temperature limits, essential for longevity in harsh settings. Application and End-User segmentations define the volume demand and specific technical specifications required, ranging from precision timing in textile machinery to heavy-duty torque transfer in mining conveyors. This multi-dimensional segmentation allows manufacturers to tailor product development and marketing strategies precisely to target industry needs, optimizing supply chain efficiency and product relevance across the global market landscape.

The analysis of these segments highlights the dominance of standard roller chains due to their ubiquitous use, but also points to the rapidly growing market share of specialized engineering chains designed for heavy industrial applications like oil and gas drilling and construction. Geographically, demand patterns show distinct preferences: regions with high automotive output prioritize high-end transmission chains, while rapidly industrializing regions demand general-purpose, cost-effective industrial chains in high volume. The increasing complexity of automated systems mandates chains with tighter tolerances and advanced material compositions, driving growth in the premium segments. Furthermore, the push towards sustainability influences material choice, increasing the demand for highly durable, long-life chains that minimize waste and replacement cycles.

- By Type:

- Roller Chains (Standard, Heavy-duty, Double Pitch)

- Silent Chains

- Leaf Chains

- Specialty/Engineering Chains (Conveyor Chains, Draw Bench Chains, Welded Steel Chains)

- By Material:

- Carbon Steel

- Stainless Steel (For corrosive environments)

- Nickel Plated and Coated Chains

- Special Alloy Steel

- By Application:

- Industrial Machinery (Manufacturing, Printing, Textile)

- Automotive and Two-Wheeler (Motorcycle primary and secondary drive)

- Material Handling Equipment (Conveyors, Forklifts)

- Agricultural Equipment (Tractors, Harvesters)

- Construction and Mining Equipment

- By End-User:

- Manufacturing Sector (OEMs and MRO)

- Mining and Quarrying

- Construction Industry

- Food Processing and Packaging

- Agriculture and Forestry

- Energy and Power Generation

Value Chain Analysis For Drive Chains Market

The value chain for the Drive Chains Market begins with upstream activities focused heavily on raw material sourcing, predominantly high-tensile steel and specialized alloys critical for link plates, pins, bushings, and rollers. Sourcing is a vital stage, as the quality and grade of steel directly determine the finished chain’s tensile strength, wear resistance, and longevity. Key upstream activities involve forging, stamping, and complex heat treatment processes necessary to achieve the requisite hardness and durability of components. Manufacturers often maintain long-term relationships with specialized steel suppliers to ensure material consistency and manage volatile commodity pricing, which constitutes a significant portion of the total manufacturing cost.

Midstream activities involve the highly precise manufacturing and assembly of the chains, including automated cutting, punching, heat treating, assembly, pre-loading, and quality inspection. Modern manufacturing facilities utilize advanced techniques like precision CNC machining and robotic assembly to maintain tight tolerances, particularly critical for silent chains and high-speed roller chains. Efficiency in this stage, including optimizing material utilization and energy consumption during heat treatment, directly translates into competitive pricing and product superiority. Research and Development (R&D) activities focused on new material coatings (e.g., anti-corrosion) and lubrication technologies (e.g., self-lubricating sintered bushes) are integrated at this stage to differentiate products.

Downstream activities center on distribution, sales, and post-sales support. Distribution channels are bifurcated into Direct Sales to Original Equipment Manufacturers (OEMs)—who integrate the chains into new machinery—and Indirect Sales through a vast network of distributors and MRO (Maintenance, Repair, and Operations) suppliers. The MRO market is critical, representing the recurring revenue stream for replacement chains. Direct channels involve close technical collaboration between the chain manufacturer and the OEM design team, while indirect channels require effective inventory management and logistics to ensure rapid availability of standard and specialized replacement parts globally. Post-sales services, including technical consultation, installation support, and advanced condition monitoring, are increasingly becoming crucial competitive differentiators, maximizing customer uptime.

Drive Chains Market Potential Customers

Potential customers for the Drive Chains Market are highly diversified, extending across almost every sector that utilizes mechanical power transfer or automated movement. The primary customer base consists of Original Equipment Manufacturers (OEMs) who integrate drive chains into their end products, such as manufacturers of construction equipment (excavators, cranes), agricultural machinery (combines, planters), and industrial equipment (printing presses, textile looms, packaging lines). These customers prioritize reliability, specific load ratings, and compatibility with their machine designs, often leading to custom chain specifications and long-term supply agreements.

A second major customer segment is the Maintenance, Repair, and Operations (MRO) market, comprising end-users like plant managers, mining operators, and production facilities responsible for keeping existing machinery running efficiently. These buyers require a rapid supply of replacement chains for ongoing maintenance, focusing heavily on availability, cost-effectiveness, and ease of replacement. Industries such as cement manufacturing, steel mills, and paper production, characterized by continuous operation and harsh conditions, represent critical MRO customers demanding heavy-duty and corrosion-resistant chains.

Specific end-user/buyer groups include automotive assembly plants utilizing chains in their conveyors and automated vehicle production lines; food and beverage processors requiring stainless steel and hygienically compliant chains for washing and packaging lines; and logistics companies relying on complex conveyor systems in distribution centers. The common need across all these groups is reliable power transmission under defined operating constraints, making durability and technical specifications the primary purchasing criteria. The shift towards automation means that buyers are increasingly interested in "smart" drive chains capable of interfacing with centralized monitoring systems to minimize costly operational interruptions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tsubakimoto Chain Co., Renold PLC, Rexnord Corporation, Timken Company, Diamond Chain Company, AB SKF, KettenWulf Betriebs GmbH, Wippermann jr. GmbH, Chiaravalli Group SpA, Sugiyama Chain Co., Ltd., Ewart Chain, Cross+Morse, IWIS drive systems, 480i Chain, Hitachi Metals, Ltd., Regina Chain, Donghua Chain Group, FB Chain, HKK Chain Corporation, REX Engineering + Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drive Chains Market Key Technology Landscape

The technological landscape of the Drive Chains Market is evolving, driven primarily by material science innovation, enhanced manufacturing precision, and the integration of digital monitoring capabilities. A significant technological focus is placed on developing superior materials, moving beyond standard carbon steel to utilize specialized alloy steels and stainless steel variants that offer improved resistance to fatigue, corrosion, and extreme temperatures. Advanced heat treatment processes, such as specialized induction hardening and carburizing techniques, are continuously refined to optimize the core strength and surface hardness of pins and bushings, which are critical areas for chain wear, thereby drastically extending the overall service life of the product in demanding industrial settings.

Another pivotal area of technological advancement is in lubrication technology and maintenance reduction. Self-lubricating chains, which incorporate sintered metal bushings impregnated with lubricant, are gaining substantial traction, especially in applications where external lubrication is hazardous, impractical, or undesirable (e.g., food processing, clean room environments, or inaccessible machinery). Furthermore, the design of chain components is increasingly optimized using Finite Element Analysis (FEA) software to model stress distribution and reduce weight while maintaining high tensile strength. This focus on design optimization, particularly for silent chains and high-speed roller chains, ensures maximum power transmission efficiency and minimizes noise output, catering to modern workplace standards.

The rise of Industry 4.0 has ushered in the era of smart drive chains. Manufacturers are integrating micro-sensors (e.g., strain gauges, accelerometers) and RFID tags into chain systems to enable real-time condition monitoring. These sensors capture vital operational data—such as chain tension fluctuations, vibration anomalies indicative of misalignment, and thermal profiles—which are then transmitted wirelessly to centralized monitoring platforms. This technology, often bundled with AI-driven analytics, allows for highly accurate predictive maintenance schedules, drastically reducing operational risks and maintenance costs for end-users. The ability to track and predict wear remotely is shifting market focus towards total cost of ownership rather than initial purchase price, benefiting manufacturers offering technologically advanced solutions.

Regional Highlights

Regional dynamics within the Drive Chains Market reflect varying degrees of industrial maturity, regulatory frameworks, and sector-specific demand patterns. Asia Pacific (APAC) stands out as the undisputed leader in both consumption volume and growth rate. This dominance is attributed to the region's massive manufacturing base, particularly in China and India, strong growth in automotive production, and continuous infrastructure development requiring heavy-duty chains for construction and port logistics. Furthermore, government initiatives promoting industrial automation and mechanization in agriculture across Southeast Asia fuel high demand for both standard industrial and specialized chains, positioning APAC as the central hub for market expansion.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on quality, standardization, and replacement demand. Europe, in particular, adheres to stringent operational and safety standards, driving demand for premium, high-precision, and technologically advanced chains, including specialized corrosion-resistant variants for the food and beverage and chemical industries. The North American market is heavily influenced by the robust mining, oil and gas, and construction sectors, demanding large, heavy-duty engineering class chains. While volume growth is slower than in APAC, the value generated per unit is generally higher in these regions due due to the preference for established, reputable brands offering comprehensive technical support and long-term reliability guarantees.

Latin America, and the Middle East and Africa (MEA), are emerging markets that show promising growth, largely spurred by localized infrastructure investments and the expansion of key sectors like mining, agriculture, and oil production. In MEA, the diversification of economies away from pure reliance on oil extraction is leading to investments in manufacturing and logistics hubs, subsequently increasing the demand for reliable power transmission components. However, these regions often face challenges related to logistics, distribution infrastructure, and price sensitivity, leading to a higher penetration of basic, cost-effective standard chains compared to the highly specialized products favored in developed economies.

- North America: Strong MRO market driven by mining, construction, and oil & gas; focus on high-durability, heavy-duty chains.

- Europe: High demand for premium, corrosion-resistant chains; market driven by stringent regulatory standards and advanced manufacturing (e.g., automotive assembly, specialized machinery).

- Asia Pacific (APAC): Largest and fastest-growing region; volume driven by automotive, general industrial machinery, and infrastructure projects in China and India.

- Latin America: Growing demand tied to agricultural mechanization and regional infrastructure development projects.

- Middle East and Africa (MEA): Increased adoption spurred by investments in oil production infrastructure and economic diversification efforts into manufacturing and logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drive Chains Market.- Tsubakimoto Chain Co. (Global leader focusing on premium and specialized chains, including smart monitoring systems)

- Renold PLC (Known for high-performance transmission and conveyor chains across harsh environments)

- Rexnord Corporation (Specializes in industrial bearings, couplings, and highly durable roller chains)

- Timken Company (Focuses on extending chain life through advanced materials and lubrication technology)

- Diamond Chain Company (A major North American producer specializing in ANSI standard roller chains)

- AB SKF (Offers integrated chain and lubrication management solutions, leveraging bearing expertise)

- KettenWulf Betriebs GmbH (European specialist in engineering and conveyor chains for heavy industries)

- Wippermann jr. GmbH (Manufacturer of high-quality industrial and precision chains)

- Chiaravalli Group SpA (Italian manufacturer providing a wide range of power transmission components)

- Sugiyama Chain Co., Ltd. (Japanese manufacturer known for quality industrial and motorcycle chains)

- Ewart Chain (Leading provider of specialized engineering chains for conveying and lifting applications)

- Cross+Morse (UK-based company offering customized chains and power transmission solutions)

- IWIS drive systems (German firm focusing on precision and timing chain solutions, especially automotive)

- 480i Chain (Manufacturer emphasizing innovation in corrosion resistance and self-lubricating designs)

- Hitachi Metals, Ltd. (Provides high-performance metal components used in chain manufacturing)

- Regina Chain (Italian manufacturer known globally for motorcycle and industrial chains)

- Donghua Chain Group (Major Chinese manufacturer providing high-volume, cost-effective chains globally)

- FB Chain (Specialist in leaf chains and customized industrial chain solutions)

- HKK Chain Corporation (Japanese quality chain manufacturer catering to various industrial needs)

- REX Engineering + Manufacturing (Focuses on heavy-duty and customized industrial chain applications)

Frequently Asked Questions

Analyze common user questions about the Drive Chains market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Drive Chains Market?

The increasing global reliance on industrial automation, particularly in manufacturing and logistics sectors in Asia Pacific, coupled with the persistent demand for efficient power transmission in heavy machinery and agricultural equipment, constitutes the main growth driver.

How is technological advancement influencing the selection of drive chains?

Technology is shifting focus toward specialized solutions like self-lubricating chains and stainless steel variants for hygienic environments, alongside the integration of IoT sensors for real-time condition monitoring, enhancing chain reliability and reducing maintenance costs.

Which drive chain type holds the largest market share globally?

Standard Roller Chains (including simplex, duplex, and triplex variants) currently hold the largest market share due to their high versatility, proven reliability, cost-effectiveness, and broad application across general industrial, automotive, and agricultural sectors.

What are the key challenges faced by drive chain manufacturers?

Manufacturers primarily face challenges related to the volatility of raw material prices (high-grade steel alloys), intense competition from alternative power transmission methods like synchronous belts, and the need to meet increasingly stringent quality and performance standards for niche applications.

How does AI impact the lifespan and maintenance of drive chains?

AI significantly impacts chain maintenance by enabling predictive failure detection through the analysis of sensor data (vibration, temperature), allowing for condition-based maintenance strategies that maximize operational uptime and extend the physical lifespan of the drive chain components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Drive Chains Market Size Report By Type (Single Row Drive Chains, Double Rows Drive Chains, Others Drive Chain), By Application (Industry, Motorcycle, Agriculture, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Drive Chains Market Statistics 2025 Analysis By Application (Industrials, Motorcycle, Agriculture), By Type (Single Row Drive Chains, Double Rows Drive Chains), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager