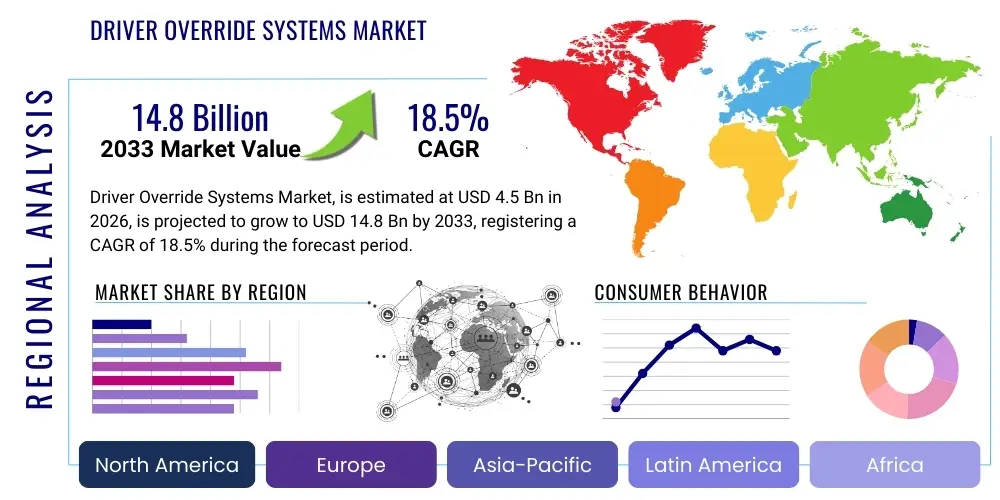

Driver Override Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434768 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Driver Override Systems Market Size

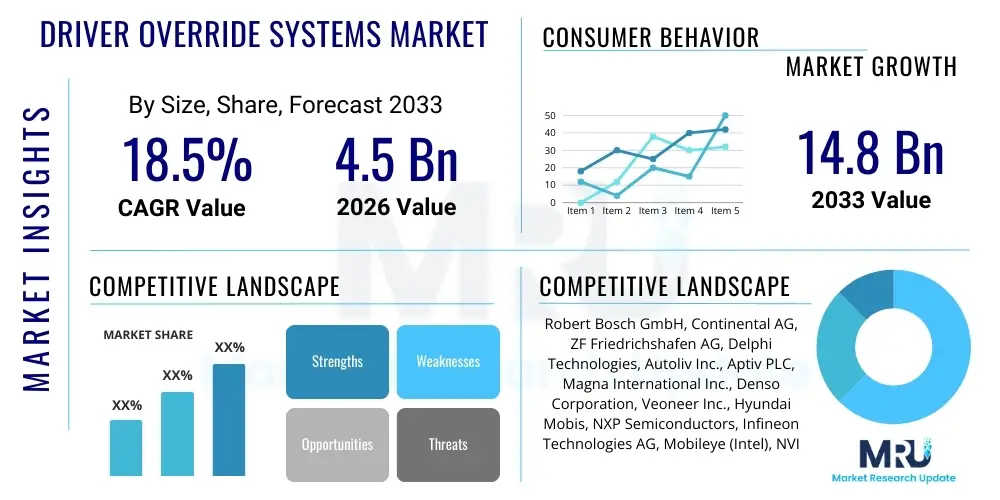

The Driver Override Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $14.8 Billion by the end of the forecast period in 2033.

Driver Override Systems Market introduction

Driver Override Systems (DOS) represent a critical layer of safety technology integrated within advanced vehicle architectures, particularly those featuring high levels of driving automation. These systems are designed to detect discrepancies between intended vehicle operation (either by the human driver or the automated system) and actual vehicle dynamics, allowing the vehicle's control logic to intervene proactively to mitigate hazardous situations. DOS mechanisms typically utilize sophisticated sensor fusion and decision-making algorithms to assess scenarios where immediate human intervention is deemed ineffective or impossible, such as sudden medical incapacitation of the driver, system malfunctions, or critical decision errors. The core functionality revolves around providing a graceful degradation of control or initiating safe stops, prioritizing passenger and surrounding traffic safety above maintaining the current trajectory.

The product scope of the Driver Override Systems market encompasses a variety of components, including highly redundant computing platforms, specialized sensor arrays (LiDAR, radar, high-resolution cameras), high-reliability actuators for steering and braking, and fail-operational software architecture. Major applications are predominantly found in Level 3 (Conditional Automation) and Level 4 (High Automation) vehicles, where the transition of control responsibility between the human and the machine is frequent and requires rigorous safety protocols. Furthermore, DOS is becoming essential in commercial trucking and fleet operations utilizing platooning or specialized delivery autonomy, ensuring the continuous safe operation of these heavy vehicles even in the face of subsystem failures or external disturbances. The system’s ability to execute a Minimum Risk Maneuver (MRM) is its defining operational benefit.

The market growth is primarily driven by escalating global mandates for vehicle safety, specifically the integration of advanced driver assistance systems (ADAS) and autonomous vehicle (AV) technologies. Regulatory bodies across North America, Europe, and Asia Pacific are enforcing stricter standards regarding the safety performance and redundancy required for automated driving functionalities. Additionally, increasing consumer acceptance and willingness to pay for premium safety features, coupled with massive investments by Original Equipment Manufacturers (OEMs) and Tier 1 suppliers in developing fail-safe and fail-operational system architectures, are propelling the adoption of complex DOS solutions. The fundamental technological shift towards software-defined vehicles (SDVs) also facilitates the easier integration and over-the-air updating of these critical override functionalities, enhancing their long-term viability and performance evolution.

Driver Override Systems Market Executive Summary

The Driver Override Systems market is characterized by rapid technological convergence, driven predominantly by the accelerated deployment of Level 3 and Level 4 automation features in luxury and mainstream vehicle segments. Business trends indicate a strong focus on strategic partnerships and collaborative ventures between traditional automotive suppliers (Tier 1) and specialized technology firms focusing on AI, real-time operating systems, and functional safety (ISO 26262 compliance up to ASIL D). Consolidation is evident as OEMs seek integrated hardware and software solutions that promise high computational redundancy and low latency for critical override decisions. Furthermore, the shift towards domain controllers and centralized E/E architectures is defining the competitive landscape, rewarding companies capable of providing comprehensive, modular DOS platforms that seamlessly integrate braking, steering, and powertrain controls, reducing complexity for the end-user manufacturer.

Regionally, North America and Europe currently dominate the market due to stringent safety regulations, a high penetration rate of premium vehicles equipped with advanced ADAS features, and significant governmental investment in testing and deploying autonomous vehicle infrastructure. However, the Asia Pacific region, particularly China and South Korea, is anticipated to exhibit the fastest growth over the forecast period. This rapid expansion is fueled by large-scale pilot projects for autonomous mobility services (Robotaxis), supportive regulatory sandboxes facilitating rapid deployment, and the ambition of local OEMs to become global leaders in electric and automated vehicle production. Infrastructure development, including 5G connectivity necessary for vehicle-to-everything (V2X) communication that supports informed override decisions, is also a key growth differentiator across these geographies.

Segmentation trends highlight the increasing importance of software and algorithm segments within the market structure. While hardware components like high-reliability sensors and redundant actuators remain foundational, the value generation is increasingly shifting towards proprietary algorithms that govern the decision-making process for intervention and the execution of Minimum Risk Maneuvers. Specifically, the segment covering Level 4 and Level 5 autonomy, though nascent, is expected to see exponential growth as commercial fleets and specialized autonomous transport services move past testing phases and enter full operational deployment. Passenger vehicles remain the largest application segment, primarily driving demand for features related to driver incapacitation detection and emergency lane-keeping/braking override functions. These trends underscore the market's evolution from simple failsafe mechanisms to complex, predictive safety intelligence platforms.

AI Impact Analysis on Driver Override Systems Market

Users frequently inquire about how Artificial Intelligence enhances the safety and reliability of Driver Override Systems, specifically asking whether AI can truly anticipate failures better than predefined logic, and what role machine learning plays in handling unforeseen edge cases that necessitate an override. Key concerns revolve around the transparency and explainability (XAI) of AI-driven intervention decisions—users want assurance that the system will not initiate an unnecessary or incorrect override. There is also significant interest in the use of neural networks for real-time driver state monitoring (detecting subtle signs of fatigue or incapacitation) and for predictive modeling of catastrophic system failures. The consensus expectation is that AI will transform DOS from reactive systems into proactive safety co-pilots, maximizing the window for a safe intervention.

AI's fundamental impact on the Driver Override Systems market lies in its ability to process vast, heterogeneous sensor data streams (from radar, camera, LiDAR, and internal diagnostics) simultaneously and extract patterns indicative of impending failure or high-risk scenarios with unparalleled speed. Traditional override systems relied on hard-coded thresholds and logic gates, limiting their responsiveness to novel or complex situations. AI, particularly deep learning models trained on extensive datasets covering millions of miles of driving and failure scenarios, allows the DOS to continuously learn and adapt its decision criteria, optimizing the timing and severity of the intervention. This capability is vital for managing the complex interplay between human control inputs and automated system outputs in Level 3 driving.

Furthermore, AI is crucial for enhancing the effectiveness of the Minimum Risk Maneuver (MRM). Instead of simply initiating a hard stop, AI algorithms can dynamically calculate the optimal safe path based on real-time environmental factors, traffic density, road conditions, and vehicle health metrics. AI facilitates predictive maintenance by continuously analyzing the performance characteristics of critical components (actuators, sensors) and alerting the system to potential degradation before it leads to a failure requiring a full system override. This predictive capability significantly boosts the overall resilience and operational availability of autonomous and semi-autonomous vehicles, validating the premium placed on AI-enabled safety architectures in the market.

- AI-powered sensor fusion enhances situational awareness crucial for accurate override decision timing.

- Machine learning algorithms predict driver incapacitation (fatigue, distraction) with higher accuracy than legacy systems.

- Deep reinforcement learning optimizes Minimum Risk Maneuvers (MRM) based on dynamic environmental variables.

- Neural networks enable real-time detection and classification of novel edge cases necessitating intervention.

- Explainable AI (XAI) tools are increasingly implemented to ensure transparency and regulatory compliance of override decisions.

- AI integrates vehicle health monitoring to anticipate and preemptively mitigate system failures requiring critical override.

DRO & Impact Forces Of Driver Override Systems Market

The Driver Override Systems market is highly influenced by a delicate balance of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its trajectory. The primary drivers are regulatory mandates worldwide, demanding higher Automotive Safety Integrity Levels (ASIL D) for critical vehicle functions and the accelerating trend of vehicle electrification, which necessitates robust software controls. Opportunities lie strongly in the development of specialized DOS solutions for commercial autonomous logistics and the integration of V2X technologies to enhance environmental perception, making override decisions more globally informed. However, the market faces significant restraints related to the complexity of achieving absolute software reliability, high development and validation costs, and prevailing public mistrust concerning complete machine control during critical safety events, forcing manufacturers to invest heavily in robust verification processes.

The impact forces are substantial, particularly driven by technological evolution and standardization efforts. The force exerted by technological advancements is positive, continuously driving innovation in sensor technology, computational redundancy (triple modular redundancy architectures), and secure over-the-air (OTA) update mechanisms essential for maintaining system integrity over the vehicle lifecycle. Conversely, the high structural complexity involved in integrating DOS with existing vehicle electronic architectures exerts a negative restraining force. Achieving seamless handoffs between human, automated, and override modes requires perfect synchronization across multiple domain controllers, posing significant engineering challenges that limit the speed of widespread commercialization, especially in lower-cost vehicle segments.

The critical factor determining the market trajectory is the regulatory environment's speed in adapting to Level 4 autonomy. If safety standards accelerate, mandating specific redundancy levels for all new automated vehicles, the market will experience a substantial surge in demand for sophisticated DOS. Conversely, slow or fragmented regulatory adoption across major economies introduces uncertainty, acting as a decelerating restraint. The competitive intensity within the industry, driven by major Tier 1 suppliers striving for monopolistic positions in proprietary safety platforms, also influences pricing and innovation speed. Overall, the powerful driving forces of safety mandates and technological necessity currently outweigh the restraints of cost and complexity, pushing the market towards significant exponential growth.

Segmentation Analysis

The Driver Override Systems market segmentation provides a comprehensive breakdown of the industry based on key parameters such as the underlying technology utilized, the specific components involved, the end-use application, and the level of autonomy supported. This granular analysis is crucial for understanding specific growth pockets and tailoring product development strategies. The market is fundamentally segmented into hardware and software, reflecting the increasing importance of intelligent algorithms over physical components in determining system performance. Application-wise, the distinction between passenger vehicles (focusing on driver monitoring and emergency braking) and commercial/autonomous fleets (focusing on high-availability and operational uptime) defines differing requirement sets for redundancy and resilience.

The components segment is vital, encompassing the highly specialized sensors (LiDAR and radar required for environmental assessment), actuators (fail-operational brake and steering systems), and the central electronic control units (ECUs) responsible for executing the override logic. Growth is particularly high in the ECU and software segments, driven by the shift towards centralized, high-performance computing platforms that consolidate various ADAS functionalities, including DOS. The Levels of Autonomy segmentation, particularly focusing on L3 and L4, highlights where the most intensive engineering and investment efforts are concentrated, given that these levels mandate complex decision-making capabilities regarding human-machine interaction and safe fallback procedures, making DOS non-negotiable safety features.

Understanding these segments allows stakeholders to pinpoint areas of highest investment return. For instance, companies specializing in functional safety software and middleware are strongly positioned to capitalize on the increasing regulatory scrutiny and the need for standardized safety validation across all vehicle platforms. The focus on commercial vehicle application is driven by the clear economic benefits associated with reducing accidents and minimizing downtime in large logistic fleets, providing a high-volume, high-value segment for sophisticated, ruggedized override systems designed for continuous operation and severe environmental conditions.

- Technology Type:

- Hardware (Sensors, Actuators, ECUs)

- Software (Control Algorithms, Operating Systems, Diagnostic Software)

- Component:

- Sensors (Radar, LiDAR, Camera, Ultrasonic)

- Actuators (Braking Systems, Steering Systems)

- Control Units/Processors (Domain Controllers, Microcontrollers)

- Application:

- Passenger Vehicles (Sedans, SUVs)

- Commercial Vehicles (Trucks, Buses)

- Autonomous Mobility Services (Robotaxis, Shuttles)

- Level of Autonomy:

- Level 2 (Partial Automation – Enhanced Redundancy)

- Level 3 (Conditional Automation – Mandatory Fail-Operational DOS)

- Level 4 (High Automation – System Override/MRM Required)

- Level 5 (Full Automation – Full System Redundancy)

Value Chain Analysis For Driver Override Systems Market

The value chain of the Driver Override Systems market begins with Upstream Analysis, which focuses on the raw material and foundational technology providers. This includes specialized semiconductor manufacturers supplying high-performance, functionally safe chips (ASIL D certified microprocessors and accelerators), sensor component manufacturers (optics, emitters, receivers for LiDAR/radar), and providers of highly reliable mechanical parts for redundant steering and braking actuators. Key activities at this stage involve rigorous sourcing, quality control, and adherence to strict functional safety standards (ISO 26262). The quality and reliability of these upstream components directly dictate the safety integrity level achievable by the final DOS product, leading to strong long-term relationships and high barriers to entry for new suppliers in this segment.

Moving downstream, the value chain encompasses Tier 1 suppliers, who are the primary integrators, taking components and combining them with proprietary software and control algorithms to create a complete Driver Override System module. These integrators perform extensive system integration, validation, and testing, often collaborating closely with specialist software firms for AI and real-time operating systems. The distribution channel is predominantly business-to-business (B2B), centered on direct sales to Original Equipment Manufacturers (OEMs). Direct distribution is favored due to the highly customized nature of these safety-critical systems, which must be tailored and calibrated specifically for each vehicle platform and E/E architecture. Indirect channels, such as aftermarket modification services, are minimal due to the regulatory necessity for safety systems to be installed during the initial vehicle manufacturing process.

The final stage involves the OEMs, who integrate the DOS module into the vehicle platform and perform final system validation, followed by sales to the end-consumer (direct channel) or to fleet operators (indirect channel via dealers). Post-sales activities, including maintenance, software updates (OTA), and diagnostics, are crucial for ensuring the long-term functional safety of the DOS. The control over software updates and data generated by the override systems represents a significant point of leverage in the value chain, increasingly favoring OEMs and their proprietary software stacks. Value migration is occurring away from pure hardware assembly towards IP creation in algorithm design and robust system validation frameworks, driving higher margins for companies dominating the software and integration stages.

Driver Override Systems Market Potential Customers

The primary customers and buyers of Driver Override Systems are large Original Equipment Manufacturers (OEMs) specializing in passenger and commercial vehicle manufacturing. These global automotive giants, including established players and emerging electric vehicle (EV) manufacturers, require functionally safe, validated, and scalable DOS solutions to meet regulatory requirements for ADAS and autonomous driving features (L3 and above). Their purchasing decisions are driven by factors such as system reliability, compatibility with their existing E/E architecture, cost-efficiency at high production volumes, and the supplier's ability to provide long-term software support and functional safety certification (ASIL D). OEMs typically integrate these systems directly into their vehicle development pipelines, seeking proprietary advantages through superior safety performance.

A secondary, yet rapidly expanding, segment of potential customers includes specialized autonomous fleet operators and Mobility-as-a-Service (MaaS) providers, often referred to as "Robotaxi" companies or autonomous logistics firms. For these buyers, the DOS is not just a safety feature but a core operational component ensuring fleet uptime and continuous safe operation without human supervision. Their needs prioritize robustness, fault tolerance, and the ability to execute complex Minimum Risk Maneuvers in dense urban environments. Since these entities often retrofit existing vehicles or design custom autonomous platforms, they require highly modular and flexible DOS architectures that can interface with diverse sensor suites and vehicle platforms.

Furthermore, major Tier 1 automotive suppliers often act as internal "customers" within the value chain, purchasing foundational semiconductor technology, specialized sensors, and certified operating system components from upstream providers to build their proprietary DOS offerings. Government and public transport agencies (buses, specialized municipal vehicles) also represent a growing customer base, especially as governments mandate or invest in autonomous public transportation pilot programs requiring certified override systems. The decision-making process for these governmental customers is heavily influenced by public safety records, total cost of ownership, and adherence to specific national safety standards and procurement guidelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $14.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Delphi Technologies, Autoliv Inc., Aptiv PLC, Magna International Inc., Denso Corporation, Veoneer Inc., Hyundai Mobis, NXP Semiconductors, Infineon Technologies AG, Mobileye (Intel), NVIDIA Corporation, TTTech Auto, Visteon Corporation, Renesas Electronics Corporation, Panasonic Corporation, Horizon Robotics, Waymo LLC (Technology Supplier Focus) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Driver Override Systems Market Key Technology Landscape

The technological landscape of the Driver Override Systems market is defined by the integration of three primary pillars: functional safety computing platforms, advanced sensor redundancy, and fail-operational actuation systems. Central to this is the adoption of high-performance computing (HPC) platforms, often utilizing System-on-Chips (SoCs) from manufacturers like NVIDIA and Mobileye, designed specifically for autonomous driving workloads while adhering strictly to ASIL D standards. These platforms implement diverse redundancy—ranging from dual-core processing to triple modular redundancy (TMR)—ensuring that if one computing pathway fails, the override logic remains fully operational. Furthermore, secure, real-time operating systems (RTOS) are essential, providing the deterministic performance required for safety-critical intervention decisions that must be executed in milliseconds.

Advanced sensor redundancy involves implementing multiple sensing modalities (LiDAR, high-resolution radar, cameras) whose inputs are fused through AI algorithms to create an incredibly robust environmental model. This redundancy ensures that the system can maintain situational awareness sufficient for a safe intervention even if one primary sensor fails due to environmental conditions (e.g., fog affecting cameras) or internal malfunctions. Technologies like 4D imaging radar are gaining prominence as they provide high precision and are less susceptible to adverse weather, serving as crucial backup sensors for the DOS. The effectiveness of the DOS is fundamentally tied to the reliability and diversity of its sensory inputs, dictating the overall safety envelope of the automated driving function.

Finally, the evolution of fail-operational actuation is paramount. Traditional vehicle control systems were designed as failsafe, meaning they would shut down upon failure. Driver Override Systems require fail-operational capabilities for steering and braking—meaning the system must continue to perform its function, albeit potentially in a reduced capacity (limp-home mode or MRM). This requires specialized mechanical and electronic hardware, such as brake-by-wire and steer-by-wire systems, featuring independent electrical supplies and redundant communication buses (e.g., FlexRay or Automotive Ethernet) to isolate failures and guarantee the successful execution of the override command, ensuring the vehicle can always reach a safe stop regardless of primary system failures.

Regional Highlights

- North America (NA): North America is a pioneer in the deployment and testing of autonomous vehicles, particularly Level 4 services in major metropolitan areas, making it a critical market for sophisticated DOS. The region benefits from significant investments by technology giants (e.g., Waymo, Cruise) and OEMs, alongside favorable regulatory frameworks (though varying state-by-state) encouraging innovation. Demand is driven by the need for high-redundancy systems in commercial trucking and the push for full automation, especially in states like California and Arizona, which serve as crucial testing grounds. The focus here is on integrating V2X capabilities with DOS for informed urban operation.

- Europe: Europe is characterized by stringent governmental safety mandates and the influential role of bodies like the European Union in setting standards for vehicle safety (e.g., GSR II). European OEMs are leading the charge in offering Level 3 systems (Traffic Jam Pilot), making DOS compliance mandatory for system approval. The market emphasizes functional safety certification (ISO 26262 ASIL D) and cyber-security resilience, as DOS are critical targets for security breaches. Germany, France, and the UK are primary hubs for R&D and implementation, particularly in fail-operational actuation and predictive software logic.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled primarily by China, South Korea, and Japan. China’s centralized planning and massive scale allow for rapid infrastructure deployment and large-scale autonomous pilot programs, especially in smart cities. Local OEMs in China are aggressively adopting advanced ADAS and L3 technologies, driving immense demand for reliable and cost-effective DOS solutions. Japan and South Korea focus heavily on integrating advanced sensing technologies (e.g., high-definition mapping and LiDAR) into their override systems to handle dense urban traffic conditions and aging driver populations requiring enhanced safety nets.

- Latin America (LATAM): The LATAM market remains relatively nascent for high-level (L3+) DOS, primarily due to slower adoption of complex ADAS and lower overall vehicle manufacturing complexity. Current demand is focused on foundational safety systems and L2 features with basic override capabilities, especially in Brazil and Mexico. However, commercial vehicle fleets are showing increasing interest in telematics and basic remote override capabilities for security and logistical monitoring, indicating future growth potential as vehicle safety standards tighten.

- Middle East and Africa (MEA): The MEA region presents a fragmented but strategically important market. Key growth is concentrated in the Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, which are investing heavily in futuristic smart city projects (e.g., NEOM) that prioritize autonomous mobility and safety technologies. These projects create a high-value, albeit localized, demand for L4 and L5 certified DOS. The primary technical challenge driving DOS development in this region includes managing extreme weather conditions (heat, dust) and ensuring system integrity under challenging driving environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Driver Override Systems Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Delphi Technologies

- Autoliv Inc.

- Aptiv PLC

- Magna International Inc.

- Denso Corporation

- Veoneer Inc.

- Hyundai Mobis

- NXP Semiconductors

- Infineon Technologies AG

- Mobileye (Intel)

- NVIDIA Corporation

- TTTech Auto

- Visteon Corporation

- Renesas Electronics Corporation

- Panasonic Corporation

- Horizon Robotics

- Baidu (Apollo Platform)

Frequently Asked Questions

Analyze common user questions about the Driver Override Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Driver Override System in Level 3 autonomous vehicles?

The primary function of a Driver Override System (DOS) in Level 3 vehicles is to execute a Minimum Risk Maneuver (MRM) or initiate a safe stop if the human driver fails to take control back from the automation system within the mandated transition time, or if a critical system failure is detected. It serves as the ultimate safety redundancy layer, ensuring the vehicle defaults to a state of minimum hazard.

How does the Driver Override System market align with functional safety standards?

The market is strictly governed by functional safety standards, primarily ISO 26262. Driver Override Systems for Level 3 and Level 4 vehicles are typically required to meet the highest safety integrity level, ASIL D, signifying that the components and software architecture must be highly redundant, fault-tolerant, and rigorously validated to prevent catastrophic system failures or unintended interventions.

What major technological advancement is currently driving DOS market growth?

The convergence of high-performance computing (HPC) platforms and Artificial Intelligence (AI) algorithms is the major growth driver. AI enables superior sensor fusion and predictive failure detection, transforming DOS from simple reactive failsafe mechanisms into proactive, intelligent systems capable of optimizing the timing and nature of safety interventions based on dynamic real-time data analysis.

Which region currently holds the largest market share for Driver Override Systems?

North America and Europe currently hold the largest market shares due to the early adoption of Level 3 automation, robust regulatory environments mandating advanced safety features, and significant investment in complex automotive technology R&D. However, the Asia Pacific region is expected to surpass them in growth rate over the forecast period driven by massive EV and autonomous mobility investments in China and South Korea.

Are Driver Override Systems utilized in fully autonomous Level 5 vehicles?

Yes, while Level 5 vehicles have no expectation of human intervention, they still require internal Driver Override Systems. In this context, the DOS acts as a high-integrity system health monitor and fail-operational manager, designed to detect and manage internal software or hardware failures (e.g., redundant brake system failure) by executing a guaranteed safe stop or limp-home operation without relying on human input.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager