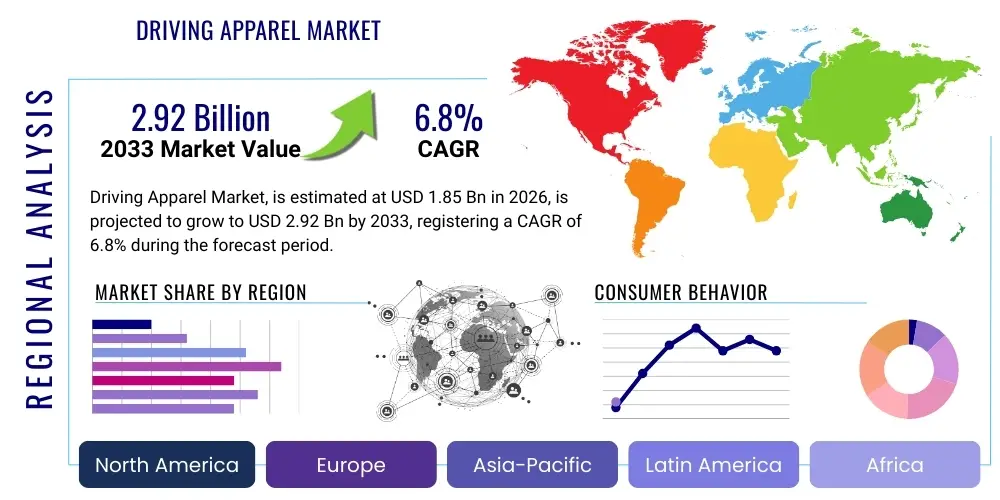

Driving Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437203 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Driving Apparel Market Size

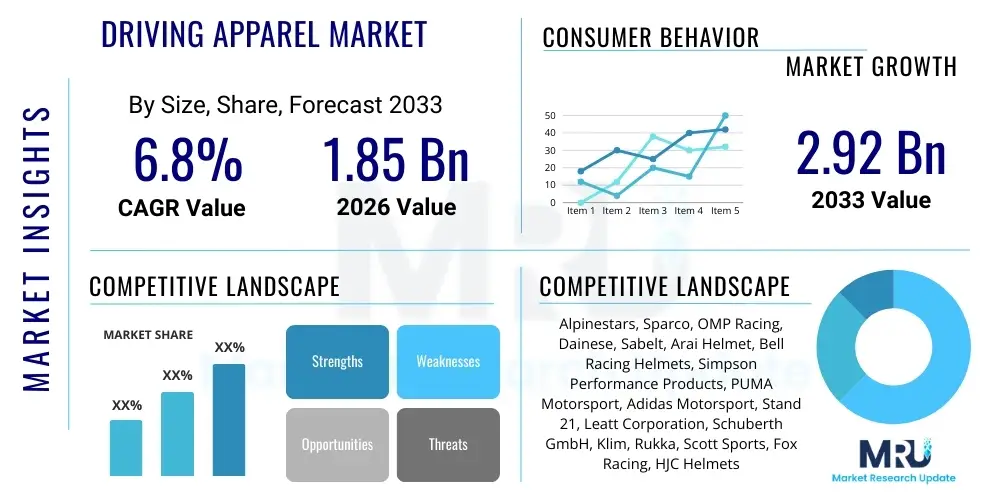

The Driving Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 2.92 billion by the end of the forecast period in 2033.

Driving Apparel Market introduction

The Driving Apparel Market encompasses specialized protective and performance clothing and gear designed for individuals engaged in motor vehicle operation, ranging from professional motorsports competitors to recreational riders and industrial drivers. This niche segment prioritizes safety, durability, and ergonomic design, utilizing advanced materials such as Nomex, Kevlar, and highly technical synthetic fibers that offer features like fire resistance, abrasion protection, and climate control. The primary product categories include racing suits, helmets, gloves, boots, and specialized undergarments, each engineered to meet stringent international safety standards set by organizations like the FIA (Fédération Internationale de l'Automobile) and Snell.

Major applications of driving apparel span professional motor racing (Formula 1, NASCAR, Rally), recreational motorsports (track days, amateur racing), and motorcycle riding (on-road and off-road). The core benefits provided by these products are superior impact protection, thermal insulation against extreme heat and fire, enhanced grip and dexterity, and improved driver comfort necessary for prolonged performance. The market growth is intrinsically linked to the rising popularity of global motorsports events, increasing awareness concerning road safety standards, and the expansion of disposable incomes in emerging economies that allow for investment in premium protective gear.

Key driving factors propelling this market include mandatory regulatory requirements for certified protective gear across various competitive driving circuits, continuous technological advancements in textile engineering leading to lighter yet stronger materials, and growing consumer preference for personalized and aesthetically appealing high-performance apparel. Furthermore, strategic collaborations between apparel manufacturers and professional racing teams serve as potent marketing tools, rapidly driving the adoption of new product innovations into the broader consumer market.

Driving Apparel Market Executive Summary

The global Driving Apparel Market is characterized by robust growth, primarily fueled by global motorsports expansion and increasingly stringent safety regulations, resulting in a high demand for premium, certified protective gear. Current business trends indicate a significant shift towards sustainable manufacturing processes and the integration of smart textiles that incorporate sensors for vital sign monitoring and accident detection. Competition is intensifying, pushing manufacturers to invest heavily in R&D to develop ultra-lightweight, highly breathable, and fire-resistant materials, thereby maintaining a technological edge in a market where performance and safety are non-negotiable consumer requirements.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, driven by rising disposable incomes, burgeoning motorsports culture, and rapid infrastructural development supporting racing venues in countries like China and India. North America and Europe remain mature markets, dominating in terms of technological adoption and premium product consumption, especially within professional racing segments. The regulatory environment in Europe, particularly concerning CE certification, sets a global benchmark for safety standards, influencing product design worldwide and compelling market players to achieve higher compliance thresholds.

Segment trends indicate that the Fire-Resistant Suits segment, categorized by product type, maintains the largest market share due to its mandatory use in competitive racing environments. Based on end-user, the Professional Drivers segment (encompassing F1, IndyCar, and top-tier motorcycle racing) holds significant revenue contribution, demanding the highest level of customization and material technology. However, the Recreational Riders segment is exhibiting the highest growth trajectory, reflecting the increased participation of amateurs in track days and motorsports enthusiasts investing in professional-grade safety equipment.

AI Impact Analysis on Driving Apparel Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Driving Apparel Market center primarily on how AI enhances safety, customizes fit, and optimizes material performance. Common questions explore AI’s role in predictive failure analysis of materials, the deployment of intelligent garment features for real-time driver health monitoring, and the automation of customized apparel manufacturing processes. Users are keenly interested in the shift from static, standard protection to dynamic, responsive safety systems. Key themes summarize to expectations of highly personalized gear that adapts instantaneously to environmental conditions and driver stress levels, moving beyond traditional passive protection to active safety augmentation.

AI’s influence is profound in optimizing material selection and product design by running vast simulations to predict how new composite fabrics will perform under extreme conditions, such as high impact or prolonged exposure to heat, significantly reducing the time and cost associated with physical prototyping. Furthermore, AI-driven computer vision systems are crucial in enhancing manufacturing precision, ensuring exact measurements for customized race suits, which is vital for maximum comfort and safety containment during high-G force maneuvers. This capability allows manufacturers to scale bespoke tailoring, previously a manual, time-intensive process, making high-performance gear accessible to a wider professional audience.

In the downstream segment, AI facilitates advanced inventory management and demand forecasting, helping manufacturers anticipate regional trends and regulatory shifts, ensuring that specialized, time-sensitive products are available efficiently. Crucially, the integration of AI-powered sensors within apparel allows for real-time telemetry analysis of the driver's physiological state (heart rate, temperature, fatigue), offering critical feedback to pit crews or fleet managers. This data-driven approach transforms apparel into a dynamic safety platform, proactively mitigating risks related to driver exhaustion or health emergencies.

- AI-driven material simulation optimizes fire-resistance and abrasion-protection properties, accelerating product development cycles.

- Computer vision systems utilize AI for precise 3D scanning, enabling perfect biometric customization of suits and helmets.

- Predictive maintenance analytics, powered by AI, assess garment integrity and predict replacement cycles based on usage and stress profiles.

- Integration of smart sensors and AI algorithms facilitates real-time monitoring of driver vitals and performance metrics, enhancing active safety.

- AI optimizes complex global supply chains, improving the efficiency of sourcing specialized technical textiles and reducing lead times for customized orders.

DRO & Impact Forces Of Driving Apparel Market

The Driving Apparel Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Primary Drivers include the global proliferation of competitive motorsports and the continuous enforcement of stringent safety mandates requiring FIA or FIM certification for professional participation. These regulations ensure a baseline demand for high-quality, certified safety equipment. Technological advancements, particularly in textile science leading to the creation of lighter, more comfortable, and highly protective materials like para-aramid fibers and basalt fiber composites, further stimulate market expansion by offering superior products that justify premium pricing. The inherent desire among recreational enthusiasts to emulate professional standards also serves as a strong demand generator.

Conversely, the market faces significant Restraints. The high cost associated with advanced protective gear, driven by expensive raw materials (e.g., carbon fiber components, specialized polymers) and complex, low-volume manufacturing processes, often acts as a barrier to entry, particularly for amateur participants and consumers in price-sensitive developing markets. Furthermore, the prevalence of counterfeit products, which fail to meet crucial safety standards, poses a critical threat to consumer safety and diminishes the value perception of certified brands. Market saturation in mature North American and European markets, coupled with long product life cycles for high-end gear, restricts sustained volume growth.

Opportunities for growth are concentrated in the rapidly expanding motorsports and motorcycle culture across the Asia Pacific region, offering vast untapped consumer bases. Moreover, significant potential lies in the integration of Internet of Things (IoT) sensors and smart fabrics within apparel, enabling data collection on driver performance and safety metrics, creating new revenue streams through value-added services. The market can also benefit from expanding into specialized industrial applications, such as high-risk fleet operations, where professional-grade protective attire can enhance worker safety and compliance, thereby diversifying the traditional consumer base.

Segmentation Analysis

The Driving Apparel Market is meticulously segmented based on product type, material, end-user, and distribution channel, reflecting the diverse requirements of various driving disciplines and consumer preferences. This segmentation allows manufacturers to target specific safety needs, performance specifications, and price points effectively. The analysis reveals distinct buying behaviors between professional organizations, which prioritize the absolute highest safety rating regardless of cost, and recreational users, who balance safety features with aesthetics and budget constraints. Understanding these divisions is crucial for strategic market positioning and product portfolio management.

- Product Type:

- Fire-Resistant Suits (Race Suits)

- Helmets (Full-face, Open-face, Modular)

- Gloves (Driving Gloves, Racing Gloves)

- Footwear (Racing Boots, Driving Shoes)

- Underwear and Balaclavas (Fire-resistant base layers)

- Others (Neck support, Arm restraints)

- Material:

- Natural Fibers (Leather for motorcycle gear)

- Synthetic Fibers (Nylon, Polyester)

- Aramid Fibers (Nomex, Kevlar)

- Composite Materials (Carbon Fiber, Fiberglass)

- End-User:

- Professional Drivers (F1, NASCAR, Moto GP)

- Recreational Riders/Amateurs (Track Day participants, Enthusiasts)

- Fleet and Commercial Drivers (Specialized industrial attire)

- Distribution Channel:

- Online Retail (E-commerce platforms, Brand websites)

- Offline Retail (Specialty Stores, Authorized Dealers, Sports Goods Stores)

Value Chain Analysis For Driving Apparel Market

The value chain for the Driving Apparel Market is complex and highly specialized, beginning with the upstream analysis dominated by advanced material science companies. This stage involves the procurement of highly specialized technical textiles, primarily aramid fibers (like Nomex and Kevlar), fire-resistant polymers, and high-impact composite materials necessary for helmets. Suppliers in this segment are characterized by high R&D intensity and strict quality control, as the performance of the final apparel is intrinsically tied to the material integrity. Strong, long-term relationships between apparel manufacturers and these material suppliers are critical for maintaining competitive differentiation and ensuring compliance with rapidly evolving safety specifications.

The midstream involves manufacturing and assembly, where raw textiles are transformed into finished protective gear. This stage includes complex processes such as multi-layer stitching for fire suits, precision molding for helmets, and integration of ergonomic designs. Manufacturing often involves a blend of automated processes for bulk cutting and highly skilled manual labor for precision assembly and customization. Quality assurance and certification testing (e.g., SFI, FIA, DOT) are non-negotiable elements embedded within the manufacturing cycle, acting as regulatory checkpoints before products can move downstream. Manufacturers often operate specialized, climate-controlled facilities to handle sensitive materials.

Downstream analysis focuses on distribution channels, which include both direct and indirect routes. Direct distribution involves sales through proprietary brand stores or e-commerce platforms, offering manufacturers greater control over branding and pricing, and facilitating highly personalized sales processes for professional teams. Indirect channels primarily utilize specialized sports retailers, motorsports equipment distributors, and authorized dealers who possess the technical knowledge required to advise consumers on complex safety requirements. The increasing prominence of online retail has broadened market reach, allowing smaller specialty brands to compete globally, though high-end professional gear often still relies on personalized B2B logistics and dedicated sales agents due to the bespoke nature of the product.

Driving Apparel Market Potential Customers

The primary customer base for the Driving Apparel Market can be broadly categorized into three distinct segments, each with unique purchasing motivations and product requirements. The most demanding segment comprises Professional Drivers and Teams, including Formula 1, MotoGP, NASCAR, and high-tier rally racing organizations. These buyers require equipment that adheres to the strictest, latest safety certifications, often demand customized fits and material compositions, and prioritize performance and weight reduction above all else. Procurement decisions in this segment are usually B2B, driven by technical specifications provided by engineers and safety managers, with purchasing cycles often tied to racing seasons.

The second major segment is the Recreational Riders and Amateur Enthusiasts. This group includes weekend track day participants, amateur competitive racers, and dedicated motorcycle riders who regularly invest in mid-to-high-range safety gear. While safety remains paramount, these consumers often balance performance requirements with affordability, aesthetics, and comfort for extended use. The purchasing decision is largely B2C, influenced heavily by brand reputation, peer reviews, and marketing that emphasizes durability and versatility across different driving conditions. This segment is highly responsive to promotional activities and product innovations that enhance the consumer experience.

The third, and increasingly important, customer segment includes Fleet Operators and Specialized Industrial Drivers. This market segment covers operators of high-risk commercial vehicles, military vehicles, and heavy machinery where specialized protective attire (often focusing on fire resistance, high visibility, and specific ergonomic support for long duration driving) is mandated or strongly recommended. For this segment, the buying decision is B2B, driven by occupational safety regulations (OSHA, similar regional bodies) and corporate risk management policies. Products here emphasize industrial durability, easy maintenance, and compliance certification for workplace safety rather than motorsports performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 billion |

| Market Forecast in 2033 | USD 2.92 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alpinestars, Sparco, OMP Racing, Dainese, Sabelt, Arai Helmet, Bell Racing Helmets, Simpson Performance Products, PUMA Motorsport, Adidas Motorsport, Stand 21, Leatt Corporation, Schuberth GmbH, Klim, Rukka, Scott Sports, Fox Racing, HJC Helmets, Troy Lee Designs, REV'IT! Sport International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Driving Apparel Market Key Technology Landscape

The technological landscape of the Driving Apparel Market is defined by relentless innovation focused on maximizing protection while minimizing weight and bulk, often leveraging advancements from aerospace and military textiles. A core technological area is the development of next-generation fire-resistant fabrics, moving beyond standard Nomex towards proprietary blends that offer enhanced thermal protective performance (TPP) with superior breathability and moisture-wicking properties. These fabrics are engineered using complex weaves and multi-layer structures designed to dissipate heat rapidly and withstand flash fire exposure for crucial seconds, meeting the ever-increasing requirements set by regulatory bodies for motorsports safety.

Another pivotal technological trend involves the sophisticated integration of high-impact composite materials, particularly in helmet manufacturing. Advanced materials such as proprietary blends of carbon fiber, aramid, and fiberglass are utilized to create extremely light yet robust shells capable of absorbing and managing severe impact energy. Furthermore, manufacturers are employing advanced techniques like Finite Element Analysis (FEA) during design to predict stress points and optimize the structure of apparel and helmets, ensuring targeted protection without unnecessary material addition. This focus on optimization is crucial as every gram counts in competitive racing, driving demand for materials with the highest strength-to-weight ratio.

Finally, the market is undergoing a transformative integration of smart technology. This includes the embedding of miniaturized biometric sensors and IoT capabilities into apparel, enabling continuous, non-invasive monitoring of the driver’s vital signs, stress levels, and fatigue markers. Data collected from these smart garments can be wirelessly transmitted for immediate analysis by race engineers or medical teams, allowing for timely intervention in case of a crash or driver distress. Moreover, 3D body scanning and rapid prototyping technologies are becoming standard, facilitating mass customization and ensuring that safety gear fits professional drivers perfectly, maximizing both comfort and safety performance.

Regional Highlights

Geographically, the Driving Apparel Market demonstrates significant variability in growth rates and product adoption, reflecting regional differences in motorsports infrastructure, regulatory stringency, and consumer purchasing power. North America and Europe currently hold the largest market shares, primarily due to the established culture of motor racing, the presence of major regulatory bodies (FIA, FIM), and high consumer awareness regarding safety certification. These regions are characterized by mature markets with high demand for premium, technologically advanced, and certified safety gear, driving innovation and setting global pricing benchmarks.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is attributed to the substantial increase in disposable income, rapid urbanization, and significant governmental investment in developing motorsports circuits and events in countries like China, Japan, and India. The rising prevalence of recreational motorcycling and the burgeoning amateur racing scene are fueling demand for both entry-level and mid-range protective apparel, creating vast opportunities for international manufacturers seeking market penetration.

Latin America, and the Middle East and Africa (MEA) represent emerging markets for driving apparel. Growth in MEA is largely driven by the high-profile motorsports events hosted in the Gulf Cooperation Council (GCC) countries, such as Formula 1 races, which stimulate regional interest in premium gear. Latin America's market growth is supported by a passionate motorcycling culture and local racing circuits, although market expansion is often constrained by economic volatility and higher price sensitivity compared to developed regions, necessitating strategic pricing models for local competitiveness.

- North America: Dominant market share fueled by major racing leagues (NASCAR, IndyCar) and high consumer willingness to invest in certified safety gear. Focus on advanced materials and integration of monitoring technology.

- Europe: Regulatory epicenter, setting global safety standards (CE, FIA). Strong demand driven by Formula 1 presence, extensive motorsports history, and high per capita expenditure on performance apparel.

- Asia Pacific (APAC): Highest projected CAGR, powered by rising affluence, rapid growth in motorcycle sales, and increased establishment of professional racing infrastructure across key emerging economies.

- Latin America: Growing market driven by strong motorcycle culture, particularly for recreational and daily commute use. Demand is often price-sensitive, focusing on value-for-money safety compliance.

- Middle East and Africa (MEA): Market growth concentrated in GCC countries due to luxury motorsports events and high-net-worth individuals, driving demand for bespoke and ultra-premium protective apparel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Driving Apparel Market.- Alpinestars S.p.A.

- Sparco S.p.A.

- OMP Racing S.p.A.

- Dainese S.p.A.

- Sabelt S.p.A.

- Arai Helmet, Ltd.

- Bell Racing Helmets, Inc.

- Simpson Performance Products, Inc.

- PUMA SE (Motorsport Division)

- Adidas AG (Motorsport Apparel)

- Stand 21

- Leatt Corporation

- Schuberth GmbH

- Klim, LLC

- Rukka (L-Fashion Group)

- Scott Sports SA

- Fox Racing, Inc.

- HJC Helmets

- Troy Lee Designs, LLC

- REV'IT! Sport International B.V.

Frequently Asked Questions

Analyze common user questions about the Driving Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for growth in the Driving Apparel Market?

The primary driver is the stringent enforcement of safety regulations by global governing bodies like the FIA and FIM, which mandates the use of certified, high-performance protective gear across all professional and major amateur motorsports competitions, constantly necessitating product upgrades.

How are technological advancements impacting the safety features of racing suits?

Technological advancements focus on utilizing aramid fibers (Nomex, Kevlar) and proprietary blends to create ultra-lightweight, multi-layer suits with enhanced Thermal Protective Performance (TPP), superior heat dissipation, and integrated fire resistance, drastically improving driver survivability during incidents.

Which regional market shows the fastest growth potential for driving apparel?

The Asia Pacific (APAC) region exhibits the highest projected growth rate (CAGR), driven by significant increases in disposable income, rapid expansion of motorsports infrastructure, and a growing population of amateur and professional motorsports enthusiasts.

What role does customization play in the professional driving apparel segment?

Customization is crucial for professional drivers as it ensures a perfect, ergonomic fit, which is essential for maximizing comfort, dexterity, and, most importantly, the effectiveness of safety features, such as impact containment and restraint system integration, during high-speed maneuvers.

Are smart textiles expected to become standard in high-end driving apparel?

Yes, smart textiles integrating IoT sensors for real-time monitoring of driver physiological data (heart rate, fatigue, temperature) are rapidly transitioning from niche applications to expected features in high-end professional and premium recreational driving apparel.

The Driving Apparel Market demands continuous innovation to balance supreme protection with ergonomic performance. The influence of global safety standards, particularly from organizations such as the Fédération Internationale de l'Automobile (FIA) and the Fédération Internationale de Motocyclisme (FIM), provides an unwavering floor for quality requirements and drives constant material and design improvements. Manufacturers are investing heavily in material science, focusing on reducing the weight of protective gear without compromising its critical barrier properties against abrasion and thermal hazards. This competitive landscape mandates a high degree of specialization, where brands often focus intensely on specific segments, such as rally racing, Formula series, or premium motorcycle touring, to establish technological superiority and brand loyalty. The shift toward sustainable materials and ethical manufacturing practices is also emerging as a significant, albeit challenging, market trend.

Furthermore, the consumer segment is increasingly discerning, often utilizing digital resources and direct interaction with brands to understand complex safety ratings and material specifications before purchase. This heightened consumer education necessitates transparent communication from manufacturers about product testing and certification compliance. The market's resilience is notable; despite economic fluctuations, the demand for certified safety gear remains strong due to the non-negotiable nature of risk mitigation in high-speed activities. The premiumization trend, where consumers are willing to pay for perceived safety advantages and technological integration (such as helmet communication systems or advanced ventilation), ensures stable revenue growth within the high-end segments of the market. Success in this domain relies on a delicate balance between regulatory compliance, material science leadership, and strategic marketing targeting safety-conscious consumers.

In terms of distribution, the transition towards omnichannel retail strategies is becoming pronounced. While specialized physical stores remain vital for fitting and personalized consultation—especially for bespoke racing suits and custom helmets—e-commerce platforms are critical for reaching the dispersed and growing global recreational riding community. This requires sophisticated logistics to handle geographically varied delivery requirements and import/export compliance for specialized safety goods. The long-term profitability of the market will be heavily influenced by how effectively companies manage the inherent tension between high manufacturing costs, driven by specialized materials, and the necessity of meeting diverse price points across various global regions, especially in the context of expanding motorsports events in economically emerging nations.

The convergence of active safety systems, where apparel provides real-time data input, and passive protection, utilizing advanced physical materials, represents the future technological trajectory of the Driving Apparel Market. For instance, advanced helmet technology now integrates complex energy management systems designed not only to absorb linear impacts but also to mitigate rotational forces, which are highly damaging to the brain. This move towards holistic safety solutions requires collaboration between apparel makers and specialized electronics and sensor companies, necessitating a blurring of traditional industry boundaries. The market is also exploring customizable cooling mechanisms integrated into suits, using phase change materials or active fluid circulation, to combat heat stress—a critical performance inhibitor for professional drivers in high-temperature environments. These technological leaps continually refresh product cycles and provide strong justification for premium pricing, sustaining the market's value proposition.

Beyond motorsports, the utilization of driving apparel technologies in adjacent industries, such as high-risk industrial environments or military applications, presents a robust diversification strategy. The core expertise in producing fire-resistant, abrasion-proof, and ergonomically superior textiles is highly valuable across various sectors requiring extreme protective gear. This cross-industry application helps manufacturers achieve economies of scale in material procurement and production, thereby stabilizing supply chains and potentially reducing the final cost to the consumer. Furthermore, the commitment to sustainability is driving research into bio-based and recycled high-performance fibers, reducing the environmental footprint of highly synthetic apparel manufacturing—a growing consideration for ethically-conscious consumer segments, particularly in European markets.

The competitive landscape is generally concentrated among a few global giants who possess the necessary capital for R&D and regulatory compliance testing. However, niche players often thrive by specializing in specific components (e.g., highly customized footwear or unique undergarment technology) or by targeting specific motorsports disciplines where high-volume manufacturing is less critical than specialized performance characteristics. Successful market players must maintain continuous engagement with regulatory bodies to anticipate future safety requirements and ensure that their product pipeline remains compliant. Failure to meet the latest safety standards, such as updated FIA homologation requirements, can severely restrict a product's market access, emphasizing the centrality of certification in all strategic decisions within this market.

The growth trajectory in mature markets is sustained not just by new entrants but primarily by replacement cycles driven by regulatory obsolescence and material degradation. For instance, racing harnesses and fire suits often have mandatory expiration dates due to safety certifications, irrespective of wear and tear, forcing professional teams and serious amateurs to routinely update their gear. This structured replacement demand provides a reliable revenue base for established manufacturers. Moreover, the increasing public visibility of motorsports through global media platforms, including streaming services and social media, continually amplifies brand recognition for key apparel suppliers, turning their products into aspirational purchases for the broader motorsports enthusiast community, thereby expanding the potential customer funnel beyond immediate competitive needs.

Investment in direct-to-consumer (D2C) channels is a key strategic move for enhancing customer lifetime value (CLV). D2C enables manufacturers to gather first-hand consumer data, offering insights into fit preferences, usage patterns, and desired features, which is invaluable for iterative product improvement. This direct relationship also supports the sale of highly customized, high-margin products without relying on intermediary markups. However, managing direct sales requires significant investment in specialized e-commerce platforms capable of handling complex customization orders and integrating with sophisticated inventory management systems, especially considering the specialized nature and high value of the stock. Balancing the effectiveness of technical support provided through physical dealers with the convenience of online purchasing remains a critical distribution challenge to be optimized.

The geopolitical climate and trade policies can significantly influence the supply chain, as specialized aramid fibers and high-performance polymers are often sourced globally from a limited number of specialized chemical companies. Any disruption in international trade routes or imposition of tariffs can directly impact the cost of raw materials and subsequently the final retail price of driving apparel. Manufacturers mitigate this risk by diversifying their sourcing geographically and maintaining robust inventory levels of critical components. Furthermore, the market for counterfeit protective gear, predominantly originating from regions with less stringent intellectual property enforcement, remains a persistent concern. Addressing counterfeiting requires proactive legal action, consumer education on recognizing certified products, and the implementation of anti-counterfeiting technologies, such as secure serialization and blockchain-based authentication, within the apparel itself. This issue is not only economic but fundamentally a matter of life and death, reinforcing the need for strict supply chain security.

The professional endorsement landscape plays a disproportionately large role in driving apparel sales. Sponsoring top-tier teams and star drivers provides manufacturers with immediate, high-visibility product testing environments and powerful marketing leverage. When a championship winner utilizes a specific brand of suit or helmet, that endorsement often translates directly into high sales volumes across recreational and mid-level competitive segments. This strategic investment in motorsports marketing ensures that the market remains highly performance-driven and brand-conscious. Manufacturers leverage this visibility to highlight their commitment to safety and innovation, continually reinforcing the value proposition that justifies the premium price points characteristic of certified driving apparel. This dynamic relationship between competitive motorsports and retail marketing underscores the symbiotic nature of the market ecosystem.

Finally, emerging niche markets, such as electric vehicle (EV) racing (Formula E, Electric Rally), are beginning to impose new requirements on driving apparel. While fire resistance remains crucial due to battery fire risks, EV racing often introduces specific ergonomic demands related to cockpit design and different types of thermal management needs. Apparel manufacturers are proactively working with EV racing teams to develop gear optimized for these unique conditions, focusing on materials that offer excellent electrical insulation alongside traditional protective qualities. This proactive adaptation to new automotive technologies ensures the market's long-term relevance and opens up fresh avenues for product differentiation and intellectual property development, maintaining the innovative pace necessary for sustainable market expansion into the next decade.

The utilization of 3D printing technology is also beginning to revolutionize the manufacturing of highly customized driving apparel components, particularly for helmet liners, padding, and ventilation systems. Additive manufacturing allows for rapid creation of bespoke parts that perfectly match the contours of a specific driver’s head or body, optimizing fit and impact absorption capabilities far beyond what traditional molding techniques can achieve. This application of 3D printing reduces production lead times for custom gear, enhancing responsiveness to the demands of professional racing teams who often require last-minute adjustments or replacements. As 3D printing materials become stronger and more cost-effective, this technology is expected to permeate more segments of the driving apparel value chain, potentially democratizing customization features previously reserved only for elite athletes.

Furthermore, the market is experiencing an evolution in testing and certification methodologies. Beyond standard physical testing (impact, puncture, abrasion), computational fluid dynamics (CFD) and sophisticated modeling are increasingly used to simulate how gear performs under aerodynamic stress, particularly critical for motorcycle racing suits and helmets. Manufacturers are collaborating with research institutions to establish testing protocols that better reflect real-world accident scenarios, moving beyond idealized test conditions. This dedication to advanced testing assures end-users of the product’s reliability under extreme duress, which is vital for maintaining consumer trust and meeting increasingly strict liability standards imposed by global regulatory bodies. The pursuit of enhanced certification methodologies continuously raises the cost of compliance but reinforces the market's commitment to safety leadership.

The trend towards modular and adaptive apparel is also gaining traction. For instance, racing suits designed with replaceable, high-abrasion panels allow for easier and more cost-effective repair after minor incidents, extending the lifespan of expensive professional gear. Similarly, motorcycle gear is increasingly designed with removable, CE-rated armor and customizable ventilation zippers, allowing riders to adapt a single garment for varied climate conditions. This modularity appeals directly to the recreational rider segment, offering enhanced versatility and perceived value. The focus on easy maintenance and long-term durability is essential for capturing and retaining consumer loyalty in segments where the initial investment is substantial, positioning manufacturers who prioritize repairability and adaptability favorably against competitors focused solely on initial purchase price.

The overall market trajectory confirms a strong preference for investment in quality, certified protective equipment, regardless of the driving discipline. Manufacturers must continuously innovate to provide lighter, safer, and smarter solutions while navigating complex regulatory frameworks and supply chain challenges. Strategic regional focus, particularly capturing the explosive growth in APAC and maintaining technological leadership in North America and Europe, will be paramount for securing a dominant market position throughout the forecast period ending in 2033. The integration of digital technologies, from manufacturing customization to consumer engagement, is the non-negotiable cornerstone of future market success.

The impact of simulation technologies, particularly virtual reality (VR) and augmented reality (AR), is emerging as a powerful tool in the sales and fitting process. Potential customers, especially high-end buyers, can use AR apps to virtually try on customized gear, viewing fit and aesthetic details before production begins. For professional teams, VR simulations are utilized to optimize the interface between the driver, the race seat, and the apparel, ensuring there is no chafing or movement restrictions under high g-forces. This enhanced pre-visualization capability not only improves customer satisfaction but also minimizes expensive returns and rework, streamlining the entire bespoke apparel creation process, which is a significant value addition in the highly customized segment of the market. This technological adoption directly addresses the complexity inherent in selling highly technical, specialized wearable products remotely.

Furthermore, intellectual property (IP) protection is a critical strategic consideration. Manufacturers invest billions in developing proprietary textile blends, innovative helmet safety mechanisms (like MIPS or similar rotational impact systems), and unique stitching patterns for enhanced fire integrity. Protecting this IP through patents and trademarks is vital for maintaining a competitive edge and preventing generic replication that could erode market value and dilute safety standards. Legal battles over IP infringement are common in this high-value, technology-driven sector, compelling major players to allocate substantial resources to legal defense and enforcement, especially against manufacturers of low-cost, uncertified imitations that pose a direct threat to the certified market's integrity.

The market also benefits from cross-segment knowledge transfer. Innovations originally developed for elite Formula 1 teams—such as sophisticated ventilation systems or extreme lightweight aramid materials—often trickle down within two to three years into premium recreational motorcycle gear. This rapid diffusion of high-end technology ensures that the entire market benefits from the intense R&D investment made by top-tier suppliers. This constant stream of performance upgrades maintains consumer interest and encourages periodic upgrades even among non-professional users. Therefore, staying at the forefront of competitive motorsports innovation is not merely a marketing exercise but a core component of sustainable product strategy for market leaders.

Finally, the growing environmental consciousness among consumers is forcing manufacturers to address the end-of-life cycle management for synthetic, high-tech apparel. Initiatives include developing robust recycling programs for composite materials (helmets) and offering repair services rather than replacement, thus minimizing waste. Brands that transparently communicate their sustainability efforts—from ethical sourcing of natural fibers (like leather) to reducing chemical waste in dyeing and treatment processes—are increasingly favored by environmentally conscious younger consumers, particularly in Western European and North American markets. This focus on corporate social responsibility (CSR) is shifting from a desirable trait to a necessary component of brand differentiation in the modern driving apparel marketplace.

The complex regulatory landscape necessitates dedicated resources for homologation and certification management. Manufacturers must maintain detailed documentation demonstrating that every batch of apparel meets international and regional standards, often requiring submission to multiple testing bodies globally (e.g., SFI in North America, FIA internationally, CE in Europe). This compliance burden raises operational overhead but ensures product integrity and consumer trust. The ability to rapidly navigate evolving compliance requirements, such as new helmet standards addressing lower-speed impacts or stricter flame retardancy tests for suits, serves as a significant non-price barrier to entry for smaller or less established manufacturers, cementing the dominance of highly specialized global firms in the premium segments of the driving apparel market.

Furthermore, specialized technical training for sales staff and distributors is paramount. Since driving apparel is a safety-critical product, sales personnel must possess deep technical knowledge regarding material composition, certification levels, and proper fitting techniques. A mistake in sizing a racing suit or improperly fitting a helmet can have severe consequences, leading to product liability issues. Therefore, leading manufacturers invest heavily in continuous education and certification programs for their global distribution networks, ensuring that the end-user receives expert advice tailored to their specific motorsports discipline and competitive level. This emphasis on technical expertise in the sales channel reinforces the perception of value and professionalism inherent in certified protective gear.

The influence of digitalization extends deeply into the B2B relationships within the market. Manufacturers utilize sophisticated Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems to manage complex B2B contracts with racing teams and fleet operators. These systems track personalized inventory, manage complex customization requests, schedule mandatory service checks (e.g., helmet re-certification), and ensure timely delivery of gear tied to race schedules. Efficient digital management of these high-value, low-volume professional contracts is a competitive necessity, enabling manufacturers to provide superior service and forge lasting partnerships that anchor their market presence and drive innovation through performance feedback.

The strategic importance of global logistics and rapid fulfillment cannot be overstated, particularly for motorsports where gear replacement is often needed urgently due to unforeseen accidents during a season. Manufacturers maintaining regionally distributed inventory hubs or utilizing advanced predictive logistics models gain a significant competitive advantage by ensuring that specialized products can reach any major racing circuit or customer base within 24 to 48 hours. This capability to guarantee speedy and reliable service is a key differentiator in securing and maintaining high-profile professional contracts, demonstrating the operational excellence required to succeed in the high-stakes environment of performance driving apparel supply.

Finally, the long-term health of the market is contingent on sustained investment in material recycling technologies. Given the complex, multi-layered nature of aramid and composite products, disassembly and recycling are challenging. However, increasing regulatory pressure and consumer demand for circular economy practices require manufacturers to innovate recycling solutions. Early movers in this area—developing processes to recover valuable fibers or safely dispose of chemical treatments—will establish a leadership position in sustainability, gaining favor among institutional buyers and positioning themselves strongly for future market evolution where environmental compliance is expected to become as critical as safety compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager