Drone Surveillance System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435555 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Drone Surveillance System Market Size

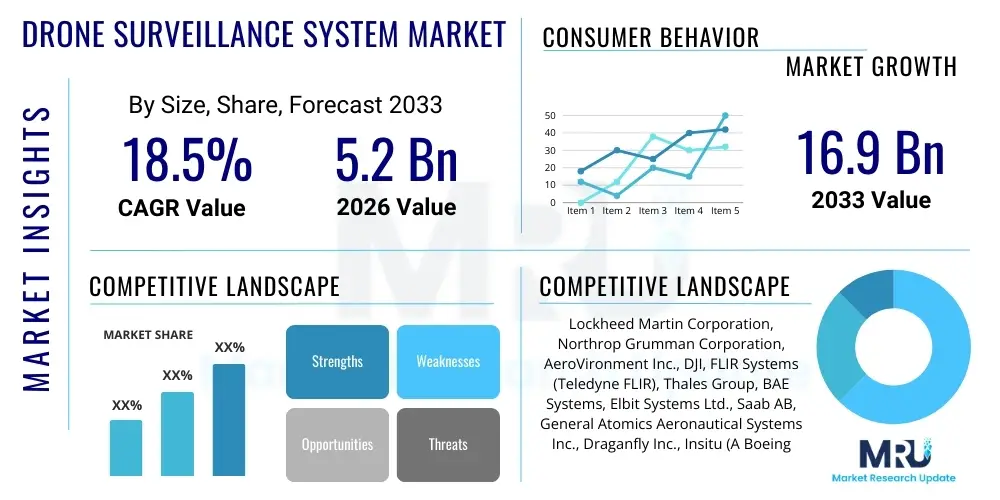

The Drone Surveillance System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 5.2 billion in 2026 and is projected to reach USD 16.9 billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the increasing need for enhanced security measures globally, coupled with the rapid technological advancements in unmanned aerial vehicle (UAV) capabilities, sensor technology, and artificial intelligence integration.

Drone Surveillance System Market introduction

The Drone Surveillance System Market encompasses the design, manufacturing, deployment, and operation of Unmanned Aerial Vehicles (UAVs) specifically equipped with advanced sensor payloads, communication systems, and processing software utilized for monitoring, intelligence gathering, reconnaissance, and security enforcement across diverse operational environments. These systems offer significant advantages over traditional manned surveillance methods, including lower operational costs, reduced risk to human personnel, and the capacity for rapid deployment in inaccessible or dangerous areas. Key product offerings range from small, tactical quadcopters utilized by local law enforcement to large, fixed-wing endurance drones employed for long-range border patrol and military intelligence missions. The fundamental purpose of these systems is to provide real-time, high-definition data streams for actionable insights, thereby enhancing situational awareness for critical decision-making processes.

Major applications of drone surveillance systems span critical sectors such as national defense, homeland security, public safety, and infrastructure monitoring. In the defense sector, drones are essential for intelligence, surveillance, and reconnaissance (ISR) operations, target acquisition, and battle damage assessment. For homeland security and law enforcement, these systems are vital tools for search and rescue operations, crowd monitoring, tracking criminal suspects, and assessing accident or disaster zones. Furthermore, commercial applications are rapidly expanding, including the surveillance of pipelines, power grids, large industrial complexes, and agricultural lands, providing a robust, scalable, and relatively non-intrusive monitoring solution. The market's growth is fundamentally underpinned by the global rise in asymmetric warfare, cross-border infiltration concerns, and the need to protect extensive national infrastructure from both physical and cyber threats, necessitating reliable and persistent aerial observation capabilities.

The primary benefits driving the adoption of these systems include their exceptional flexibility and adaptability to various terrains and weather conditions, coupled with the precision offered by integrated GPS and advanced navigation software. Driving factors encompass the continuous miniaturization of sophisticated sensor technology—such as thermal, LiDAR, and hyperspectral cameras—which enhances data quality while reducing payload weight. Moreover, favorable regulatory shifts in various jurisdictions, particularly concerning Beyond Visual Line of Sight (BVLOS) operations, are unlocking greater commercial potential. The increasing affordability of high-end drone technology is also allowing smaller agencies and private entities to incorporate aerial surveillance into their operational strategies, further fueling market expansion and technological innovation across software analytics platforms, enabling autonomous detection and tracking capabilities.

Drone Surveillance System Market Executive Summary

The Drone Surveillance System Market exhibits robust growth driven by technological convergence, including sophisticated sensor integration and advanced Artificial Intelligence for real-time data processing. Business trends show a strong shift toward service-based models (Drone-as-a-Service, DaaS), where end-users lease fully managed surveillance capabilities rather than investing heavily in proprietary hardware and training, ensuring continuous uptime and access to the latest technological upgrades. Geographically, North America and Asia Pacific are dominating the market; North America leads in military expenditure and advanced R&D, while APAC demonstrates explosive adoption in civil infrastructure monitoring and manufacturing due to less restrictive regulatory environments in key markets like China and India. Segment trends indicate that the Software and Service components are rapidly gaining market share over traditional Hardware sales, primarily because the complexity and volume of data collected necessitate highly specialized, AI-powered analytics packages capable of autonomous threat detection, thermal signature analysis, and facial recognition, thereby driving superior operational value.

AI Impact Analysis on Drone Surveillance System Market

User inquiries regarding the integration of Artificial Intelligence (AI) into the Drone Surveillance System Market frequently center on the balance between operational autonomy and ethical governance. Common questions analyze how AI enhances the effectiveness of real-time threat detection, specifically concerning the transition from human-monitored feeds to autonomous anomaly identification, and the capabilities of predictive analytics to forecast security breaches or environmental hazards. Users are keenly interested in the performance metrics of AI-driven computer vision systems, particularly their accuracy in object classification (e.g., distinguishing humans from animals, or identifying unauthorized ground vehicles) under challenging conditions, such as low visibility or extreme weather. Furthermore, significant concern revolves around the regulatory challenges associated with fully autonomous drone decision-making, the security implications of managing vast amounts of collected sensitive data, and the potential for algorithmic bias impacting surveillance fairness and privacy rights. The market's expectation is clear: AI must deliver significant operational efficiency gains while maintaining strict adherence to legal and ethical surveillance protocols.

The integration of AI is fundamentally transforming drone surveillance from a passive data collection exercise into an active, intelligent, and highly automated security solution. AI algorithms enable sophisticated real-time data fusion, combining inputs from multiple sensors—including visual, thermal, and acoustic data—to create a comprehensive and accurate understanding of the operational environment. This capability dramatically reduces the reliance on human operators to sift through hours of footage, concentrating attention only on high-priority security events. Predictive maintenance scheduling for both the UAV platform and critical infrastructure being monitored is also a major outcome, where AI analyzes usage patterns and sensor anomalies to anticipate failures, increasing operational reliability and minimizing system downtime. This level of enhanced autonomy and precision elevates the drone surveillance system’s role from a simple camera platform to a crucial component of networked security intelligence architecture.

Furthermore, AI facilitates advanced swarm intelligence capabilities, allowing multiple drones to coordinate complex missions collaboratively, such as coordinated tracking of moving targets, simultaneous area mapping, or creating adaptive communication relays in dynamic environments. This reduces the mission complexity for individual operators and significantly expands the surveillance coverage area and persistence. However, this autonomy necessitates robust cybersecurity protocols to protect the AI models from adversarial attacks that could compromise decision-making processes or data integrity. The ongoing development focuses heavily on integrating Edge AI processing directly onto the drone hardware, ensuring that crucial detection and response decisions can be made instantaneously without relying on high-latency cloud connectivity, which is critical for time-sensitive security operations.

- AI-powered Computer Vision enables real-time object detection and classification, significantly improving threat identification accuracy.

- Autonomous Navigation and obstacle avoidance reduce reliance on human pilots, allowing for complex BVLOS operations.

- Predictive Analytics models analyze spatial-temporal data to forecast potential security threats or infrastructure failures.

- Swarm Technology, managed by AI, allows coordinated operation of multiple UAVs for comprehensive coverage.

- Edge Computing integration processes sensor data locally, minimizing latency for immediate security responses.

- AI contributes to advanced counter-UAS (C-UAS) identification and mitigation strategies.

DRO & Impact Forces Of Drone Surveillance System Market

The market for Drone Surveillance Systems is shaped by powerful interconnected forces encompassing high-level security demands, technological innovation, stringent regulatory frameworks, and societal privacy concerns. The primary driver is the accelerating global requirement for enhanced security and counter-terrorism measures, particularly in protecting vast critical infrastructure networks, including energy pipelines, airports, and national borders, where traditional methods are cost-prohibitive or ineffective. This demand is met by the opportunity created by rapid advancements in miniaturized sensor payloads, efficient battery technology, and robust data analytics software, leading to highly capable, endurance-focused platforms. However, the market faces significant restraint from complex, often fragmented, international air traffic regulations that restrict crucial BVLOS operations and mandate strict flight ceilings and zones, severely limiting commercial deployment scalability. The impact forces are balanced by the ongoing tension between national security imperatives favoring broad surveillance capabilities and strong public backlash related to data privacy, algorithmic bias, and the potential misuse of collected personal information, requiring manufacturers to develop ethical, transparent, and legally compliant data handling protocols.

Key drivers include substantial military and defense spending increases focused on modernizing ISR capabilities, replacing manned aircraft with cost-effective and persistent UAV fleets. Furthermore, the rapid integration of 5G and satellite communication technologies provides the necessary bandwidth and reliability for real-time, high-definition data transmission from remote locations, which is critical for effective surveillance operations. The regulatory environment, while restrictive in some areas, is slowly evolving toward establishing clearer pathways for routine commercial drone operations, such as standardized air corridor management and Remote Identification (Remote ID) rules, which represent a significant market opportunity. This gradual regulatory easing is enabling the transition of drone surveillance from specialized military use to widespread application in public safety and commercial sectors, increasing market accessibility and competitive intensity among global manufacturers seeking to establish early market dominance in emerging applications like urban air mobility security.

Conversely, critical restraints are centered on the inherent complexity of integrating drone operations into existing national airspace management systems, leading to air traffic control concerns and potential collision risks with traditional aviation. The public acceptance of drone surveillance remains a pervasive challenge; persistent public discourse regarding mass surveillance capabilities, especially concerning facial recognition and autonomous targeting, forces manufacturers and operators to invest heavily in ethical design and robust data security infrastructure to maintain public trust and legal compliance. Overcoming these restraints necessitates global standardization of operational protocols, transparent data usage policies, and the development of sophisticated detect-and-avoid (DAA) technologies that can ensure absolute flight safety, thereby unlocking the full potential for long-range, continuous surveillance missions.

Segmentation Analysis

The Drone Surveillance System Market is comprehensively segmented based on Component, Application, End-Use, and Platform Type, reflecting the technological complexity and diverse operational requirements of the end-users. This segmentation is crucial for understanding the market's value distribution, highlighting the shift from hardware-centric sales to sophisticated software and service offerings. The Component segment, comprising Hardware (UAV platforms, sensors), Software (flight control, image processing, AI analytics), and Services (maintenance, training, DaaS), clearly illustrates that high growth is now concentrated in the areas providing actionable intelligence, specifically advanced software and professional managed services. The Application segmentation differentiates between high-value defense procurement and the rapidly expanding commercial use, while the End-Use breakdown distinguishes between governmental entities (military, law enforcement) which demand high-specification, ruggedized systems, and the private sector which prioritizes cost-efficiency and scalable solutions for infrastructure monitoring.

- By Component:

- Hardware (UAVs, Ground Control Stations, Payloads)

- Software (Image Processing, Fleet Management, AI/Analytics)

- Services (Maintenance, Training, Drone-as-a-Service - DaaS)

- By Platform Type:

- Fixed-Wing Drones

- Rotary-Wing Drones (Multi-rotor and Single Rotor)

- Hybrid Drones (VTOL)

- By Application:

- Defense and Military (ISR, Border Security)

- Homeland Security (Law Enforcement, Traffic Management, Search and Rescue)

- Commercial and Civil Infrastructure (Oil & Gas, Energy Utilities, Construction)

- By End-Use:

- Government and Public Sector (Federal, State, Local)

- Private Sector and Critical Infrastructure Operators

Value Chain Analysis For Drone Surveillance System Market

The value chain for the Drone Surveillance System Market is highly specialized and integrated, beginning with upstream component manufacturing, progressing through complex assembly and software integration (midstream), and culminating in the highly localized service provision and end-user operations (downstream). Upstream activities involve specialized suppliers providing high-value sub-components such as advanced microprocessors, inertial measurement units (IMUs), customized high-density batteries, and sophisticated sensor payloads (LiDAR, Synthetic Aperture Radar, EO/IR cameras). The quality and miniaturization of these components directly dictate the final system's performance metrics, such as endurance, payload capacity, and data resolution, making component sourcing a critical competitive factor. A healthy supply chain ensures resilience against geopolitical risks and guarantees access to cutting-edge technologies.

The midstream segment is dominated by drone manufacturers and system integrators who focus on assembling the UAV platform, developing proprietary flight control systems, and crucially, integrating the surveillance software and AI analytics engines that turn raw data into actionable intelligence. This stage represents the greatest value addition, particularly through the development of intuitive Ground Control Stations (GCS) and robust, secure communication links. The integration complexity is heightened by the need for regulatory compliance (e.g., meeting national security standards for data encryption) and ensuring interoperability with existing end-user security networks. Companies that excel in modular design and seamless software updates maintain a significant competitive edge in this stage, offering greater flexibility and future-proofing to their clientele.

Downstream activities involve the distribution channels—which include direct sales to large governmental entities and military organizations, and indirect distribution through specialized surveillance integrators and DaaS providers serving the commercial market. The service providers are responsible for deployment logistics, pilot training, regulatory clearance acquisition for specific missions, and continuous system maintenance. The indirect channel, particularly the Drone-as-a-Service model, is becoming increasingly critical for commercial end-users as it lowers the barrier to entry by shifting the technical and regulatory burden onto the specialized service provider. Success in the downstream market hinges on robust local support infrastructure, compliance expertise, and the ability to tailor surveillance solutions precisely to the unique operational challenges faced by the end-user, such as monitoring expansive agricultural areas or complex urban environments.

Drone Surveillance System Market Potential Customers

The primary customers for Drone Surveillance Systems are diverse yet unified by the need for persistent, reliable, and cost-effective aerial monitoring capabilities, falling broadly into governmental and critical infrastructure categories. Governmental end-users constitute the largest market share, predominantly driven by military and national defense organizations that utilize high-end, long-endurance fixed-wing and VTOL drones for Intelligence, Surveillance, and Reconnaissance (ISR), border patrol, and counter-insurgency operations. Law enforcement agencies and public safety departments represent the second major governmental buyer group, deploying rotary-wing drones for rapid incident response, forensic mapping, search and rescue, and large-scale crowd monitoring, seeking systems that emphasize ease of deployment and real-time situational awareness. These customers demand highly secure, ruggedized systems with certified operational pedigrees, often procured through established defense contracts and specialized procurement channels.

Critical infrastructure operators form the rapidly expanding private sector customer base. This includes major entities in the energy sector (oil and gas pipelines, power transmission lines, nuclear facilities), utilities (water management, communication towers), and transportation hubs (ports, airports, railways). These organizations leverage drone surveillance to conduct routine inspections, monitor physical security perimeters, and rapidly assess damage following environmental events, significantly reducing inspection costs and minimizing downtime compared to traditional methods like helicopters or manual inspections. The key purchasing criteria for these commercial buyers are cost of ownership, scalability, reliability in harsh environments, and the ability of the system to integrate seamlessly with existing enterprise asset management and security software platforms, often preferring subscription-based service models that ensure continuous technological relevance without massive capital outlay.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 16.9 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lockheed Martin Corporation, Northrop Grumman Corporation, AeroVironment Inc., DJI, FLIR Systems (Teledyne FLIR), Thales Group, BAE Systems, Elbit Systems Ltd., Saab AB, General Atomics Aeronautical Systems Inc., Draganfly Inc., Insitu (A Boeing Company), Textron Inc., Israel Aerospace Industries (IAI), Parrot Drones SAS, Raytheon Technologies Corporation, Leonardo S.p.A., Anduril Industries, Skydio, Inc., Teledyne Technologies Incorporated |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drone Surveillance System Market Key Technology Landscape

The technological landscape of the Drone Surveillance System Market is rapidly advancing, focusing primarily on enhancing autonomy, improving data acquisition quality, and ensuring robust, secure communication links. A cornerstone of modern surveillance systems is the proliferation of high-resolution multi-modal sensors, including Electro-Optical/Infrared (EO/IR) gimbals for day and night operation, sophisticated LiDAR for 3D mapping and terrain navigation, and miniature Synthetic Aperture Radar (SAR) systems capable of penetrating foliage or low-visibility conditions. The increasing integration of these advanced payloads provides persistent, all-weather surveillance capabilities crucial for military and critical infrastructure security. Furthermore, improved battery chemistry and aerodynamic designs are pushing UAV flight endurance, allowing for hours of continuous monitoring, significantly reducing the cost per flight hour and increasing operational effectiveness across expansive geographical areas such as border zones or offshore assets.

Beyond hardware, the primary technological differentiator lies in advanced processing capabilities, specifically Edge Computing and Artificial Intelligence (AI). Edge computing involves situating powerful processors directly on the drone platform, enabling real-time analysis of massive data streams without transmitting everything back to a central ground station. This reduces communication bandwidth requirements and minimizes latency, which is critical for time-sensitive applications like autonomous threat tracking or immediate localized decision-making. AI and machine learning algorithms are utilized for sophisticated computer vision tasks, including automated anomaly detection, target recognition, behavioral analysis, and classifying objects under diverse environmental conditions. This AI integration allows the surveillance system to transition from simple data collection to providing immediate, actionable intelligence to the human operator, significantly reducing cognitive load and maximizing the effectiveness of limited personnel resources.

Connectivity and networking technologies are also paramount, particularly with the rise of network-centric warfare and expanded commercial BVLOS operations. The adoption of 5G infrastructure provides the low latency and high bandwidth necessary to reliably control drones and transmit high-fidelity video feeds over long distances. Secure, resilient mesh networking capabilities enable drone swarms to communicate internally and maintain connectivity even in GPS-denied environments or areas with jamming, ensuring mission continuity. Finally, Counter-UAS (C-UAS) technology is rapidly becoming integrated into surveillance systems, allowing surveillance drones to identify and track unauthorized or hostile drones operating within their protected airspace. This defensive capability transforms the surveillance drone into an integral component of a layered air defense system, reflecting the market’s focus on comprehensive airspace security solutions and mitigating the threat posed by malicious or errant unmanned aerial vehicles.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by extensive defense spending in the United States and Canada, which fuels advanced research and development in drone autonomy, sensor fusion, and AI-enabled ISR platforms. The U.S. Federal Aviation Administration (FAA) is gradually liberalizing BVLOS regulations, although strict frameworks still exist, encouraging large defense contractors and tech giants to invest heavily in next-generation surveillance systems for homeland security and critical infrastructure protection, particularly in border areas and major metropolitan centers.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, driven by escalating geopolitical tensions, significant investments in maritime security (particularly by China, India, and Japan), and massive infrastructural development (e.g., smart cities, energy grids). This region benefits from a large, competitive manufacturing base, making drone hardware more accessible. The market is characterized by rapid adoption of commercial surveillance applications in environmental monitoring, disaster management, and large-scale industrial facility security, often operating under less stringent regulatory hurdles than North America or Europe.

- Europe: The European market is characterized by a high emphasis on sophisticated border management (e.g., Frontex operations) and counter-terrorism initiatives, alongside strict regulatory oversight led by EASA (European Union Aviation Safety Agency). Growth is fueled by government demand for advanced surveillance solutions to monitor maritime zones and ensure critical infrastructure resilience. The focus here is balanced between acquiring high-quality military platforms and integrating ethical, privacy-compliant systems for civil applications, requiring manufacturers to meet rigorous data protection standards like GDPR.

- Middle East and Africa (MEA): This region is a significant consumer of advanced military drone surveillance technology, driven by persistent internal security concerns, regional conflicts, and large-scale investments in oil and gas infrastructure protection. High defense budgets, particularly in the Gulf Cooperation Council (GCC) countries, lead to robust demand for long-endurance, high-altitude surveillance platforms for monitoring vast desert and coastal areas. Commercial use is emerging, focused on massive construction projects and energy infrastructure integrity checks.

- Latin America: This market segment is growing steadily, primarily driven by governmental needs related to combating illegal activities, including drug trafficking, deforestation, and illegal mining, especially across expansive, often inaccessible territories like the Amazon basin. Law enforcement and environmental agencies are key purchasers, prioritizing cost-effective, durable systems for wide-area monitoring and rapid response capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drone Surveillance System Market.- Lockheed Martin Corporation

- Northrop Grumman Corporation

- AeroVironment Inc.

- DJI

- Teledyne FLIR (formerly FLIR Systems)

- Thales Group

- BAE Systems

- Elbit Systems Ltd.

- Saab AB

- General Atomics Aeronautical Systems Inc.

- Draganfly Inc.

- Insitu (A Boeing Company)

- Textron Inc.

- Israel Aerospace Industries (IAI)

- Parrot Drones SAS

- Raytheon Technologies Corporation

- Leonardo S.p.A.

- Anduril Industries

- Skydio, Inc.

- Teledyne Technologies Incorporated

Frequently Asked Questions

Analyze common user questions about the Drone Surveillance System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Drone Surveillance System Market?

The primary driver is the accelerating global need for enhanced security measures and persistent monitoring of critical infrastructure and national borders, coupled with the decreasing cost and increasing capability of advanced sensor technologies and AI integration in UAV platforms.

How does Artificial Intelligence impact the effectiveness of drone surveillance systems?

AI significantly enhances effectiveness by enabling real-time autonomous object detection, classification, and tracking, transforming raw footage into actionable intelligence. AI also facilitates complex coordinated operations (swarming) and predictive maintenance capabilities.

What are the main regulatory challenges facing commercial drone surveillance adoption?

The main challenges are stringent and often fragmented regulatory frameworks, particularly restrictions on Beyond Visual Line of Sight (BVLOS) operations, which limit the ability of commercial operators to conduct long-range, continuous surveillance missions efficiently.

Which component segment is expected to experience the fastest growth rate?

The Software and Services component segment, particularly those offering AI-powered data analytics and Drone-as-a-Service (DaaS) models, is expected to grow fastest. This shift is driven by the need for advanced processing capabilities to manage and interpret the massive volume of collected surveillance data.

Who are the major end-users of high-end drone surveillance systems globally?

The major end-users are military and defense organizations, followed closely by homeland security and law enforcement agencies. Critical infrastructure operators in the energy, utilities, and transportation sectors represent the fastest-growing commercial end-user base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager