Drum Melters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433056 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Drum Melters Market Size

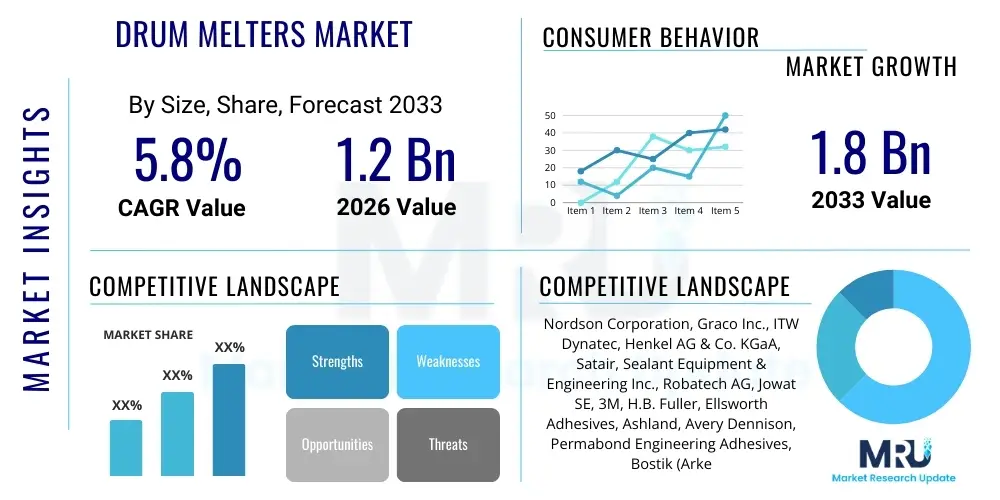

The Drum Melters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at 1.2 Billion USD in 2026 and is projected to reach 1.8 Billion USD by the end of the forecast period in 2033. This consistent growth trajectory is fueled primarily by the increasing automation across various manufacturing sectors, particularly packaging and automotive, which rely heavily on efficient, high-throughput adhesive and sealant dispensing systems. The demand for drum melters, which are essential for processing high-viscosity materials stored in standard industry drums, is intrinsically linked to global industrial output expansion and the shift towards sophisticated, environmentally compliant materials that require precise temperature control and melting capabilities. Market expansion is further supported by technological advancements focusing on energy efficiency and improved material handling ergonomics.

Drum Melters Market introduction

The Drum Melters Market encompasses equipment designed to efficiently melt and dispense viscous materials, such as hot melt adhesives, sealants, waxes, and specialized polymers, packaged in standard industrial drums (typically 55-gallon, 30-gallon, or 5-gallon sizes). These systems are crucial components in manufacturing lines requiring continuous and controlled application of materials in large volumes. Drum melters function by applying controlled heat to the material within the drum, often utilizing platen-based technology or follower plates to create a tight seal and minimize thermal degradation while ensuring consistent material flow to the dispensing heads or applicators. Their primary function is to transform solid or highly viscous raw materials into a pumpable, workable state suitable for automated application.

Major applications of drum melters span across diverse heavy and light manufacturing industries, including high-speed packaging operations where hot melt adhesives secure cartons and packages, the automotive sector utilizing structural adhesives and sealants for assembly and noise reduction, and the construction industry employing specialized moisture-curing sealants. Key benefits derived from utilizing these systems include enhanced process efficiency due to continuous material availability, reduced material waste through precise melting and dispensing, improved worker safety by minimizing manual handling of high-temperature materials, and superior product quality resulting from consistent material temperature and viscosity control. These benefits collectively drive the adoption of drum melting technology globally.

Driving factors for the market include the robust growth of the global packaging industry, particularly flexible and sustainable packaging solutions requiring advanced bonding agents. The increasing complexity and use of lightweight materials in the automotive and aerospace industries necessitate high-performance, specialized adhesives and sealants, processed effectively by drum melters. Furthermore, stringent regulatory standards concerning volatile organic compounds (VOCs) are accelerating the shift toward solvent-free, 100% solids hot melt formulations, which often require specialized melting equipment capable of handling high viscosity and precise thermal profiles, thus sustaining market momentum.

Drum Melters Market Executive Summary

The Drum Melters Market is experiencing dynamic growth driven by automation imperatives and the necessity for precise material processing in high-volume manufacturing environments. Business trends indicate a strong move towards integrated systems, where drum melters are seamlessly linked with robotic dispensing arms and sophisticated monitoring software to ensure optimal material flow and quality control. This integration minimizes downtime and maximizes the utilization of increasingly expensive specialty adhesives. Furthermore, sustainability is becoming a key business focus, pushing manufacturers towards energy-efficient melter designs and systems capable of processing bio-based or recycled adhesive formulations without compromising performance. Competitive strategies involve expanding service networks and offering modular, scalable melter solutions that can adapt to varying production demands and drum sizes.

Regional trends reveal that Asia Pacific (APAC) is the fastest-growing market, largely due to rapid industrialization, particularly in China and India, coupled with massive investments in automotive and electronics manufacturing infrastructure. North America and Europe remain mature markets characterized by replacement demand, technological upgrades focused on Industry 4.0 connectivity, and a strong preference for advanced, high-precision equipment suitable for complex industrial applications such as electronic component assembly and medical device manufacturing. Regulatory pressures regarding workplace safety and environmental compliance further necessitate the adoption of modern, enclosed drum melter systems in these developed economies, ensuring sustained high average selling prices for sophisticated units.

Segment trends highlight the dominance of the 55-gallon drum size segment, driven by large-scale users in packaging and construction. However, the smaller 5-gallon and 30-gallon units are gaining traction in specialized manufacturing and high-value applications, such as medical and aerospace, where batch sizes are smaller or material changeovers are frequent. In terms of melt material, the hot melt adhesives segment, including Polyurethane Reactive (PUR) and standard EVA/Polyolefin types, holds the largest share, reflecting its ubiquity across numerous end-use sectors. Technology segmentation shows a growing adoption of specialized cold melt systems alongside established hot melt technology, catering to materials sensitive to high temperatures, further diversifying product offerings.

AI Impact Analysis on Drum Melters Market

Common user questions regarding AI's impact on the Drum Melters Market revolve around predictive maintenance capabilities, optimization of melting cycles, and integration with broader supply chain logistics. Users are keen to understand how AI can minimize adhesive degradation (a common concern when materials are exposed to heat for extended periods), predict component failure in pumping systems, and ultimately reduce operational expenditure (OPEX) through optimized energy consumption. There is significant interest in leveraging machine learning algorithms to analyze material usage patterns, forecast adhesive needs, and automatically adjust melting parameters based on ambient temperature or production speed fluctuations, thereby enhancing system responsiveness and material integrity. The key theme is the shift from reactive maintenance and static process settings to proactive, adaptive, and intelligent melting operations.

The core concerns center on the cost and complexity of implementing AI-driven monitoring systems into existing legacy drum melters, data security vulnerabilities associated with cloud-connected industrial equipment, and the need for specialized training for maintenance personnel. Expectations focus strongly on achieving "zero defect" dispensing through real-time viscosity monitoring and autonomous parameter adjustments. Users anticipate AI will not necessarily replace the mechanical function of the drum melter but will transform its control, efficiency, and integration within the smart factory ecosystem. This strategic overlay of intelligence is expected to differentiate high-end melter manufacturers who successfully transition from hardware suppliers to providers of integrated material processing solutions.

- AI-Powered Predictive Maintenance: Algorithms analyze vibration, temperature, and pressure data from pumps and heating elements to anticipate failures, maximizing uptime.

- Optimized Energy Consumption: Machine learning models adjust heating cycles based on real-time demand forecasting and material thermal properties, minimizing electricity usage.

- Real-time Viscosity Control: AI monitors material flow and automatically adjusts melt temperature or pump speed to maintain optimal viscosity for dispensing, reducing application errors.

- Inventory and Supply Chain Integration: AI systems forecast adhesive consumption rates, triggering automated replenishment orders and optimizing drum utilization.

- Automated Process Calibration: Self-learning systems adapt melting parameters (temperature ramp rates, platen pressure) to new adhesive batches or environmental changes, ensuring consistent material quality.

DRO & Impact Forces Of Drum Melters Market

The market dynamics for drum melters are shaped by a confluence of accelerating industrial automation (Driver), stringent safety and regulatory hurdles (Restraint), and the emergence of specialized high-performance materials (Opportunity). The primary impact force is the pervasive adoption of Industry 4.0 concepts, mandating that industrial equipment, including drum melters, be capable of real-time communication, remote diagnostics, and seamless integration into factory-wide Manufacturing Execution Systems (MES). This push for smart functionality elevates the barrier to entry for lower-end manufacturers and places intense pressure on established players to continuously innovate their control platforms. Simultaneously, global economic volatility and fluctuations in raw material prices for both adhesives and the metal used in melter construction introduce pricing instability, affecting capital expenditure decisions among end-users.

Driving forces center around the global increase in packaged goods consumption, demanding faster, more reliable bonding solutions, and the continuous innovation in adhesive chemistry, requiring specialized melting equipment that can handle higher melt temperatures and complex materials like polyurethane reactive (PUR) hot melts. However, market growth is tempered by significant restraints, primarily the high initial capital investment required for sophisticated drum melting and dispensing systems, which can deter Small and Medium Enterprises (SMEs). Furthermore, the long operational lifespan of current equipment means replacement cycles are lengthy, slowing the adoption rate of newer, more efficient models. The complexity associated with maintaining and troubleshooting advanced dispensing systems also requires specialized technical expertise, representing an operational challenge for many users.

Opportunities for expansion lie in the developing regions of APAC and Latin America, where manufacturing capabilities are rapidly scaling up, creating substantial greenfield investment opportunities. The shift towards sustainable manufacturing practices opens avenues for drum melters specifically designed for bio-based or recycled adhesives, offering manufacturers a competitive edge. Moreover, the increasing demand for miniaturization in electronics and medical devices necessitates extremely precise dispensing of high-viscosity materials, driving demand for specialized, smaller-capacity melters integrated with high-precision pumping technologies. The synergistic effect of these drivers and opportunities, coupled with ongoing technological improvements addressing restraint challenges, generates a substantial positive impact force on the overall market trajectory.

Segmentation Analysis

The Drum Melters Market is highly segmented based on material processed, drum capacity, melting technology employed, and the specific end-use industry. This layered segmentation allows manufacturers to tailor products precisely to the varied requirements of their customer base, ranging from high-volume automotive assembly to highly specialized electronics encapsulation. Analyzing these segments is critical for understanding current market dynamics, identifying high-growth niches, and formulating effective market penetration strategies. The primary differentiators between segments often involve temperature range, pump capacity, material compatibility (e.g., handling moisture-sensitive PURs versus standard EVA), and the level of automation integration offered by the control system.

The dominance of the packaging sector underscores the importance of high-speed, reliable hot melt melters optimized for standard EVA and polyolefin adhesives, driving volume in the 55-gallon segment. Conversely, sectors like medical and aerospace emphasize precision and material integrity, leading to higher adoption rates for specialized, smaller-capacity melters (5-gallon or 30-gallon) featuring sophisticated inert gas blanketing capabilities to protect sensitive materials from atmospheric moisture and oxidation. Technology-wise, while conventional hot melt systems are ubiquitous, the increasing demand for room-temperature dispensing of certain sealants and coatings is boosting the cold melt segment, particularly in construction and general assembly applications where rapid solidification is not desired.

- By Melt Material

- Adhesives (Hot Melt, PUR, PSA)

- Sealants and Caulks

- Waxes and Paraffin

- Specialty Polymers and Coatings

- By Drum Size

- 5-gallon (20-liter)

- 30-gallon (113-liter)

- 55-gallon (208-liter)

- By Technology

- Hot Melt Drum Melters

- Cold Melt Drum Melters

- Specialized Extrusion Systems

- By End-Use Industry

- Packaging and Converting

- Automotive and Transportation

- Construction and Infrastructure

- Electronics and Appliance Manufacturing

- Medical and Hygiene Products

- General Assembly and Others

Value Chain Analysis For Drum Melters Market

The value chain for the Drum Melters Market commences with upstream activities involving raw material suppliers, primarily specialized metal alloy providers (for components requiring high heat resistance and durability) and electronics manufacturers supplying sensors, controllers, and programmable logic controllers (PLCs). The quality and consistency of these upstream components directly influence the longevity and performance of the final melter unit. Key strategic relationships at this stage involve securing reliable, high-quality components, particularly for critical heating elements and high-precision pumps, which constitute a significant portion of the melter's cost and technical complexity. Efficiency in this phase dictates manufacturing cost optimization and the ability to incorporate cutting-edge technologies like advanced connectivity modules.

Midstream activities involve the core drum melter manufacturers who focus on design, fabrication, assembly, and rigorous testing. This stage is characterized by high engineering intensity, especially concerning thermal management, fluid dynamics modeling for pumping efficiency, and user interface development. Successful manufacturers integrate advanced manufacturing techniques, such as lean production and automated assembly, to ensure high quality and scalability. The direct distribution channel involves large melter manufacturers selling complex, customized, and integrated systems directly to large end-users (e.g., Tier 1 automotive suppliers or major packaging corporations), allowing for direct consultation, installation, and post-sales service tailored to highly specific application needs and maximizing customer relationship value.

The indirect distribution channel leverages a network of specialized industrial distributors, system integrators, and value-added resellers (VARs). These intermediaries play a crucial role in reaching smaller manufacturers (SMEs) and providing localized technical support, inventory stocking, and minor system customizations. Downstream analysis focuses on the end-users—the various manufacturing sectors—whose requirements dictate the melter specifications. Post-sales services, including maintenance contracts, spare parts supply, technical training, and system upgrades, represent a vital revenue stream and a key competitive differentiator in the value chain, ensuring high customer retention rates and maximizing the operational lifespan of the capital equipment.

Drum Melters Market Potential Customers

The primary customers for drum melters are major manufacturers operating production lines that require continuous, high-volume dispensing of hot melt adhesives, sealants, or specialized viscous coatings. These end-users are defined by their reliance on automated processes where manual material handling is impractical or inconsistent. Key buyers include large corporations in the Fast-Moving Consumer Goods (FMCG) packaging sector, such as food and beverage producers and personal care product companies, who utilize melters for carton sealing and tray forming at high speeds. Their purchasing decisions are highly sensitive to uptime, energy efficiency, and ease of integration with existing packaging machinery.

Another significant customer segment includes the automotive industry, encompassing both original equipment manufacturers (OEMs) and Tier 1 and Tier 2 suppliers. These companies utilize drum melters for critical applications such as bonding structural components, applying sound dampening materials, and sealing windows and electronic modules. The purchasing criteria here are dominated by precision, repeatability, and the ability to process high-performance, often moisture-sensitive, adhesives like Polyurethane Reactives (PURs) under tightly controlled conditions. The requirement for detailed process documentation and validation also makes these customers seek melters with advanced data logging and Industry 4.0 connectivity features.

Furthermore, the construction industry (for sealants, roofing materials, and insulation bonding), the medical device sector (for non-woven product assembly and specialized bonding), and electronics manufacturing (for potting and encapsulation) represent specialized, high-growth customer bases. These buyers often require melters capable of handling diverse chemistries, operating within cleanroom standards (in the case of medical devices), and providing meticulous temperature uniformity to preserve material integrity during the melting process. Procurement is usually driven by total cost of ownership (TCO), system reliability, and compliance with specific industry standards (e.g., FDA regulations or specific automotive standards like IATF 16949).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 1.2 Billion USD |

| Market Forecast in 2033 | 1.8 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Graco Inc., ITW Dynatec, Henkel AG & Co. KGaA, Satair, Sealant Equipment & Engineering Inc., Robatech AG, Jowat SE, 3M, H.B. Fuller, Ellsworth Adhesives, Ashland, Avery Dennison, Permabond Engineering Adhesives, Bostik (Arkema Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drum Melters Market Key Technology Landscape

The technological landscape of the Drum Melters Market is characterized by continuous refinement aimed at improving thermal efficiency, material integrity, and operational connectivity. Platen-based melting technology remains the dominant method, utilizing a heated platen or follower plate that seals against the material surface, melting only the top layer as needed. This design minimizes the exposure of the bulk material to heat, significantly reducing thermal degradation, especially crucial for materials like reactive polyurethanes (PURs) that degrade rapidly when overheated or exposed to moisture. Recent innovations in platen design include segmented heating zones and non-stick coatings to improve heat transfer uniformity and ease of cleaning, thereby enhancing overall system reliability and material throughput.

A major focus is on integrated pumping systems and control architecture. Modern drum melters utilize high-precision gear pumps or piston pumps, often coupled with flux-vector control or servo drives, to ensure extremely accurate and pulsation-free material delivery, vital for robotic dispensing applications. The control technology has advanced significantly, moving towards PLC-based systems equipped with high-resolution touchscreen interfaces and embedded diagnostic capabilities. This shift supports the Industry 4.0 mandate by enabling seamless communication via protocols such as Ethernet/IP and Profinet, allowing for remote monitoring, data logging of crucial process variables (temperature profiles, pressure, flow rate), and centralized quality control management across multiple units.

Furthermore, technology development is heavily influenced by sustainability and safety requirements. Energy-efficient heating technology, including advanced insulation and optimized wattage control, is being implemented to reduce operational energy costs. For handling reactive materials, specialized systems incorporating nitrogen blanketing or dehumidified air purging are standard features, preventing moisture ingress that can prematurely cure adhesives inside the drum or pump. The evolution of the technology landscape ensures that drum melters move beyond simple heating devices to sophisticated, data-generating, and environmentally controlled material processing units essential for high-tech manufacturing processes.

Regional Highlights

- North America: Characterized by early adoption of highly automated, high-precision dispensing systems, particularly in the automotive, aerospace, and non-woven hygiene product sectors. The region maintains strong demand for sophisticated melters with robust data connectivity and predictive maintenance features. Stringent safety regulations drive the adoption of fully enclosed and sealed systems, maintaining premium pricing.

- Europe: A mature market focusing heavily on sustainability and energy efficiency. European manufacturers often lead in developing melters optimized for bio-based and low-VOC adhesives. Germany, Italy, and the Benelux countries show high utilization in advanced machinery manufacturing and packaging, emphasizing modular design and rapid material changeover capabilities.

- Asia Pacific (APAC): The fastest-growing region, fueled by massive expansion in manufacturing capacity, particularly in China, India, and Southeast Asia. Growth is driven by both large-scale packaging operations and increasing sophistication in electronics assembly and automotive production. This region exhibits demand for a wide range of melter types, from cost-effective standard units to advanced, imported high-precision systems.

- Latin America (LATAM): Emerging market demonstrating steady growth, driven by increasing foreign investment in localized manufacturing, especially in Brazil and Mexico (automotive and construction sectors). Demand is typically concentrated on reliable, rugged equipment suitable for moderate automation levels and capable of handling varying power supply conditions.

- Middle East and Africa (MEA): Growth is focused on infrastructure projects (construction sealants) and developing packaging sectors. Demand is specialized, often targeting heavy-duty melters for materials used in extreme climate applications. Market penetration remains lower compared to developed regions but shows stable potential linked to economic diversification efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drum Melters Market.- Nordson Corporation

- Graco Inc.

- ITW Dynatec

- Henkel AG & Co. KGaA

- Satair

- Sealant Equipment & Engineering Inc.

- Robatech AG

- Jowat SE

- 3M

- H.B. Fuller

- Ellsworth Adhesives

- Ashland

- Avery Dennison

- Permabond Engineering Adhesives

- Bostik (Arkema Group)

Frequently Asked Questions

Analyze common user questions about the Drum Melters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using platen-based drum melters over traditional melt tanks?

Platen-based systems significantly reduce thermal degradation and charring of hot melt adhesives by melting only the top layer of the material on demand. This minimizes exposure to prolonged high heat, reduces material waste, and extends the lifespan of sensitive adhesives like PURs. They also offer cleaner material changeovers and superior sealing capabilities against ambient moisture.

How does Industry 4.0 integration benefit drum melter operations?

Industry 4.0 integration allows drum melters to connect seamlessly to factory networks, enabling real-time monitoring of critical parameters (temperature, pressure, flow), remote diagnostics, and predictive maintenance scheduling. This connectivity minimizes unexpected downtime, optimizes material usage, and ensures consistent quality control through centralized data logging.

Which end-use industry drives the highest demand for 55-gallon drum melters?

The Packaging and Converting industry drives the highest volume demand for 55-gallon drum melters. These large-capacity units are essential for high-speed, continuous production lines requiring massive quantities of standard hot melt adhesives used for carton sealing, tray forming, and product assembly in FMCG manufacturing.

What specific technological features are required to process moisture-sensitive Polyurethane Reactive (PUR) adhesives?

Processing PUR adhesives requires specialized drum melters featuring airtight platen seals and often incorporating nitrogen blanketing or dehumidified air systems (inert gas purging). These features prevent atmospheric moisture from reacting with the PUR material during the melting and dispensing process, maintaining material reactivity and preventing premature curing.

How is sustainability influencing the design and technology of new drum melters?

Sustainability influences design through the demand for energy-efficient heating systems and advanced insulation to reduce power consumption. Furthermore, melters are being designed to handle next-generation, environmentally friendly materials, such as bio-based or recycled content adhesives, requiring precise thermal profiles to ensure proper melting without degradation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager