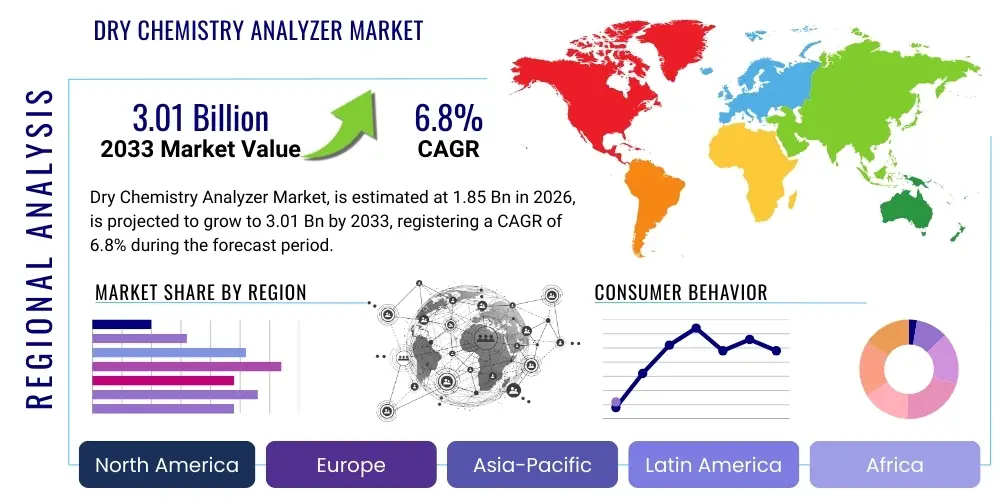

Dry Chemistry Analyzer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440072 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Dry Chemistry Analyzer Market Size

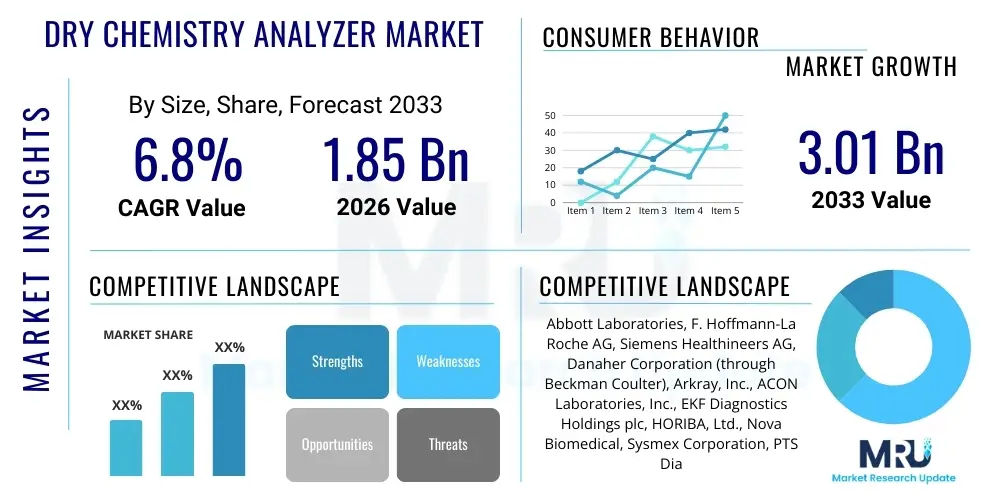

The Dry Chemistry Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 billion in 2026 and is projected to reach USD 3.01 billion by the end of the forecast period in 2033. This growth trajectory is underpinned by the increasing global demand for rapid, accurate, and decentralized diagnostic solutions, particularly in point-of-care settings. The inherent advantages of dry chemistry analyzers, such as ease of use, minimal reagent handling, and portability, position them as critical tools in modern healthcare delivery, contributing significantly to their expanding market footprint across diverse clinical and non-clinical applications.

Dry Chemistry Analyzer Market introduction

The Dry Chemistry Analyzer Market encompasses a range of diagnostic devices that utilize dry reagents to perform various biochemical tests, eliminating the need for wet reagents, water, or extensive laboratory infrastructure. These analyzers operate on principles such as reflectance photometry, where light reflected from a test strip changes based on the analyte concentration, providing quantitative results. This technology offers significant advantages, including rapid turnaround times, portability, minimal sample volume requirements, and simplified operation, making them ideal for point-of-care testing (POCT) and settings with limited resources. The core product description revolves around a compact, user-friendly instrument designed for quick and reliable analysis of various analytes in blood, urine, or other body fluids, often employing disposable test strips or cartridges.

Major applications for dry chemistry analyzers span a broad spectrum of healthcare segments. They are extensively used in blood glucose monitoring for diabetes management, lipid panel testing for cardiovascular risk assessment, liver and renal function tests, electrolyte analysis, and urinalysis. Beyond routine clinical diagnostics in hospitals and clinics, these analyzers find critical utility in emergency rooms, remote healthcare facilities, veterinary clinics, and even home-based patient monitoring. The versatility and efficiency of dry chemistry platforms allow for swift diagnostic decisions, which are paramount in acute care settings and for managing chronic conditions effectively.

The benefits derived from the adoption of dry chemistry analyzers are multifaceted. They include enhanced patient convenience due to rapid results at the point of care, reduced laboratory workflow burdens, improved diagnostic accessibility in underserved areas, and a lower environmental footprint compared to traditional wet chemistry methods, primarily due to less waste generation. Key driving factors propelling market expansion include the escalating global prevalence of chronic diseases suchates diabetes, cardiovascular conditions, and renal disorders, all necessitating frequent monitoring. Furthermore, an aging global population, the increasing emphasis on preventive healthcare, the decentralization of diagnostic services, and continuous technological advancements leading to more comprehensive test menus and enhanced accuracy are significant contributors to the market's robust growth.

Dry Chemistry Analyzer Market Executive Summary

The Dry Chemistry Analyzer Market is experiencing dynamic growth, driven by a confluence of evolving business trends, distinct regional market dynamics, and burgeoning segment-specific demands. In terms of business trends, the industry is witnessing a robust focus on strategic collaborations, mergers, and acquisitions aimed at expanding product portfolios, enhancing technological capabilities, and increasing market reach, particularly in emerging economies. There is a growing emphasis on research and development to introduce innovative, multi-parameter testing platforms and integrated solutions that offer broader diagnostic capabilities and seamless data connectivity with electronic health records (EHRs) and laboratory information systems (LIS). Furthermore, sustainability initiatives are gaining traction, with manufacturers striving to reduce waste and improve the eco-friendliness of their test consumables and instruments, aligning with global environmental concerns and regulatory pressures.

Regionally, the market exhibits varied growth patterns and maturity levels. North America and Europe, characterized by advanced healthcare infrastructures, high healthcare expenditure, and a strong emphasis on early disease detection and management, currently hold dominant market shares. These regions are also early adopters of new technologies, further bolstering their market positions. The Asia Pacific region, however, is projected to demonstrate the fastest growth rate, fueled by rapidly developing healthcare sectors, increasing awareness about chronic diseases, rising disposable incomes, and significant investments in healthcare infrastructure by governments and private entities. Latin America, the Middle East, and Africa are also emerging as promising markets, driven by improving healthcare access, increasing prevalence of infectious and non-communicable diseases, and growing demand for affordable and accessible diagnostic solutions.

Segment-wise, the market's expansion is particularly evident across several key areas. The point-of-care testing segment, encompassing applications in clinics, emergency rooms, and home care, is experiencing substantial growth due to the demand for immediate results and decentralized diagnostics. Within applications, blood glucose monitoring continues to be a cornerstone, but other areas such as lipid panel testing, liver and renal function analysis, and infectious disease diagnostics using dry chemistry are gaining significant traction. End-user segments like hospitals and diagnostic centers remain major consumers, but the home care and veterinary diagnostics sectors are demonstrating accelerated adoption, reflecting a broader shift towards accessible and patient-centric healthcare models. The increasing sophistication and expanding test menu of dry chemistry analyzers are key drivers for this diversified segmental growth.

AI Impact Analysis on Dry Chemistry Analyzer Market

The integration of Artificial intelligence (AI) is poised to significantly transform the Dry Chemistry Analyzer Market, addressing key user questions related to diagnostic accuracy, workflow efficiency, and data management. Users are increasingly curious about how AI can enhance the precision of test results by minimizing human error in interpretation, particularly for visually complex readings or subtle changes on test strips. There is also considerable interest in AI's potential to automate and streamline the entire diagnostic process, from sample analysis and quality control to result interpretation and reporting, thereby reducing turnaround times and optimizing laboratory personnel allocation. Furthermore, users are exploring AI's role in predictive analytics, enabling earlier disease detection, personalized treatment recommendations, and improved patient outcomes through intelligent data pattern recognition. Concerns often revolve around data security, regulatory compliance, and the need for robust validation of AI algorithms to ensure clinical reliability and avoid misdiagnosis. Users also seek clarity on how AI integration will impact existing infrastructure and require training for healthcare professionals.

- Enhanced Diagnostic Algorithms: AI algorithms can analyze complex reflectance patterns or subtle color changes on test strips with greater precision than the human eye or conventional photometric methods, leading to more accurate and consistent results, reducing inter-operator variability.

- Automated Data Interpretation and Reporting: AI can automate the interpretation of results, flag abnormal values, and generate comprehensive reports, minimizing manual review time and potential for transcription errors, thus improving overall laboratory efficiency.

- Predictive Maintenance and Quality Control: AI models can monitor analyzer performance in real-time, predict potential equipment failures, and suggest proactive maintenance, ensuring continuous operation and high data integrity, while also optimizing calibration schedules.

- Personalized Patient Management: By integrating test results with patient historical data and other clinical parameters, AI can assist healthcare providers in developing more personalized treatment plans and predicting disease progression or response to therapy.

- Remote Monitoring and Telemedicine Integration: AI-powered dry chemistry analyzers can seamlessly integrate with telehealth platforms, enabling remote diagnostic capabilities, facilitating real-time data sharing with clinicians, and supporting remote patient management, especially in distributed healthcare models.

- Optimized Workflow and Resource Allocation: AI can analyze workflow patterns within clinics or labs, identify bottlenecks, and suggest optimal resource allocation, leading to more efficient patient flow and better utilization of personnel and equipment.

- Expanded Test Menu and Development: AI can accelerate the research and development of new dry chemistry test parameters by rapidly analyzing vast datasets of chemical reactions and clinical outcomes, leading to more comprehensive diagnostic panels.

DRO & Impact Forces Of Dry Chemistry Analyzer Market

The Dry Chemistry Analyzer Market is propelled by a robust set of drivers, simultaneously encountering various restraints, and poised to capitalize on significant opportunities, all influenced by overarching impact forces. Key drivers include the escalating global prevalence of chronic diseases such as diabetes, cardiovascular conditions, and renal disorders, which necessitate frequent and rapid diagnostic monitoring. The increasing demand for point-of-care testing (POCT) in diverse settings, ranging from physician offices to emergency rooms and remote clinics, further fuels market growth due to the convenience and immediate results offered by dry chemistry systems. Moreover, an aging global population contributes to a higher burden of age-related illnesses requiring diagnostic intervention. Technological advancements, particularly in sensor technology, miniaturization, and improved assay specificity, are continuously expanding the capabilities and test menus of these analyzers, making them more attractive. Government initiatives promoting early disease detection and preventive healthcare also act as significant market catalysts, supporting the adoption of accessible diagnostic tools. The ease of use, portability, and minimal infrastructure requirements of dry chemistry analyzers make them invaluable in resource-limited settings, fostering broader adoption.

However, the market also faces considerable restraints that could impede its full potential. The relatively high initial cost of advanced dry chemistry analyzers compared to some traditional laboratory equipment can be a barrier for smaller clinics or facilities with limited budgets. A more significant limitation is often the restricted test menu compared to fully automated wet chemistry analyzers, which can perform a much wider array of tests, making dry chemistry less suitable for comprehensive laboratory operations. Regulatory complexities and the stringent approval processes for diagnostic devices in various regions pose challenges for manufacturers in terms of time and cost. Reimbursement issues, where dry chemistry tests may not always be fully covered or reimbursed at favorable rates, can also affect adoption. Additionally, the requirement for specific, often proprietary, test strips or cartridges can lead to vendor lock-in and higher ongoing operational costs for end-users, while the need for precise calibration and quality control procedures, though simplified, still requires trained personnel to ensure accuracy.

Despite these challenges, substantial opportunities exist for market expansion and innovation. Emerging markets in Asia Pacific, Latin America, and Africa present significant untapped potential, driven by improving healthcare infrastructure, rising healthcare expenditure, and a large patient base. The ongoing development of new test parameters and the expansion of the test menu to cover a broader range of conditions will enhance the utility and market penetration of dry chemistry analyzers. Integration with digital health platforms, including telemedicine and electronic health records, represents a major opportunity to improve data management, patient care coordination, and remote monitoring capabilities. The growing trend towards home-based testing for chronic disease management and wellness monitoring offers a burgeoning market for compact, user-friendly dry chemistry devices. Furthermore, strategic collaborations between manufacturers and healthcare providers, as well as academic institutions, can accelerate product development and market access. The veterinary diagnostics segment is also a rapidly expanding niche, leveraging the advantages of dry chemistry for animal health management. These opportunities, coupled with the inherent benefits of dry chemistry, present a robust outlook for growth.

Segmentation Analysis

The Dry Chemistry Analyzer Market is comprehensively segmented to provide granular insights into its diverse components, allowing for a detailed understanding of market dynamics, growth drivers, and competitive landscapes across different product types, applications, end-users, and geographic regions. This segmentation is crucial for stakeholders to identify lucrative niches, formulate targeted strategies, and adapt to evolving market demands. Analysts typically categorize the market based on the inherent characteristics of the analyzers, their primary intended uses, the types of facilities or individuals employing them, and the geographical distribution of demand and supply. Each segment reveals unique patterns of adoption, technological preferences, and growth trajectories, collectively painting a complete picture of the market's structure and potential.

- By Product Type:

- Benchtop Analyzers: These are larger, more stationary units typically found in hospitals, diagnostic centers, and larger clinics, offering a broader test menu and higher throughput compared to portable versions. They are designed for regular, higher-volume testing.

- Portable/Handheld Analyzers: Characterized by their compact size, lightweight design, and battery operation, these devices are ideal for point-of-care testing, home care settings, remote clinics, and emergency medical services, prioritizing mobility and rapid results.

- By Application:

- Blood Glucose Monitoring: A dominant segment due to the global prevalence of diabetes and the need for frequent, self-monitoring.

- Lipid Panel Testing: Crucial for assessing cardiovascular risk and managing dyslipidemia.

- Electrolyte Testing: Essential for evaluating fluid balance, kidney function, and cardiac health.

- Liver Function Tests: Used to diagnose and monitor liver diseases.

- Renal Function Tests: Important for assessing kidney health and diagnosing renal impairments.

- Urinalysis: Basic diagnostic tool for kidney diseases, urinary tract infections, and other systemic conditions.

- Cardiac Markers Testing: For rapid diagnosis and monitoring of acute myocardial infarction and other cardiac events.

- Infectious Disease Testing: Growing segment for rapid screening of certain infectious agents, particularly in POCT settings.

- Other Applications: Include drug monitoring, toxicology screening, and various specialized biochemical analyses.

- By End-User:

- Hospitals: Utilize dry chemistry analyzers in emergency rooms, ICUs, wards, and outpatient departments for rapid diagnostics and decentralized testing.

- Clinics and Physician Offices: Primary care settings where quick diagnostic results aid in immediate patient management decisions.

- Diagnostic Centers: Offer a range of dry chemistry tests, often supplementing central laboratory services or providing specialized POCT options.

- Home Care Settings: Driven by increasing chronic disease prevalence and patient preference for self-monitoring and convenience.

- Veterinary Hospitals and Clinics: Employ dry chemistry analyzers for rapid animal health diagnostics, offering quick insights into various conditions.

- Research Laboratories: Used for specific research applications requiring quick and precise biochemical analysis.

- Pharmaceutical & Biotech Companies: For in-house screening, quality control, and preliminary testing during drug development.

Value Chain Analysis For Dry Chemistry Analyzer Market

The value chain for the Dry Chemistry Analyzer Market encompasses a complex series of activities, beginning with raw material sourcing and culminating in the delivery of diagnostic solutions to end-users, involving multiple upstream and downstream stakeholders. The upstream segment of the value chain is critical, focusing on the procurement of specialized raw materials and the manufacturing of intricate components essential for both the analyzer instruments and their associated consumables, primarily test strips and cartridges. This includes suppliers of high-purity chemicals for reagents, enzymes, and dyes, which are fundamental to the biochemical reactions on the test strips. Precision optics, sensor technology components, microfluidic structures, and advanced plastics for instrument housing and disposable components are also sourced from specialized manufacturers. Additionally, software and firmware developers contribute significantly to the intelligent processing and user interface of the analyzers, providing the computational backbone for accurate readings and data management. These upstream activities are vital for ensuring the quality, reliability, and cost-effectiveness of the final product, directly impacting manufacturing efficiency and overall product performance in the market.

Moving through the midstream, the core manufacturing and assembly processes take place, where all the procured components and raw materials are meticulously integrated to produce the dry chemistry analyzers and their consumables. This phase involves advanced engineering, stringent quality control, and often automated assembly lines to ensure consistency and precision. Research and development activities are intrinsically linked at this stage, focusing on innovation to expand test menus, improve accuracy, enhance portability, and integrate new features like connectivity and AI capabilities. Branding, marketing, and sales strategies are also developed and implemented during this phase to position products effectively in the competitive market, communicating their unique selling propositions to potential customers. The efficiency and technological prowess of manufacturers at this stage are key determinants of their market share and ability to respond to evolving diagnostic needs, driving continuous product enhancement and diversification.

The downstream segment focuses on the distribution and ultimate delivery of dry chemistry analyzers and their consumables to end-users. Distribution channels are varied and strategically chosen based on the target market and product type. Direct sales forces are often employed by major manufacturers to reach large hospital networks, key opinion leaders, and government healthcare procurement agencies, allowing for direct engagement, personalized support, and stronger customer relationships. Indirect distribution involves a network of third-party distributors, wholesalers, and medical device suppliers who have extensive reach into smaller clinics, independent diagnostic centers, veterinary practices, and remote healthcare facilities, leveraging their established logistics and local market knowledge. For certain products, particularly those for home-based use, e-commerce platforms and retail pharmacies serve as increasingly important channels, providing broad accessibility and convenience to individual consumers. The effectiveness of these distribution channels, coupled with efficient logistics and after-sales support, including installation, training, and maintenance services, is crucial for market penetration, customer satisfaction, and building long-term brand loyalty in the dry chemistry analyzer market.

Dry Chemistry Analyzer Market Potential Customers

The Dry Chemistry Analyzer Market serves a diverse and expanding base of potential customers, ranging from large institutional healthcare providers to individual patients, all seeking rapid, reliable, and accessible diagnostic information. Hospitals represent a foundational customer segment, particularly their emergency rooms, intensive care units (ICUs), and various specialized departments. In these high-stakes environments, the ability of dry chemistry analyzers to deliver quick results for critical parameters like blood glucose, electrolytes, and cardiac markers is indispensable for timely patient assessment and treatment initiation. Wards and outpatient clinics within hospitals also utilize these devices to streamline patient care, reduce turnaround times, and alleviate pressure on central laboratories. The ease of use and minimal training requirements often associated with these analyzers make them suitable for deployment across various clinical settings within a hospital framework, thereby decentralizing diagnostic capabilities and improving overall operational efficiency.

Beyond the hospital setting, a significant and growing customer base includes independent clinics and physician offices. General practitioners, specialists, and urgent care centers increasingly adopt dry chemistry analyzers to offer on-site testing, enabling immediate patient consultations based on diagnostic results, thereby enhancing patient satisfaction and clinical workflow efficiency. Diagnostic centers, while often equipped with comprehensive wet chemistry systems, also serve as potential customers for dry chemistry analyzers, particularly for specialized point-of-care panels or as backup systems. The rising trend of home care settings and personal health management further expands the customer landscape. Patients with chronic conditions such as diabetes, along with their caregivers, are significant end-users for handheld dry chemistry devices for self-monitoring, empowering them with real-time health data to manage their conditions proactively and in consultation with their healthcare providers. This shift towards patient-centric and home-based care models underscores a substantial growth opportunity.

Furthermore, the Dry Chemistry Analyzer Market extends its reach to several specialized segments. Veterinary hospitals and clinics represent a rapidly expanding customer category, where dry chemistry analyzers provide rapid and accurate diagnostic tests for animal health, critical for immediate treatment decisions in diverse animal species. Research laboratories, though often equipped with advanced analytical instrumentation, utilize dry chemistry analyzers for specific, quick screening tests or for applications where sample volume is limited. Pharmaceutical and biotechnology companies may also employ these analyzers for preliminary in-house testing, quality control, or specific biochemical assays during early-stage research and development. Public health programs and remote healthcare facilities in underserved or rural areas are also key potential customers, as the portability, minimal infrastructure requirements, and ease of operation of dry chemistry analyzers make them ideal tools for expanding diagnostic access and improving health outcomes in these challenging environments. The continuous development of new test parameters and improved analyzer capabilities further broadens the appeal to this diverse customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.01 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, F. Hoffmann-La Roche AG, Siemens Healthineers AG, Danaher Corporation (through Beckman Coulter), Arkray, Inc., ACON Laboratories, Inc., EKF Diagnostics Holdings plc, HORIBA, Ltd., Nova Biomedical, Sysmex Corporation, PTS Diagnostics, SD Biosensor, Inc., Mindray Medical International Limited, Randox Laboratories Ltd., Seimens Healthineers, Awareness Technology Inc., Fujifilm Corporation, Sinocare Inc., Bionime Corporation, Convergent Technologies GmbH & Co. KG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Chemistry Analyzer Market Key Technology Landscape

The Dry Chemistry Analyzer Market is underpinned by a sophisticated and continuously evolving technology landscape, integrating principles from optics, biochemistry, materials science, and digital engineering to deliver rapid and accurate diagnostic results. At its core, the primary technology employed is reflectance photometry, where the analyzer measures the intensity of light reflected from a reagent-impregnated test strip or cartridge after a chemical reaction with the patient sample. The color change on the strip, indicative of analyte concentration, is precisely quantified by an optical detection system comprising light sources (often LEDs) and photodetectors. This optical system must be highly sensitive and calibrated to detect subtle color variations across a wide dynamic range, ensuring both precision and linearity of results. Advancements in miniaturized optical components and robust calibration algorithms are crucial for maintaining accuracy in portable devices, which are often subjected to varying environmental conditions.

Beyond reflectance photometry, the technology landscape incorporates enzyme-based methods and specific immunoassay principles for certain dry chemistry tests. Test strips are impregnated with specific enzymes, substrates, and chromogens that react selectively with the target analyte in the sample (e.g., glucose oxidase for glucose, cholesterol esterase for cholesterol). The specificity and stability of these dry reagents are paramount, requiring advanced chemical formulations and manufacturing techniques to ensure long shelf life and consistent performance without refrigeration. Microfluidics plays an increasingly important role, especially in more advanced cartridge-based systems, allowing for precise sample handling, reagent delivery, and waste management within a compact, disposable format. This technology facilitates multi-parameter testing on a single strip or cartridge, improving efficiency and reducing the need for multiple separate tests, thereby enhancing the analytical capabilities of the dry chemistry platforms.

Furthermore, the modern dry chemistry analyzer market leverages significant advancements in sensor technology and digital integration. Highly sensitive biosensors are being developed to detect analytes at lower concentrations and with greater specificity. Integrated circuit technology and advanced microcontrollers power the analyzers, enabling rapid data processing, robust self-diagnostics, and user-friendly interfaces. Wireless connectivity options, such as Bluetooth and Wi-Fi, are becoming standard, facilitating seamless data transfer to electronic health records (EHRs), laboratory information systems (LIS), and cloud-based platforms, which is critical for remote monitoring and centralized data management. Battery technology has also seen considerable improvements, extending the operational life of portable devices and enhancing their utility in field settings or during power outages. The convergence of these technologies – precise optics, stable biochemistry, intelligent microfluidics, advanced sensors, and robust digital connectivity – defines the cutting-edge of the dry chemistry analyzer market, driving innovation towards more accurate, portable, and interconnected diagnostic solutions that meet the evolving demands of modern healthcare systems globally.

Regional Highlights

- North America: North America stands as a dominant force in the Dry Chemistry Analyzer Market, primarily due to its highly advanced healthcare infrastructure, significant healthcare expenditure, and a strong emphasis on early disease detection and management. The region benefits from a high adoption rate of advanced diagnostic technologies, driven by a growing prevalence of chronic diseases like diabetes and cardiovascular conditions, coupled with an aging population that necessitates frequent monitoring. Furthermore, the presence of major market players and a robust R&D landscape contribute to continuous innovation and product development, ensuring a steady stream of cutting-edge dry chemistry solutions. Strict regulatory frameworks, while challenging, also foster a high degree of product quality and reliability, building clinician and patient confidence. The widespread acceptance of point-of-care testing and decentralized diagnostic models further solidifies North America's leading position, leveraging dry chemistry analyzers for rapid decision-making in diverse clinical settings, from large hospitals to remote clinics.

- Europe: The European Dry Chemistry Analyzer Market is characterized by a mature healthcare system, an aging demographic, and a strong focus on cost-efficiency and accessible diagnostics. Countries like Germany, France, and the UK are significant contributors, propelled by well-established medical facilities and a high incidence of lifestyle-related diseases. The demand for rapid and accurate diagnostic tools is consistently high, driven by the need to manage chronic conditions effectively and reduce the burden on central laboratories. Regulatory harmonization across the European Union facilitates market entry for manufacturers, while governmental initiatives to improve public health and streamline diagnostic pathways encourage the adoption of efficient dry chemistry solutions. Economic considerations and the push for sustainable healthcare practices also favor dry chemistry analyzers, which typically require less reagent volume and generate less waste compared to traditional wet chemistry methods, aligning with European environmental and economic priorities.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for dry chemistry analyzers, fueled by a confluence of factors including rapidly developing healthcare infrastructure, escalating healthcare expenditure, and a massive, underserved patient population. Countries such as China, India, Japan, and South Korea are at the forefront of this expansion. The increasing prevalence of chronic diseases, coupled with rising awareness about health and diagnostics, is driving significant demand for accessible and affordable testing solutions. Government initiatives to expand healthcare access in rural areas and improve diagnostic capabilities contribute substantially to market growth. Local manufacturing capabilities are also expanding, offering competitive pricing and solutions tailored to regional needs. The growing medical tourism industry and increased foreign investment in healthcare further bolster the adoption of advanced diagnostic technologies, positioning APAC as a crucial growth engine for the global dry chemistry analyzer market.

- Latin America: The Latin American Dry Chemistry Analyzer Market is experiencing steady growth, driven by improving healthcare access, increasing awareness about various diseases, and ongoing economic development across several countries. Brazil, Mexico, and Argentina are key markets within the region, witnessing greater investment in healthcare facilities and a push towards modernizing diagnostic capabilities. The rising prevalence of both communicable and non-communicable diseases necessitates efficient and rapid diagnostic tools, which dry chemistry analyzers are well-suited to provide. Public-private partnerships are playing a vital role in enhancing healthcare infrastructure and expanding diagnostic services, particularly in remote and underserved areas where the portability and ease of use of dry chemistry systems are highly advantageous. The market is also benefiting from increased adoption of point-of-care testing to improve patient outcomes and streamline clinical workflows, leading to sustained demand for these diagnostic instruments.

- Middle East & Africa (MEA): The Middle East & Africa region represents a developing but increasingly promising market for dry chemistry analyzers. Significant investments in healthcare infrastructure, particularly in countries like Saudi Arabia, UAE, and South Africa, are creating new avenues for market penetration. The rising burden of non-communicable diseases, coupled with persistent challenges from infectious diseases, highlights the critical need for accessible and rapid diagnostic solutions. Government initiatives aimed at diversifying economies and improving public health services are driving the adoption of advanced medical technologies, including dry chemistry analyzers. While regulatory frameworks and economic stability can vary, the inherent advantages of these devices—such as their suitability for remote clinics and environments with limited resources—make them attractive options for expanding diagnostic capabilities across the region. The increasing awareness among healthcare professionals and patients about the benefits of early diagnosis is further stimulating demand in the MEA market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Chemistry Analyzer Market.- Abbott Laboratories

- F. Hoffmann-La Roche AG

- Siemens Healthineers AG

- Danaher Corporation (through Beckman Coulter)

- Arkray, Inc.

- ACON Laboratories, Inc.

- EKF Diagnostics Holdings plc

- HORIBA, Ltd.

- Nova Biomedical

- Sysmex Corporation

- PTS Diagnostics

- SD Biosensor, Inc.

- Mindray Medical International Limited

- Randox Laboratories Ltd.

- Awareness Technology Inc.

- Fujifilm Corporation

- Sinocare Inc.

- Bionime Corporation

- Convergent Technologies GmbH & Co. KG

- DiaSys Diagnostic Systems GmbH

Frequently Asked Questions

What is a dry chemistry analyzer?

A dry chemistry analyzer is a diagnostic device that performs biochemical tests using dry reagents embedded in test strips or cartridges, eliminating the need for liquid reagents. It typically operates on principles like reflectance photometry to provide rapid, quantitative results for various analytes in biological samples.

What are the primary advantages of dry chemistry analyzers?

Key advantages include rapid turnaround times, ease of use with minimal training, portability for point-of-care testing, small sample volume requirements, reduced reagent waste, and no need for external water supplies, making them highly efficient and accessible.

Where are dry chemistry analyzers commonly used?

Dry chemistry analyzers are widely used in hospitals (ERs, ICUs, wards), clinics, physician offices, diagnostic centers, home care settings for patient self-monitoring, and veterinary clinics due to their quick results and operational simplicity.

How does AI impact dry chemistry analyzers?

AI enhances dry chemistry analyzers by improving diagnostic accuracy through advanced algorithm analysis, automating data interpretation and reporting, enabling predictive maintenance, assisting in personalized patient management, and facilitating seamless integration with telehealth platforms for remote monitoring and enhanced workflow efficiency.

What are the key trends shaping the dry chemistry analyzer market?

Key trends include the increasing demand for point-of-care testing (POCT), miniaturization and enhanced portability of devices, expansion of test menus to cover more analytes, integration with digital health and AI platforms, and a growing focus on sustainable and cost-effective diagnostic solutions, particularly in emerging markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager