Dry Chillies Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434187 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Dry Chillies Market Size

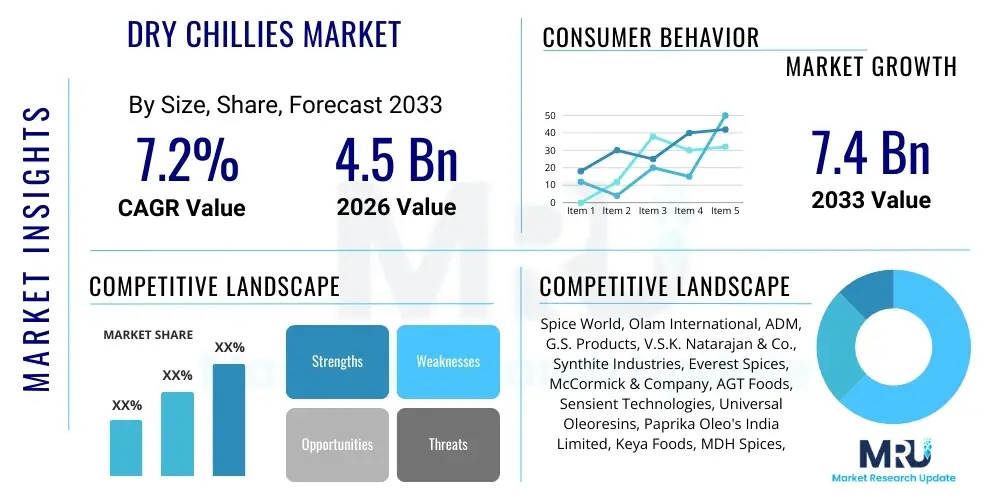

The Dry Chillies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033. This steady expansion is predominantly fueled by the increasing global consumption of spicy food products, the growing trend of ethnic cuisines crossing geographical boundaries, and the utilization of dried chillies in the natural food colorant and pharmaceutical industries.

Dry Chillies Market introduction

The Dry Chillies Market encompasses the trade and consumption of various dehydrated forms of Capsicum species, which are essential ingredients in global cuisine, ranging from everyday household spice racks to large-scale food processing operations. These products are valued primarily for their flavor (pungency and sweetness), color, and essential health benefits derived from compounds like capsaicin and antioxidants. The market thrives on the diverse varietals available, such as cayenne, paprika, bird's eye, and ghost peppers, each catering to specific heat profiles and culinary requirements across different consumer bases.

Major applications for dry chillies extend significantly beyond simple flavoring agents. In the industrial sector, they are crucial for manufacturing condiments, sauces, and ready-to-eat meals, where consistent quality and standardized pungency levels are required. Furthermore, the oleoresin extracted from dried chillies is highly sought after by the food coloring industry as a natural alternative to synthetic dyes, capitalizing on consumer demand for cleaner labels and natural ingredients. The pharmaceutical sector also utilizes capsaicin derived from chillies for topical pain relief applications and certain metabolic health supplements.

Key driving factors accelerating market expansion include the increasing disposable income in emerging economies, leading to higher spending on processed and flavored foods, and the continuous innovation in product offerings, such as organic, sustainably sourced, and specially processed (e.g., smoked or roasted) dry chilli products. Moreover, the widely recognized health benefits associated with capsaicin, including its anti-inflammatory properties and ability to boost metabolism, further solidify the demand for dry chillies as a functional food ingredient, cementing its role as a globally important agricultural commodity and spice.

Dry Chillies Market Executive Summary

The Dry Chillies Market is characterized by robust growth, driven primarily by evolving consumer preferences favoring bold, international flavors and the significant expansion of the processed food and beverage industry, particularly in the Asia Pacific region. Business trends highlight a crucial shift towards supply chain transparency and sustainable sourcing practices, addressing consumer concerns regarding pesticide use and ethical farming. Manufacturers are increasingly focusing on vertical integration or forging strong partnerships with farmers to ensure a consistent supply of high-quality, certified organic or specialty chillies, which command premium pricing and higher margins in competitive retail environments.

Regionally, Asia Pacific continues to dominate the market share, driven by cultural integration of chillies in daily cuisine across India, China, and Southeast Asia, where consumption rates are among the highest globally. However, North America and Europe are exhibiting the fastest growth rates, attributed to the escalating demand for ethnic food preparation at home, coupled with the increasing penetration of global foodservice chains. This dynamic shift necessitates robust global logistics capabilities and adherence to stringent food safety and import regulations imposed by Western nations, influencing packaging and preservation technologies significantly.

Segmentation trends indicate a strong preference shift towards value-added products, with chilli powder and crushed chilli flakes dominating the processing segment, due to their ease of use and standardization in industrial applications. Furthermore, the market is segmenting by pungency level (measured in Scoville Heat Units, SHU), allowing manufacturers to target niche consumer groups, from mild paprika users to extreme heat enthusiasts. The application segment sees the Food & Beverage industry maintaining supremacy, while the nutraceutical segment offers lucrative opportunities for future expansion, driven by research into the medicinal properties of capsaicinoids.

AI Impact Analysis on Dry Chillies Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dry Chillies Market predominantly center on optimizing supply chain resilience, enhancing agricultural productivity in volatile climates, and ensuring rigorous quality control (QC). Users seek clarity on how AI-driven predictive analytics can mitigate risks associated with climate change—a major constraint for chilli farming—and how machine learning algorithms can standardize product quality, specifically concerning color consistency, moisture content, and Scoville Heat Unit (SHU) measurement, which currently relies on slower or less accurate methods. The key themes revolve around achieving higher yields with fewer resources, improving traceability from farm to table, and using AI-powered demand forecasting to minimize inventory waste, especially for highly seasonal commodities like chillies.

- AI-driven Precision Agriculture: Utilization of machine learning models on satellite imagery and sensor data to optimize irrigation, fertilization, and pest management, leading to higher yields and reduced resource consumption in chilli cultivation.

- Predictive Supply Chain Optimization: AI algorithms analyzing historical data, climate forecasts, and geopolitical factors to predict bottlenecks, optimize logistics routes, and manage inventory levels for dried chilli stocks, ensuring supply stability.

- Enhanced Quality Control (QC): Implementation of computer vision and deep learning tools for automated sorting of dried chillies based on color defects, size uniformity, and identifying contaminants during the processing phase.

- Automated Pungency Measurement: Use of spectroscopic analysis coupled with AI to provide real-time, non-destructive estimation of capsaicinoid content (SHU), replacing slower traditional methods like High-Performance Liquid Chromatography (HPLC).

- Demand Forecasting and Market Trend Analysis: AI tools analyzing point-of-sale data, social media sentiment, and global culinary trends to accurately predict consumer demand for specific chilli varieties or heat levels, informing procurement strategies.

- Blockchain Integration via AI: Using AI to automatically log and verify key steps in the drying and processing cycle onto immutable ledger systems, significantly boosting traceability and minimizing counterfeiting risks.

- Optimized Drying Processes: Machine learning models controlling industrial drying parameters (temperature, humidity) in real-time to minimize energy usage while maximizing the retention of color and flavor profiles.

DRO & Impact Forces Of Dry Chillies Market

The Dry Chillies Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining its future trajectory. A primary driver is the pervasive globalization of food culture, where increasing travel and digital exposure lead to greater acceptance and demand for exotic and high-pungency chilli varieties in traditionally non-spicy markets. This is strongly supported by the growing awareness regarding the scientifically backed health benefits of capsaicin, positioning dry chillies not just as a spice but as a functional food ingredient, thereby increasing consumption across both the general population and the specialty health sector. Furthermore, the rapid expansion of the food processing industry, particularly in sauces, marinades, and snack seasonings, demands a stable, high-volume supply of processed chilli products, sustaining market growth.

Conversely, significant restraints hinder market potential, most notably the high vulnerability of chilli crops to adverse climatic conditions, including droughts and excessive rainfall, which lead to volatile supply and price fluctuations. Regulatory challenges pose another substantial hurdle; strict import standards in regions like the European Union regarding maximum residue limits (MRLs) for pesticides, as well as concerns over aflatoxins and microbial contamination during the drying process, often restrict global trade flows and necessitate heavy investment in quality assurance technologies. These restraints often disproportionately affect small-scale farmers who lack the capital for advanced drying and testing facilities, creating bottlenecks in the supply chain.

Opportunities for expansion are prominent in the development of certified organic and sustainable chilli farming, catering to the environmentally conscious consumer base willing to pay a premium for ethically sourced goods. There is also a substantial market opportunity in the nutraceutical and pharmaceutical segments, focusing on extracting high-purity capsaicin for medical applications such as pain management and weight loss supplements, representing a high-value niche. Lastly, technological advancements in post-harvest handling, specifically implementing large-scale, controlled-environment drying systems like solar or infrared drying, offer solutions to improve quality consistency and reduce post-harvest losses, mitigating the impact of current restraints and optimizing the overall supply chain efficiency.

Segmentation Analysis

The Dry Chillies Market segmentation offers a granular understanding of consumer demand and industrial applications, primarily categorized by Product Type, Application, and Distribution Channel. The diversity inherent in dry chillies—from mild Paprika used primarily for color to highly pungent Habanero or Ghost Peppers used for heat—necessitates detailed segregation to accurately assess market size and growth potential within specific verticals. Understanding these segments is crucial for manufacturers to tailor their production, packaging, and marketing strategies to meet the distinct requirements of diverse end-user industries, such as commercial kitchens demanding bulk chilli powder versus specialized ingredient suppliers requiring whole, certified specialty varieties.

- By Product Type:

- Whole Dried Chillies (Sabor, Kashmiri, Bird’s Eye)

- Chilli Powder/Ground Chillies (Standard Heat, Low Heat/Paprika)

- Chilli Flakes/Crushed Chillies

- Chilli Paste and Puree (Intermediate products)

- By Pungency Level (SHU):

- Mild (0 – 10,000 SHU)

- Medium (10,001 – 50,000 SHU)

- Hot (50,001 – 1,00,000 SHU)

- Super Hot (Greater than 1,00,000 SHU)

- By Application:

- Food and Beverage Industry (Seasoning, Sauces, Ready-to-Eat Meals)

- Food Colorants (Oleoresin extraction)

- Pharmaceutical and Healthcare (Capsaicin extraction for pain relief)

- Cosmetics and Personal Care

- By Distribution Channel:

- Direct Sales/B2B (Industrial procurement)

- Indirect Sales/Retail (Supermarkets, Hypermarkets, Convenience Stores)

- E-commerce/Online Retail

Value Chain Analysis For Dry Chillies Market

The Dry Chillies Market value chain is a multi-stage process beginning with agricultural input and culminating in final consumer consumption, involving several critical transformations and logistical steps. The upstream segment is dominated by cultivation and harvesting, which is highly sensitive to climate, input costs (seeds, fertilizers), and labor availability. Post-harvest processing, which includes critical steps like cleaning, sorting, and drying (both traditional sun drying and modern mechanical drying), dictates the quality, color, and microbial safety of the final product. Effective management at this stage is crucial for achieving high market acceptance and mitigating post-harvest losses, which can be substantial for fresh produce.

The midstream involves extensive processing and manufacturing, where raw dry chillies are transformed into value-added products such as ground chilli powder, flakes, oleoresins, and specialized extracts. Major processors invest heavily in milling, blending, quality testing (for SHU and contaminants), and industrial packaging to ensure homogeneity and compliance with stringent international food safety standards. Distribution channels then link these processors to end-users. Direct channels involve large-scale B2B transactions supplying food manufacturing giants (e.g., sauce producers, snack companies) and pharmaceutical firms requiring oleoresin extracts for standardized production runs.

The downstream segment focuses on reaching the final consumer, primarily through indirect channels such as organized retail (supermarkets, hypermarkets), specialized spice shops, and the rapidly growing e-commerce platforms. These channels often require smaller pack sizes, attractive branding, and high traceability information. The effectiveness of the value chain is increasingly reliant on streamlined logistics and cold chain management (where applicable for pastes or high-moisture products) and utilizing advanced inventory systems to match the seasonal agricultural cycles with continuous industrial demand, ensuring optimal efficiency from farm gate to consumer plate.

Dry Chillies Market Potential Customers

The primary potential customers for the Dry Chillies Market span across various industrial sectors and consumer demographics, anchored predominantly by the Food and Beverage (F&B) manufacturing sector. This includes large-scale manufacturers of processed foods such as seasonings, rubs, ready-to-eat meals, soups, and, most critically, various sauces and condiments (ketchup, hot sauce, chili dips). These customers demand bulk quantities, consistent quality specifications, and strict adherence to moisture content and pungency standards (SHU), often entering into long-term procurement contracts with large processors and exporters to ensure supply stability and predictable input costs.

Another significant customer base comprises the Horeca (Hotel, Restaurant, and Catering) segment and specialized food service providers. Ethnic restaurants, ranging from Indian and Thai to Mexican and Peruvian cuisine establishments, rely heavily on specific chilli varieties and quality dried products to maintain authenticity and consistency in their menu offerings. Spice grinders and repackaging companies also act as crucial intermediaries, purchasing raw or semi-processed chillies in bulk and packaging them into consumer-friendly sizes for retail sale under various private or established brands, catering directly to household consumption demands.

Beyond the culinary world, pharmaceutical and nutraceutical companies represent a high-value niche segment. These customers procure high-grade chilli extracts or pure capsaicinoids for manufacturing topical pain relief creams, weight management supplements, and anti-inflammatory compounds. Their requirements are the most stringent, demanding highly purified, certified organic, and contaminant-free raw materials, often requiring specialized extraction technology and validated supply chains to meet regulatory standards set by bodies like the FDA or EFSA, thereby driving demand for premium, scientifically tested chilli products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spice World, Olam International, ADM, G.S. Products, V.S.K. Natarajan & Co., Synthite Industries, Everest Spices, McCormick & Company, AGT Foods, Sensient Technologies, Universal Oleoresins, Paprika Oleo's India Limited, Keya Foods, MDH Spices, Kerry Group, Kancor Ingredients, R. K. Enterprises, Symrise, Mane Kancor, Naturex (Givaudan) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Chillies Market Key Technology Landscape

The technological landscape in the Dry Chillies Market is rapidly evolving, driven by the need for enhanced food safety, consistent quality, and energy efficiency in post-harvest processing. Traditional sun drying is being gradually supplemented or replaced by advanced mechanical drying techniques, such as continuous flow dryers, fluidized bed dryers, and increasingly, solar-assisted greenhouse drying systems. Infrared drying technology is gaining traction because it significantly reduces drying time while better preserving the color (Asta values) and pungency (SHU) of the chillies, addressing critical industrial requirements for standardized input materials. These technological shifts are pivotal for reducing microbial contamination risks, such as mold and aflatoxin development, which are major concerns in global trade.

Furthermore, technology plays a crucial role in improving traceability and authentication throughout the supply chain. The adoption of Blockchain technology is allowing major exporters and large processing houses to create immutable digital records of the chilli’s journey, from the farm plot where it was grown, through the drying and processing stages, up to the final packaged product. This heightened level of transparency directly addresses the growing consumer demand for ethical sourcing and the increasing need for quick identification and recall of contaminated batches, thereby enhancing consumer trust and regulatory compliance, particularly in high-value segments like organic or specialty chillies.

In the processing stage, automation is transforming quality control. High-speed optical sorters equipped with machine vision systems are now mandatory in large facilities. These systems can analyze thousands of chillies per minute, identifying and removing foreign material, discolored pods, or chillies with inconsistent moisture levels that could compromise the final product quality or shelf life. Coupled with Near-Infrared (NIR) spectroscopy, which offers quick, non-destructive measurements of moisture content and, in some advanced systems, capsaicinoid levels, these technologies ensure that batch quality is consistently met before packaging or further extraction, guaranteeing the market demands for standardization are satisfied efficiently.

Regional Highlights

The Dry Chillies Market exhibits significant regional variation in production, consumption patterns, and trade dynamics. Asia Pacific (APAC) stands as the undisputed leader, both in terms of volume consumption and production, spearheaded by major producers like India, China, Thailand, and Vietnam. India, being the world's largest producer, consumer, and exporter of dry chillies, dictates global prices and supply trends, benefiting from vast arable land and diverse climatic conditions supporting numerous chilli varieties. The high domestic consumption is intrinsically linked to local culinary traditions, driving demand for both ground powder and whole dried pods for everyday cooking.

North America and Europe represent mature markets characterized by high import dependency and sophisticated demand profiles. In North America, growth is heavily influenced by the demographic shift toward ethnic food consumption, particularly Mexican and South Asian cuisines, propelling the demand for premium chilli powders and flakes used in foodservice and ready-to-eat meals. European markets, while smaller in volume compared to APAC, impose the most stringent quality and safety standards, especially concerning Maximum Residue Limits (MRLs) for pesticides. This regulatory environment drives a strong demand for certified organic, tested, and sustainably sourced dry chillies, positioning quality over cost as the primary purchasing factor.

Latin America, particularly Mexico and Peru, plays a historically significant role as a center of origin and diversity for chillies, focusing intensely on specialty and indigenous varieties essential for authentic regional cuisine. This region is strong in domestic consumption and also serves as a crucial supplier to North American markets. Meanwhile, the Middle East and Africa (MEA) region shows accelerating growth, fueled by population expansion and increasing consumption of processed foods and international cuisine. Countries in the Gulf Cooperation Council (GCC) import substantial volumes of dried chillies for both local consumption and re-export, reflecting growing urbanization and changing dietary habits across the region.

- Asia Pacific (APAC): Dominates production and consumption; centers of trade are India (Guntur, Byadgi) and China (Xinjiang). Growth driven by traditional food use and large food processing sectors.

- North America: High growth rate fueled by increasing popularity of international and fusion cuisines; strong demand for organic and non-GMO certified chilli products.

- Europe: Characterized by stringent food safety regulations; focuses heavily on premium, high-quality, and traceable chilli imports, particularly from African and Indian suppliers who comply with EU standards.

- Latin America (LATAM): Key producers of specialty and heritage varieties (e.g., Ancho, Chipotle); domestic market strongly tied to cultural culinary identity.

- Middle East and Africa (MEA): Rapidly expanding market due to demographic growth and increasing consumption of processed and convenience foods; acts as a major hub for re-export of spices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Chillies Market.- McCormick & Company

- Olam International

- Archer Daniels Midland Company (ADM)

- Synthite Industries Ltd.

- Kancor Ingredients Limited

- Sensient Technologies Corporation

- G.S. Products

- Universal Oleoresins

- Everest Spices

- MDH Spices

- Kerry Group Plc

- Acheson & Acheson Ltd (A&A)

- V.S.K. Natarajan & Co.

- Paprika Oleo's India Limited

- Keya Foods International Pvt. Ltd.

- R. K. Enterprises

- Symrise AG

- AGT Foods and Ingredients Inc.

- Naturex (Givaudan)

- Hindustan Spices

Frequently Asked Questions

Analyze common user questions about the Dry Chillies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Dry Chillies Market?

The Dry Chillies Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.2% between the forecast years 2026 and 2033, driven by expanding applications in the processed food and nutraceutical industries globally.

Which region currently dominates the global Dry Chillies Market?

Asia Pacific (APAC) dominates the global market, primarily due to the colossal production and consumption base in India and China, where dry chillies are integral to traditional and industrial food processing.

What are the primary factors driving demand for dried chillies?

Key drivers include the global spread of spicy and ethnic cuisines, rising consumer awareness regarding the health benefits of capsaicin (anti-inflammatory properties), and the increasing industrial demand for natural food colorants (oleoresin) and seasonings.

How does the quality of dry chillies typically get measured in the industry?

Quality is primarily measured by Pungency (Scoville Heat Units or SHU), Color (Asta rating), and safety parameters like moisture content and the absence of contaminants such as aflatoxins and pesticide residues (MRLs).

What role does technology play in mitigating risks in the dry chillies supply chain?

Advanced technologies, including infrared drying, optical sorting powered by AI, and Blockchain traceability systems, are crucial for ensuring product consistency, reducing post-harvest losses, and complying with strict international food safety standards.

Are organic dry chillies a significant market trend?

Yes, the demand for organic and sustainably sourced dry chillies is a significant trend, particularly in North America and Europe, where consumers are increasingly prioritizing non-GMO and pesticide-free ingredients, commanding a notable price premium.

What is the main application segment for dry chillies?

The Food and Beverage industry constitutes the largest application segment, encompassing usage in seasonings, sauces, marinades, and specialized processed food products, leveraging chillies for flavor and heat profiles.

What are the biggest challenges faced by the Dry Chillies Market?

The market faces significant restraints from volatile climate conditions impacting crop yield, strict global regulatory hurdles concerning contaminant levels (aflatoxins), and price instability due to complex supply chain logistics.

Which product type holds the largest market share in the dry chillies segment?

Chilli Powder/Ground Chillies holds the largest market share globally due to its versatility, standardized industrial application, and ease of use in both B2B food manufacturing and household consumer kitchens.

How do climate change concerns affect the market forecast?

Climate volatility introduces uncertainty in supply, potentially leading to higher price fluctuations and necessitating greater investment in climate-resilient farming techniques and controlled-environment post-harvest processing facilities to stabilize market supply.

What are the key technological advancements for processing dry chillies?

Key advancements include automated quality control via high-speed optical sorters, the adoption of energy-efficient drying methods like solar and infrared drying, and the implementation of traceability platforms based on blockchain technology.

Who are the typical end-users in the B2B segment of this market?

Typical B2B end-users include large Food and Beverage manufacturers (sauce, seasoning, snack producers), oleoresin extractors for coloring agents, and pharmaceutical companies requiring high-purity capsaicin for pain management products.

How significant is the oleoresin segment in the overall dry chillies market?

The oleoresin segment is highly significant as it represents a high-value derivative, primarily used as a natural food colorant (capsanthin) and for standardized pungency addition, commanding premium pricing and driving demand for specific, high-color chilli varieties.

Is Latin America a significant exporter or importer of dry chillies?

Latin America, particularly Mexico, is a historically important producer and exporter of unique, large-sized dry chillies (like Ancho and Pasilla) crucial for regional cuisine, serving as a key supplier to North American markets while also maintaining high domestic consumption.

What impact does the Scoville Heat Unit (SHU) measurement have on pricing?

SHU is a critical determinant of value; specialty high-SHU chillies (like Carolina Reaper or Ghost Pepper) command significantly higher prices per weight compared to common, mild varieties (like Paprika or low-pungency Cayenne), segmenting the market dramatically.

What is the primary role of AI in dry chilli cultivation?

AI's primary role is in precision agriculture, utilizing predictive models based on weather and soil data to optimize irrigation, fertilizer use, and early detection of diseases, thereby maximizing yield and resource efficiency for chilli farmers.

Which distribution channel is showing the fastest growth?

The E-commerce/Online Retail distribution channel is exhibiting the fastest growth, enabling specialty chilli providers and smaller brands to reach a wide, globally dispersed customer base directly, bypassing traditional retail barriers.

How are strict European import standards influencing the market?

Strict European import standards, especially MRLs and aflatoxin limits, compel exporters worldwide to adopt advanced processing and testing technologies, favoring suppliers who can provide certified, high-quality, and traceable products, elevating overall industry standards.

Are chillies considered a functional food ingredient?

Yes, due to the high content of capsaicinoids and antioxidants, dry chillies are increasingly marketed and consumed as a functional food ingredient offering health benefits such as metabolic boost, pain relief, and cardiovascular support.

How is the market addressing the seasonal nature of chilli harvesting?

Processors address seasonality by investing heavily in large-scale storage facilities (warehousing) and utilizing sophisticated predictive inventory management systems to ensure a consistent year-round supply for industrial clients, mitigating price spikes caused by harvest cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager