Dry Construction Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436333 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dry Construction Material Market Size

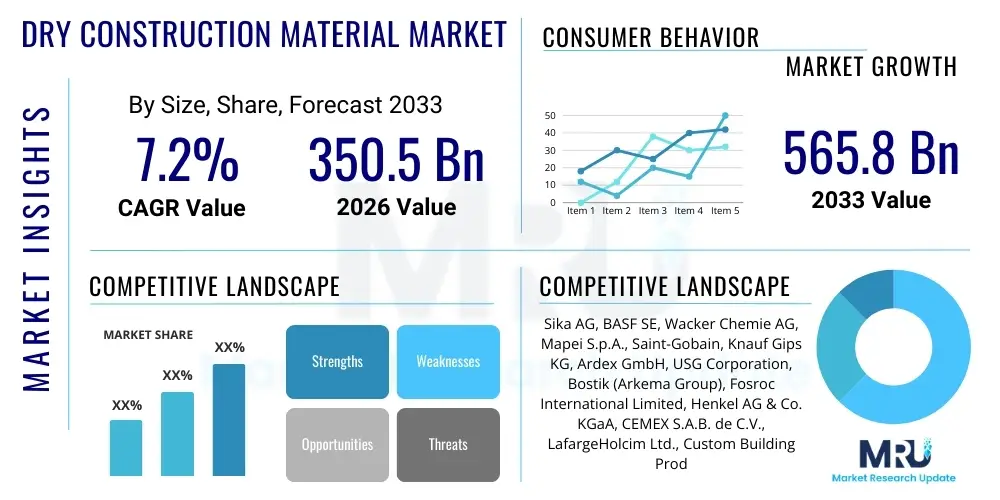

The Dry Construction Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 565.8 Billion by the end of the forecast period in 2033.

Dry Construction Material Market introduction

The Dry Construction Material Market encompasses a range of factory-produced, pre-mixed, and ready-to-use building materials that require only the addition of water (or sometimes no addition at all) on site. These materials, which include specialized mortars, plasters, tile adhesives, cementitious mixes, and insulation systems, offer superior quality consistency, reduced site waste, and significantly faster application times compared to traditional wet construction methods. The inherent advantages of dry construction materials—such as enhanced durability, specific performance characteristics (like thermal insulation or fire resistance), and improved labor efficiency—are driving their rapid adoption across global construction sectors.

Major applications for dry construction materials span across residential, commercial, and infrastructure projects, addressing critical needs in interior finishing, facade construction, flooring installation, and structural repairs. Key products like gypsum boards, dry mix mortars, and self-leveling compounds are instrumental in modern rapid construction techniques, particularly in urban areas prioritizing fast turnover and precision engineering. The convenience and quality control offered by these pre-batched solutions minimize human error during mixing and application, leading to structures that are more energy-efficient and compliant with stringent regulatory standards related to safety and environmental performance.

The primary driving factors propelling this market include the global trend toward sustainable and green building practices, increasing governmental focus on affordable housing initiatives requiring rapid construction methods, and stringent requirements for high-performance buildings, especially in developed economies. Furthermore, the persistent shortage of skilled construction labor in many regions necessitates the use of easy-to-apply, standardized material systems. The ongoing technological advancements in binder and polymer chemistry are consistently leading to the development of new, high-performance dry mixes that cater to specialized architectural and engineering demands.

Dry Construction Material Market Executive Summary

The Dry Construction Material Market is experiencing robust growth driven by the shift from conventional on-site mixing to controlled, factory-produced dry mixes, ensuring consistency and accelerated project timelines globally. Business trends highlight significant investment in automated production facilities and logistics networks, particularly in the Asia Pacific region where mega-infrastructure projects are abundant. Key players are focusing on backward integration to secure raw material supply (like specialized gypsum and polymers) and expanding product portfolios to include sustainable and low-carbon footprint materials, aligning with ESG (Environmental, Social, and Governance) investment criteria increasingly influencing purchasing decisions.

Regionally, Asia Pacific maintains market dominance due to massive urbanization rates and governmental support for smart city development, while Europe and North America demonstrate maturity, emphasizing innovation in high-performance segments such as thermal insulation and acoustic solutions required by stringent energy efficiency codes. Latin America and MEA are emerging as high-potential regions, benefiting from increased foreign direct investment in residential and commercial real estate development, driving demand for cost-effective and efficient dry walling and tiling solutions. The competitive landscape is characterized by intense R&D focusing on admixture technology to enhance setting times, workability, and final strength of dry mortars.

Segment trends reveal that the Dry Mix Mortars segment, particularly tile adhesives and floor screeds, holds the largest market share, fueled by global flooring renovation and new installation activities. Simultaneously, the Gypsum-based products segment is growing rapidly, favored for non-structural interior partition walls due to their fire-resistant and lightweight properties. The residential application segment remains the primary consumer base, but the infrastructure segment is projected to exhibit the fastest growth, primarily due to the large-scale investment in road networks, high-speed rail, and public utilities that increasingly utilize polymer-modified repair and grouting dry mixes for enhanced longevity and durability.

AI Impact Analysis on Dry Construction Material Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Dry Construction Material Market typically revolve around optimizing material composition, predicting material performance under varied environmental conditions, and automating supply chain logistics from raw material sourcing to final delivery on construction sites. Users are particularly concerned about how AI can enhance quality control in factory mixing processes to maintain zero-defect standards and whether AI-driven predictive maintenance can reduce downtime in capital-intensive dry mix production plants. Furthermore, there is significant interest in utilizing AI to analyze complex project schedules and material flow, ensuring Just-in-Time (JIT) delivery of specific dry mixes, thereby minimizing on-site storage costs and potential material degradation.

- AI optimizes raw material formulation by predicting the performance characteristics (e.g., strength, setting time) of different chemical combinations, leading to specialized, high-performance dry mixes.

- Predictive analytics driven by AI enhances demand forecasting accuracy, minimizing inventory holding costs and ensuring timely production based on projected regional construction activity.

- Machine vision systems utilizing AI are deployed for real-time quality assurance during factory mixing and packaging, identifying defects in consistency or improper filling immediately.

- AI-enabled scheduling and routing algorithms optimize the transportation of bulky dry construction materials, reducing fuel consumption, delivery time, and overall logistics footprint.

- Generative design tools, powered by AI, assist architects and engineers in selecting the optimal dry construction system (e.g., drywall or facade solution) based on project constraints, performance goals, and material availability.

DRO & Impact Forces Of Dry Construction Material Market

The Dry Construction Material Market is propelled by strong drivers such as rapid urbanization and infrastructure expansion, particularly in emerging economies, alongside a stringent regulatory environment in developed markets demanding high-performance, energy-efficient building systems. However, market growth is significantly restrained by the high initial capital expenditure required for setting up automated dry mix production facilities and the volatility in pricing of key raw materials like polymers, specialized binders, and gypsum. The interplay of these forces creates a complex market dynamic where material innovation (Opportunity) is critical for overcoming cost pressures (Restraint), while the global push for sustainable building (Driver) enhances market penetration potential.

Key impact forces include the increasing global adoption of modular and prefabricated construction techniques, which rely heavily on precisely dimensioned dry construction elements like gypsum panels and pre-cast concrete dry mixes for connection. This shift intensifies the need for specialized, highly consistent dry materials. Furthermore, the growing awareness regarding health and safety on construction sites favors dry systems, as they often reduce exposure to dust and hazardous wet chemical mixtures. Conversely, the significant energy consumption associated with the grinding and drying processes in material production remains an influential restraint, prompting industry stakeholders to invest in more energy-efficient production technologies to maintain competitive pricing structures.

Opportunities for market players are vast, centered on developing ultra-lightweight and multifunctional dry construction materials that combine insulation, acoustic damping, and structural integrity into single systems. The circular economy trend provides a major avenue for innovation, focusing on incorporating industrial by-products (like fly ash or slag) into dry mixes to reduce reliance on virgin cement, offering a clear competitive advantage in sustainable construction projects. The collective impact of these forces dictates that market success hinges on a balance between process optimization, product differentiation through advanced material science, and strategic regional expansion into high-growth construction hubs.

Segmentation Analysis

The Dry Construction Material Market is comprehensively segmented based on product type, application, and end-user, providing a granular view of market dynamics and adoption patterns across various construction facets. Understanding these segments is crucial for manufacturers to tailor their production, distribution, and marketing strategies effectively. The inherent variability in construction methods and regional building codes necessitates a diversified product offering, ranging from basic cementitious dry mixes to highly specialized polymer-modified dry mortars used in complex façade systems and critical infrastructure repairs. The segmentation highlights the market’s transition from generic commodity products to high-value, performance-driven specialty chemicals in construction.

The Product Type segment, encompassing plasters, mortars, putties, and waterproofing materials, dictates the primary material science focus of key players. For instance, the high growth in the mortar segment is directly linked to the widespread adoption of standardized tile installation systems, demanding high-quality, specialized dry tile adhesives and grouts that offer superior bond strength and water resistance. Similarly, the Application segment, covering residential, commercial, and infrastructure, shows distinct procurement patterns; residential construction often focuses on cost-effectiveness and ease of application, while infrastructure demands materials with extreme durability and resistance to harsh environmental conditions, driving the usage of high-performance repair mortars and concrete additives.

- By Product Type:

- Dry Mix Mortars (Tile Adhesives, Renders, Floor Screeds, Grouts, Repair Mortars)

- Gypsum Plasters and Boards

- Putties and Wall Care Products

- Waterproofing Dry Mixes and Sealants

- Specialty Concrete Additives (Dry Powder Form)

- By Application:

- Residential Construction (New Builds and Renovation)

- Commercial Construction (Offices, Retail, Hospitality)

- Industrial Construction (Factories, Warehouses)

- Infrastructure (Roads, Bridges, Dams, Utilities)

- By End-User:

- Contractors and Builders

- Individual Homeowners (DIY)

- Specialized Construction Companies

Value Chain Analysis For Dry Construction Material Market

The value chain for the Dry Construction Material Market begins with the highly specialized upstream analysis involving the sourcing and processing of core raw materials, which include cement, gypsum, sand (silica), and high-value chemical additives such as polymer binders (e.g., redispersible polymer powders, cellulose ethers), and specialized fillers. The ability to secure stable, high-quality supply of these chemical additives is a critical determinant of manufacturing cost and final product performance. Efficient grinding, drying, and mixing operations—often capital-intensive and highly automated—form the core manufacturing process, ensuring the homogenous blend and particle size distribution necessary for consistent product application on site.

The downstream analysis focuses on the distribution and end-use application of the finished products. Due to the high weight and bulk nature of dry construction materials, distribution channel efficiency is paramount. The primary channels involve large-scale construction material distributors, specialized dealers, and direct sales to major construction companies and infrastructure contractors. Direct and indirect sales channels coexist; large volume infrastructure projects often involve direct negotiation and delivery (Direct), while smaller residential or renovation projects typically rely on a network of localized hardware stores and specialized building material retailers (Indirect).

Optimization across the value chain increasingly focuses on streamlining logistics to manage the high volume of materials moved. Technology integration, such as sophisticated Warehouse Management Systems (WMS) and route optimization software, plays a critical role in reducing transportation costs and minimizing delivery delays. Successful market players often possess a robust network of strategically located manufacturing units, reducing the distance between production and major construction hubs. Furthermore, providing technical support and application training to contractors through the distribution channel adds significant downstream value, ensuring proper product use and performance.

Dry Construction Material Market Potential Customers

Potential customers for the Dry Construction Material Market are primarily segmented into professional entities involved in large-scale construction projects and individual consumers undertaking repair or small-scale building activities. Professional end-users include general contractors, specialized sub-contractors (e.g., drywall installers, tilers, facade specialists), and real estate developers who prioritize material consistency, fast installation times, and compliance with performance specifications. These bulk buyers require reliable supply chains, technical data sheets demonstrating regulatory compliance, and competitive pricing based on large order volumes.

The segment of specialized construction companies, particularly those involved in high-rise building, infrastructure development (bridges, tunnels), and complex refurbishment projects, represents a high-value customer base for advanced dry mixes such as high-strength repair mortars, specialized grouts, and self-leveling floor compounds. These customers are driven by performance guarantees, demanding materials that offer extended durability, specific aesthetic finishes, or resistance to extreme environments. Manufacturers often engage in direct collaboration with these professional firms to develop customized dry mix formulations meeting unique project requirements.

Additionally, the burgeoning DIY (Do-It-Yourself) market and individual homeowners constitute a significant purchasing group, particularly for interior finishing products like gypsum plasters, ready-mix putties, and tile adhesives sold in smaller, user-friendly packaging. This segment values ease of application, clear instructions, and local availability through retail channels. Market strategies targeting this group often focus on brand recognition, robust packaging, and simplified product lines emphasizing DIY suitability, ensuring a broad market reach beyond professional construction sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 565.8 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, BASF SE, Wacker Chemie AG, Mapei S.p.A., Saint-Gobain, Knauf Gips KG, Ardex GmbH, USG Corporation, Bostik (Arkema Group), Fosroc International Limited, Henkel AG & Co. KGaA, CEMEX S.A.B. de C.V., LafargeHolcim Ltd., Custom Building Products, ParexGroup. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Construction Material Market Key Technology Landscape

The technology landscape in the Dry Construction Material Market is characterized by continuous innovation in material science, focusing primarily on optimizing the chemical composition of dry mixes to enhance performance characteristics. A core technological area is the development and incorporation of advanced redispersible polymer powders (RDPs) and cellulose ethers. RDP technology is vital as it allows dry mixes, such as tile adhesives and self-leveling compounds, to achieve high levels of flexibility, adhesion strength, and water resistance upon mixing with water on site. Manufacturers are continuously refining RDP chemistry to allow for faster hydration and setting times without compromising workability, a critical factor for professional contractors.

Another significant technological advancement involves the integration of high-performance supplementary cementitious materials (SCMs), such as micro-silica, fly ash, and ground granulated blast-furnace slag (GGBS), into dry mixes. This not only improves the final strength and durability of the material but also significantly reduces the overall carbon footprint of the product, aligning with green building standards. The technology ensures that these SCMs are uniformly distributed within the dry powder, requiring sophisticated blending and particle size analysis equipment to maintain quality control. Furthermore, specialized dry-powder defoamers and air-entraining agents are being refined to ensure consistent density and minimal air pockets in the applied material, particularly in self-leveling floor screeds.

Process automation technology is equally crucial, encompassing highly efficient, closed-loop mixing and packaging systems in manufacturing plants. Modern dry mix plants utilize advanced sensors and PLC (Programmable Logic Controller) systems to monitor moisture content, particle size, and batch consistency in real-time, minimizing variability and ensuring product standardization across different batches. This high level of process control facilitates the production of highly technical, customized dry materials needed for specialized applications, such as thermal insulating mortars or fireproof spray plasters, marking a key differentiation point among leading market players.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for dry construction materials, primarily driven by massive infrastructure spending, rapid urbanization, and a burgeoning middle class demanding higher quality housing standards. Countries like China, India, and Southeast Asian nations are undergoing intensive construction booms, where the efficiency and consistency offered by dry mix products are essential for meeting project deadlines. The regional market is characterized by strong price sensitivity and a focus on both high-volume standardized products (like basic tile adhesives) and increasingly, on sophisticated dry wall systems (gypsum boards) favored in modern commercial and high-rise residential construction. The region's growth is heavily supported by government initiatives promoting sustainable and earthquake-resistant building codes.

- Europe: Europe represents a mature market focused heavily on renovation, energy efficiency, and high-performance requirements mandated by the European Union’s energy directives. Demand is concentrated in specialized segments, particularly Exterior Insulation and Finish Systems (EIFS) utilizing dry mortars for bonding and rendering, driven by the necessity to upgrade the thermal performance of existing building stock. Germany, France, and the UK are key markets, characterized by stringent quality control and high adoption rates of environmentally certified (e.g., LEED, BREEAM) dry materials. Innovation in bio-based and low-VOC dry construction products provides a competitive edge in this highly regulated environment.

- North America: The North American market, led by the United States, is characterized by high adoption of lightweight construction methods, particularly extensive use of gypsum wallboard systems for interior partitioning. Market growth is robust in the commercial and institutional sectors, where speed of installation and superior acoustic performance are critical. The demand for advanced dry mix mortars, especially self-leveling floor underlayments and high-performance tile installation systems, is driven by the growing renovation sector and the preference for large-format ceramic and stone tiles. Logistics efficiency and standardized product certification (e.g., ASTM standards) are key market entry factors.

- Latin America (LATAM): LATAM is an emerging market showing steady growth, driven by residential construction activity and public works projects. Brazil and Mexico are the dominant markets, where local manufacturers are competing with global players by focusing on product accessibility and regional adaptation of dry mix formulations to suit local raw material availability and climatic conditions. While price sensitivity remains high, the increasing awareness of material quality and durability is gradually pushing demand toward standardized dry products over traditional site-mixed materials. Infrastructure modernization initiatives, especially related to transportation networks, boost demand for specialized repair and grouting mortars.

- Middle East and Africa (MEA): The MEA region is expanding rapidly due to large-scale urban development projects, particularly in the GCC countries (UAE, Saudi Arabia). The market is defined by extreme weather conditions, necessitating high-performance dry materials that offer enhanced heat resistance, waterproofing capabilities, and anti-efflorescence properties. Investment in mega-projects and diversification away from oil economies fuel demand for premium façade mortars and advanced repair compounds. Africa, while geographically diverse, presents significant potential driven by rapid population growth and increasing investment in affordable housing projects, creating a strong market for basic, reliable dry plasters and mortars.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Construction Material Market.- Sika AG

- BASF SE

- Wacker Chemie AG

- Mapei S.p.A.

- Saint-Gobain

- Knauf Gips KG

- Ardex GmbH

- USG Corporation

- Bostik (Arkema Group)

- Fosroc International Limited

- Henkel AG & Co. KGaA

- CEMEX S.A.B. de C.V.

- LafargeHolcim Ltd.

- Custom Building Products

- ParexGroup

- Drymix International

- Schluter-System KG

- Röfix AG

- Weber (Saint-Gobain subsidiary)

- HB Fuller

Frequently Asked Questions

Analyze common user questions about the Dry Construction Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using dry construction materials over traditional wet methods?

Dry construction materials offer superior quality consistency due to factory pre-mixing, significantly reduce on-site waste, enhance construction speed, and provide specialized performance features such as improved thermal insulation, fire resistance, and superior adhesion qualities, leading to more durable structures.

Which segment of the Dry Construction Material Market is showing the highest growth potential?

The Dry Mix Mortars segment, particularly specialized tile adhesives and self-leveling floor screeds, exhibits the highest growth potential, driven by global renovation trends and the need for precision flooring installation in commercial and residential developments across APAC and Europe.

How is sustainability impacting the development of dry construction materials?

Sustainability demands are driving manufacturers to incorporate recycled content and supplementary cementitious materials (SCMs) into dry mixes, thereby reducing the reliance on high-carbon footprint Portland cement and lowering the embodied energy of the final construction product.

What major challenges does the Dry Construction Material Market face globally?

Major challenges include the high logistical costs associated with transporting bulky materials, the fluctuating prices of petrochemical-derived polymer additives, and the need for significant capital investment to establish regional, automated manufacturing facilities capable of maintaining high-quality standards.

Which region dominates the global consumption of dry construction materials?

The Asia Pacific (APAC) region dominates the global market, fueled by aggressive governmental spending on infrastructure, high rates of urbanization, and a massive scale of residential and commercial construction projects, particularly in emerging economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dry Construction Material Market Statistics 2025 Analysis By Application (Wall, Ceiling, Flooring), By Type (Metal, Wood, Gypsum Board, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Dry Construction Material Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Plasterboard, Wood, Metal, Plastic, Others), By Application (Residential, Non-residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager