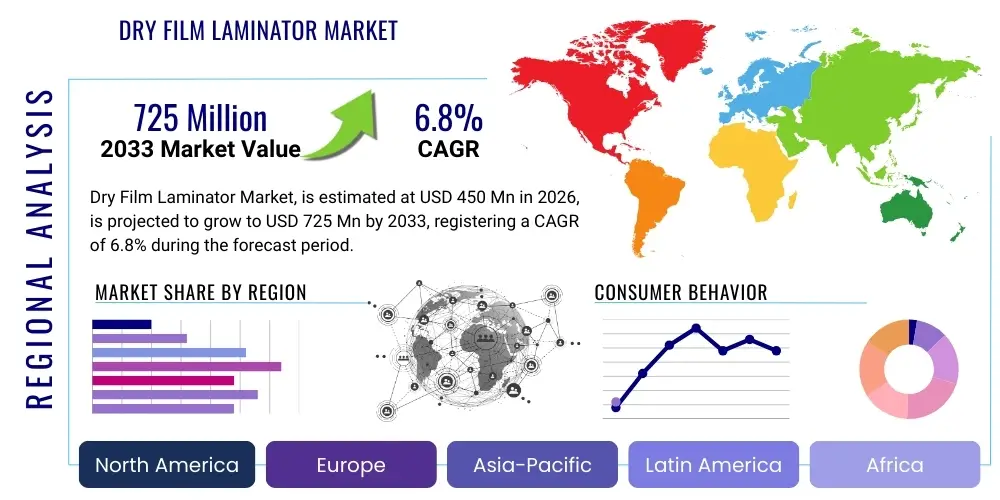

Dry Film Laminator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436851 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dry Film Laminator Market Size

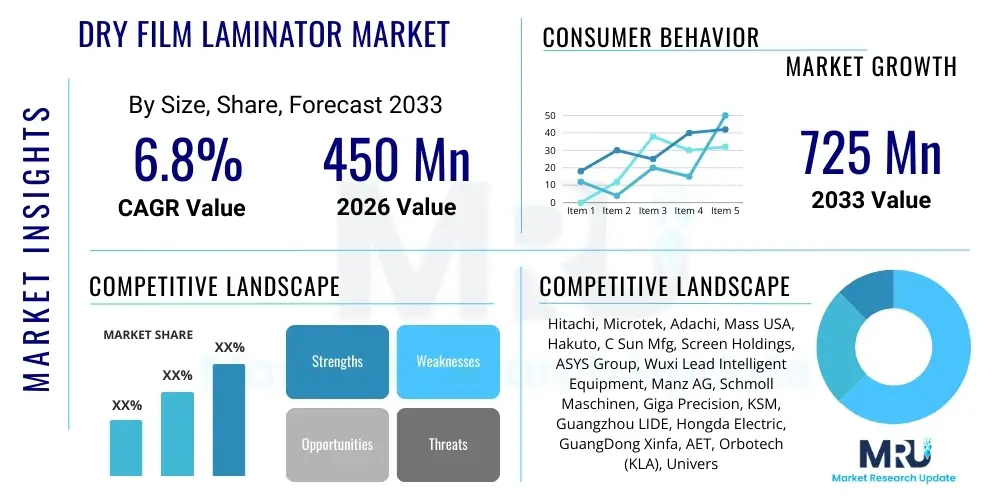

The Dry Film Laminator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $725 Million USD by the end of the forecast period in 2033.

Dry Film Laminator Market introduction

The Dry Film Laminator Market encompasses specialized industrial machinery designed for applying dry photoresist films, protective films, or specialized insulating layers onto substrates, predominantly utilized in the manufacturing of Printed Circuit Boards (PCBs), flexible electronics, semiconductor packaging, and specific optical components. Dry film photoresists offer superior resolution and consistency compared to liquid resists, making the laminators essential for high-precision patterning processes required in advanced electronics manufacturing. These machines operate using precise temperature, pressure, and speed controls to ensure bubble-free adhesion and uniform thickness of the applied film, which is crucial for subsequent etching or plating processes.

The primary product served by this market is the automated or semi-automated lamination system capable of handling various substrate sizes and material types, ranging from rigid copper-clad laminates (CCL) to flexible polyimide films. Major applications span high-density interconnect (HDI) PCB production, semiconductor wafer thinning protection, flexible printed electronics (FPC), and microelectromechanical systems (MEMS) fabrication. The core benefits derived from utilizing high-quality dry film laminators include enhanced circuit line resolution, reduced material wastage due to precise application, improved operational throughput, and cleaner processing environments compared to traditional liquid coating methods, which directly contributes to the reliability and miniaturization capabilities of modern electronic devices.

Driving factors for sustained market growth include the relentless global demand for advanced electronic devices such as 5G infrastructure components, high-performance computing (HPC) platforms, electric vehicle (EV) electronics, and Internet of Things (IoT) devices, all of which require increasingly complex and miniaturized PCBs. Furthermore, the expansion of flexible electronics and the trend toward thinner, lighter electronic modules necessitate sophisticated lamination techniques that dry film laminators are uniquely positioned to provide. Technological advancements, particularly in automated material handling and in-line inspection systems integrated within the laminators, are further accelerating adoption rates across Asia Pacific and other major manufacturing hubs.

Dry Film Laminator Market Executive Summary

The Dry Film Laminator Market is experiencing robust expansion driven by significant shifts in global electronics manufacturing, characterized by a move towards higher layer count PCBs and advanced packaging technologies. Business trends indicate a strong competitive focus on developing highly automated, large-format laminating systems capable of precision handling ultra-thin substrates, thereby addressing the yield challenges associated with HDI and FPC production. Key manufacturers are increasingly prioritizing integration capabilities, offering solutions that seamlessly connect lamination processes with upstream cleaning and downstream exposure equipment, leading to fully synchronized production lines. Strategic collaborations and mergers among equipment suppliers and specialized film producers are notable, aiming to optimize the chemical compatibility and mechanical performance of the lamination process. Furthermore, sustainability is emerging as a business imperative, pushing vendors to design machines with reduced energy consumption and improved material utilization efficiency.

Regional trends clearly highlight the Asia Pacific (APAC) region, specifically China, Taiwan, South Korea, and Japan, as the definitive epicenter of demand and innovation, fueled by the massive concentration of PCB fabrication plants and semiconductor foundries. This region not only dominates manufacturing output but also exhibits the fastest adoption rate of next-generation laminators to support the rapidly growing 5G and data center markets. North America and Europe, while possessing mature markets, are focusing primarily on high-mix, low-volume production for specialized aerospace, defense, and medical electronics applications, demanding equipment capable of extreme precision and flexibility in handling diverse material chemistries. Emerging markets, particularly Southeast Asia, are showing increasing investment in basic and mid-range lamination equipment as global supply chains diversify manufacturing footprints away from established hubs.

Segmentation trends reveal that the Automatic Dry Film Laminator segment, due to its efficiency and reduced dependency on manual labor, maintains the largest market share and is projected to witness the highest growth, driven by economies of scale in high-volume PCB operations. In terms of application, the High-Density Interconnect (HDI) segment remains pivotal, reflecting the ongoing miniaturization trend in consumer electronics. Technology-wise, vacuum lamination remains critical for applications requiring zero air inclusion, such as advanced semiconductor packaging and multi-layer PCB bonding. The trend is moving towards multi-functional systems that can handle both standard photoresist lamination and specialized protective film bonding for final product assembly stages, thereby diversifying the product offerings of market participants.

AI Impact Analysis on Dry Film Laminator Market

User queries regarding AI's influence on the Dry Film Laminator Market primarily revolve around questions concerning predictive maintenance, process optimization, yield enhancement, and the potential for fully autonomous lamination processes. Users frequently ask how AI can utilize real-time sensor data—such as temperature uniformity, pressure profiles, and material stretch—to preemptively identify potential defects like bubbling or incomplete adhesion. A key concern is whether AI algorithms can minimize material waste and energy consumption by dynamically adjusting lamination parameters based on substrate variability and environmental factors. Overall expectations center on AI providing a significant leap in operational efficiency, moving beyond traditional statistical process control (SPC) towards true machine learning-driven quality assurance and throughput maximization, essential for the demanding tolerances of advanced PCB fabrication.

- AI-Driven Predictive Maintenance: Utilizing machine learning algorithms on sensor data (vibration, heat, current draw) to forecast equipment failure, minimizing unplanned downtime and optimizing maintenance schedules for critical lamination rollers and heating elements.

- Real-Time Parameter Optimization: Implementing AI to dynamically adjust lamination speed, pressure, and temperature settings based on real-time feedback from in-line quality inspection systems, ensuring optimal film adhesion and uniformity across varying batch materials.

- Enhanced Yield Management: Employing computer vision coupled with AI to detect micro-defects (e.g., trapped air, wrinkles) immediately post-lamination, classifying defect severity, and correlating them with preceding process variables to improve overall fabrication yield.

- Automated Recipe Generation: AI tools capable of analyzing historical production data to automatically generate optimized lamination recipes for new or unusual substrate/film combinations, significantly reducing setup time and expert reliance.

- Energy Consumption Reduction: Using predictive models to optimize heating and cooling cycles within the laminator, ensuring energy is only utilized when necessary and reducing the overall carbon footprint of the manufacturing process.

- Supply Chain and Inventory Forecasting: Applying machine learning to forecast demand fluctuations for specific film types (e.g., dry film photoresists vs. permanent protective films), allowing laminator users to optimize inventory levels and material sourcing.

- Autonomous Quality Control Integration: Integrating deep learning models with in-line cameras and sensors to provide autonomous, high-speed defect scrutiny that surpasses human detection capabilities, ensuring compliance with ultra-high resolution requirements.

DRO & Impact Forces Of Dry Film Laminator Market

The Dry Film Laminator Market is heavily influenced by a confluence of driving factors, market restraints, and significant growth opportunities, collectively shaping its trajectory and competitive landscape. Key drivers include the exponential growth in demand for High-Density Interconnect (HDI) PCBs and multi-layer substrates necessitated by the global adoption of 5G technology, cloud infrastructure, and advanced automotive electronics, all requiring superior circuit resolution that dry film processes enable. The rising investment in semiconductor fabrication facilities, particularly in advanced packaging which utilizes specialized dry films for temporary protection and structuring, further fuels machinery demand. Additionally, the inherent advantages of dry film lamination—such as improved uniformity, higher chemical resistance, and cleaner processing compared to wet processes—are accelerating its adoption in precision manufacturing environments. These factors collectively exert a strong upward force on market expansion, compelling manufacturers to invest in faster, more accurate lamination equipment to meet industrial scalability needs.

Despite the strong growth momentum, the market faces several restraining forces that challenge widespread adoption and profitability. The high initial capital investment required for purchasing advanced, fully automated dry film laminators, especially those incorporating vacuum technology, can be prohibitive for small and medium-sized PCB manufacturers, particularly in developing economies. Furthermore, the operational complexity and the need for specialized technical expertise to maintain and troubleshoot high-precision lamination systems present a barrier to entry. Price volatility and supply chain disruptions affecting key components, such as sophisticated roller materials and precision heating elements, can impact manufacturing costs and lead times for the laminator producers. Moreover, the increasing regulatory scrutiny concerning chemical waste management, although less severe than wet processing, still requires careful consideration and specialized infrastructure, marginally curbing deployment speed.

Opportunities for market expansion are predominantly centered around the rising prominence of flexible hybrid electronics (FHE) and the commercialization of novel materials, such as ultra-thin glass and advanced composite substrates, which demand specialized lamination techniques. The growing focus on environmental, social, and governance (ESG) factors provides an opportunity for manufacturers to innovate towards eco-friendly lamination processes that utilize solvent-free films or significantly reduce energy consumption, attracting investment from environmentally conscious corporations. Geographically, there is substantial untapped potential in expanding manufacturing capacities across Southeast Asia (e.g., Vietnam, Thailand) and India, driven by global supply chain diversification strategies. Integrating advanced automation technologies, including AI-driven process control and robotics for material handling, represents a key opportunity for premium equipment providers to differentiate their offerings and achieve higher price points based on superior yield and reduced operational complexity.

Segmentation Analysis

The Dry Film Laminator Market is segmented based on critical factors including product type, operational mechanism, application, and end-use industry, providing a granular view of market dynamics and adoption patterns. Segmentation by type differentiates between fully automatic, semi-automatic, and manual systems, reflecting varying throughput requirements and capital investment capabilities across the industry. The operational mechanism segmentation often includes standard roller lamination, vacuum lamination, and hot press systems, catering to specific technical requirements such as achieving void-free bonding essential for multi-layer PCBs and sensitive substrates. Application analysis focuses heavily on the distinct demands of High-Density Interconnect (HDI), standard multi-layer PCBs, and specialized flexible printed circuits (FPC), which dictate the precision and substrate handling capabilities of the required laminator. End-use categorization targets high-growth sectors like consumer electronics, automotive, telecommunications, and aerospace, each having unique demands regarding lamination tolerances and material compatibility.

- By Product Type

- Automatic Dry Film Laminators

- High-Volume Production Systems

- Large Format Systems

- Semi-Automatic Dry Film Laminators

- Mid-Range Capacity Systems

- R&D and Prototyping Units

- Manual Dry Film Laminators (Niche Applications)

- Automatic Dry Film Laminators

- By Technology/Operational Mechanism

- Standard Hot Roller Lamination

- Double-Sided Lamination

- Single-Sided Lamination

- Vacuum Dry Film Lamination

- Enhanced Void-Free Bonding

- Used for Multi-Layer and HDI

- Hot Press Lamination (Primarily for Permanent Bonding/Coverlay)

- Standard Hot Roller Lamination

- By Application

- Printed Circuit Board (PCB) Manufacturing

- Outer Layer Photoresist Application

- Inner Layer Photoresist Application

- Flexible Printed Circuit (FPC) Fabrication

- Semiconductor Wafer Packaging/Thinning Protection

- Microelectromechanical Systems (MEMS) Production

- Display and Touch Panel Manufacturing

- Printed Circuit Board (PCB) Manufacturing

- By End-Use Industry

- Consumer Electronics (Smartphones, Wearables)

- Automotive Electronics (ADAS, Battery Management Systems)

- Telecommunications and Data Centers (5G Infrastructure, Servers)

- Aerospace and Defense

- Medical Devices and Healthcare Equipment

- Industrial Automation and Control Systems

Value Chain Analysis For Dry Film Laminator Market

The value chain for the Dry Film Laminator Market begins with upstream activities involving the sourcing and refinement of specialized raw materials and components, which are crucial for the performance and longevity of the machinery. Key upstream suppliers provide high-precision rollers (often made of specialized rubber or silicone), advanced heating elements (infrared and contact heating units), precision control systems (PLCs, sensors, and servomotors), and structural metals and alloys. The quality of these inputs directly impacts the laminator’s ability to maintain uniform temperature and pressure, which is critical for high-yield lamination. Strong relationships with reliable component suppliers, especially those specializing in temperature control and pneumatic systems, are essential for maintaining manufacturing quality and competitive pricing in the final equipment assembly stage. Any disruption in the supply of these specialized components can significantly affect the production timelines of laminator manufacturers.

Midstream activities encompass the design, manufacturing, assembly, and testing of the dry film laminator systems. This phase requires sophisticated engineering expertise, particularly in thermal dynamics, mechanics, and software control integration. Manufacturers focus on product differentiation through features such as automated material handling, in-line vision inspection systems, and advanced vacuum capabilities. Downstream activities involve distribution, sales, installation, and comprehensive post-sales service, including maintenance contracts and spare parts supply. The distribution channel is predominantly direct, especially for high-end, custom-built automatic systems, where technical consultation and complex installation are required. Indirect channels, involving regional agents and distributors, are more common for standardized or smaller semi-automatic models targeting smaller enterprises or educational institutions.

The primary distribution mechanism relies on direct sales teams engaged in technical selling, leveraging their expertise to provide tailored solutions to large PCB fabrication houses (Tier 1 and Tier 2 manufacturers). Indirect distribution channels, while present, mainly serve localized markets or handle the logistics of equipment placement. The effectiveness of the value chain is determined by the manufacturer's ability to maintain high intellectual property control over proprietary temperature and pressure control algorithms and to provide rapid, high-quality technical support to minimize customer production downtime. The strong service component in the downstream segment is a significant differentiator, as end-users prioritize maximum uptime and precise calibration to meet stringent quality standards in electronics manufacturing.

Dry Film Laminator Market Potential Customers

The primary end-users and buyers of Dry Film Laminator equipment are corporations operating within the global electronics manufacturing ecosystem, requiring high-precision application of photoresist or protective films. These include dedicated Printed Circuit Board (PCB) fabrication houses, ranging from massive multi-national contract manufacturers specializing in high-volume, standard PCBs to highly specialized boutique firms focusing on rigid-flex, HDI, and specialized aerospace boards. These customers are driven by the need for repeatable quality, high throughput, and the ability to handle the increasing complexity of circuit design features, which mandates the use of highly automated dry film systems over older, less precise technologies.

A significant customer segment also includes semiconductor companies, particularly those engaged in advanced wafer-level packaging (WLP) and 3D integration technologies. These manufacturers utilize high-precision laminators for temporary bonding films, protective films during thinning and handling processes, and for certain steps in bump or redistribution layer (RDL) formation. The stringent requirements for cleanliness, lack of voids, and extremely low Total Thickness Variation (TTV) in semiconductor processing make them buyers of the highest-specification, vacuum-enabled lamination systems. Furthermore, manufacturers of flexible electronics, touchscreens, high-end sensors, and specialized thin-film devices represent a growing segment seeking equipment optimized for delicate and non-standard substrate materials.

Beyond core manufacturing, academic and industrial research institutions (R&D centers) also represent a niche but important customer base. These organizations require flexible, semi-automatic laminators for prototyping new materials and developing next-generation manufacturing processes, particularly in the fields of photonics, microfluidics, and advanced material science. The purchase decision across all segments is heavily influenced not just by the machine's initial cost, but critically by the demonstrated Mean Time Between Failure (MTBF), service availability, and the laminator’s proven ability to achieve high yields in demanding manufacturing environments, often measured in terms of line width/space resolution capability and registration accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $725 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi, Microtek, Adachi, Mass USA, Hakuto, C Sun Mfg, Screen Holdings, ASYS Group, Wuxi Lead Intelligent Equipment, Manz AG, Schmoll Maschinen, Giga Precision, KSM, Guangzhou LIDE, Hongda Electric, GuangDong Xinfa, AET, Orbotech (KLA), Universal Instruments, Fuji Machine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Film Laminator Market Key Technology Landscape

The technological landscape of the Dry Film Laminator Market is rapidly evolving, driven by the persistent industry push towards tighter tolerances, higher throughput, and reduced material defects, particularly in response to the demands of advanced PCB and semiconductor packaging. The most prominent technological advancement remains the refinement of vacuum lamination technology. Vacuum laminators are essential for multi-layer and fine-pitch applications where trapped air between the substrate and the film, or between stacked layers, is completely unacceptable. Modern vacuum systems utilize sophisticated chambers and precise pressure regulation to ensure a void-free bond, critical for maintaining signal integrity in high-frequency circuits (e.g., 5G components). Manufacturers are focusing on reducing cycle times within the vacuum chamber, thereby improving overall system throughput without compromising the quality of the lamination.

Another crucial technological focus involves the optimization of thermal control and roller systems. Achieving perfect temperature uniformity across the width of large-format substrates is challenging but necessary. Advanced laminators now incorporate multi-zone heating systems, often utilizing sophisticated infrared and PID controllers, coupled with specialized roller materials (e.g., high-temperature resistant silicone or composite materials) that ensure consistent pressure distribution and minimized substrate warping. Furthermore, the integration of automated material handling and alignment systems has become standard for high-end automatic laminators. These systems use precision optics and machine vision to achieve sub-micron registration accuracy, ensuring that the photoresist is perfectly aligned with the underlying circuit image, which is paramount for HDI fabrication.

The trend towards Industry 4.0 integration is also transforming the market. New laminator models are equipped with extensive sensor arrays and internet connectivity, facilitating real-time monitoring of critical parameters (temperature, pressure, speed, tension) and enabling data transmission for centralized Manufacturing Execution Systems (MES) and AI-driven process control. This connectivity allows for remote diagnostics, predictive maintenance scheduling, and historical data analysis for continuous process improvement. Furthermore, there is ongoing innovation in developing laminators specifically optimized for thin and flexible substrates, featuring specialized tension control mechanisms and low-stress handling systems to prevent damage or permanent deformation of delicate materials used in flexible OLED displays and wearable devices. These technological improvements collectively aim to enhance yield rates and reduce operational expenditure for end-users, solidifying the market's technical sophistication.

Regional Highlights

The global Dry Film Laminator Market demonstrates highly asymmetric regional demand, intrinsically linked to the geographical concentration of global electronics manufacturing capabilities. Asia Pacific (APAC) dominates the market share and represents the primary growth engine, driven by countries such as China, Taiwan, South Korea, and Japan, which together constitute the world’s largest hub for PCB fabrication, semiconductor packaging, and consumer electronics assembly. The immense capital expenditure directed towards expanding capacity for 5G components, automotive electronics, and high-end servers ensures sustained, high-volume demand for advanced automatic laminators. Government initiatives supporting local electronics manufacturing and rapid industrial automation in countries like China further solidify APAC's leading position, making it the most competitive and technologically active region globally.

North America and Europe represent mature markets characterized by stable but slower growth rates, focusing primarily on high-value, niche applications rather than sheer volume. Demand in these regions is heavily weighted towards highly specialized laminators capable of handling complex substrates for sectors like aerospace, defense, medical imaging, and R&D activities. Manufacturers here emphasize quality, precision, and compliance with stringent regulatory standards. The preference is often for vacuum laminators and systems offering maximum flexibility for high-mix, low-volume production runs. While manufacturing output is lower than in APAC, the high average selling price (ASP) of specialized equipment maintains the financial relevance of these regions.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares, but exhibit growth potential. Growth in MEA is largely dependent on diversification efforts in countries aiming to establish local electronics assembly and maintenance centers, supported by government investment in digitalization infrastructure. Latin America's market growth is driven by localized assembly operations, particularly in Mexico and Brazil, which serve regional consumer electronics and automotive supply chains. Adoption in these regions tends to favor semi-automatic and standard automatic models, focusing on balancing initial investment costs with moderate production requirements, although the overall influence on global market trajectory remains moderate compared to the dominating Asian market.

- Asia Pacific (APAC): Dominates the market due to concentrated PCB and semiconductor manufacturing hubs; fastest growth driven by 5G, IoT, and electric vehicle component production; high adoption rate of fully automatic and vacuum laminators. Key countries include China, Taiwan, South Korea, and Japan.

- North America: Mature market focused on high-precision applications in defense, aerospace, and high-reliability industrial electronics; significant demand for specialized R&D and prototyping systems; emphasis on quality control and stringent process documentation.

- Europe: Stable demand centered around automotive, medical device electronics, and specialized industrial control systems; strong focus on energy-efficient and compliant machinery (e.g., CE marking); adoption rates driven by technological upgrades rather than greenfield capacity expansion.

- Latin America (LATAM): Emerging market segment focusing on localized assembly for consumer and automotive industries; characterized by demand for cost-effective semi-automatic systems; growth influenced by regional economic stability and trade agreements.

- Middle East & Africa (MEA): Smallest regional share, with nascent demand linked to infrastructural development and governmental push towards industrial diversification and technology self-sufficiency; initial adoption concentrated in Gulf Cooperation Council (GCC) countries for maintenance and specialized electronics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Film Laminator Market.- Hitachi High-Tech Corporation (A major supplier known for advanced automated and highly reliable laminating equipment, serving both PCB and specialized film markets.)

- Microtek International Inc. (Renowned for a wide range of dry film lamination solutions, including systems designed for mass production in the Asian market.)

- Adachi Corporation (Specializes in precision equipment, including hot press and advanced lamination systems used in various specialized electronics manufacturing steps.)

- Mass USA (Focuses on providing robust, high-performance laminating solutions tailored for the North American and European PCB manufacturing sectors.)

- Hakuto Co., Ltd. (A technology-oriented firm offering sophisticated machinery and integrated solutions, often catering to high-end Japanese and international electronics clients.)

- C Sun Mfg. (Taiwanese manufacturer recognized for competitive and reliable dry film laminators, especially popular in high-volume Asian PCB facilities.)

- Screen Holdings Co., Ltd. (While known for imaging equipment, they offer integrated solutions that include precision lamination and associated processes for PCB fabrication.)

- ASYS Group (Primarily serving the SMT and electronics assembly markets, offering automation solutions that include high-accuracy lamination steps.)

- Wuxi Lead Intelligent Equipment Co., Ltd. (A fast-growing Chinese automation giant expanding its presence in precision machinery, including lamination systems for batteries and electronics.)

- Manz AG (German company providing high-tech production equipment, particularly strong in systems for flexible electronics, displays, and specialized battery lamination.)

- Schmoll Maschinen GmbH (Specializes in drilling and imaging, offering systems that integrate seamlessly with high-precision dry film lamination processes in advanced PCB plants.)

- Giga Precision Inc. (Provides automation and precision equipment, with a strong focus on enhancing yield and throughput in PCB manufacturing lamination lines.)

- KSM Co., Ltd. (South Korean supplier often focusing on equipment for domestic and regional flexible electronics and display panel manufacturing lines.)

- Guangzhou LIDE Equipment Co., Ltd. (Chinese manufacturer providing various levels of automation in dry film lamination for the rapidly expanding domestic PCB market.)

- Hongda Electric Co., Ltd. (Offers specialized lamination and exposure equipment, contributing to the complete photolithography process chain in electronics fabrication.)

- GuangDong Xinfa Photoelectric Equipment Co., Ltd. (A key player in the supply of equipment for the Chinese electronics market, emphasizing cost-effectiveness and localized support.)

- AET Technologies (Provides precision equipment and integrated solutions for advanced manufacturing, targeting the demanding requirements of specialized circuit boards.)

- Orbotech (KLA Corporation) (Although primarily known for yield management and inspection, their offerings often integrate with and influence the specifications of high-end lamination equipment.)

- Universal Instruments Corporation (Focuses on automation and assembly solutions, increasingly integrating lamination capabilities into broader manufacturing lines.)

- Fuji Machine Mfg. Co., Ltd. (Japanese equipment provider known for precision and reliability, supplying advanced machinery to various segments of the electronics assembly industry.)

Frequently Asked Questions

Analyze common user questions about the Dry Film Laminator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using dry film lamination over liquid photoresist coating methods?

Dry film lamination offers superior resolution, crucial for HDI and fine-pitch circuitry, excellent uniformity of thickness for improved etching consistency, significantly reduced material waste, and a cleaner, more environmentally compliant process due to the elimination of liquid solvents required in coating and developing steps.

How does vacuum lamination technology improve the manufacturing yield in PCB production?

Vacuum lamination technology improves yield by removing all air between the dry film and the substrate surface prior to applying pressure. This process eliminates entrapped air pockets, which, if present, would lead to bubbles, voids, and subsequent circuit defects during etching or plating, ensuring optimal adhesion and reliability, particularly for multi-layer boards.

Which factors are most critical when selecting a high-end automatic dry film laminator for HDI production?

Critical selection factors include high registration accuracy (sub-micron precision), uniformity of roller pressure and temperature across the entire substrate width, maximum throughput capabilities (panels per hour), and advanced automation features such as automatic material loading, alignment systems, and integrated defect detection capabilities.

What is the expected impact of 5G infrastructure expansion on the future demand for dry film laminators?

The deployment of 5G infrastructure necessitates complex, high-frequency, and miniaturized components, requiring PCBs with higher layer counts and finer line/space specifications (HDI). This increased complexity mandates the use of highly precise dry film lamination technology, directly driving robust demand for advanced, high-specification automatic laminators globally.

Are there significant maintenance challenges associated with advanced dry film laminator equipment?

Yes, advanced laminators require specialized maintenance, primarily concerning the periodic calibration of temperature and pressure sensors, replacement of specialized rollers to maintain uniformity, and sophisticated troubleshooting of complex PLC and motion control systems. Downtime can be minimized through predictive maintenance programs and robust manufacturer support services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager