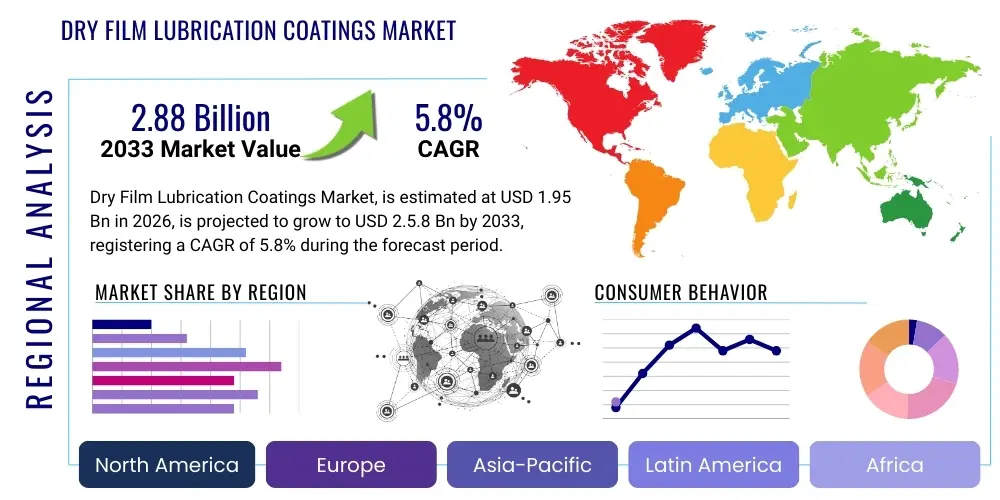

Dry Film Lubrication Coatings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438364 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dry Film Lubrication Coatings Market Size

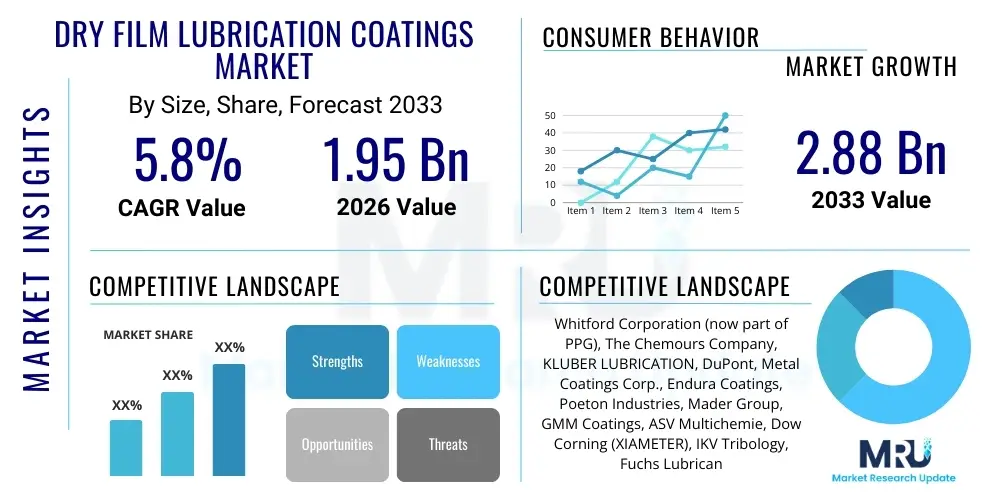

The Dry Film Lubrication Coatings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.88 Billion by the end of the forecast period in 2033. This substantial growth trajectory is driven primarily by the escalating demand for high-performance materials capable of operating efficiently under extreme conditions, such as high temperatures, high pressure, and vacuum environments, particularly across the aerospace and automotive sectors.

Dry Film Lubrication Coatings Market introduction

Dry film lubrication coatings, often referred to as solid lubricants, are specialized surface treatments that provide lubrication without the use of liquid oils or greases. These coatings consist of materials like Molybdenum Disulfide (MoS2), Polytetrafluoroethylene (PTFE), and Graphite, formulated within binders that are applied to substrates. Once cured, they form a robust, thin film offering low friction coefficients and exceptional wear resistance. The primary function is to prevent direct metal-to-metal contact, thereby reducing friction, minimizing heat generation, and significantly extending the operational life of components, particularly where conventional wet lubricants fail or cannot be used, such as in clean rooms, space mechanisms, or high-vacuum chambers.

The major applications for these coatings span critical industries, including automotive systems (especially engine components, fasteners, and transmissions), aerospace mechanisms (actuators, bearings, and gears), and heavy industrial machinery (valves, pumps, and sliding parts). Dry film lubricants are essential in optimizing energy efficiency and ensuring reliability in mission-critical applications. Their benefits are multifaceted, encompassing corrosion protection, excellent performance in harsh chemical environments, and the ability to handle high static loads without displacement or rupture, which is common with liquid films. The move towards electrification in automotive and the need for lighter, more efficient components in aviation are strongly catalyzing market expansion.

Key driving factors fueling market growth include stringent regulatory standards related to emission reduction, which necessitate lightweight and low-friction components, and the increasing utilization of advanced manufacturing techniques that require specialized surface finishes. Furthermore, the rising demand for maintenance-free operation in remote industrial installations, coupled with advancements in coating application technologies like thermal spray and electroplating, ensures that dry film lubricants remain a critical component in modern engineering design. The continuous innovation in binder chemistry, leading to more durable and adherent films, further solidifies the market's positive outlook.

Dry Film Lubrication Coatings Market Executive Summary

The Dry Film Lubrication Coatings Market is characterized by robust business trends emphasizing material science innovation, particularly in developing novel composites that offer superior temperature stability and lower cure times. There is a discernible shift towards fluoropolymer-based coatings (like PTFE) in food processing and medical sectors due to their inertness and non-contaminating properties, while MoS2 and Graphite dominate high-load, extreme-pressure applications in aerospace and defense. Strategic mergers, acquisitions, and partnerships focused on consolidating expertise in niche application areas, such as vacuum sputtering for space applications, define the competitive landscape. Supply chain stability, especially concerning raw materials like Molybdenum and specialized PTFE powders, remains a crucial management focus for leading market participants globally.

Regionally, the market demonstrates distinct development patterns. North America, driven by massive defense spending and advanced aerospace manufacturing (Boeing, Lockheed Martin), represents a mature yet high-value segment demanding military-grade, certified coatings. Asia Pacific (APAC) is projected to exhibit the fastest growth, propelled by the booming automotive manufacturing industry in China and India, coupled with rapid industrialization and escalating investments in general manufacturing infrastructure. Europe maintains a strong market presence, particularly due to stringent environmental regulations (REACH), which favor solvent-free and water-based coating systems, thus fostering innovation in eco-friendly formulations across Germany's and France’s industrial bases.

Segment trends highlight the dominance of Molybdenum Disulfide (MoS2) coatings by volume due to their exceptional load-bearing capacity and versatility in general engineering. However, PTFE and derivative coatings are experiencing accelerated adoption, capitalizing on their versatility in low-friction, chemically resistant, and clean applications. By application, the Automotive segment remains the largest consumer, seeking coatings to improve fuel economy and reduce noise, vibration, and harshness (NVH). Conversely, the Aerospace and Defense segment commands the highest price realization per unit, reflecting the stringent performance specifications, rigorous testing, and high certification costs associated with these critical components.

AI Impact Analysis on Dry Film Lubrication Coatings Market

Common user questions regarding AI's impact on dry film lubrication revolve around how artificial intelligence can optimize coating formulation, predict coating life under variable operational stress, and enhance quality control during application. Users are keen to understand if AI can accelerate the R&D process for novel solid lubricants, especially those tailored for extreme environments, and how machine learning (ML) models can integrate sensor data from coated components to provide predictive maintenance alerts. The central theme emerging is the transition from empirical, trial-and-error coating development to data-driven, accelerated material discovery and application monitoring, leading to better resource allocation and superior product performance predictability.

- AI-driven Predictive Maintenance: ML algorithms analyze real-time sensor data (temperature, vibration, pressure) on coated parts to predict wear rates and optimal re-lubrication intervals, minimizing downtime.

- Formulation Optimization: AI and deep learning accelerate the discovery of novel binder-lubricant combinations, predicting properties like adhesion, friction coefficient, and thermal stability based on molecular structure simulation.

- Automated Quality Control: Computer vision systems utilize AI to inspect coating thickness uniformity, porosity, and surface defects during the application process, ensuring high-fidelity outputs and reducing material waste.

- Enhanced Manufacturing Efficiency: AI optimizes robotic spray patterns and curing oven parameters, reducing energy consumption and achieving higher throughput in coating facilities.

- Customized Coating Solutions: AI processes vast datasets of application requirements (load, speed, environment) to design and suggest highly tailored coating systems for specific component geometries and operational envelopes.

DRO & Impact Forces Of Dry Film Lubrication Coatings Market

The Dry Film Lubrication Coatings Market is primarily driven by technological advancements in materials science, focusing on developing durable, temperature-resistant, and environmentally compliant formulations, particularly water-borne systems. Restraints predominantly involve the high initial investment required for specialized application equipment (e.g., plasma vapor deposition units) and regulatory hurdles associated with certain raw materials (like fluoropolymers) in various geographies. Opportunities lie in expanding adoption within emerging sectors such as renewable energy (wind turbine components) and electric vehicle manufacturing, where traditional lubricants often present inefficiencies. The impact forces are strong, centered on the pervasive demand for improved component longevity and efficiency across high-reliability industries, pushing manufacturers towards continuous performance enhancements and regulatory adherence, particularly concerning volatile organic compound (VOC) emissions during application.

Segmentation Analysis

The Dry Film Lubrication Coatings Market is critically segmented based on the type of lubricating material, the specific application environment, and the end-use industry. This structure allows market participants to tailor their offerings—from specialized MoS2 coatings for high-load aerospace hinges to inert PTFE coatings for medical device components. The complexity arises from the need to match material characteristics, such as thermal stability and load capacity, precisely to the operational demands of the component. Understanding these detailed segments is vital for developing targeted marketing strategies and investing strategically in R&D, ensuring compliance with diverse sector-specific performance and environmental mandates globally.

- By Type: Molybdenum Disulfide (MoS2), Polytetrafluoroethylene (PTFE), Graphite, Tungsten Disulfide (WS2), Others (e.g., Ceramic Composites, Boron Nitride).

- By Application Technique: Spray Coating, Powder Coating, Electroplating, Sputtering/PVD, Dipping.

- By End-Use Industry: Automotive, Aerospace & Defense, Industrial Machinery, Medical & Healthcare, Energy (Oil & Gas, Renewables), Electronics, Others.

- By Function/Environment: High Temperature, High Load/Pressure, Vacuum, Chemical Resistance, Low Friction/Clean Environment.

- By Formulations: Solvent-borne, Water-borne, Hybrid.

Value Chain Analysis For Dry Film Lubrication Coatings Market

The value chain for dry film lubrication coatings begins with upstream activities focused on raw material sourcing and refinement. This involves the extraction and purification of key solid lubricants (e.g., Molybdenum ore for MoS2, Graphite for powdered lubricants) and the synthesis of specialized binders, resins (like epoxy or phenolic resins), and solvents. Quality control at this stage is paramount, as the purity and particle size of the lubricant directly impact the final coating's performance characteristics. Key suppliers in the upstream segment specialize in high-grade chemical processing and powder metallurgy, facing challenges related to volatile commodity pricing and the need for consistent material quality necessary for aerospace-grade applications.

Midstream activities encompass the manufacturing, formulation, and application of the coatings. Manufacturers combine the raw lubricants, binders, and additives to create proprietary coating solutions, often focusing on advanced dispersion technologies to ensure stability and homogeneity. The distribution channel plays a crucial role here; direct distribution is common for large OEM contracts (especially in automotive and aerospace) where technical consultation and post-application support are critical. Indirect distribution, leveraging specialized chemical distributors and regional agents, handles smaller industrial clients and maintenance, repair, and overhaul (MRO) markets. Certification and technical services, including application process training, form a significant value-add in this stage.

Downstream activities involve the final end-user application and post-sales support. For major industries, coatings are often applied in-house by OEMs or by highly specialized, certified coating service providers (applicators). The end-users, such as automotive component manufacturers or aerospace contractors, prioritize coatings based on stringent specification adherence, durability, and cost-effectiveness over the product lifecycle. The long-term value generated is derived from improved operational efficiency, reduced maintenance, and enhanced component life. The feedback loop from end-users regarding coating wear, failure modes, and performance in real-world environments drives innovation in the upstream R&D segment.

Dry Film Lubrication Coatings Market Potential Customers

The primary consumers of dry film lubrication coatings are entities requiring high-performance, durable, and reliable surface treatments for components operating under conditions where traditional liquid lubrication is infeasible or insufficient. This includes Original Equipment Manufacturers (OEMs) across multiple heavy industries. In the automotive sector, customers are Tier 1 suppliers specializing in engine, transmission, and braking systems who need to reduce friction in high-temperature, high-stress components such as pistons, valves, and fasteners to meet fuel efficiency targets. They demand high-volume, cost-effective, and reproducible coating processes.

Another significant customer base resides in the aerospace and defense sectors, including military contractors and commercial aircraft manufacturers. These customers prioritize performance specifications above all, requiring certified coatings (often based on military or FAA standards) for critical flight components like landing gear mechanisms, actuators, satellite gears, and vacuum-exposed parts. The purchasing decision here is heavily influenced by quality assurance, traceability, and the ability of the coating to withstand extreme temperature cycling and radiation exposure. These entities typically engage in long-term, direct procurement relationships with specialized coating formulators.

Beyond transportation, the industrial machinery, and energy sectors represent growing customer groups. Companies manufacturing industrial valves, high-speed bearings, compressors, and food processing equipment are critical buyers. They seek dry film solutions to eliminate contaminant leakage risks, reduce particle generation in clean environments, or provide lubrication in chemically aggressive settings (e.g., oil and gas drilling equipment). The expanding medical device manufacturing sector is also a high-potential buyer, demanding bio-compatible and non-toxic PTFE-based coatings for instruments and implants that require smooth, frictionless movement within the human body or during sterile handling processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.88 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Whitford Corporation (now part of PPG), The Chemours Company, KLUBER LUBRICATION, DuPont, Metal Coatings Corp., Endura Coatings, Poeton Industries, Mader Group, GMM Coatings, ASV Multichemie, Dow Corning (XIAMETER), IKV Tribology, Fuchs Lubricants, Henkel Corporation, Aalberts Surface Technologies, NIPPON CHEMI-CON, Bechem, Everlube Products, Micro Surface Corporation, Zeller+Gmelin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Film Lubrication Coatings Market Key Technology Landscape

The technology landscape for dry film lubrication coatings is constantly evolving, driven by the need for enhanced durability, thermal stability, and environmental compliance. A core focus is on optimizing the application technology, moving beyond traditional batch processing (like dipping and spraying) toward advanced, controlled techniques. Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), particularly for Tungsten Disulfide (WS2) and MoS2, are gaining traction. These vacuum-based methods allow for the creation of extremely thin, highly adherent, and pure lubricating films, essential for components operating in high-vacuum or space applications where any binder residue is unacceptable. Furthermore, researchers are heavily invested in developing nano-composite coatings that incorporate functionalized nanoparticles (like graphene or carbon nanotubes) to significantly boost mechanical strength and anti-wear properties without compromising the low coefficient of friction.

Innovations in binder technology are equally crucial. There is a strong industry movement towards utilizing high-performance resins, such as polyimides, polyamides, and specialized fluoropolymers, capable of sustaining continuous operational temperatures exceeding 300°C. This allows dry films to replace wet lubricants in challenging engine and brake applications. Simultaneously, regulatory pressures, especially in Europe and North America, mandate the transition from traditional solvent-borne formulations (high in VOCs) to water-borne or 100% solid systems. Water-borne technology requires sophisticated chemistry to ensure adequate pigment dispersion, film formation, and adhesion while maintaining performance parity with solvent-based predecessors, driving significant R&D investment.

Beyond formulation and application, the development of smart and responsive coating systems represents the cutting edge of the technology landscape. Research into self-healing coatings, where microcapsules containing reserve lubricant or repair agents rupture upon excessive wear or thermal stress, is demonstrating early commercial potential. These "intelligent" coatings extend the component lifespan dramatically, reducing the need for premature maintenance. Furthermore, integration with IoT (Internet of Things) and sensor technology allows the coating itself, or embedded layers within it, to communicate real-time degradation data, facilitating proactive decision-making in high-capital assets like wind turbines or nuclear facility components.

Regional Highlights

Regional dynamics are critical to understanding the global Dry Film Lubrication Coatings market, reflecting diverse industrial bases, regulatory environments, and technological adoption rates.

- North America: Highly mature market, dominated by the robust Aerospace & Defense industry. Stringent military specifications (MIL-SPEC) drive demand for premium, high-certification MoS2 and proprietary fluoropolymer coatings. The US is a major technology developer, focusing on high-load and extreme-temperature solutions for automotive performance enhancement and space exploration.

- Europe: Characterized by strong environmental regulations (REACH), forcing a rapid transition to water-borne and low-VOC formulations. Germany is a key demand center, driven by precision engineering, automotive manufacturing, and industrial machinery production. Emphasis is placed on coatings that provide long-term corrosion protection and energy efficiency gains.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid industrialization, expansion of the automotive sector (China, India, South Korea), and burgeoning electronics manufacturing. Demand is characterized by high volume, cost-competitiveness, and a growing adoption of advanced coatings to meet rising domestic quality standards and export requirements.

- Latin America: Emerging market with moderate growth, primarily tied to oil and gas extraction and heavy machinery maintenance. Demand is sensitive to global commodity prices, with primary uptake centered on maintenance and repair applications for existing industrial infrastructure.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by infrastructure investment and the large-scale petrochemical and oil & gas industries. Coatings are essential for components exposed to high heat, corrosive environments, and abrasive sand particles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Film Lubrication Coatings Market.- Whitford Corporation (now part of PPG)

- The Chemours Company

- KLUBER LUBRICATION

- DuPont

- Metal Coatings Corp.

- Endura Coatings

- Poeton Industries

- Mader Group

- GMM Coatings

- ASV Multichemie

- Dow Corning (XIAMETER)

- IKV Tribology

- Fuchs Lubricants

- Henkel Corporation

- Aalberts Surface Technologies

- NIPPON CHEMI-CON

- Bechem

- Everlube Products

- Micro Surface Corporation

- Zeller+Gmelin

Frequently Asked Questions

Analyze common user questions about the Dry Film Lubrication Coatings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of dry film lubrication over traditional wet lubrication?

Dry film lubrication excels in environments where wet lubricants fail, such as extreme temperatures, high vacuum, or exposure to harsh chemicals. They prevent particle contamination, do not attract dust, and offer maintenance-free performance, providing superior anti-stick and corrosion protection for the component.

Which industrial application segment accounts for the largest share of dry film coatings demand?

The Automotive segment holds the largest market share. Dry films are critically used in automotive components, including internal engine parts, braking systems, and fasteners, to improve fuel efficiency, reduce component wear, and manage heat dissipation effectively.

How do regulatory changes, such as VOC restrictions, influence the formulation of dry film coatings?

Environmental regulations, particularly regarding Volatile Organic Compounds (VOCs), mandate a shift toward solvent-free and water-borne coating formulations. Manufacturers are investing heavily in water-based binders and dispersion technologies to ensure coatings remain compliant without compromising performance characteristics like adhesion and durability.

What is the main difference between Molybdenum Disulfide (MoS2) and Polytetrafluoroethylene (PTFE) coatings?

MoS2 coatings are primarily used for high-load, high-pressure, and vacuum environments, offering excellent extreme-pressure properties. PTFE coatings, conversely, offer superior chemical inertness, excellent non-stick properties, and lower friction coefficients in clean, lower-load, and corrosive environments, making them ideal for food and medical applications.

What cutting-edge technologies are being developed in the dry film coatings space?

Key technological advancements include the utilization of Physical Vapor Deposition (PVD) for ultra-thin, highly pure films; the incorporation of nano-materials like graphene for enhanced tribological properties; and the development of 'smart' coatings capable of self-healing or communicating real-time wear data via embedded sensors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager