Dry Film Photoresist Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437435 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Dry Film Photoresist Market Size

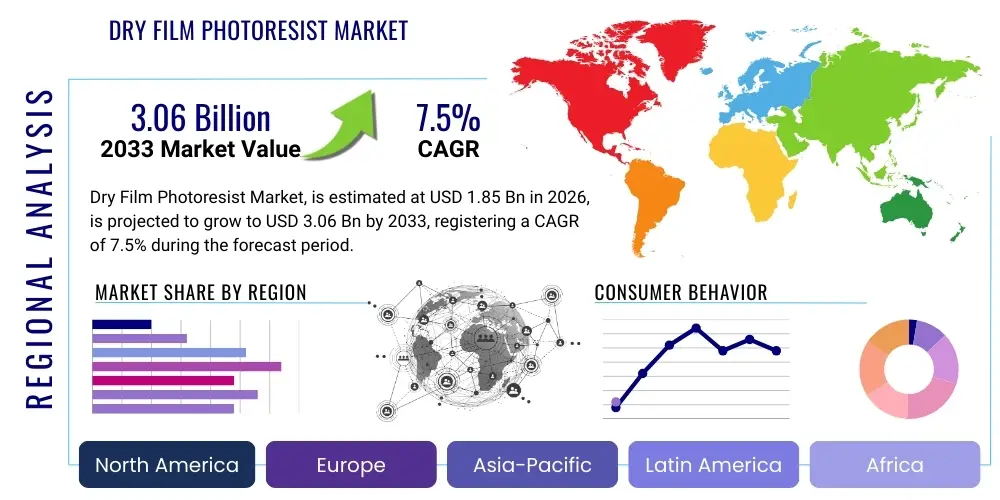

The Dry Film Photoresist Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.06 Billion by the end of the forecast period in 2033.

Dry Film Photoresist Market introduction

Dry film photoresist (DFPR) materials constitute specialized polymer films used extensively in microlithography processes, particularly within the manufacturing of Printed Circuit Boards (PCBs), semiconductor packaging, and advanced display technologies. Unlike liquid photoresists, DFPRs offer superior uniformity, excellent resolution capabilities, and environmentally friendlier processing, eliminating the need for complex spin-coating equipment and reducing solvent waste. These films are laminated onto a substrate, exposed to UV light through a photomask, and then developed to create precise patterns necessary for subsequent etching or plating processes. The inherent advantages of dry films, such as better adherence on rough surfaces and consistent thickness control, make them crucial for high-density interconnect (HDI) PCBs and fine-pitch semiconductor applications.

The primary applications driving the Dry Film Photoresist Market include the production of multi-layer PCBs, flexible printed circuits (FPCs), advanced packaging structures like Wafer Level Packaging (WLP) and Redistribution Layers (RDLs), and increasingly, in microelectromechanical systems (MEMS) fabrication. The demand acceleration is intrinsically linked to the global proliferation of complex electronic devices, 5G infrastructure deployment, and the automotive industry’s shift toward advanced driver-assistance systems (ADAS), all requiring higher circuit density and improved reliability. Benefits of utilizing DFPRs encompass reduced operational costs through lower material consumption, enhanced process stability due to uniform thickness, and improved handling safety compared to volatile liquid chemicals.

Key driving factors supporting market expansion include the sustained miniaturization trend in consumer electronics, necessitating finer line widths and spaces that DFPR technology effectively supports. Furthermore, significant investment in high-end semiconductor manufacturing capacity, particularly in Asia Pacific, coupled with the necessity for high-performance packaging solutions, solidifies the market’s growth trajectory. The transition from traditional PCBs to HDI and flexible circuits, which greatly benefit from the conformal coverage and robust nature of dry films, is also a pivotal catalyst for market expansion throughout the forecast period.

Dry Film Photoresist Market Executive Summary

The Dry Film Photoresist Market is currently experiencing robust growth, primarily fueled by rapid expansion in the global electronics manufacturing sector and pivotal technological advancements in advanced semiconductor packaging. Business trends indicate a strategic focus among major manufacturers on developing high-resolution, high-aspect-ratio dry films capable of meeting the stringent demands of 5G components and Artificial Intelligence (AI) hardware, which require extremely complex circuit patterns. Consolidation and strategic partnerships between DFPR suppliers and large-scale electronics manufacturers are becoming prevalent, aimed at securing stable supply chains and customizing film properties for specific fabrication processes. Furthermore, there is a distinct business shift towards environmentally sustainable film chemistries and solvent-free processing methods, aligning with global regulatory pressures regarding hazardous material usage, particularly in established markets like Europe and North America.

Regionally, Asia Pacific (APAC) dominates the Dry Film Photoresist Market, serving as the epicenter for global electronics manufacturing, encompassing key production hubs in China, South Korea, Taiwan, and Japan. This regional strength is underpinned by massive investments in PCB fabrication capacity and cutting-edge semiconductor foundries, particularly in advanced packaging (e.g., flip-chip and WLP). North America and Europe, while smaller in volume, represent critical markets for high-value, specialized DFPR applications, including aerospace, defense electronics, and advanced MEMS devices, prioritizing innovative materials that offer superior thermal and chemical resistance. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging slowly, driven by localized consumer electronics assembly and infrastructural development projects.

Segmentation trends highlight the increasing prominence of permanent dry film photoresists, especially those utilized in advanced semiconductor packaging and specialized high-reliability PCBs, due to their requirement for structural integrity after processing. By application, the semiconductor packaging segment is exhibiting the highest growth rate, surpassing traditional PCB applications, propelled by the shift towards smaller, more powerful integrated circuits (ICs) utilizing advanced backend processing. In terms of thickness, the demand for thin films (less than 20 µm) is accelerating rapidly, crucial for fine-pitch WLP and RDL applications where ultra-fine feature definition is paramount, necessitating continuous innovation in film lamination and resolution capabilities to maintain competitive edge in complex manufacturing environments.

AI Impact Analysis on Dry Film Photoresist Market

User queries regarding AI's impact on the Dry Film Photoresist Market often center around two main themes: the direct demand surge driven by AI hardware and the implementation of AI/Machine Learning (ML) within the manufacturing process itself. Users are concerned about whether existing DFPR materials can sustain the density and thermal demands of next-generation AI accelerators (GPUs, TPUs) and high-performance computing (HPC) modules, which necessitate extremely complex, multi-layer interconnects and superior thermal management. Furthermore, there is significant interest in how AI tools, particularly predictive maintenance and quality control systems, are being integrated into the lithography and lamination steps of DFPR processing to improve yield rates, minimize defects, and optimize chemical usage, thus reducing operational costs and enhancing material throughput in high-volume production lines.

- Increased Demand for Advanced Packaging: AI hardware necessitates complex chip architectures requiring high-density interconnects (HDIs) and advanced packaging (RDL, 3D stacking), directly boosting demand for high-resolution DFPRs.

- Quality Control Automation: Implementation of AI-powered vision systems for real-time defect detection during lamination and exposure processes, significantly improving yield rates.

- Process Optimization and Predictive Maintenance: ML algorithms optimize parameters such as lamination temperature, pressure, and exposure dose, ensuring consistency and prolonging equipment lifespan in DFPR handling.

- Material Design Acceleration: AI tools are used in computational chemistry to rapidly screen and design new polymer formulations for DFPRs with enhanced resolution, adhesion, and thermal stability features crucial for AI chips.

- Supply Chain Resilience: AI and analytics improve forecasting and inventory management for specialty chemical inputs and DFPR stock, addressing supply chain vulnerabilities exposed by fluctuating global demand for AI infrastructure.

DRO & Impact Forces Of Dry Film Photoresist Market

The Dry Film Photoresist Market is driven by the relentless progress in electronic miniaturization and the burgeoning demand for high-performance computing devices, which necessitate finer circuit patterns achievable through DFPR technology. However, this growth is partially restrained by high initial capital investment requirements for advanced lamination and exposure equipment, coupled with the competitive threat posed by superior liquid photoresist formulations targeting specific high-end semiconductor applications like extreme ultraviolet (EUV) lithography. The primary opportunities lie in the adoption of DFPRs in niche, high-growth segments such as flexible electronics, sophisticated sensor fabrication for IoT devices, and specialized biocompatible films for medical applications, alongside continuous development of ultra-thin films for 3D packaging. These market forces collectively dictate pricing strategies, investment cycles in R&D, and the eventual success of market penetration efforts across different electronic sub-sectors, creating an environment defined by continuous technological innovation and intense price competition in standardized applications.

Key drivers include the global rollout of 5G technology, which demands high-frequency, high-reliability PCBs that utilize multi-layer structures best facilitated by DFPRs, and the explosive growth in electric vehicle (EV) electronics, particularly power management modules and complex sensor arrays. The constraints on the market involve technical limitations concerning the inherent resolution capability of standard dry films compared to leading-edge liquid resists used in front-end semiconductor fabrication, alongside the challenge of managing waste associated with large-area applications. Impact forces driving market momentum are the increasing adoption of wafer-level packaging (WLP) and chiplet architectures, which depend heavily on the precision offered by dry films for RDL creation. Conversely, the environmental impact of certain chemical developers and strippers remains a significant counteracting force, pushing R&D towards greener alternatives and sustainable processing.

The overarching impact forces shaping the market trajectory are cyclical demand patterns in the consumer electronics sector, which significantly influence PCB and packaging volumes, and regulatory standards related to material safety and environmental compliance (such as RoHS and REACH). Opportunities also materialize through geographic expansion into emerging manufacturing hubs in Southeast Asia and Mexico, allowing companies to diversify their production footprint. The balance between technological innovation (achieving sub-10 µm resolution with DFPRs) and cost-effectiveness remains a crucial competitive battleground, where manufacturers must constantly optimize production processes to maintain profitability while satisfying increasingly demanding performance specifications for advanced electronics applications.

Segmentation Analysis

The Dry Film Photoresist Market is comprehensively segmented based on Type, Application, and Thickness, reflecting the diverse industrial requirements and technological specifications needed across various electronic manufacturing processes. The segmentation by Type primarily distinguishes between permanent films, which remain part of the final structure for insulation or protection, and strippable films, which are removed after the etching or plating process. Application segmentation reveals the end-use demand centers, dominated by the high-volume PCB sector but rapidly evolving towards sophisticated semiconductor packaging solutions. Analyzing the market by Thickness is crucial as it directly correlates with the feature size and complexity required for applications, dictating the required resolution and uniformity performance of the film.

The rapid advancements in semiconductor technology, particularly in heterogeneous integration and fan-out wafer-level packaging (FOWLP), have necessitated a shift towards higher performance and customized dry film solutions. This customization spans formulation chemistry, adherence properties, and thermal characteristics. Consequently, market players are increasingly focusing on developing niche films specifically designed for high-aspect-ratio plating or extremely fine line and space requirements, ensuring optimized performance within the specific lithographic equipment used by end-users. This granular segmentation approach aids manufacturers in targeting specific market needs and optimizing their product portfolios for maximum profitability and technical superiority.

- By Type:

- Permanent Dry Film Photoresist (Used for insulation, structural layers, and protective coating, often required in advanced packaging and specific PCB applications).

- Strippable Dry Film Photoresist (Used as a temporary mask for etching or plating processes, predominantly in standard PCB fabrication).

- By Application:

- Printed Circuit Boards (PCBs) (Multi-layer PCBs, HDI, Flexible PCBs).

- Semiconductor Packaging (Wafer Level Packaging (WLP), Redistribution Layers (RDL), Bumping, Interposers).

- Advanced Display Technology (OLED, LCD, Touch Panels).

- Microelectromechanical Systems (MEMS) and Sensors.

- Others (Chemical Milling, Decorative Applications).

- By Thickness:

- Thin Film (<20 µm) (Crucial for fine-pitch semiconductor packaging and RDLs).

- Medium Film (20-50 µm) (Standard for high-density PCBs and basic packaging).

- Thick Film (>50 µm) (Used for specialized applications like high-aspect-ratio electroplating and complex MEMS structures).

Value Chain Analysis For Dry Film Photoresist Market

The Dry Film Photoresist value chain commences with upstream activities involving the synthesis and supply of raw materials, primarily specialty polymers (resins), photoinitiators, monomers, plasticizers, and solvents, sourced from large chemical companies. This phase requires high purity and consistent quality, as minor variations in raw material inputs directly impact the final film performance, such as resolution, sensitivity, and adhesion. Key suppliers often include specialized divisions of major chemical and materials giants. The midstream involves the core manufacturing process, where these raw materials are formulated, coated onto carriers (like PET film), dried, laminated, and finally cut into rolls. This stage is capital-intensive and requires proprietary coating and quality control technologies to ensure uniform thickness and zero defects.

Downstream activities focus on distribution, sales, and end-user integration. Distribution channels are highly specialized, often involving direct sales to large-scale PCB fabricators (PCBs Fabs) and Outsourced Semiconductor Assembly and Test (OSAT) companies, or through specialized regional distributors who provide technical support and localized inventory management. Direct channels are preferred for high-volume, critical applications where technical collaboration is essential, while indirect channels serve smaller or geographically dispersed customers. The end-users then integrate the DFPR into their complex lithography lines, where performance validation and technical service from the DFPR manufacturer are crucial for successful adoption and yield optimization. Technical training and troubleshooting form a significant part of the downstream value proposition.

The integration of the value chain is critical for maintaining competitiveness. Manufacturers that possess strong backward integration, controlling the synthesis of core proprietary resins, often achieve better cost control and faster innovation cycles. Conversely, forward integration, providing advanced technical support directly to leading-edge OSATs and PCB manufacturers, ensures that product development remains aligned with evolving industry needs, such as the transition to thinner films and higher throughput lamination processes. The efficiency of the logistics network, ensuring temperature and humidity-controlled transport of sensitive film materials, is also a critical component of the distribution channel’s effectiveness and overall supply chain robustness.

Dry Film Photoresist Market Potential Customers

The primary customers for Dry Film Photoresist are large-scale electronic manufacturing service providers and specialized fabrication houses that produce the foundational components of modern electronic devices. These customers can be broadly categorized into PCB manufacturers, which constitute the largest volume consumers, utilizing the films for multi-layer structure creation, circuit tracing, and protective mask formation on flexible and rigid substrates. Given the continuous drive for thinner, more powerful electronics, this segment is increasingly demanding DFPRs capable of supporting fine-line technology and improved dielectric properties for high-frequency applications.

A rapidly growing segment of potential customers includes Outsourced Semiconductor Assembly and Test (OSAT) companies and Integrated Device Manufacturers (IDMs) involved in advanced semiconductor packaging. These entities use DFPRs extensively for creating Redistribution Layers (RDLs), forming copper pillars, and applying bumping processes in Wafer Level Packaging (WLP) and Fan-Out Wafer Level Packaging (FOWLP). For these customers, the film's ability to maintain high resolution and aspect ratio on non-planar surfaces, coupled with excellent thermal stability, is a non-negotiable requirement, making them high-value buyers in the market.

Furthermore, specialized manufacturers in emerging technology fields represent high-potential, albeit smaller volume, customers. These include companies focused on developing high-end display technologies (OLED/MicroLED), biomedical sensor arrays, microfluidic devices, and Microelectromechanical Systems (MEMS). These users often require DFPRs with unique chemical resistances or biocompatibility features tailored for specific fabrication protocols, often involving thick-film photoresists for high-aspect-ratio micromachining or specialized plating processes, driving demand for customized, premium-priced DFPR products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.06 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, Fujifilm Corporation, Kolon Industries Inc., Eternal Materials Co., Ltd., Hitachi Chemical Co., Ltd. (now Showa Denko Materials), Asahi Kasei Corporation, Merck KGaA, MicroChem Corp. (KMG), Toyo Ink SC Holdings Co., Ltd., Dongjin Semichem Co., Ltd., Sumitomo Chemical Co., Ltd., Shin-Etsu Chemical Co., Ltd., JSR Corporation, Mitsubishi Chemical Corporation, Brewer Science Inc., Changchun Group, Sanwa Kagaku Kogyo Co., Ltd., Jiangsu Kuangshun Photosensitivity New Material Stock Co., Ltd., Wuxi Huada Semiconductor Materials Co., Ltd., and Taiyo Ink Mfg. Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Film Photoresist Market Key Technology Landscape

The technological landscape of the Dry Film Photoresist Market is characterized by continuous efforts to enhance resolution, increase aspect ratio capability, and improve handling characteristics to support next-generation electronic components. A critical area of innovation is the development of ultra-thin DFPRs (sub-10 µm) specifically tailored for advanced semiconductor packaging applications like Redistribution Layers (RDLs) and micro-bumping. These films require exceptional uniformity and adherence to complex 3D topography found on packaged wafers. The technology involves advancements in polymer molecular weight distribution and specialized additives to control dimensional stability during post-exposure processing, ensuring pattern fidelity crucial for high-density interconnects. Furthermore, equipment manufacturers are focusing on improved vacuum lamination systems to eliminate trapped air bubbles and minimize defects, optimizing the application process for these delicate, high-performance films.

Another significant technological focus lies in improving the environmental profile of the lithography process. This includes the development of DFPRs compatible with aqueous alkaline developers, moving away from harsh organic solvents, and incorporating chemistries that minimize hazardous byproducts. New photoinitiator systems are being engineered to enhance sensitivity across broader UV spectrums, allowing for faster throughput and lower energy consumption during the exposure phase. Furthermore, the integration of advanced metrology and in-situ monitoring tools, often leveraging AI and machine vision, is becoming standard practice to maintain tight process control over film thickness, pattern registration, and development uniformity, especially critical in volume production environments where yield maximization is paramount.

The convergence of material science and process engineering is defining the competitive edge. For high-aspect-ratio applications, particularly in MEMS and specific rigid PCB segments, DFPR manufacturers are researching specialized "thick film" formulations that can be uniformly applied up to 100 µm or more while maintaining vertical sidewall profiles after development. This often involves incorporating cross-linking agents and optimized thermal treatments. Moreover, the industry is exploring hybrid photoresist solutions that blend the benefits of dry film processing (uniformity, handling) with the high resolution achievable through liquid applications, particularly relevant for specialized patterning requirements in emerging flexible electronic substrates, driving the need for materials that adhere equally well to unconventional, non-rigid surfaces.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned global leader in the Dry Film Photoresist Market, holding the largest market share and demonstrating the highest growth trajectory. This dominance is attributed to the presence of global giants in electronics manufacturing, including Taiwan (semiconductor packaging and foundries), China (mass-volume PCB production and consumer electronics assembly), South Korea (advanced displays and memory chip production), and Japan (specialty chemical and materials supply). The continuous influx of investment into sophisticated semiconductor fabrication facilities (Fabs) and the relentless expansion of 5G infrastructure drive massive consumption of DFPRs, particularly for HDI PCBs and RDL applications. The region serves as the hub for both high-volume standardized production and cutting-edge advanced packaging innovation.

- North America: The North American market represents a significant consumer base, driven primarily by demand from high-reliability applications in aerospace, defense, and specialized high-performance computing (HPC) sectors. While not matching APAC in sheer volume, North America focuses on high-margin, technologically advanced DFPR solutions, including those for complex MEMS fabrication, biomedical devices, and experimental flexible electronics. The presence of major semiconductor design houses and specialty equipment manufacturers ensures a steady demand for innovative, customized dry film chemistries, often prioritizing technical specification and rapid prototyping over cost minimization. Research and development activities, particularly related to advanced lithography processes, are strong drivers in this region.

- Europe: Europe holds a stable market share, characterized by mature industrial electronics, automotive, and specialized industrial control systems manufacturing. The European market exhibits strong demand for DFPRs utilized in high-reliability automotive PCBs (e.g., ADAS, electric vehicle battery management systems) and industrial automation equipment. This region is also a key center for regulatory compliance, pushing manufacturers toward developing more environmentally friendly, halogen-free, and solvent-free DFPR solutions, aligning with strict environmental directives like REACH. European manufacturers often prioritize long-term reliability and process consistency, leading to stable, albeit slower, growth rates compared to Asia.

- Latin America (LATAM): The LATAM market is currently characterized by moderate consumption, largely focused on localized assembly of consumer electronics and telecommunications equipment. Demand is primarily centered on standard and medium-thickness DFPRs for basic and multi-layer PCBs. Market growth is gradually accelerating, fueled by increasing regional digitalization initiatives and infrastructural investments, particularly in Brazil and Mexico. However, the market remains reliant on imported finished DFPR products, with less localized manufacturing capacity, offering opportunities for global suppliers to establish stronger distribution networks.

- Middle East and Africa (MEA): The MEA market for Dry Film Photoresist is nascent, with demand driven primarily by telecommunication infrastructure projects (especially 5G rollout), defense electronics, and burgeoning smart city initiatives in the Gulf Cooperation Council (GCC) countries. Consumption volumes are currently low, heavily concentrated in specialized areas. Long-term opportunities are linked to government efforts to diversify economies and establish domestic manufacturing capabilities in electronics, though this segment faces challenges related to logistics and technical expertise compared to established global manufacturing hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Film Photoresist Market.- DuPont

- Fujifilm Corporation

- Kolon Industries Inc.

- Eternal Materials Co., Ltd.

- Hitachi Chemical Co., Ltd. (now Showa Denko Materials)

- Asahi Kasei Corporation

- Merck KGaA

- MicroChem Corp. (KMG)

- Toyo Ink SC Holdings Co., Ltd.

- Dongjin Semichem Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- JSR Corporation

- Mitsubishi Chemical Corporation

- Brewer Science Inc.

- Changchun Group

- Sanwa Kagaku Kogyo Co., Ltd.

- Jiangsu Kuangshun Photosensitivity New Material Stock Co., Ltd.

- Wuxi Huada Semiconductor Materials Co., Ltd.

- Taiyo Ink Mfg. Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Dry Film Photoresist market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between dry film and liquid photoresist materials?

Dry film photoresist (DFPR) is supplied as a solid film laminated onto the substrate, offering superior thickness uniformity, better resolution for fine-pitch PCBs, and easier handling. Liquid photoresists are spin-coated, typically offering higher resolution capabilities essential for front-end semiconductor processing (e.g., EUV lithography).

Which application segment drives the highest growth rate for Dry Film Photoresists?

The Semiconductor Packaging segment, specifically Wafer Level Packaging (WLP) and Redistribution Layers (RDL), exhibits the highest growth rate due to the global trend toward IC miniaturization, 3D packaging, and the increasing complexity of high-density interconnects required for AI and 5G hardware.

How does the thickness of the dry film photoresist influence its usage?

Film thickness is crucial: Thin films (under 20 µm) are used for high-resolution, fine-pitch applications like RDLs. Medium films (20-50 µm) are standard for HDI PCBs. Thick films (over 50 µm) are necessary for high-aspect-ratio features required in electroplating, MEMS, and complex packaging processes.

Which region dominates the global Dry Film Photoresist Market in terms of volume consumption?

Asia Pacific (APAC) dominates the market in consumption volume. This is driven by its centralized role in global electronics manufacturing, extensive PCB fabrication capacity in China and Taiwan, and massive investments in advanced semiconductor packaging and display technology across the region.

What major technical challenges are Dry Film Photoresist manufacturers currently addressing?

Manufacturers are focused on improving the intrinsic resolution of dry films to support sub-10 µm line widths, enhancing adhesion to diverse substrate materials (like flexible polymers), and developing more sustainable, eco-friendly chemistries to comply with global environmental regulations.

The Dry Film Photoresist Market is continually evolving, driven by the escalating performance demands of modern electronics. Key players are investing heavily in research to overcome technical hurdles associated with achieving finer resolution and maintaining process stability across varied substrate types. The dominance of the Asia Pacific region dictates much of the global supply chain dynamics, requiring manufacturers worldwide to establish robust production and distribution capabilities within this critical geographical hub. Strategic development focuses heavily on integrating DFPRs into next-generation packaging technologies, such as fan-out and 3D stacking, where precision and reliability are paramount. Furthermore, sustainability is becoming a non-negotiable factor, pushing the industry toward aqueous processing and halogen-free formulations, particularly in highly regulated markets like Europe. The ongoing 5G deployment cycle and the accelerating use of Artificial Intelligence in end-use applications guarantee sustained high demand for high-performance DFPRs throughout the forecast period, emphasizing the material’s critical role in the foundational layer of digital infrastructure. The competitive landscape is characterized by intellectual property battles over proprietary polymer formulations and strategic pricing to capture high-volume PCB orders, while simultaneously offering premium, specialized products for the advanced packaging sector. Manufacturers must navigate global economic fluctuations, commodity price volatility, and geopolitical supply chain risks to maintain market leadership and capitalize on emerging technological opportunities in MEMS and flexible electronics.

In conclusion, the Dry Film Photoresist Market demonstrates resilience and strong growth potential, intrinsically linked to the macroeconomic trends favoring electronic device miniaturization and complexity. Success in this market is determined not only by material innovation, such as achieving superior uniformity in ultra-thin films, but also by efficiency in process integration and the provision of exceptional technical support to highly automated manufacturing facilities. The forecast confirms that DFPR will remain indispensable for the high-density interconnection requirements of future electronic devices, consolidating its position as a foundational material in the digital age. The focus remains on strategic alignment with major semiconductor and PCB manufacturers, continuous process optimization, and the proactive development of materials that meet increasingly rigorous performance and environmental standards globally.

Further analysis indicates that while liquid resists maintain an edge in the most cutting-edge front-end lithography nodes (sub-10 nm), DFPRs are strategically positioned to capture the exponential growth in back-end packaging (WLP, RDL), where cost-effectiveness, high-throughput processing, and excellent pattern fidelity over larger areas provide significant operational advantages. This strategic segmentation allows DFPR suppliers to maintain a distinct and expanding revenue stream, insulated somewhat from the extreme R&D costs associated with EUV technology. Moreover, the trend towards panel-level packaging (PLP), moving from expensive wafer formats to larger panel substrates, represents a massive opportunity for DFPRs, which are generally better suited for large-area coating and processing compared to traditional liquid spin-coating techniques, positioning them as the preferred choice for this evolving manufacturing paradigm.

The shift towards permanent dry films, particularly those serving as protective layers or structural components in multi-chip modules, reflects the growing requirement for enhanced device reliability and longevity. These permanent films must offer outstanding chemical resistance, low dielectric constants for high-frequency signal integrity, and robust thermal stability to withstand subsequent thermal processing steps during device assembly. This technological push is driving higher average selling prices (ASPs) for specialized DFPR products compared to commodity strippable films used primarily in basic PCB etching. Therefore, market players are incentivized to move up the value chain by developing these advanced, permanent material solutions, thereby mitigating the risk associated with volume-driven price erosion in the standard PCB market segments. This strategic maneuver is crucial for long-term profitability and technological leadership within the highly specialized materials domain.

Finally, competition in the Dry Film Photoresist Market is intensifying, characterized by fierce rivalry between established Asian chemical conglomerates and legacy North American/European specialty material providers. Differentiation increasingly relies on proprietary formulations, coupled with seamless integration into the customer's manufacturing process, necessitating close technical collaboration and the provision of advanced lamination and exposure guidance. The ability of a supplier to guarantee consistent quality and deliver tailored solutions rapidly is often more critical than unit cost, particularly in the high-stakes semiconductor packaging environment where yield loss due to material inconsistency is extremely costly. Future market dynamics will be influenced by how effectively manufacturers can scale their production of ultra-high-resolution, specialized films while maintaining global supply chain resilience in the face of geopolitical instability and fluctuating raw material costs. Continuous monitoring of technological shifts in 3D integration and flexible electronics remains essential for capitalizing on emerging DFPR demand drivers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dry Film Photoresist Market Size Report By Type (Positive, Negative), By Application (PCB, MPU Packaging, COF/TAB, FPC, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dry Film Photoresist Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Positive, Negative), By Application (PCB, Lead Frame, Chemical Milling, IC Substrate, IC Packaging), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager