Dry Vacuum Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432201 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Dry Vacuum Pumps Market Size

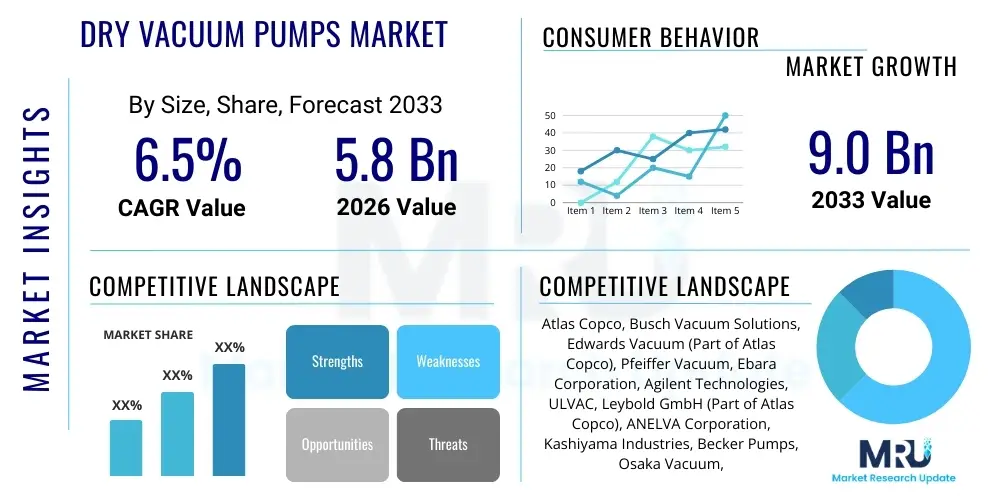

The Dry Vacuum Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Dry Vacuum Pumps Market introduction

Dry vacuum pumps represent a critical class of vacuum generation equipment distinguished by their ability to operate entirely without sealing or lubricating fluids in the pump mechanism, thereby eliminating the risk of process contamination by oil backstreaming. These pumps are essential components in environments requiring ultra-clean, high-throughput vacuum conditions, primarily within advanced manufacturing and high-energy physics research. Their design typically involves positive displacement mechanisms, such as multi-stage Roots, screw, or scroll configurations, which are engineered for robustness, high reliability, and minimal maintenance requirements compared to traditional oil-sealed pumps. The fundamental product description emphasizes hermetic sealing, advanced material science (for corrosion resistance), and intelligent control systems for optimizing pumping speed and operational efficiency under varying load conditions, especially important in demanding processes like plasma etching and deposition.

The major applications driving the adoption of dry vacuum pumps center heavily on the semiconductor and flat panel display (FPD) manufacturing sectors, where contamination control is paramount. In these environments, dry pumps manage corrosive gases used in etching, deposition, and ion implantation processes, requiring pumps capable of handling high particulate loads and aggressive chemical environments without internal degradation. Beyond microelectronics, dry pumps are increasingly utilized in pharmaceutical lyophilization, specialized chemical processing (handling toxic or reactive compounds), scientific instrument manufacturing (mass spectrometry, electron microscopy), and emerging fields such as photovoltaic cell production and advanced coating applications. The need for precise pressure control, coupled with environmental compliance avoiding oil disposal, solidifies their position as the preferred technology in these high-value segments.

Key benefits derived from the deployment of dry vacuum pump technology include significantly reduced operational costs due to decreased maintenance intervals and the elimination of costly oil and filter changes. Furthermore, the inherent cleanliness of dry pumps supports higher process yields, which is a critical driving factor, particularly in 300mm and 450mm wafer fabrication. Driving factors for market growth encompass the persistent global expansion of semiconductor fabrication capacity (driven by IoT, 5G, and AI infrastructure), escalating demand for large, high-resolution FPDs (OLED, QLED), and increasing stringent environmental and safety regulations mandating cleaner process equipment. The ongoing technological migration towards smaller process nodes (e.g., 5nm, 3nm) requires even more stable and contaminant-free vacuum environments, thereby reinforcing the market's trajectory towards dry vacuum solutions.

Dry Vacuum Pumps Market Executive Summary

The Dry Vacuum Pumps Market is exhibiting robust growth, fundamentally driven by sustained capital expenditure within the global microelectronics supply chain and the transition toward more complex manufacturing processes demanding superior vacuum stability and purity. Current business trends indicate a strong preference among major OEMs and end-users for integrated vacuum solutions that combine primary dry pumps with booster pumps and advanced diagnostic software, moving beyond simple component sales to holistic vacuum management systems. Key market players are heavily focused on developing pumps that offer enhanced energy efficiency (lower power consumption per unit throughput), reduced footprint, and improved resistance to precursor gases and aggressive chemistries used in Atomic Layer Deposition (ALD) and Chemical Vapor Deposition (CVD). Furthermore, strategic mergers and acquisitions, along with increased collaboration between pump manufacturers and semiconductor equipment suppliers (SEMs), are accelerating product development cycles and ensuring compatibility with next-generation fabrication tools, defining the competitive landscape.

Regional trends highlight the undeniable dominance of the Asia Pacific (APAC) region, particularly China, South Korea, Taiwan, and Japan, which serve as the epicenter of global semiconductor and FPD manufacturing. Massive governmental and private investments in new fabrication facilities (fabs) across China and Taiwan are creating unparalleled demand for high-capacity, reliable dry vacuum systems. While North America and Europe remain crucial markets, driven primarily by R&D, specialized scientific instrumentation, and high-end aerospace coatings, the volume growth trajectory is firmly rooted in APAC’s expanding industrial base. The European market, benefiting from stringent environmental regulations, shows strong adoption in pharmaceutical and chemical sectors seeking cleaner process solutions, whereas North America drives demand through advanced computing research and specialized thin-film applications, requiring high-end turbo-molecular dry systems.

Analysis of segment trends reveals that the Screw Pump segment, known for its robustness and cost-effectiveness in handling high flow rates and particulates, maintains a leading market share, especially in harsh industrial applications. However, the Multistage Dry Pump segment is projected to exhibit the highest growth rate, fueled by the complex, contamination-sensitive requirements of sub-10nm semiconductor lithography and deposition processes, which require exceptionally low base pressures and high pumping speeds. Application-wise, the Semiconductor & Electronics segment remains the primary revenue generator, but significant growth opportunities are emerging within the Photovoltaic (PV) sector, driven by global sustainability mandates and the increasing efficiency and complexity of solar cell manufacturing processes, necessitating high-throughput vacuum systems for coating and doping procedures.

AI Impact Analysis on Dry Vacuum Pumps Market

Common user questions regarding AI's impact on the Dry Vacuum Pumps Market predominantly revolve around predictive maintenance capabilities, energy consumption optimization, and integration into Smart Factory environments. Users are intensely interested in how AI algorithms can leverage real-time sensor data (temperature, vibration, power consumption, gas composition) to predict potential component failures, thereby minimizing unplanned downtime in critical, high-cost semiconductor fabrication lines. A significant concern is the difficulty of applying generic AI models to highly specialized and proprietary pump designs, leading to questions about the necessity for customized, manufacturer-specific machine learning models. Expectations are high concerning AI's ability to autonomously adjust pump parameters (such as rotation speed or heating jacket temperatures) in response to fluctuating process conditions (e.g., changes in gas flow or pressure spikes), ensuring maximum efficiency and prolonging pump life, ultimately moving vacuum technology toward a truly self-optimizing system within Industry 4.0 frameworks.

- Implementation of Predictive Maintenance (PdM) using machine learning models to analyze vibration and temperature signatures, forecasting component failures days or weeks in advance.

- Optimization of Energy Consumption by dynamically adjusting pump speed and operation cycles based on real-time process load and chamber pressure requirements.

- Integration of Vacuum System Health Monitoring into centralized Smart Factory platforms (MES/SCADA) for holistic operational oversight.

- Enhanced Process Control through AI algorithms that stabilize pumping speeds and maintain ultra-precise base pressures despite corrosive gas flow variations.

- Improved Root Cause Analysis by correlating historical operational data with fault occurrences, leading to faster diagnosis and better engineering design iterations.

- Autonomous Calibration and Tuning capabilities, reducing the need for manual intervention by highly skilled vacuum technicians.

DRO & Impact Forces Of Dry Vacuum Pumps Market

The market dynamics for dry vacuum pumps are defined by a powerful convergence of technological necessity, economic viability, and regulatory pressures. The primary drivers include the relentless global expansion of semiconductor manufacturing capacity, necessitating vast quantities of high-purity vacuum systems, particularly in Asia. Simultaneously, the inherent cleanliness and efficiency of dry pump technology—eliminating process contamination caused by oil—position it as an indispensable technology for advanced process nodes (sub-10nm) and highly sensitive thin-film deposition required for next-generation computing and memory chips. Coupled with these technological pushes, the increasing focus on sustainable manufacturing practices, driven by global environmental mandates and corporate sustainability goals, favors dry pumps over traditional oil-sealed alternatives, providing a strong structural tailwind for market adoption and innovation.

However, the market faces significant restraints, notably the exceptionally high initial capital investment required for complex dry vacuum pump systems compared to oil-sealed pumps, posing a barrier to entry for smaller-scale industrial or R&D users. Furthermore, the specialized materials and complex internal geometries required for these pumps, particularly those designed to handle highly corrosive gases, result in higher maintenance complexity and longer lead times for specialized component replacements. The market concentration among a few key global players also contributes to price rigidity and limited flexibility for customized solutions in niche applications. Another operational restraint is the vulnerability of some dry pump designs (like claw or scroll types) to extreme particulate accumulation without adequate upstream filtering, leading to potential operational halts and costly remediation.

Opportunities abound, primarily within the burgeoning markets of lithium-ion battery production (requiring clean vacuum for drying processes), medical device manufacturing, and the rapidly scaling industrial coating sector (PVD/CVD coatings for automotive and industrial tools). The development of highly modular and smaller-footprint dry pumps, suitable for integration into compact analytical instrumentation and specialized laboratory equipment, opens new avenues for market penetration. The major impact forces governing the market include the accelerating pace of miniaturization in electronics (requiring higher vacuum standards), volatile semiconductor capital expenditure cycles (which directly influence pump purchasing), and geopolitical shifts impacting supply chain stability and the location of major fabrication facilities (e.g., US and EU subsidies encouraging localized semiconductor production), demanding flexible and robust supply chain responses from pump manufacturers.

Segmentation Analysis

The Dry Vacuum Pumps Market is comprehensively segmented based on technology type, material construction, end-user industry, and geographic region, reflecting the diverse and specialized nature of vacuum requirements across various industrial and scientific domains. Segmentation by technology is crucial, as the performance characteristics—such as ultimate pressure, pumping speed, power consumption, and particulate tolerance—vary significantly between screw, claw, and scroll designs. The choice of technology is often dictated by the specific application’s contamination sensitivity and gas load handling requirements. Segmentation by end-user provides insight into the primary demand drivers, with the semiconductor segment dominating due to its high volume and stringent requirements, while emerging sectors like photovoltaics and lithium-ion batteries show disproportionately high growth potential.

- By Type:

- Screw Dry Pumps

- Claw Dry Pumps

- Scroll Dry Pumps

- Multistage Dry Pumps (Roots/Lobe combination)

- Turbo-molecular Pumps (Hybrid Dry Systems)

- By Application/End-User Industry:

- Semiconductor & Electronics (Wafer Fabrication, Ion Implantation, Etching, PVD/CVD)

- Flat Panel Displays (FPD)

- Chemical & Pharmaceutical (Lyophilization, Distillation)

- Industrial Coatings & Thin Films (Metallurgy, Optics)

- Scientific Instruments & R&D (Mass Spectrometry, High Energy Physics)

- Others (Medical, Aerospace)

- By Pressure Range:

- Low Vacuum (100 kPa to 100 Pa)

- Medium Vacuum (100 Pa to 0.1 Pa)

- High & Ultra-High Vacuum (Below 0.1 Pa)

Value Chain Analysis For Dry Vacuum Pumps Market

The value chain for the dry vacuum pumps market begins with upstream activities, primarily involving the sourcing of highly specialized raw materials and precision components essential for manufacturing. Upstream analysis focuses heavily on materials like high-grade stainless steel (for corrosion resistance), specialized ceramics (for seals and bearings), and advanced composite materials capable of withstanding high temperatures and aggressive process gases. Key suppliers include specialized metallurgical companies and precision machining firms providing rotors, stators, and complex housing components built to ultra-tight tolerances. Ensuring a stable and reliable supply of these materials, particularly those resistant to fluorine and chlorine chemistries prevalent in semiconductor etching, is critical for maintaining high-quality production and managing manufacturing costs. Manufacturers must manage complex sourcing relationships to mitigate risks associated with material price volatility and specialized component lead times, particularly in the current geopolitical climate.

Midstream activities involve the design, assembly, and rigorous testing of the dry vacuum pump systems. This stage is characterized by high intellectual property intensity, focusing on proprietary rotor designs (screw profiles, claw geometry) that maximize efficiency and resistance to fouling. Manufacturing processes include specialized coating techniques (e.g., anti-corrosion plasma coatings) and the integration of advanced electronics for speed control, temperature management, and remote diagnostics. Distribution channels are highly critical, operating through a dual strategy: direct sales to major Original Equipment Manufacturers (OEMs) and indirect sales via highly specialized Maintenance, Repair, and Operations (MRO) distributors or authorized service partners for end-user support. Direct distribution dominates sales to semiconductor tool builders (OEMs like Applied Materials or Lam Research), where deep technical integration and customized solutions are necessary during the tool build phase. Indirect channels manage the aftermarket, providing essential services, replacement units, and consumables.

The downstream analysis focuses on the end-users—the potential customers identified primarily within the semiconductor, FPD, and chemical processing sectors. These buyers require extensive post-sales support, including installation, commissioning, preventative maintenance contracts, and rapid response services, given the critical nature of vacuum integrity in their operations. The profitability in the downstream segment is highly dependent on long-term service agreements (LSAs) and the sale of highly engineered spare parts. Effective value chain management, therefore, requires manufacturers not only to excel in product engineering but also to establish a robust global service network capable of supporting complex systems operating 24/7 in demanding industrial environments. The relationship between pump manufacturer and end-user often extends to co-development of solutions tailored for specific process challenges, maximizing the lifetime value derived from the pump installation.

Dry Vacuum Pumps Market Potential Customers

The primary potential customers for dry vacuum pumps are defined by industries where maintaining ultra-clean, precise, and high-volume vacuum conditions is non-negotiable for product quality and operational efficiency. The most significant segment comprises the global semiconductor fabrication facilities (fabs), including Integrated Device Manufacturers (IDMs) and pure-play foundries such as TSMC, Samsung, Intel, and Micron. These entities are continuous buyers, requiring dry pumps for virtually every stage of wafer processing, including PVD, CVD, etching, and load lock management. Their purchasing decisions are heavily influenced by mean time between failures (MTBF), total cost of ownership (TCO), and the pump's ability to handle highly corrosive and toxic process gases without backstreaming contaminants. As technology nodes shrink, their demand shifts towards more advanced, multistage dry pumps capable of higher ultimate vacuum and tighter process integration.

The second major cohort of potential customers consists of Original Equipment Manufacturers (OEMs) specializing in semiconductor and FPD processing equipment. Companies like Applied Materials, Tokyo Electron, and ASML integrate thousands of dry pumps annually into their larger deposition, etch, and lithography tools before selling the complete systems to the fabs. For these buyers, compatibility, ease of integration, footprint optimization, and rapid supply chain execution are paramount. Their purchasing volume is cyclical, tied directly to global capital expenditure cycles in microelectronics. Furthermore, end-users in the rapidly expanding Flat Panel Display (FPD) market—manufacturing OLED and QLED screens—represent robust customers, requiring large-capacity dry pumps for plasma deposition and large-area substrate handling, driven by the increasing size and sophistication of consumer display technologies.

Beyond electronics, key end-users include specialized chemical and pharmaceutical manufacturers employing processes like solvent recovery, distillation, and lyophilization (freeze-drying) of sensitive products. These customers prioritize compliance with stringent regulatory standards (e.g., FDA, GMP) and zero contamination risk, making dry pumps essential for handling volatile organic compounds (VOCs) and sensitive biological substances. Additionally, organizations involved in advanced R&D, high-energy physics laboratories (CERN, national labs), and companies producing specialized thin films (e.g., aerospace coatings, optical films) are high-value, albeit lower volume, customers. These research-focused buyers typically demand bespoke, high-performance turbo-molecular hybrid dry systems optimized for ultra-high vacuum (UHV) applications, emphasizing performance metrics like lowest achievable pressure and vibration damping rather than throughput volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Busch Vacuum Solutions, Edwards Vacuum (Part of Atlas Copco), Pfeiffer Vacuum, Ebara Corporation, Agilent Technologies, ULVAC, Leybold GmbH (Part of Atlas Copco), ANELVA Corporation, Kashiyama Industries, Becker Pumps, Osaka Vacuum, VAT Group, Shimadzu Corporation, Tuthill Corporation, KNF Neuberger, Dekker Vacuum Technologies, Trillium Vacuum, Dürr Group, Gardner Denver. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Vacuum Pumps Market Key Technology Landscape

The technological landscape of the dry vacuum pump market is dynamic, characterized by continuous innovation focused on maximizing uptime, minimizing vibration, and improving energy efficiency while maintaining operational stability in corrosive environments. The leading technologies are based on positive displacement mechanisms, with the Screw Dry Pump being highly prominent due to its symmetrical rotor design, offering superior robustness, tolerance for particulates, and ease of manufacturing complex profiles. However, recent advancements focus on optimizing the screw profile geometry to achieve higher compression ratios in fewer stages, reducing the overall pump size and complexity. Claw pumps, utilized primarily in medium vacuum, high-flow industrial applications, are seeing innovations related to specialized coatings and hardened materials to extend component lifespan when handling high particulate loads in processes like heat treatment and material conveying. These continuous refinements are critical for reducing Total Cost of Ownership (TCO) across all major industrial applications.

For high-sensitivity applications, particularly within semiconductor manufacturing, the Multistage Dry Pump (often combining Roots blowers with mechanical boosters) and the integration of highly efficient Scroll Dry Pumps are dominating the growth trajectory. Scroll pumps, due to their near-oil-free operation and compact size, are favored in analytical instrumentation and R&D environments requiring clean, moderate vacuum. Key technological innovations in this space involve magnetic bearing technology in certain high-speed turbo-molecular pumps, which eliminates friction and lubrication requirements, achieving exceptional ultimate vacuum and minimal vibration, crucial for metrology tools. Furthermore, sophisticated control systems are now standard, featuring embedded electronics that monitor gas flow, temperatures, and power consumption, allowing for fine-tuning of pump performance and integration into centralized factory control systems (Industry 4.0 compatibility).

A central theme in modern dry vacuum pump development is the focus on sustainability and operational resilience against process gas aggression. Manufacturers are heavily investing in proprietary surface treatments and advanced sealing technologies (e.g., exclusion seals, purge systems) to ensure longevity when exposed to etching gases (e.g., NF3, C4F8) and precursor chemicals used in ALD and CVD. Furthermore, energy efficiency remains a primary technological differentiator. New pump designs employ variable speed drives (VSDs) that dynamically adjust motor speed according to the actual load requirement, drastically reducing power consumption during idle or low-load periods, aligning the technology perfectly with global efforts to reduce industrial energy footprints. The future direction of the technology landscape involves miniaturization of high-performance units and enhanced connectivity for remote monitoring and AI-driven predictive maintenance across diverse fleets.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Dry Vacuum Pumps Market, accounting for the largest market share and exhibiting the highest growth rate. This dominance is directly attributable to the concentration of global semiconductor and flat panel display manufacturing hubs across Taiwan, South Korea, China, and Japan. Massive government-backed investments in new fabrication facilities (fabs) in mainland China and the continuous technological expansion of leading foundries (TSMC, Samsung) drive relentless demand for high-capacity, highly reliable dry vacuum systems for etching, deposition, and lithography processes. Furthermore, APAC's growing market for photovoltaics and lithium-ion batteries contributes significantly to regional demand, positioning it as the undisputed center for both production and consumption.

- North America: The North American market is characterized by high investment in advanced research, specialized analytical instrumentation, and high-tech defense and aerospace applications. While the region’s volume consumption is lower than APAC, it leads in the adoption of cutting-edge, high-end dry pump technologies, particularly those used in ultra-high vacuum (UHV) systems for particle physics and sophisticated metrology tools. Demand is sustained by semiconductor R&D, specialized thin-film coating operations, and the ongoing modernization of pharmaceutical manufacturing facilities, prioritizing efficiency and contamination control.

- Europe: Europe represents a mature market with stable demand, strongly influenced by strict environmental regulations favoring oil-free technologies. Key demand drivers include the robust chemical and pharmaceutical sectors, especially in Germany, France, and Switzerland, where dry pumps are critical for safe handling of volatile or toxic compounds and for high-throughput lyophilization. Additionally, Europe's strong presence in specialized automotive and industrial coating technologies (PVD/CVD) ensures consistent demand for robust screw and claw pump systems.

- Latin America, Middle East, and Africa (MEA): This combined region represents a smaller but expanding market. Growth is primarily concentrated in the Middle East, driven by petrochemical processing and emerging specialized industrial clusters requiring vacuum for material treatment and advanced coating applications. In Latin America, demand is concentrated in the pharmaceutical and food processing sectors. Market penetration remains constrained by high capital costs, but infrastructural development and industrial diversification are expected to foster steady growth in the long term, particularly for standard industrial dry pump models.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Vacuum Pumps Market.- Atlas Copco

- Busch Vacuum Solutions

- Edwards Vacuum (Part of Atlas Copco)

- Pfeiffer Vacuum

- Ebara Corporation

- Agilent Technologies

- ULVAC

- Leybold GmbH (Part of Atlas Copco)

- ANELVA Corporation

- Kashiyama Industries

- Becker Pumps

- Osaka Vacuum

- VAT Group

- Shimadzu Corporation

- Tuthill Corporation

- KNF Neuberger

- Dekker Vacuum Technologies

- Trillium Vacuum

- Dürr Group

- Gardner Denver

Frequently Asked Questions

Analyze common user questions about the Dry Vacuum Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of dry vacuum pumps over oil-sealed pumps?

The primary driver is the critical need for contamination-free environments, particularly in the semiconductor and flat panel display industries. Dry pumps eliminate the risk of oil backstreaming into the process chamber, which is essential for maximizing yield and quality in highly sensitive thin-film deposition and etching processes.

Which dry pump technology segment is experiencing the fastest growth in the market?

The Multistage Dry Pump segment, which often incorporates Roots-type boosters with mechanical pumps, is expected to exhibit the fastest growth. This is due to its superior capability to achieve high pumping speeds and stable ultimate vacuum required for advanced semiconductor nodes (sub-10nm) and complex, high-throughput manufacturing processes.

How is AI impacting the operational efficiency and maintenance of dry vacuum pump systems?

AI implementation is revolutionizing maintenance through predictive maintenance (PdM). Machine learning algorithms analyze real-time operational data (vibration, temperature) to forecast potential component failures, enabling proactive servicing, minimizing unplanned downtime, and optimizing energy consumption by dynamically adjusting pump speed.

What are the key application areas outside of the traditional semiconductor sector driving market expansion?

Significant expansion is occurring in the Photovoltaic (PV) sector, driven by global solar energy demand, and in the manufacturing of Lithium-ion batteries, where clean vacuum is essential for drying and degassing processes. Additionally, specialized industrial coatings and advanced chemical processing are increasing their adoption of dry pump technology.

What is the main challenge related to the Total Cost of Ownership (TCO) for dry vacuum pumps?

The main challenge is the high initial capital investment required for dry pump systems, which often exceeds that of oil-sealed alternatives. While dry pumps offer lower long-term operational costs (due to reduced oil changes and less maintenance), the initial outlay remains a significant financial barrier, especially for smaller enterprises.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dry Vacuum Pumps Market Statistics 2025 Analysis By Application (Industrial and Manufacturing, Semiconductor & Electronics, Chemical & Pharmaceutical Processing), By Type (Dry Roots Vacuum Pumps, Dry Screw Vacuum Pump, Dry Scroll Vacuum Pump, Dry Claw Vacuum Pumps, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Dry Vacuum Pumps Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dry Screw Vacuum Pump, Dry Scroll Vacuum Pump, Dry Diaphragm Vacuum Pump, Dry Claw and Hook Pump, Others), By Application (Industrial and Manufacturing, Semiconductor & Electronics, Chemical & Pharmaceutical Processing, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager