Dry Whole Milk Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432208 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Dry Whole Milk Powder Market Size

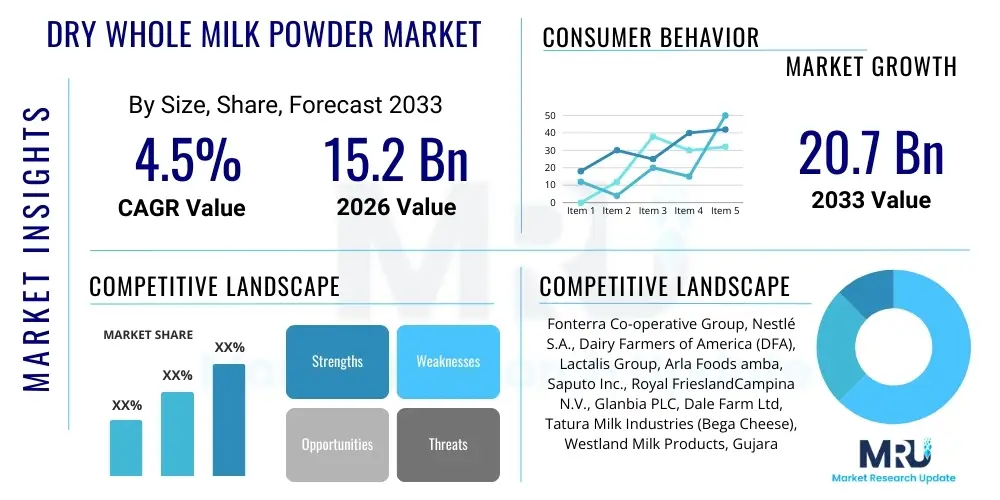

The Dry Whole Milk Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 20.7 Billion by the end of the forecast period in 2033.

Dry Whole Milk Powder Market introduction

The Dry Whole Milk Powder (DWMP) Market encompasses the production, distribution, and consumption of powdered milk manufactured by evaporating water from pasteurized whole milk. This process preserves the full fat content (typically 26% or more) and nutritional profile, including essential proteins, vitamins, and minerals, making it a stable and versatile dairy ingredient. DWMP is highly valued in the food processing industry due to its extended shelf life, ease of transport, and superior functional properties, such as excellent solubility, emulsification capabilities, and a rich, creamy flavor profile that replicates fresh milk.

Major applications of DWMP span across various sectors, including infant formula, confectionery (especially chocolate production), bakery goods, functional foods, and beverage mixes, such as coffee whiteners and ready-to-drink formulations. Its high fat content contributes significantly to texture, mouthfeel, and flavor delivery in end products. The increasing global demand for processed foods, coupled with rising populations in developing economies and logistical challenges associated with transporting liquid milk across vast distances, fundamentally drives the utility and expansion of the DWMP market.

Key benefits driving market adoption include reduced storage space compared to liquid milk, lower transportation costs dueability to non-refrigeration requirements, and enhanced food security in regions with limited access to fresh dairy supplies. Furthermore, the inherent stability of DWMP allows for year-round sourcing and standardization of ingredients for large-scale manufacturers, mitigating seasonal fluctuations in raw milk production. The principal driving factors involve shifting consumer preferences towards convenience foods, strategic government initiatives promoting milk consumption, and advancements in drying and homogenization technologies that improve powder quality and nutritional retention.

Dry Whole Milk Powder Market Executive Summary

The Dry Whole Milk Powder (DWMP) market is characterized by robust business trends centered on supply chain resilience and strategic capacity expansion, particularly across Oceania and North America, which remain dominant production hubs. Business models are increasingly focusing on specialized, high-specification DWMP variants tailored for sensitive applications like clinical nutrition and premium confectionery, demanding stringent quality control and certification. Sustainability and traceability are emerging as critical competitive differentiators, with major players investing heavily in technologies to reduce carbon footprint and ensure ethical sourcing of raw milk, responding directly to heightened consumer and regulatory scrutiny regarding environmental, social, and governance (ESG) factors.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapidly urbanizing populations, expanding middle-class disposable incomes, and the widespread adoption of Western diets and processed food consumption patterns. China and India, with their massive consumer bases and underdeveloped cold chain infrastructures, rely heavily on shelf-stable DWMP for reconstituted milk and industrial use. Europe and North America demonstrate mature, yet stable markets, focusing more on premiumization, organic, and grass-fed DWMP variants, while the Middle East and Africa (MEA) offer substantial opportunities driven by inherent dairy deficit issues and population growth.

In terms of segment trends, the Infant Formula segment maintains its position as the highest-value application segment, necessitating superior quality and nutritional precision, thereby commanding premium pricing. However, the Food Processing segment, encompassing bakery, confectionery, and dairy alternatives, is anticipated to register the fastest volume growth due to the accelerating pace of new product development and the global expansion of multinational food corporations utilizing standardized ingredients. Furthermore, the popularity of specialized packaging formats, such as small sachets and nitrogen-flushed cans, designed to extend shelf life in humid climates, significantly influences distribution and segment profitability across emerging markets.

AI Impact Analysis on Dry Whole Milk Powder Market

Common user questions regarding AI's impact on the Dry Whole Milk Powder market frequently revolve around how artificial intelligence can stabilize volatile raw material prices, optimize complex global logistics networks, and improve quality consistency in the manufacturing process. Users are particularly keen to understand the role of predictive analytics in forecasting raw milk supply and demand fluctuations, thereby minimizing waste and ensuring optimal stock levels. Another significant concern relates to leveraging AI for advanced food safety and adulteration detection, given the high value and vulnerability of dairy commodities to fraud. The underlying theme across these inquiries is the expectation that AI and machine learning will drive operational efficiency, enhance regulatory compliance, and deliver a more consistent and sustainable DWMP product to the global market, moving beyond traditional statistical quality control methods.

AI is set to revolutionize dairy farming and subsequent DWMP processing by integrating real-time data from milking parlors, processing plants, and consumer demand points. By employing machine learning algorithms, processors can accurately predict equipment failure in spray dryers, schedule maintenance preemptively, and optimize energy consumption during the drying phase, which is traditionally the most energy-intensive step. This level of predictive maintenance significantly reduces downtime and operational expenditure, directly translating into cost savings and a more competitive pricing structure for the finished product, especially critical given the tight profit margins often associated with bulk commodity dairy ingredients.

Furthermore, the application of sophisticated neural networks in quality assurance marks a paradigm shift. AI-powered vision systems are being deployed to analyze the physical attributes of DWMP—such as particle size distribution, color homogeneity, and solubility index—at micron levels during production. This ensures that every batch meets specific customer specifications (e.g., high-heat stability for UHT applications or low-spore counts for infant formula). Simultaneously, AI aids in demand sensing, helping manufacturers align production schedules precisely with fluctuating international shipping requirements and regional consumption surges, optimizing working capital management and inventory turnover across highly seasonal markets.

- Predictive Supply Chain Optimization: AI models forecast raw milk availability and global demand shifts, minimizing spoilage and optimizing procurement strategies.

- Enhanced Quality Control: Machine learning algorithms analyze powder specifications (texture, solubility, heat stability) in real-time, drastically reducing batch variability and ensuring compliance.

- Automated Processing Efficiency: AI optimizes energy use in spray drying, the most expensive operational step, and predicts maintenance needs for critical equipment.

- Fraud and Adulteration Detection: Utilizing AI and blockchain integration to verify the origin and purity of milk solids throughout the supply chain, protecting brand reputation.

- Personalized Product Development: AI analyzes large datasets of consumer feedback and nutritional science to rapidly iterate and develop new functional or low-lactose DWMP variants.

DRO & Impact Forces Of Dry Whole Milk Powder Market

The Dry Whole Milk Powder market is simultaneously propelled by substantial market drivers, contained by significant restraints, and presents numerous untapped opportunities, all shaped by internal and external impact forces. A primary driver is the accelerating urbanization and the corresponding increase in global processed food consumption, particularly in high-growth economies where the convenience and stability of DWMP are crucial ingredients for various mass-market products like ice cream, chocolate, and specialized baked goods. Concurrently, high volatility in international dairy commodity pricing, influenced by geopolitical factors, climate change impacts on feed costs, and government subsidy policies, acts as a major restraint, creating significant financial risks for processors and buyers reliant on stable long-term contracts.

A substantial opportunity lies in the development and marketing of premium, value-added DWMP products, such as organic, non-GMO, A2 milk-based, or specialized high-protein powders specifically targeting the burgeoning health and wellness segment. Addressing lactose intolerance issues through enzymatic treatment during processing or developing low-lactose DWMP variants offers a significant pathway for market penetration into previously underserved consumer groups. However, the market faces intense regulatory scrutiny regarding labeling, nutritional claims, and standards related to infant formula production, particularly in China and the European Union, which imposes rigorous compliance costs and limits rapid market entry for new players, thus acting as a structural restraint.

The impact forces are fundamentally driven by geopolitical trade agreements and shifts in global agricultural policy. For example, trade disputes or the imposition of tariffs can dramatically reroute supply chains, altering regional pricing dynamics and increasing the focus on domestic production capabilities, especially in dairy-importing nations. Furthermore, environmental sustainability concerns, particularly relating to methane emissions from dairy livestock and water usage in processing, exert a powerful long-term force, pushing the industry towards costly, but necessary, adoption of sustainable farming practices and waste management technologies, influencing consumer purchasing decisions and corporate investment strategies across the entire value chain.

Segmentation Analysis

The Dry Whole Milk Powder market is meticulously segmented based on end-use application, packaging type, and distribution channel, reflecting the diverse requirements of industrial users, retail consumers, and institutional buyers. Analyzing these segments provides strategic insights into which sectors are driving volume versus value growth. The critical distinction lies between the large industrial bulk buyers, who prioritize price stability and functional characteristics (e.g., heat stability), and the retail segment, which focuses on brand reputation, premium packaging, and specific health claims such as 'natural' or 'grass-fed' origin.

Application segmentation reveals that the largest volumetric demand emanates from the Food Processing sector, primarily used in convenience foods and confectionery, followed closely by the fast-growing Infant Formula industry, which, although lower in volume, commands the highest average selling price due to stringent quality requirements. Geographically, segmentation highlights the dominance of export-focused regions like Oceania (Australia and New Zealand) in high-quality production, contrasting with the massive consumption markets in Asia, necessitating complex global logistics and trade facilitation mechanisms to meet the sustained demand.

- By Application:

- Infant Formula

- Confectionery

- Bakery

- Dairy Products (Recombined Milk, Yogurt)

- Beverages (Coffee, Tea Mixes)

- Nutritional and Functional Foods

- By Packaging Type:

- Bags (25kg bulk industrial)

- Cans and Tins

- Pouches and Sachets (Retail/Small Institutional)

- Bulk Containers

- By Distribution Channel:

- Business to Business (B2B - Direct sales to manufacturers)

- Business to Consumer (B2C - Supermarkets/Hypermarkets, Convenience Stores, Online Retail)

Value Chain Analysis For Dry Whole Milk Powder Market

The value chain for Dry Whole Milk Powder is intensive and begins with the upstream raw milk production, where efficiency and quality are paramount. Upstream analysis involves dairy farming, which must adhere to strict standards for animal welfare, feed quality, and hygiene to ensure the suitability of raw milk for drying. Procurement and collection of raw milk from numerous farms necessitate robust cold chain infrastructure and prompt transportation to processing plants. Optimization in this phase involves technologies like automated herd management and precision farming to maximize milk yield and consistency while minimizing the environmental footprint and ensuring compliance with increasing sustainability mandates.

The midstream processing phase is capital-intensive, dominated by pasteurization, evaporation, and the critical step of spray drying, which transforms liquid whole milk into stable powder. Efficiency here relies heavily on advanced drying technology to minimize energy consumption and preserve the nutritional and functional integrity of the milk solids. This stage also includes specialized steps like instantization, which improves the solubility of the powder—a key quality factor for end-use manufacturers. Quality control and packaging into specialized formats (e.g., nitrogen-flushed cans or multi-ply paper bags) are essential to prevent oxidation and ensure the extended shelf life demanded by global trade.

Downstream analysis focuses on distribution and market penetration, involving both direct and indirect channels. Direct distribution is crucial for large industrial buyers (e.g., infant formula producers) where volume, specifications, and long-term contracts dictate the relationship. Indirect channels involve sophisticated logistics providers, commodity traders, and specialized food distributors who manage international transport, customs, and inventory for fragmented markets and retail sectors. The dominance of indirect channels in emerging markets allows for wider reach, relying on local distributors' expertise in navigating complex regulatory environments and localized trade practices, ultimately connecting the product to the diverse potential customers.

Dry Whole Milk Powder Market Potential Customers

The end-user base for Dry Whole Milk Powder is highly diversified, ranging from global multinational food conglomerates requiring consistent bulk ingredients to specialized niche manufacturers focused on functional nutrition. The primary large-scale customers are Infant Formula Manufacturers; these companies demand the highest quality, stringent microbial control, and customized nutritional profiles, often establishing long-term, exclusive supply agreements with processors to ensure supply stability and ingredient purity. Their purchasing decisions are driven by regulatory compliance, brand safety, and proprietary formulation requirements, making them the most valuable, albeit most demanding, customer segment.

Another major segment comprises manufacturers in the Confectionery and Bakery industries. For confectionery, especially chocolate producers, DWMP's high-fat content and rich flavor are crucial for achieving the desired sensory profile and texture. Bakery manufacturers utilize DWMP for improved dough handling, better crust color, and extended freshness in products like bread and cakes. These buyers are generally sensitive to price fluctuations but value reliable supply and functional consistency (e.g., protein stability during baking). Their volume requirements are typically enormous, requiring standardized 25kg bulk packaging.

Emerging potential customers include manufacturers of Functional and Nutritional Supplements, particularly those producing high-protein drinks, meal replacements, and sports nutrition products. These customers seek DWMP as a complete protein source, often preferring specific origins (e.g., grass-fed milk) to align with consumer wellness trends. Additionally, institutional buyers, such as government entities (for strategic food reserves or school feeding programs) and military organizations, represent a substantial, recurring customer base, valuing DWMP for its longevity, nutritional density, and logistical advantages in large-scale humanitarian or disaster relief operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 20.7 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fonterra Co-operative Group, Nestlé S.A., Dairy Farmers of America (DFA), Lactalis Group, Arla Foods amba, Saputo Inc., Royal FrieslandCampina N.V., Glanbia PLC, Dale Farm Ltd, Tatura Milk Industries (Bega Cheese), Westland Milk Products, Gujarat Co-operative Milk Marketing Federation (GCMMF), Meiji Co. Ltd., Miraka Limited, Synlait Milk Ltd., Dairygold Co-operative Society Ltd., Land O’Lakes Inc., Associated Milk Producers Inc. (AMPI), Panagora Group, Almarai Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dry Whole Milk Powder Market Key Technology Landscape

The Dry Whole Milk Powder market relies heavily on advanced thermal processing and drying technologies to maintain product integrity and extend shelf life. The core technology remains Spray Drying, but innovations focus on optimizing the process parameters, such as temperature gradients and atomization techniques, to minimize heat degradation of proteins and vitamins. Recent technological advancements include the use of sophisticated fluid bed systems post-drying, primarily for instantization, which enhances the powder's rehydration properties—a crucial characteristic for consumer acceptability in beverages and reconstituted milk applications. Furthermore, membrane filtration technologies, specifically ultrafiltration and reverse osmosis, are increasingly utilized upstream to pre-concentrate the liquid milk before evaporation, significantly reducing the energy required for the subsequent drying phase, thereby driving operational efficiency and sustainability goals.

Packaging technology constitutes another crucial pillar of the market landscape, particularly given the vulnerability of DWMP to oxidation and moisture absorption, which can lead to rancidity and caking. High-barrier packaging materials, often multilayered foils or specialized polyethylene liners, combined with modified atmosphere packaging (MAP) or nitrogen flushing, are standard practice, especially for products destined for long transit times or humid climates. These technological enhancements ensure that the DWMP retains its functional properties, such as excellent solubility and flavor profile, over an extended period, meeting the stringent shelf-life demands of global retailers and industrial users.

In addition to manufacturing processes, the technological landscape includes digital integration tools designed to enhance supply chain transparency and quality assurance. This encompasses sensors and IoT devices deployed in processing plants for real-time monitoring of critical control points (CCPs), integrated with cloud-based platforms for data analysis. Furthermore, the adoption of blockchain technology is gaining traction to provide end-to-end traceability of the milk source, particularly vital for premium and organic DWMP segments, offering verifiable proof of origin and processing conditions to address consumer trust and complex regulatory requirements.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant consumer market and the fastest-growing region, driven by immense population growth, increasing disposable income, and inadequate local raw milk production capacity in key countries like China, India, and Southeast Asia. DWMP is essential for reconstituted milk and localized processed food manufacturing.

- North America: A mature, net-exporting region, focusing on high-volume production using highly automated, energy-efficient facilities. Demand centers around specialized industrial use (e.g., confectionery) and a growing consumer segment interested in premium, organic, or specialized functional dairy powders.

- Europe: Characterized by high regulatory standards and a strong focus on sustainability and traceability. The region is a major exporter of high-quality DWMP, with market trends leaning towards value-added products derived from specific breeds or feeding practices, adhering strictly to EU-mandated environmental standards.

- Latin America: This region presents a mix of production and consumption, with countries like Argentina and Brazil being significant producers and exporters. Internal regional demand is accelerating due to rising use in local bakery and prepared foods, although market stability is often affected by fluctuating local economic conditions and trade policies.

- Middle East and Africa (MEA): A highly import-dependent region due to severe dairy deficits, offering significant opportunities for international DWMP suppliers. Demand is primarily driven by institutional purchasing, population growth, and the necessity for shelf-stable food ingredients in environments lacking comprehensive cold chain logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dry Whole Milk Powder Market.- Fonterra Co-operative Group

- Nestlé S.A.

- Dairy Farmers of America (DFA)

- Lactalis Group

- Arla Foods amba

- Saputo Inc.

- Royal FrieslandCampina N.V.

- Glanbia PLC

- Dale Farm Ltd

- Tatura Milk Industries (Bega Cheese)

- Westland Milk Products

- Gujarat Co-operative Milk Marketing Federation (GCMMF)

- Meiji Co. Ltd.

- Miraka Limited

- Synlait Milk Ltd.

- Dairygold Co-operative Society Ltd.

- Land O’Lakes Inc.

- Associated Milk Producers Inc. (AMPI)

- Panagora Group

- Almarai Company

Frequently Asked Questions

Analyze common user questions about the Dry Whole Milk Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for Dry Whole Milk Powder globally?

The central driver is the increasing global consumption of processed and convenience foods, particularly in Asia Pacific, where DWMP provides a stable, easy-to-transport ingredient crucial for confectionery, bakery, and the reconstitution of liquid dairy products, circumventing cold chain limitations.

How does the volatility of raw milk prices impact the DWMP market?

Raw milk price volatility significantly impacts the DWMP market by increasing production costs and making long-term pricing contracts challenging. Processors mitigate this by hedging, focusing on value-added specialty powders, or leveraging AI-driven predictive analytics for better procurement timing.

Which application segment offers the highest value opportunity for manufacturers?

The Infant Formula segment provides the highest value opportunity due to the necessity for superior quality, stringent testing, and highly specialized nutritional profiles, allowing manufacturers to command a substantial premium over commodity-grade DWMP used in general food processing.

What key technological innovations are shaping DWMP manufacturing?

Key technological innovations include optimized spray drying techniques to enhance heat stability, the use of ultrafiltration for energy-efficient pre-concentration, and advanced packaging systems (nitrogen flushing, high-barrier foils) to maximize product shelf life and prevent oxidation.

What role do sustainability concerns play in the Dry Whole Milk Powder supply chain?

Sustainability is becoming critical, driving investment in reducing methane emissions and water usage at the farm level. Consumers and regulators increasingly demand traceability, pushing processors to adopt blockchain technology and certified sustainable sourcing practices.

This report provides a comprehensive overview of the global Dry Whole Milk Powder market dynamics, covering size, growth projections, technological landscape, and strategic segmentations. The analysis highlights the confluence of industrial demand, logistical efficiency, and technological advancements as key determinants of market trajectory through 2033. Strategic focus areas for market participants must center on mitigating commodity volatility, capitalizing on the high-value infant nutrition segment, and adopting sustainable, traceable supply chain solutions to ensure long-term competitive advantage in a rapidly evolving global dairy ecosystem. Continued research and development into specialized, functional powders will be essential to meet the sophisticated demands of the modern food industry.

The pronounced growth rate projected for the Dry Whole Milk Powder market underscores its fundamental role in global food security and manufacturing. As populations continue to grow, particularly in regions where access to fresh milk is constrained, DWMP remains an indispensable ingredient. Market players are advised to prioritize operational excellence through AI-driven process optimization and strategic geographical expansion, particularly focusing on deepening market penetration within the high-potential Asia Pacific region while maintaining export dominance from established hubs in Oceania and North America. Regulatory compliance, especially concerning product safety and labeling in international trade, will continue to dictate entry barriers and success thresholds for all participants.

Future market evolution will likely involve increased consolidation among major global producers seeking to control raw milk supply and distribution channels. The emphasis on clean label ingredients and non-GMO sourcing represents an opportunity for differentiation and premium pricing, contrasting sharply with the price-sensitive bulk commodity sector. Ultimately, success in this market will depend on a balanced strategy that integrates cost efficiency in production with agility in adapting to consumer preferences for health, convenience, and ethical sourcing, supported by resilient and technologically advanced supply chain infrastructure capable of handling global demands.

Furthermore, the competitive landscape is shifting towards specialized nutritional attributes. Manufacturers are increasingly exploring opportunities in grass-fed certification and A2 milk production to cater to niche, affluent consumer segments willing to pay a premium for perceived health benefits. This specialization mitigates some of the risk associated with undifferentiated commodity trading. Investment in research and development to improve the functional properties of DWMP—such as enhanced solubility for sports drinks or specific heat stability for UHT milk reconstitution—will be paramount for maintaining a leading edge over competitors focusing solely on volume. The interplay between stringent quality standards for high-value uses and large-scale efficiency for bulk uses defines the multifaceted operational complexity of the DWMP market.

In conclusion, the Dry Whole Milk Powder market presents a stable investment thesis characterized by predictable industrial demand growth and dynamic opportunities within the premium segments. Addressing environmental impacts and ensuring robust supply chain transparency are not just regulatory requirements but crucial elements for maintaining corporate reputation and long-term market access. The adoption of smart factory technologies, including advanced sensors and automation, promises to enhance productivity and reduce operational waste, further strengthening the economic viability of DWMP production as a critical component of the global food system. The ongoing expansion of organized retail and e-commerce platforms also facilitates B2C distribution, opening new avenues for branded DWMP products.

Geopolitical stability, particularly in relation to major exporting and importing nations, exerts a considerable influence on the market's fluidity. Trade agreements and tariff adjustments between blocs like the EU, North America, and key Asian markets directly affect procurement costs and competitive positioning. Companies must maintain flexible supply chain strategies that can quickly pivot sourcing and distribution routes in response to shifting global trade policies. This strategic flexibility, coupled with robust inventory management systems, is vital for mitigating the external shock forces inherent in the international agricultural commodity trade, securing continuous supply for critical end-users such as infant formula manufacturers.

The regulatory environment remains a constant, influential force, especially regarding maximum residue limits (MRLs) for pesticides and veterinary drugs, and strict nutritional composition requirements for specific products like follow-on formula. Compliance requires continuous investment in analytical testing and quality management systems. Moreover, market penetration in emerging economies is often tied to obtaining necessary local certifications and navigating complex import licensing procedures. The cumulative effect of these requirements elevates the barriers to entry, favoring large, well-established global dairy processors with proven track records in international regulatory affairs and comprehensive internal quality control frameworks that exceed baseline industry requirements.

The consumer-facing retail segment, though smaller in volume than the B2B sector, offers higher profit margins and opportunities for brand building. Marketing efforts in this area are increasingly focused on transparency of origin (e.g., 'New Zealand Grass-Fed') and specific health attributes (e.g., 'High Calcium,' 'Vitamin D Fortified'). The rise of direct-to-consumer models, facilitated by e-commerce, allows specialized DWMP brands to reach niche health-conscious consumers directly, bypassing traditional retail bottlenecks. This segmentation by value proposition demonstrates the market's maturity and its ability to simultaneously serve both vast industrial needs and targeted consumer demands.

Finally, the long-term outlook for the DWMP market is intrinsically linked to global population growth and dairy consumption patterns. As middle-class populations expand in high-growth regions, demand for shelf-stable ingredients capable of supporting widespread food manufacturing will only intensify. This ensures the foundational stability of the bulk DWMP segment. Meanwhile, innovation continues to drive the top-tier, specialized powder segment, promising continuous market evolution driven by technological breakthroughs in processing and consumer preferences for specialized nutrition. Strategic integration across the entire value chain, from farm gate to final packaging, is the enduring competitive imperative.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager