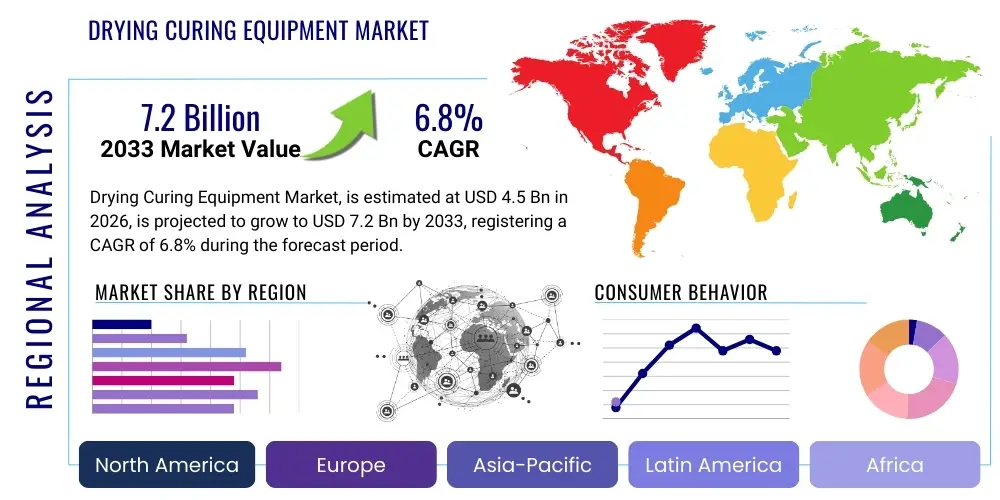

Drying Curing Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436625 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Drying Curing Equipment Market Size

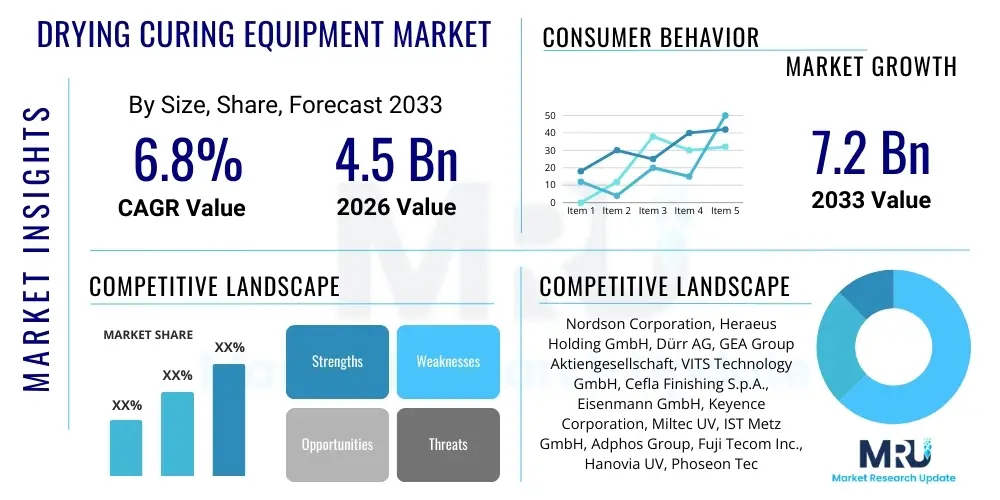

The Drying Curing Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Drying Curing Equipment Market introduction

The Drying Curing Equipment Market encompasses a broad range of industrial machinery designed to remove solvents, moisture, or volatile components from materials and substrates, or to induce chemical reactions (polymerization, cross-linking) using controlled heat, radiation, or air flow. This equipment is essential across nearly all manufacturing sectors where surface treatment, coating application, or material integrity is critical. Key product types include industrial ovens (batch and continuous), infrared (IR) systems, ultraviolet (UV) curing lamps, electron beam (EB) systems, and specialized dryers like fluid bed dryers or spray dryers, each tailored to specific operational requirements concerning throughput, energy consumption, and material sensitivity.

The primary applications of drying and curing equipment span high-growth sectors such as automotive coating, electronics manufacturing (for circuit board conformal coatings and adhesives), printing and packaging (ink curing), and medical device sterilization or bonding. The inherent benefits include significant improvements in product quality, enhanced durability and wear resistance of coatings, faster production cycle times, and reduced environmental impact through the implementation of solvent-free or low-VOC (Volatile Organic Compound) processes facilitated by advanced UV and EB curing technologies. This technological shift is a core driver for market expansion.

Driving factors for the market include stringent regulatory requirements mandating VOC reduction in industrial emissions, coupled with the global push for manufacturing automation and process efficiency. Furthermore, the rapid growth in flexible electronics, 3D printing post-processing, and high-performance material applications requires sophisticated curing capabilities that traditional thermal systems cannot provide, thereby accelerating the adoption of high-intensity radiation curing technologies. Continuous innovation in energy recovery systems and process control software further reinforces market growth by offering superior operating cost efficiency and precision.

Drying Curing Equipment Market Executive Summary

The Drying Curing Equipment Market is characterized by robust growth driven by accelerating industrial automation and the necessity for superior surface finish quality, particularly in the automotive and electronics sectors. Key business trends indicate a substantial shift towards continuous, high-throughput systems utilizing advanced non-thermal technologies like UV and EB curing, which offer faster processing times and lower energy consumption compared to conventional convection ovens. Manufacturers are focusing heavily on integrating IoT and advanced sensor technology into equipment to enable real-time monitoring, predictive maintenance, and optimized process recipes, enhancing operational efficiency and reducing downtime across diverse industrial environments globally.

Regionally, Asia Pacific maintains market dominance, fueled by massive expansion in electronics assembly, automotive production, and packaging industries, especially in China, South Korea, and India. North America and Europe, while mature markets, are experiencing strong growth in the retrofit and modernization segments, driven by strict environmental regulations pushing for the replacement of older, high-emission thermal systems with highly energy-efficient, low-VOC alternatives. The Middle East and Africa (MEA) region is emerging as a significant market, particularly in infrastructure and construction coatings, necessitating durable and fast-curing solutions suitable for demanding environments.

Segment trends reveal that the UV Curing Equipment segment is poised for the highest CAGR due to its immediate curing capabilities, minimal heat generation, and suitability for heat-sensitive substrates common in printed electronics and medical device manufacturing. Concurrently, the continuous drying segment is growing faster than the batch segment, reflecting the industry's demand for high-volume, uninterrupted production flows. Strategic competition is intensifying around developing multi-functional equipment capable of handling diverse materials and integrating seamlessly into Industry 4.0 production lines, emphasizing precision and reduced footprint in sophisticated manufacturing facilities.

AI Impact Analysis on Drying Curing Equipment Market

User inquiries regarding AI's impact on the Drying Curing Equipment Market predominantly center on how artificial intelligence can optimize energy consumption, predict equipment failure, and fine-tune complex curing recipes for diverse materials. Users are seeking quantifiable data on AI-driven efficiency gains, particularly in minimizing defects (e.g., uneven curing or surface blemishes) and adapting equipment parameters dynamically based on fluctuating environmental conditions or material batches. The key concerns revolve around data security, the complexity of initial AI implementation, and the need for specialized personnel to manage AI-integrated systems. Overall, the expectation is that AI will transform drying and curing from a fixed-parameter process into a highly adaptive, self-optimizing system, significantly improving throughput and quality consistency while reducing operational costs associated with energy use and waste generation.

- AI integration enables predictive maintenance schedules, drastically reducing unexpected downtime and optimizing component lifecycles, especially for expensive elements like UV lamps and heating coils.

- Machine learning algorithms analyze real-time sensor data (temperature, humidity, airflow, coating thickness) to dynamically adjust curing speeds and power levels, achieving optimal process consistency and minimizing energy waste.

- AI-powered visual inspection systems detect subtle curing defects immediately, allowing for closed-loop feedback correction in continuous coating lines, leading to near-zero defect rates.

- Optimization of complex, multi-stage drying cycles (e.g., in pharmaceutical or food processing) through reinforcement learning models to ensure maximum removal of solvents or moisture without compromising product integrity.

- Facilitation of digital twin technology for drying and curing processes, allowing manufacturers to simulate and test new materials or process changes virtually before costly physical implementation.

DRO & Impact Forces Of Drying Curing Equipment Market

The Drying Curing Equipment Market is propelled by robust drivers centered on industrial efficiency and sustainability, yet faces critical restraints related to high capital expenditure and technological complexity. Opportunities arise from emerging high-tech applications demanding novel curing solutions, creating a dynamic interplay of impact forces. The primary drivers include global adoption of Industry 4.0 standards, which necessitate networked, precise curing systems, and the strict governmental mandates focusing on reducing VOC emissions, thereby accelerating the switch to energy-efficient UV/EB technologies. Conversely, the initial cost of advanced continuous drying systems and the energy intensive nature of traditional thermal ovens in certain legacy industries present substantial barriers to entry and modernization.

The market impact forces are categorized by supply-side pressures related to raw material costs (especially for specialized heating elements and high-purity quartz glass used in lamps) and demand-side impetus from sectors like electric vehicle battery production, which requires extremely controlled drying environments. The market equilibrium is constantly shifting as manufacturers invest heavily in R&D to develop compact, high-efficiency equipment that integrates seamlessly into automated lines, mitigating the initial capital restraint through superior long-term operational savings. The impact forces collectively enforce a continuous cycle of innovation focused on modular design, energy recovery, and process digitalization.

Opportunities are largely concentrated in developing custom solutions for nascent technologies, such as advanced composite manufacturing, printed electronics, and bio-based coatings that require specific, low-temperature, or radiation-based curing methods. Furthermore, the growing pharmaceutical sector’s need for sterile and highly precise drying techniques for powders and granular materials offers a consistent avenue for market expansion. Navigating these forces requires strategic vendor partnerships focused on offering comprehensive, integrated solutions rather than standalone machinery.

Segmentation Analysis

The Drying Curing Equipment Market is meticulously segmented based on product type, operation mode, application, and end-user, reflecting the diverse industrial requirements for thermal and non-thermal processing. This segmentation highlights the technological shifts occurring in the market, particularly the increasing preference for radiation-based curing systems (UV and EB) over conventional thermal ovens due to advantages in speed, energy consumption, and environmental compliance. Analyzing these segments provides strategic insights into investment priorities, regional consumption patterns, and the varying levels of technological sophistication adopted across different industrial verticals, from high-volume automotive assembly to specialized medical device fabrication.

By Product Type

The market for drying and curing equipment is segmented into several core technologies, with industrial ovens representing the traditional, high-volume workhorse, while UV and IR systems drive technological advancement. Industrial ovens, including convection, vacuum, and curing ovens, are predominantly used where prolonged heat exposure is necessary for solvent removal or high-temperature material treatments, especially in heavy industries and powder coating applications. The ongoing focus in this segment is on improving insulation, airflow uniformity, and heat recovery to minimize energy footprint, making them suitable for long-cycle processes.

In contrast, UV (Ultraviolet) and EB (Electron Beam) curing systems constitute the fastest-growing segment, owing to their ability to achieve instantaneous curing of specialized coatings, inks, and adhesives without generating significant heat. This speed drastically shortens production cycles and allows for processing heat-sensitive materials. UV curing is essential in printing, packaging, and electronics, particularly with the proliferation of low-migration, LED-compatible UV inks. Manufacturers are consistently launching higher-intensity, more compact UV LED systems that offer greater spectral efficiency and longer operating lifespans compared to traditional mercury vapor lamps, aligning perfectly with sustainability goals.

Infrared (IR) and RF/Microwave drying systems occupy an important niche, providing efficient, focused heating that penetrates the material surface quickly, often used as pre-treatment or intermediate drying stages in continuous lines. IR technology is favored in paint drying (automotive repair) and textile processing due to its speed and targeting capability. The strategic evolution across all product types emphasizes modularity, ease of integration into existing lines, and sophisticated process control software to ensure precise, repeatable results, essential for minimizing waste in modern high-precision manufacturing.

- Industrial Ovens: Convection Ovens, Vacuum Ovens, Batch Ovens, Continuous Ovens.

- UV Curing Systems: UV LED Curing Systems, Arc Lamp Systems, Excimer Lamps.

- Infrared (IR) Heaters: Short Wave, Medium Wave, Long Wave IR Emitters.

- Microwave and Radio Frequency (RF) Dryers: Used for volumetric heating and moisture removal in specific materials like ceramics and food.

- Electron Beam (EB) Curing Systems: High-precision curing for specialized protective coatings and advanced composites.

By Operation Mode

The segmentation by operation mode distinguishes between Batch and Continuous systems, reflecting fundamental differences in production scale, product variety, and throughput requirements. Batch curing equipment is typically employed in low-to-medium volume production, specialized manufacturing, or R&D environments where flexibility and the ability to handle various product sizes and material types are paramount. Batch ovens and chambers allow for precise, isolated processing of discrete product lots, ensuring quality control for highly specific or custom orders. Their flexibility makes them ideal for small and medium enterprises (SMEs) or facilities handling complex, multi-step processes where materials require specific holding times.

The Continuous operation mode dominates high-volume manufacturing sectors, including automotive assembly, coil coating, printing, and packaging. Continuous systems, such as conveyorized ovens, continuous UV lines, or tunnel dryers, are engineered for maximized throughput and integration into automated production lines. These systems are characterized by their stable, repeatable process parameters, minimizing variability across the production run. Investment in continuous equipment is justified by the significant economies of scale achieved through reduced labor and accelerated production cycles, which are critical in competitive global markets where time-to-market is a significant differentiator.

The trend is decisively favoring continuous systems, driven by the increasing automation across all industrial verticals. However, advancements in digital control technologies are blurring the lines, with some modern batch systems offering rapid changeovers and integrated robotics that mimic the efficiency of continuous lines for small-batch runs. Continuous systems also present greater complexity in energy management and failure recovery; thus, they are increasingly integrated with AI for predictive maintenance and real-time process optimization to ensure uninterrupted high-speed operation and reduce energy fluctuation costs associated with high-power industrial equipment.

- Batch Systems: Used for low volume, high complexity, and specialized production runs; characterized by high flexibility and ease of parameter modification per batch.

- Continuous Systems: Designed for high throughput and integration into automated assembly lines; features include conveyor belts, indexing systems, and tunnel configurations for non-stop processing.

By Application

The diverse industrial applications of drying and curing equipment highlight the indispensable role of these processes in achieving functional and aesthetic product specifications. The Automotive sector is a cornerstone application, relying heavily on both large thermal ovens for paint curing on car bodies (e-coat, primer, clear coat) and sophisticated UV curing systems for interior components, adhesives, and headlight assembly. The shift toward electric vehicle manufacturing introduces new demands, particularly for precise, low-temperature curing of battery pack adhesives and coatings to ensure thermal stability and safety, driving innovation in specialized IR and convection drying equipment for cell manufacturing lines.

The Electronics segment utilizes specialized curing equipment for manufacturing printed circuit boards (PCBs), encapsulating components, and applying conformal coatings. UV curing is preferred here due to its instantaneous, low-heat nature, preventing damage to sensitive electronic components while ensuring environmental protection and electrical insulation. As devices become smaller and more complex, the demand for highly precise, small-footprint UV LED systems for micro-curing applications, such as micro-LED display manufacturing and semiconductor fabrication, continues to rise sharply. This sector demands extremely high uniformity and cleanliness standards, driving investments in filtered and controlled-atmosphere curing chambers.

Furthermore, the Printing and Packaging industries are major consumers, rapidly transitioning from solvent-based flexographic and gravure inks to UV and EB curable inks and coatings. This shift is motivated by regulatory compliance (VOC reduction), superior print quality (gloss and adhesion), and the need for immediate post-print processing. The medical device and pharmaceutical sectors require validated, highly controlled drying processes for sterilization, coating drug-eluting stents, and processing bulk pharmaceutical powders, driving the specialized demand for vacuum drying, freeze drying (lyophilization), and validated convection ovens adhering to GMP (Good Manufacturing Practice) standards, underscoring the critical nature of precision drying in human health applications.

- Automotive: E-coat curing, clear coat baking, plastic component bonding, battery thermal management coatings.

- Electronics: Conformal coating curing, adhesive bonding, PCB fabrication, semiconductor encapsulation.

- Printing and Packaging: Curing inks (UV/EB), protective varnishes, flexible packaging lamination.

- Medical Devices: Sterilization drying, catheter coating, adhesive curing for disposable devices.

- Aerospace and Composites: Curing high-performance composite materials (prepregs) using specialized autoclaves and industrial ovens with advanced temperature ramping profiles.

- Chemical and Pharmaceutical: Drying granular materials, powder processing, solvent removal.

By End-User

Segmentation by end-user differentiates between Large Enterprises and Small and Medium-sized Enterprises (SMEs), each exhibiting distinct purchasing behaviors, technological adoption rates, and equipment requirements. Large enterprises, including global automotive manufacturers, multinational electronics corporations, and major packaging converters, are characterized by their high-volume production needs, necessitating significant investment in continuous, highly automated, and custom-engineered drying and curing lines. These organizations often prioritize seamless integration with enterprise resource planning (ERP) systems, demanding equipment with advanced IoT connectivity, robust data logging capabilities, and long-term service contracts. Their purchasing decisions are primarily driven by throughput, process consistency, and total cost of ownership (TCO) over a decade-long operational span.

Conversely, SMEs, which include specialty job shops, regional printing houses, and small component manufacturers, typically opt for more flexible, modular, or batch-style equipment. Their investment capacity is often constrained, leading them to favor standardized models, refurbished equipment, or systems that offer versatility across different production tasks. While SMEs require less complex automation, there is a growing trend of adopting entry-level or modular UV LED curing systems due to their relatively lower operating costs and maintenance simplicity compared to large thermal ovens. The key drivers for SMEs are low initial capital outlay, ease of use, and quick return on investment, often favoring localized vendors who can provide rapid technical support and training tailored to smaller operational teams.

The market strategies deployed by equipment suppliers must cater to these divergent needs. Suppliers target large enterprises with advanced, integrated Industry 4.0 solutions, including customized software and remote diagnostics services. For SMEs, the focus shifts to providing scalable, easy-to-install packages, often utilizing financing options and emphasizing the immediate quality and energy efficiency benefits of migrating from older, less compliant technologies. The growth of the SME segment, particularly in emerging markets like Southeast Asia, provides a substantial opportunity for manufacturers offering cost-effective and highly modular drying and curing solutions that minimize reliance on extensive infrastructure modifications.

- Large Enterprises: Require high-throughput continuous systems, custom integration, comprehensive automation, and robust data reporting capabilities.

- Small and Medium-sized Enterprises (SMEs): Prefer flexible, modular, batch-style equipment, emphasizing low capital cost, ease of operation, and versatility for diverse product lines.

Value Chain Analysis For Drying Curing Equipment Market

The value chain for the Drying Curing Equipment Market spans from raw material sourcing and specialized component manufacturing through final equipment assembly, distribution, and critical post-sales services. Upstream analysis involves the procurement of highly specialized materials, including high-pgrade stainless steel for oven construction, specialized heating elements (like silicon carbide or tungsten), quartz glass and reflectors for UV lamps, and intricate control electronics. Dependency on a few specialized suppliers for core components, such as high-intensity LED chipsets or sophisticated thermal sensors, creates potential bottlenecks. Component manufacturers focus on efficiency and longevity, driving innovation in magnetic bearings and high-temperature insulation materials, crucial for operational robustness.

The midstream stage involves equipment manufacturing and integration. Key Original Equipment Manufacturers (OEMs) focus on designing energy-efficient chamber geometries, optimizing airflow dynamics, and integrating advanced control software (HMI/PLC systems). Design intellectual property (IP) related to thermal uniformity and radiation efficiency is a key differentiator. Distribution channels are varied, including direct sales for large, custom projects involving significant engineering consultation, and reliance on specialized distributors or system integrators for standardized or smaller equipment sales. System integrators play a vital role, often modifying and installing equipment to fit specific plant layouts and process requirements, especially in complex manufacturing environments.

Downstream analysis is dominated by the critical need for comprehensive after-sales support, including installation, calibration, preventive maintenance, and the supply of consumable components (e.g., UV lamps, filters, heating coils). Customer satisfaction heavily relies on equipment uptime, making service provision a high-margin activity and a key competitive factor. The shift towards IoT-enabled equipment allows manufacturers to offer remote diagnostics and predictive maintenance contracts, tightening the relationship between the supplier and the end-user and ensuring continuous operational performance. The efficient functioning of this value chain is paramount for minimizing lead times and sustaining equipment performance across various demanding industrial applications globally.

Drying Curing Equipment Market Potential Customers

Potential customers for drying and curing equipment encompass a wide spectrum of industrial processors who require precise control over material properties and surface integrity. The primary end-users are large manufacturing entities within high-throughput sectors, including Automotive OEMs and their tier suppliers who utilize extensive continuous thermal and UV curing lines for painting and component bonding. Electronics manufacturers, particularly those involved in PCB assembly, semiconductor packaging, and display manufacturing, constitute a highly demanding customer base requiring ultra-precise, low-temperature UV/EB systems to protect sensitive components from thermal degradation while ensuring reliability and moisture protection. The stringent quality requirements in this sector translate into high purchasing power for premium, specialized equipment.

The packaging and printing industries represent another massive segment, consisting of flexible packaging converters, label printers, and corrugated box manufacturers who are rapidly migrating to UV and LED curing technologies to accelerate printing speeds and meet evolving food safety standards concerning ink migration. Furthermore, specialized industrial sectors such as composite materials fabrication (Aerospace and Wind Energy), medical device manufacturing (requiring cleanroom compatible, validated curing processes), and high-end consumer goods assembly also serve as significant end-user groups. These customers prioritize equipment validation, process repeatability, and compliance with sectoral regulatory frameworks such as FDA or GMP standards, often leading to custom-engineered solutions that integrate seamlessly with robotic handling systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nordson Corporation, Heraeus Holding GmbH, Dürr AG, GEA Group Aktiengesellschaft, VITS Technology GmbH, Cefla Finishing S.p.A., Eisenmann GmbH, Keyence Corporation, Miltec UV, IST Metz GmbH, Adphos Group, Fuji Tecom Inc., Hanovia UV, Phoseon Technology, Datapaq Inc., Sidel Group, Global Finishing Solutions, Tensor Systems, Precision Quartz Co. Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drying Curing Equipment Market Key Technology Landscape

The Drying Curing Equipment Market is undergoing a significant technological evolution, characterized by the convergence of high-efficiency hardware and sophisticated digital control systems. A pivotal development is the proliferation of UV LED curing technology, which replaces traditional mercury arc lamps. UV LEDs offer precise wavelength control, drastically reduced power consumption, immediate on/off capabilities, and longer operational lifespans, eliminating the need for complex lamp cooling and shortening maintenance cycles. This transition is highly valued in heat-sensitive applications and aligns with global phase-out directives for mercury-containing products. Furthermore, advancements in IR emitter technology now include highly focused, customizable short-wave emitters capable of rapid, localized curing, reducing overall thermal exposure to the substrate and improving processing speeds significantly in automotive refinishing and industrial coatings.

Beyond hardware, digitalization is redefining the operational landscape. Key technologies include the integration of Industrial Internet of Things (IIoT) sensors for comprehensive data collection on parameters such as air velocity, temperature uniformity, coating thickness, and moisture content. This sensor data feeds into sophisticated Process Analytical Technology (PAT) systems, particularly crucial in pharmaceutical drying, ensuring consistent product quality and regulatory compliance. Software platforms utilizing proprietary algorithms are increasingly used to create "smart recipes," allowing equipment to self-adjust heating or radiation intensity based on incoming material variability or ambient conditions, guaranteeing optimal and repeatable results while maximizing energy efficiency through load-dependent power scaling.

Future technological advancements are focused on developing hybrid curing systems that combine the benefits of multiple techniques (e.g., UV pretreatment followed by IR or low-temperature convection drying) to handle complex, multi-layer coatings or difficult substrates. Electron Beam (EB) curing is gaining traction for high-performance applications requiring extreme cross-linking and scratch resistance, particularly in high-security printing and advanced composites, despite the higher capital cost associated with radiation shielding. The technological trend universally points toward miniaturization, modular design for flexible manufacturing lines, and a heightened emphasis on energy recovery systems (e.g., regenerative thermal oxidizers and heat exchangers) to reduce the substantial operational carbon footprint associated with large-scale industrial drying operations.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share due to unparalleled growth in electronics manufacturing (China, South Korea, Taiwan), high-volume automotive production (Japan, India), and robust expansion of the packaging and construction industries. The region is characterized by significant capital investment in new manufacturing facilities adopting continuous, high-speed drying and curing lines, particularly UV LED systems for the fast-growing flexible electronics sector. Environmental regulation tightening in countries like China is accelerating the phase-out of older, energy-intensive equipment, driving demand for modern, efficient replacements.

- North America: A mature market characterized by technological leadership and a strong emphasis on compliance with strict environmental standards (e.g., EPA mandates on VOC reduction). Growth is concentrated in the aerospace composite manufacturing sector, specialized medical device production, and the retrofitting of existing industrial lines with advanced controls and energy recovery systems. The US and Canada are pioneers in adopting sophisticated EB curing technologies for highly regulated high-performance coatings, driven by quality and durability requirements.

- Europe: Exhibits steady growth fueled by the automotive premium sector (Germany, France) and stringent EU regulations mandating energy efficiency and low emissions. The focus is on precision engineering and highly automated curing solutions tailored for complex, specialized industrial components. There is a strong regional emphasis on sustainability, promoting the rapid adoption of highly efficient infrared and convection drying systems incorporating advanced heat recovery and thermal management techniques.

- Latin America (LATAM): Represents an emerging market with growth driven by expansion in infrastructure projects, automotive assembly (Brazil, Mexico), and the packaging industry. Market penetration is gradually increasing, with initial adoption favoring cost-effective, standardized thermal ovens and conventional UV systems, though there is a rising demand for modernized equipment as manufacturing quality standards improve across the region.

- Middle East and Africa (MEA): Growth is primarily concentrated in the industrial coating, construction, and oil & gas sectors (Saudi Arabia, UAE), where specialized, robust drying equipment is required for protective coatings in harsh environments. Investment in localized manufacturing capabilities and diversification from oil revenues are key drivers, leading to increasing purchases of robust, large-scale industrial ovens and powder coating lines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drying Curing Equipment Market.- Nordson Corporation

- Heraeus Holding GmbH

- Dürr AG

- GEA Group Aktiengesellschaft

- VITS Technology GmbH

- Cefla Finishing S.p.A.

- Eisenmann GmbH

- Keyence Corporation

- Miltec UV

- IST Metz GmbH

- Adphos Group

- Fuji Tecom Inc.

- Hanovia UV

- Phoseon Technology

- Datapaq Inc.

- Sidel Group

- Global Finishing Solutions

- Tensor Systems

- Precision Quartz Co. Inc.

- Glenro, Inc.

Frequently Asked Questions

Analyze common user questions about the Drying Curing Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of UV LED curing over traditional thermal systems?

The primary driver is the necessity for energy efficiency and compliance with environmental regulations. UV LED systems offer instantaneous curing, drastically reduce energy consumption compared to large thermal ovens, and eliminate the release of volatile organic compounds (VOCs) associated with solvent-based coatings, thereby improving both sustainability and throughput rates substantially.

How is Industry 4.0 influencing the design and functionality of industrial drying equipment?

Industry 4.0 integrates IoT sensors and AI into drying equipment, enabling real-time monitoring, predictive maintenance, and closed-loop process control. This smart connectivity allows the equipment to self-adjust parameters (e.g., temperature, airflow) based on material feedback, maximizing process uniformity, minimizing defects, and optimizing energy consumption autonomously.

Which application segment holds the highest growth potential for drying and curing equipment in the forecast period?

The Electronics manufacturing segment, particularly for specialized applications like printed circuit boards, display manufacturing, and battery cell coating, holds the highest growth potential. This sector demands precision, low-temperature processing, and high-speed curing, driving robust investment in advanced UV LED and specialized IR curing technologies.

What are the key differences between Batch and Continuous drying systems regarding throughput and flexibility?

Batch systems offer high flexibility, suitable for low-volume, customized runs with varied material specifications, but have lower overall throughput. Continuous systems, designed with conveyors or automated lines, offer maximized throughput and consistency essential for high-volume production (e.g., automotive or packaging), but lack the immediate flexibility to handle diverse product types.

What role does predictive maintenance play in optimizing the operating costs of drying and curing machinery?

Predictive maintenance utilizes AI to analyze operational data and forecast component failure (e.g., lamp burnout, heater coil degradation) before it occurs. This proactive approach minimizes expensive unplanned downtime, optimizes the schedule for part replacement, and ensures maximum operational efficiency, thus significantly lowering long-term maintenance and operating costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager