Drywall and Gypsum Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436907 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Drywall and Gypsum Board Market Size

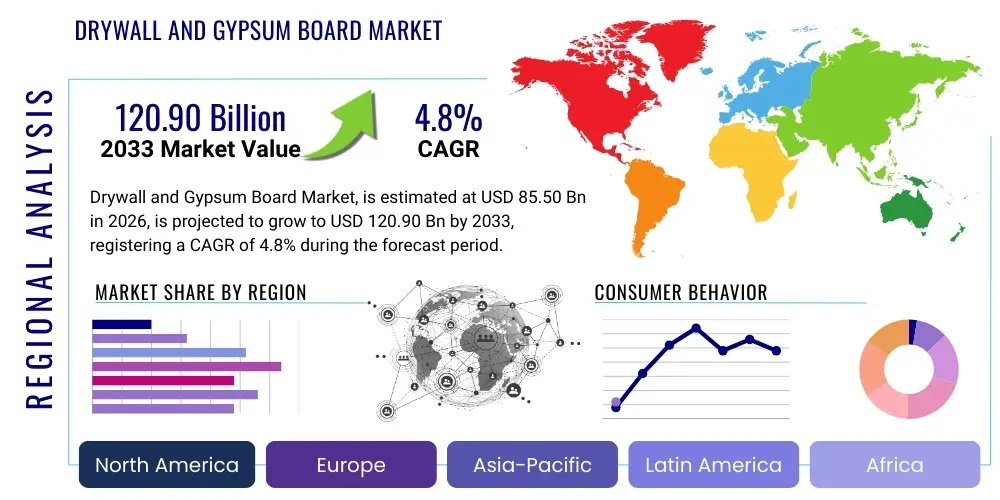

The Drywall and Gypsum Board Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 85.50 Billion in 2026 and is projected to reach USD 120.90 Billion by the end of the forecast period in 2033.

Drywall and Gypsum Board Market introduction

The Drywall and Gypsum Board Market encompasses the production, distribution, and utilization of construction materials primarily used for interior walls and ceilings. These materials, commonly known as plasterboard or wallboard, are fundamentally manufactured from gypsum, a soft sulfate mineral, pressed between thick sheets of facing paper or fiberglass mats. The inherent fire-resistant and soundproofing properties of gypsum board make it an indispensable material in modern residential, commercial, and industrial construction sectors globally. Its widespread adoption is driven by its ease of installation, durability, and cost-effectiveness compared to traditional plastering methods, significantly accelerating construction timelines and reducing overall project costs.

Major applications for drywall and gypsum board span across new construction projects and extensive renovation activities. In commercial settings, specialized boards offering enhanced moisture resistance, mold inhibition, or increased fire ratings are critical for areas like kitchens, bathrooms, and high-traffic corridors. Residential construction utilizes standard lightweight boards for interior partitions, providing smooth, paint-ready surfaces. The product diversity, including specialized types such as Type X (fire-rated), water-resistant boards, and noise-reducing acoustic panels, allows manufacturers to cater to stringent building codes and evolving consumer demands for sustainable and high-performance building envelopes. The increasing urbanization rates, particularly in developing economies, sustain a high demand for high-quality, prefabricated building solutions.

Key driving factors supporting the sustained growth of this market include robust governmental investments in infrastructure development, increasing regulatory pressure mandating energy-efficient and fire-resistant building materials, and the steady recovery of the global housing market. Furthermore, advancements in manufacturing technology, leading to lighter yet stronger boards and the integration of recycled content, align with global sustainability goals. The benefits of using drywall—such as excellent thermal insulation capabilities, aesthetic versatility, and minimal environmental impact compared to high-embodied-energy materials—cement its position as a cornerstone material in the global construction landscape.

Drywall and Gypsum Board Market Executive Summary

The global Drywall and Gypsum Board Market is experiencing robust expansion, primarily fueled by accelerated construction activities in the Asia Pacific region and the persistent demand for quick-install, cost-efficient interior solutions worldwide. Current business trends indicate a strong focus on sustainability, with leading manufacturers investing heavily in closed-loop recycling systems for gypsum waste and developing gypsum panels with lower carbon footprints. Technological innovation centers on enhancing functional attributes, such including superior mold and moisture resistance essential for applications in humid climates, and boards offering higher impact resistance for institutional buildings. The competitive landscape is characterized by strategic mergers and acquisitions aimed at expanding geographic reach and consolidating raw material supply chains, ensuring stable pricing and operational efficiency in a volatile commodity market.

Regional trends highlight Asia Pacific (APAC) as the undisputed leader in market size and growth trajectory, driven by massive urbanization, infrastructure spending in China and India, and the rising adoption of dry construction techniques replacing traditional masonry. North America and Europe, characterized by mature markets, exhibit demand centered around renovation, repair, and remodeling (RRR) activities, alongside strict adherence to energy performance standards which favor advanced thermal insulation properties in gypsum boards. Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets, where rapid population growth and new commercial construction projects, particularly related to tourism and housing schemes, are spurring demand for imported and locally produced drywall solutions.

Segmentation trends reveal that the standard drywall segment continues to dominate based on volume, given its universal applicability in residential construction. However, specialized segments such as Type X (Fire-Resistant) and mold-resistant boards are projected to witness higher-than-average growth rates due to increasingly stringent global safety codes and heightened consumer awareness regarding indoor air quality and structural longevity. Furthermore, the commercial end-user segment, including offices, hospitals, and educational institutions, remains the primary revenue driver for high-margin, specialized acoustic and water-resistant panels, whereas the residential sector anchors the overall market volume.

AI Impact Analysis on Drywall and Gypsum Board Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the Drywall and Gypsum Board Market frequently revolve around three core themes: operational efficiency, sustainability, and predictive maintenance. Users are keenly interested in how AI can optimize complex manufacturing processes, particularly the crucial drying phase, to reduce energy consumption and improve material consistency. Another major concern is the application of AI in construction site logistics, specifically optimizing the delivery and placement of panels to minimize waste and labor time. Finally, there is significant interest in how computer vision and AI-driven quality control can detect subtle defects in finished boards instantaneously, ensuring adherence to high-quality standards before shipment, thereby reducing recalls and improving brand reputation across the fragmented construction supply chain.

- AI-driven optimization of the calcination and drying process, leading to significant energy consumption reduction and improved thermal efficiency during manufacturing.

- Predictive maintenance analytics applied to production lines, minimizing unexpected downtime and maximizing machine lifespan in high-volume gypsum processing plants.

- Machine Learning algorithms utilized for supply chain forecasting, ensuring optimal inventory levels of raw gypsum, additives, and facing materials based on real-time construction market demand signals.

- Integration of Computer Vision systems for automated, non-destructive quality control checks on finished boards, identifying surface imperfections, density inconsistencies, and dimensional tolerances with high precision.

- AI software used in architectural design and Building Information Modeling (BIM) to automatically calculate the optimal board sizes and quantities required, minimizing on-site cutting waste (optimization for specific project sizes).

- Intelligent routing and logistics platforms optimizing transportation schedules for bulky drywall panels, reducing freight costs and minimizing delivery delays to remote construction sites.

- Implementation of robotic automation guided by AI in warehousing and loading, enhancing safety and speed in handling large, heavy pallet loads of gypsum board.

DRO & Impact Forces Of Drywall and Gypsum Board Market

The dynamics of the Drywall and Gypsum Board Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the market’s impact forces. The primary driver remains the massive global shift towards urbanization and the increasing governmental expenditure on residential infrastructure and commercial complexes, particularly in developing nations where modern construction techniques are replacing traditional methodologies. Furthermore, stringent regulations focusing on fire safety, noise reduction, and thermal insulation necessitate the use of specialized gypsum products, thereby expanding the high-value segment of the market. These external pressures ensure a continuous baseline demand for high-performance and specialty drywall materials, sustaining market momentum despite economic fluctuations.

However, the market faces significant restraints, notably the high volatility in the pricing of essential raw materials, including natural gypsum, synthetic gypsum (a byproduct of flue-gas desulfurization), and particularly the paper facing used in standard boards, which is tied to the global pulp and paper market. Operational profitability is also constrained by high energy consumption requirements during the drying process, making manufacturers vulnerable to fluctuating energy costs. Additionally, the market’s reliance on the cyclical nature of the construction industry means that economic downturns, rising interest rates, and geopolitical instability can temporarily stifle large-scale project initiation, leading to periods of dampened demand and excess capacity.

Opportunities for future growth lie predominantly in the realm of sustainable innovation and geographic market penetration. The development of eco-friendly boards utilizing higher percentages of recycled materials or alternative core materials represents a major opportunity to attract environmentally conscious builders and adhere to green building standards (e.g., LEED certification). Expansion into untapped secondary cities within high-growth regions like Southeast Asia and Africa, coupled with the introduction of modular and prefabricated construction systems which heavily rely on standardized drywall panels, presents significant revenue prospects. The market forces are generally positive, with the long-term need for superior, sustainable, and rapidly deployable building interiors outweighing the short-term volatility associated with commodity pricing.

Segmentation Analysis

The Drywall and Gypsum Board Market is comprehensively segmented across several dimensions, including product type, application, thickness, and end-user vertical, allowing for targeted analysis of supply and demand dynamics. Product type segmentation is critical, dividing the market between standard, regular gypsum boards and specialized functional boards such as moisture-resistant, fire-resistant (Type X), acoustic, and exterior glass-mat faced sheathing. This distinction reflects the divergent value propositions and price points, where specialized boards command a premium due to enhanced performance characteristics required by modern building codes and commercial applications. Understanding the growth rate disparity between these segments is key for investment strategies, as standard boards drive volume while specialty boards drive margin expansion.

The market is also heavily segmented by its application across residential, commercial, and industrial construction. The residential sector typically dominates volume, driven by high rates of new housing starts and extensive remodeling projects, utilizing mostly standard thickness boards. Conversely, the commercial sector, encompassing hospitals, office towers, hotels, and schools, is the largest consumer of thicker, specialized, and highly regulated products like Type X fire-rated boards and acoustic panels due to stringent safety and operational requirements. Geographic segmentation further dissects these application patterns, showing, for example, a preference for higher fire ratings in densely populated urban centers in North America versus a greater emphasis on moisture resistance in tropical APAC regions. This granular segmentation provides critical insights into tailoring product offerings and regional sales strategies.

- By Product Type:

- Standard/Regular Gypsum Board

- Type X/Fire-Resistant Gypsum Board

- Moisture-Resistant Gypsum Board

- Acoustic/Soundproofing Gypsum Board

- Foil-Backed Gypsum Board

- Other Specialty Boards (Impact-resistant, Mold-resistant)

- By Thickness:

- 1/2 Inch (Standard Residential)

- 5/8 Inch (Fire-Rated/Commercial)

- 3/8 Inch and Other Thin Boards

- By Application:

- Wall Construction (Interior Partitions)

- Ceiling Construction

- Shaftwall Systems

- By End-User:

- Residential Construction (Single-family, Multi-family)

- Commercial Construction (Offices, Retail, Hospitality, Healthcare)

- Industrial Construction

- Institutional Construction

Value Chain Analysis For Drywall and Gypsum Board Market

The value chain for the Drywall and Gypsum Board Market is characterized by highly consolidated upstream sourcing and a fragmented downstream distribution network. Upstream analysis focuses on the procurement of primary raw materials: gypsum (both natural and synthetic), paper facings or fiberglass mats, and various chemical additives (e.g., starch, accelerators, foam). Manufacturers often control or have long-term contracts with mines for natural gypsum or with power plants for synthetic gypsum, securing supply stability. Energy consumption, especially during the calcination and drying stages, constitutes a significant portion of upstream costs. Efficiency in raw material conversion directly impacts the final board cost and is a key competitive differentiator among major players, driving vertical integration strategies.

The midstream stage involves the highly capitalized manufacturing process, including slurry preparation, continuous casting, cutting, drying, and packaging. Direct distribution channels, where large manufacturers sell directly to major commercial contractors and national homebuilders, ensure bulk orders and customized logistics solutions, often involving proprietary fleet management. Indirect channels, which form the backbone of the retail and small-to-mid-sized construction market, rely heavily on independent building material wholesalers, distributors, and large retail home improvement chains. These intermediaries provide essential inventory management, localized delivery services, and credit financing for smaller buyers, connecting the high-volume production output to the dispersed consumer base.

Downstream analysis centers on the installation contractors, remodelers, and end-users who consume the product. The demand pull is primarily driven by construction schedules and local economic health. The final value added in the downstream segment includes installation quality, finishing (taping, mudding, sanding), and painting. Since installation labor costs often exceed the material cost, the ease and speed of installation—a core benefit of drywall—are crucial. The distribution channel’s efficiency, particularly in handling the bulky and fragile nature of gypsum boards, is paramount. Efficient logistics and timely delivery by distributors are critical factors determining contractor preference and overall project success in the highly competitive final stages of the construction supply chain.

Drywall and Gypsum Board Market Potential Customers

Potential customers for the Drywall and Gypsum Board Market are broadly categorized into three major purchasing groups: professional construction firms, large commercial developers, and the retail/DIY sector. Professional construction firms, including general contractors and specialized drywall installation subcontractors, constitute the largest volume buyers. These customers require consistent quality, high-volume supply, competitive pricing, and logistical support for job sites. They typically procure standard and fire-rated boards directly from manufacturers or major regional distributors, prioritizing reliability and adherence to project specifications and timelines for large-scale residential and commercial builds.

Large commercial and institutional developers, such as healthcare system managers, hotel chains, and governmental agencies, represent high-value potential customers focused on specialized, technical specifications. These buyers demand advanced gypsum products, including those with superior acoustic performance, moisture resistance, and stringent health certifications (e.g., low-VOC). Their procurement decisions are heavily influenced by the product’s compliance with complex building codes and long-term performance guarantees, often leading to relationships with manufacturers capable of providing highly customized technical support and innovative materials for complex interior systems.

The third group includes smaller remodelers, handymen, and the burgeoning DIY (Do-It-Yourself) market segment, served primarily through indirect channels like home improvement retail giants (e.g., Home Depot, Lowe's) and local building supply stores. These customers prioritize accessibility, ease of transport, and readily available instructional support. While their individual purchase volumes are smaller, the collective volume from the RRR (Renovation, Repair, and Remodeling) sector provides essential stable demand, especially in mature Western markets. Manufacturers must ensure their distribution partners effectively stock varied thicknesses and specialty items tailored for smaller-scale repair and renovation work.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.50 Billion |

| Market Forecast in 2033 | USD 120.90 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, Knauf Gips KG, USG Corporation, Etex Group, Boral Limited, National Gypsum Company, Continental Building Products, PABCO Building Products, Yoshino Gypsum Co., Ltd., China National Building Material (CNBM), LafargeHolcim, Siniat (Etex Group), Gypfor, Panel Rey, Jason Plasterboard, CSR Limited, Georgia-Pacific LLC, Winstone Wallboards, CertainTeed (Saint-Gobain), Volma Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drywall and Gypsum Board Market Key Technology Landscape

The Drywall and Gypsum Board Market's technology landscape is rapidly evolving, moving beyond simple material mixing toward highly sophisticated manufacturing optimization and product feature enhancement. Key technological advancements are centered around improving the core material properties—specifically lightness, strength, and environmental footprint—while simultaneously accelerating production speed. Continuous casting lines now integrate advanced sensor technology and process control systems, allowing for real-time adjustments of slurry mix, foam injection, and drying parameters. This optimization is crucial because the drying phase, which consumes the most energy, is now being managed using microwave and radio frequency (RF) drying assistance, supplementing traditional kiln drying to reduce drying time and minimize fuel consumption, a significant step toward manufacturing sustainability.

In terms of product innovation, the development and mass production of glass-mat faced gypsum panels represent a major technological shift. These panels replace traditional paper facings with fiberglass mats, offering dramatically superior resistance to mold, moisture, and fire, making them ideal for high-humidity environments and exterior sheathing applications. Furthermore, nanotechnology is beginning to influence additive compounds, allowing manufacturers to incorporate specialized chemical agents and crystalline structures that enhance board hardness, nail pull-out resistance, and overall structural integrity without increasing weight. This focus on performance additives ensures that modern drywall meets the demands of increasingly complex and durable building designs required by updated international building standards.

The integration of Industry 4.0 principles, including high-level automation, robotic handling, and interconnected production facilities, is transforming operational efficiency. Manufacturers are leveraging digital twin technology to simulate and optimize factory floor layouts and process flows before physical implementation. This technological push is not only about cost reduction but also about achieving unparalleled product consistency and minimizing material waste, thereby addressing both economic and environmental objectives. The adoption of smart packaging and tracking technologies further enhances the logistics phase, ensuring product integrity from the plant floor to the final installation point on the construction site.

Regional Highlights

Regional variations in construction trends, climate conditions, and building codes dictate the consumption patterns and growth rates within the Drywall and Gypsum Board Market. The Asia Pacific (APAC) region stands out as the primary growth engine globally, driven by massive public and private infrastructure spending, rapid urbanization, and a burgeoning middle class demanding higher quality housing. Countries like China, India, and Southeast Asian nations are transitioning quickly from traditional brick-and-mortar construction to more efficient, industrialized building systems, significantly boosting demand for interior partitioning materials like gypsum board. This region not only consumes the largest volume but also attracts substantial investment for new manufacturing capacity.

North America and Europe represent mature, high-value markets characterized by stable replacement demand, rigorous environmental standards, and a high proportion of specialized product consumption. In North America, the market is highly responsive to the housing start rate and the vigorous renovation and remodeling segment, which demands a high volume of standard and specialty fire-rated boards. European demand is strongly influenced by energy efficiency mandates (e.g., nearly zero-energy building standards), driving the adoption of high-performance drywall integrated with insulation systems to enhance thermal envelopes in both new builds and retrofitting projects, favoring innovative acoustic and thermal insulation panels.

The Middle East and Africa (MEA), alongside Latin America, are emerging markets displaying high growth potential. In the MEA region, large-scale commercial and mixed-use development projects, particularly in the Gulf Cooperation Council (GCC) states, create substantial demand for fire-resistant and highly durable boards for large, high-rise structures. Latin America's market growth is catalyzed by improving economic conditions and increased foreign investment in construction, though logistical challenges and varying building standards across countries necessitate a highly localized approach by international manufacturers. Overall, the regional landscape indicates a global market with diverse, highly specific product requirements tied to local regulatory and climatic demands.

- Asia Pacific (APAC): Dominates market volume; driven by rapid urbanization, infrastructure expansion (China, India), and industrialized building adoption; focus on standard and moisture-resistant boards.

- North America: Stable, high-value market; strong focus on renovation/repair; high demand for Type X fire-rated and high-performance acoustic boards due to strict codes.

- Europe: Mature market characterized by stringent energy efficiency regulations and sustainability mandates; leading adoption of specialized boards for thermal and acoustic insulation (retrofit projects).

- Latin America (LATAM): Emerging growth market; increasing residential construction; market volatility tied to regional economic stability; emphasis on cost-effective solutions.

- Middle East and Africa (MEA): High growth potential fueled by large-scale commercial and governmental construction projects (Saudi Arabia, UAE); significant demand for fire-resistant and exterior gypsum sheathing solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drywall and Gypsum Board Market.- Saint-Gobain

- Knauf Gips KG

- USG Corporation (A subsidiary of Knauf)

- Etex Group

- Boral Limited

- National Gypsum Company

- Continental Building Products (Acquired by Saint-Gobain)

- PABCO Building Products

- Yoshino Gypsum Co., Ltd.

- China National Building Material (CNBM)

- LafargeHolcim

- Siniat (Etex Group)

- Gypfor

- Panel Rey

- Jason Plasterboard

- CSR Limited

- Georgia-Pacific LLC

- Winstone Wallboards

- CertainTeed (Saint-Gobain)

- Volma Group

Frequently Asked Questions

Analyze common user questions about the Drywall and Gypsum Board market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Drywall and Gypsum Board Market?

The primary factor driving growth is the accelerating rate of global urbanization, particularly across the Asia Pacific region, leading to massive residential and commercial construction projects that require fast, cost-effective, and standardized interior walling systems. Additionally, tightening global fire and safety regulations mandate the use of gypsum boards with superior fire-resistance ratings, ensuring steady demand in mature markets.

How do sustainability trends impact the manufacturing of gypsum board?

Sustainability significantly impacts manufacturing by pushing companies to increase the incorporation of recycled content, primarily recycled paper for the facing and synthetic gypsum (a byproduct of industrial processes) for the core. Manufacturers are also heavily investing in technology (like AI and optimized drying kilns) to drastically reduce the high energy consumption associated with the board drying process, aiming for lower-carbon products that meet green building certifications (e.g., LEED).

Which product type is projected to exhibit the highest growth rate during the forecast period?

While standard gypsum boards maintain the largest market share by volume, specialized products, particularly Type X (Fire-Resistant) and moisture/mold-resistant gypsum boards, are projected to show the highest compound annual growth rates. This acceleration is driven by increasingly strict global building codes for public and commercial spaces, and growing consumer awareness regarding indoor air quality and durability in high-humidity areas.

What are the main risks associated with the Drywall and Gypsum Board supply chain?

The main supply chain risks involve the price volatility of raw materials, specifically the cost of paper facing and energy required for processing. Furthermore, the market is highly susceptible to the cyclical nature of the construction industry; economic downturns or rising interest rates can immediately dampen new project starts, leading to short-term excess production capacity and margin pressure for manufacturers.

How does the commercial sector differ from the residential sector in terms of drywall product demand?

The residential sector primarily demands high volumes of standard, cost-effective 1/2-inch boards for interior partitions. Conversely, the commercial sector (offices, hospitals) dictates demand for thicker (5/8-inch), highly specialized, and higher-margin products, including acoustic panels, severe-duty, and Type X fire-rated boards, due to stringent compliance requirements for safety, sound isolation, and long-term durability in high-traffic environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager