Drywall Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436248 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Drywall Panels Market Size

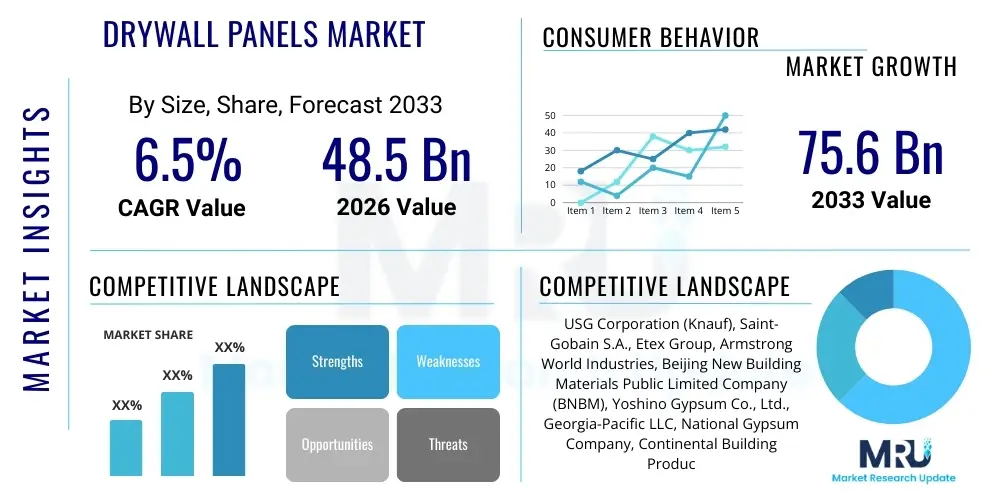

The Drywall Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 48.5 Billion in 2026 and is projected to reach USD 75.6 Billion by the end of the forecast period in 2033.

Drywall Panels Market introduction

The Drywall Panels Market, integral to modern construction and interior finishing, encompasses gypsum-based sheets used for constructing non-load-bearing walls and ceilings. Drywall, also known as plasterboard or gypsum board, offers superior fire resistance, sound dampening properties, and thermal insulation compared to traditional plaster and lath systems. The core material is typically calcium sulfate dihydrate (gypsum), pressed between thick sheets of facing paper or fiberglass matting. This standardized product has revolutionized the building industry due by providing a quick, cost-effective, and highly versatile method for creating smooth, paint-ready surfaces in residential, commercial, and institutional structures.

Major applications of drywall panels span across new construction, renovation, and repair projects globally. In the residential sector, drywall is indispensable for interior partitioning and ceiling installation in single-family homes, apartments, and condominiums. Commercial applications include offices, retail establishments, hospitals, and educational facilities, often utilizing specialized types such as moisture-resistant (green board) or fire-resistant (Type X) panels to meet stringent building codes. The inherent benefits, including ease of installation, high durability, and lower material costs compared to wet construction methods, continually reinforce drywall's position as the primary interior walling solution.

Driving factors fueling market expansion include rapid global urbanization, particularly in emerging economies like India and China, which necessitates high-volume, rapid-deployment housing solutions. Furthermore, increasing regulatory emphasis on energy efficiency and fire safety standards mandates the use of improved panel technologies, such as enhanced thermal and acoustic drywall products. The growing trend of aesthetically driven renovations and remodeling activities, especially in developed markets, further supports demand for specialized gypsum products that offer unique textures or finishes, ensuring sustained growth in the construction materials sector.

Drywall Panels Market Executive Summary

The Drywall Panels Market is characterized by robust growth driven primarily by recovery in the global construction sector and sustained infrastructure investments. Business trends indicate a strong focus on sustainability, leading manufacturers to invest heavily in recycling programs for gypsum waste and developing lightweight, high-performance panels that reduce logistical costs and construction time. Consolidation among major players is observed, aiming to optimize supply chains and achieve economies of scale, while technological advancements focus on improving moisture, mold, and fire resistance. The industry is responding to labor shortages in construction by providing easily installable systems, making specialized drywall variants highly attractive to large contractors globally, thereby influencing purchasing decisions based on total cost of installation rather than just unit price.

Regional trends reveal Asia Pacific (APAC) as the dominant growth engine, fueled by massive government spending on housing and commercial real estate development, particularly in Southeast Asia and China. North America and Europe, while mature markets, demonstrate stable demand driven by renovation activities, adherence to increasingly strict green building codes, and the replacement cycle of older infrastructure. The Middle East and Africa (MEA) are showing promising growth, primarily concentrated around large-scale mega-projects and diversification efforts away from oil economies, necessitating vast new commercial and residential developments. These regional dynamics highlight the necessity for tailored product offerings, such as thermal drywall for colder climates and moisture-resistant panels for humid zones.

Segment trends emphasize the escalating demand for Type X (fire-resistant) and specialized moisture/mold-resistant boards, reflecting tighter safety and health regulations in public and residential construction. The residential segment remains the largest consumer, but the commercial segment is rapidly expanding its share due to the proliferation of large office complexes, data centers, and specialized institutional buildings that require specific performance characteristics. Thickness segmentation shows a continued preference for standard 1/2 inch panels for residential use, alongside increasing adoption of 5/8 inch panels in commercial settings where enhanced fire rating and rigidity are mandatory. Innovations in fiberglass-faced panels are also gaining traction, offering superior mold resistance compared to traditional paper-faced products, reshaping the competitive landscape based on specialized performance features.

AI Impact Analysis on Drywall Panels Market

User queries regarding AI's impact on the Drywall Panels Market commonly revolve around themes of manufacturing efficiency, waste reduction, supply chain optimization, and the potential for autonomous installation systems. Users are keen to understand how AI-driven predictive maintenance can reduce operational downtime in gypsum board plants, and how machine learning algorithms can optimize panel cutting and utilization rates on construction sites, thereby minimizing scrap material. Furthermore, significant interest exists concerning AI's role in improving quality control (detecting surface imperfections or inconsistencies during high-speed production) and enhancing logistics planning, ensuring just-in-time delivery of bulky drywall panels to complex construction schedules, summarizing key user expectations focused on efficiency gains, cost reduction, and quality assurance across the value chain.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the manufacturing process of drywall panels. AI can analyze sensor data from production lines—including moisture levels, temperature, and material flow—to predict equipment failures before they occur, significantly reducing unplanned downtime and improving overall equipment effectiveness (OEE). Moreover, computer vision systems powered by AI are being deployed for real-time quality inspection, capable of identifying subtle defects in the paper facing or core density far faster and more consistently than human inspectors. This leads to higher product reliability and reduced material waste, directly impacting manufacturing costs and environmental footprint.

Beyond the factory, AI influences the construction phase through advanced project management and site logistics. ML models can integrate Building Information Modeling (BIM) data with material delivery schedules, optimizing the sequencing and stacking of different drywall types on multi-story construction sites, preventing bottlenecks and minimizing on-site damage. In the future, AI-guided robotics and autonomous systems may handle repetitive tasks like panel transportation, lifting, and initial fastening, addressing persistent labor challenges and improving safety standards within the industry. This integration of digital intelligence promises a fundamental shift towards smarter, faster, and more precise drywall installation processes.

- AI-driven predictive maintenance optimizes manufacturing equipment uptime and reduces operational costs.

- Machine Learning enhances quality control through real-time defect detection during production.

- AI optimizes supply chain logistics, predicting material demand and scheduling just-in-time site delivery for bulky materials.

- Integration with BIM software allows AI to optimize panel cutting layouts, minimizing construction waste (scrap reduction).

- Future adoption of AI-guided robotics for semi-autonomous installation processes addresses construction labor shortages.

- Data analytics derived from AI helps tailor product specifications based on regional climate and performance data.

DRO & Impact Forces Of Drywall Panels Market

The Drywall Panels Market is primarily driven by escalating global construction activities, particularly sustained residential growth and large-scale urban infrastructure projects in developing nations. Simultaneously, the market is constrained by volatility in the prices of key raw materials, particularly gypsum and paper facing, and the challenges associated with the sheer bulk and fragility of the panels, which impose high logistical costs. Significant opportunities lie in the expansion of green building mandates, driving demand for specialized sustainable and high-performance drywall (e.g., low-VOC, recycled content, and acoustic insulation boards). These forces collectively shape the competitive environment, pushing manufacturers toward efficiency gains and specialized product innovation to maximize margins and market share.

Key drivers include favorable government policies supporting affordable housing projects and the global focus on energy-efficient building standards, which necessitate better insulation properties inherent in advanced drywall systems. Conversely, restraints involve environmental concerns related to landfilling gypsum waste, requiring substantial investment in recycling infrastructure, and the cyclical nature of the construction industry, making long-term demand planning challenging. Furthermore, the market faces competition from alternative walling systems, such as prefabricated walls and specialized composite panels, particularly in modular construction settings, though drywall generally maintains a cost advantage.

The key impact forces highlight the transition towards performance-based building materials. Regulatory pressure concerning fire safety and mold prevention has accelerated the adoption of premium Type X and moisture-resistant boards. Moreover, evolving consumer preferences favor quiet living spaces, boosting the segment for specialized acoustic drywall. The overall market trajectory is highly sensitive to interest rate fluctuations affecting housing starts and the pace of technological integration, specifically concerning automation in manufacturing and installation, which serves as a major opportunity for market disruption and differentiation.

Segmentation Analysis

The Drywall Panels Market is comprehensively segmented based on its structural characteristics, application requirements, and geographical distribution. Key segmentations include classification by product type (standard, Type X, Type C, moisture/mold resistant), which reflects varying levels of fire rating and environmental suitability; by thickness, catering to residential, commercial, or structural needs; and crucially, by end-use application, encompassing the high-volume residential sector versus the stringent requirements of the commercial and institutional sectors. Understanding these segments is vital for manufacturers to align production capabilities with evolving regulatory demands and end-user performance expectations, particularly concerning safety, durability, and sustainability.

- By Product Type:

- Standard Drywall

- Type X Drywall (Fire Resistant)

- Type C Drywall (Enhanced Fire Resistant)

- Moisture-Resistant Drywall

- Mold-Resistant Drywall

- Acoustic Drywall

- Shaftliner Panels

- By Thickness:

- 1/4 inch

- 3/8 inch

- 1/2 inch

- 5/8 inch

- 3/4 inch and above

- By End-Use Application:

- Residential Construction (New Builds & Renovation)

- Commercial Construction (Offices, Retail, Hospitality)

- Industrial Construction

- Institutional Construction (Hospitals, Schools)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Drywall Panels Market

The value chain for the Drywall Panels Market begins with the highly capital-intensive upstream segment, focused on the extraction or sourcing of raw materials, primarily crude gypsum (natural or synthetic). Suppliers of facing paper, fiberglass matting, and chemical additives (such as starches, foam agents, and binders) constitute the remainder of the upstream input. Efficiency in this stage is heavily influenced by proximity to gypsum sources or access to reliable sources of synthetic gypsum, often a byproduct of flue gas desulfurization in power plants. Optimization here is critical, as raw material costs represent a substantial proportion of the final product cost, compelling manufacturers to secure long-term contracts and integrate backward where feasible.

The manufacturing process itself represents the core value addition, involving calcination of the gypsum rock, mixing with water and additives, forming the slurry between the facing materials, and subsequent drying in massive industrial kilns. Downstream activities involve distribution and final installation. Drywall panels, being bulky and susceptible to damage, require specialized logistics. The distribution channel is bifurcated into direct sales to large commercial contractors and indirect sales through extensive networks of building material distributors, wholesalers, and specialized retailers (e.g., home improvement stores) serving smaller contractors and DIY customers. The choice of channel significantly impacts pricing and market penetration.

The final stage involves the professional installation by drywall contractors, who apply specialized labor and tools for hanging, taping, and finishing. This stage determines the final quality perceived by the end-user. Direct channels often handle high-volume commercial projects requiring specific logistical precision, while the indirect channel leverages the existing retail infrastructure to reach a fragmented residential renovation market. The efficiency of the entire chain is increasingly being evaluated based on sustainability metrics, particularly the end-of-life recycling and minimizing transportation-related carbon emissions, prompting greater regionalization of production facilities.

Drywall Panels Market Potential Customers

The potential customer base for the Drywall Panels Market is broadly categorized into the Residential, Commercial, and Institutional sectors, each possessing distinct purchasing behaviors and material requirements. Residential builders and contractors represent the largest volume segment, focusing on cost-effectiveness, speed of installation, and standard panel performance for new homes and large-scale apartment complexes. Homeowners undertaking renovation projects also form a significant customer group, typically sourcing materials through retail channels and requiring smaller quantities of specialized products like mold-resistant drywall for bathrooms or acoustic panels for home theaters.

The Commercial sector, encompassing office developers, retail chain builders, and hospitality developers, prioritizes compliance with stricter building codes, demanding high volumes of Type X fire-rated panels and shaftliner systems. These customers often procure directly from manufacturers or large distributors, necessitating strong technical support, certifications, and highly reliable supply chains to avoid project delays. The institutional market (hospitals, schools, government buildings) operates under the most stringent regulations, frequently requiring advanced specifications for impact resistance, superior acoustics, and stringent microbial control (mold/mildew), driving demand for specialized fiberglass-faced boards and robust core designs.

Furthermore, specialized segments such as modular construction companies are emerging as important customers, requiring customized panel dimensions and integrated framing systems. Architects and specifiers play a critical role as indirect customers, influencing the material choices made by builders by selecting specific product types and brands based on performance criteria, sustainability ratings, and aesthetics. Therefore, successful market penetration relies on providing a wide range of products that meet both high-volume residential needs and the specialized performance requirements of commercial and institutional end-users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 48.5 Billion |

| Market Forecast in 2033 | USD 75.6 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | USG Corporation (Knauf), Saint-Gobain S.A., Etex Group, Armstrong World Industries, Beijing New Building Materials Public Limited Company (BNBM), Yoshino Gypsum Co., Ltd., Georgia-Pacific LLC, National Gypsum Company, Continental Building Products (Part of Saint-Gobain), Kingspan Group plc, Gypsemna, LafargeHolcim (Siniat), PABCO Building Products, Winstone Wallboards (Fletcher Building), Volma Group, Jason Industrial (Taiwan), Panel Rey, CSR Limited, China Lesso Group Holdings Ltd., Vesta Construction Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drywall Panels Market Key Technology Landscape

The technology landscape in the Drywall Panels Market is rapidly evolving, focusing primarily on enhancing product performance, improving manufacturing efficiency, and driving sustainability. In terms of product innovation, the focus is on developing gypsum cores with enhanced properties, such as lightweight formulations that maintain structural rigidity and fire rating (using micro-foaming agents), and specialized core chemistries that inhibit mold and mildew growth more effectively than traditional water-resistant boards. A major technological advancement involves incorporating recycled content, including synthetic gypsum derived from industrial waste streams and recycled paper, aligning production with circular economy principles and increasingly strict environmental standards imposed by global certification bodies like LEED and BREEAM.

Manufacturing technologies are transitioning toward automation and digitalization. Advanced continuous drying processes utilizing improved kiln designs and precise moisture sensors reduce energy consumption, which is a major operational cost for drywall producers. Furthermore, digitalization enables the integration of Industry 4.0 principles, where IoT sensors monitor every stage of production—from slurry mixing consistency to panel cutting precision—allowing for real-time adjustments and minimizing product defects. These sophisticated control systems ensure highly consistent quality across high-speed production lines, a necessity for meeting large commercial project demands.

Looking ahead, emerging technologies are centered around installation efficiency and specialized applications. Self-healing or surface-repairing drywall compounds, designed to mitigate minor dents and scratches post-installation, are under development. Moreover, the deployment of robotic and semi-automated machinery for handling and installing large format drywall sheets on construction sites is a critical technological trajectory aimed at mitigating acute labor shortages in developed markets. This holistic technological approach—spanning material science, manufacturing optimization, and installation automation—is defining the competitive edge in the modern drywall industry.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest market due to unprecedented levels of infrastructure development, rapid urbanization, and massive government investments in affordable housing, particularly in India, China, and Southeast Asian nations. The demand here is largely volume-driven, focusing on standard and cost-effective panels, although regulatory improvements are starting to push for wider adoption of fire-resistant (Type X) boards in major metropolitan centers.

- North America: This region is characterized by high adoption of specialized, high-performance drywall panels (acoustic, mold-resistant, high-impact) driven by stringent building codes and a strong renovation market. While new construction is stable, the emphasis is on sustainability, prompting demand for low-VOC and recycled-content gypsum board. The U.S. and Canada remain technology leaders in installation methods and specialized product development.

- Europe: The European market is highly mature and innovation-focused, driven by rigorous energy efficiency standards (e.g., Passive House standards) and a strong regulatory environment regarding noise reduction and fire safety. Demand is particularly high for integrated thermal and acoustic insulation panels. The renovation of aging building stock constitutes a major source of demand, particularly in Western Europe.

- Latin America (LATAM): Growth in LATAM is promising but volatile, dependent on the economic stability of key countries like Brazil and Mexico. The market is slowly transitioning from traditional wet construction methods to dry construction, favoring lightweight and easily installable drywall systems. Pricing is a critical factor, and localized production is key to reducing import dependency.

- Middle East and Africa (MEA): This region exhibits significant growth potential tied to large-scale, planned urban development projects and commercial expansion in the GCC countries (UAE, Saudi Arabia). The challenging climate requires high-specification panels offering enhanced moisture and heat resistance. Government diversification strategies are fueling construction in hospitality and institutional sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drywall Panels Market.- USG Corporation (A subsidiary of Knauf)

- Saint-Gobain S.A.

- Etex Group

- Armstrong World Industries

- Beijing New Building Materials Public Limited Company (BNBM)

- Yoshino Gypsum Co., Ltd.

- Georgia-Pacific LLC

- National Gypsum Company

- Continental Building Products (Part of Saint-Gobain)

- Kingspan Group plc

- Gypsemna

- LafargeHolcim (Siniat)

- PABCO Building Products

- Winstone Wallboards (Fletcher Building)

- Volma Group

- Jason Industrial (Taiwan)

- Panel Rey

- CSR Limited

- China Lesso Group Holdings Ltd.

- Vesta Construction Products

- CertainTeed Corporation

- CEMEX S.A.B. de C.V.

- ACG Materials

- Gipskarton- und Faserplattenwerk Gotha GmbH

- Ayasofya Gypsum

Frequently Asked Questions

Analyze common user questions about the Drywall Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Drywall Panels Market?

The Drywall Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by increasing residential and commercial construction activities globally, particularly in the APAC region.

Which product type of drywall panel shows the highest growth in demand?

The highest growth is observed in specialized drywall types, particularly Type X (fire-resistant) and moisture/mold-resistant panels, due to increasingly stringent global safety and health-related building codes across residential and commercial applications.

How is the Drywall Panels Market addressing sustainability and waste concerns?

Manufacturers are heavily investing in sourcing synthetic gypsum (a byproduct of power generation) and increasing the recycled content in panels. Furthermore, many companies offer programs for recycling gypsum waste generated on construction sites to minimize landfill impact.

Which geographical region dominates the consumption of drywall panels?

The Asia Pacific (APAC) region currently dominates the market in terms of volume and exhibits the fastest growth rate, fueled by rapid urbanization, massive housing projects, and large-scale infrastructure investments across major economies.

What impact does raw material pricing volatility have on manufacturers?

Volatility in the cost of raw materials, such as gypsum, paper facing, and chemical additives, significantly compresses profit margins for drywall panel manufacturers. This pressure encourages backward integration and increased reliance on lower-cost synthetic gypsum sources.

Are lightweight drywall panels gaining market share?

Yes, lightweight drywall panels are rapidly gaining market share, especially in North America and Europe. These panels offer comparable performance to traditional heavy boards while reducing installation labor stress, minimizing transport costs, and accelerating construction schedules.

How do construction trends like modular building affect drywall demand?

While modular construction utilizes alternative wall systems, it still incorporates large quantities of drywall for interior finishing. The trend often demands precision-cut and specialized high-strength panels suitable for transportation and rapid assembly, necessitating manufacturers to adapt to faster production cycles.

What role does digitalization play in the drywall manufacturing process?

Digitalization, including Industry 4.0 integration and IoT sensors, optimizes the manufacturing process by providing real-time quality control, precise moisture regulation during drying, and predictive maintenance, leading to higher output consistency and lower energy usage.

What is the primary constraint hindering market growth in developed economies?

A key constraint in developed economies like North America and Europe is the high logistical cost associated with transporting bulky, fragile drywall panels over long distances, coupled with labor shortages affecting installation capacity.

What is the difference between Type X and Type C drywall?

Both Type X and Type C are fire-resistant. Type X contains special additives to enhance fire resistance for one-hour ratings. Type C offers superior fire resistance, often required for two-hour rated assemblies, by including more glass fibers and vermiculite to maintain structural integrity longer under high heat.

Who are the primary end-users in the Commercial segment?

Primary end-users in the Commercial segment include developers of office complexes, retail centers, hotels (hospitality sector), and large public infrastructure projects, all requiring specialized fire-rated and sound-dampening panel solutions.

How do global oil price changes indirectly affect the drywall market?

Global oil price changes affect the cost of energy required for manufacturing (kiln drying is energy-intensive) and significantly impact transportation costs for both raw materials and finished goods, indirectly influencing the final market price of drywall panels.

What technical innovation is helping to mitigate construction site waste?

Integration of advanced software like Building Information Modeling (BIM) with AI algorithms helps optimize the layout and cutting patterns for drywall panels, minimizing offcuts and construction waste on site, improving overall material efficiency.

Why is the 5/8 inch thickness standard preferred in commercial construction?

The 5/8 inch thickness panel provides higher rigidity, superior sound attenuation, and is generally required to meet the enhanced fire resistance ratings (Type X and Type C specifications) mandated for non-load-bearing walls in commercial and institutional structures.

What impact is the rise of smart building technology having on drywall applications?

Smart building technology integration requires internal structures to support complex wiring and sensor installations. Specialized drywall systems are being developed with integrated channels or enhanced strength to accommodate smart infrastructure seamlessly, requiring new specifications from manufacturers.

How does the availability of synthetic gypsum influence the market?

The increasing availability of high-quality synthetic gypsum, a consistent and domestically sourced byproduct, reduces manufacturer reliance on natural gypsum mining, offering more stable raw material pricing and supporting environmental sustainability claims, especially in highly industrialized regions.

What are the key characteristics of acoustic drywall panels?

Acoustic drywall panels are engineered with a denser core or laminated layers to significantly increase Sound Transmission Class (STC) ratings, making them crucial for applications such as hospitals, schools, apartments, and commercial theaters where noise control is paramount.

Which factor is the primary driver for drywall demand in mature European markets?

The primary driver in mature European markets is the extensive renovation and retrofit activities of aging building stock, coupled with stringent government mandates requiring superior energy performance, necessitating specialized high-insulation and acoustic drywall products.

How does the trend toward larger, seamless wall panels affect the industry?

The demand for larger, seamless wall panels necessitates investment in specialized handling equipment for both manufacturing and installation. While these panels reduce finishing time (fewer joints to tape), they increase logistical complexity and the risk of damage during transport.

What steps are manufacturers taking to address the construction labor shortage?

Manufacturers are innovating by developing lightweight panels, faster setting joint compounds, and collaborating on semi-automated installation robotics and easier-to-handle sizes, all aimed at reducing manual effort and installation time on construction sites.

What differentiates standard drywall from moisture-resistant drywall?

Standard drywall uses paper facing and a regular gypsum core, making it susceptible to moisture damage. Moisture-resistant (Green Board) features water-repellent additives in the core and treated paper facing, making it suitable for high-humidity areas like bathrooms and utility rooms, though it is not waterproof.

In which sector is the use of shaftliner panels mandatory?

Shaftliner panels, typically heavy, fire-resistant 1-inch or 3/4-inch gypsum core boards, are mandatory in commercial and high-rise residential construction for enclosing vertical shafts such as elevators, stairwells, and utility chases to maintain critical fire barriers.

How do manufacturers ensure product quality consistency globally?

Leading manufacturers utilize standardized global production protocols, advanced automated quality control systems (including AI vision inspection), and rigorous third-party certification processes to ensure that all panels meet relevant international building codes and performance standards.

What is the most significant opportunity for growth in the next five years?

The most significant opportunity lies in the burgeoning Asian residential market, coupled with the global shift towards high-performance specialty boards driven by increasing environmental, fire, and acoustic regulatory requirements across all major geographic regions.

How does the fragmentation of the installation contracting industry affect sales?

The highly fragmented nature of the installation contracting industry necessitates reliance on extensive indirect distribution channels (wholesalers and retailers) to reach small and medium-sized contractors, requiring manufacturers to maintain strong partnerships within the retail sector.

What technological advancement is improving the environmental profile of drywall production?

Energy-efficient kiln technologies and closed-loop water systems are crucial technological advancements. These innovations reduce the vast energy required for drying the gypsum slurry and minimize water consumption, significantly lowering the overall environmental footprint of the manufacturing process.

What are the key technical specifications required by institutional buildings?

Institutional buildings (hospitals, labs) require panels with high impact resistance, superior fire ratings, stringent mold and mildew resistance, and excellent acoustic performance to ensure patient well-being and meet strict public safety regulations.

Which factor is restraining growth specifically in the Latin American market?

Economic and political instability in several major Latin American countries often leads to unpredictable construction spending and project delays, acting as a primary restraint on consistent growth for high-volume materials like drywall panels.

How has the COVID-19 pandemic affected the long-term demand for drywall?

Initially causing supply chain disruptions, the pandemic ultimately spurred long-term demand by increasing residential renovation activity (driven by work-from-home trends) and accelerating the need for new healthcare infrastructure, positively impacting specialty panel segments.

What is the primary function of the paper or fiberglass facing in drywall panels?

The facing material provides tensile strength, acts as a durable surface for finishing (painting or wallpapering), and, in the case of fiberglass, offers enhanced protection against moisture absorption and mold growth compared to traditional paper facing.

What are the typical end-of-life options for drywall panels?

End-of-life options include landfill disposal (a major environmental challenge) or, increasingly, separation of the gypsum core from the paper and recycling the clean gypsum back into new panel production or as soil amendment in agriculture.

How does the rise of DIY renovation influence the market segmentation?

The rise of DIY renovation drives demand for smaller format, easier-to-handle panels and specialized lightweight products sold through big-box retail stores, increasing the importance of the residential and retail distribution segments.

What are the main competitors to gypsum drywall panels?

Main competitors include masonry (brick and mortar), cement board, wood-based paneling (plywood or oriented strand board), and specialized prefabricated composite panels used primarily in modular and off-site construction environments.

Why is backward integration important for major drywall manufacturers?

Backward integration (securing or owning gypsum quarries/sources) is crucial because it ensures a stable, cost-controlled supply of the primary raw material, mitigating the risk associated with external price volatility and supply chain disruptions.

What key strategic focus are leading companies adopting in R&D?

Leading companies are focusing R&D efforts on advanced core technologies to improve fire resistance (Type C), enhance moisture protection (fiberglass mats), and reduce product weight while meeting high acoustic performance specifications required by high-density urban housing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Drywall Panels Market Statistics 2025 Analysis By Application (Residential Building, Commercial Building, Industrial Building), By Type (Regular Drywall Panels, Mold Resistant Drywall Panels, Moisture Resistant Drywall Panels, Fire Resistant Drywall Panels, Other Types), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Drywall Panels Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Regular Drywall Panels, Mold Resistant Drywall Panels, Moisture Resistant Drywall Panels), By Application (Residential Building, Commercial Building, Industrial Building), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager