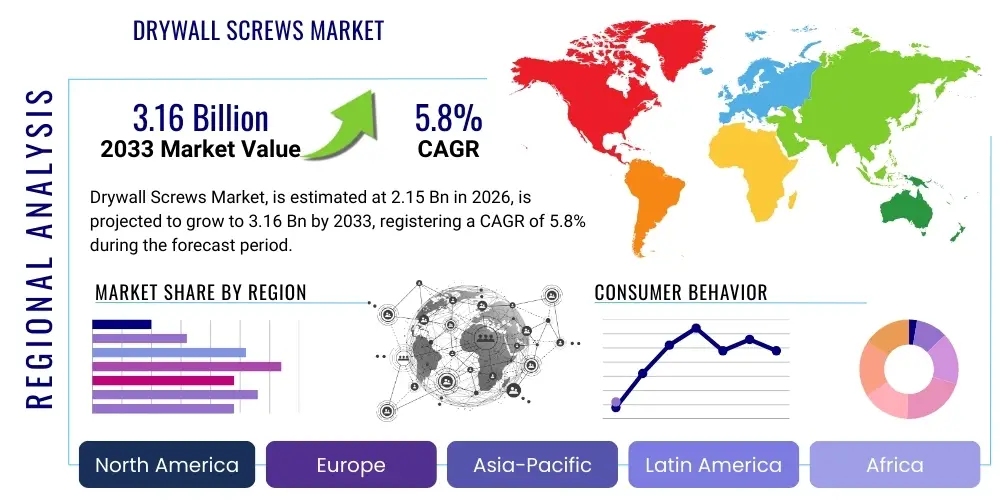

Drywall Screws Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440471 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Drywall Screws Market Size

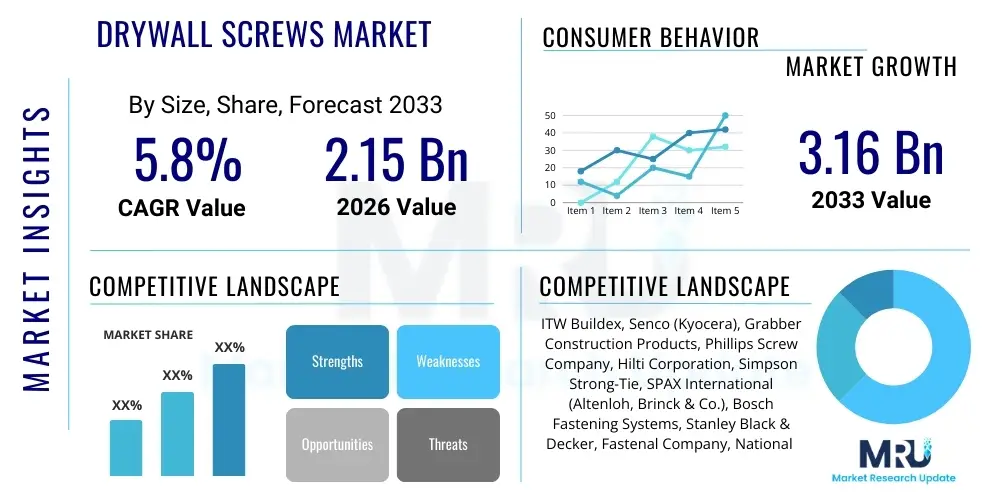

The Drywall Screws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.16 Billion by the end of the forecast period in 2033.

Drywall Screws Market introduction

The Drywall Screws Market represents a vital segment within the broader construction materials industry, providing essential fastening solutions for the installation of gypsum plasterboard in building structures. These specialized screws are meticulously engineered with distinct thread patterns, sharp points, and specific head designs, such as bugle heads, to ensure secure attachment to various framing materials like wood and metal studs without damaging the drywall surface. Their design facilitates rapid, efficient, and reliable installation, making them indispensable in modern construction practices across residential, commercial, and industrial sectors.

The primary applications of drywall screws span new construction projects, extensive renovation and remodeling initiatives, and DIY home improvement tasks. They are crucial for creating interior walls and ceilings, ensuring structural stability and a smooth finish ready for painting or other decorative treatments. The versatility of drywall screws, available in various lengths, gauges, and thread types (coarse for wood, fine for metal, and self-drilling for thicker gauge metal), allows them to cater to diverse construction requirements and material combinations, significantly enhancing productivity on job sites.

Key benefits driving the widespread adoption of drywall screws include their superior holding power, resistance to pull-out, and ease of use with power drills, which streamlines installation processes and reduces labor costs. The market is propelled by a confluence of factors such as increasing global construction activity, particularly in emerging economies, a growing trend towards remodeling and renovation of existing structures, and the continuous demand for efficient and durable fastening solutions that meet evolving building codes and aesthetic standards. Innovations in screw coatings and material compositions further enhance their performance, offering improved corrosion resistance and durability.

Drywall Screws Market Executive Summary

The Drywall Screws Market is experiencing robust growth driven by sustained expansion in the global construction industry and a continuous focus on efficient building practices. Business trends indicate a move towards greater automation in manufacturing, which enhances product consistency and reduces costs, alongside a growing emphasis on product innovation, including advanced coatings for corrosion resistance and specialized thread designs for diverse applications. Consolidation among manufacturers and suppliers is also a notable trend, aiming to achieve economies of scale and strengthen market presence, while strategic partnerships are being forged to optimize supply chains and distribution networks.

Regionally, the market exhibits dynamic trends with significant growth opportunities. Asia Pacific, particularly countries like China, India, and Southeast Asian nations, is poised for substantial market expansion due to rapid urbanization, increasing disposable incomes, and large-scale infrastructure development projects. North America and Europe, while mature markets, continue to demonstrate steady demand, fueled by residential remodeling, commercial renovations, and a strong emphasis on sustainable building practices. Latin America and the Middle East & Africa are emerging as significant contributors to market growth, driven by ambitious construction programs and rising investment in commercial and residential developments.

Segmentation trends within the drywall screws market highlight a rising demand for specialized products, such as self-drilling screws for metal framing and screws with advanced anti-corrosion coatings for exterior or moisture-prone applications. The coarse thread segment continues to dominate due to its widespread use in wood framing, while fine thread screws maintain steady demand for metal stud applications. The distribution landscape is evolving with a growing influence of online retail channels and large hardware store chains, alongside traditional wholesale networks, providing broader access for both professional contractors and DIY enthusiasts. Material advancements, particularly in carbon steel variants with enhanced properties, are also shaping segment performance, ensuring product durability and performance under varying conditions.

AI Impact Analysis on Drywall Screws Market

The impact of Artificial Intelligence (AI) on the Drywall Screws Market, while not immediately obvious in the final product itself, is profoundly influencing its operational backbone, manufacturing processes, and supply chain dynamics. Users frequently inquire about how AI could potentially revolutionize the production efficiency, quality control, and predictive maintenance of manufacturing lines for drywall screws. There is also significant interest in AI's role in optimizing inventory management, forecasting market demand more accurately, and streamlining logistics from raw material procurement to final product distribution. Concerns often revolve around the initial investment costs for AI implementation and the need for skilled labor to manage these advanced systems.

Furthermore, users are keen to understand if AI-driven robotics could lead to increased automation in screw installation on construction sites, thereby influencing the demand for specific screw types or packaging. The expectation is that AI will contribute to smarter, more efficient construction processes, potentially enabling just-in-time delivery of fasteners and reducing waste. Discussions also touch upon AI's ability to analyze vast datasets related to material science, leading to the development of new, high-performance, and sustainable screw materials or coatings, which could redefine product specifications and market preferences.

Ultimately, the overarching themes indicate that stakeholders anticipate AI to enhance productivity, improve quality, reduce operational costs, and foster innovation across the entire value chain of the drywall screws market. The industry is exploring AI as a strategic tool to gain competitive advantages through data-driven decision-making, greater operational agility, and the creation of more resilient and responsive supply networks capable of adapting to market fluctuations and evolving customer needs.

- AI optimizes manufacturing lines for increased production efficiency and reduced waste.

- Predictive maintenance using AI minimizes downtime and prolongs machinery lifespan in screw production.

- AI-driven demand forecasting improves inventory management and supply chain responsiveness.

- Robotics integrated with AI can enhance precision and speed in automated screw installation on construction sites.

- AI analyzes material properties to facilitate the development of innovative and sustainable screw designs and coatings.

- Enhanced quality control through AI vision systems detects defects more accurately during manufacturing.

- AI supports logistics optimization, leading to more efficient delivery and reduced transportation costs for fasteners.

- Data analytics powered by AI provides deeper market insights for strategic product development and pricing.

DRO & Impact Forces Of Drywall Screws Market

The Drywall Screws Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that influence its growth trajectory and competitive landscape. A primary driver is the robust expansion of the global construction industry, particularly the residential and commercial sectors, which directly correlates with the demand for drywall and, consequently, drywall screws. This is further amplified by significant government investments in infrastructure development, rising urbanization trends, and the increasing global population, all of which necessitate new building constructions and extensive renovation projects. The inherent efficiency and ease of use of drywall screws, coupled with their superior fastening capabilities, continue to make them the preferred choice over traditional nails and other fasteners, thereby sustaining their market demand.

Despite these strong drivers, the market faces several notable restraints. Volatility in the prices of raw materials, primarily steel, which constitutes the core component of drywall screws, can significantly impact manufacturing costs and profit margins. Geopolitical tensions and trade disputes can exacerbate these price fluctuations and disrupt the global supply chain, leading to production delays and increased operational expenses. Furthermore, the market is subject to stringent environmental regulations concerning manufacturing processes and material sourcing, which can impose additional compliance costs on manufacturers. Intense competition from alternative fastening methods and the availability of substitute products, though less efficient for drywall, also present a restraint by fragmenting market share and putting downward pressure on pricing.

Opportunities for growth are abundant, particularly in emerging economies where construction activity is booming and modern building techniques are increasingly adopted. The ongoing trend towards sustainable and green building practices creates avenues for manufacturers to develop and offer eco-friendly screw materials and coatings, aligning with evolving consumer preferences and regulatory requirements. Moreover, advancements in automation and smart construction technologies present opportunities for integrating specialized drywall screws within robotic installation systems, enhancing efficiency and precision on construction sites. Investment in research and development for innovative screw designs that offer superior performance, such as enhanced corrosion resistance or faster installation, also represents a significant growth opportunity for market players.

Beyond these specific DRO factors, the Drywall Screws Market is influenced by broader impact forces. Economic cycles play a crucial role, with periods of economic growth typically correlating with increased construction spending and, conversely, economic downturns leading to a contraction in construction projects. Technological advancements in material science and manufacturing processes continually push the boundaries of product performance and cost-effectiveness. Furthermore, shifts in consumer preferences towards DIY projects and the increasing demand for prefabricated construction solutions also impact market dynamics, requiring manufacturers to adapt their product offerings and distribution strategies. Geopolitical stability and global trade policies significantly affect the import and export of raw materials and finished goods, impacting market accessibility and competitive balance.

Segmentation Analysis

The Drywall Screws Market is meticulously segmented to provide a granular understanding of its diverse components, catering to varied applications, material preferences, and distribution channels. This segmentation allows for targeted market analysis, enabling manufacturers to tailor their product offerings and marketing strategies to specific customer needs and market niches. The primary segmentation criteria include the type of screw, the material used in its construction, the coatings applied for enhanced performance, the specific application areas, and the various channels through which these products reach end-users. Each segment reflects unique demand patterns, technological requirements, and competitive landscapes, contributing to the overall dynamics of the market.

Understanding these segments is crucial for identifying growth opportunities and anticipating market shifts. For instance, the demand for coarse-thread screws remains consistently high for wood framing, while fine-thread and self-drilling screws are gaining traction with the increasing use of metal studs in commercial and residential construction. Similarly, the choice of coating, from standard phosphate to advanced ceramic or Ruspert coatings, is driven by the required level of corrosion resistance and durability for specific environmental conditions, such as those found in bathrooms, basements, or exterior applications. The application segments, ranging from large-scale commercial projects to individual DIY tasks, dictate product volume, packaging requirements, and distribution strategies.

Moreover, the distribution channel segmentation highlights the evolving retail landscape, with a growing emphasis on online platforms alongside traditional hardware stores and wholesale networks. This multi-channel approach is essential for reaching a broad spectrum of customers, from professional contractors who purchase in bulk to individual homeowners engaged in small-scale renovations. The intricate interplay between these segments provides a comprehensive framework for market participants to strategize effectively, innovate in product development, and optimize their supply chains to meet the diverse demands of the global drywall screws market.

- By Type

- Coarse Thread

- Fine Thread

- Self-Drilling

- High-Low Thread

- Others (e.g., Wafer Head, Trim Head)

- By Material

- Carbon Steel

- Stainless Steel

- Other Alloys

- By Coating

- Phosphate

- Zinc

- Ceramic

- Ruspert

- Polymer

- Others (e.g., Dacromet, Black Oxide)

- By Application

- Residential Construction

- Commercial Construction

- Industrial Construction

- Renovation & Remodeling

- DIY (Do-It-Yourself)

- Furniture Manufacturing

- By Distribution Channel

- Wholesalers/Distributors

- Retail Stores (Hardware Stores, Big Box Retailers)

- Online Retail

- Direct Sales to OEMs/Contractors

Value Chain Analysis For Drywall Screws Market

The value chain for the Drywall Screws Market encompasses a series of interconnected activities, beginning with the sourcing of raw materials and extending through manufacturing, distribution, and final application by end-users. The upstream segment of the value chain is primarily concerned with the procurement of raw materials, predominantly high-quality steel wire rod. Key suppliers in this phase include steel mills and specialized wire manufacturers who convert raw iron ore into suitable grades of steel. The quality and consistent supply of these raw materials are paramount, as they directly impact the strength, durability, and overall performance of the finished drywall screws. Fluctuations in raw material prices and geopolitical factors affecting steel production can have significant ripple effects throughout the entire value chain.

The manufacturing process forms the core of the value chain, involving several specialized stages such as cold heading, thread rolling, point forming, and heat treatment to create the screw's robust structure. This is followed by critical finishing processes, including cleaning, phosphating, zinc plating, or applying more advanced coatings like ceramic or Ruspert, which provide corrosion resistance and enhance driveability. Manufacturers often invest heavily in advanced machinery and quality control systems to ensure product consistency, adherence to industry standards, and efficiency in large-scale production. Innovations in manufacturing technology, such as automated inspection systems and energy-efficient processes, are crucial for maintaining competitiveness and optimizing production costs.

Downstream activities involve the distribution and sale of drywall screws to a diverse customer base. This phase includes a complex network of distribution channels, both direct and indirect. Indirect channels typically involve large wholesalers and distributors who purchase screws in bulk from manufacturers and then supply them to smaller retail outlets, hardware stores, and professional contractors. These distributors play a vital role in inventory management, logistics, and providing regional market access. Direct sales, on the other hand, often involve manufacturers supplying directly to large construction companies, prefabricated building manufacturers, or original equipment manufacturers (OEMs) who require customized orders or large volumes, fostering closer relationships and tailored service. The growing prominence of online retail platforms represents a significant evolution in distribution, offering convenience and broader product accessibility to both professional and DIY customers.

Drywall Screws Market Potential Customers

The Drywall Screws Market serves a broad and diverse spectrum of potential customers, all reliant on efficient and reliable fastening solutions for construction and assembly. The primary and most substantial customer segment comprises professional construction companies and general contractors involved in both residential and commercial building projects. These entities require large volumes of screws that meet stringent quality and performance standards, often purchasing through wholesalers or directly from manufacturers. Their demand is driven by new construction starts, major remodeling, and infrastructure development, focusing on screws that offer durability, ease of installation, and compliance with building codes.

Another significant customer base includes specialized trade contractors, such as drywall installers, carpenters, and interior finishing companies. These professionals often prioritize specific screw types, such as self-drilling for metal studs or fine-thread for precise applications, seeking products that enhance their productivity and the quality of their workmanship. Their purchasing decisions are influenced by factors like screw head design, thread pitch, and the effectiveness of corrosion-resistant coatings, as well as the availability of bulk packaging options and reliable supply chains from local hardware suppliers or specialty distributors.

The DIY (Do-It-Yourself) market represents a growing segment of potential customers, consisting of homeowners undertaking renovation, remodeling, or small repair projects. These buyers typically purchase smaller quantities from retail stores, big box retailers, or online platforms, valuing ease of use, clear product labeling, and accessibility. Furthermore, the market extends to furniture manufacturers, cabinet makers, and other industrial fabricators who utilize drywall screws for various assembly purposes, particularly when working with composite materials or where a secure, flush finish is required. The increasing trend of prefabrication in construction also creates a niche for drywall screws, as these components are assembled off-site, demanding consistent and reliable fastening solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.16 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ITW Buildex, Senco (Kyocera), Grabber Construction Products, Phillips Screw Company, Hilti Corporation, Simpson Strong-Tie, SPAX International (Altenloh, Brinck & Co.), Bosch Fastening Systems, Stanley Black & Decker, Fastenal Company, National Nail Corp. (STINGER), MKT Fastening, LLC, Ejot SE & Co. KG, Lindapter International, Wurth Group, Brighton-Best International, Penn Engineering, ARaymond, Bulten AB, Nucor Fastener |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Drywall Screws Market Key Technology Landscape

The Drywall Screws Market is continually shaped by advancements in manufacturing processes and material science, leading to the development of more efficient, durable, and application-specific fastening solutions. A cornerstone of the key technology landscape is precision manufacturing, utilizing advanced cold heading and thread rolling techniques. These processes ensure consistency in screw dimensions, optimal thread formation for superior grip, and enhanced structural integrity, minimizing instances of shearing or stripping during installation. Automation in production lines, including robotic handling and automated quality control via vision systems, further boosts efficiency and reduces manufacturing defects, ensuring a high-quality product that meets stringent industry standards.

Another critical area of technological innovation lies in the development of specialized coatings. Traditional phosphate and zinc coatings provide basic corrosion resistance, but modern applications demand more robust protection, especially in moisture-prone environments or for exterior use. This has led to the proliferation of advanced coatings such as ceramic, Ruspert, and polymer-based finishes. These coatings offer superior corrosion resistance, reduce friction during driving, and often provide better adhesion for paints and finishes, thereby extending the lifespan of the fastened materials and improving the aesthetic outcome. Research continues into environmentally friendly coating alternatives that meet evolving sustainability regulations without compromising performance.

Furthermore, advancements in material composition are driving product differentiation. While carbon steel remains the predominant material, metallurgical improvements are leading to screws with enhanced hardness, ductility, and fatigue resistance. The development of self-drilling and self-tapping screw designs with specialized points and flutes significantly reduces installation time and eliminates the need for pre-drilling, particularly in metal stud applications, offering considerable labor savings on construction sites. These technological strides not only improve the functionality and versatility of drywall screws but also contribute to overall project efficiency, cost-effectiveness, and the long-term integrity of building structures, maintaining their essential role in modern construction.

Regional Highlights

The global Drywall Screws Market demonstrates significant regional variations, influenced by differing construction trends, economic development levels, and regulatory environments. Each major region contributes uniquely to the market's overall growth and innovation, reflecting specific demands and supply chain characteristics. Analyzing these regional dynamics is crucial for stakeholders seeking to understand market opportunities, competitive pressures, and strategic entry points across the world. From the rapid urbanization of Asia Pacific to the mature but evolving markets of North America and Europe, distinct factors drive the consumption and production of drywall screws.

- North America: This region represents a mature and stable market, characterized by a high rate of residential and commercial construction, coupled with extensive renovation and remodeling activities. The demand is driven by stringent building codes emphasizing safety and durability, and a strong preference for high-quality, efficient fastening solutions. Key players have a strong presence, and innovation focuses on ease of use and compliance with environmental standards.

- Europe: Europe is another established market, with demand primarily fueled by renovation, refurbishment, and a growing emphasis on sustainable construction practices. Strict regulations concerning materials and construction techniques influence product development, leading to a demand for environmentally friendly and high-performance screws. Western European countries are significant consumers, while Eastern Europe presents emerging growth opportunities.

- Asia Pacific (APAC): The APAC region is the fastest-growing market for drywall screws, propelled by rapid urbanization, significant infrastructure development, and increasing disposable incomes in countries like China, India, and Southeast Asian nations. Large-scale residential and commercial projects, coupled with a rising adoption of modern construction methods, are driving robust demand. The region also hosts a significant portion of global manufacturing capacity.

- Latin America: This region is experiencing steady growth in its construction sector, particularly in residential and commercial segments, driven by economic development and improving living standards. Brazil, Mexico, and Argentina are key markets, with increasing investment in infrastructure and housing projects stimulating demand for various construction materials, including drywall screws.

- Middle East and Africa (MEA): The MEA market is witnessing considerable growth, primarily due to ambitious construction and diversification projects in the Gulf Cooperation Council (GCC) countries. Investments in mega-projects, tourism infrastructure, and residential complexes are creating substantial demand. Africa's burgeoning population and developing economies also offer long-term growth potential for the drywall screws market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Drywall Screws Market.- ITW Buildex

- Senco (Kyocera)

- Grabber Construction Products

- Phillips Screw Company

- Hilti Corporation

- Simpson Strong-Tie

- SPAX International (Altenloh, Brinck & Co.)

- Bosch Fastening Systems

- Stanley Black & Decker

- Fastenal Company

- National Nail Corp. (STINGER)

- MKT Fastening, LLC

- Ejot SE & Co. KG

- Lindapter International

- Wurth Group

- Brighton-Best International

- Penn Engineering

- ARaymond

- Bulten AB

- Nucor Fastener

Frequently Asked Questions

What is the projected growth rate of the Drywall Screws Market?

The Drywall Screws Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, reaching an estimated value of USD 3.16 Billion by 2033.

What are the primary drivers for the Drywall Screws Market?

Key drivers include global growth in construction and infrastructure development, increasing renovation and remodeling activities, the efficiency and ease of use of drywall screws, and advancements in fastening technologies.

Which types of drywall screws are most common?

The most common types include coarse-thread screws for wood studs, fine-thread screws for metal studs, and self-drilling screws, often differentiated by various head types and lengths for specific applications.

How do environmental concerns impact the Drywall Screws Market?

Environmental concerns are driving demand for sustainable materials and eco-friendly coatings, pushing manufacturers to innovate in product development to meet evolving regulations and consumer preferences for green building solutions.

What role does technology play in the Drywall Screws Market?

Technology plays a crucial role through advanced manufacturing processes, specialized corrosion-resistant coatings, innovative screw designs for efficiency, and potential integration with AI and automation in construction, enhancing product performance and installation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager