DSLR Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433231 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

DSLR Cameras Market Size

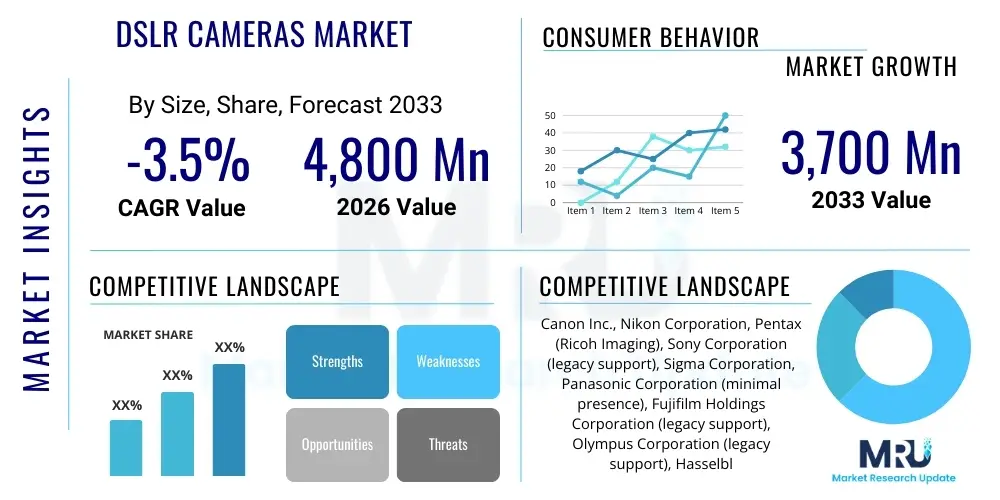

The DSLR Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of -3.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033. While the overall market volume is experiencing contraction due to the rapid adoption and technological superiority of mirrorless systems, the remaining market value is sustained primarily by professional photographers, advanced enthusiasts, and specialized industrial applications that rely on the established ergonomics, expansive lens ecosystem, and robust build quality inherent to DSLR technology.

DSLR Cameras Market introduction

The DSLR (Digital Single-Lens Reflex) Cameras Market encompasses the manufacturing, distribution, and sale of interchangeable-lens digital cameras that utilize a mechanical mirror system to direct light from the lens to either the optical viewfinder or the image sensor. These devices are characterized by their superior image quality, achieved through large sensors (APS-C or Full-Frame), high customization capabilities via interchangeable lenses, and low-latency optical viewfinders. Major applications of DSLR cameras span professional photography (portrait, commercial, and news), advanced enthusiast usage, educational institutions, and niche industrial inspection tasks requiring high resolution and reliability. The inherent benefits include superior battery life compared to early mirrorless counterparts, a massive legacy lens pool, and a well-established user interface preferred by long-time professionals. Despite strong competition from advanced mirrorless systems and high-end smartphones, the market continues to be driven by the need for specialized optics, depth of field control, and extreme durability, particularly in field environments where ruggedness is paramount.

DSLR Cameras Market Executive Summary

The DSLR Cameras Market is currently navigating a period of significant strategic transition, primarily characterized by consolidation among leading manufacturers who are shifting their core R&D focus toward mirrorless technology. Business trends indicate a sharp decline in entry-level and mid-range DSLR sales, offset slightly by consistent demand for flagship, high-value professional models (Full-Frame). The strategic emphasis for existing players is maintaining support for the vast installed user base and leveraging the robust profitability associated with high-margin lenses and accessories. Regional trends show that mature markets, particularly North America and Europe, are experiencing the steepest decline as early adopters transition swiftly to mirrorless technology, while certain emerging markets in Asia Pacific and Latin America still show resilience due to lower initial costs and brand loyalty associated with older DSLR models.

Segmentation trends reveal that the Full-Frame segment maintains better stability compared to the APS-C segment, reflecting the focus on professional applications where the image quality advantages of larger sensors are indispensable. Consumer behavior analysis confirms that while new entrants overwhelmingly favor mirrorless or smartphone alternatives, established professionals often prioritize the extensive lens infrastructure and known performance metrics of their existing DSLR systems. The overall market trajectory is defined by managed obsolescence, where manufacturers incrementally phase out DSLR production lines while guaranteeing service and support for premium systems, thus maximizing lifetime value from the existing technology base before complete transition.

AI Impact Analysis on DSLR Cameras Market

User queries regarding the impact of Artificial Intelligence on the DSLR market frequently center on three critical areas: computational photography parity, enhanced in-camera processing capabilities, and the future viability of optical viewfinders versus EVFs integrated with AI features. Consumers are concerned whether traditional DSLRs can effectively integrate sophisticated AI-driven algorithms—such as advanced subject recognition, deep-learning based autofocus tracking, and complex HDR blending—that are now standard in mirrorless and smartphone platforms. The expectation is that AI implementation in DSLRs could potentially extend their functional lifespan, primarily by improving existing mechanics (like AF systems) or automating post-capture optimization, thereby bridging the feature gap with newer systems. However, a major concern remains the physical limitation of the DSLR architecture, particularly the mechanical reliance on separate phase-detection sensors, which are less amenable to comprehensive AI integration than the on-sensor systems found in mirrorless cameras.

The primary direct impact of AI is indirect competition from computational photography embedded in smartphones, which has severely eroded the entry-level and enthusiast DSLR segments by offering superior processing power for general-purpose imaging. For high-end professional DSLRs, AI’s influence is manifesting through sophisticated external tools and post-processing software that enhance RAW file manipulation, rather than primary in-camera functionality, though some high-end models have adopted advanced deep-learning autofocus algorithms to enhance subject tracking effectiveness. The long-term challenge for DSLRs is the lack of seamless integration for real-time AI processing capabilities that modern mirrorless systems leverage, pushing innovation toward external computational aid rather than internal architectural advancement.

- Computational photography in smartphones displaces entry-level DSLR demand.

- AI enhances autofocus (AF) tracking reliability in high-end professional DSLR bodies.

- Deep learning algorithms are utilized for improved exposure control and white balance accuracy.

- AI-driven post-processing software (e.g., noise reduction, object removal) boosts the usability of DSLR RAW files.

- Limited capacity for integrated real-time processing due to architectural constraints compared to EVF-based mirrorless systems.

- Potential for AI to optimize battery usage and mechanical component longevity through intelligent operation management.

DRO & Impact Forces Of DSLR Cameras Market

The dynamics of the DSLR Cameras Market are dominated by powerful forces related to technological evolution and consumer preference shifts. The main drivers revolve around the legacy infrastructure, the massive installed base of lenses, and the inherent durability of high-end models. Restraints are primarily linked to the architectural limitations—namely, bulkiness, slower burst rates compared to electronic shutters, and inherent challenges in developing deep AI integration—which are overcome by mirrorless cameras. Opportunities exist in specialized applications, such as rugged outdoor photography, astronomical imaging, and educational sectors where cost-effectiveness and familiar operation are critical. The combination of these forces results in a market undergoing controlled decline, where market participants focus on maximizing returns from the existing ecosystem while strategically managing the transition to newer technologies.

The most significant impact force shaping the market structure is the irreversible technological advancement of mirrorless systems, which now consistently outperform DSLRs in areas such as high-speed tracking, video capabilities, and form factor. This gravitational pull towards mirrorless is accelerating the retirement of older DSLR lines and prompting manufacturers to discontinue non-premium models. Conversely, the high replacement cost associated with shifting entire professional lens kits (which often represent investments exceeding the cost of the camera body) acts as a powerful stabilizing factor, particularly for long-established photographers who rely on older DSLR systems, thus slowing the rate of decline in the premium segment. Market participants must strategically balance the phasing out of DSLR products while maintaining high-quality support and lucrative accessory sales to this highly committed, professional user base.

The persistence of the DSLR platform in specific niche markets also offers a unique opportunity. For instance, in controlled studio environments, the optical viewfinder provides a distinct advantage over electronic viewfinders (EVFs) due to zero lag and instantaneous response, appealing to photographers who value the traditional workflow. Furthermore, the robust, weather-sealed bodies of professional DSLRs often surpass early mirrorless counterparts in extreme environmental durability. Understanding and capitalizing on these distinct advantages, coupled with competitive pricing on entry-level lenses, are key strategic imperatives for sustaining market presence and profitability throughout the forecast period, especially against the backdrop of pervasive competition from computationally powerful alternatives.

Segmentation Analysis

The DSLR Cameras Market is comprehensively segmented based on sensor type, application, and distribution channel, providing a granular view of purchasing behavior and technological adoption patterns. Analyzing these segments is crucial for understanding where value persists in a contracting market. Segmentation by sensor type (APS-C vs. Full-Frame) clearly delineates the consumer market from the professional market, with Full-Frame models demonstrating greater market resilience due to their necessity in high-end commercial and artistic photography. Application segmentation highlights the crucial role DSLRs continue to play in professional, photojournalistic, and studio settings, contrasting sharply with the decreasing utilization in general consumer and casual travel photography segments.

The market structure is heavily influenced by the distribution segment, where specialized retail stores and dedicated online photography vendors remain pivotal, emphasizing the need for expert advice and hands-on experience before a high-value purchase. The reliance on indirect distribution channels through authorized dealers is critical for preserving brand trust and ensuring compatibility with existing lens ecosystems. Furthermore, the segmentation by price point reflects the industry’s shift away from low-margin entry-level kits toward higher-margin, high-specification bodies and associated professional lenses, directly impacting the average selling price (ASP) and overall market valuation. This strategic focus ensures that, despite falling unit volumes, the market retains significant financial value.

- By Sensor Type:

- APS-C Sensor (Advanced Photo System type-C)

- Full-Frame Sensor

- By Application:

- Professional Photography (Studio, Commercial, Event)

- Enthusiast & Hobbyist Use

- Educational and Research Institutions

- Journalism and Media

- By Distribution Channel:

- Online Retail (E-commerce platforms, Direct manufacturer sales)

- Offline Retail (Specialized Camera Stores, Consumer Electronics Stores)

Value Chain Analysis For DSLR Cameras Market

The value chain for the DSLR Cameras Market begins with complex upstream activities dominated by specialized component suppliers. Upstream analysis involves the procurement and manufacturing of critical, proprietary components, including high-resolution image sensors (CMOS/CCD), microprocessors (image processors and AI accelerators), optical prisms and mirror mechanisms, and high-precision mechanical shutters. Leading semiconductor and optics firms form the backbone of this stage, maintaining long-term relationships with camera Original Equipment Manufacturers (OEMs). The high cost and specialized intellectual property associated with Full-Frame sensor manufacturing mean that the upstream segment holds significant negotiating power, demanding consistent technological innovation to sustain competitive advantage.

Downstream analysis focuses on the stages after manufacturing, encompassing distribution, marketing, and post-sale services. The distribution channel is bifurcated into direct sales, often catering to large institutional buyers or professional studios, and indirect sales, which utilize extensive networks of authorized dealers and specialized online retailers. These indirect channels are critical because customers often require personalized advice, product demonstrations, and system integration services (especially regarding lens compatibility). Effective marketing strategies center on showcasing the technical superiority and robustness of flagship models, targeting professional communities through sponsorships, workshops, and industry publications. Post-sale services, including repairs, firmware updates, and extended warranties, are essential components that enhance customer loyalty and contribute significantly to the overall lifetime value of the product.

The shift towards an AEO-optimized value chain necessitates manufacturers providing comprehensive digital support and resources. While traditional distribution remains strong for high-touch sales, online channels increasingly serve as platforms for education, peer reviews, and detailed technical comparisons, influencing purchasing decisions long before the transaction occurs. The profitability of the value chain is highly dependent on the success of the lens ecosystem; since lenses often outlive camera bodies, companies prioritize maximizing the attachment rate of high-margin lenses and accessories across both direct and indirect sales channels. Efficiency in inventory management, particularly for slower-moving DSLR bodies and faster-moving professional glass, is paramount for maintaining healthy margins.

DSLR Cameras Market Potential Customers

The primary potential customers for the remaining DSLR camera market are defined by specialized needs that prioritize established performance, ergonomics, and cost-efficiency over the latest technological advancements in mirrorless systems. End-users fall into three main categories: seasoned professional photographers, value-conscious advanced enthusiasts, and institutional/educational buyers. Professional photographers, particularly those specializing in fast-paced photojournalism, sports, or studio portraiture, often prefer flagship DSLR models for their rugged durability, guaranteed optical viewfinder response, and reliance on extensive, long-held collections of legacy lenses. For these users, the cost of transitioning an entire system far outweighs the benefits of marginal gains offered by new platforms.

Advanced enthusiasts and hobbyists represent a secondary, but crucial, customer base. They often seek high-quality imaging performance at a lower price point compared to contemporary mirrorless equivalents. The resale market and the availability of affordable, high-quality used DSLR lenses make this platform highly accessible for individuals looking to upgrade from entry-level point-and-shoots or smartphones without the significant capital investment required for a new mirrorless ecosystem. These buyers prioritize sensor size and image quality over portability and cutting-edge video features, often opting for APS-C DSLR bodies.

Furthermore, educational institutions, government agencies, and industrial inspection sectors constitute a stable niche customer segment. Educational bodies favor DSLRs due to their standardized operation, robust repairability, and the lower cost associated with classroom kits compared to new mirrorless gear. Industrial applications, such as machine vision or controlled environment documentation, often require the predictable, established performance parameters of specific DSLR models, valuing consistency and reliability over maximum frame rates. These segments provide predictable, bulk purchasing demand, offering stable revenue streams for manufacturers focusing on legacy system maintenance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,800 Million |

| Market Forecast in 2033 | USD 3,700 Million |

| Growth Rate | CAGR -3.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon Inc., Nikon Corporation, Pentax (Ricoh Imaging), Sony Corporation (legacy support), Sigma Corporation, Panasonic Corporation (minimal presence), Fujifilm Holdings Corporation (legacy support), Olympus Corporation (legacy support), Hasselblad, Leica Camera AG, Samsung Electronics Co., Ltd. (ceased production, but relevant installed base), Blackmagic Design, E-Ting Digital Technology, Zhejiang Lishan Photoelectric Technology Co., Ltd., RED Digital Cinema, Kenko Tokina Co., Ltd., Tamron Co., Ltd., Samyang Optics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DSLR Cameras Market Key Technology Landscape

The current technology landscape of the DSLR Cameras Market is defined by refinement and optimization of established systems rather than radical innovation, as major research and development budgets have been reallocated to mirrorless platforms. Core technologies remain centered on advanced CMOS and occasionally CCD sensor technology, optimized for high dynamic range and low-light performance. Key technological differentiators in flagship models include proprietary image processors (such as Canon’s DIGIC and Nikon’s EXPEED), which manage high-speed data throughput for superior continuous shooting and video recording capabilities. A crucial technology unique to DSLRs is the Phase Detection Autofocus (PDAF) module, separate from the sensor, offering reliable, high-speed tracking through the optical viewfinder, which is constantly being refined through AI-assisted tracking algorithms to maintain competitiveness.

Further technological advancements focus on maximizing the operational lifecycle and user experience within the existing architecture. This includes sophisticated mechanical shutter mechanisms designed for extreme longevity (rated for hundreds of thousands of cycles), advanced metering systems, and robust weather sealing and construction materials crucial for professional use. While video capabilities are generally inferior to mirrorless counterparts, modern DSLRs often incorporate advanced video codecs and external recording capabilities to satisfy users requiring high-quality cinematic capture. The sustained competitiveness of DSLRs relies on continuous optimization of battery management systems and ergonomic design, capitalizing on the platform's efficiency and user familiarity.

Connectivity technology also remains a focus, with integrated Wi-Fi, Bluetooth, and GPS capabilities enabling faster image transfer and remote control, catering to the demands of modern photojournalism and studio setups. Furthermore, the technology landscape is heavily influenced by the established standard of interchangeable lens mounts (e.g., Canon EF, Nikon F), which dictates compatibility and ensures the market for used and third-party lenses remains vibrant. The technological maturity of the DSLR platform means that manufacturers are now primarily investing in specialized software features and improved lens integration rather than fundamental architectural changes, supporting the professional user base transitioning slowly.

Regional Highlights

Regional dynamics within the DSLR market reflect varying speeds of transition away from the DSLR format and differing levels of economic maturity. North America and Europe, representing the most mature photographic markets, are witnessing the most accelerated decline in DSLR sales volume. However, these regions still account for the highest value share, as the professional base here demands high-end Full-Frame bodies and premium lenses, sustaining significant Average Selling Prices (ASP). Manufacturers focus strategic efforts in these areas on maintaining high-touch service and support for professional contracts.

The Asia Pacific (APAC) region presents a more nuanced scenario. While developed economies like Japan and South Korea have rapidly embraced mirrorless technology, large emerging markets like China and India still show robust, albeit shrinking, demand for entry-level and mid-range DSLRs. This resilience is often driven by price sensitivity, the established availability of affordable third-party accessories, and the use of DSLRs in a burgeoning educational and photography enthusiast market. APAC is crucial for managing inventory and transitioning entry-level products efficiently.

Latin America (LATAM) and the Middle East & Africa (MEA) represent smaller but stable market niches. In these regions, high import duties and economic constraints often make the established, slightly older technology of DSLRs a more accessible professional option compared to the newly launched, premium mirrorless systems. Market activity here is characterized by sustained demand for durable, proven camera bodies and reliance on established distribution networks, suggesting a slower rate of technological displacement compared to Western markets.

- North America: Highest value share driven by professional Full-Frame purchases; rapid decline in consumer segments; focus on ecosystem retention.

- Europe: Similar to North America, characterized by rapid transition to mirrorless but maintaining strong demand for high-end legacy models; robust secondhand market.

- Asia Pacific (APAC): Mixed market dynamics; faster decline in developed areas, sustained volume demand in emerging economies due to affordability and educational use.

- Latin America (LATAM): Stable niche market prioritizing durability and established technology; slower adoption rate of newer systems due to cost barriers.

- Middle East and Africa (MEA): Focus on reliability and ruggedness for specific field applications; limited market size but consistent demand for essential professional gear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DSLR Cameras Market.- Canon Inc.

- Nikon Corporation

- Pentax (Ricoh Imaging)

- Sony Corporation (Legacy lens support and installed base management)

- Sigma Corporation (Lens and accessory manufacturing)

- Tamron Co., Ltd. (Lens manufacturing)

- Samyang Optics (Lens manufacturing)

- Kenko Tokina Co., Ltd. (Accessory and lens manufacturing)

- Fujifilm Holdings Corporation (Legacy support for older systems)

- Olympus Corporation (Legacy support for older systems)

- Leica Camera AG (Niche high-end systems)

- Hasselblad (Specialized professional systems)

- Blackmagic Design (Video accessory convergence)

- Vitec Group (Related gear and accessories)

- Profoto (Studio lighting and accessories)

- DJI Innovations (Camera stabilizers and related systems)

- GoPro, Inc. (Action camera alternative pressure)

- Phase One A/S (High-end digital backs)

- Samsung Electronics Co., Ltd. (Historical relevance and installed base)

- E-Ting Digital Technology

Frequently Asked Questions

Analyze common user questions about the DSLR Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth trajectory of the DSLR Cameras Market?

The DSLR Cameras Market is experiencing a projected decline with a CAGR of -3.5% between 2026 and 2033. This contraction is due to the widespread adoption of technologically advanced mirrorless systems and high-end computational photography smartphones, leading manufacturers to prioritize high-margin professional models while phasing out entry-level DSLR production.

Are DSLR cameras obsolete due to mirrorless technology?

DSLR cameras are not obsolete, especially in professional and specialized niche markets. They retain advantages in areas like battery life, the presence of a zero-lag optical viewfinder, established ergonomics, and access to a massive, cost-effective legacy lens ecosystem. Flagship Full-Frame DSLRs remain relevant for many established professionals who value reliability and lens investment protection.

Which sensor type segment is the most resilient in the DSLR market?

The Full-Frame sensor segment exhibits the highest resilience and stability within the DSLR market. This segment caters predominantly to professional photographers and advanced enthusiasts who require superior low-light performance and image quality, making them less sensitive to the price competition driving the decline in the APS-C consumer segment.

How is Artificial Intelligence (AI) influencing the competitiveness of DSLRs?

AI primarily influences DSLRs by enhancing autofocus tracking capabilities and improving in-camera image processing (like noise reduction). However, the architectural design of DSLRs limits the comprehensive integration of real-time AI features seen in mirrorless systems, forcing DSLRs to rely more on external computational tools and post-processing software to remain competitive in image quality output.

Which regions are driving the highest market value for DSLR cameras?

North America and Europe currently drive the highest market value for DSLR cameras, despite rapid volume decline. This is attributable to the high demand and expenditure on premium Full-Frame professional bodies and high-value telephoto and specialty lenses by established industry professionals in these mature markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager