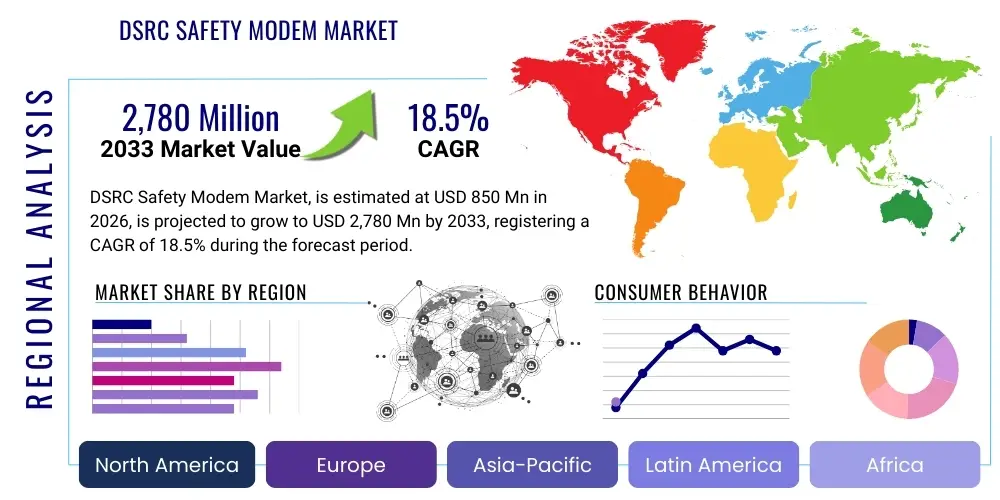

DSRC Safety Modem Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435809 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

DSRC Safety Modem Market Size

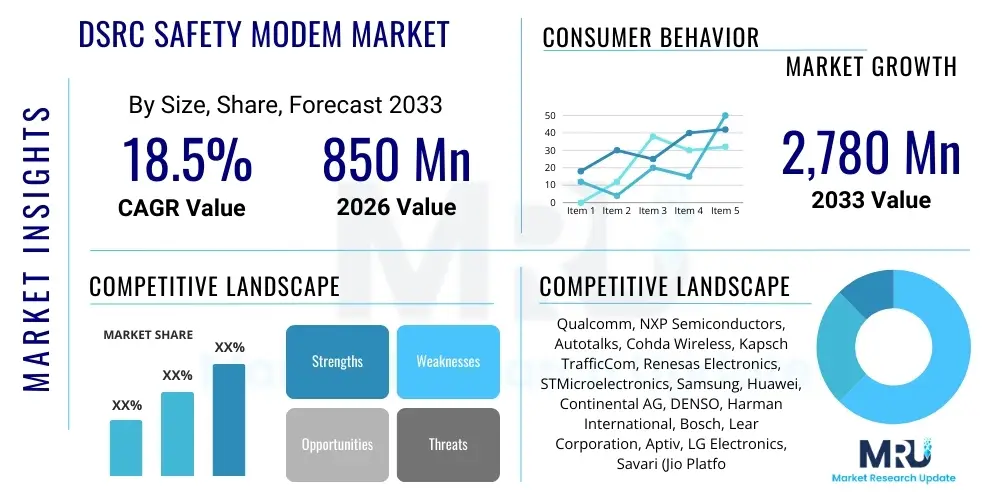

The DSRC Safety Modem Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $2,780 Million by the end of the forecast period in 2033.

DSRC Safety Modem Market introduction

The Dedicated Short-Range Communications (DSRC) Safety Modem Market encompasses specialized wireless communication devices designed to facilitate critical safety applications within the intelligent transportation system (ITS) framework. DSRC technology, primarily based on the IEEE 802.11p standard, enables low-latency, short-to-medium range, direct vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication without relying on cellular networks. These modems are integral components of safety-critical systems, allowing vehicles to broadcast and receive vital information such as speed, location, direction, and braking status, providing drivers and automated systems with early warnings regarding potential collisions or hazards, thereby significantly improving road safety metrics.

The core functionality of DSRC modems involves processing standardized Basic Safety Messages (BSMs) that are exchanged rapidly across the allocated 5.9 GHz spectrum band. This technology operates under the Vehicle-to-Everything (V2X) umbrella, focusing specifically on achieving the near-instantaneous transmission necessary for collision avoidance. Major applications span cooperative adaptive cruise control, curve speed warnings, intersection movement assist, and electronic emergency brake lights. The key benefits driving adoption include enhancing situational awareness for drivers, reducing traffic congestion through coordinated flow, and providing a foundational platform for future autonomous driving capabilities where predictive communication is paramount.

Driving factors for this market include global governmental initiatives mandating V2X readiness, the increasing penetration of advanced driver-assistance systems (ADAS) that rely on external data inputs, and the continuous need to mitigate the high costs associated with traffic accidents and fatalities. Although facing competition from alternative V2X technologies like Cellular V2X (C-V2X), DSRC maintains relevance in regions that have heavily invested in its infrastructure or possess regulatory frameworks favoring its established reliability and proven low-latency performance in direct communication scenarios. The ongoing development of updated DSRC standards (like IEEE 802.11bd) aims to bridge performance gaps and secure its position in hybrid V2X ecosystems.

DSRC Safety Modem Market Executive Summary

The DSRC Safety Modem Market exhibits dynamic business trends characterized by intense technological competition and shifting regulatory landscapes, particularly concerning spectrum allocation in major economies like the United States. While early deployments concentrated heavily on foundational V2V functionality, current business models are pivoting toward integrated solutions that combine DSRC with other connectivity standards (e.g., GNSS, cellular) to offer comprehensive safety and efficiency packages. Strategic partnerships between chipset manufacturers, Tier 1 automotive suppliers, and municipal infrastructure providers are crucial for market penetration. The primary operational challenge remains the high initial cost of deploying roadside units (RSUs) necessary for robust V2I applications, leading companies to prioritize software-defined modems capable of adapting to future V2X standards with minimal hardware changes.

Regionally, the market presents a fragmented picture. North America, historically a strong proponent of DSRC, faces uncertainty following regulatory decisions favoring C-V2X, leading to a temporary slowdown in new DSRC deployment mandates but continued support for legacy systems and existing infrastructure. Conversely, certain European and Asia Pacific nations, particularly Japan and parts of the EU, maintain strong commitments to DSRC or its derivatives, driving sustained demand for hardware and associated services. The Asia Pacific region, fueled by massive smart city investments and high levels of vehicular population growth, represents the fastest-growing segment, focusing heavily on utilizing DSRC for congestion management and high-density urban safety applications.

Segment trends indicate robust demand for integrated hardware modules that simplify OEM integration processes. Within the component segment, the microcontroller and secure element sub-segments are experiencing high growth, driven by the stringent security requirements (PKI management) inherent in V2X communication to ensure message authenticity and privacy. The application segment shows a clear differentiation between passenger vehicles, which drive volume and standardization, and commercial vehicles (fleet management, heavy trucking), which focus on specific operational efficiencies such as platooning and logistics optimization enabled by reliable DSRC links. Furthermore, the aftermarket segment is gaining traction as vehicle owners seek to retrofit older vehicles with basic V2V safety features, though this remains secondary to original equipment manufacturer (OEM) installations.

AI Impact Analysis on DSRC Safety Modem Market

Common user questions regarding AI's influence on the DSRC Safety Modem Market typically revolve around how machine learning can enhance traditional DSRC safety functions, particularly addressing issues related to message overload, data validity, and predictive capabilities. Users are concerned about whether AI integration can overcome DSRC’s fundamental limitations, such as restricted range and the inherent difficulty in interpreting complex, dynamic traffic scenarios solely based on BSM data. There is significant interest in understanding how AI-driven edge computing within the modem or RSU can facilitate real-time anomaly detection and improve the trustworthiness of safety messages, especially in environments where signal integrity may be compromised or malicious activity is suspected. Furthermore, users frequently question the synergy between AI-powered autonomous driving stacks (which often use sensor fusion) and the communication data provided by DSRC.

AI’s primary role is evolving beyond simple data filtering to sophisticated predictive analytics and cognitive decision-making at the edge of the network. By applying machine learning models to the continuous stream of DSRC data, systems can predict dangerous situations several seconds before they manifest, providing more contextually relevant warnings than rule-based systems. For instance, AI algorithms can analyze the spatial-temporal correlation between incoming BSMs (from multiple vehicles and infrastructure units) alongside onboard sensor data, allowing for a more accurate risk assessment in complex intersections or highway merging scenarios. This capability moves DSRC from a purely reactive warning system to a proactive safety predictor, significantly enhancing its value proposition in advanced ADAS architectures.

However, integrating AI necessitates robust computational power within the DSRC modem unit itself, shifting the technological focus toward higher-performance microcontrollers and dedicated neural processing units (NPUs). This shift impacts market players by demanding deeper expertise in software optimization and energy efficiency, as these systems must operate reliably under stringent automotive constraints. The implementation of federated learning techniques also offers a pathway for vehicles to collectively improve threat detection models without compromising privacy, utilizing DSRC as the reliable communication link for sharing localized safety insights. This convergence reinforces the DSRC modem as a crucial data acquisition and immediate action layer, even as the broader V2X ecosystem embraces high-bandwidth cellular connectivity for non-safety-critical services.

- Enhanced Predictive Safety: AI processes DSRC BSMs faster to predict accident likelihood, improving warning fidelity.

- Optimized Data Filtering: Machine learning algorithms prioritize critical safety messages, mitigating data overload in high-density traffic.

- Edge Computing Integration: AI models deployed directly on the modem or RSU enable real-time anomaly detection and reduced latency for critical decisions.

- Improved Signal Trustworthiness: AI verifies the authenticity and relevance of incoming DSRC signals, bolstering security against spoofing or message injection.

- Adaptive Traffic Management: Infrastructure units use AI fed by DSRC data to dynamically adjust signal timing and optimize traffic flow patterns.

DRO & Impact Forces Of DSRC Safety Modem Market

The DSRC Safety Modem Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively representing the Impact Forces that dictate its trajectory. The dominant drivers stem from global governmental mandates focused on reducing road fatalities and improving vehicle safety standards, where DSRC has historically been the chosen, standardized technology for rapid, low-latency communication. Regulatory support in regions committed to DSRC deployment (e.g., select European countries, Japan) provides essential market certainty for OEMs and infrastructure providers. Coupled with this is the accelerating demand for seamless integration of V2X functionality into advanced driver-assistance systems (ADAS) and future Level 3 and Level 4 autonomous vehicles, which critically rely on the external awareness DSRC provides.

Restraints primarily revolve around the severe uncertainty created by global spectrum allocation decisions, most notably the U.S. Federal Communications Commission (FCC) reallocation of the 5.9 GHz safety band, shifting priority towards C-V2X (Cellular V2X). This regulatory ambiguity has significantly deterred large-scale DSRC investment by automakers in North America and encouraged a wait-and-see approach globally, hindering market expansion. Furthermore, the relatively low data throughput of IEEE 802.11p compared to 5G-enabled C-V2X poses a technical restraint for future, bandwidth-intensive V2X applications beyond basic safety messages. The lack of widespread, uniform infrastructure (RSUs) deployment globally also limits the full realization of DSRC’s V2I potential, leading to a patchwork adoption landscape.

Opportunities for DSRC proliferation exist predominantly in the development of hybrid communication modules that can concurrently support DSRC and C-V2X, offering future-proofing capabilities and satisfying regional regulatory divergence. Substantial opportunities lie in smart city initiatives outside of the primary competitive battlegrounds, where dedicated short-range communication can facilitate specific municipal applications like connected public transport, smart parking systems, and localized traffic management protocols. The aftermarket segment, focusing on upgrading existing vehicle fleets and specialized industrial vehicles (mining, ports) that require highly reliable, confined communication, also presents a viable growth avenue. The market impact forces thus create an environment where DSRC must leverage its proven reliability and low latency for specific safety applications while strategically integrating with newer communication technologies to maintain long-term viability.

Segmentation Analysis

The DSRC Safety Modem market segmentation is crucial for understanding the diverse technological requirements and application spectrum across the Intelligent Transportation System (ITS) ecosystem. The market is primarily analyzed based on the components utilized in the modem assembly, the specific deployment model focusing on the communication target, and the end-use application determining vehicle type. Component segmentation highlights the shift towards integrated System-on-Chips (SoCs) and highly secure cryptographic hardware necessary for V2X integrity. Deployment segmentation clearly distinguishes between the foundational V2V segment—which is device-centric and requires peer-to-peer communication reliability—and the V2I segment, which is reliant on substantial infrastructure investment and governmental coordination for implementation.

The segmentation structure reflects the maturity of DSRC technology. While V2V communication is relatively standardized and implemented through OEM partnerships, V2I deployments often require tailored solutions suitable for specific infrastructure requirements (e.g., tunnel communication, complex intersections). The application segmentation demonstrates varying demand elasticity; passenger vehicle manufacturers drive large volumes but prioritize cost efficiency and size reduction, whereas commercial vehicle operators emphasize ruggedness, long-term durability, and specific safety functions like platooning. Analyzing these segments helps stakeholders—from semiconductor manufacturers to Tier 1 suppliers—to align product development with targeted market needs, focusing investment either on robust hardware or sophisticated, compliant software stacks.

Furthermore, geographic variances heavily influence which segments are prioritized. Regions maintaining DSRC mandates are investing heavily in the hardware component segment and V2I deployment for large-scale pilot projects. In contrast, regions preparing for a technology migration might focus on flexible, software-defined modems capable of supporting legacy DSRC standards while offering an upgrade path to newer V2X variants. This granular segmentation provides a strategic framework for market participants to identify lucrative niches, especially in specialized commercial fleet applications or targeted governmental infrastructure projects that require DSRC's unique low-latency attributes.

- By Component

- Hardware (Transceivers, Microcontrollers, Antenna Modules, Secure Elements)

- Software (Operating Systems, Middleware, Communication Protocol Stacks, Security Algorithms)

- Services (Testing, Certification, Maintenance, Infrastructure Deployment)

- By Deployment Type

- Vehicle-to-Vehicle (V2V) Communication

- Vehicle-to-Infrastructure (V2I) Communication

- Vehicle-to-Pedestrian (V2P) Communication (Emerging)

- By Application

- Passenger Vehicles

- Commercial Vehicles (Trucks, Buses, Fleet Management)

- Aftermarket Solutions

- By Frequency Band

- 5.9 GHz Band

- Other Dedicated Bands (Regional Specific)

Value Chain Analysis For DSRC Safety Modem Market

The DSRC Safety Modem market value chain is characterized by a high degree of technological specialization and sequential integration, starting with raw component manufacturing and culminating in vehicle integration and post-sale service provision. The upstream analysis focuses heavily on semiconductor companies that design and fabricate the core DSRC chipsets, encompassing the RF transceivers, baseband processors, and integrated security hardware (HSM/Secure Elements). These firms, often highly specialized, invest heavily in R&D to ensure compliance with demanding automotive standards (AEC-Q100) and specific communication protocols (IEEE 802.11p/DSRC standards). The quality and reliability of these chipsets are paramount, as they determine the low-latency performance essential for safety applications. Raw material suppliers and specialized component providers (antennas, filters) form the foundational layer, providing essential inputs to the chip manufacturers and Tier 1 assemblers.

The midstream segment is dominated by Tier 1 automotive suppliers, who serve as the critical nexus between technology providers and vehicle manufacturers. These suppliers take the core chipsets and integrate them into robust, vehicle-grade On-Board Units (OBUs) and Roadside Units (RSUs), handling the crucial tasks of housing design, thermal management, software stack integration, and system validation. Their role includes ensuring compliance with OEM specifications, performing exhaustive interoperability testing, and managing complex supply chains. Distribution channels for DSRC modems are segmented into direct and indirect routes. Direct distribution involves Tier 1 suppliers delivering OBUs directly to Original Equipment Manufacturers (OEMs) for factory installation in new vehicles. Indirect channels are utilized for the distribution of RSUs to governmental agencies or municipal traffic management bodies, often facilitated by system integrators who specialize in infrastructure deployment and maintenance.

Downstream analysis involves the application and service layers. Vehicle OEMs are the primary end-users for OBUs, driving volume based on production mandates and safety feature inclusion. For V2I infrastructure, the end-users include government transportation departments, toll authorities, and smart city operators. Post-deployment services, including security key management (Public Key Infrastructure maintenance), software updates, diagnostics, and long-term maintenance of roadside units, represent a growing revenue stream. The successful flow of value depends heavily on standardized interfaces and security certifications across all stages, ensuring that safety messages are consistently and securely exchanged, creating a tightly coupled ecosystem where security and reliability dictate market success.

DSRC Safety Modem Market Potential Customers

The primary customers for DSRC Safety Modems can be broadly categorized into automotive manufacturers and governmental entities responsible for infrastructure development. Automotive OEMs (Original Equipment Manufacturers) represent the largest volume buyers, integrating DSRC On-Board Units (OBUs) into new passenger cars and commercial vehicles as standard or optional safety features. Their purchasing criteria prioritize cost-effectiveness, reliability, integration ease with existing vehicle architecture (e.g., CAN bus), and strict adherence to established safety and regulatory standards. The demand from OEMs is directly correlated with regulatory mandates, creating a cyclical demand pattern based on the implementation timelines of safety standards across various jurisdictions globally.

Governmental and municipal bodies constitute the second major customer segment, specifically targeting Roadside Units (RSUs) essential for V2I applications such as traffic signal optimization, hazardous location warnings, and smart toll collection. These buyers include departments of transportation (DOTs), highway authorities, and urban planning agencies involved in smart city initiatives. For these customers, factors like environmental resilience (RSUs must withstand extreme weather), long-term operational lifespan, seamless integration into existing traffic control systems, and high reliability in data backhaul are critical procurement considerations. The purchasing decisions in this segment are often tied to large-scale public investment projects and infrastructure grants.

A third, rapidly growing customer base includes large commercial fleet operators and logistics companies. Although sometimes classified under the OEM segment (for new truck purchases), many fleet operators seek aftermarket DSRC solutions for their existing fleets to enable cooperative services like truck platooning, which significantly reduces fuel consumption and increases highway capacity. For these buyers, the return on investment (ROI) derived from operational efficiency gains and reduced accident rates is the primary driver. Additionally, specialized markets such as mining, port operations, and military applications require DSRC for highly localized, mission-critical communication where existing cellular infrastructure is either unreliable or non-existent, valuing the technology's dedicated spectrum and non-reliance on external networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $2,780 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Qualcomm, NXP Semiconductors, Autotalks, Cohda Wireless, Kapsch TrafficCom, Renesas Electronics, STMicroelectronics, Samsung, Huawei, Continental AG, DENSO, Harman International, Bosch, Lear Corporation, Aptiv, LG Electronics, Savari (Jio Platforms), Panasonic, Mitsubishi Electric, Toshiba. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DSRC Safety Modem Market Key Technology Landscape

The DSRC Safety Modem market is fundamentally defined by the IEEE 802.11p standard, also known as Wireless Access in Vehicular Environments (WAVE). This foundational technology utilizes the 5.9 GHz spectrum and is specifically engineered to support high-speed mobility and rapid handoffs, delivering the sub-100 millisecond latency crucial for safety-critical applications. The modem architecture relies heavily on highly optimized physical (PHY) and medium access control (MAC) layers to ensure reliable communication despite high Doppler shifts and constantly changing network topologies. Crucially, the technology landscape includes the necessary cryptographic security mechanisms, often integrated into dedicated secure elements (hardware security modules), that handle the Public Key Infrastructure (PKI) required for signing and verifying Basic Safety Messages (BSMs), ensuring trust and non-repudiation in the communications.

Current technological developments focus on enhancing the robustness and expanding the capabilities of DSRC. The forthcoming standard, IEEE 802.11bd (DSRC Evolution), aims to significantly improve data throughput, range, and reliability, addressing some of the comparative disadvantages against competing technologies like C-V2X. This evolution includes improvements in modulation and coding schemes designed to maintain performance in dense urban environments and at higher speeds. Furthermore, technological innovation is centered on co-existence mechanisms—solutions that allow DSRC systems to operate harmoniously alongside other wireless technologies within the shared spectrum environment. This is particularly relevant in regulatory regions where the 5.9 GHz band has been partially reallocated, requiring sophisticated spectral sensing and agile frequency shifting capabilities within the modem hardware.

System integration and software optimization are equally critical technological factors. The modem must interface seamlessly with a vehicle’s main processing unit and sensor suite, often leveraging complex middleware and standardized application interfaces defined by standards bodies like SAE and ETSI. The trend toward software-defined radio (SDR) architectures is growing, enabling modem hardware to be updated remotely to comply with evolving communication standards or regional regulatory changes (e.g., transition protocols). This adaptability reduces hardware obsolescence risk, a significant concern given the long lifecycle of vehicle platforms. The overall technology landscape is thus characterized by the need for ultra-low latency, robust security handling, compliance with evolving standards, and high integration density within the vehicle’s constrained electronic control unit (ECU) environment.

Regional Highlights

North America: The North American DSRC market, primarily driven by the United States Department of Transportation's early investment and pilot programs, has historically been a significant adopter. However, the region currently faces substantial regulatory headwinds following the FCC's decision to reallocate a portion of the 5.9 GHz safety spectrum for unlicensed use and designate the remainder for C-V2X. This decision has created a state of uncertainty, halting major new OEM commitments to DSRC deployment, though substantial DSRC infrastructure (Roadside Units) remains active across various states and municipalities. The market focus has shifted towards maintaining existing DSRC-equipped fleet safety and exploring hybrid solutions that ensure backward compatibility while paving the way for future cellular connectivity. Canada, while often aligning with U.S. standards, exhibits slightly more regulatory stability for existing DSRC operations in its key urban corridors, focusing primarily on V2I applications for traffic flow optimization.

Europe: Europe presents a complex but relatively stable environment for DSRC adoption, mainly through the European Telecommunications Standards Institute (ETSI) ITS-G5 standard, which is functionally equivalent to IEEE 802.11p. Key countries, notably Germany, Netherlands, and France, have actively pursued large-scale deployment of ITS-G5 based RSUs and OBUs through collaborative pilot projects and binding mandates. The European Union has emphasized interoperability and cross-border functionality, making DSRC a vital component of integrated continental transportation safety networks. While C-V2X is also being evaluated, the significant existing investment in ITS-G5 infrastructure and its proven performance in specific safety applications (particularly cooperative intelligent transport systems) ensures sustained demand for DSRC modems in the short to medium term. The emphasis here is on ensuring that new vehicular platforms include the capability for reliable short-range communication as part of standardized safety packages.

Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate, driven primarily by strong governmental commitment to smart city development and rapidly expanding vehicle fleets in countries such as Japan, South Korea, and increasingly China. Japan has been a pioneer in deploying DSRC-based electronic toll collection (ETC) and safety systems for over a decade, providing a mature technological base and continuous demand for advanced modems. South Korea is also heavily invested in DSRC for V2X safety applications within its highly connected infrastructure programs. While China has largely favored C-V2X (LTE-V2X and 5G-V2X), specific industrial and closed environment applications still utilize DSRC. The overarching regional driver is the urgent need to manage extreme traffic congestion and drastically improve road safety in mega-cities, making the region a key battleground for V2X technologies and driving intensive technological development in modem performance and reliability.

Latin America and Middle East & Africa (MEA): These emerging markets represent significant long-term opportunities, though DSRC adoption currently remains limited, primarily focused on specific commercial applications and isolated governmental pilot projects. In Latin America, initial adoption is often seen in electronic tolling systems and high-value fleet management operations, where the technology’s reliability in areas with poor cellular coverage is valued. In the MEA region, particularly in the Gulf Cooperation Council (GCC) countries investing heavily in futuristic cities (like NEOM), DSRC is being considered alongside C-V2X as part of foundational intelligent transportation infrastructure planning. However, the market remains highly dependent on external technological standards and funding for infrastructure rollout. The pace of DSRC modem penetration here will be dictated by the maturity of regulatory frameworks and the speed of national infrastructure buildouts, often favoring versatile solutions that can adapt to rapid technological evolution.

- North America: Regulatory instability post-FCC 5.9 GHz decision, focus on existing infrastructure maintenance and hybrid solutions.

- Europe: Stable adoption based on ETSI ITS-G5 standard, strong governmental backing for V2I deployment, emphasis on cross-border interoperability.

- Asia Pacific: Fastest growth market, driven by Japan’s established ETC/safety systems and South Korea’s pervasive V2X pilots, focused on smart city integration.

- Latin America: Niche adoption primarily for tolling and specialized commercial fleet applications, early stages of safety system deployment.

- Middle East & Africa (MEA): Limited adoption, potential growth tied to ambitious smart city projects and high-value infrastructure investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DSRC Safety Modem Market.- Qualcomm

- NXP Semiconductors

- Autotalks

- Cohda Wireless

- Kapsch TrafficCom

- Renesas Electronics

- STMicroelectronics

- Samsung

- Huawei

- Continental AG

- DENSO

- Harman International

- Bosch

- Lear Corporation

- Aptiv

- LG Electronics

- Savari (Jio Platforms)

- Panasonic

- Mitsubishi Electric

- Toshiba

Frequently Asked Questions

Analyze common user questions about the DSRC Safety Modem market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between DSRC and C-V2X, and how does this affect safety applications?

DSRC (IEEE 802.11p) is based on Wi-Fi technology, providing highly reliable, short-range, direct vehicle-to-vehicle (V2V) communication in a dedicated spectrum without relying on cellular network infrastructure. This results in ultra-low, predictable latency (critical for immediate collision warnings). C-V2X (Cellular V2X) uses cellular standards (4G/5G) and can operate either directly (PC5 interface) or via network infrastructure (Uu interface). While C-V2X offers higher throughput and better long-range non-safety data transmission, its direct communication reliability and latency predictability are still under scrutiny compared to DSRC in certain high-mobility, dense environments, making DSRC preferred by some regulators for immediate, safety-critical alerts.

How has the regulatory uncertainty in North America impacted the long-term viability of the DSRC Safety Modem market globally?

The regulatory shift in the U.S. 5.9 GHz band away from dedicated DSRC use created significant market instability and uncertainty. While this decision dampened investment in DSRC hardware in North America, it did not eliminate the global market. Regions like Europe (ITS-G5) and Japan continue to rely on and invest in DSRC/802.11p based systems due to existing infrastructure and demonstrated performance. The instability has accelerated the development of hybrid modems, which can simultaneously or interchangeably support both DSRC and C-V2X, thus future-proofing OEM installations against diverse regional mandates.

What are the most critical components required for security within a DSRC Safety Modem?

Security is paramount in DSRC, preventing malicious actors from injecting false safety messages (spoofing). The most critical component is the Hardware Security Module (HSM) or Secure Element. This dedicated hardware handles the Public Key Infrastructure (PKI) management, performing cryptographic signing and verification of all Basic Safety Messages (BSMs). This process ensures that every message received is authenticated, confirming the sender's identity and message integrity, which is essential for maintaining trust in the V2V and V2I communication system.

In which application segment does the DSRC Safety Modem technology show the most immediate growth potential?

The commercial vehicles application segment, particularly fleet management and long-haul trucking, shows robust immediate growth potential. DSRC is highly advantageous for cooperative maneuvering applications such as truck platooning, where maintaining extremely low and consistent latency between multiple heavy vehicles is crucial for safety and fuel efficiency. While passenger vehicle volume is higher, specialized commercial applications leverage DSRC's core technical strengths (dedicated spectrum, low latency) to achieve specific operational efficiencies and safety improvements not easily replicated by competing technologies.

How does the integration of Artificial Intelligence (AI) enhance the functionality of DSRC modems?

AI integration enhances DSRC functionality primarily through predictive analytics and intelligent data filtering at the edge. By applying machine learning models directly on the modem or RSU, systems can rapidly process incoming DSRC safety messages in conjunction with sensor data, detecting anomalies and predicting complex hazards far faster and more accurately than traditional rule-based systems. This allows the modem to deliver contextually richer and earlier warnings, optimizing the effectiveness of DSRC data within sophisticated Advanced Driver-Assistance Systems (ADAS).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager