DTH Drill Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439354 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

DTH Drill Market Size

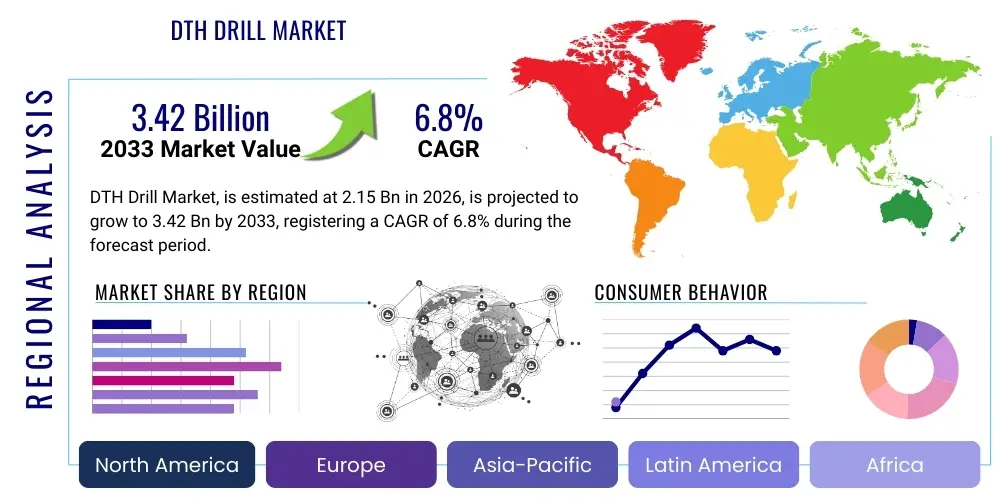

The DTH Drill Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.15 billion in 2026 and is projected to reach USD 3.42 billion by the end of the forecast period in 2033.

DTH Drill Market introduction

The Down-The-Hole (DTH) drill market encompasses the manufacturing, distribution, and utilization of DTH drilling equipment, which is primarily used for creating boreholes in various hard rock formations. This method involves a percussion hammer located directly behind the drill bit, transferring impact energy efficiently to the rock, resulting in highly effective and rapid drilling operations. DTH drills are renowned for their ability to produce straight, clean holes with minimal deviation, making them indispensable across a wide array of heavy industries. Their design allows for drilling in different rock types, from soft to extremely hard, and under varying geological conditions, providing exceptional versatility compared to other drilling techniques. The consistent performance and reliability of DTH drills contribute significantly to operational efficiency and cost-effectiveness in projects requiring extensive rock penetration.

Major applications for DTH drilling technology span critical sectors such as mining and quarrying, construction, water well drilling, and oil and gas exploration. In mining, DTH drills are crucial for blast-hole drilling, allowing for the precise placement of explosives to extract valuable minerals efficiently. For large-scale construction projects, they are used for foundation drilling, piling, and road construction through rocky terrain. Water well drilling relies on DTH technology for accessing deep aquifers, particularly in areas with challenging ground conditions. Benefits of DTH drilling include superior drilling speed and penetration rates, reduced fuel consumption due to optimized energy transfer, lower noise levels compared to top hammer drills, and extended bit life. These advantages contribute to a lower overall cost per meter drilled, enhancing project economics and operational sustainability. The robust design and technological advancements in DTH drilling equipment continually push the boundaries of what is achievable in demanding geological environments, making it a cornerstone technology in modern earthworks.

The market is primarily driven by significant global investments in infrastructure development, particularly in emerging economies where urbanization and industrialization are accelerating. The escalating demand for minerals and raw materials worldwide fuels mining activities, creating a sustained need for efficient drilling solutions. Furthermore, increasing exploration for water resources, especially in arid and semi-arid regions, provides a substantial impetus for the DTH drill market. Technological advancements, including automation, improved material science for drill bits, and enhanced energy efficiency in air compressors, also act as key driving factors, making DTH drilling more appealing and productive. These innovations not only improve operational safety and precision but also extend the operational lifespan of the equipment, reducing maintenance downtime and improving overall project timelines. As industries continue to seek more sustainable and productive drilling methods, the DTH drill market is poised for consistent growth and innovation.

DTH Drill Market Executive Summary

The DTH Drill Market is experiencing robust growth, primarily fueled by a surge in global infrastructure projects and sustained demand from the mining sector. Business trends indicate a strong focus on automation and digital integration within drilling equipment, aiming to enhance operational efficiency, safety, and precision. Manufacturers are increasingly investing in research and development to introduce next-generation DTH drills that offer superior performance, reduced environmental impact, and lower operating costs. This includes the development of more durable drill bits, energy-efficient compressors, and advanced telemetry systems for real-time monitoring and diagnostics. Furthermore, there is a growing trend towards providing comprehensive service packages, including maintenance, spare parts, and operator training, which helps in building long-term customer relationships and ensuring optimal equipment utilization. The competitive landscape is characterized by both established global players and emerging regional manufacturers, leading to continuous innovation and product differentiation.

Regional trends highlight the Asia Pacific region as a dominant force in market expansion, driven by massive infrastructure investments in countries like China, India, and Southeast Asian nations, alongside significant mining operations. North America and Europe, while more mature markets, are witnessing demand for technologically advanced and environmentally compliant DTH drilling solutions, with a strong emphasis on automation and digital transformation. Latin America and the Middle East & Africa regions are also showing considerable growth, primarily due to rich mineral reserves and ongoing construction activities, attracting investments in DTH drilling technology. These regions are often characterized by challenging geological conditions, making the efficiency and reliability of DTH drills particularly valuable. The demand in these regions is not just for new equipment but also for robust after-sales support and the availability of genuine spare parts to minimize downtime.

In terms of segment trends, the mining and quarrying application segment continues to hold the largest market share, with DTH drills being integral for blast-hole drilling in open-pit and underground mines. The construction sector is rapidly catching up, driven by large-scale urban development projects, road networks, and critical infrastructure requiring precise and deep hole drilling. From a product perspective, hydraulic DTH drill rigs are gaining traction due to their enhanced power efficiency and precision control, although pneumatic systems remain prevalent, especially in smaller to medium-scale operations. The market is also seeing an increased preference for multi-purpose rigs that can adapt to various drilling methods, offering greater flexibility and return on investment for contractors. The advancements in drill bit materials and designs, such as those incorporating carbide inserts, are extending the lifespan and penetration rates, further solidifying the performance advantages across different segments. Moreover, customization options for DTH drill rigs, tailored to specific geological conditions and project requirements, are becoming a key differentiating factor among manufacturers, allowing for more specialized and efficient solutions.

AI Impact Analysis on DTH Drill Market

Users frequently inquire about the transformative potential of Artificial Intelligence (AI) in revolutionizing DTH drilling operations, often expressing a desire to understand how AI can enhance efficiency, safety, and reduce operational costs. Common questions revolve around predictive maintenance capabilities to minimize downtime, the integration of autonomous drilling systems for increased productivity and remote operation, and the role of AI in optimizing drilling parameters based on real-time geological data. There is also significant interest in AI's contribution to improving environmental sustainability by optimizing energy consumption and reducing waste, as well as its impact on workforce skills and training requirements in an increasingly automated drilling environment. Users are keen to identify tangible benefits and practical applications that move beyond theoretical concepts, seeking evidence of improved decision-making and operational intelligence within the DTH drilling ecosystem. Furthermore, concerns about data security, initial investment costs, and the complexity of integrating AI systems with existing legacy equipment are frequently raised, highlighting a need for clear pathways and demonstrations of return on investment.

- Predictive maintenance algorithms analyze sensor data from DTH drills to forecast equipment failures, enabling proactive repairs and significantly reducing unplanned downtime.

- AI-powered autonomous drilling systems can execute complex drilling patterns with minimal human intervention, enhancing precision, consistency, and operational speed.

- Real-time optimization of drilling parameters (feed force, rotation speed, air pressure) is achieved through AI, adapting to changing rock formations to maximize penetration rates and prolong tool life.

- Enhanced safety protocols through AI-driven anomaly detection and collision avoidance systems, reducing human exposure to hazardous drilling environments.

- Data analytics and machine learning optimize logistics, supply chain management, and inventory for DTH drill consumables and spare parts, leading to cost savings.

- Remote operation capabilities are expanded with AI, allowing skilled operators to manage multiple drills from a central control room, improving efficiency and reducing on-site personnel.

- AI contributes to environmental sustainability by optimizing drilling patterns and energy consumption, reducing fuel use and carbon emissions per drilled meter.

- Improved geological mapping and characterization through AI analysis of seismic, acoustic, and drilling data, leading to more accurate resource estimation and mine planning.

- AI-driven training simulations offer realistic scenarios for DTH drill operators, accelerating skill development and reducing the learning curve for complex operations.

- Automated reporting and compliance monitoring, using AI to track operational parameters and generate reports, ensuring adherence to environmental and safety regulations with less manual effort.

DRO & Impact Forces Of DTH Drill Market

The DTH Drill Market is propelled by several key drivers, most notably the escalating global demand for minerals and metals, which necessitates extensive drilling operations in the mining sector. Rapid urbanization and industrialization in emerging economies are leading to substantial investments in infrastructure projects, including roads, bridges, and buildings, all of which require robust DTH drilling for foundation work and site preparation. The construction of new energy infrastructure, such as hydropower projects and geothermal plants, further contributes to this demand. Technological advancements in DTH drilling equipment, including improved bit designs, automation features, and enhanced energy efficiency, make these systems more attractive to end-users, boosting adoption rates. Additionally, increasing exploration activities for water resources, particularly in regions facing water scarcity, provide a consistent growth impetus for the market. These drivers collectively create a fertile ground for market expansion, pushing manufacturers to innovate and expand their product offerings to meet diverse industrial needs.

However, the market also faces significant restraints. The high initial capital investment required for DTH drill rigs and associated equipment can be a major barrier for small to medium-sized enterprises (SMEs) and contractors, particularly in developing regions. Fluctuations in commodity prices, especially for minerals and construction materials, can directly impact investment decisions in mining and construction projects, subsequently affecting the demand for drilling equipment. Stringent environmental regulations and permitting processes for mining and construction activities, aiming to mitigate ecological impact, can lead to project delays or even cancellations, thereby restraining market growth. Furthermore, the availability of alternative drilling technologies, such as rotary drilling or top hammer drilling, which might be more suitable or cost-effective for specific geological conditions or project scales, poses competitive pressure. The operational complexity and the need for skilled labor to operate and maintain sophisticated DTH drilling equipment also represent a restraint, especially in regions with limited technical expertise.

Opportunities within the DTH drill market are abundant, primarily driven by the increasing adoption of automation and digital technologies. The integration of IoT, AI, and telematics in DTH drills offers significant potential for enhancing operational efficiency, predictive maintenance, and remote monitoring, creating new avenues for growth and value-added services. The expansion of exploration activities into challenging and remote terrains, often rich in untapped mineral resources, presents a niche market for advanced, robust DTH drilling solutions capable of performing under extreme conditions. Furthermore, the growing focus on sustainable mining practices and energy-efficient drilling methods creates opportunities for manufacturers to develop and market greener DTH drill technologies that comply with evolving environmental standards. The untapped potential in emerging markets, characterized by rapid infrastructure development and industrial growth, offers significant scope for market penetration and expansion. Strategic collaborations, mergers, and acquisitions among market players can also lead to market consolidation, shared expertise, and the development of comprehensive drilling solutions, opening new commercial pathways and enhancing market reach. These forces collectively shape the competitive dynamics and growth trajectory of the DTH drill market.

Segmentation Analysis

The DTH Drill Market is comprehensively segmented to provide a detailed understanding of its diverse components and dynamics. This segmentation helps in analyzing market trends, identifying key growth areas, and understanding the specific needs of various end-user industries. The market can be broadly categorized based on factors such as the type of product, the application area, the end-user industry, and the operational mechanism. Each segment exhibits unique characteristics, driven by distinct technological requirements, economic factors, and geographical influences. A thorough analysis of these segments is crucial for strategic planning, product development, and market entry strategies for stakeholders across the value chain, enabling targeted solutions that cater to the nuanced demands of different operational environments and project scales. The diversity in segmentation also reflects the versatility of DTH drilling technology itself, adaptable to a wide range of geological conditions and operational objectives.

- By Product Type:

- DTH Hammers: Classified by bore diameter, air consumption, and design for different rock types.

- DTH Bits: Segmented by head design (convex, flat, concave), carbide button configurations, and material composition for specific drilling challenges.

- DTH Drill Rigs: Categorized by mounting (crawler-mounted, truck-mounted, skid-mounted), power source (pneumatic, hydraulic, electric), and drilling depth capacity.

- Drill Pipes/Rods: Distinguished by diameter, length, and thread types, crucial for deep hole drilling integrity.

- Associated Accessories: Including lubricants, adapters, shock absorbers, and various spare parts essential for continuous operation.

- By Application:

- Mining & Quarrying: Primary application for blast-hole drilling, production drilling, and exploration.

- Construction: Used for foundation drilling, piling, anchoring, road construction, and utility trenching in rocky areas.

- Water Well Drilling: For accessing underground aquifers, irrigation wells, and potable water sources.

- Oil & Gas Exploration: Primarily for shallow and medium depth exploration wells, as well as seismic shot holes.

- Geothermal Drilling: For exploring and harnessing geothermal energy resources, requiring specialized high-temperature resistance.

- Specialty Drilling: Includes horizontal drilling, micro-piling, and other niche applications requiring precise control.

- By End-User Industry:

- Contractors & Rental Companies: Major buyers due to diverse project requirements and need for flexible equipment access.

- Mining Companies: Direct purchase for large-scale, continuous mining operations.

- Construction Companies: For specific infrastructure and building projects.

- Government Agencies: For public works, water supply projects, and geological surveys.

- Oil & Gas Companies: For exploration and well development.

- Agriculture Sector: For irrigation and farm water wells.

- By Operation Type:

- Pneumatic DTH Drills: Air-powered, commonly used for smaller to medium-scale operations due to simplicity and cost-effectiveness.

- Hydraulic DTH Drills: Offer greater power, precision, and efficiency, preferred for large-scale and complex projects.

- Electric DTH Drills: Emerging segment, offering quieter operation and lower emissions, suitable for specific environmental regulations.

- By Sales Channel:

- Direct Sales: Manufacturers sell directly to large enterprises or government bodies.

- Indirect Sales: Through distributors, dealers, and third-party vendors, particularly for smaller clients and regional markets.

- Online Sales & E-commerce: Growing channel for parts, accessories, and smaller equipment.

Value Chain Analysis For DTH Drill Market

The value chain of the DTH Drill Market begins with the upstream activities involving raw material suppliers and component manufacturers. This includes suppliers of high-grade steel alloys crucial for drill bits and hammers, specialized carbides for cutting inserts, and various metallic components for rig structures and hydraulic systems. The quality and availability of these raw materials directly impact the performance, durability, and cost-effectiveness of the final DTH drilling equipment. Manufacturers of compressors, hydraulic pumps, engines, and electronic control systems also form a critical part of the upstream segment, providing specialized components that are integrated into the final drill rigs. Strong relationships with reliable suppliers are paramount for maintaining product quality, ensuring timely production, and managing costs, as disruptions in the supply of these specialized materials or components can significantly affect the entire production process. Innovation in material science, leading to more wear-resistant and efficient components, is a continuous driver within this upstream segment, influencing subsequent stages of the value chain.

Moving downstream, the value chain encompasses the manufacturing, assembly, and testing of DTH drill hammers, bits, rods, and complete drill rigs. This stage involves complex engineering processes, precision machining, and rigorous quality control to ensure that the final products meet industry standards and customer specifications. Manufacturers like Epiroc, Sandvik, and Atlas Copco invest heavily in advanced manufacturing facilities and R&D to produce innovative and high-performance drilling solutions. After manufacturing, these products are distributed to end-users through a combination of direct and indirect channels. Direct sales typically involve large manufacturers selling directly to major mining companies, construction giants, or government bodies, often accompanied by comprehensive service and support agreements. This direct approach allows for closer customer relationships, better understanding of specific needs, and faster feedback loops for product improvement. It also often includes direct customization and integration services for complex drilling systems.

Indirect distribution channels involve a network of authorized distributors, dealers, and rental companies that cater to a broader range of customers, including smaller contractors and regional businesses. These intermediaries play a crucial role in market penetration, providing local sales support, maintenance services, and access to spare parts, which are vital for reducing operational downtime for end-users. The choice of distribution channel often depends on the geographic reach, market maturity, and the scale of the customer base. Post-sales services, including maintenance, repairs, training, and technical support, constitute a significant part of the downstream value chain, ensuring customer satisfaction and equipment longevity. These services often involve the deployment of field engineers and technicians, diagnostic tools, and the timely supply of genuine spare parts. The efficiency of the entire value chain, from raw material sourcing to after-sales support, is critical for competitive advantage, customer loyalty, and sustainable growth within the DTH Drill Market. Effective management of these channels and services is crucial for manufacturers to maintain their market position and capture new opportunities, especially in regions with burgeoning demand for drilling equipment.

DTH Drill Market Potential Customers

The DTH Drill Market serves a diverse range of potential customers, primarily classified by their operational needs and industrial applications. At the forefront are mining companies, both large-scale multinational corporations and smaller regional players, engaged in the extraction of various minerals such as iron ore, copper, gold, coal, and aggregates. These customers rely heavily on DTH drills for blast-hole drilling in open-pit mines, as well as for production drilling and exploration in underground operations. Their purchasing decisions are often driven by factors like drill rig efficiency, penetration rates in hard rock, fuel consumption, and the durability of consumables, as these directly impact their operational costs and overall productivity. The continuous demand for raw materials globally ensures a stable customer base from the mining sector, making them a cornerstone of the DTH drill market. These companies frequently seek advanced, automated drilling solutions to enhance safety and optimize resource extraction processes, prioritizing total cost of ownership over initial acquisition cost.

Another significant customer segment comprises construction companies and infrastructure development firms. These entities utilize DTH drills for a multitude of applications, including foundation drilling for large buildings, bridges, and dams; piling and anchoring in challenging ground conditions; tunneling projects; and site preparation for roads and railways. Their demand is highly influenced by government spending on public infrastructure, urban development projects, and private sector investments in commercial and residential construction. Construction contractors often seek versatile DTH drill rigs that can adapt to different project scales and geological conditions, emphasizing reliability, ease of transport, and efficient setup. The ability to drill accurate and straight holes is paramount for structural integrity in construction, making DTH technology a preferred choice. Companies involved in utility installation, such as those laying pipelines or fiber optic cables through rocky terrain, also represent a growing customer base, seeking precise and minimally invasive drilling methods.

Furthermore, government agencies and organizations involved in water resource management, geological surveys, and environmental projects constitute an important customer group. This includes entities focused on drilling water wells for agricultural irrigation, municipal water supply, and humanitarian aid in remote or arid regions. DTH drills are particularly effective in these applications due to their ability to penetrate hard rock efficiently to access deep aquifers. Oil and gas exploration companies also represent a niche but significant customer segment, using DTH drills for shallow and medium-depth exploration, seismic shot holes, and sometimes for preparing sites for deeper conventional drilling. The agricultural sector, though often through contractors, also indirectly drives demand for DTH drills for farm irrigation wells. Lastly, rental companies form a crucial channel, providing DTH drilling equipment to smaller contractors and project-specific needs, thereby broadening market access and ensuring high utilization rates of the equipment across various industries without the need for direct ownership investment. These diverse end-users collectively contribute to the sustained demand and growth of the DTH Drill Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.42 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Epiroc AB, Sandvik AB, Atlas Copco AB, Ingersoll Rand Inc., Komatsu Ltd., Metso Outotec Corporation, Doosan Infracore Co. Ltd., Furukawa Co. Ltd., Montabert S.A.S., Schramm Inc., Rockmore International, Mitsubishi Materials Corporation, Herrenknecht AG, TEI Rock Drills, Mincon Group PLC, Numa Tool Company LLC, Driconeq AB, Halco Rock Tools Ltd., Shandong Jinbo Mining Equipment Co. Ltd., Hongwuhuan Group Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DTH Drill Market Key Technology Landscape

The DTH Drill Market is characterized by a dynamic and evolving technology landscape, constantly driven by the need for increased efficiency, safety, and environmental sustainability. A pivotal aspect of this landscape involves advancements in drilling automation. Modern DTH drill rigs are increasingly incorporating sophisticated control systems that enable automated drilling cycles, auto-collaring, and even autonomous operation in some cases. This automation minimizes human error, ensures consistent drilling performance, and significantly enhances operational safety by removing personnel from hazardous environments. The integration of sensors and telemetry allows for real-time monitoring of drilling parameters such as feed pressure, rotation speed, and air consumption, providing operators with critical data for optimizing performance. Furthermore, GPS and precise navigation systems are being deployed to ensure accurate hole placement, which is crucial for blast-hole patterns in mining and structural integrity in construction. These automation features not only boost productivity but also enable remote diagnostics and troubleshooting, reducing maintenance downtime and operational costs.

Material science innovations play a crucial role in enhancing the durability and performance of DTH drill components. This includes the development of advanced carbide grades for drill bits, which offer superior wear resistance and impact toughness, leading to extended bit life and higher penetration rates in abrasive and hard rock formations. Heat treatment processes and surface coatings are also continually being refined to improve the strength and longevity of DTH hammers and drill rods. Beyond the drilling tools themselves, improvements in hydraulic systems, engine technology, and air compressors are contributing to greater energy efficiency and reduced environmental footprint. Hybrid and electric-powered DTH rigs are emerging as environmentally friendlier alternatives, especially in regions with stringent emissions regulations, offering lower noise levels and reduced fuel consumption. These technological strides not only meet regulatory compliance but also cater to a growing industry demand for greener and more sustainable drilling solutions. The focus on robust and lightweight materials also improves the maneuverability and transportability of drill rigs, enhancing operational flexibility across diverse project sites.

The digitalization and connectivity aspects are profoundly reshaping the DTH drill market's technological frontier. The Internet of Things (IoT) is being widely adopted, connecting DTH drill rigs to cloud-based platforms for data collection, analysis, and remote management. This allows for predictive maintenance capabilities, where AI algorithms analyze equipment performance data to anticipate potential failures, enabling proactive servicing and reducing unplanned breakdowns. Digital twins, virtual models of physical DTH drills, are also being developed to simulate operational scenarios, test new configurations, and optimize performance before physical implementation. Furthermore, enhanced telematics systems provide comprehensive insights into fleet utilization, fuel consumption, and operational efficiency, empowering managers to make data-driven decisions and optimize resource allocation. The integration of augmented reality (AR) and virtual reality (VR) is also finding applications in operator training and remote technical support, providing immersive and interactive learning experiences. These interconnected technologies are driving a paradigm shift towards smart, efficient, and highly productive DTH drilling operations, offering significant competitive advantages to adopters and pushing the entire industry towards a more integrated and data-centric future.

Regional Highlights

- North America: This region represents a mature DTH drill market with high adoption rates of advanced drilling technologies. The demand is primarily driven by robust mining activities, especially for aggregates, copper, and precious metals, coupled with significant investments in infrastructure upgrades. Strict safety and environmental regulations here push manufacturers towards developing highly automated, fuel-efficient, and low-emission DTH drill rigs. The presence of major global players and a strong focus on research and development contribute to technological innovation and a competitive landscape. The market in the United States and Canada also benefits from the demand for water well drilling in agricultural and residential sectors.

- Europe: The European DTH drill market is characterized by stringent environmental norms and a strong emphasis on operational efficiency and sustainable practices. Demand is influenced by quarrying activities for construction materials, limited but high-value mining operations, and significant investments in urban infrastructure and renewable energy projects like geothermal drilling. Countries such as Sweden, Germany, and Finland, with their advanced engineering capabilities, are at the forefront of developing innovative DTH drilling solutions, including electric and hybrid rigs. The market here also shows a strong preference for high-quality, durable equipment with comprehensive after-sales support.

- Asia Pacific (APAC): The APAC region stands as the largest and fastest-growing market for DTH drills globally. This exponential growth is primarily fueled by massive infrastructure development projects in countries like China, India, and Indonesia, including extensive road networks, high-speed railways, and large-scale urban construction. Furthermore, the region's rich mineral resources drive significant mining and quarrying activities. Rapid industrialization and urbanization continue to boost demand across the construction, water well drilling, and mining sectors. The market is also seeing increasing adoption of automation and advanced drilling techniques as the region's industries mature and seek greater efficiency.

- Latin America: This region is a vital market for DTH drills, largely owing to its rich mineral reserves and extensive mining operations, particularly for copper, gold, and iron ore in countries like Chile, Peru, and Brazil. The robust mining sector acts as a primary driver, with ongoing exploration and expansion projects creating sustained demand for high-performance drilling equipment. Additionally, growing investments in infrastructure development, albeit at a slower pace than APAC, contribute to market growth. The region's geological diversity often requires versatile DTH drilling solutions capable of handling various rock formations and challenging conditions.

- Middle East & Africa (MEA): The MEA region presents significant growth opportunities, driven by increasing mining activities, particularly in South Africa, Saudi Arabia, and parts of North Africa, for minerals such as gold, phosphates, and diamonds. Large-scale construction and infrastructure projects, funded by oil revenues and economic diversification initiatives, also contribute substantially to the demand for DTH drills. Water well drilling is a critical application in many arid parts of the region, further boosting market expansion. The market is characterized by a mix of demand for cost-effective solutions and advanced, robust equipment suitable for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DTH Drill Market.- Epiroc AB

- Sandvik AB

- Atlas Copco AB

- Ingersoll Rand Inc.

- Komatsu Ltd.

- Metso Outotec Corporation

- Doosan Infracore Co. Ltd.

- Furukawa Co. Ltd.

- Montabert S.A.S.

- Schramm Inc.

- Rockmore International

- Mitsubishi Materials Corporation

- Herrenknecht AG

- TEI Rock Drills

- Mincon Group PLC

- Numa Tool Company LLC

- Driconeq AB

- Halco Rock Tools Ltd.

- Shandong Jinbo Mining Equipment Co. Ltd.

- Hongwuhuan Group Co. Ltd.

Frequently Asked Questions

What are the primary applications driving the growth of the DTH Drill Market?

The DTH Drill Market is primarily driven by extensive applications in mining and quarrying for blast-hole drilling, large-scale construction projects for foundation and piling work, and water well drilling to access underground aquifers. Global infrastructure development and the increasing demand for minerals and water resources are key factors fueling this growth.

How do technological advancements influence the DTH Drill Market?

Technological advancements significantly impact the DTH Drill Market by introducing automation, IoT integration, AI-driven predictive maintenance, and more energy-efficient designs. These innovations lead to enhanced operational efficiency, improved safety, reduced downtime, and lower operating costs, making DTH drills more attractive and competitive across various industries.

Which geographical region holds the largest share in the DTH Drill Market, and why?

The Asia Pacific (APAC) region currently holds the largest market share in the DTH Drill Market, primarily due to rapid industrialization, massive infrastructure development initiatives in countries like China and India, and extensive mining operations across the region. These factors collectively drive a high demand for efficient and reliable drilling solutions.

What are the key challenges faced by manufacturers and operators in the DTH Drill Market?

Key challenges include the high initial capital investment for DTH drill rigs, volatility in commodity prices impacting project viability, stringent environmental regulations necessitating greener solutions, and the need for a skilled workforce to operate and maintain sophisticated equipment. Competition from alternative drilling technologies also poses a restraint.

What role does sustainability play in the future development of DTH drilling technology?

Sustainability is playing an increasingly critical role, driving the development of DTH drilling technology towards energy-efficient systems, hybrid and electric drill rigs to reduce emissions and noise, and advanced materials that prolong equipment life and minimize waste. The focus is on reducing the environmental footprint and operational costs while maintaining high performance standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- DTH Drill Market Size Report By Type (DTH Drill Bits M30, Type II), By Application (Mining and Quarry Industry, Waterwell Drilling, Construction, Oil & Gas Industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- DTH Drill Market Statistics 2025 Analysis By Application (Mining and Quarry Industry, Waterwell Drilling, Construction, Oil & Gas Industry), By Type (Concave, Flat, Convex), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- DTH Drill Rig Market Statistics 2025 Analysis By Application (Quarries, Opencast Mines, Construction Projects), By Type (Electric DTH Drill Rig, Hydraulic DTH Drill Rig, Pneumatic DTH Drill Rig, Other DTH Drill Rigs), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Top Hammer Drill Rig Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Electric DTH Drill Rig, Hydraulic DTH Drill Rig, Pneumatic DTH Drill Rig, Others), By Application (Quarries, Opencast Mines, Construction Projects, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- DTH Drill Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Internal Combustion Drill, Electric Drive DTH Drill), By Application (Construction, Waterwell Drilling, Mining and Quarry Industry), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager