DTH Hammer Bits Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438695 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

DTH Hammer Bits Market Size

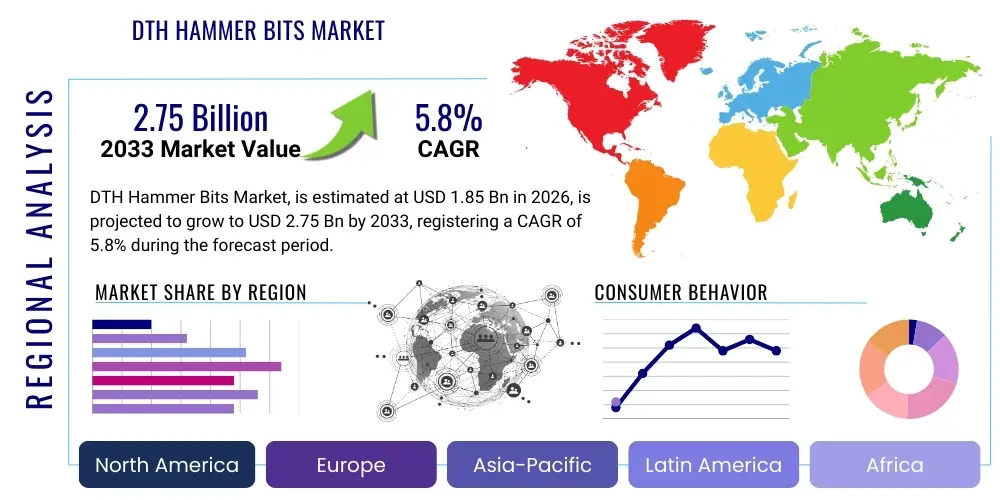

The DTH Hammer Bits Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

DTH Hammer Bits Market introduction

The Down-the-Hole (DTH) hammer bits market encompasses the manufacturing and distribution of specialized drilling tools crucial for hard rock excavation across various sectors. DTH drilling technology involves a percussive mechanism located directly behind the drill bit, transferring impact energy efficiently to the rock face. This method is highly effective for drilling deep, straight holes with optimal speed and reduced energy loss, making it superior to conventional rotary drilling in certain geological formations. Market growth is fundamentally driven by sustained global infrastructure development, robust mining activities, and increasing demand for renewable energy installations, such as geothermal and wind power, which require extensive foundational drilling.

DTH hammer bits are precision-engineered components, typically featuring tungsten carbide inserts and strategic flushing channels. Their design varies significantly based on geological requirements, including button profiles (e.g., spherical, ballistic, conical), face designs (flat, concave, convex), and shank styles compatible with specific DTH hammers. Key product differentiation focuses on durability, penetration rate, and resistance to wear and tear in abrasive conditions, directly impacting operational efficiency and cost per meter drilled. The technical complexity and demanding environment of applications necessitate continuous material science innovation, particularly in carbide metallurgy and heat treatment processes, to extend the lifespan of these critical tools.

Major applications of DTH hammer bits span critical industries including open-pit and underground mining for extraction of metals and minerals, construction projects requiring blasting hole drilling and foundational piling, and specialized applications like water well drilling, oil and gas exploration (seismic drilling), and quarrying. The primary benefit of using DTH technology is its ability to achieve superior straightness and consistency in boreholes, even in highly fractured or heterogeneous rock formations. Furthermore, the inherent efficiency of energy transfer minimizes vibration and noise pollution compared to top-hammer systems, increasingly aligning the technology with stringent environmental and safety regulations globally. Continuous performance improvements and enhanced longevity of the bits serve as primary factors driving adoption across emerging economies undergoing rapid industrialization.

DTH Hammer Bits Market Executive Summary

The DTH Hammer Bits market demonstrates robust expansion, characterized by significant investment in large-scale infrastructure and mineral exploration activities, particularly across the Asia Pacific region and emerging markets in Africa. Business trends indicate a strong move toward high-performance, specialized bits manufactured using advanced materials like premium tungsten carbide grades and proprietary steel alloys, aimed at maximizing drilling productivity and reducing downtime. Consolidation among major original equipment manufacturers (OEMs) and aggressive pursuit of after-sales service contracts are defining competitive strategies. Furthermore, sustainability pressures are driving demand for more durable bits that minimize material consumption and waste, favoring suppliers who can demonstrate superior product lifespan and consistent quality control through rigorous testing protocols and verifiable material traceability.

Regionally, Asia Pacific maintains the highest growth trajectory, primarily fueled by massive infrastructure investment in China and India, alongside sustained high-volume iron ore and coal mining in Australia and Indonesia. North America and Europe, while mature, focus heavily on technological refinement, demanding automation compatibility and specialized bits for complex applications like geothermal drilling and specialized civil engineering projects. The market in Latin America is tied closely to commodity price cycles, particularly copper mining in the Andean region, showing intermittent but substantial demand spikes. Manufacturers are adapting their distribution models to regional needs, emphasizing robust supply chain management to counter logistical challenges in remote mining sites worldwide.

Segment trends reveal that the mining sector remains the largest end-user segment, driving demand for large-diameter bits suitable for blasting and pre-splitting. However, the construction and quarrying segment is experiencing the fastest growth rate, propelled by urbanization and global demand for aggregates. From a product perspective, the market is shifting towards button bits, favored for their versatility and durability over blade bits. Moreover, there is an increasing adoption of specialized deep-hole drilling bits designed to handle extreme temperature and pressure variations encountered in deep exploration, showcasing the continuous innovation required to maintain market relevance across diverse drilling requirements.

AI Impact Analysis on DTH Hammer Bits Market

User queries regarding AI's influence on the DTH Hammer Bits market predominantly center on improving operational efficiency, predicting wear life, and optimizing drilling parameters in real-time. Key themes include the use of machine learning (ML) for predictive maintenance to prevent premature bit failure, integrating sensors into drilling rigs to collect real-time data on rock hardness and drilling fluid pressure, and leveraging AI algorithms to recommend the optimal bit design and operational speed for specific geological conditions. Users are concerned about the complexity and cost of integrating AI-enabled monitoring systems but expect significant reductions in non-productive time (NPT) and improvements in drilling accuracy through data-driven decisions. The expectation is that AI will transform DTH operations from reactive maintenance cycles to proactive, highly efficient drilling campaigns.

AI's primary impact involves enhancing the entire drilling lifecycle, from pre-site simulation and geological modeling to post-operation performance analysis. By processing vast datasets encompassing drilling parameters (torque, feed pressure, rotational speed), bit material properties, and historical failure rates, ML models can accurately predict when a specific bit is likely to reach its maximum wear threshold. This predictive capability allows operators to schedule bit replacements during planned maintenance windows, maximizing drilling time and minimizing expensive, unplanned interruptions. Furthermore, AI-driven process optimization facilitates 'drilling automation', where the rig autonomously adjusts parameters based on immediate down-hole feedback, ensuring maximum penetration rate while safeguarding the bit and hammer mechanism from excessive stress or damage.

The integration of digital twins and advanced analytics is making DTH drilling smarter. AI-powered diagnostic systems are increasingly being used to analyze vibration patterns and acoustic signatures transmitted from the DTH hammer, identifying early signs of component degradation, including bearing wear or insert loss on the bit. This level of granular, non-invasive monitoring provides unparalleled insight into down-hole conditions, previously only achievable through time-consuming inspections. While the DTH bits themselves remain passive mechanical tools, AI ensures they are utilized under optimal conditions, extending tool life, improving energy consumption per meter drilled, and significantly raising the overall return on investment for high-capital drilling equipment, thereby reshaping procurement and maintenance strategies across the mining and construction industries.

- AI-driven Predictive Maintenance: Forecasting bit wear and failure probability using machine learning models based on real-time operational telemetry.

- Automated Parameter Optimization: Utilizing algorithms to dynamically adjust feed pressure, rotation speed, and air volume for maximizing penetration rate (ROP) while minimizing wear.

- Geological Mapping and Simulation: Employing AI to analyze seismic and geological data to recommend the most suitable bit profile and material composition before drilling commences.

- Digital Twin Integration: Creating virtual models of the DTH hammer and bit system for simulating stress, thermal load, and performance under varying rock conditions.

- Enhanced Supply Chain Efficiency: Predicting demand for specific bit types based on forecasted project activity and geological data analysis, optimizing inventory management.

DRO & Impact Forces Of DTH Hammer Bits Market

The DTH Hammer Bits market is propelled by key Drivers (D) such as escalating global mining output and intensified infrastructure development, demanding reliable, high-speed drilling solutions. However, it faces significant Restraints (R), primarily high operational costs associated with maintaining drilling fleet, volatility in raw material prices (especially tungsten carbide), and the necessity for specialized, high-skilled labor. Opportunities (O) emerge from advancements in specialized drilling techniques, particularly for unconventional energy sources (geothermal, horizontal drilling), and the burgeoning aftermarket for high-quality replacement parts. These forces collectively shape the competitive landscape and technological trajectory of the market.

Impact Forces are predominantly shaped by supply chain dynamics and technological substitution threats. The availability and pricing of high-purity tungsten carbide, often sourced from geopolitically sensitive regions, directly impact manufacturing margins and product cost stability. Furthermore, intense competition among manufacturers drives continuous investment in R&D to enhance bit lifespan and drilling efficiency, turning technological superiority into a critical barrier to entry. Regulatory shifts in environmental and occupational safety standards also influence product design, pushing manufacturers toward cleaner, less abrasive drilling methods and components that reduce dust exposure and noise levels on site. The market’s responsiveness to global commodity cycles, specifically for metals and construction materials, dictates short-term demand variability.

The convergence of these forces mandates strategic agility for market participants. Manufacturers must diversify their material sourcing and invest in recycling technologies to mitigate raw material volatility (R), while simultaneously leveraging advanced manufacturing techniques like additive manufacturing (O) to reduce lead times and customize products. The long-term driver remains the irreplaceable role of DTH technology in hard rock excavation, where alternatives often prove less cost-effective or technically infeasible for deep holes. Successful market players focus on building robust service networks and providing end-to-end operational support, transitioning from being mere component suppliers to integrated drilling solution partners, thereby stabilizing revenue streams amidst fluctuating project cycles.

Segmentation Analysis

The DTH Hammer Bits Market is comprehensively segmented based on three primary criteria: the type of product (determining design and geometry), the application where the bit is used (dictating performance requirements), and the diameter size (which correlates directly with hole size and end-use requirements). Analyzing these segments provides a granular view of market dynamics, revealing varying growth rates and specialized demands across different industry verticals. The button bits segment dominates due to their superior durability and versatility across diverse rock formations, while the mining and construction sectors remain the foundational pillars of demand, necessitating continuous innovation in metallurgy and design to maximize drilling efficiency and tool longevity.

Within the application segmentation, the mining segment leads, requiring both large-diameter bits for production blasting and smaller diameters for exploration and rock bolting. The construction segment follows closely, driven by large civil engineering projects, foundation drilling for high-rise buildings, tunneling, and road construction, which often require specialized bits for heterogeneous and urban environments. The utilities segment, encompassing water well drilling, geothermal installations, and seismic exploration, although smaller in volume, demands high precision and specific bit designs capable of deep penetration in unique geological settings, representing a niche area of high technological focus and growth.

Furthermore, segmentation by diameter is crucial for understanding operational requirements. Bits with diameters ranging from 4 to 6 inches are the most commonly traded in the market, serving general construction and small-to-medium-scale quarrying operations. Conversely, large-diameter bits (8 inches and above) are vital for high-volume production blasting in large open-pit mines and specialized infrastructure projects like deep piling, commanding a higher price point due to increased material consumption and manufacturing complexity. Manufacturers often tailor their product portfolio to efficiently cater to the distinct performance and volume requirements characteristic of each diameter category, ensuring optimal stock levels and rapid fulfillment for global operations.

- By Product Type:

- Button Bits (Spherical, Ballistic, Conical, Parabolic)

- Blade Bits (Cross, X-type)

- Core Bits

- By Application:

- Mining (Open-Pit, Underground)

- Construction and Infrastructure (Piling, Tunneling, Foundations)

- Quarrying

- Water Well and Geothermal Drilling

- Oil and Gas Exploration (Seismic Drilling)

- By Diameter Size:

- Less than 4 inches

- 4 inches to 6 inches

- 6 inches to 8 inches

- More than 8 inches

Value Chain Analysis For DTH Hammer Bits Market

The value chain for the DTH Hammer Bits market starts with the upstream sourcing of critical raw materials, primarily high-grade alloy steel and specialized tungsten carbide components. Manufacturers engage in rigorous material selection and processing, including forging, heat treatment, and precision machining, which are capital-intensive and critical steps determining the final product's performance. The upstream segment is characterized by reliance on a few global suppliers for high-quality cemented carbide inserts, making supply stability and material cost control significant determinants of competitive advantage. Investment in proprietary coating technologies and specialized bonding processes represents substantial value addition in this initial phase.

Moving downstream, the distribution channel plays a pivotal role due to the highly technical nature and consumable status of DTH bits. Distribution is categorized into direct sales by major OEMs, who maintain dedicated sales teams and service centers to handle large mining and construction contracts, and indirect channels relying on specialized industrial distributors, dealers, and regional agents. These indirect channels are crucial for reaching smaller quarrying operations and localized construction firms, particularly in geographically diverse markets. The decision between direct and indirect distribution often hinges on the volume requirements, the complexity of the sale, and the necessary level of after-sales technical support, with OEMs typically favoring direct routes for key strategic accounts requiring integrated drilling solutions.

The final stage involves the provision of after-market services, including bit inspection, resharpening, and failure analysis, which are increasingly important sources of revenue and customer retention. The lifespan and performance of DTH bits are monitored closely by end-users, and rapid replacement or servicing minimizes costly downtime. The efficiency of the distribution network, therefore, directly impacts operational profitability for the end-user. Value creation throughout the chain is fundamentally linked to quality assurance and technical expertise, ensuring the delivered product meets the stringent performance expectations required for efficient hard rock drilling across global project sites.

DTH Hammer Bits Market Potential Customers

The primary consumers and end-users of DTH hammer bits are entities engaged in high-volume, deep, or precise drilling operations across the extraction and civil engineering sectors. Major potential customers include multinational mining corporations (e.g., BHP, Rio Tinto, Vale) that operate large-scale open-pit and underground mines requiring continuous supply of blasting and production drilling tools. These customers prioritize high penetration rates, long bit life, and comprehensive contractual service agreements provided by the supplier. Due to their scale, these corporations often negotiate direct supply agreements with Tier 1 manufacturers, focusing on customized bit solutions tailored to specific ore bodies and geological challenges encountered globally.

Another significant customer segment comprises large government and private construction and infrastructure firms (e.g., Bechtel, Skanska) involved in major civil works, such as tunneling for metropolitan transport, large hydroelectric projects, and foundational work for bridges and skyscrapers. These users require DTH bits for piling, micro-piling, and geotechnical stabilization, where hole straightness and accuracy are paramount. Demand in this sector is project-driven and often requires bits capable of handling variable geological layers, including fractured rock and overburden, necessitating robust, versatile, and often disposable bit designs optimized for speed over absolute longevity.

The remaining substantial customer base consists of smaller, localized operations, including independent water well drillers, regional quarry operators supplying aggregates, and specialist geotechnical contractors. These buyers typically procure DTH bits through indirect distribution channels and prioritize cost-effectiveness, immediate availability, and local technical support. Growth in this segment is strongly correlated with localized economic activity, agricultural expansion (requiring water wells), and residential construction, demanding durable, general-purpose bits suitable for common rock types, representing a critical volume segment for aftermarket sales and distributor networks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sandvik AB, Atlas Copco, Epiroc AB, Mincon Group PLC, Rockmore International, Numa Tool Company, Drill King International, Bulroc (UK) Ltd., Fordia Group (Wassara), Driconeq AB, JVC Drill Solutions, Mitsubishi Materials Corporation, Furukawa Rock Drill Co., Ltd., Halco Drilling International, Micon Products, Inc., Boart Longyear, Robit Plc, Zhongke Drilling Tools, ProDrill, Starockdrill |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

DTH Hammer Bits Market Key Technology Landscape

The DTH Hammer Bits market is characterized by incremental but continuous technological improvements focused primarily on optimizing the material composition and geometrical design of the bit for maximum operational life and penetration rate. A core technology advancement involves the development and utilization of proprietary, high-density tungsten carbide grades, specifically designed for extreme impact resistance and abrasion tolerance. Manufacturers are leveraging advanced powder metallurgy techniques, including Hot Isostatic Pressing (HIP), to eliminate micro-porosity in the carbide inserts, significantly enhancing their toughness and reducing the likelihood of premature fracturing when drilling in highly abrasive or fractured rock formations. This material science focus is crucial, as the bit’s longevity directly determines the economic viability of the entire drilling operation.

In terms of design, computational fluid dynamics (CFD) and Finite Element Analysis (FEA) are essential technologies utilized during the product development phase. CFD simulation optimizes flushing port design to ensure efficient evacuation of cuttings (cuttings removal efficiency, or CRE), preventing regrinding and reducing excessive heat buildup, both of which severely shorten bit life. FEA is employed to simulate stress distribution across the bit face and shank under high impact loads, enabling engineers to refine the body material thickness and ensure structural integrity. The optimization of the button layout, transitioning from conventional rows to patented, asymmetric patterns, is another technological thrust aimed at improving impact energy transfer and promoting uniform wear across the bit face, thereby extending the tool's usable life.

Furthermore, technology integration within the broader drilling system is becoming increasingly important. This includes the development of sensor-enabled bits (though still nascent due to the harsh downhole environment) that can transmit real-time data regarding temperature, vibration, and impact forces to the surface. While direct sensor embedding is challenging, coupling standard bits with advanced monitoring systems integrated into the DTH hammer allows for sophisticated analysis of drilling dynamics. This focus on "system performance" rather than just the bit as an isolated tool allows for better compatibility with automated drilling rigs and facilitates the use of AI/ML for dynamic parameter adjustment, representing the future direction of technological refinement in this mature industrial segment.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by China, India, and Australia. China and India's sustained investment in massive infrastructure projects (roads, rail, hydroelectric power) fuels demand for construction-grade bits, while Australia’s dominance in iron ore, coal, and gold mining drives the demand for heavy-duty, large-diameter drilling tools. The region benefits from lower manufacturing costs in some areas but increasingly demands high-specification bits for competitive resource extraction.

- North America: North America is characterized by high technological adoption and a strong focus on efficiency and automation, particularly in Canadian mining (gold, diamonds) and US quarrying operations. Demand here centers on specialized, premium-priced bits designed for specific geological challenges and compatibility with highly automated, large-fleet drilling rigs. The market is mature, focused on replacement parts and incremental performance improvements rather than overall volume growth.

- Europe: Europe exhibits moderate, stable growth, driven largely by quarrying, tunneling, and increasing investment in renewable energy projects, notably geothermal drilling in countries like Iceland and Turkey. European regulations mandate high safety and environmental standards, pushing manufacturers to develop bits that reduce noise and dust generation while maintaining efficiency, driving specialized product development.

- Latin America: This region's market dynamics are highly sensitive to global commodity prices, particularly copper (Chile, Peru) and iron ore (Brazil). Demand for DTH hammer bits is substantial but volatile, driven by capital expenditure cycles of major mining houses. Localized challenges, such as highly abrasive rock and remote operational sites, necessitate durable bits and robust supply chain logistics.

- Middle East and Africa (MEA): MEA represents a market with high future growth potential, driven by mineral exploration across Central and Southern Africa (gold, platinum, diamonds) and infrastructural development in the Gulf Cooperation Council (GCC) countries. The African segment requires robust, straightforward drilling technology that can withstand challenging logistics, while the Middle East demands specialized bits for foundation work in highly variable desert geology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the DTH Hammer Bits Market.- Sandvik AB

- Atlas Copco

- Epiroc AB

- Mincon Group PLC

- Rockmore International

- Numa Tool Company

- Drill King International

- Bulroc (UK) Ltd.

- Fordia Group (Wassara)

- Driconeq AB

- JVC Drill Solutions

- Mitsubishi Materials Corporation

- Furukawa Rock Drill Co., Ltd.

- Halco Drilling International

- Micon Products, Inc.

- Boart Longyear

- Robit Plc

- Zhongke Drilling Tools

- ProDrill

- Starockdrill

Frequently Asked Questions

Analyze common user questions about the DTH Hammer Bits market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor influencing the DTH hammer bit market growth?

The primary factor driving market growth is the global acceleration of infrastructure development and sustained capital expenditure in the mining sector, particularly for hard rock extraction and high-volume quarrying operations worldwide.

Which type of DTH hammer bit is most widely utilized?

Button bits are the most widely utilized type of DTH hammer bit, favored for their versatility, superior longevity, and high-impact energy transfer efficiency across a diverse range of geological conditions and operational requirements.

How does the volatility of tungsten carbide prices affect manufacturers?

Tungsten carbide is the critical raw material for the inserts; therefore, price volatility directly impacts manufacturing margins, procurement strategies, and the final pricing structure of high-performance DTH hammer bits globally.

Which application segment holds the largest share in the DTH hammer bit market?

The mining segment holds the largest market share, driven by constant demand for drilling blasting holes, pre-splitting, and exploration boreholes in major global mineral extraction projects (e.g., copper, iron ore, and coal).

What role does automation play in the future of DTH drilling technology?

Automation, enabled by advanced sensors and AI analytics, is pivotal in optimizing drilling parameters in real-time, leading to increased penetration rates, reduced non-productive time (NPT), and significantly extended operational life for DTH hammer bits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager