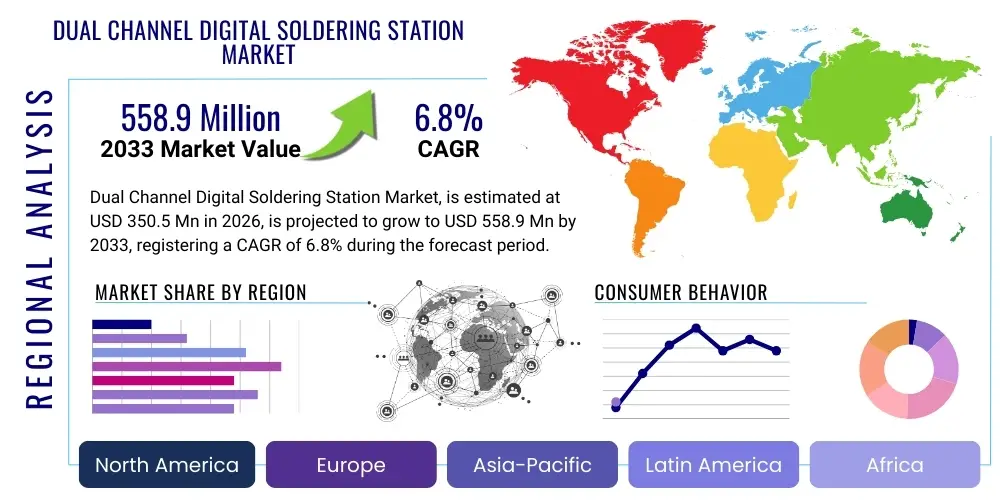

Dual Channel Digital Soldering Station Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437878 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dual Channel Digital Soldering Station Market Size

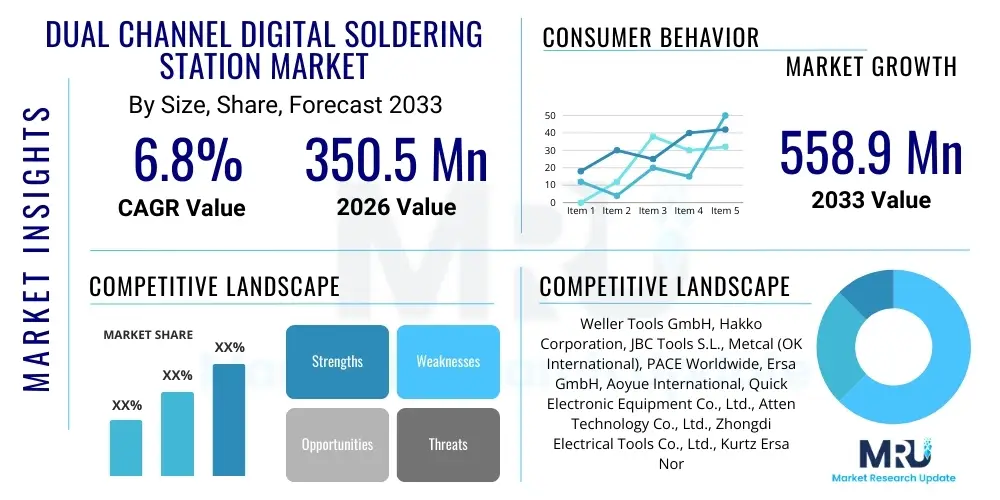

The Dual Channel Digital Soldering Station Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 558.9 Million by the end of the forecast period in 2033.

Dual Channel Digital Soldering Station Market introduction

The Dual Channel Digital Soldering Station Market encompasses specialized equipment designed for professional electronic assembly, rework, and repair, offering precise temperature control and simultaneous operation of two independent tools, typically a soldering iron and a hot air pencil or desoldering tweezers. These stations utilize advanced microprocessors and digital interfaces, enabling users to program specific temperature profiles, ensuring thermal efficiency and component protection during delicate soldering processes, particularly involving sensitive surface-mount devices (SMDs) and complex multilayer printed circuit boards (PCBs). The enhanced precision and flexibility offered by dual-channel systems are critical in high-reliability applications where consistent joint quality and rapid component exchange are non-negotiable requirements, driving their adoption across various high-tech manufacturing sectors.

The core product description revolves around its capacity to manage two separate heating elements concurrently, each with independent thermal settings and stabilization algorithms. Major applications span industrial manufacturing, particularly in aerospace and automotive electronics where component tolerance is extremely tight, and R&D prototyping labs demanding repeatable and verifiable soldering outcomes. Key benefits include improved throughput, reduced thermal stress on components due to highly stable temperature delivery, and enhanced safety features such as automatic standby and tip grounding. The integration of calibration functions further ensures compliance with stringent industry standards like ISO 9001 and J-STD-001, making them indispensable tools in professional environments.

Primary driving factors for market expansion include the miniaturization trend in consumer electronics, which necessitates highly precise soldering tools for micro-components, and the burgeoning demand for complex electronic control units (ECUs) in the electric vehicle (EV) industry. Furthermore, the proliferation of Internet of Things (IoT) devices and sophisticated telecommunication infrastructure mandates precise rework capabilities that only high-end digital stations can reliably provide. The continual advancements in thermal management technology, including inductive heating and rapid recovery systems, are also fueling the replacement cycle of older, less efficient analog equipment, pushing market growth globally.

Dual Channel Digital Soldering Station Market Executive Summary

The Dual Channel Digital Soldering Station market exhibits robust growth driven by accelerating digitalization in industrial automation and the complexity inherent in modern PCB designs. Business trends indicate a strong shift towards modular and customizable station platforms, allowing end-users to select and interchange various specialized tools (e.g., micro-soldering pencils, desoldering guns) onto a single control unit, optimizing capital expenditure and workspace efficiency. Competitive strategies focus heavily on incorporating sophisticated connectivity features, such as data logging via USB or Ethernet, enabling quality control tracking and ensuring process repeatability, which is highly valued in regulated industries like medical device manufacturing and aerospace maintenance. Manufacturers are also prioritizing energy efficiency and ergonomic design to meet contemporary sustainability and occupational health standards.

Regionally, the Asia Pacific (APAC) stands as the dominant market, propelled by its status as the global hub for electronics manufacturing (EMS providers) and the rapid expansion of semiconductor fabrication facilities, particularly in China, Taiwan, and South Korea. North America and Europe maintain significant market share, characterized by high adoption rates in specialized fields like military and defense electronics, where stringent reliability requirements justify investment in premium, high-performance equipment. The ongoing trade dynamics and geopolitical influences are prompting diversification of manufacturing bases, which concurrently drives demand for standardized, high-quality soldering equipment across emerging regions like Southeast Asia and Eastern Europe.

Segment trends reveal that the High Power Stations (>150W per channel) segment is experiencing accelerated growth, largely attributed to their necessity in handling complex, high thermal mass boards often found in power electronics and EV battery management systems. The application segment dominated by Industrial Manufacturing and R&D/Prototyping continues to lead, demanding superior temperature stability and fast thermal recovery. Furthermore, there is a distinct vertical trend favoring stations compatible with lead-free soldering processes, requiring higher operating temperatures and specialized tip materials, aligning with global environmental compliance mandates, thus necessitating advanced digital control capabilities for thermal precision.

AI Impact Analysis on Dual Channel Digital Soldering Station Market

Users frequently inquire whether Artificial Intelligence (AI) and Machine Learning (ML) integration will automate or enhance the precision soldering process traditionally performed by skilled technicians using dual-channel stations. Key concerns center on AI's ability to interpret complex thermal profiles, predict optimal solder joint formation parameters, and manage dynamic component placement variations in real-time. Users also seek information regarding how AI can streamline quality control (QC) by analyzing thermal data logs generated by digital stations to predict potential joint failures or identify calibration drift before it affects production yield. The overarching expectation is that AI will transform the Dual Channel Soldering Station from a manually operated tool into an intelligent, adaptive subsystem within the automated electronic assembly line, enhancing process consistency and dramatically reducing reliance on human operator subjective judgment regarding thermal application.

The integration of AI into the Dual Channel Digital Soldering Station ecosystem is primarily focused on process optimization and predictive maintenance. AI algorithms can analyze thousands of soldering cycles, correlating temperature settings, tip wear, power consumption fluctuations, and time-in-use data with final joint quality reports. This analysis allows the system to autonomously suggest adjustments to pre-set profiles to account for environmental factors, specific component types, or minor variations in board material, moving beyond simple PID control to achieve true adaptive thermal management. For instance, in complex rework scenarios, AI can dynamically adjust the heating ratio between the soldering iron and the hot air channel to minimize localized thermal stress.

Moreover, AI supports AEO goals by providing quantifiable data regarding process efficacy and operator performance. When queries arise about achieving specific J-STD standards, AI-driven feedback loops within the station software can instantly alert the operator to deviations, offering guided corrective actions. This intelligent monitoring capability significantly reduces the training curve for new technicians and ensures that even highly complex manual soldering tasks adhere to stringent, factory-level quality specifications. The future trajectory involves stations that not only record data but actively learn from successful and failed solder joints, continuously refining the thermal delivery mechanism to near-perfect repeatability, making the dual-channel station a smarter, more productive investment.

- AI-driven predictive thermal profiling based on component type and PCB thermal mass, minimizing heat damage.

- Machine learning algorithms enhancing self-calibration accuracy and detecting tip degradation proactively.

- Integration with vision systems for real-time solder joint quality assessment and automated process correction.

- Optimized energy usage through AI control, managing standby modes and power delivery based on anticipated task loads.

- Advanced data logging and analytics to ensure compliance and traceability across regulated industries.

DRO & Impact Forces Of Dual Channel Digital Soldering Station Market

The market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the exponential growth in global electronics production, particularly complex, high-density PCBs utilized in 5G infrastructure, data centers, and advanced driver-assistance systems (ADAS) in vehicles, demanding precision soldering tools. The mandatory global transition towards lead-free soldering necessitates stations capable of higher, precisely maintained operating temperatures and faster thermal recovery, favoring advanced digital dual-channel solutions over basic models. Conversely, restraints involve the high initial capital investment required for these premium digital stations compared to traditional single-channel or analog units, posing a barrier to entry for small-scale repair shops or educational institutions with limited budgets. Additionally, the complexity of maintaining and calibrating these sophisticated systems requires specialized technical training, which can be a limiting factor in some geographies.

Opportunities for growth are concentrated in the rapidly expanding rework and repair sector, driven by the sustainability movement and the increasing cost of complex electronic devices, making repair a cost-effective alternative to replacement. The emergence of micro-soldering for intricate tasks on smartphones and high-end graphics cards presents a highly specialized opportunity for dual-channel stations equipped with ultra-fine tips and micro-hot air tools. Furthermore, the push for Industry 4.0 integration creates opportunities for connectivity features, enabling centralized monitoring and control of multiple soldering stations within a smart factory environment, transforming soldering from an isolated task into a fully traceable step in the manufacturing execution system (MES).

The overall Impact Forces score is moderately positive, indicating that the prevailing drivers—specifically the technological complexity of modern electronics and compliance requirements—outweigh the restrictive factors such as high cost. The critical success factor for market participants is the continuous innovation in heating element technology and software integration, ensuring superior thermal performance and user-friendly operation. Geopolitical shifts, particularly regarding technology transfer and manufacturing localization, also exert significant force, creating regional hotspots of demand where new fabrication facilities are established, requiring immediate deployment of state-of-the-art dual-channel equipment to meet output and quality mandates.

Segmentation Analysis

The Dual Channel Digital Soldering Station market is rigorously segmented based on product specifications, power output, application environment, and the ultimate end-user industries they serve. Understanding these segments is crucial for market participants to tailor product offerings and strategic marketing efforts, ensuring that the specialized needs of sectors ranging from high-volume industrial assembly to intricate prototype development are met. The segmentation by power capacity—Low, Medium, and High Power—directly reflects the thermal mass and complexity of the components and PCBs being handled, influencing the station’s maximum sustained temperature and recovery time, which are key performance indicators for professional users.

The segmentation based on application highlights the primary use case, dividing the market into Industrial Manufacturing (characterized by high throughput and repeatability), R&D/Prototyping (requiring maximum flexibility and precision), Consumer Electronics Repair (focused on rework efficiency), and Hobbyist/Educational settings (value-conscious yet demanding digital control). End-user industry segmentation further refines the analysis, recognizing that sectors like Aerospace & Defense impose unique requirements regarding traceability, robustness, and compliance with military specifications (Mil-Spec), justifying the premium positioning of specific high-reliability dual-channel models tailored for those environments.

Detailed analysis of these segments confirms that the Industrial Manufacturing segment commands the largest market share due to the scale of global electronics production, while the High Power segment is anticipated to exhibit the fastest growth CAGR, correlating directly with the increased complexity and thermal demands of advanced power electronics used in emerging technologies. This nuanced segmentation allows manufacturers to focus R&D investment on areas promising the highest returns, such as developing specialized micro-soldering tools for the medical device sector or extremely robust stations for automotive electronics subjected to harsh operating conditions.

- By Type:

- High Power Stations (>150W per channel)

- Medium Power Stations (80W to 150W per channel)

- Low Power Stations (<80W per channel)

- By Application:

- Industrial Manufacturing and Mass Assembly

- R&D and Prototyping Laboratories

- Consumer Electronics Repair and Rework

- Educational and Vocational Training Centers

- By End-User Industry:

- Aerospace and Defense

- Automotive Electronics (Including EV/HEV)

- Telecommunications and Networking (5G Infrastructure)

- Medical Devices and Instrumentation

- General Electronics and Contract Manufacturing

Value Chain Analysis For Dual Channel Digital Soldering Station Market

The value chain for Dual Channel Digital Soldering Stations begins upstream with the procurement of highly specialized raw materials, primarily focusing on advanced heating element technologies, precision sensors, high-grade control circuitry (microcontrollers and digital signal processors), and durable, heat-resistant housing materials. Upstream analysis focuses on ensuring stable supply chains for ceramic heating cores, specialized thermocouple sensors, and proprietary iron alloys used in soldering tips, which directly affect the station's performance and longevity. Key challenges upstream include managing the costs of specialized, high-purity metals required for lead-free compatible tips and ensuring regulatory compliance concerning restricted substances, such as those governed by RoHS directives, requiring close collaboration with specialized component suppliers.

The core manufacturing and assembly stage involves integrating the dual control units, sophisticated power management systems, and the ergonomic design of the handpieces. Manufacturers often employ high-precision robotics for PCB assembly within the control unit to ensure reliability and temperature accuracy. The downstream component of the value chain involves effective distribution channels, segmented primarily into direct sales to large industrial customers (e.g., major EMS providers, defense contractors) and indirect distribution through specialized electronics tool distributors and e-commerce platforms servicing smaller R&D labs and repair centers. Direct channels facilitate technical support and customization for large-volume orders, ensuring integration into established production lines.

Indirect distribution relies heavily on well-established technical resellers who provide local inventory, basic technical training, and after-sales service, broadening market penetration, particularly in emerging economies. The choice of channel is dictated by the complexity of the product and the required level of customer support. Stations sold directly typically include comprehensive maintenance contracts and proprietary software integration, while those sold indirectly prioritize availability and competitive pricing. The efficiency of the distribution network, coupled with robust customer support for calibration and troubleshooting, significantly impacts brand loyalty and market success in this precision tool segment.

Dual Channel Digital Soldering Station Market Potential Customers

The primary potential customers and end-users of Dual Channel Digital Soldering Stations are entities requiring high-precision, repeatable, and simultaneous thermal application for electronic assembly and rework, prioritizing quality control and operational efficiency. The largest segment comprises Contract Electronics Manufacturers (CEMs) and Electronic Manufacturing Services (EMS) providers globally. These large-scale operators utilize dual-channel stations for both prototype verification before mass production and complex, high-reliability rework tasks on boards that have failed initial inspection, where replacing the entire assembly is cost-prohibitive. Their purchasing decisions are driven by Mean Time Between Failure (MTBF), calibration stability, and the ability to interface with Manufacturing Execution Systems (MES) for traceability.

Another crucial customer base is found within Original Equipment Manufacturers (OEMs) specializing in high-value, high-reliability electronics, such as aerospace, automotive, and medical device companies. For these customers, the dual-channel station is essential for mission-critical applications where failure is unacceptable. Automotive electronics engineers, for example, require precise thermal control for soldering components subject to high vibration and extreme temperatures, often utilizing one channel for standardized soldering and the second for precise component pre-heating or integrated hot-air removal. Quality assurance laboratories and specialized repair depots also represent significant buyers, valuing the station's ability to maintain certification standards.

Beyond the core industrial sector, the professional repair market, including independent repair shops specializing in micro-soldering of consumer devices (laptops, gaming consoles, mobile phones), constitutes a growing customer segment. Although these buyers are often more price-sensitive than major industrial players, their need for simultaneous micro-soldering and desoldering capabilities for multi-component chip repair drives demand for mid-range, flexible dual-channel units. Additionally, academic institutions and specialized vocational training centers purchase these stations to train the next generation of electronics technicians on industry-standard, sophisticated equipment, ensuring a long-term pipeline of demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 558.9 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weller Tools GmbH, Hakko Corporation, JBC Tools S.L., Metcal (OK International), PACE Worldwide, Ersa GmbH, Aoyue International, Quick Electronic Equipment Co., Ltd., Atten Technology Co., Ltd., Zhongdi Electrical Tools Co., Ltd., Kurtz Ersa North America, Circuit Specialists, SRA Soldering Products, X-Tronic, Thermaltronics, Velleman, Black & Decker, Apollo Seiko, Solder-Pro, Apex Tool Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dual Channel Digital Soldering Station Market Key Technology Landscape

The Dual Channel Digital Soldering Station market is characterized by intense technological competition focused on maximizing thermal efficiency, ensuring temperature stability, and enhancing user interface capabilities. A pivotal technological advancement is the widespread adoption of high-frequency inductive heating technology, replacing older resistance heating methods. Inductive heating allows for extremely rapid heat-up times and near-instantaneous thermal recovery upon contact with a thermal load, crucial for maintaining tip temperature consistency during demanding applications, particularly with high thermal mass PCBs or lead-free solders that require higher melting points. This technology is essential for dual-channel systems to simultaneously support diverse thermal demands across both active tools without performance degradation.

Another crucial element of the technological landscape is the development of sophisticated digital control algorithms, moving beyond standard Proportional-Integral-Derivative (PID) control to proprietary algorithms that anticipate thermal demands based on operator usage patterns and component profiles. These advanced controllers, often powered by dedicated microprocessors, allow the station to precisely manage the power distribution between the two channels, ensuring optimal performance from both the soldering iron and the auxiliary tool (e.g., desoldering pencil or hot air station). Furthermore, the integration of advanced sensor technology, typically embedded within the soldering tip (sensor-in-tip design), provides immediate, accurate temperature readings directly at the point of contact, drastically reducing temperature overshoot and undershoot.

The market is also witnessing a significant push towards connectivity and modularity, aligning with Industry 4.0 principles. Modern stations feature USB and sometimes Ethernet connectivity for firmware updates, profile management, and data logging, allowing manufacturers to maintain detailed records of soldering performance for quality control and compliance audits, especially in aerospace and medical sectors. The modular design trend ensures that a single control unit can accommodate a wide array of specialized tools—from micro-tweezers for tiny chip components to high-flow desoldering guns for through-hole technology—maximizing the versatility and future-proofing the investment for professional users. The continuous evolution of ergonomic, lightweight handpieces incorporating these high-power heating elements also contributes significantly to reducing operator fatigue and improving precision.

Regional Highlights

The global Dual Channel Digital Soldering Station market exhibits varied growth dynamics and adoption patterns across key geographical regions, dictated largely by regional electronic manufacturing capabilities, regulatory frameworks, and technological maturity.

Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by its unparalleled scale in electronics manufacturing services (EMS) and semiconductor production, particularly in China, Japan, South Korea, Taiwan, and increasingly, Vietnam and India. The region's robust industrial base necessitates continuous investment in high-throughput, high-reliability dual-channel stations to meet global demand for consumer electronics, automotive components, and telecom equipment. Government initiatives supporting local electronics manufacturing and the rapid expansion of research and development facilities further cement APAC’s dominant position.

North America: North America represents a mature, high-value market, characterized by strong demand from specialized sectors such as defense, aerospace, and high-end medical device manufacturing. Adoption is driven by stringent quality standards (e.g., MIL-SPEC compliance) and the need for advanced traceability features integrated into the soldering stations. Innovation adoption is high, with customers prioritizing stations featuring advanced inductive heating and superior digital control systems, often justifying higher acquisition costs for superior performance and reduced risk of component damage during rework.

Europe: Europe is a substantial market focused on high-quality industrial automation, automotive electronics, and specialized industrial machinery. Demand is strongly influenced by environmental regulations (such as RoHS and REACH), pushing companies towards advanced dual-channel stations optimized for efficient, reliable lead-free soldering processes. Countries like Germany and the Scandinavian nations emphasize ergonomic design and robust connectivity for integrating equipment into standardized factory floors, supporting localized high-value manufacturing and precision engineering.

Latin America and Middle East & Africa (MEA): These regions are emerging markets with moderate growth potential. Demand is driven by local electronics assembly operations, telecommunications infrastructure build-out, and maintenance and repair centers. While price sensitivity is generally higher compared to developed markets, the increasing complexity of imported electronic goods mandates the use of professional, reliable dual-channel equipment for local repair and maintenance, particularly in the oil and gas sector (MEA) and automotive sector (LATAM).

- China: Primary manufacturing hub driving massive industrial demand and technological adoption.

- United States: Focus on high-reliability, defense, and aerospace applications requiring certified equipment and advanced data logging.

- Germany: Key European market emphasizing compliance with environmental standards and industrial automation integration (Industry 4.0).

- South Korea and Taiwan: Strong demand fueled by semiconductor fabrication and R&D activities related to advanced consumer electronics.

- Mexico and Brazil: Growing centers for automotive and contract manufacturing, increasing the need for professional, traceable soldering solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dual Channel Digital Soldering Station Market.- Weller Tools GmbH

- Hakko Corporation

- JBC Tools S.L.

- Metcal (OK International)

- PACE Worldwide

- Ersa GmbH

- Aoyue International

- Quick Electronic Equipment Co., Ltd.

- Atten Technology Co., Ltd.

- Zhongdi Electrical Tools Co., Ltd.

- Kurtz Ersa North America

- Circuit Specialists

- SRA Soldering Products

- X-Tronic

- Thermaltronics

- Velleman

- Black & Decker

- Apollo Seiko

- Solder-Pro

- Apex Tool Group

Frequently Asked Questions

Analyze common user questions about the Dual Channel Digital Soldering Station market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of a dual channel digital soldering station over single channel models?

The primary advantage of a dual channel station is its capability to simultaneously operate two specialized tools, such as a soldering iron and desoldering tweezers or a hot air pencil, each with independent, digitally controlled temperature settings. This drastically improves workflow efficiency and precision during complex rework tasks involving multiple component types or demanding diverse thermal application techniques, essential for modern high-density PCBs.

How does the Dual Channel Digital Soldering Station market support the transition to lead-free soldering?

Lead-free solders require higher operating temperatures and highly stable thermal delivery. Dual Channel Digital Soldering Stations utilize advanced technologies like high-frequency inductive heating and sophisticated PID control to achieve faster thermal recovery and maintain the precise, elevated temperatures necessary for reliable lead-free joint formation, ensuring compliance with global environmental directives such as RoHS.

Which technical specifications are most critical when selecting a high-end dual channel unit for industrial use?

For industrial applications, the most critical specifications are high power output (typically >150W per channel) for handling high thermal mass, rapid thermal recovery rate, tip-to-ground resistance (must be low for ESD safety), calibration accuracy, and connectivity features (USB/Ethernet) for data logging and traceability, which are vital for quality control and process repeatability compliance.

How is Industry 4.0 influencing the design and adoption of these soldering stations?

Industry 4.0 drives the need for connectivity and smart integration. Modern dual channel stations are equipped with digital interfaces that allow them to communicate data (temperature logs, usage patterns, calibration records) with Manufacturing Execution Systems (MES) and centralized factory monitoring software, enabling predictive maintenance, automated quality assurance, and enhanced process control across the entire assembly line.

What is the market growth outlook for Dual Channel Digital Soldering Stations in the Automotive Electronics sector?

The Automotive Electronics sector, particularly driven by the rapid growth of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS), shows a highly positive market outlook. These applications require extremely robust and reliable electronic components, necessitating high-precision rework and assembly capabilities provided by high-power, certified dual-channel stations to ensure component longevity and operational safety under harsh conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager