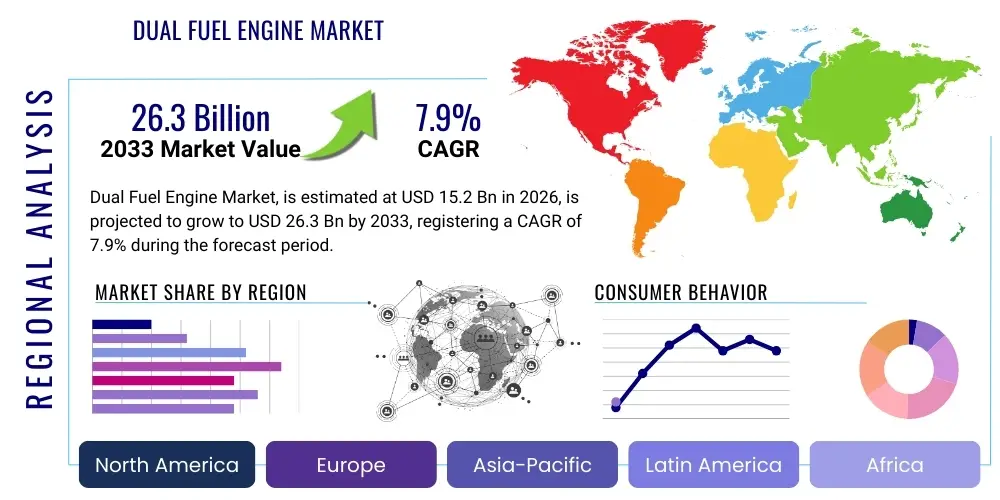

Dual Fuel Engine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439148 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dual Fuel Engine Market Size

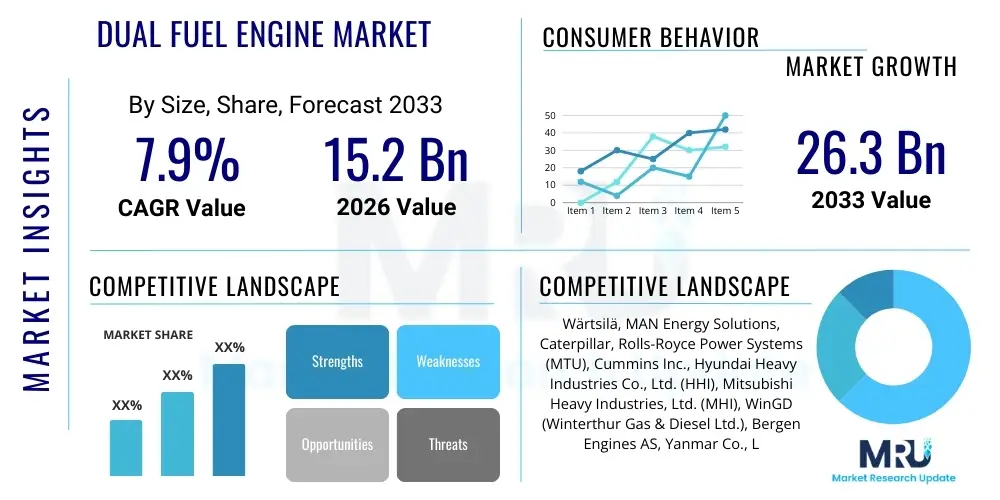

The Dual Fuel Engine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 26.3 Billion by the end of the forecast period in 2033. This significant expansion is primarily driven by rigorous international maritime emissions regulations and the increasing global adoption of Liquefied Natural Gas (LNG) as a transitional marine fuel, offering substantial reductions in sulfur oxides (SOx) and particulate matter emissions compared to traditional heavy fuel oil (HFO) or marine gas oil (MGO).

Dual Fuel Engine Market introduction

The Dual Fuel Engine Market encompasses internal combustion engines designed to operate primarily on two distinct fuel sources simultaneously or interchangeably, most commonly utilizing natural gas (methane) in combination with a small amount of pilot fuel (typically diesel or MGO) for ignition. These sophisticated power solutions are crucial in high-power applications such as marine propulsion, stationary power generation, and specialized locomotive operations, offering unparalleled flexibility in fuel sourcing and compliance with stringent environmental standards. The engines leverage the high energy density of gas while retaining the reliability and performance characteristics of diesel combustion, ensuring operational robustness across varied environments and load conditions.

Dual fuel technology enables operators to switch seamlessly between gas mode, which significantly lowers carbon emissions and virtually eliminates SOx, and liquid fuel mode, providing essential redundancy, especially in remote areas or during volatile fuel market conditions. Major applications include LNG carriers, cruise ships, container vessels, and grid-connected decentralized power plants. The product description emphasizes high thermal efficiency, low maintenance requirements, and the fundamental benefit of achieving compliance with the International Maritime Organization (IMO) Tier III nitrogen oxide (NOx) limits without the need for extensive exhaust gas after-treatment systems like Selective Catalytic Reduction (SCR) when operating in gas mode.

The market is primarily driven by global decarbonization goals, amplified by the escalating price volatility of traditional bunker fuels and substantial government incentives promoting cleaner energy infrastructure. The benefits extend beyond regulatory compliance to operational cost savings due to the favorable pricing structure and reliable supply chain development for LNG. Furthermore, the inherent design flexibility prepares these engines for future fuel transitions, including the potential integration of synthetic methane, bio-LNG, or ammonia, securing long-term viability for major industry stakeholders in shipping and energy generation sectors.

Dual Fuel Engine Market Executive Summary

The Dual Fuel Engine Market is witnessing robust expansion, characterized by a fundamental shift toward sustainable propulsion and power solutions driven by global regulatory mandates and business trends favoring lower operational expenditure. Current business trends indicate heavy investment in the marine sector, particularly for new builds of large vessels like ultra-large container ships and LNG tankers, where dual fuel technology is becoming the standard rather than the exception. Furthermore, manufacturers are increasingly focusing on developing medium-speed and low-speed engines capable of utilizing alternative fuels like methanol and ammonia alongside gas, diversifying the market beyond conventional LNG compatibility.

Regionally, the market is highly dynamic. Asia Pacific (APAC), particularly China, South Korea, and Japan, dominates engine manufacturing and shipbuilding, making it the central hub for demand and supply. Europe is a significant consumer, driven by stringent EU environmental policies and extensive port infrastructure development supporting LNG bunkering, especially in the North Sea and the Mediterranean. North America exhibits strong growth in stationary power generation, where natural gas availability is abundant, and dual fuel solutions provide crucial resilience against grid intermittency. The strategic focus across all regions remains on balancing capital expenditure with long-term fuel flexibility and emissions reduction capabilities.

Segment trends highlight the dominance of medium-speed engines, favoured for their balance of power output and physical footprint, making them suitable for diverse marine and decentralized power applications. The rapid development of LNG bunkering infrastructure globally has accelerated the adoption rate within the shipping segment. Technological innovation is centered on optimizing combustion processes for higher efficiency in gas mode, managing methane slip—the emission of uncombusted methane, a potent greenhouse gas—and ensuring seamless transition capabilities between fuels. These advancements are crucial for sustained market growth and meeting evolving climate targets.

AI Impact Analysis on Dual Fuel Engine Market

Common user questions regarding AI’s impact on the Dual Fuel Engine Market center on how artificial intelligence can address core operational challenges, particularly maximizing fuel efficiency, minimizing methane slip, and improving long-term engine reliability. Users are interested in AI's role in optimizing the complex combustion dynamics inherent in dual fuel systems, where factors like pilot fuel quantity, timing, and gas quality fluctuate. Key themes include the integration of predictive maintenance systems that use machine learning to forecast component failures, thereby reducing downtime, and the application of cognitive control systems that dynamically adjust engine parameters in real-time to maintain optimal performance and environmental compliance under varying operational loads and ambient conditions. Expectations are high that AI will be the key differentiator in reducing total cost of ownership (TCO) and achieving unprecedented levels of thermal efficiency.

- AI-driven optimization of combustion timing and air-fuel ratio, resulting in reduced fuel consumption and minimized methane slip across variable loads.

- Implementation of predictive maintenance algorithms using real-time sensor data (vibration, temperature, pressure) to anticipate component failure and schedule preventative interventions.

- Enhanced diagnostics and fault isolation capabilities, drastically shortening repair times and improving engine availability in remote maritime environments.

- Development of autonomous engine control systems that adapt to varying gas quality (e.g., varying Wobbe Index) and ensure stable performance during fuel switching operations.

- Simulation and digital twinning of engine performance, accelerating the design and testing phases for next-generation dual fuel technologies and alternative fuel adoption.

DRO & Impact Forces Of Dual Fuel Engine Market

The Dual Fuel Engine Market is shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively form the impact forces steering its evolution and adoption trajectory. Key drivers include stringent international regulatory mandates, such as the IMO 2020 sulfur cap and the IMO GHG strategy aiming for a 50% reduction in greenhouse gas emissions by 2050, which fundamentally necessitate the adoption of cleaner engine technologies. Additionally, the economic attractiveness of natural gas over HFO, coupled with substantial governmental and private sector investment in LNG bunkering infrastructure globally, provides a robust economic impetus for market growth, ensuring fuel availability and price stability.

However, market expansion faces notable restraints. The primary impediment is the significantly higher initial capital expenditure required for dual fuel engines and the associated fuel handling systems (cryogenic tanks, gas supply systems) compared to conventional diesel engines. Furthermore, concerns over methane slip—the leakage of uncombusted methane, a greenhouse gas significantly more potent than CO2 in the short term—pose a technological and environmental challenge that manufacturers must continuously address through advanced combustion optimization techniques. Operational complexity, requiring specialized crew training for gas handling and safety protocols, also presents a logistical restraint, particularly in developing regions.

Opportunities in the market are abundant, centered largely on the rapid development and commercialization of engines capable of using future sustainable fuels like bio-LNG, synthetic natural gas (SNG), methanol, and ammonia. This technological foresight positions dual fuel platforms as 'future-proof' solutions, allowing operators to transition smoothly as renewable fuel production scales up. Moreover, the expanding application scope beyond traditional marine use into high-power segments like large-scale mining trucks and railroad locomotives offers new avenues for market penetration. The increasing demand for resilient, localized power generation capacity, especially in areas prioritizing clean energy transition, further solidifies the long-term opportunity landscape for dual fuel technologies.

Segmentation Analysis

The Dual Fuel Engine Market is broadly segmented based on Fuel Type, Application, and Engine Type, reflecting the diverse industrial requirements and technological differentiation within the sector. Understanding these segments is crucial for strategic market positioning, as each segment is influenced by unique regulatory frameworks and operational priorities. For instance, the choice of fuel type is often dictated by regional availability and specific emission mandates, while the engine type (speed class) relates directly to the size and functional requirements of the vessel or power plant. This complex segmentation allows engine manufacturers to tailor solutions precisely to customer needs, whether focusing on maximum power output for large container ships or high efficiency for base-load power generation.

The Fuel Type segment is predominantly driven by the Diesel/LNG combination, which currently holds the largest market share due to the established supply chain of LNG and its proven effectiveness in reducing SOx and particulate matter emissions. However, the Diesel/Methanol and emerging Diesel/Ammonia segments are rapidly gaining traction, particularly in niches where logistics or toxicity considerations favor these alternatives. For example, methanol, being liquid at ambient temperatures, simplifies onboard storage, making it attractive for smaller vessels or ferry operations. The development of multi-fuel platforms that can handle three or more fuel types interchangeably represents the cutting edge of technological evolution in this segment, offering maximum flexibility to fleet owners navigating uncertain future fuel landscapes.

The Application segmentation underscores the dominance of the Marine sector, which accounts for the vast majority of dual fuel engine installations, particularly in new ship construction driven by global trade and strict environmental regulations (IMO Tier III compliance). The Power Generation segment, while smaller, is growing steadily, primarily in decentralized plants and industrial co-generation facilities seeking reliable, low-emission power solutions. Within Power Generation, dual fuel engines serve vital roles as peaker plants and reliable base load generators, especially where natural gas pipeline access is secure but liquid fuel backup is required for redundancy. The expanding use in specialized Off-highway and Locomotive applications further diversifies the revenue streams, indicating a mature technology capable of adapting to various heavy-duty operational demands.

- Fuel Type:

- Diesel/LNG

- Diesel/MGO

- Diesel/Methanol

- Diesel/Ammonia (Emerging)

- Application:

- Marine (LNG Carriers, Cruise Ships, Tankers, Container Vessels)

- Power Generation (Base Load, Peak Shaving, Industrial)

- Locomotive

- Off-highway/Mining

- Engine Type:

- Low-speed Dual Fuel Engines (Primarily marine propulsion)

- Medium-speed Dual Fuel Engines (Marine propulsion and power generation)

- High-speed Dual Fuel Engines (Power generation, auxiliary, and smaller applications)

Value Chain Analysis For Dual Fuel Engine Market

The value chain of the Dual Fuel Engine Market begins with complex upstream activities, involving the sourcing of specialized raw materials such as high-strength alloys for engine blocks and high-precision components required for advanced injection and gas handling systems. Key upstream participants include specialized metal suppliers, sophisticated sensor manufacturers, and control system software developers. Engine manufacturers often engage in vertical integration or strategic partnerships to secure the supply of proprietary components like high-pressure pumps and cryostats, which are essential for reliable gas operation. Research and development activities, focusing heavily on materials science and advanced thermodynamics to manage high combustion temperatures and pressures, constitute a significant portion of upstream investment, determining the engine's final performance characteristics and emissions profile.

Midstream processes center on the core manufacturing, assembly, and rigorous testing of the dual fuel engines. This stage is dominated by a few global conglomerates (OEMs) who possess the necessary engineering expertise and large-scale manufacturing capacity. Following manufacturing, the engines are distributed through complex channels. For the marine sector, the distribution is often direct to major shipyards (South Korea, China, Japan) as part of large vessel construction contracts, requiring close collaboration between the engine supplier, the shipyard, and the vessel owner from the design phase onwards. For stationary power generation, indirect distribution through specialized EPC (Engineering, Procurement, and Construction) firms and regional distributors is more common, leveraging their local installation and maintenance expertise.

Downstream activities involve installation, commissioning, operation, and maintenance (O&M) services. The high complexity of dual fuel systems mandates specialized after-sales service, which is a major profit center for OEMs. Direct service provision, including long-term maintenance contracts, digital monitoring, and spare parts supply, ensures optimal engine performance and compliance. Indirect downstream channels include authorized service partners who provide localized support, training, and troubleshooting, essential for global fleets. The fuel supply infrastructure—LNG bunkering operations and gas supply networks—forms a critical parallel downstream element, directly impacting the operational viability and geographic constraints of the dual fuel engine user base.

Dual Fuel Engine Market Potential Customers

The primary consumers and end-users of Dual Fuel Engine technology are large-scale operators within the global maritime and energy sectors who face significant regulatory pressure to decarbonize while maintaining operational efficiency and reliability. The largest segment of potential customers comprises international shipping companies, including owners and operators of LNG carriers, which utilize dual fuel technology for both propulsion and cargo management (boil-off gas utilization); cruise lines, which prioritize low emissions in environmentally sensitive zones; and major container ship operators investing in green fleets to meet EEXI and CII metrics. These customers are driven by a need for long-term fuel flexibility and immediate compliance with IMO regulations, viewing the high initial investment as a hedge against future carbon taxes and volatile fuel prices.

Another critical customer segment is the decentralized and utility-scale power generation industry. This includes independent power producers (IPPs), state-owned utilities, and large industrial facilities (e.g., petrochemical plants, mining operations) that require reliable base load power or peak shaving capacity. These buyers favor dual fuel engines because they provide crucial operational resilience, allowing immediate switchover to liquid fuel backup during natural gas supply interruptions or price spikes. Customers in this segment are often situated in regions with developing gas infrastructure or where environmental permitting requires the use of cleaner-burning fuels, making the fuel flexibility of dual fuel systems a deciding factor in procurement.

Niche but high-value customers exist within the heavy off-highway and specialty vessel sectors. This includes operators of large mining equipment and high-power locomotive fleets, particularly in regions where environmental protection demands the shift away from high-sulfur diesel. Furthermore, governments and military organizations are increasingly exploring dual fuel solutions for naval vessels and coast guard fleets to enhance energy security, reduce logistics complexity, and demonstrate environmental stewardship. The increasing adoption of smaller dual-fuel gensets in offshore oil and gas platforms for cleaner, localized power further expands the target audience, all of whom prioritize performance, safety, and minimized environmental footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 26.3 Billion |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wärtsilä, MAN Energy Solutions, Caterpillar, Rolls-Royce Power Systems (MTU), Cummins Inc., Hyundai Heavy Industries Co., Ltd. (HHI), Mitsubishi Heavy Industries, Ltd. (MHI), WinGD (Winterthur Gas & Diesel Ltd.), Bergen Engines AS, Yanmar Co., Ltd., Niigata Power Systems Co., Ltd., General Electric (GE), Kawasaki Heavy Industries, Ltd., Scania AB, Deutz AG, Volvo Penta, Anglo Belgian Corporation (ABC), Daihatsu Diesel Mfg. Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dual Fuel Engine Market Key Technology Landscape

The technological landscape of the Dual Fuel Engine Market is defined by sophisticated advancements aimed at maximizing combustion efficiency, minimizing harmful emissions, and ensuring reliable operation under variable fuel conditions. The core technology revolves around two primary system designs: High-Pressure Direct Injection (HPDI) and Low-Pressure Injection (LPI). HPDI systems, championed by companies like Westport Fuel Systems and integrated into key OEM offerings, inject gaseous fuel at extremely high pressures (up to 300 bar) toward the end of the compression stroke, mirroring diesel injection dynamics. This technique maximizes volumetric efficiency and drastically reduces methane slip because the gas does not enter the cylinder prematurely, leading to very low GHG emissions in gas mode, a crucial feature driving adoption in the high-power segment.

Conversely, Low-Pressure Injection systems mix the gas and air before compression (port injection or low-pressure direct injection). While simpler and often utilizing spark ignition or a smaller pilot diesel injection (typically less than 1% of total energy), LPI systems require careful tuning to manage the trade-off between power density and methane slip. Recent technological breakthroughs in LPI systems include advanced Miller timing and exhaust gas recirculation (EGR) to lower combustion temperatures and pressures, thereby mitigating the risk of knocking and improving thermal efficiency. The continuous refinement of control algorithms, often leveraging AI and real-time engine mapping, is essential for both HPDI and LPI systems to optimize performance across the operational envelope, ensuring seamless and safe switching between the two fuel types.

Beyond the fundamental injection mechanism, ancillary technologies play a vital role in market differentiation. These include advanced cryogenic fuel storage and handling systems, specialized components designed to manage the extreme cold temperatures of LNG, and sophisticated safety management systems compliant with the IMO's IGF Code (International Code of Safety for Ships using Gases or other Low-flashpoint Fuels). Furthermore, the integration of digital twinning and cloud-based performance monitoring allows operators to remotely track fuel consumption, emissions, and predictive maintenance alerts. The industry is also witnessing significant R&D in developing materials and internal coatings robust enough to handle the corrosive properties of emerging fuels like ammonia, preparing the current dual fuel platforms for the next wave of sustainable energy transitions.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, regulation, and technological adoption within the Dual Fuel Engine Market, reflecting varied levels of infrastructure development and environmental policy stringency across the globe. Asia Pacific (APAC) currently holds the dominant market share, primarily driven by its undisputed leadership in global shipbuilding. Countries like South Korea (HHI, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering) and China possess the largest manufacturing capacity for large LNG carriers and container ships, where dual fuel engines are essential components. The significant expansion of domestic gas networks and increasing energy demand in industrialized nations like China and India further stimulates the stationary power generation segment, where dual fuel engines offer rapid deployment and flexible operation. Regulatory pushes in Japan and South Korea to decarbonize their fleets also underpin the consistent high demand for these cleaner solutions, making APAC the primary engine of global market growth and innovation.

Europe represents a highly mature but rapidly evolving market, characterized by stringent environmental regulations enforced by the European Union and regional bodies like the IMO. The EU’s Green Deal and FuelEU Maritime initiatives are accelerating the retirement of older, non-compliant fleets and mandates the adoption of low-carbon fuels, making dual fuel technology highly attractive. Scandinavian countries and key maritime nations (Germany, Netherlands, France) have heavily invested in developing comprehensive LNG and future fuel bunkering infrastructure across major ports. Demand in Europe is primarily focused on retrofitting existing vessels and equipping specialized segments such as cruise ships, ferries operating in sensitive coastal areas, and high-performance vessels requiring immediate environmental compliance. The European market leads in the adoption of alternative dual-fuel combinations, including methanol, driven by strong regulatory incentives and a proactive approach to long-term sustainability.

North America demonstrates stable growth, concentrated primarily in stationary power generation and localized marine applications. The abundance of relatively low-cost natural gas, particularly in the United States, makes dual fuel engines economically compelling for industrial power, oil and gas operations, and utility peak shaving facilities. While the marine sector is smaller compared to APAC, regulatory requirements set by the US Environmental Protection Agency (EPA) in Emission Control Areas (ECAs) along the coasts drive the transition to cleaner technologies for vessels trading domestically. Furthermore, the use of dual fuel technology in niche applications like high-horsepower rail locomotives operating across large interstate networks is a distinctive feature of the North American market, seeking emissions reductions without sacrificing payload capacity or reliability. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is highly dependent on developing localized gas infrastructure and utilizing dual fuel engines for crucial base-load power generation in rapidly industrializing economies or remote locations lacking stable grid access.

- Asia Pacific (APAC): Dominates the market due to world-leading shipbuilding capabilities (South Korea, China) and massive domestic energy demand, driving both marine and stationary power adoption.

- Europe: Driven by stringent environmental policies (EU Green Deal) and extensive LNG bunkering networks, focusing on high-value vessels and leadership in alternative fuel (Methanol, Ammonia) dual fuel adoption.

- North America: Strong market presence in stationary power generation and specialized locomotive applications, benefiting from abundant and inexpensive domestic natural gas supplies, complying with EPA regulations in coastal areas.

- Middle East and Africa (MEA): Emerging growth potential, concentrated on utilizing local gas reserves for power generation and improving energy security, with increasing interest from regional maritime hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dual Fuel Engine Market.- Wärtsilä

- MAN Energy Solutions

- Caterpillar

- Rolls-Royce Power Systems (MTU)

- Cummins Inc.

- Hyundai Heavy Industries Co., Ltd. (HHI)

- Mitsubishi Heavy Industries, Ltd. (MHI)

- WinGD (Winterthur Gas & Diesel Ltd.)

- Bergen Engines AS

- Yanmar Co., Ltd.

- Niigata Power Systems Co., Ltd.

- General Electric (GE)

- Kawasaki Heavy Industries, Ltd.

- Scania AB

- Deutz AG

- Volvo Penta

- Anglo Belgian Corporation (ABC)

- Daihatsu Diesel Mfg. Co., Ltd.

- Doosan Engine Co., Ltd.

- IHI Corporation

Frequently Asked Questions

Analyze common user questions about the Dual Fuel Engine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using dual fuel engines over conventional diesel engines?

Dual fuel engines offer significant advantages in regulatory compliance and operational flexibility. They allow vessels and power plants to switch between liquid fuel and cleaner natural gas (LNG), drastically reducing sulfur oxides (SOx) and particulate matter (PM), and meeting strict IMO Tier III NOx limits without extensive exhaust treatment, while maintaining essential fuel redundancy.

How does dual fuel technology address the challenge of methane slip?

Methane slip, the release of uncombusted methane, is mitigated through advanced technologies like High-Pressure Direct Injection (HPDI) and optimized Low-Pressure Injection combustion strategies. Manufacturers employ sophisticated electronic control units and real-time mapping to precisely manage pilot fuel injection and gas timing, ensuring near-complete combustion of the gas fuel.

What is the economic impact of the high initial cost of dual fuel engines?

While the initial capital expenditure (CAPEX) for dual fuel engines is higher than conventional engines due to complex fuel storage (cryogenic tanks) and injection systems, this cost is often offset over the engine's lifespan by lower operating expenses (OPEX), primarily through the lower price and favorable tax treatment of LNG compared to heavy fuel oil (HFO).

Which market segment dominates the global demand for dual fuel engines?

The Marine Application segment overwhelmingly dominates global demand. This is driven by large new-build vessel orders, particularly for LNG carriers, cruise ships, and major container vessels, all required to meet increasingly severe international environmental regulations regarding emissions.

Are dual fuel engines capable of operating on future low-carbon fuels like ammonia or methanol?

Yes, many dual fuel engine platforms are designed to be adaptable or are currently being adapted to handle emerging low-carbon fuels such as methanol and ammonia, often requiring only modification of the fuel supply and injection systems. This technological flexibility ensures long-term asset security and readiness for the industry's ultimate decarbonization goals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager