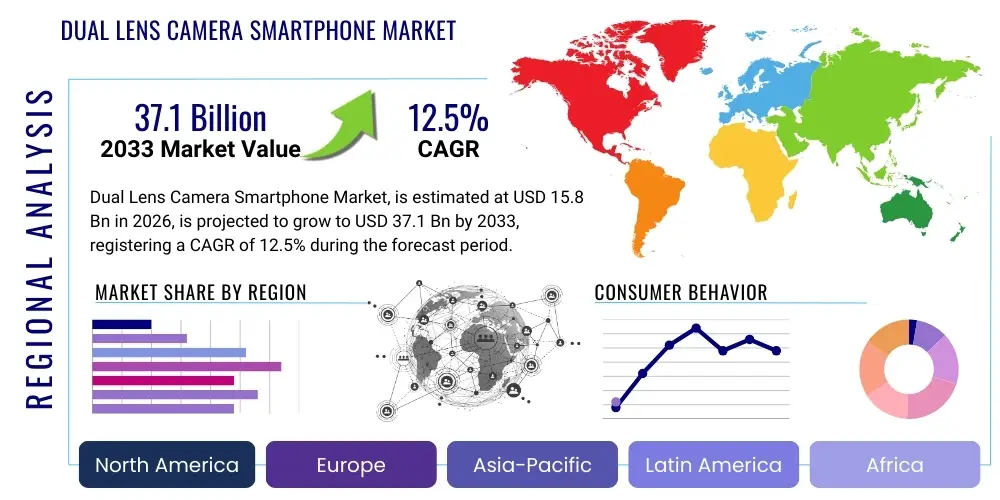

Dual Lens Camera Smartphone Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435570 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Dual Lens Camera Smartphone Market Size

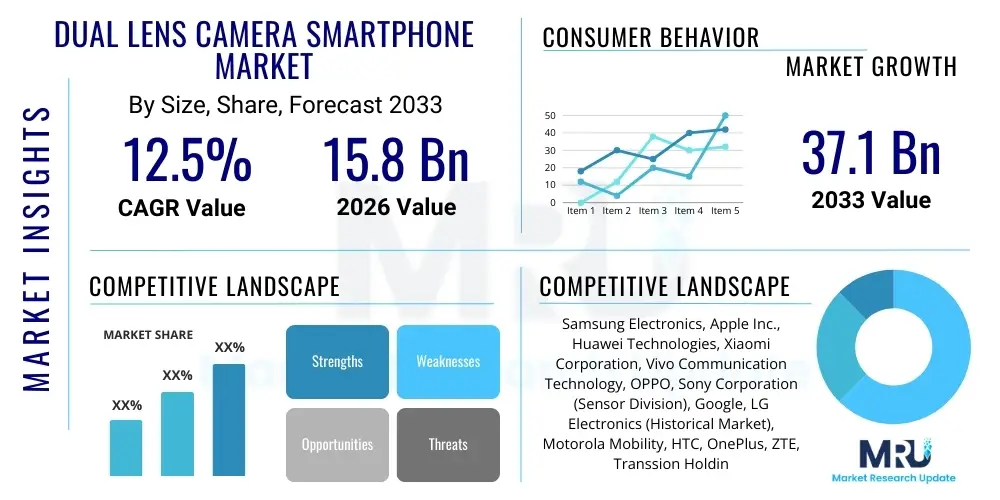

The Dual Lens Camera Smartphone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 37.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating consumer demand for enhanced mobile photography capabilities, including optical zoom, depth sensing for portrait mode, and improved low-light performance, all of which are fundamental capabilities provided by multi-lens systems. The ongoing miniaturization of advanced sensor technologies and the decreasing manufacturing costs associated with integrating dual or multi-camera modules are significant factors supporting this upward trend.

Market expansion is also heavily reliant on the aggressive adoption of dual-camera setups across mid-range and budget smartphone segments, shifting the technology from a premium feature to a standard industry expectation. Manufacturers are continually innovating to differentiate their products, integrating software algorithms like computational photography and AI-driven image stabilization that leverage the data captured by both lenses simultaneously. This focus on software-hardware integration significantly elevates the overall user experience, driving high replacement cycles among technologically conscious consumers globally.

Furthermore, the increased use of smartphones for content creation, including professional-grade video and high-resolution imaging for social media and commercial applications, reinforces the need for superior optical configurations. Geographically, the Asia Pacific region, particularly China and India, remains the largest contributor to both production and consumption, characterized by a highly competitive smartphone landscape and rapidly expanding middle-class populations with disposable income increasingly allocated to mobile devices featuring advanced imaging capabilities.

Dual Lens Camera Smartphone Market introduction

The Dual Lens Camera Smartphone Market encompasses mobile devices equipped with at least two distinct camera sensors and associated lens modules on the rear or front panel, working in tandem to capture superior imagery compared to single-lens systems. These systems typically utilize varied configurations, such as a wide-angle lens paired with a telephoto lens, an ultra-wide lens, or a dedicated monochrome or depth sensor, enabling functionalities like optical zoom, enhanced depth-of-field effects (bokeh), and improved light capture. The fundamental purpose of this technology is to mimic the versatility and quality previously restricted to professional standalone cameras, thereby elevating the mobile photography experience.

The primary applications of dual-lens technology extend across consumer photography, professional content creation, mobile gaming (using depth sensors for AR applications), and increasingly, in specialized industrial use cases requiring high-fidelity depth data. The benefits are multifold: users gain access to lossless zoom capabilities, highly accurate portrait modes through depth mapping, significantly improved image clarity in diverse lighting conditions due to enhanced data aggregation, and greater creative control over composition. This technology democratizes advanced photography, making sophisticated tools accessible to the mass market. The integration of two separate optical paths allows for computational synthesis of images, leading to superior final output that overcomes the physical limitations of thin smartphone form factors.

Driving factors for this market include the global obsession with visual content sharing, continuous advancements in sensor technology miniaturization, and aggressive competition among Original Equipment Manufacturers (OEMs) to offer unique value propositions. Consumer expectation for flagship camera features to trickle down rapidly into mid-range devices accelerates market adoption. Moreover, the continual optimization of System-on-Chips (SoCs) to handle massive parallel data streams from multiple sensors efficiently further solidifies the dual-lens architecture as a standard in modern mobile design. The strategic focus on maximizing image quality while maintaining sleek industrial design necessitates multi-sensor solutions.

Dual Lens Camera Smartphone Market Executive Summary

The Dual Lens Camera Smartphone Market is experiencing dynamic shifts, characterized by evolving business models centered on computational photography and strategic component sourcing. Business trends indicate a consolidation among major sensor and module suppliers, forcing smartphone OEMs to forge long-term strategic partnerships to secure high-quality, reliable components, particularly specialized optics and high-resolution sensors. Furthermore, manufacturers are increasingly emphasizing software differentiation, leveraging proprietary AI algorithms to maximize the output from standard dual-lens configurations, thus shifting the competitive landscape from hardware specifications alone to integrated system performance. The overall trend suggests that while dual-lens systems remain vital, the market is quickly moving towards triple and quad-lens setups, with dual-lens primarily dominating the high-volume mid-range sector, ensuring sustained market volume growth in this specific segment.

Regional trends highlight the Asia Pacific (APAC) region’s unparalleled dominance, both in terms of manufacturing capacity and consumer uptake, driven by domestic smartphone giants in China and South Korea who rapidly deploy new camera technologies across all price points. North America and Europe, while representing high average selling price (ASP) markets, focus intensely on premium features, demanding the highest quality sensors and integration with advanced features like 3D sensing and LiDAR complements. Emerging markets in Latin America and the Middle East and Africa (MEA) are witnessing rapid growth in the affordable dual-lens segment as basic smartphone users upgrade their devices, seeking essential features like bokeh effects, contributing significantly to volume sales globally.

Segment trends reveal that the 'Wide Angle + Telephoto' configuration remains the most commercially successful and high-value segment due to its versatility in providing genuine optical zoom, a highly valued feature by premium consumers. However, the 'Wide Angle + Depth Sensor' segment is crucial for the mid-range market, offering popular portrait capabilities at a lower manufacturing cost. The 5G network rollout is a cross-segment catalyst, facilitating the quick upload and processing of high-resolution images and videos produced by these advanced camera systems, thereby encouraging further investment and development in higher-megapixel dual-lens arrays. The persistent drive for high-quality video recording capabilities, including 4K and 8K capture, necessitates high bandwidth sensors often utilized in dual-lens arrangements.

AI Impact Analysis on Dual Lens Camera Smartphone Market

Users frequently inquire about how Artificial Intelligence (AI) will redefine mobile photography standards, specifically focusing on its integration with dual-lens systems. Common questions revolve around AI’s ability to autonomously optimize image quality, handle complex scene segmentation (e.g., separating foreground and background for accurate depth effects), and its influence on processing speed and battery life. There is high user expectation regarding AI-driven computational photography algorithms that can seamlessly merge data from two different sensors—such as a high-resolution color sensor and a monochrome sensor—to produce images with superior dynamic range and reduced noise, especially in challenging low-light environments. Users are also keen to understand AI's role in future enhancements like real-time video bokeh and advanced subject tracking, moving beyond static photography improvements.

The core theme emerging from user inquiries is the expectation that AI acts as the unifying software layer that maximizes the potential of the physical dual-lens hardware. Without sophisticated AI, dual-lens systems merely offer multiple viewing options; with AI, they transform into intelligent imaging platforms capable of semantic analysis of the captured scene. AI enables features such as intelligent exposure control, auto-HDR balancing across multiple frames, and automatic white balance correction, ensuring consistency and professional quality regardless of the user's skill level. This reliance on AI ensures that the physical limitations imposed by smartphone size (small sensors, thin lenses) are overcome computationally.

Consequently, the market is prioritizing investment in neural processing units (NPUs) within smartphone SoCs, specifically optimized to run AI imaging models efficiently. The impact of AI is to shift the value proposition of a dual-lens smartphone from 'what hardware it has' to 'how smart its processing is.' This shift allows smaller manufacturers to compete effectively by developing superior algorithms, even if they utilize less expensive standard camera modules. The ongoing race involves optimizing machine learning models for tasks like super-resolution enhancement, minimizing chromatic aberration, and performing complex depth-of-field adjustments post-capture, reinforcing the symbiotic relationship between dual-lens hardware and advanced AI software.

- AI-driven semantic segmentation enhances portrait mode accuracy and reduces processing artifacts.

- Computational photography relies on AI to fuse multi-sensor data, improving dynamic range and low-light performance.

- Real-time object recognition and scene optimization automatically adjust dual-lens parameters for optimal capture.

- Neural Processing Units (NPUs) accelerate AI tasks, making complex imaging operations instantaneous.

- AI algorithms facilitate advanced video stabilization by analyzing movement across multiple sensor inputs.

DRO & Impact Forces Of Dual Lens Camera Smartphone Market

The Dual Lens Camera Smartphone Market is driven by the relentless consumer demand for professional-grade imaging quality in a portable format, coupled with the decreasing cost of high-quality sensor components. The primary driver remains the continuous pursuit of optical zoom and superior depth sensing, functionalities that a single camera lens cannot adequately provide within the constraint of thin smartphone designs. Restraints include the increasing complexity in manufacturing and calibration, requiring extremely precise alignment of two or more sensors, which can increase production costs and lead to yield issues. Furthermore, the higher power consumption associated with processing large volumes of data captured simultaneously by dual sensors poses a technical challenge that manufacturers must constantly address through optimized hardware and software integration. The rapid technological obsolescence, where dual-lens setups are quickly being superseded by triple or quad-lens configurations in the flagship segment, also presents a restraint, potentially limiting the long-term premium appeal of the 'dual-lens' moniker.

Opportunities in this market are robust, particularly in the integration of dual-lens systems with emerging technologies such as Augmented Reality (AR) and Virtual Reality (VR), where accurate, real-time depth mapping is crucial for immersive experiences. The proliferation of 5G infrastructure enables consumers to rapidly share the high-quality content generated by these advanced camera systems, further incentivizing upgrades. Manufacturers also have an opportunity to diversify applications, utilizing depth-sensing lenses for secure facial recognition and 3D scanning, moving beyond mere photographic utility. The growth in the video content creation economy, demanding better mobile stabilization and dynamic range, provides a persistent market opportunity for dual-lens optimization.

The impact forces are substantial, manifesting primarily through technological convergence and intense market competition. The rapid reduction in sensor module size (miniaturization) acts as a powerful enabling force, making dual-lens integration feasible even in compact device designs. Consumer preference, heavily influenced by social media trends and peer usage, exerts a significant pulling force, making features like "bokeh" (portrait mode) non-negotiable for purchase decisions in many segments. Regulatory factors, particularly around data privacy and security related to depth sensing and 3D mapping capabilities, represent potential moderating forces that could influence market feature deployment. Overall, the market remains highly dynamic, driven by a powerful confluence of technological capability and immediate consumer gratification derived from high-quality mobile imaging.

Segmentation Analysis

The Dual Lens Camera Smartphone Market is segmented based on critical technical and commercial parameters, allowing for precise market analysis and strategic targeting. Key segmentation criteria include the type of lens combination utilized (e.g., Wide + Telephoto, Wide + Ultra-wide, Wide + Depth Sensor), the maximum resolution supported, the target device price range (low, mid, high-end), and the end-user application (consumer photography, AR/VR, enterprise). This granular segmentation helps manufacturers identify niche markets and tailor their product offerings to specific consumer needs, such as professional photographers requiring telephoto capabilities versus general users prioritizing aesthetic depth effects.

Analysis of these segments reveals distinct growth patterns. The high-end market continues to drive innovation in sensor quality and computational efficiency, frequently adopting dual-lens setups that include high-megapixel sensors and optical image stabilization (OIS). Conversely, the mid-range segment focuses on maximizing perceived value, often integrating a standard wide-angle lens with an inexpensive dedicated depth sensor to deliver popular portrait mode features, ensuring market penetration through competitive pricing. Understanding the intersectionality of these segments, such as how mid-range devices adopt high-end resolutions with cheaper secondary lenses, is crucial for accurate market forecasting and inventory management.

Furthermore, segmentation by sensor technology, particularly distinguishing between systems utilizing CMOS vs. CCD sensors (though CMOS dominates), or between different pixel architectures (e.g., dual-pixel autofocus), provides insight into manufacturing maturity and component sourcing strategies. The application-based segmentation is becoming increasingly important as dual-lens cameras move into specialized fields like mobile health diagnostics or security surveillance, where the dual perspective offers unique analytical advantages beyond standard consumer imaging, thus broadening the total addressable market (TAM) for this technology.

- By Lens Combination:

- Wide Angle + Telephoto

- Wide Angle + Ultra-wide Angle

- Wide Angle + Depth Sensor (Monochrome/ToF)

- Wide Angle + Macro

- By Resolution (Main Sensor):

- 12 MP and Below

- 13 MP to 48 MP

- Above 48 MP

- By Price Range:

- Low-End (Budget)

- Mid-Range

- High-End (Premium)

- By End-User Application:

- Consumer Photography

- Augmented Reality (AR) and 3D Mapping

- Video Content Creation

- Social Media and Communication

Value Chain Analysis For Dual Lens Camera Smartphone Market

The value chain for the Dual Lens Camera Smartphone Market is complex and highly specialized, beginning with the upstream supply of core components. Upstream analysis involves key players such as sensor manufacturers (CMOS image sensors), lens module suppliers (precision optics and glass components), and specialized semiconductor providers (for specialized image signal processors - ISPs and NPUs). The quality and cost of these raw materials, particularly the wafer fabrication of sensors, dictate the final cost and performance characteristics of the camera system. Strategic relationships with a limited number of high-quality sensor vendors, notably those producing stacked CMOS architectures, are critical for securing supply, especially in high-volume segments. Fluctuation in the cost of rare earth elements used in lens production can also impact the upstream segment significantly.

The mid-stream encompasses the Camera Module Assembly (CMA) providers, who integrate the sensors, lenses, actuators (for OIS and autofocus), and interconnects into a cohesive module. This stage involves high-precision calibration and testing, which is crucial for dual-lens alignment accuracy. Original Equipment Manufacturers (OEMs) then integrate these complex modules into the smartphone chassis, requiring sophisticated manufacturing processes to ensure optimal positioning and protection. The design and software optimization stage, where computational photography algorithms are developed and implemented on the integrated ISP/NPU, adds substantial value and serves as a major point of differentiation among brands.

Downstream distribution channels are characterized by a mix of direct and indirect sales models. Direct channels include manufacturer-owned retail stores and e-commerce platforms, offering greater control over branding and customer experience. Indirect channels, which account for the majority of global sales, involve collaboration with mobile network operators (MNOs), large electronics retail chains, and independent distributors. The success in the downstream market heavily relies on effective retail merchandising that highlights the tangible benefits of the dual-lens system, such as demonstrating optical zoom or depth effects. Effective logistics and supply chain management are paramount to ensure timely product delivery in highly competitive regional markets, particularly in APAC where device lifecycles are exceptionally short.

Dual Lens Camera Smartphone Market Potential Customers

The primary potential customers in the Dual Lens Camera Smartphone Market are broadly categorized into technology-conscious consumers, visual content creators, and enterprise users requiring advanced imaging capabilities. Technology-conscious consumers, particularly millennials and Gen Z, represent the largest segment; they prioritize immediate sharing on social platforms and demand high-fidelity images and videos without the need for extensive post-production. They are driven by feature parity with flagship models and often upgrade frequently to access the latest camera hardware and AI-enhanced features like superior low-light performance and personalized depth effects. Their purchasing decisions are heavily influenced by online reviews and influencer endorsements focusing on camera performance benchmarks.

The secondary, yet rapidly growing, segment comprises professional and semi-professional content creators, including social media influencers, vloggers, and mobile journalists. These end-users require the versatility offered by dual lenses, such as dedicated telephoto lenses for diverse framing options and high-quality ultra-wide lenses for landscape or architectural shots. For this segment, the consistency of image quality, coupled with advanced video features like robust stabilization and high frame rates (e.g., 60fps at 4K), is non-negotiable. They are willing to invest in premium devices that maximize sensor size and processing power, ensuring that the device can reliably serve as their primary creation tool.

The third significant customer segment includes enterprise and specialized application users. This group includes organizations involved in property inspection, asset management, and healthcare, where the depth-sensing capabilities (Time-of-Flight or dedicated depth sensors) of dual-lens systems are utilized for accurate 3D mapping, measurement, and augmented reality overlays for training or maintenance purposes. For these commercial buyers, the reliability, integration capability with enterprise software, and robust data security features associated with the camera's output are the primary purchasing drivers. This niche segment often purchases devices in bulk and prioritizes long-term software support and integration rather than consumer-driven aesthetic features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 37.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, Apple Inc., Huawei Technologies, Xiaomi Corporation, Vivo Communication Technology, OPPO, Sony Corporation (Sensor Division), Google, LG Electronics (Historical Market), Motorola Mobility, HTC, OnePlus, ZTE, Transsion Holdings, Panasonic, Sharp Corporation, Realme, Honor, Nokia (HMD Global), TCL Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dual Lens Camera Smartphone Market Key Technology Landscape

The technology landscape of the Dual Lens Camera Smartphone Market is defined by continuous innovation in sensor fabrication, optical design, and computational integration. Key technologies include advanced CMOS Image Sensors (CIS), particularly those utilizing stacked sensor technology (like Sony's Exmor RS or Samsung's ISOCELL) which integrate the logic circuit beneath the pixels, enabling faster readout speeds and superior low-light performance essential for handling the high data throughput of dual-lens systems. Furthermore, specialized lens elements, including hybrid glass and plastic optics, are crucial for achieving high sharpness and minimizing distortion across multiple focal lengths while adhering to stringent size constraints. The integration of Phase Detection Autofocus (PDAF) and Dual Pixel Autofocus (DPAF) systems allows both lenses to achieve rapid and accurate focusing, especially critical when the system is switching between sensors for zoom or depth calculation.

Optical Image Stabilization (OIS) remains a vital technology, necessary for compensating for hand shake, particularly when using the higher-magnification telephoto lens in a dual setup. High-end implementations now incorporate Sensor-Shift OIS, moving the sensor rather than the lens elements, offering more comprehensive stabilization. Another critical technological component is the specialized Image Signal Processor (ISP) and Neural Processing Unit (NPU), integral to the smartphone's System-on-Chip (SoC). These processors are specifically engineered to handle parallel processing tasks, quickly receiving, correcting, and fusing the distinct data streams captured simultaneously by the two cameras, ensuring a seamless and high-quality final image output through complex algorithms like multi-frame noise reduction and HDR synthesis.

Emerging technologies, such as Time-of-Flight (ToF) sensors being paired as the secondary or tertiary sensor, are rapidly gaining traction as they provide highly precise depth maps regardless of lighting conditions, superior to passive depth sensors. This technology enhances the dual-lens system's utility for AR applications and complex edge detection. Furthermore, advancements in periscope lens systems, although primarily associated with triple or quad setups, influence the dual-lens market by pushing traditional telephoto lens technology to achieve slimmer profiles and greater magnification potential. The increasing sophistication of AI-powered super-resolution techniques, where software interpolates detail using data from the standard and specialized lens, is also a significant technological trend driving perceived quality improvements in the dual-lens domain, reducing the reliance solely on high-megapixel counts.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the Dual Lens Camera Smartphone Market, dominating both manufacturing and consumption. Countries like China, India, and South Korea host the largest smartphone assembly plants and semiconductor fabrication facilities, ensuring competitive pricing and rapid feature adoption. Consumer demand in APAC is vast and diverse, ranging from budget-conscious buyers in Southeast Asia prioritizing the aesthetic benefit of the bokeh effect (achieved with depth sensors) to affluent consumers in North Asia demanding the latest computational photography innovations and sensor technologies, often requiring high-end wide-angle plus telephoto combinations. The region's hyper-competitive landscape drives the fastest trickle-down effect, making dual-lens setups standard even in entry-level segments.

- North America: This region is characterized by high average selling prices (ASPs) and a strong emphasis on brand loyalty and integration within established ecosystems (iOS and high-end Android). North American consumers prioritize software performance, seamless connectivity (especially 5G), and features related to premium video creation and robust low-light photography, demanding top-tier sensors, extensive computational algorithms, and superior telephoto capabilities. The market penetration of devices utilizing dual-lens technology for sophisticated AR applications and security features (like facial recognition using depth sensors) is also notably higher here, reflecting a greater appetite for integrated smart technology.

- Europe: The European market displays a balanced demand profile, valuing both performance and aesthetic design. Consumer preferences lean toward devices offering strong battery life and versatile camera systems, often favoring dual-lens setups that combine excellent general photography with a useful secondary perspective (either ultra-wide or telephoto). Regulatory environments, particularly regarding data privacy (GDPR), slightly influence the adoption rate and integration methods of depth-sensing technology. Western Europe acts as a key market for mid-to-high-end devices, whereas Eastern Europe demonstrates significant growth potential in the budget and mid-range segments driven by upgrades from feature phones to affordable dual-camera smartphones.

- Latin America (LATAM): The LATAM region represents a high-growth emerging market where affordability and value retention are crucial. Market penetration of dual-lens technology is accelerating rapidly, primarily concentrated in the mid-range and budget segments. Consumers prioritize features that offer tangible, visible improvements over older devices, such as improved image quality and the highly demanded portrait mode effect, which is often facilitated by inexpensive dedicated depth sensors. Brazil and Mexico are key markets, showing rapid volume growth driven by increasing smartphone penetration and replacement cycles focused on camera improvements.

- Middle East and Africa (MEA): This region is highly fragmented, with strong growth potential in urbanized areas. Adoption is driven by device affordability and the influence of global technology trends. The MEA market sees significant uptake in mid-range dual-lens smartphones, leveraging the enhanced camera capabilities for social sharing and communication. Investment in local assembly and distribution networks is increasing, facilitating the broader availability of dual-lens devices. The market structure varies significantly, with the GCC nations prioritizing high-end features similar to North America, while African sub-regions focus heavily on robust, durable, and cost-effective dual-camera solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dual Lens Camera Smartphone Market.- Samsung Electronics

- Apple Inc.

- Huawei Technologies

- Xiaomi Corporation

- Vivo Communication Technology

- OPPO

- Sony Corporation (Sensor Division)

- Motorola Mobility

- HTC

- OnePlus

- ZTE

- Transsion Holdings

- Panasonic

- Sharp Corporation

- Realme

- Honor

- Nokia (HMD Global)

- TCL Corporation

- Micron Technology (Sensor Contributor)

Frequently Asked Questions

Analyze common user questions about the Dual Lens Camera Smartphone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a dual-lens camera system over a single-lens system?

The primary advantage is the ability to capture multiple perspectives or depth data simultaneously, enabling true optical zoom (using a telephoto lens), superior depth-of-field effects (bokeh) for professional-looking portraits, and enhanced low-light performance through computational fusion of data from two sensors. This overcomes the physical limitations of a thin smartphone body.

How does AI technology specifically enhance the performance of dual-lens cameras?

AI significantly enhances dual-lens performance by managing computational photography tasks, including semantic segmentation, multi-frame noise reduction, and automatic scene recognition. AI algorithms intelligently fuse data captured by the two sensors (e.g., wide and telephoto) to produce a single, optimally processed image with superior dynamic range, color accuracy, and detail.

Which dual-lens configuration dominates the market, and why is it preferred by OEMs?

The Wide Angle plus Depth Sensor configuration currently dominates the high-volume mid-range market. OEMs prefer this combination because it allows them to deliver the highly demanded portrait mode feature (bokeh) at a substantially lower manufacturing cost compared to integrating a more expensive telephoto lens with Optical Image Stabilization (OIS).

What role does the Image Signal Processor (ISP) play in optimizing dual-lens smartphone imaging?

The ISP, often integrated into the smartphone's System-on-Chip (SoC), is crucial for coordinating the simultaneous data streams from both lenses. It performs initial image processing tasks, including color correction, demosaicing, and noise reduction, rapidly fusing the two inputs into a single, cohesive image file. High-performance ISPs are essential for real-time video processing and fast capture speeds.

Is the dual-lens camera setup being replaced by triple or quad-lens systems in the premium market?

While premium flagship devices increasingly adopt triple or quad-lens setups to incorporate ultra-wide, telephoto, and macro capabilities simultaneously, the dual-lens system remains the strategic standard for the high-volume mid-range market. Dual lenses continue to offer an optimal balance of cost, complexity, and performance necessary to deliver key consumer-demanded features effectively.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager