Duplex Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436813 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Duplex Board Market Size

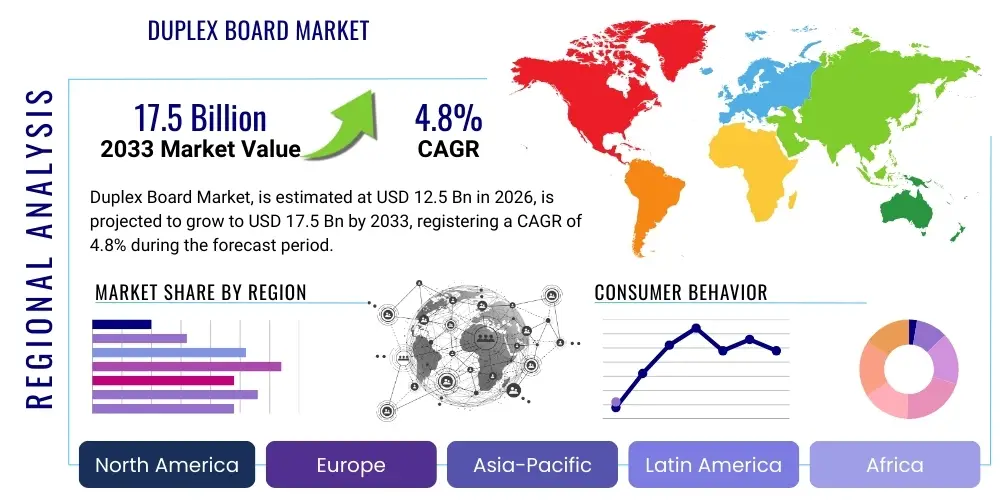

The Duplex Board Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for sustainable and cost-effective packaging solutions across developing economies, particularly in the fast-moving consumer goods (FMCG) and pharmaceutical sectors.

The consistent expansion of the global retail sector, coupled with stringent regulatory pressure to reduce plastic usage, is significantly accelerating the adoption of paperboard-based packaging, positioning duplex board as a preferred choice. Its structural rigidity, excellent printing surface, and superior folding capabilities make it highly suitable for high-quality consumer product cartons. Furthermore, continuous advancements in coating technology are improving the board's barrier properties, enabling its use in more demanding applications previously reserved for specialized materials. This sustained innovation ensures its relevance in a rapidly evolving packaging landscape.

Geographically, the Asia Pacific region dominates the consumption and production landscape, characterized by rapid industrialization, population growth, and increasing disposable incomes leading to higher per capita consumption of packaged goods. The market valuation reflects strong investment in new capacity expansions, focusing on boards manufactured primarily from recycled fibers, addressing both cost efficiency and environmental stewardship goals. The stability of raw material prices (pulp and recovered paper) is a critical determinant influencing the profitability and overall market expansion rate during the forecast period.

Duplex Board Market introduction

The Duplex Board Market encompasses the production, distribution, and consumption of a type of paperboard characterized by a two-layer structure, typically utilizing a superior coated white surface layer for printing and a lower, often grey or brown, back layer usually made from recycled pulp. This multi-layered construction provides exceptional stiffness, smoothness, and bulk necessary for high-performance packaging applications. The product is fundamentally utilized for creating folding cartons, blister packs, and small consumer goods boxes where both aesthetic appeal and structural integrity are paramount. Key applications span the packaging of pharmaceuticals, cosmetics, food items, confectionery, and general consumer electronics, valuing its combination of printability and protective qualities.

Major driving factors fueling this market expansion include the global shift towards environmentally conscious packaging, as duplex boards predominantly utilize recycled content, aligning with circular economy principles. Furthermore, the rising global middle class, particularly in emerging markets, dictates increased consumption of packaged products, directly inflating demand for cost-effective yet high-quality board materials. The inherent benefits of duplex boards—such as superior surface finish allowing high-fidelity graphic reproduction, excellent folding resistance preventing damage during transport, and versatility across diverse printing technologies—cement its position as a staple material in the packaging supply chain.

The market environment is highly competitive, characterized by large-scale production capacities and focused efforts on improving technical specifications, such as brightness, caliper consistency, and moisture resistance. Technological innovation in coating materials, specifically the application of aqueous barrier coatings, is expanding the utility of duplex boards into semi-liquid and refrigerated food packaging, traditionally dominated by plastic films. This continuous product enhancement, driven by sustainability mandates and consumer preference for convenient, single-material recyclable packaging, underpins the positive market outlook.

Duplex Board Market Executive Summary

The Duplex Board Market Executive Summary highlights robust growth projected through 2033, primarily propelled by favorable business trends surrounding sustainable packaging mandates and sustained growth in the FMCG sector globally. Business trends indicate a strong focus on capacity utilization optimization and strategic mergers and acquisitions among major regional players aiming to consolidate market share and leverage economies of scale in raw material procurement, especially recycled fiber stock. Furthermore, there is an increasing inclination among brand owners to standardize packaging materials globally, benefiting versatile materials like duplex board that can meet diverse regulatory requirements and printing standards across different regions.

Regionally, the Asia Pacific region maintains its dominance, not only in terms of market size but also in production capacity expansion, supported by lower labor and operational costs and burgeoning domestic demand from countries like China and India. Europe and North America, while mature, exhibit trends focused on high-quality, fully recyclable grades, often driven by stricter waste management directives, favoring materials with high post-consumer recycled content. Latin America and the Middle East and Africa are emerging as high-growth markets, characterized by rapid urbanization and the proliferation of organized retail formats, necessitating standardized and attractive packaging solutions for imported and locally manufactured consumer goods.

Segmentation trends indicate that Coated Duplex Board (especially Grey Back) remains the highest revenue-generating segment due to its cost-effectiveness and wide applicability in mass-market packaging. However, the high-density and premium white-back segments are experiencing faster growth rates, fueled by the cosmetics and pharmaceutical industries which demand superior surface smoothness and whiteness for high-end branding. The application segment growth is overwhelmingly concentrated in packaging, particularly folding cartons for food and beverage, reflecting fundamental consumer spending patterns worldwide. Innovation in barrier coatings applied to standard duplex board substrates represents a key segment evolution, enabling broader market penetration.

AI Impact Analysis on Duplex Board Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Duplex Board market primarily revolve around operational efficiency, supply chain optimization, and sustainable resource management. Users frequently ask how AI can predict demand fluctuations to reduce inventory waste, optimize trimming and cutting processes during manufacturing to minimize scrap material, and enhance quality control systems to detect printing and coating defects in real-time. There is also significant interest in how machine learning algorithms can analyze global recovered paper market trends, allowing manufacturers to make strategic, timely procurement decisions, thereby stabilizing input costs which are highly volatile.

AI is beginning to revolutionize the manufacturing floor by implementing predictive maintenance schedules for high-capital equipment like fourdrinier machines, significantly reducing unexpected downtime and improving overall equipment effectiveness (OEE). Furthermore, in the design and prototyping phase, AI-powered software can quickly generate optimized carton structural designs, considering material properties, stress points, and printing requirements, accelerating the time-to-market for new packaging formats. This integration of smart technologies ensures higher consistency, lower operational expenditure, and a reduction in material wastage, key metrics for competitive advantage in paper manufacturing.

In the broader supply chain context, AI and advanced analytics are crucial for logistics planning, route optimization for finished goods, and inventory management at distribution centers, crucial given the high bulk and low value-to-weight ratio of duplex board products. By integrating AI into material flow analysis, mills can fine-tune production batches to match customer order sizes with greater precision, minimizing the need for large, costly storage facilities. Ultimately, users anticipate that AI integration will lead to a more resilient, sustainable, and highly personalized manufacturing environment tailored to specific customer packaging specifications.

- AI optimizes trim planning, reducing manufacturing waste (scrap rate minimization).

- Predictive maintenance schedules for paper machines minimize costly downtime and improve operational longevity.

- Machine learning enhances real-time quality inspection (coating consistency, print registration faults).

- AI-driven demand forecasting stabilizes volatile inventory levels of raw materials (recycled pulp).

- Generative AI assists in optimizing folding carton structural design and material selection for specific end-use requirements.

- Automated logistics planning minimizes transportation costs for bulky finished products.

DRO & Impact Forces Of Duplex Board Market

The Duplex Board Market is shaped by a confluence of strong drivers (D), persistent restraints (R), and compelling opportunities (O), creating complex impact forces across the value chain. Key drivers include robust demand from the burgeoning e-commerce sector, which necessitates corrugated and secondary protective packaging often utilizing duplex board, and the intrinsic advantage of duplex board being manufactured predominantly from recycled fibers, appealing to global sustainability targets. Conversely, major restraints involve the high volatility of raw material prices, specifically recovered paper fiber, and significant energy intensity required for pulp processing and drying, which exposes manufacturers to fluctuating utility costs and pressure to decarbonize operations. The primary opportunities lie in developing advanced barrier coatings (e.g., oil, grease, moisture) to displace specialized plastic packaging in food contact applications and expanding capacity in rapidly industrializing regions like Southeast Asia and Africa.

The impact forces generated by these DRO elements dictate market structure and competitive dynamics. The strong driver of sustainability is forcing manufacturers to invest heavily in deinking and recycling technology to maintain high quality while maximizing recycled content, potentially leading to higher capital expenditure but yielding better market positioning. The restraint of price volatility pushes players towards vertical integration, securing captive sources of recovered fiber or establishing long-term hedging contracts. The opportunity presented by barrier coatings is driving collaboration between chemical suppliers and board manufacturers to create novel, functional, and fully recyclable board grades.

Overall market elasticity is moderate; while substitution threats from Virgin Fiber based materials (like FBB or SBS) exist for premium applications, the cost advantage of duplex board ensures its persistent market share in the mass packaging sector. The long-term impact force is the inexorable shift towards paper-based packaging across all consumer sectors, providing a stable foundation for demand growth, provided manufacturers can effectively manage the inherent challenges associated with raw material sourcing and process energy consumption efficiency.

Segmentation Analysis

The Duplex Board Market is comprehensively segmented based on its structural characteristics (Type), material quality (Grade), intended usage (Application), and the ultimate consumer category (End-Use Industry). Understanding these segments is critical for manufacturers to tailor their production capabilities and for purchasers to select the optimal board for specific packaging requirements. The segmentation highlights the diverse functional requirements placed upon duplex board, ranging from basic transit packaging to high-end cosmetic cartons requiring superior surface finish and structural integrity. Segmentation by Type, specifically distinguishing between Coated Duplex Board with Grey Back (GD) and White Back (GT), remains the most financially significant categorization, reflecting major differences in raw material cost and target aesthetic quality.

The application segmentation is currently dominated by folding cartons for consumer goods, driven by the global necessity for standardized, secure, and brandable containers for retail sale. Within this application scope, the food and beverage industry represents the largest consumer volume due to high turnover and single-use requirements. Grade segmentation, differentiating high-density boards used where stiffness and protection are paramount from lower-density options prioritizing bulk and cost-efficiency, dictates which manufacturing technologies and coating chemistries are deployed. These detailed segment analyses provide granular insights into consumer preferences and regional regulatory influences impacting material choice.

- By Type:

- Coated Duplex Board (Grey Back - GD): Cost-effective, high recycled content, widely used for general packaging and mass consumer goods.

- Coated Duplex Board (White Back - GT): Higher brightness, premium appearance, used for pharmaceutical and cosmetic packaging.

- Uncoated Duplex Board: Lower quality surface finish, primarily used for internal liners or industrial applications where aesthetics are secondary.

- By Grade:

- High-Density Duplex Board: Offers superior stiffness and structural performance; utilized for heavy consumer goods or complex folding requirements.

- Low-Density Duplex Board: Provides higher bulk-to-weight ratio; optimized for lighter packaging where cost efficiency is key.

- By Application:

- Packaging (Folding Cartons): Largest segment, including general retail packaging.

- Printing & Graphics (Posters, Cards, Displays): Specialized niche requiring high print fidelity.

- By End-Use Industry:

- Food & Beverage: Confectionery, dry foods, frozen goods.

- Pharmaceuticals & Healthcare: Compliance packaging, medicine boxes.

- Cosmetics & Personal Care: High-end primary and secondary packaging.

- Consumer Electronics & Appliances: Component protection, smaller appliance packaging.

Value Chain Analysis For Duplex Board Market

The value chain of the Duplex Board Market is characterized by highly consolidated upstream raw material suppliers and fragmented downstream converters, with significant complexity arising from recovered paper sourcing. The upstream segment involves the procurement and processing of key inputs, predominantly recovered paper (waste paper), chemical pulps, starch, and coating pigments (e.g., China Clay, Calcium Carbonate). The stability and quality of the recovered paper supply directly impact the final board quality and manufacturing costs, making waste management efficiency a critical upstream factor. Chemical suppliers provide essential additives, including binders and sizing agents, crucial for achieving desired mechanical and surface properties.

Midstream operations involve the capital-intensive manufacturing process within integrated paper mills, encompassing pulping, stock preparation, forming (multi-ply sheet formation), drying, surface sizing, coating application, calendering for smoothness, and final slitting into rolls or sheets. Operational efficiency, energy management, and environmental compliance are paramount at this stage. Effective management of water consumption and effluent treatment significantly affects profitability and regulatory standing.

The downstream segment includes converting and distribution channels. Converters take the manufactured board, print upon it using offset or digital presses, apply necessary finishes (e.g., UV varnishes, laminations), and die-cut it into specific folding carton blanks before shipping to the end-users. Distribution utilizes both direct channels—where large paper mills supply directly to major converters under long-term contracts—and indirect channels involving specialized paper merchants and distributors who manage inventory and supply smaller converters and local printers. The final stage is reached when end-user brands utilize these converted cartons for packaging their consumer products, completing the cycle.

Duplex Board Market Potential Customers

Potential customers for Duplex Board primarily encompass businesses operating within high-volume manufacturing sectors that require protective, aesthetically pleasing, and cost-effective secondary packaging solutions. These customers are typically the brand owners and manufacturing organizations across various consumer goods segments. The decision to purchase is generally driven by factors such as material cost per unit, necessary print quality, structural integrity for automated packaging lines, and adherence to specific market sustainability criteria, often demanding high recycled content.

The largest group of buyers includes Fast-Moving Consumer Goods (FMCG) companies involved in producing soap, detergents, packaged snacks, and personal hygiene products, where duplex board is vital for shelf presentation and product protection. A second significant customer base is the Pharmaceutical Industry, utilizing white-back duplex board for medicine cartons, requiring precise printing for dosage information and tamper-evident features, emphasizing compliance and safety over purely aesthetic concerns. The Cosmetics and Premium Goods sectors also represent a critical customer segment, demanding the highest quality coated duplex boards to convey luxury branding and product value.

Additionally, large-scale third-party packaging converters act as essential intermediaries, purchasing immense volumes of raw board stock from the mills. These converters then process the material based on specific orders received from the ultimate brand owners. Therefore, potential customers span the entire spectrum from integrated global pharmaceutical corporations demanding strict material specifications to regional confectionery manufacturers focused primarily on optimizing packaging material costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper Company, Smurfit Kappa Group, Nine Dragons Paper (Holdings) Limited, WestRock Company, Oji Holdings Corporation, Stora Enso Oyj, Mayr-Melnhof Karton AG, Shandong Sun Paper Industry Joint Stock Co., Ltd., JK Paper Ltd., BILT Graphic Paper Products Limited, Shanying International Holdings Co., Ltd., Asia Pulp & Paper (APP), Mondi Group, Sappi Limited, Rengo Co., Ltd., TC Transcontinental Inc., Huhtamaki Oyj, Kotkamills Oy, Pankaboard Oy, Holmen AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Duplex Board Market Key Technology Landscape

The technological landscape of the Duplex Board Market is characterized by continuous refinement of paper machine efficiency and innovative coating solutions designed to enhance performance and sustainability. Core production relies heavily on sophisticated multi-ply forming technology, often utilizing cylinder mould or complex fourdrinier setups, which are critical for laying down different fiber layers (recycled pulp core and virgin/bleached outer layers) simultaneously to achieve maximum stiffness and desired caliper consistency. Recent technological advancements focus on closed-loop water systems and optimized deinking plants to improve the quality of recycled fiber input and reduce the environmental footprint associated with manufacturing.

Coating technology represents another crucial area of innovation. Manufacturers are increasingly moving away from traditional clay and latex coatings towards functional barrier coatings, including bio-based materials and aqueous dispersions, which impart resistance to grease, oil, and moisture without compromising the material's recyclability. These barrier advancements are critical for positioning duplex board as a viable alternative to poly-coated materials in demanding food service and frozen food applications. Furthermore, highly advanced calenders and smoothing presses are employed post-coating to achieve the extremely high surface smoothness required for high-resolution offset printing utilized by the cosmetics and luxury packaging segments.

Digitalization and automation are also key technology drivers. Integrated Quality Control Systems (IQCS) use sensors and machine vision to monitor web characteristics, moisture content, basis weight, and coating thickness in real-time, ensuring stringent quality control across large-scale production runs. Advanced process control (APC) systems utilize AI and machine learning to adjust machine speed, steam pressure, and chemical dosing automatically, leading to significant reductions in material variation and energy consumption. The convergence of superior forming technology, advanced sustainable coatings, and automated process management defines the modern competitive edge in duplex board manufacturing.

Regional Highlights

The Asia Pacific (APAC) region is the most significant market for duplex board, commanding the largest share in both volume and value. This dominance is attributed to rapid economic development, high population density, and surging domestic consumption across key economies such as China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs, making it a global hub for production, and its demand is heavily driven by the booming retail and fast-food sectors, which heavily rely on cost-effective folding cartons, particularly the grey-back variety.

North America and Europe represent mature markets characterized by stable, high-value demand. Here, the focus is less on volume growth and more on premiumization and sustainability. European regulations, such as the Packaging and Packaging Waste Directive, strongly favor highly recyclable materials, boosting demand for high-quality white-back duplex boards compliant with strict food contact standards and maximizing recycled content. The North American market mirrors this trend, with major brand owners committing to specific recycled content goals, driving investment into deinking and high-speed coating lines.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting rapid expansion. Urbanization and the formalization of retail channels are the primary catalysts. Increased foreign direct investment in manufacturing facilities in countries like Brazil, Mexico, and South Africa is creating localized demand for packaging materials. While cost sensitivity remains high in MEA, the introduction of global FMCG brands necessitates the use of high-quality, recognizable duplex board packaging, promising substantial CAGR during the forecast period.

- Asia Pacific (APAC): Dominates market volume and production capacity; driven by massive FMCG consumption in China and India; focus on cost-efficient grey-back grades.

- Europe: High-value market focused on sustainability and premiumization; strict regulatory environment boosts demand for highly recyclable, food-contact compliant white-back boards.

- North America: Stable demand influenced by corporate sustainability commitments; significant market for pharmaceutical and cosmetic packaging requiring superior print quality.

- Latin America (LATAM): Rapidly developing market driven by urbanization and modern retail growth; increasing local manufacturing necessitates standard packaging solutions.

- Middle East & Africa (MEA): High growth potential fueled by economic diversification and expanding consumer goods imports; investment in localized paper production is accelerating.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Duplex Board Market.- International Paper Company

- Smurfit Kappa Group

- Nine Dragons Paper (Holdings) Limited

- WestRock Company

- Oji Holdings Corporation

- Stora Enso Oyj

- Mayr-Melnhof Karton AG

- Shandong Sun Paper Industry Joint Stock Co., Ltd.

- JK Paper Ltd.

- BILT Graphic Paper Products Limited

- Shanying International Holdings Co., Ltd.

- Asia Pulp & Paper (APP)

- Mondi Group

- Sappi Limited

- Rengo Co., Ltd.

- TC Transcontinental Inc.

- Huhtamaki Oyj

- Kotkamills Oy

- Pankaboard Oy

- Holmen AB

Frequently Asked Questions

Analyze common user questions about the Duplex Board market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Grey Back and White Back Duplex Board?

The distinction lies in the composition and color of the reverse side (back liner). Grey Back (GD) uses unbleached recycled fiber, making it cost-effective and suitable for general packaging. White Back (GT) uses bleached chemical pulp or high-quality deinked pulp for the back layer, offering a cleaner, premium appearance ideal for pharmaceutical or food packaging where enhanced aesthetics are required.

Is Duplex Board considered a sustainable packaging material?

Yes, Duplex Board is highly regarded for its sustainability because its core structure predominantly utilizes recovered (recycled) paper fiber, minimizing reliance on virgin pulp. This high recycled content aligns with circular economy goals and makes it widely recyclable through established paper waste streams, unlike complex multi-material plastic alternatives.

What are the main factors driving the current market growth for Duplex Board?

The primary growth factors include the expansion of the global e-commerce sector requiring robust and customizable protective packaging, rapid consumption growth in emerging economies, and the increasing preference of brand owners for fiber-based solutions over plastics due to legislative and consumer pressure regarding environmental impact.

How does the volatile price of recovered paper affect Duplex Board manufacturers?

Since recovered paper is the main raw material, its price volatility directly impacts manufacturing costs and profitability. Manufacturers mitigate this by optimizing inventory management, diversifying fiber sourcing geographically, and investing in advanced deinking technologies to handle lower-grade recovered paper efficiently, thus stabilizing input costs.

In which application segment is Duplex Board witnessing the fastest adoption rate?

The fastest adoption rate is currently observed within the Pharmaceuticals and Cosmetics & Personal Care segments. These industries increasingly require high-quality coated white-back duplex boards (GT) that offer superior printability and surface hygiene, necessary for product differentiation and compliance with regulatory standards for sensitive consumer products.

Duplex board's position as a versatile and economical packaging solution remains strong, driven by its intrinsic material characteristics and its alignment with global environmental mandates. The market is not only sustaining its core applications but is also expanding into new segments through targeted innovation in barrier coatings and enhanced surface treatments. Key stakeholders across the value chain, from raw material suppliers to final packaging converters, are focused on maximizing resource efficiency and optimizing the structural integrity of the final product to meet the rigorous demands of modern automated packaging lines and high-speed printing operations.

Looking ahead, the competitive landscape will be defined by manufacturers who can most effectively manage the complex interplay between input cost volatility—stemming primarily from recovered fiber and energy prices—and the necessity for continuous quality improvement. Investment in advanced manufacturing technologies, particularly those leveraging AI for quality control and process optimization, will be crucial for maintaining profitability and securing long-term contracts with major global brand owners. Regional growth disparities will persist, with APAC continuing to drive volume, while Europe and North America lead innovation in sustainability and premium grade development. Strategic partnerships and targeted M&A activities are expected to reshape the supply side, leading to greater consolidation and focused specialization in certain board grades, further solidifying the material’s vital role in the global packaging ecosystem.

The transition toward sustainable packaging mandates a renewed focus on technical collaboration within the industry. Future developments in duplex board are anticipated to center around achieving lighter weights without compromising stiffness (lightweighting), improving moisture and grease resistance using non-plastic alternatives, and ensuring complete compliance with stringent food contact regulations globally. Successful market players will be those capable of offering a diversified portfolio that balances high-volume, cost-effective standard boards with specialized, high-performance sustainable grades, ensuring resilience against fluctuating economic conditions and evolving consumer preferences.

Moreover, the integration of advanced digital printing technologies is opening up new avenues for duplex board utilization, especially in personalized packaging and short-run promotional cartons. This technological integration allows for faster turnaround times and reduced inventory risk for converters and brand owners. The high surface uniformity of coated duplex board is particularly well-suited for high-resolution digital applications, providing an advantage over certain lower-quality fiberboards. This adaptability to modern printing techniques ensures the material's longevity and expands its potential reach beyond traditional mass-market packaging into specialized promotional and customized product lines, thereby enhancing the overall market valuation.

The robust demand from the pharmaceutical sector, driven by an aging global population and increasing regulatory requirements for product traceability and anti-counterfeiting measures, acts as a stabilizing force for the high-end segment of the duplex board market. Pharmaceutical packaging necessitates exceptional consistency in caliper, surface characteristics for complex serialization printing, and strict chemical neutrality. Manufacturers capable of maintaining ISO and GMP (Good Manufacturing Practice) standards consistently for their white-back duplex board grades are strategically positioned to capture premium pricing and secure high-volume, long-term supply agreements within this recession-resilient industry.

In summary, the Duplex Board Market stands on a foundation of cost-efficiency and sustainability, projected to expand significantly over the next seven years. The market dynamics are highly influenced by regional consumer behavior, regulatory frameworks emphasizing recycled content, and technological shifts towards functional coatings and optimized manufacturing using AI. Competitive advantage will increasingly rely on maintaining a robust, sustainable supply chain for recovered paper and delivering exceptional, consistent product quality suitable for high-speed automated processes.

Technological advancement is not limited to manufacturing processes; it also extends to the logistics and handling of the finished board. Optimized reel winding and sheet stacking technologies minimize potential damage during transportation and preparation for converting, a critical factor given the volume and weight of the product. Furthermore, the development of specialized adhesives and sealing technologies compatible with the coated surface of duplex board allows for high-speed carton erecting and sealing processes, directly impacting the efficiency of the end-user's automated packaging lines. This technical collaboration between board manufacturers, equipment suppliers, and converters is essential for unlocking further efficiency gains across the entire supply chain.

The long-term outlook for the Duplex Board Market remains positive, anchored by the indispensable role of folding cartons in the consumer goods economy. While global economic factors and raw material prices introduce volatility, the fundamental shift towards fiber-based packaging provides a powerful underlying driver. Companies that prioritize investment in deinking capacity, maintain strict quality controls, and effectively address the need for innovative barrier solutions are expected to outperform competitors. The market is transitioning from simply supplying a commodity product to offering specialized, high-performance materials tailored for complex industrial and sustainability requirements, securing its relevance well beyond the forecast horizon.

Environmental certifications, such as those from the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC), while traditionally more common for virgin fiberboards, are becoming increasingly important for recycled content duplex boards to ensure responsible sourcing of the minimal virgin pulp components and chemical inputs. Compliance with these stringent certifications opens doors to environmentally conscious major retailers and multinational brands that have mandatory green procurement policies. Therefore, transparent sourcing and environmental reporting are evolving from a differentiator into a fundamental requirement for market participation in developed economies.

Another emerging trend involves the use of near-infrared (NIR) and RFID technologies integrated into the duplex board itself, allowing for enhanced end-of-life sorting and traceability. This innovation addresses a key concern for recycling facilities, ensuring that non-fiber coatings or contaminants are correctly identified, thereby maintaining the integrity of the recovered fiber stream. Although still niche, the push for ‘smart packaging’ that aids in sorting and tracking is set to gradually increase the technical specification requirements for duplex board, necessitating further R&D investment by leading manufacturers to stay ahead of future recycling legislation and infrastructure advancements.

The competitive strategy among the top key players increasingly involves geographical diversification and product portfolio rationalization. Companies are strategically establishing manufacturing bases closer to high-demand centers in APAC and LATAM to mitigate logistics costs and leverage regional raw material sourcing advantages. Simultaneously, rationalization focuses on reducing the number of lower-margin, highly commoditized products in favor of high-performance, coated grades that command better margins, driving the overall value proposition of the market upward.

Finally, the threat of substitution, mainly from high-quality folding boxboard (FBB) or solid bleached sulphate (SBS) board in premium segments, continues to pressure duplex board manufacturers to improve surface characteristics, particularly brightness and whiteness, typically achieved through higher quality coatings and bleached top-ply fibers. However, the inherent cost structure advantage of utilizing recycled fiber ensures that duplex board remains the undisputed leader in the mass-market and general consumer goods packaging segments, securing the majority of the projected growth volume throughout the forecast period.

The need for bulk material handling systems and optimized internal logistics within the paper mill remains a constant area for efficiency improvement. The sheer size and weight of jumbo rolls of duplex board require specialized conveyor systems, automated storage and retrieval systems (AS/RS), and precise slitting machinery. Investing in these automated handling systems not only reduces labor costs and risk of injury but also minimizes potential damage to the board surface and edges, which is critical before final conversion. This capital investment across major manufacturing sites further cements the high barrier to entry in this market.

Furthermore, energy conservation initiatives, particularly the capture and reuse of process heat (cogeneration or combined heat and power - CHP), are becoming standard practice to combat the high energy intensity of drying massive paper webs. Successful implementation of these energy recovery strategies directly contributes to lower operating costs, offering a substantial competitive advantage in a market where margins are constantly scrutinized. Manufacturers who successfully integrate renewable energy sources into their power matrix will also benefit from enhanced corporate sustainability profiles, appealing to environmentally conscious investors and customers.

The regulatory environment concerning food contact materials (FCM) is becoming exceptionally stringent, particularly in Europe and North America. Duplex board used for food packaging must adhere to strict compositional limits regarding mineral oils and other chemical migrants originating from recycled fiber. This necessitates advanced testing and barrier application technologies for the food-facing side of the board. Compliance with FCM regulations, such as FDA and EU directives, is a non-negotiable prerequisite for participation in the high-value food and beverage packaging segment, driving specialization in manufacturing processes and quality assurance protocols across the industry.

The market also sees considerable influence from graphic design trends. As branding becomes more critical, the demand for boards that can support complex and vibrant color palettes, textural coatings, and specialized printing effects (like embossing and foiling) is rising. Duplex board, particularly the GT grades with a high white surface, provides an ideal substrate for these advanced finishing techniques, allowing brand owners to create a premium shelf presence. This synergy between material capability and aesthetic demands drives innovation in both the board surface quality and the printing technology utilized by downstream converters.

Finally, the ongoing geopolitical dynamics, including trade tariffs and regional protectionism, can temporarily disrupt the global trade flows of both finished duplex board and recovered paper fiber. Manufacturers with diversified global supply chains and localized production assets are better equipped to navigate these uncertainties. The reliance on China as both a major producer and consumer introduces specific market sensitivities, requiring global competitors to maintain a dynamic and adaptable sourcing and distribution strategy to ensure uninterrupted supply to key converting partners.

The demand for duplex board is inextricably linked to the global economic cycle, particularly retail sales and consumption patterns. While structural advantages provide resilience, significant economic downturns can lead to reduced consumption of packaged consumer goods, impacting order volumes and pressuring pricing. However, due to its cost-effective nature compared to virgin-fiber boards, duplex board often sees sustained usage even during challenging economic periods as brand owners look to manage packaging costs without sacrificing fundamental product protection or basic shelf appeal, positioning it as a relatively stable packaging material.

Investment in human capital and specialized technical expertise is increasingly vital. Operating highly sophisticated paper machines and advanced coating lines requires highly skilled engineers and technicians. Companies are focusing on training programs and R&D partnerships with academic institutions to ensure a steady pipeline of experts knowledgeable in fiber science, coating chemistry, and industrial automation. This focus on expertise is necessary to drive incremental improvements in product performance and operational efficiency, thereby maintaining a competitive edge in a capital-intensive industry.

The transition toward lighter-weight board grades is a pervasive trend driven by cost reduction and sustainability targets (less material usage per package). Achieving lightweighting requires manufacturers to enhance the internal structure of the board using micro-fillers or advanced multi-ply layering techniques to maintain the necessary stiffness and compression strength required for folding cartons, which is technically challenging but crucial for future market competitiveness.

The influence of large multinational retailers cannot be overstated. Retailers often dictate packaging size, material composition, and sustainability requirements for products sold through their channels, acting as a powerful downstream influencer on duplex board specifications. Compliance with retailer-specific packaging guides is mandatory for many brand owners, pushing the entire supply chain, including duplex board manufacturers, to adhere to increasingly stringent performance and environmental criteria.

In conclusion, the Duplex Board Market demonstrates characteristics of a mature yet dynamically evolving sector. Its growth is secure due to fundamental global consumption trends, while its future innovation path is guided by the twin priorities of maximizing recycled content and delivering specialized functional performance through advanced coatings and process digitalization. The market remains an essential backbone of the consumer goods packaging landscape.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager