Dust, Fume, and Mist Collector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435550 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Dust, Fume, and Mist Collector Market Size

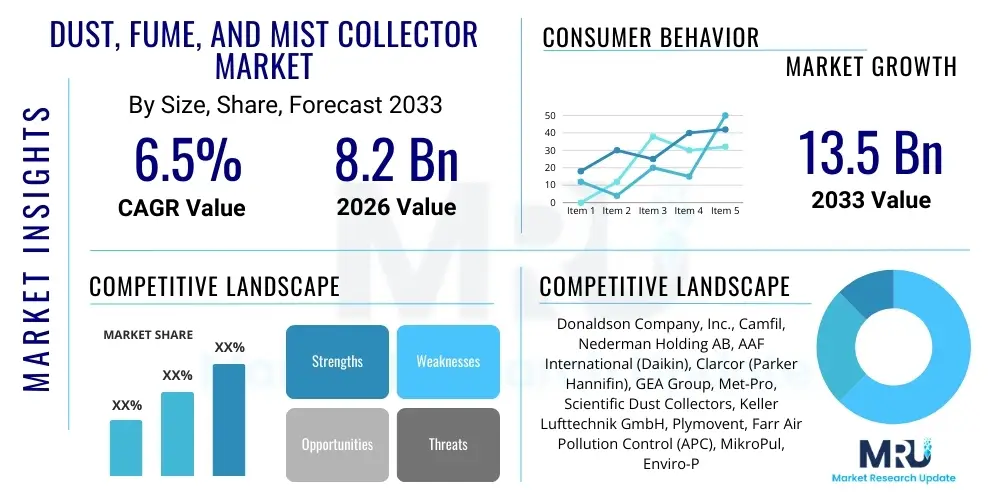

The Dust, Fume, and Mist Collector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 8.2 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

Dust, Fume, and Mist Collector Market introduction

The Dust, Fume, and Mist Collector Market encompasses specialized industrial air pollution control equipment designed to capture, filter, and mitigate airborne particulate matter generated during various manufacturing and processing activities. These systems are critical for maintaining compliance with strict occupational safety and environmental regulations imposed by agencies such as OSHA, EPA, and analogous bodies globally. The increasing awareness regarding the long-term health hazards associated with exposure to particulate matter (PM2.5 and PM10), welding fumes, and oil mist drives the mandatory installation of robust air purification solutions across highly industrialized sectors.

Products within this market range significantly in technology and scale, including centralized baghouse collectors, modular cartridge collectors, sophisticated electrostatic precipitators, and wet scrubbers designed for highly combustible or sticky dusts. Cartridge collectors, favored for their high efficiency and compact footprint, are dominating new installations, especially in metalworking and pharmaceutical manufacturing where fine dust control is paramount. Furthermore, the integration of high-efficiency particulate air (HEPA) filtration is becoming standard practice in industries requiring cleanroom conditions or handling hazardous materials, such as battery production and advanced composite manufacturing.

The core benefit derived from these systems is enhanced worker health and safety, directly reducing the incidence of respiratory diseases and workplace accidents caused by poor visibility or slippery residue. Beyond safety, these collectors protect sensitive manufacturing equipment, preventing downtime and maintaining product quality by eliminating contaminant build-up. Key driving factors include rigorous government mandates for industrial air quality, rapid industrialization in developing economies, and technological advancements leading to more energy-efficient and smarter collection systems capable of real-time performance monitoring and optimized filtration.

Dust, Fume, and Mist Collector Market Executive Summary

The global Dust, Fume, and Mist Collector Market is characterized by robust growth, primarily fueled by a stringent global regulatory landscape and accelerated investments in industrial infrastructure, particularly in the Asia Pacific region. Business trends indicate a pronounced shift towards customized, application-specific solutions, moving away from generic collectors. Manufacturers are focusing heavily on developing collectors that utilize advanced materials for filtration media, increasing efficiency (measured by MERV ratings) while simultaneously reducing energy consumption through smart motor controls and optimized airflow designs. The aftermarket service segment, encompassing replacement filters, maintenance, and system audits, continues to be a significant and high-margin revenue stream for key market participants, stabilizing profitability across business cycles.

Regional trends highlight the Asia Pacific (APAC) as the epicenter of demand growth, largely due to massive investments in automotive manufacturing, electronics production, and heavy industries across China, India, and Southeast Asian nations. While North America and Europe demonstrate moderate growth, the demand in these mature markets is driven by the replacement of aging infrastructure and the continuous tightening of emission standards, prompting end-users to upgrade to collectors with superior capture efficiencies and lower fugitive emissions. The European market, in particular, shows strong adoption of wet scrubbers and mist eliminators due to stringent directives regarding coolant mist and oily residue in precision engineering environments.

Segmentation trends reveal that cartridge collectors maintain the highest market share due to their superior filtration efficiency and ease of maintenance, making them suitable for fine dust applications. However, within the application segment, the metal fabrication and processing industry remains the largest consumer, generating significant amounts of welding fumes and grinding dust. There is a rapidly growing niche in the pharmaceuticals and food and beverage sectors, where the focus is on sanitary design (eliminating crevices for bacteria growth) and regulatory compliance specific to combustible dust standards (e.g., NFPA requirements). The long-term trajectory is defined by digitalization, integrating sensors and IoT capabilities for preventative maintenance and remote diagnostics, maximizing uptime and operational transparency.

AI Impact Analysis on Dust, Fume, and Mist Collector Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Dust, Fume, and Mist Collector market overwhelmingly center on optimizing operational expenditure, enhancing system reliability, and preempting maintenance failures. Key themes derived from common questions revolve around the quantifiable benefits of predictive maintenance algorithms—specifically, how AI can accurately predict filter saturation levels and schedule replacements before efficiency drops, thus maximizing filter lifespan and reducing unnecessary downtime. Users also frequently ask about AI's role in real-time energy management, querying how machine learning models can dynamically adjust fan speeds and airflow volumes based on changing production loads and particulate concentration, ensuring regulatory compliance while minimizing power consumption.

The implementation of AI and machine learning models provides a paradigm shift from reactive to proactive air quality management. These intelligent systems process vast amounts of data points, including pressure differential readings, power usage, ambient temperature, and production schedules, to create highly accurate performance profiles. By identifying anomalies and subtle drifts in performance that human operators or standard Programmable Logic Controllers (PLCs) might miss, AI algorithms can pinpoint impending mechanical failures in blowers or valves, issuing alerts that allow maintenance teams to address issues before they cascade into costly breakdowns. This transition significantly elevates the overall equipment effectiveness (OEE) of industrial filtration systems.

Furthermore, AI-driven analytics are being utilized to refine system design and placement during the initial engineering phase. By simulating various operational scenarios and airflow dynamics within a facility, AI helps in sizing the collector correctly and optimizing ductwork layout, avoiding common issues like inefficient capture velocities or excessive energy draw. For end-users in volatile industries like chemicals or heavy manufacturing, this enhanced analytical capability translates directly into better risk management, ensuring continuous compliance with fluctuating environmental permit requirements, which is a major financial and legal concern.

- AI algorithms enable predictive maintenance, anticipating filter clogging and component failure based on real-time sensor data.

- Machine learning optimizes fan and damper controls, adjusting airflow dynamically to reduce energy expenditure while maintaining required capture velocity.

- AI facilitates compliance reporting by automatically correlating production activities with emissions data and identifying patterns of non-compliance risk.

- Computer vision systems, often linked with AI, monitor capture hood efficiency and identify fugitive emission sources in real-time.

- Data analytics improve system sizing and design parameters, reducing capital expenditure and ensuring peak performance efficiency over the collector's lifecycle.

DRO & Impact Forces Of Dust, Fume, and Mist Collector Market

The dynamics of the Dust, Fume, and Mist Collector Market are heavily influenced by stringent regulatory frameworks (Drives) compelling industrial compliance, counterbalanced by the substantial initial investment and ongoing operational expenses (Restraints) associated with sophisticated filtration technology. Opportunities primarily lie in the rapid proliferation of IoT and smart systems, offering manufacturers a pathway to enhance efficiency and provide value-added services. The combination of these forces—regulatory compliance urgency, economic viability constraints, and technological innovation—creates intense market competition and defines the long-term strategic direction of the industry, particularly emphasizing sustainable and low-energy solutions.

Key drivers include the global tightening of Occupational Safety and Health Administration (OSHA) standards regarding exposure limits for respirable crystalline silica, welding fumes, and metal particulates. This regulatory pressure forces industries like construction, foundries, and aerospace to invest in high-efficiency capture systems. Moreover, rapid industrialization, particularly the expansion of manufacturing bases in emerging economies, creates a massive greenfield opportunity for collector installation. The increasing adoption of high-speed machining and laser cutting techniques, which generate finer, more hazardous particulates, further necessitates specialized filtration equipment, serving as a continuous technological driver.

Restraints largely center on the high capital expenditure required for installing centralized dust collection systems, which can deter smaller enterprises, leading them to adopt less efficient, localized solutions. The ongoing operational costs, primarily driven by energy consumption (for high-power fans) and the frequent replacement of expensive, proprietary filter media, also pose a significant barrier. Additionally, the complexity of customizing collectors for diverse industrial applications (e.g., handling explosive dusts versus abrasive dusts) requires specialized engineering expertise, increasing lead times and installation complexities. Opportunities are abundant in retrofitting existing facilities with smart controls and developing modular, decentralized systems that offer flexible and scalable solutions suitable for dynamic factory layouts.

- Drivers (D): Increased stringency in occupational health and safety regulations (OSHA, EPA); accelerated industrial infrastructure development globally; rising incidence of respiratory diseases linked to industrial pollutants.

- Restraints (R): High initial capital investment cost; significant operating expenses related to energy consumption and filter replacement; lack of awareness or poor maintenance practices in smaller enterprises.

- Opportunities (O): Integration of IoT, AI, and remote monitoring for predictive maintenance; growth of specialized applications (e.g., additive manufacturing, battery production); development of sustainable, low-energy collection technologies.

- Impact Forces: Regulatory compliance dictates minimum efficiency standards; technological innovation drives competitive advantage; energy efficiency concerns influence purchasing decisions and long-term cost viability.

Segmentation Analysis

The Dust, Fume, and Mist Collector Market is systematically segmented based on Product Type, Application, End-Use Industry, and Configuration, allowing for targeted product development and market penetration strategies. Product segmentation provides clarity on the underlying filtration technology, differentiating systems like baghouses, known for high volume and heavy dust loads, from cartridge collectors, suitable for finer particulates and smaller footprints. Understanding this segmentation is vital for matching the appropriate compliance solution to the specific industrial process, considering factors such as particle size distribution, dust load concentration, and temperature requirements.

Further breakdown by Application (e.g., metal grinding, welding, woodworking, pharmaceuticals) highlights the functional requirements unique to each process, driving demand for specialized features such as spark arrestors or washdown capabilities. The End-Use Industry segment—which includes Automotive, Chemical, Aerospace, and Food & Beverage—reveals where the highest volume and most critical demands for air quality control reside. The growth trajectory of each segment is intrinsically linked to macro-economic trends, such as the global push toward advanced manufacturing and the strict hygiene requirements within life sciences, ensuring sustained and diverse market expansion.

- By Product Type:

- Baghouse/Fabric Collectors

- Cartridge Collectors

- Wet Scrubbers

- Electrostatic Precipitators (ESPs)

- Cyclone Collectors

- Mist Collectors (Oil Mist, Coolant Mist, Smoke Mist)

- By Application:

- Welding Fume Extraction

- Grinding and Polishing Dust

- Process Ventilation

- Wood Dust Collection

- Powder Handling and Weighing

- By End-Use Industry:

- Metal Fabrication and Machining

- Pharmaceuticals and Life Sciences

- Automotive and Transportation

- Chemical Processing

- Food and Beverage

- Construction and Mining

- By Configuration:

- Centralized Systems

- Decentralized/Modular Systems

Value Chain Analysis For Dust, Fume, and Mist Collector Market

The value chain for the Dust, Fume, and Mist Collector Market begins with the upstream procurement of specialized raw materials, primarily focusing on high-grade steel and alloys for housing and ductwork, as well as proprietary synthetic and natural fibers for filtration media. The quality and performance characteristics of the filtration media (e.g., PTFE membranes, cellulose blends) are critical, often being the most technologically advanced and proprietary component. Upstream analysis also involves sourcing high-efficiency fans, motors, and intelligent control components (PLCs, sensors, VFDs). Suppliers must adhere to strict quality standards as the durability of these components directly impacts system reliability and lifespan, ensuring the collector maintains high-efficiency filtration under continuous industrial operation.

The middle segment involves manufacturing, assembly, and integration. Manufacturers differentiate themselves through specialized engineering expertise, particularly in customizing designs for challenging applications like explosive dust (requiring explosion venting) or high-temperature environments. This phase includes rigorous testing and certification to meet ATEX, NFPA, and local regulatory standards. Distribution channels are highly varied; large, centralized systems are often sold directly to major industrial OEMs or through specialized engineering consulting firms (EPCs) who manage large-scale factory construction projects. Decentralized or modular units, especially those targeting smaller workshops or specific spot welding applications, often utilize indirect channels through industrial equipment distributors, offering faster delivery and localized support.

The downstream component is dominated by installation, commissioning, and, most importantly, aftermarket services. Installation and commissioning require specialized field services to optimize ductwork and calibrate controls for site-specific conditions. The long-term profitability of the market relies heavily on recurring revenue from replacement parts, primarily high-wear components like filters and solenoids, along with scheduled maintenance contracts. Direct sales models facilitate closer customer relationships, enabling manufacturers to offer predictive maintenance services and customized optimization programs, which are essential for maximizing the operational efficiency and compliance of the installed base.

Dust, Fume, and Mist Collector Market Potential Customers

Potential customers for dust, fume, and mist collection systems are universally found across any industrial sector involving material processing, thermal treatments, or powder handling—processes that inherently generate airborne pollutants that must be controlled for safety and compliance. These end-users are typically sophisticated industrial buyers, whose purchasing decisions are driven not merely by cost, but primarily by regulatory compliance requirements, system reliability, and total cost of ownership (TCO) calculated over the equipment's lifecycle, factoring in energy usage and filter replacement frequency. Industries facing the most stringent environmental scrutiny, such as pharmaceuticals and aerospace, represent the most lucrative and demanding customer base.

The largest customer cohort resides within the metalworking and fabrication industry, encompassing automotive assembly, heavy equipment manufacturing, and steel production. These customers require robust solutions capable of handling massive volumes of high-temperature welding fumes, abrasive grinding dust, and heavy oil mist generated from machining processes. The second critical segment is the pharmaceutical industry, where systems must meet exacting FDA and cGMP standards, requiring stainless steel construction, polished interiors, and validated HEPA or ULPA filtration to prevent cross-contamination during powder blending, tablet pressing, and encapsulation processes.

Emerging high-growth customer segments include the battery manufacturing industry (gigafactories), which requires highly specialized dust collectors to safely handle potentially explosive lithium compounds and cathode materials, alongside the additive manufacturing (3D printing) sector, which generates extremely fine metal powders requiring inert atmosphere handling and closed-loop filtration systems. These new applications demand collectors with advanced features, including inert gas purging capabilities and strict adherence to explosion protection standards (e.g., NFPA 652 and 654), making them high-value opportunities for manufacturers specializing in advanced safety features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.2 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Donaldson Company, Inc., Camfil, Nederman Holding AB, AAF International (Daikin), Clarcor (Parker Hannifin), GEA Group, Met-Pro, Scientific Dust Collectors, Keller Lufttechnik GmbH, Plymovent, Farr Air Pollution Control (APC), MikroPul, Enviro-Pak, Airflow Systems, Inc., Absolent Group AB, Binks Manufacturing, Lincoln Electric, RoboVent, Dürr Group, Filtermist International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dust, Fume, and Mist Collector Market Key Technology Landscape

The modern technology landscape of the dust, fume, and mist collector market is increasingly focused on maximizing efficiency (measured by minimizing energy consumption and maximizing filtration performance) and enhancing system intelligence through digital integration. A critical technological evolution is the development and adoption of advanced filter media, such as nanofiber technology and specialized ePTFE (expanded polytetrafluoroethylene) membranes. These media offer significantly higher efficiency (often achieving MERV 16 ratings or better) and longer lifespan compared to traditional cellulose or polyester media. Furthermore, self-cleaning mechanisms, especially pulse-jet technology, are continually being refined to minimize compressed air usage while ensuring thorough filter regeneration, thereby reducing operational expenditure and increasing uptime across demanding industrial applications.

Energy management is a core technological driver. The widespread adoption of Variable Frequency Drives (VFDs) linked to system blowers allows for precise control of airflow based on real-time dust loading and duct pressure readings, dramatically reducing power consumption during periods of low production activity. This shift from constant volume operation to demand-flow control is a significant factor in reducing the total cost of ownership (TCO) for large-scale centralized systems. Manufacturers are also focusing on aerodynamic designs for collector housing and ductwork to minimize static pressure losses, ensuring that less motor power is needed to move the necessary volume of air, thereby achieving compliance standards with optimized power draw.

Finally, the integration of Industrial Internet of Things (IIoT) sensors and cloud-based monitoring platforms represents the forefront of market innovation. These smart systems utilize pressure differential sensors, temperature gauges, and vibration monitors to transmit real-time performance data. This data feeds into proprietary diagnostic algorithms, enabling features like remote performance checks, automated compliance reporting, and the aforementioned predictive maintenance alerts. This digital overlay not only enhances reliability but also allows end-users to comply with complex regulatory reporting requirements automatically, making the filtration system a key component of the factory's overall digital ecosystem.

Regional Highlights

Regional variations in the Dust, Fume, and Mist Collector Market are defined by differing regulatory stringencies, industrial maturity levels, and growth rates across key geographical areas. North America, characterized by highly stringent regulatory environments enforced by OSHA and the EPA, represents a mature but stable market. Demand here is predominantly driven by replacement cycles, upgrades to meet newer, tougher emission standards (especially concerning ultrafine particulates and toxic fumes), and the high adoption rate of advanced, intelligent collection systems that integrate seamlessly with existing factory automation networks. The U.S. remains the largest consumer, primarily due to large aerospace, heavy machinery, and pharmaceutical sectors demanding sophisticated filtration technology.

Europe mirrors North America in its regulatory strictness, particularly through directives like ATEX (for explosion protection) and various EU environmental standards. The European market exhibits strong demand for high-efficiency mist collectors, driven by the continent's advanced precision machining and automotive manufacturing sectors that heavily rely on coolants and metalworking fluids. Germany, Italy, and France are key contributors, focusing heavily on bespoke, energy-efficient filtration solutions tailored for specialized engineering processes. The adoption of modular, decentralized systems is notably high in Europe, allowing for easy integration into existing, often older, manufacturing facilities.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This accelerated growth is attributed to the rapid expansion of industrial capacity, massive infrastructure investments, and a gradual tightening of local environmental regulations, although the enforcement level varies by country. China, India, and Southeast Asian nations are undergoing massive industrialization, driving demand for both large-scale baghouses for heavy industries (cement, mining) and cartridge collectors for electronics and automotive production. The sheer scale of new facility construction (greenfield projects) makes APAC the primary focus for global collector manufacturers seeking volume growth, despite price sensitivity remaining a challenge in certain sub-regions.

- North America: Market stability driven by replacement and upgrade cycles; high demand for smart filtration systems to meet strict OSHA and EPA compliance; focus on advanced materials and energy efficiency.

- Europe: Strong regulatory focus (ATEX, EU Directives); high adoption of specialized mist collectors for precision engineering; mature market prioritizing energy reduction and customized modular solutions.

- Asia Pacific (APAC): Highest growth rate fueled by rapid industrialization and greenfield investments (China, India); increasing demand across electronics, automotive, and heavy manufacturing sectors; gradual but significant strengthening of local environmental regulations.

- Latin America & MEA (Middle East & Africa): Emerging markets with moderate growth, primarily driven by resource extraction (mining, oil & gas) and increasing domestic manufacturing capabilities; adoption often follows multinational standards rather than purely local mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dust, Fume, and Mist Collector Market.- Donaldson Company, Inc.

- Camfil

- Nederman Holding AB

- AAF International (Daikin)

- Clarcor (Parker Hannifin)

- GEA Group

- Keller Lufttechnik GmbH

- Plymovent

- Farr Air Pollution Control (APC)

- Absolent Group AB

- MikroPul

- Scientific Dust Collectors

- Dürr Group

- RoboVent

- Filtermist International

- TDC Filter Manufacturing (a part of Donaldson)

- Lincoln Electric

- Binks Manufacturing

- Schenck Process

- Vortec (Illinois Tool Works Inc.)

Frequently Asked Questions

Analyze common user questions about the Dust, Fume, and Mist Collector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current demand in the Dust, Fume, and Mist Collector Market?

The primary driver is the rigorous enforcement of occupational health and safety regulations, particularly those concerning worker exposure limits to respirable particulate matter (PM2.5, PM10) and hazardous fumes, compelling mandatory industrial upgrades and new installations across all manufacturing sectors.

How does IoT integration affect the total cost of ownership (TCO) of collector systems?

IoT integration significantly lowers TCO by enabling predictive maintenance. This prevents catastrophic failures, maximizes filter lifespan through optimized usage, and reduces energy consumption by dynamically adjusting fan speeds based on real-time operational demand.

Which type of collector is seeing the highest growth in the fine dust segment?

Cartridge collectors are experiencing the highest growth in the fine dust segment due to their high filtration efficiency, compact footprint, and effective self-cleaning capabilities, making them ideal for pharmaceutical, electronics, and precision metal finishing applications.

What are the key technological advancements concerning filter media?

Key technological advancements include the use of nanofiber coatings and ePTFE membrane media, which significantly boost filtration efficiency (reaching MERV 16+) while maintaining low pressure drop, thereby extending the filter life and reducing system energy requirements.

Is the aftermarket service segment important for market revenue?

Yes, the aftermarket service segment is crucial, representing a high-margin, stable revenue source. This includes the sale of proprietary replacement filters, maintenance contracts, and specialized system audits necessary to ensure continuous regulatory compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager