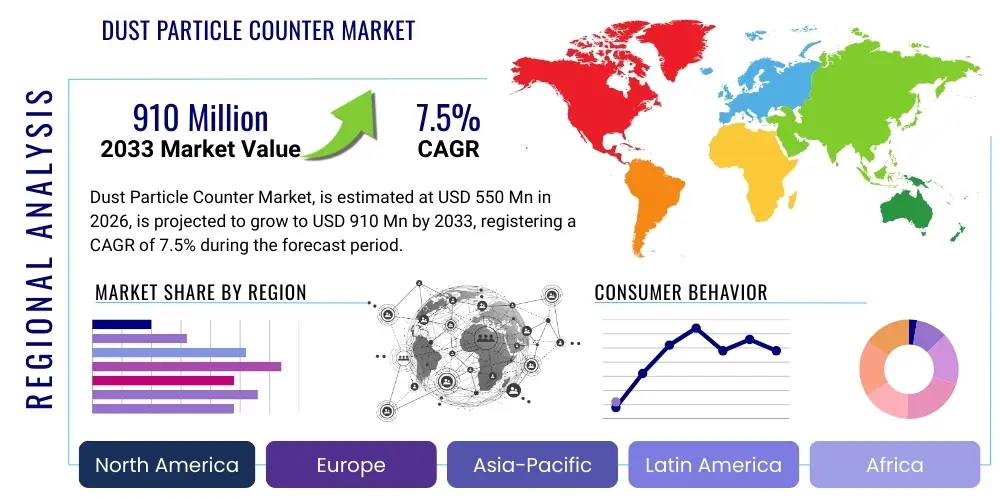

Dust Particle Counter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438661 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dust Particle Counter Market Size

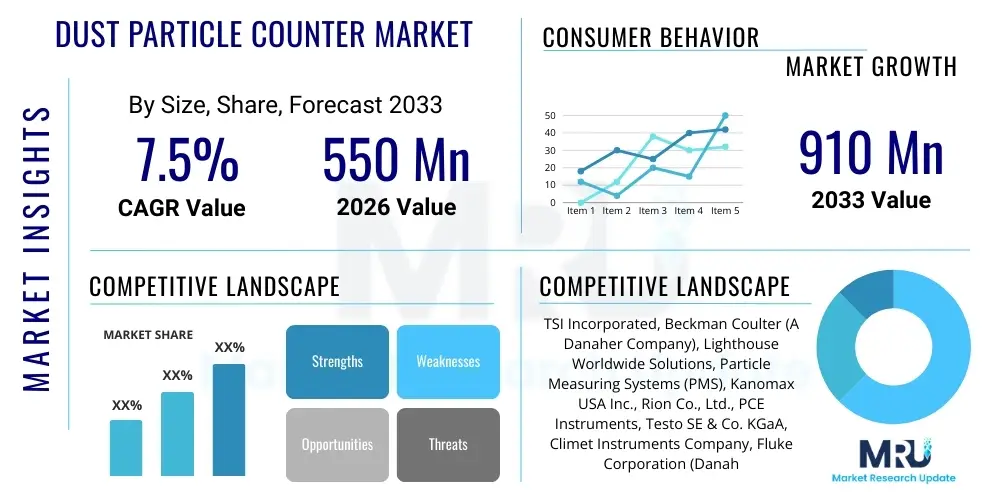

The Dust Particle Counter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033. This robust expansion is primarily fueled by stringent regulatory frameworks mandating air quality monitoring across critical industrial sectors, coupled with the increasing adoption of automated cleanroom environments in pharmaceuticals and microelectronics manufacturing.

Market size determination is significantly influenced by the escalating global concern over air pollution and its adverse health effects, driving both industrial and environmental monitoring needs. Furthermore, technological advancements leading to the development of highly accurate, portable, and remote-sensing dust particle counters are expanding the utility and accessibility of these instruments beyond traditional laboratory settings. The transition toward smart manufacturing and the integration of these counters into larger IoT ecosystems further contribute to the overall market valuation and anticipated growth trajectory during the forecast period.

The core application areas, particularly pharmaceutical validation (ISO 14644 compliance) and HVAC system efficiency testing, represent substantial revenue streams. The increasing complexity and sensitivity of advanced manufacturing processes, such as semiconductor fabrication where even minute particulate contamination can cause catastrophic yield losses, necessitate continuous investment in sophisticated particle detection instrumentation. This consistent, high-demand requirement across multiple high-value industries secures the predicted market size increase.

Dust Particle Counter Market introduction

The Dust Particle Counter Market encompasses the manufacturing, distribution, and utilization of instruments designed to measure the concentration of airborne particulate matter (dust) in a controlled volume of air. These instruments operate predominantly on light scattering principles, counting and sizing particles ranging typically from 0.1 micrometers to 25 micrometers, classifying air quality according to established international standards such as ISO, FDA, and WHO guidelines. These critical measurement devices are fundamental tools in ensuring process integrity, product quality, regulatory compliance, and occupational health across a diverse range of industries.

Major applications for dust particle counters span cleanroom monitoring, industrial hygiene, indoor air quality (IAQ) assessment, filter testing, and emission monitoring. In cleanrooms, these devices are indispensable for validating and certifying controlled environments crucial for the production of sensitive materials like microchips, medical devices, and injectable drugs. Beyond industrial use, the growing awareness regarding health implications associated with fine particulate matter (PM2.5 and PM10) is spurring demand for reliable monitoring solutions in commercial buildings, schools, and residential areas, broadening the market scope considerably.

Key driving factors underpinning market expansion include the globalization of pharmaceutical manufacturing standards requiring rigorous clean environment validation, rapid industrialization in emerging economies leading to increased environmental scrutiny, and continuous technological breakthroughs enhancing the precision, portability, and network capabilities of the counters. The tangible benefits derived from using these devices—such as reducing product defect rates, ensuring worker safety, and minimizing operational risks associated with contamination—make them essential capital equipment in high-tech and regulated environments globally.

Dust Particle Counter Market Executive Summary

The Dust Particle Counter Market Executive Summary indicates robust expansion, driven primarily by the convergence of stringent global cleanroom standards and the accelerating adoption of real-time monitoring technologies. Business trends show a strong shift towards highly integrated, software-enabled instruments capable of continuous data logging and analysis, moving away from standalone, manual counting devices. Key market participants are focusing on strategic partnerships and mergers to integrate sensor technologies and cloud computing platforms, offering comprehensive, end-to-end air quality management solutions to large-scale industrial consumers in the semiconductor and life sciences sectors. The need for precise measurements in sub-micron ranges (ultrafine particles) is spurring R&D investment in laser diode technology and advanced calibration methods, ensuring product differentiation and competitive advantage.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in domestic semiconductor manufacturing capacity expansion (particularly in China, Taiwan, and South Korea) and the rapid establishment of pharmaceutical and biotechnology hubs across the region. North America and Europe, while mature, maintain strong market share due to consistent demand for high-end, compliant instruments used for sophisticated research and development activities and maintaining legacy cleanroom infrastructures. Regulatory harmonization, specifically the global adherence to ISO 14644-1:2015, acts as a uniform stimulus across all geographical areas, ensuring standardized purchasing criteria.

Segment trends highlight the dominance of the Portable Dust Particle Counter segment due to its versatility in fieldwork, qualification, and troubleshooting tasks, though the Fixed/Remote Monitoring Systems segment is witnessing the fastest growth rate. This accelerated growth is attributed to the necessity for continuous, remote monitoring in large, critical facilities to reduce human intervention and enhance data integrity. Furthermore, the pharmaceutical and biotechnology segment remains the largest end-user category, emphasizing the high-value nature of environmental control in drug manufacturing and sterile packaging operations, demanding instruments with precise validation capabilities and compliance features.

AI Impact Analysis on Dust Particle Counter Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Dust Particle Counter Market revolve around several core themes: Can AI predict contamination events before they occur? How will machine learning (ML) improve the calibration and accuracy of older sensors? Will AI automate regulatory reporting and compliance auditing? Users are keenly interested in predictive maintenance, seeking solutions that minimize downtime caused by unexpected contamination spikes or instrument failures. There is also significant curiosity about AI’s role in analyzing massive datasets generated by continuous monitoring systems, transforming raw particle counts into actionable environmental intelligence and optimizing HVAC system performance within cleanroom settings. The overarching expectation is that AI integration will shift the industry paradigm from reactive measurement to proactive, intelligent environmental control.

AI's primary influence centers on enhancing data analysis, operational efficiency, and predictive capabilities within monitored environments. By applying sophisticated ML algorithms to time-series data from particle counters, alongside correlated environmental factors (temperature, humidity, pressure differentials), AI systems can establish detailed baseline profiles. Any significant deviation from this learned pattern—not merely exceeding a static threshold—triggers an intelligent alert, allowing facility managers to identify and mitigate contamination sources faster. This capability significantly reduces the risk of batch losses in critical manufacturing processes, increasing overall yield and quality assurance efficacy.

Furthermore, AI is crucial for optimizing the strategic placement and operational cycles of particle counters in complex cleanroom layouts. Simulation and modeling driven by AI can determine the optimal sampling locations to ensure comprehensive coverage with minimal instrument deployment, driving down initial capital expenditure and maintenance costs. AI also assists in automating the generation of compliance reports required by regulatory bodies like the FDA and EMA. By autonomously structuring, validating, and presenting data in audit-ready formats, AI minimizes the human error associated with manual data handling, significantly streamlining the validation and re-qualification processes essential to the pharmaceutical industry.

- AI enables predictive anomaly detection, anticipating particulate spikes based on operational patterns.

- Machine Learning algorithms optimize particle counter sampling frequency and location planning within controlled environments.

- AI-driven data fusion correlates particle data with pressure, temperature, and air flow metrics for root cause analysis of contamination.

- Automated compliance reporting and digital log generation reduce audit preparation time and minimize regulatory risk exposure.

- Intelligent calibration systems use historical performance data to signal required maintenance for sensors, improving uptime and measurement reliability.

- AI supports the development of smart, self-correcting environmental control systems (Smart HVAC).

- Enhanced facility mapping and visualization through AI-processed particle distribution data.

- Optimization of energy consumption by intelligently modulating air handling units based on predicted contamination levels, rather than fixed schedules.

- Natural Language Processing (NLP) aids in analyzing operator notes and environmental event logs for deeper insight into operational contamination risks.

- AI facilitates edge computing solutions, enabling immediate data processing and response at the instrument level before data transmission to the cloud.

- Development of digital twin models for cleanrooms, utilizing particle counter data to simulate contamination spread scenarios.

DRO & Impact Forces Of Dust Particle Counter Market

The Dust Particle Counter Market dynamics are defined by a strong interplay between regulatory mandates (Drivers), high initial investment hurdles (Restraints), advancements in sensor technology (Opportunities), and the overarching pressure of environmental health concerns (Impact Forces). The core Driver lies in the non-negotiable requirement for ISO 14644 compliance in high-tech manufacturing, pushing companies globally to invest in sophisticated monitoring infrastructure. Simultaneously, the inherent Restraints, such as the high cost of advanced instruments and the complexity associated with continuous system validation and maintenance, often slow down adoption rates, particularly in small and medium enterprises (SMEs). Strategic Opportunities are realized through the integration of IoT and cloud connectivity, enabling manufacturers to transition from selling hardware to providing comprehensive, subscription-based air quality management services. The immediate Impact Force is the globally intensifying scrutiny on airborne pollutants, driving consumer and governmental demand for verified air quality data in both industrial and public spaces.

Key Drivers include the booming pharmaceutical and biotechnology sectors, which demand absolute sterility in production, making particle monitoring a critical quality control step. The rapid expansion of the semiconductor industry, driven by the demand for smaller and more powerful chips, necessitates ultra-clean environments (ISO Class 1 and 2), where particle counting is indispensable for yield maintenance. Additionally, increasing occupational safety regulations require industrial hygienists to continuously monitor workplace air quality for hazardous dust exposure, broadening the application base beyond cleanrooms into heavy industry, mining, and construction sectors, further propelling market growth significantly.

However, the market faces significant Restraints, including the steep price point of high-precision, compliant particle counters, particularly those meeting 0.1 µm standards. This cost barrier is exacerbated by the requirement for regular, complex calibration and certification, often involving specialized third-party services, adding substantial operational expenditure. Furthermore, data management complexity, stemming from the massive volumes of continuous monitoring data generated, poses a challenge for end-users lacking adequate infrastructure or specialized analytical personnel. Opportunities arise from leveraging miniaturization and cost-effective sensor technologies to develop affordable, robust counter networks tailored for broader IAQ applications and integrating them seamlessly into existing building management systems (BMS).

Segmentation Analysis

The Dust Particle Counter Market is meticulously segmented across several dimensions, including the type of product (Portable, Remote, Handheld), measurement principle (Light Scattering, Condensation), particle size range, and end-user industry. This segmentation reflects the varied operational requirements across different sectors, ranging from quick, localized spot checks using handheld devices in residential settings to permanent, fixed monitoring arrays providing continuous, multi-point data streams in ISO Class 1 semiconductor facilities. The primary objective of segmentation analysis is to highlight the specific technological requirements and purchasing trends unique to each category, revealing that while the Portable segment holds the largest current market share, the Remote/Fixed segment is poised for the fastest expansion due to the shift toward centralized, automated monitoring solutions driven by compliance and efficiency mandates.

Further granularity in segmentation reveals distinct differences in regional adoption. For instance, North America and Europe show high penetration of high-end, compliant counters (especially 0.1 µm capability) in the Pharmaceutical and Aerospace segments, whereas the Asia Pacific region demonstrates faster uptake in the Industrial Manufacturing and IAQ segments, often utilizing more cost-effective, handheld, or basic remote counters. The Measurement Principle segmentation indicates that Light Scattering remains the dominant technology due to its broad applicability and relative simplicity, though Condensation Particle Counters (CPCs) are critical for ultra-low concentration, sub-0.1 µm particle detection, essential in the most advanced microelectronics cleanrooms.

Understanding the interplay between product type and end-use application is crucial for market participants. Suppliers must tailor their offerings—whether high-throughput data loggers for continuous compliance or ruggedized, battery-powered portable units for environmental field studies—to meet highly specific industry needs. The shift in end-user preferences towards bundled solutions that include software, data hosting, and maintenance contracts, rather than just the physical hardware, also shapes strategic segmentation and pricing models across all geographical markets.

- Product Type:

- Portable Particle Counters (Largest segment by volume)

- Remote/Fixed Particle Counters (Fastest growing segment by value)

- Handheld Particle Counters

- Benchtop Particle Counters

- Measurement Principle:

- Light Scattering Particle Counters (LSPC)

- Condensation Particle Counters (CPC)

- Optical Particle Counters (OPC)

- Particle Size Range:

- 0.1 Micrometers and Above

- 0.3 Micrometers and Above

- 0.5 Micrometers and Above

- PM2.5 and PM10 Specific Counters

- End-User Industry:

- Pharmaceutical and Biotechnology (Largest revenue segment)

- Semiconductor and Microelectronics (Highest precision requirement)

- Aerospace and Defense

- Hospitals and Healthcare

- Food and Beverage Processing

- Industrial Manufacturing (Automotive, Optics)

- HVAC and Indoor Air Quality (IAQ)

- Environmental Monitoring and Research

- Application:

- Cleanroom Monitoring and Certification

- Filter Testing (HEPA/ULPA)

- Industrial Hygiene and Occupational Health

- Compliance and Validation Services

Value Chain Analysis For Dust Particle Counter Market

The value chain for the Dust Particle Counter Market begins with sophisticated Upstream activities focused on the procurement and manufacturing of highly specialized components, primarily high-quality laser diodes, precision optics, and sensitive photo-detectors which are central to the instrument's accuracy. Key suppliers must maintain rigorous quality control over these components, as their performance directly dictates the counter's capability and compliance standing. Research and Development, encompassing firmware, software integration, and calibration methodologies, represents a critical early stage where intellectual property provides significant competitive leverage. The assembly phase requires clean manufacturing environments and highly skilled technical personnel to ensure the precise alignment of optical components, culminating in the final product characterized by high reliability and measurement fidelity.

Downstream activities involve specialized distribution channels, focusing heavily on technical expertise and localized support due to the specialized nature of the equipment and its integration into complex industrial control systems. Direct sales models are often employed for large industrial and governmental contracts, where customized systems and extensive pre-sales consultation are required. Indirect channels, typically composed of specialized environmental equipment distributors and representatives, handle sales to SMEs and general IAQ markets, often bundling the counters with complementary services like installation, calibration, and ongoing maintenance contracts, ensuring localized reach and rapid service response.

The distribution channel emphasizes the crucial role of after-sales support, encompassing mandatory annual calibration, preventative maintenance, and system validation services, which constitute a significant recurring revenue stream and a core element of customer retention. The effectiveness of the value chain is measured not only by the efficiency of hardware delivery but also by the quality and speed of technical support and certification services, which are critical for regulated industries such as pharmaceuticals where compliance validation is continuous and non-negotiable. Customers prioritize suppliers who offer integrated solutions that simplify data management and regulatory reporting throughout the lifecycle of the instrument.

Dust Particle Counter Market Potential Customers

Potential customers, or end-users/buyers, of dust particle counters are predominantly high-value, quality-sensitive entities operating in regulated or technologically demanding environments where contamination control is paramount. The pharmaceutical and biotechnology industry represents the single largest customer base, purchasing instruments for critical tasks such as sterility assurance, aseptic processing validation, and cleanroom certification (Class A/B/C/D monitoring). These buyers require instruments capable of measuring ultra-low concentrations down to 0.1 µm with secure data logging compliant with FDA 21 CFR Part 11, making them demanding consumers focused on compliance and data integrity features rather than cost alone.

The semiconductor and microelectronics sector forms another essential customer segment, requiring the most technologically advanced and sensitive counters for monitoring ISO Class 1 and 2 cleanrooms. Given that particulate contamination directly correlates with wafer yield loss, these companies invest heavily in remote, fixed monitoring systems integrated with sophisticated Facility Monitoring Systems (FMS). Their purchasing decisions are driven by detection sensitivity, reliability, network connectivity, and the ability to process continuous, high-volume data streams rapidly, emphasizing the demand for real-time fault detection and advanced predictive maintenance capabilities facilitated by AI integration.

A rapidly emerging customer demographic includes institutions focused on Indoor Air Quality (IAQ), such as commercial building managers, schools, hospitals, and HVAC service providers. Driven by public health concerns (e.g., post-COVID-19 air safety mandates) and energy efficiency goals, these customers increasingly seek user-friendly, cost-effective, portable, and IoT-enabled devices that provide easy-to-interpret data regarding PM2.5 and PM10 levels. This expansion into the commercial and residential sectors signifies a strategic shift for manufacturers, requiring the development of simpler, more robust, and highly networkable products tailored for non-specialist users and large-scale deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TSI Incorporated, Beckman Coulter (A Danaher Company), Lighthouse Worldwide Solutions, Particle Measuring Systems (PMS), Kanomax USA Inc., Rion Co., Ltd., PCE Instruments, Testo SE & Co. KGaA, Climet Instruments Company, Fluke Corporation (Danaher), Met One Instruments Inc., Setra Systems, Pamis GmbH, Airmodus Oy, GrayWolf Sensing Solutions, Sensidyne, TSI Taiwan, Dylos Corporation, Nanoscan Environmental, Palas GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dust Particle Counter Market Key Technology Landscape

The technological landscape of the Dust Particle Counter Market is rapidly evolving, moving primarily towards higher sensitivity, miniaturization, and seamless integration with digital infrastructure. The foundation remains the Optical Particle Counter (OPC), which relies on laser scattering technology. Recent advancements focus on utilizing highly stabilized, long-life laser diodes (e.g., blue or green lasers) coupled with optimized optical chambers to improve detection efficiency for smaller particles (down to 0.1 µm) at higher flow rates, thereby reducing sampling time while maintaining high statistical confidence. The integration of multi-channel sizing capabilities allows a single instrument to simultaneously monitor multiple particle size bins, providing comprehensive data critical for modern cleanroom classification and process analysis.

A major development driving the remote and fixed monitoring segment is the widespread integration of Internet of Things (IoT) capabilities. Modern dust particle counters are now equipped with wireless connectivity (Wi-Fi, Ethernet, proprietary mesh networks) and advanced microprocessors, allowing them to function as smart sensors. These IoT-enabled devices continuously stream data to centralized Facility Monitoring Systems (FMS) or cloud-based platforms, enabling remote calibration checks, over-the-air firmware updates, and comprehensive, real-time data visualization. This digital transformation reduces the need for manual data collection and significantly improves the efficiency and auditability of the monitoring process, particularly in large-scale pharmaceutical facilities.

For ultra-critical applications, the Condensation Particle Counter (CPC) technology remains paramount. CPCs utilize controlled condensation of a working fluid (typically butanol or water) onto ultrafine particles to grow them to a size detectable by conventional optical methods. Although more complex and expensive, CPCs are essential for research and high-end microelectronics manufacturing as they accurately measure particle sizes below 0.1 µm, often down to the nanometer range, which is crucial for monitoring airborne molecular contamination (AMC) precursors and validating specialized filtration systems (ULPA filters). Future trends include integrating CPC capabilities into more compact, easier-to-maintain formats and exploring solid-state sensing technologies to further reduce maintenance demands and total cost of ownership.

Regional Highlights

The Dust Particle Counter Market exhibits distinct characteristics across major geographical regions, influenced by localized regulatory environments, industrial concentration, and technological adoption rates. North America, encompassing the United States and Canada, represents a mature market characterized by stringent FDA and environmental protection agency regulations. The region sustains high demand for advanced, compliant particle counters, particularly in the pharmaceutical, aerospace, and high-tech manufacturing sectors. Investment is concentrated in replacing older infrastructure with automated, fully validated remote monitoring systems that support 21 CFR Part 11 requirements for electronic records. The presence of major biotechnology and semiconductor R&D centers ensures continuous demand for cutting-edge, high-sensitivity instruments.

Europe mirrors North America in terms of regulatory strictness, driven by EU GMP guidelines and ISO standards, especially within Germany, France, and the UK. The market shows strong demand for portable counters utilized in the qualification and re-qualification of certified cleanrooms, as well as a growing focus on industrial hygiene applications within manufacturing facilities adhering to regional occupational health directives. Eastern European countries are experiencing accelerated adoption as they modernize their manufacturing bases and harmonize their quality standards with Western EU regulations. Key growth drivers include the automotive industry’s reliance on clean processes for sensor and battery production, alongside ongoing investments in sustainable environmental monitoring solutions across urban centers.

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate globally, making it the most dynamic market segment. This explosive expansion is driven by massive governmental and private investments into semiconductor fabrication plants (fabs) in countries like China, South Korea, and Taiwan, which necessitate thousands of fixed and remote particle counters for continuous ISO Class 1 monitoring. Furthermore, the burgeoning pharmaceutical industry in India and Southeast Asia, aimed at serving both domestic and international markets, requires immediate establishment of compliant cleanroom infrastructure. APAC’s market is characterized by a higher volume of sales for cost-effective, high-throughput counters, alongside premium instruments for critical applications, reflecting a diverse economic landscape.

Latin America (LATAM) presents an emerging market opportunity, currently characterized by fragmented demand but with significant potential, particularly in Brazil and Mexico. Demand is largely driven by the localized presence of multinational pharmaceutical corporations establishing regional production hubs and the growing adoption of internationally recognized standards. The market penetration rate is lower compared to developed regions, but increasing governmental focus on industrial quality control and public health standards is expected to catalyze growth, focusing initially on handheld and portable devices for validation and audit purposes. Price sensitivity remains a key purchasing factor in this region, favoring suppliers who offer robust, mid-range technology with strong local service support.

The Middle East and Africa (MEA) region is exhibiting steady growth, fueled by infrastructure development projects, large-scale investments in healthcare facilities, and the establishment of local pharmaceutical and medical device manufacturing plants in the UAE, Saudi Arabia, and South Africa. These countries are increasingly prioritizing air quality monitoring as part of urban planning and occupational safety initiatives. The market in MEA often requires instruments capable of operating reliably under challenging environmental conditions, such as high heat and dust levels, leading to demand for ruggedized and highly stable remote sensing equipment integrated with facility cooling systems. The oil and gas sector also provides a niche market for industrial hygiene monitoring in harsh operational environments.

- North America: Dominance in high-end, 0.1 µm sensitive instruments due to significant pharmaceutical R&D and aerospace demands.

- Asia Pacific (APAC): Highest CAGR driven by vast semiconductor fabrication expansion and rising localized pharmaceutical manufacturing in China and India.

- Europe: Strong demand sustained by regulatory adherence (EU GMP) and investments in clean technologies for the automotive and advanced materials sectors (Germany, UK).

- China: Major contributor to APAC growth, focusing heavily on national self-sufficiency in high-grade microelectronics, necessitating large-volume fixed monitoring networks.

- Japan and South Korea: Leaders in adopting ultra-high precision condensation particle counters (CPCs) for advanced research and leading-edge semiconductor processing.

- Latin America: Emerging market centered around pharmaceutical hubs in Brazil and Mexico, characterized by increasing, albeit price-sensitive, demand for compliant portable counters.

- Middle East: Growing investment in hospital infrastructure and localized drug production drives demand for reliable cleanroom certification equipment.

- India: Rapidly expanding market due to domestic biotechnology and vaccine manufacturing, pushing the need for ISO-compliant monitoring solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dust Particle Counter Market.- TSI Incorporated

- Beckman Coulter (A Danaher Company)

- Lighthouse Worldwide Solutions

- Particle Measuring Systems (PMS)

- Kanomax USA Inc.

- Rion Co., Ltd.

- PCE Instruments

- Testo SE & Co. KGaA

- Climet Instruments Company

- Fluke Corporation (Danaher)

- Met One Instruments Inc.

- Setra Systems

- Pamis GmbH

- Airmodus Oy

- GrayWolf Sensing Solutions

- Sensidyne

- TSI Taiwan

- Dylos Corporation

- Nanoscan Environmental

- Palas GmbH

Frequently Asked Questions

Analyze common user questions about the Dust Particle Counter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Dust Particle Counter Market?

The primary driver is the global increase in stringent regulatory requirements, particularly ISO 14644 standards for cleanroom environments, alongside massive investments in the pharmaceutical and semiconductor manufacturing sectors, which critically depend on accurate particle monitoring for quality assurance and yield preservation.

How are remote monitoring systems changing the operational efficiency of cleanrooms?

Remote monitoring systems, especially those utilizing fixed particle counters integrated with IoT and cloud platforms, enhance operational efficiency by providing continuous, real-time data streaming, enabling immediate contamination event alerts, reducing the need for manual data logging, and supporting rapid, data-driven root cause analysis.

Which end-user segment accounts for the highest revenue share in the Dust Particle Counter Market?

The Pharmaceutical and Biotechnology end-user segment accounts for the highest revenue share. This segment requires high-precision, validated instruments and extensive supporting services for compliance with global regulatory bodies (FDA, EMA), resulting in high-value, recurring purchases.

What technological advancements are expected to reshape particle counter design in the forecast period?

Key technological advancements include the miniaturization and cost reduction of high-sensitivity sensors, increased integration of AI and Machine Learning for predictive maintenance and data anomaly detection, and the proliferation of networked, battery-operated units for broad Indoor Air Quality (IAQ) applications beyond traditional industrial settings.

What is the core difference between Optical Particle Counters (OPC) and Condensation Particle Counters (CPC)?

OPCs measure particles by scattering light from a laser and are generally used for sizes above 0.3 µm or 0.1 µm. CPCs, conversely, use controlled condensation to grow ultrafine particles (often below 0.1 µm down to nanometer range) large enough to be optically detected, making CPCs essential for measuring ultra-low concentrations in the most critical semiconductor cleanrooms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager