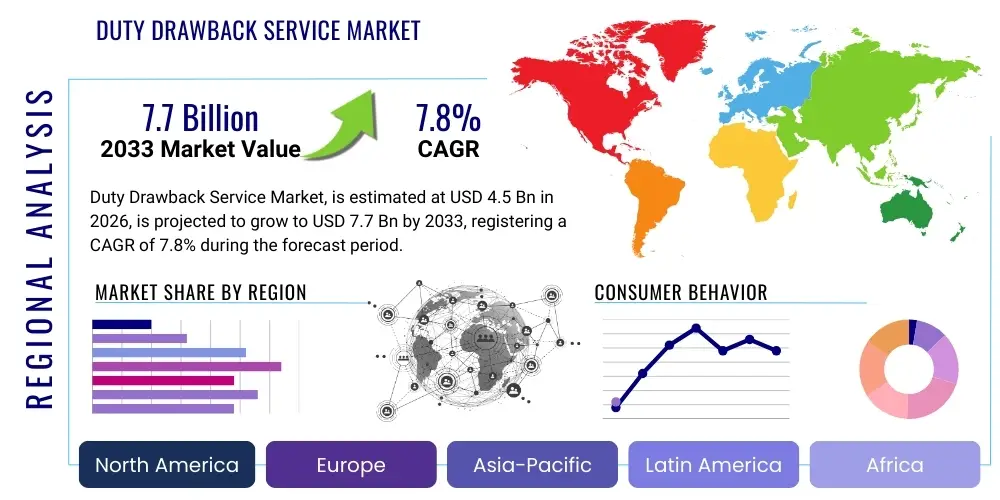

Duty Drawback Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438627 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Duty Drawback Service Market Size

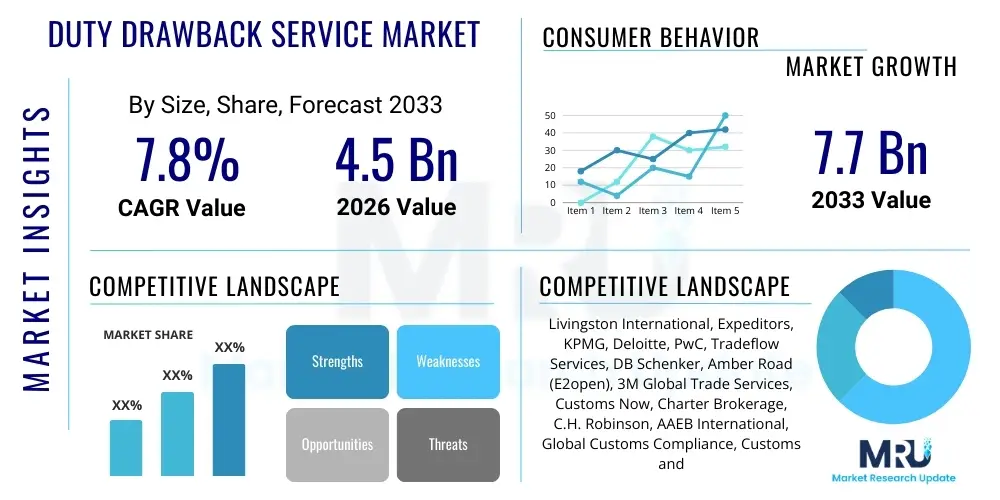

The Duty Drawback Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Duty Drawback Service Market introduction

The Duty Drawback Service Market encompasses specialized financial and regulatory compliance services designed to assist international trade participants, primarily exporters, in recovering customs duties previously paid on imported merchandise that is subsequently exported or destroyed. This mechanism, formalized under national customs laws globally, aims to prevent the accumulation of embedded duties in export costs, thereby enhancing the competitiveness of domestically manufactured and exported goods in the global marketplace. The complexity of modern supply chains, coupled with evolving global trade regulations and agreements, makes outsourced duty drawback services indispensable for maximizing recovery and ensuring stringent compliance with governmental regulations.

The core product offered in this market includes consulting, data management, claims preparation, and submission services, often leveraging sophisticated software platforms for tracking import entries against subsequent export documentation. Major applications span across heavy manufacturing, automotive, aerospace, electronics, chemicals, and retail industries, where companies frequently import components or materials that undergo processing before final exportation. The growing recognition among businesses that duty recovery represents a critical, often overlooked, source of liquidity and cost reduction is significantly boosting market demand.

Key benefits derived from utilizing professional duty drawback services include optimized cash flow through timely refunds, minimized risk of non-compliance and resulting audits or penalties, and operational efficiency by shifting complex regulatory tasks to experts. Driving factors for market expansion include the continuous globalization of trade, the rising complexity introduced by multifaceted trade tariffs (such as those arising from trade disputes), and the increasing adoption of automated solutions that simplify the burdensome reconciliation process required for accurate claims. Furthermore, the strategic focus of multinational corporations on supply chain finance and optimization heavily relies on successful duty recovery mechanisms.

Duty Drawback Service Market Executive Summary

The Duty Drawback Service Market is experiencing robust growth driven by accelerating global trade and the necessity for intricate compliance management in diverse regulatory environments. Current business trends indicate a significant shift toward technology integration, where service providers are increasingly adopting cloud-based platforms and advanced data analytics to enhance the speed and accuracy of claim processing. The trend towards global sourcing and decentralized manufacturing models mandates sophisticated duty management solutions, positioning outsourced providers as essential partners for managing cross-border complexity. Strategic partnerships between customs brokers, logistics providers, and specialized drawback firms are defining the competitive landscape, aiming to offer end-to-end supply chain financial optimization.

Regionally, North America maintains its dominance, primarily due to the expansive and intricate nature of the US Duty Drawback program (especially the move to the TFTEA framework), requiring specialized expertise for compliance and maximal recovery. Asia Pacific is emerging as the fastest-growing region, fueled by massive export volumes from manufacturing hubs like China, India, and Vietnam, where governmental incentives and the quest for international competitiveness heighten the need for efficient duty recovery. European growth is sustained by the continuous harmonization and occasional fracturing (post-Brexit) of customs regulations, pushing companies to seek external guidance to navigate changing customs codes and indirect taxation complexities.

Segment trends reveal that the manufacturing sector remains the largest end-user, given the high volume of processing and transformation activities eligible for drawback. The shift from standard drawback claims to more complex manufacturing drawback claims is notable, reflecting the sophistication of global production networks. Furthermore, the market segment dedicated to software and managed technology services is projected to exhibit the highest CAGR, emphasizing the industry's reliance on automation for handling the immense transactional data required for substantiation and audit trails. The increasing complexity of the substitution ruling eligibility criteria under new trade acts further solidifies the need for specialized external services.

AI Impact Analysis on Duty Drawback Service Market

User queries regarding AI's influence in the Duty Drawback Service Market frequently revolve around automation capabilities, data integrity, and predictive compliance. Key themes include whether AI can completely replace human analysts, how machine learning (ML) improves the accuracy of matching import records to export shipments across disparate datasets, and the potential for AI-driven risk assessment to preempt customs audits. Users are highly interested in AI’s ability to handle massive volumes of transactional data (often spread across multiple Enterprise Resource Planning systems) needed for complex manufacturing drawback claims, especially concerning the verification of usage and eligibility under substitution rules. The general expectation is that AI will streamline the identification of recoverable duties, minimize human error, and accelerate the refund cycle time, moving the service model toward real-time optimization rather than retrospective claim filing.

AI and ML technologies are poised to revolutionize the Duty Drawback service sector by automating the most labor-intensive aspects of claims preparation. Specifically, Natural Language Processing (NLP) can be deployed to analyze and interpret unstructured documentation, such as bills of lading, commercial invoices, and manufacturing process descriptions, ensuring that all necessary evidentiary documentation is correctly categorized and linked to the corresponding customs entries. This reduces the administrative burden and accelerates the initial data aggregation phase, which historically has been the primary bottleneck in claim preparation. Furthermore, AI-driven algorithms are exceptionally effective at cross-referencing millions of lines of historical import data against export data, identifying potential drawback opportunities that might be missed during manual reviews, thereby increasing the total recovery for clients.

Beyond data matching, AI's role extends into predictive modeling and compliance assurance. Machine learning models can be trained on historical audit data to identify patterns or anomalies in claims that increase the likelihood of customs scrutiny. This allows service providers to proactively adjust the documentation or methodology before submission, significantly lowering the risk profile for clients. Predictive analytics can also forecast the likely recovery amount and timeline, offering better financial planning tools to exporting companies. This shift towards intelligent compliance management transforms the service from purely administrative recovery into strategic financial planning, ensuring AEO standards are maintained and regulatory requirements are met with higher certainty, thus reinforcing the market value proposition of service providers.

- AI-powered automated classification and reconciliation of import/export records.

- Machine learning for predictive audit risk assessment and compliance optimization.

- Natural Language Processing (NLP) for processing unstructured customs and manufacturing documentation.

- Enhanced fraud detection by analyzing data anomalies in utilization and substitution claims.

- Automation of complex manufacturing usage consumption calculations (bill of materials reconciliation).

- Real-time monitoring of regulatory changes and automated adjustment of claim filing procedures.

DRO & Impact Forces Of Duty Drawback Service Market

The Duty Drawback Service Market is heavily influenced by dynamic global trade environments, balancing the push toward efficiency and the constraints imposed by stringent governmental oversight. Key drivers include the exponential growth in global sourcing strategies, where complex, multi-country supply chains necessitate professional management of customs duties to remain competitive. Restraints center on the inherent complexity and specialized knowledge required for navigating varied national drawback regimes, coupled with the significant administrative burden and high risk of non-compliance penalties, which deter some companies from pursuing claims. Opportunities are concentrated in leveraging digital transformation—specifically, the integration of advanced data analytics and cloud-based platforms to automate compliance and identify previously unrealized recovery opportunities. These forces collectively shape the market's trajectory, driving investment in technological solutions and expert consultation services.

Drivers: The most prominent driver is the increasing volume and complexity of international trade, particularly the reliance on intermediate goods (components) that are imported, processed, and subsequently exported. Companies operating under global trade agreements, such as the USMCA (United States-Mexico-Canada Agreement) or various free trade pacts, rely on duty drawback to maintain competitive pricing by removing embedded tariffs. Furthermore, the continuous modernization of customs administrations, like the U.S. transition to the Automated Commercial Environment (ACE) for drawback filing, facilitates faster processing, making claims more financially attractive and thus increasing the incentive for exporters to utilize specialized services. The growing awareness among Chief Financial Officers (CFOs) that duty recovery is a critical component of supply chain financial optimization and working capital management also fuels demand.

Restraints: Significant barriers to market growth include the inherent regulatory risk associated with duty drawback programs. Claims require meticulous documentation and strict adherence to technical deadlines and rules (e.g., substitution criteria, time limits for export), and even minor errors can lead to substantial penalties or audits that negate the value of the recovery. The substantial investment required for an in-house team to acquire and maintain the specialized legal and regulatory expertise needed for compliance acts as a restraint, particularly for Small and Medium-sized Enterprises (SMEs). Moreover, the initial difficulty in aggregating, cleansing, and reconciling vast amounts of transactional data from disparate legacy IT systems often delays or prevents companies from initiating drawback programs efficiently.

Opportunities: Major opportunities lie in expanding services to emerging markets, where trade regulations are rapidly evolving and local expertise is scarce. The integration of drawback management systems directly into clients' ERP (Enterprise Resource Planning) and SCM (Supply Chain Management) platforms provides a crucial competitive edge by enabling seamless, real-time data capture and claims monitoring. A major opportunity also exists in developing niche services focused on specific, complex drawback types, such as unused merchandise or rejected merchandise drawback, which often yield high-value claims but require highly specialized handling. The proliferation of blockchain technology for creating verifiable, immutable records of goods movement offers a future opportunity to simplify proof of import and export, significantly reducing the evidential burden.

Segmentation Analysis

The Duty Drawback Service Market is predominantly segmented based on the type of service provided, the mode of deployment, and the primary industry served (end-user). Analyzing these segments provides crucial insights into market dynamics, identifying the areas of highest growth potential and specialization. The market is increasingly polarizing into highly complex, specialized consulting services for large multinational enterprises navigating intricate manufacturing drawback laws, and standardized, automated software solutions targeting mid-market players focused on simpler unused merchandise claims. The technological segment, including managed software and outsourced processing, is rapidly capturing market share due to its efficiency and scalability in handling massive transactional volumes required for comprehensive claims filing.

Segmentation by Service Type highlights the critical difference between standard claims (simple import/export matching) and complex claims (manufacturing, substitution, rejected goods), with the latter requiring significantly more expertise and command higher service fees, driving revenue growth for specialist firms. End-user segmentation shows that capital-intensive sectors like Automotive and Aerospace, characterized by intricate global supply chains and high duty values, are major revenue generators. The shift towards greater outsourcing reflects companies' desires to focus internal resources on core competencies while ensuring maximum compliance and recovery through third-party experts.

- By Service Type:

- Standard Drawback Services (Unused Merchandise)

- Manufacturing Drawback Services (Substitution, Same Condition)

- Rejected Merchandise Drawback

- Audit Support and Compliance Consulting

- By Mode of Deployment:

- Managed Services (Fully Outsourced)

- Software-as-a-Service (SaaS) Platform

- Hybrid/Consulting Services

- By End-User Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and High-Tech

- Chemicals and Pharmaceuticals

- Retail and Consumer Goods

- Industrial Machinery and Manufacturing

- By Program Type:

- Direct Identification Drawback Programs

- Substitution Drawback Programs (e.g., H.S. Code substitution)

Value Chain Analysis For Duty Drawback Service Market

The value chain for Duty Drawback Services begins with upstream activities focused heavily on data acquisition and technology infrastructure development. This includes the development and maintenance of sophisticated, cloud-based software platforms capable of integrating with client ERP systems (SAP, Oracle, etc.) and various customs entry systems (like ACE in the US). Technology developers, data scientists, and customs software vendors form the crucial upstream component, providing the technological backbone necessary to handle the colossal data reconciliation tasks. The quality and robustness of these upstream technologies directly determine the efficiency and accuracy of subsequent service delivery stages.

Midstream activities represent the core service provision phase, involving specialized customs brokers, trade compliance consultants, and licensed drawback specialists. This stage encompasses the complex process of data cleansing, validation, regulatory interpretation, preparation of official claim filings (including supporting documentation), and submission to the relevant customs authority. The value added here is intellectual and process-driven, focusing on maximizing recovery while minimizing compliance risk through expert application of complex tariff schedules and drawback regulations. Specialized knowledge of specific country programs (e.g., US Treasury Decision 95-56 vs. standard drawback) is essential at this juncture.

Downstream activities involve interactions with the final end-users and the management of the claim lifecycle post-submission. This includes handling government queries, managing audits, securing the final refund payment, and conducting post-claim reporting and reconciliation. Distribution channels are primarily direct, involving contractual agreements between the service provider and the exporter. However, indirect channels are growing, where large customs brokers or third-party logistics (3PL) providers integrate drawback services into their broader supply chain offerings, effectively acting as intermediaries to their client base. The final value captured is the realized cost saving and working capital enhancement for the exporting company.

Duty Drawback Service Market Potential Customers

Potential customers for Duty Drawback Services are primarily organizations engaged in significant volumes of international trade, especially those operating multi-jurisdictional supply chains where goods are imported, transformed, and subsequently exported. The primary end-users are multinational manufacturing and production companies that rely on global sourcing for components or raw materials. These include automotive manufacturers who import parts for assembly before exporting the finished vehicle, or electronics companies importing microprocessors for integration into final consumer products.

The breadth of potential customers extends beyond large multinational corporations to include mid-market companies that often lack the internal expertise or resources to dedicate to drawback compliance but still export high-value goods. Retail and consumer goods companies are also significant buyers, particularly those managing large-scale global apparel or accessory lines where merchandise is imported, consolidated, sometimes repackaged, and then re-exported to foreign markets, qualifying for unused merchandise drawback. Any entity that demonstrates a clear link between imported goods (on which duties were paid) and subsequent exportation of those goods or products derived from them represents a viable target customer.

Key sectors prioritizing these services are those facing high tariffs or competitive pressures requiring meticulous cost management. This includes the Aerospace sector, which involves highly valuable components crossing borders multiple times during the manufacturing cycle, and the Chemical industry, where raw material costs (including duties) significantly impact the final product price. The increasing complexity of global tax and customs reporting makes the CFO and VP of Global Trade Compliance the key buyers and decision-makers for adopting professional duty drawback services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Livingston International, Expeditors, KPMG, Deloitte, PwC, Tradeflow Services, DB Schenker, Amber Road (E2open), 3M Global Trade Services, Customs Now, Charter Brokerage, C.H. Robinson, AAEB International, Global Customs Compliance, Customs and International Trade Consulting (CITC), TASA, MIC Customs Solutions, OCR Services, Trade Technologies, WSP (World Shipping Partners) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Duty Drawback Service Market Key Technology Landscape

The technological landscape of the Duty Drawback Service Market is defined by advanced software solutions focused on data aggregation, reconciliation, and automated compliance. Central to this landscape are dedicated Drawback Management Systems (DMS) offered primarily as Software-as-a-Service (SaaS) platforms. These systems provide centralized data repositories capable of ingesting information from disparate internal and external sources—including ERP systems, WMS (Warehouse Management Systems), customs brokers, and carriers. The shift to SaaS models ensures scalability, reduces client IT overhead, and allows service providers to rapidly implement regulatory updates, such as changes arising from new trade agreements or national customs rulings, ensuring continuous compliance for all users.

Data reconciliation technology forms the functional core of modern drawback services. Given that a single drawback claim often requires matching thousands of import entries to corresponding export shipments (sometimes years apart), sophisticated algorithms are necessary. These systems utilize rule-based engines combined with machine learning to ensure high-fidelity matching, especially for complex manufacturing drawback claims that necessitate tracking inventory consumption (First-In, First-Out, or substitution methods). Furthermore, these platforms include robust audit trail capabilities, generating the precise reports and summaries required by customs authorities to substantiate the claims, thereby mitigating audit risk and accelerating the refund process.

Integration capabilities are critical for market differentiation. Leading technology solutions offer Application Programming Interfaces (APIs) and pre-built connectors to widely used trade execution and supply chain visibility platforms. This integration ensures a smooth flow of required transactional data (e.g., proof of export, manufacturing usage records) without manual intervention. The emerging use of blockchain is also being explored, particularly for securing the chain of custody and providing verifiable proof points for imported materials and exported finished goods, offering a transparent and potentially irrefutable audit trail that could revolutionize the documentation process, though this remains an early-stage development in widespread commercial application.

Regional Highlights

- North America: Dominance Driven by Complexity and High Trade Volume

- United States: Largest market share due to the size of its import/export economy and regulatory complexity (TFTEA).

- Canada and Mexico: Strong demand linked to cross-border trade optimization under USMCA.

- High adoption of managed services and dedicated SaaS platforms for risk mitigation.

- Europe: Navigating Harmonization and Fragmentation

- United Kingdom: High growth fueled by new customs requirements and duty exposure post-Brexit.

- Continental Europe: Driven by utilization of UCC procedures and multi-jurisdictional compliance needs.

- Focus on integrating drawback strategy with wider indirect tax and customs procedures (IPR).

- Asia Pacific (APAC): The Fastest Growing Export Hub

- China and Vietnam: High demand due to massive export volumes and local governmental duty reduction incentives.

- India: Growing complexity in customs and GST regimes necessitating professional external support.

- Focus on scaling automated solutions to handle high-volume, low-margin transactions typical of Asian manufacturing.

- Latin America, Middle East, and Africa (LAMEA): Emerging Markets and Resource Trade

- Middle East: Growing demand driven by economic diversification and development of free zones.

- Latin America: Complexity of domestic regulations (e.g., Brazil’s RECOF) necessitates specialized local consultation.

- Market characterized by high duty rates, amplifying the financial importance of successful drawback claims.

- Livingston International

- Expeditors International of Washington, Inc.

- KPMG International

- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Tradeflow Services

- DB Schenker

- E2open (incorporating Amber Road)

- 3M Global Trade Services

- Customs Now

- Charter Brokerage

- C.H. Robinson Worldwide, Inc.

- AAEB International

- Global Customs Compliance

- Customs and International Trade Consulting (CITC)

- TASA International

- MIC Customs Solutions

- OCR Services, Inc.

- Trade Technologies Inc.

- Bureau Veritas

North America, particularly the United States, commands the largest share of the global Duty Drawback Service Market. This dominance is attributable to the sheer volume of high-value imports and subsequent exports, coupled with the intricate and often changing nature of the U.S. drawback program, most recently formalized under the Trade Facilitation and Trade Enforcement Act (TFTEA). The transition mandated by TFTEA introduced significant complexity, particularly regarding substitution eligibility and the consolidation of various drawback types, requiring companies to overhaul their entire compliance framework. This regulatory shift has dramatically increased the reliance on specialized external service providers and advanced software platforms capable of managing the stricter record-keeping requirements and the longer permissible claim periods.

Canadian and Mexican drawback programs, while distinct, also contribute significantly to regional demand, particularly within the context of the USMCA agreement, which necessitates careful duty management to optimize cross-border movement and qualification for preferential treatment. The maturity of the logistics and trade compliance infrastructure in this region facilitates the adoption of high-tech drawback solutions. Demand is especially robust in the automotive, aerospace, and high-tech manufacturing sectors, which are characterized by deep global supply chain integration and high duty exposure, making recovery essential for maintaining cost efficiency and competitiveness.

The European Duty Drawback Service Market is driven by the complexities associated with the Union Customs Code (UCC) and the regulatory challenges introduced by Brexit. Although the EU framework seeks harmonization, member state interpretations and specialized procedures (such as Inward Processing Relief, which functions similarly to drawback) create significant demand for expert guidance. The UK market, post-Brexit, has necessitated the creation of entirely new customs procedures and duty recovery mechanisms for trade between the UK and the EU, resulting in a surge in demand for compliance consulting services specifically tailored to the new dual regulatory environment.

European companies, especially those in chemicals, luxury goods, and industrial machinery, often operate extensive intra-European supply chains supplemented by global sourcing. Service providers in this region focus heavily on integrating drawback claims with VAT and other indirect tax considerations to provide comprehensive financial optimization. The emphasis here is on ensuring continuous compliance across multiple EU jurisdictions while strategically utilizing mechanisms like customs warehousing and free zones to defer or eliminate duties where possible before pursuing drawback recovery on necessary imports.

APAC is projected to be the fastest-growing region, owing to its position as the global manufacturing powerhouse and the exponential increase in export volumes, particularly from China, Vietnam, South Korea, and India. Governments in this region frequently utilize duty refund or exemption schemes (which mirror drawback) as primary tools to encourage and support export-oriented industries. The rapid expansion of international trade flows, coupled with relatively nascent or rapidly developing regulatory structures, creates substantial opportunities for professional service providers.

Challenges in APAC often center on language barriers, varied bureaucratic processes across different countries, and the difficulty of tracking supply chain data across multiple manufacturing tiers. Therefore, the demand is strong for technologically robust solutions that can handle data in diverse formats and provide localized regulatory interpretation. As Western multinationals increasingly diversify their supply chains away from single regions, they require duty drawback services that can seamlessly handle claims across multiple high-growth Asian manufacturing bases, driving up the need for pan-regional service coverage and sophisticated cross-border expertise.

The LAMEA region represents a market with high growth potential, largely centered on resource extraction, commodities trading, and localized manufacturing for regional markets. Duty drawback programs in countries like Brazil and South Africa are complex and highly specific, requiring intensive local knowledge. Market growth is being propelled by large infrastructure projects and increasing industrialization, which involves importing high-value machinery and inputs that are later exported or used in production for export. However, political instability and fluctuating customs enforcement levels can sometimes act as restraints.

In the Middle East, the focus on diversifying economies away from oil (e.g., through manufacturing and technology hubs) is stimulating demand for structured trade compliance services. Service providers often enter these markets through partnerships with local customs brokers, offering standardized software and consulting methodologies adapted to the specific regulatory landscape, particularly concerning free trade zones and specialized economic areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Duty Drawback Service Market.Frequently Asked Questions

Analyze common user questions about the Duty Drawback Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of outsourcing duty drawback services instead of managing them internally?

Outsourcing provides immediate access to specialized regulatory expertise and sophisticated software platforms essential for navigating complex customs laws, ensuring maximum recovery of duties, and significantly minimizing the risk of non-compliance penalties and costly customs audits. It also frees up internal financial resources to focus on core business operations.

How has the US Duty Drawback program changed under the Trade Facilitation and Trade Enforcement Act (TFTEA)?

TFTEA streamlined and simplified the program by consolidating nine drawback types into four, extending the time limit for filing claims, and fundamentally altering the requirements for substitution claims (allowing substitution based on Harmonized Tariff Schedule (HTS) codes rather than strict interchangeability). These changes mandate modern data tracking systems for compliance.

Which technology is most critical for optimizing high-volume duty drawback claims?

Dedicated Drawback Management Systems (DMS), often delivered via SaaS, are most critical. These systems leverage robust data ingestion and reconciliation algorithms, often enhanced by AI, to accurately match vast quantities of import entry data with subsequent export documentation, a task impossible to perform efficiently manually.

What industries are the largest consumers of manufacturing duty drawback services?

The largest consumers are industries characterized by complex, multi-stage global production cycles and high-value components, including Automotive and Transportation, Aerospace and Defense, and Electronics and High-Tech manufacturing. These sectors frequently import materials that are physically or chemically transformed before the final product is exported.

What key risk factors are associated with filing duty drawback claims?

The primary risk factors include the high probability of regulatory audit, stringent time limits for filing claims, and severe penalties or forced repayment if documentation is deemed insufficient or inaccurate. Failure to maintain a verifiable audit trail linking import duties paid to specific exported merchandise poses the greatest financial and legal compliance risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager