Duty Free Travel Retail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432408 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Duty Free Travel Retail Market Size

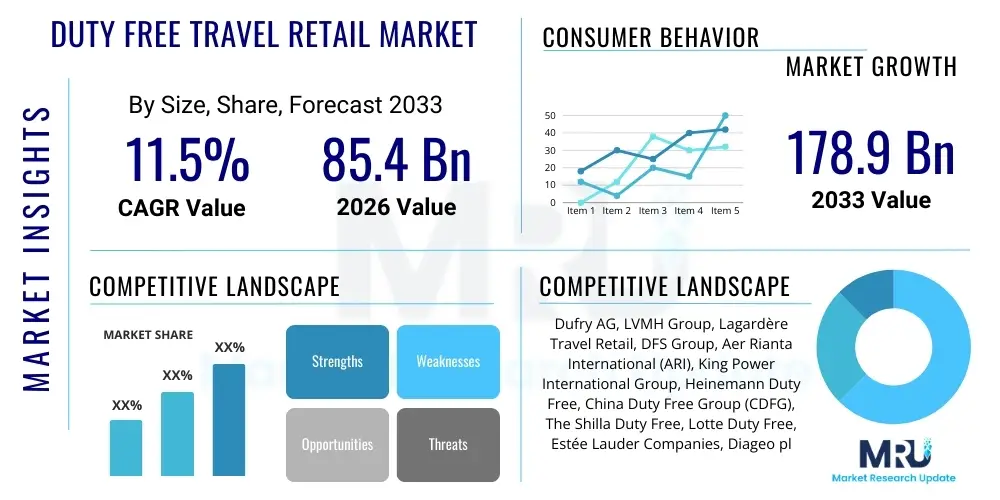

The Duty Free Travel Retail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. This robust expansion is fueled by the sustained recovery in global air traffic, increasing disposable incomes in emerging economies, and the strategic expansion of retail spaces within key international travel hubs. The inherent value proposition of tax-free purchasing remains a powerful incentive for international travelers, driving consistent sales across high-margin categories such as luxury goods and cosmetics. Furthermore, the market benefits significantly from evolving consumer expectations, which demand enhanced, personalized, and digitally integrated shopping experiences, prompting significant investments in retail technology and experiential store designs, particularly within large airport concessionaires.

The market is estimated at USD 85.4 Billion in 2026 and is projected to reach USD 178.9 Billion by the end of the forecast period in 2033. This remarkable growth trajectory is supported by demographic shifts, notably the rising affluence of Asian travelers, who historically exhibit a high propensity for duty-free spending. While geopolitical instability and regulatory complexities, particularly surrounding tobacco and alcohol sales, present minor headwinds, the underlying structural drivers—such as the continuous globalization of travel and the modernization of airport infrastructure—provide a strong foundation for sustained double-digit growth throughout the projected timeline. Strategic mergers and acquisitions among major travel retail groups also play a crucial role in consolidating market share and enhancing operational efficiencies on a global scale.

Duty Free Travel Retail Market introduction

The Duty Free Travel Retail Market encompasses the sale of goods exempt from various national duties and taxes to international travelers, typically conducted at controlled access points such as international airports, border crossings, cruise ships, and designated downtown duty-free stores. This niche retail segment primarily focuses on products categorized as Perfumes & Cosmetics, Wines & Spirits, Fashion & Accessories, and Confectionery. The core product description involves high-value, branded consumer goods offered at a price advantage compared to domestic retail prices, serving as a powerful purchase motivator for tourists and business travelers alike. Major applications include enhancing the passenger experience at travel hubs, providing key revenue streams for airport authorities, and acting as a primary channel for global luxury brands to build international recognition and volume sales. The primary benefit of this market lies in its ability to capture discretionary spending from consumers in transit, optimizing the retail footprint of transportation infrastructure.

The market is primarily driven by macro-economic factors such as increasing global tourism volume, rising middle-class disposable income, and continuous liberalization of cross-border trade agreements, which facilitate easier international movement. Furthermore, the development of major new airport infrastructure, especially in the Asia Pacific region, significantly expands the available retail space, directly contributing to market growth potential. The proliferation of Low-Cost Carriers (LCCs) has democratized air travel, increasing the overall pool of potential duty-free shoppers. However, the market must constantly innovate to address challenges such as evolving customs regulations and the increasing competitive pressure from domestic e-commerce platforms and digital travel retailers. The experiential element of duty-free shopping, focusing on product discovery and brand immersion, remains a crucial driving factor distinguishing it from mainstream retail.

Duty Free Travel Retail Market Executive Summary

The Duty Free Travel Retail Market is poised for substantial expansion, characterized by significant shifts towards digitalization and experiential retail formats. Key business trends include the convergence of physical and digital shopping pathways, leveraging pre-order and click-and-collect services to capture passenger attention before arrival at the point of sale. Major operators are focusing heavily on data analytics and Customer Relationship Management (CRM) tools to personalize offerings, addressing the diverse needs of different traveler demographics, especially the high-spending segments from Northeast Asia. Geographically, Asia Pacific remains the engine of growth, driven by China’s outbound tourism market, though North America and Europe are showing strong recovery and stable growth, focusing on high-margin luxury goods and premium travel-exclusive products. Retailers are strategically optimizing product portfolios to emphasize travel-exclusive sizes, limited editions, and sustainable offerings, aligning with contemporary consumer values.

Regional trends indicate that regulatory harmonization and infrastructure development are crucial determinants of regional market performance. In Asia Pacific, the construction of mega-airports and integrated travel retail complexes, such as Hainan’s duty-free zones, is creating new consumer hotspots, diverting spending patterns. European growth is stable, often linked to intercontinental flights and robust sales in the Wines & Spirits category, benefiting from long-standing tradition and brand heritage. North America is experiencing modernization of its airport retail concessions, integrating local flavors and highly engaging experiences to appeal to domestic travelers and international visitors alike. Segment trends highlight that Perfumes & Cosmetics maintain the largest market share due to high turnover and continuous product innovation, while the Fashion & Accessories segment is rapidly gaining traction, driven by exclusive high-end collaborations and limited-time collections offered specifically in the travel environment. The digitalization of payment systems and loyalty programs is unifying the global duty-free landscape, making the shopping experience seamless regardless of location.

AI Impact Analysis on Duty Free Travel Retail Market

User inquiries regarding AI's impact on the Duty Free Travel Retail Market consistently revolve around personalization, operational efficiency, and the future role of physical retail staff. Key questions often focus on how AI can enhance customer segmentation, predict purchasing behavior based on flight itineraries and loyalty data, and streamline supply chain logistics within complex airport environments. There is significant interest in using generative AI for creating dynamic, multilingual marketing content tailored to specific traveler groups, and implementing sophisticated AI-powered security and inventory systems that minimize stockouts and reduce shrinkage. Concerns typically center on data privacy, the integration cost of advanced AI solutions, and ensuring that automation does not diminish the high-touch customer service expected in luxury travel retail settings. Users anticipate that AI will primarily drive optimization, transforming the passenger journey from a transactional event into a highly customized, predictive, and friction-less retail experience, setting a new benchmark for global travel commerce.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally reshaping the competitive landscape of duty-free retail, moving beyond basic automation toward sophisticated predictive intelligence. AI is being deployed extensively in inventory management, utilizing real-time sales data and flight schedule projections to ensure optimal stock levels for fast-moving consumer goods and high-demand luxury items. This precise forecasting minimizes capital tied up in slow-moving inventory and drastically reduces out-of-stock scenarios during peak travel periods, thereby enhancing customer satisfaction and maximizing sales potential per passenger. Furthermore, AI-driven pricing strategies are allowing retailers to implement dynamic pricing models that respond instantly to competitor actions, currency fluctuations, and specific concessionaire mandates, optimizing revenue yield from every square meter of retail space.

Crucially, AI’s greatest contribution lies in perfecting the customer experience (CX) through hyper-personalization. By analyzing vast datasets encompassing traveler demographics, past purchase history, flight routes, and online browsing behavior, AI engines can generate highly targeted product recommendations delivered via mobile apps, personalized digital signage, or through sales associates equipped with smart devices. This targeted approach transforms the often-rushed airport shopping experience into an efficient and relevant interaction. AI-powered chatbots and virtual assistants are also handling pre-travel inquiries and post-purchase support in multiple languages, ensuring 24/7 customer engagement, thus extending the retail opportunity beyond the physical airport terminal and deeply integrating the duty-free offer into the overall travel planning process. This technological shift is essential for maintaining growth momentum in an increasingly competitive environment.

- AI-driven personalized marketing and product recommendations based on travel itinerary and purchase history.

- Predictive inventory management and demand forecasting, reducing stockouts and optimizing working capital.

- Implementation of AI-powered security and anti-theft systems to minimize losses in high-traffic areas.

- Use of Machine Learning for dynamic pricing optimization based on real-time currency exchange rates and foot traffic.

- Enhanced customer service via multilingual AI chatbots and virtual assistants for pre-order and inquiry handling.

- Optimization of store layouts and staffing schedules using AI analytics on passenger flow data.

- Deployment of computer vision systems for monitoring shelf compliance and shopper engagement metrics.

DRO & Impact Forces Of Duty Free Travel Retail Market

The Duty Free Travel Retail Market dynamics are heavily influenced by a critical interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the impact forces defining its growth trajectory. The primary driver remains the exponential increase in global middle-class populations, particularly in Asia, leading to higher rates of international leisure travel and business movement, directly correlating with duty-free spending. However, the market faces significant restraints, notably the regulatory heterogeneity across different customs jurisdictions, making inventory management and compliance exceedingly complex. Furthermore, the persistent threat of economic instability and the volatility of global air traffic due to unforeseen events (like pandemics or geopolitical conflicts) introduce inherent risks. The foremost opportunity lies in leveraging digital transformation—creating seamless omnichannel experiences that connect the shopper's journey from home to destination, significantly extending the purchasing window beyond the physical time spent in the airport terminal. These forces demand that retailers adopt flexible, data-driven strategies to capitalize on high-growth segments while mitigating external volatility.

Driving factors are numerous and interconnected, focused on the consumer desire for value and experience. The perceived price advantage, often highlighting savings on luxury items, acts as a primary magnet for sales. Airports are increasingly investing in sophisticated retail environments, transforming transit areas into curated shopping destinations that enhance the customer dwell time and boost commercial conversion rates. Travel retailers are strategically collaborating with major brands to offer exclusive products and travel-specific packaging, providing a unique proposition unavailable in domestic markets, thereby justifying the purchase impulse. The development of robust loyalty programs and targeted communication channels further ensures that brand connection is maintained and repeat purchases are encouraged among frequent flyers, solidifying the revenue base. These drivers are pushing the market towards premiumization and specialization.

Restraints, however, pose structural challenges that require ongoing mitigation. The complexity of customs and taxation laws governing what can be sold and to whom creates operational friction, requiring substantial investment in compliance technology and personnel training. Secondly, the severe limitations on physical expansion within existing airport terminals mean that growth must be achieved through higher sales per square foot, necessitating advanced retail optimization techniques. The rise of e-commerce platforms and the increasing digitalization of domestic markets also narrow the historical price gap advantage, forcing duty-free operators to emphasize experiential retail and exclusive product offerings over mere price savings. The major impact forces thus center on balancing regulatory adherence with continuous innovation in customer engagement and digital integration to overcome spatial and competitive limitations inherent in the travel retail ecosystem.

Segmentation Analysis

The Duty Free Travel Retail Market is primarily segmented based on Product Type, Sales Channel, and Category, reflecting the diverse nature of goods and the varied operational environments involved in tax-free commerce. Product segmentation provides crucial insights into high-margin areas, with Perfumes & Cosmetics dominating due to consistent consumer demand, high replacement frequency, and the launch of travel-exclusive kits. The Sales Channel segmentation reveals the significant dependence on international airports as the dominant point of sale, although the strategic expansion of downtown duty-free stores, especially in APAC, is offering consumers greater access and time to browse. Understanding these segments is paramount for major stakeholders—including brands, airport operators, and concessionaires—to allocate capital effectively, tailor marketing campaigns, and optimize inventory distribution across a global network of disparate retail locations.

- Product Type

- Perfumes & Cosmetics

- Wines & Spirits

- Fashion & Accessories

- Tobacco

- Confectionery & Fine Food

- Electronics

- Others (Jewelry, Watches, Souvenirs)

- Sales Channel

- Airports (Major International Hubs, Regional Airports)

- Airlines

- Ferries & Cruise Ships

- Downtown Stores

- Border Stores

- Category

- Luxury Goods

- Premium Products

- Mass Market Products

Value Chain Analysis For Duty Free Travel Retail Market

The value chain for the Duty Free Travel Retail Market is intricate, involving highly regulated upstream activities and complex, time-sensitive downstream distribution networks. Upstream analysis focuses on the manufacturers of luxury goods, cosmetics, and alcoholic beverages. These brands (the suppliers) must adapt their product formats, packaging, and supply volume forecasts specifically for the travel retail environment, often developing 'travel exclusive' SKUs. Negotiation and sourcing are critical, as manufacturers must ensure product traceability and adhere to various international trade and customs requirements before goods enter the duty-free ecosystem. The efficient management of the supply chain here dictates product freshness and availability, particularly for consumable goods and limited-edition items.

The core of the value chain involves the retail operators and concessionaires (such as Dufry, Lotte, or CDFG), who act as the central distribution channel. They negotiate concession agreements with airport authorities (the landlords) and manage the logistical complexities of operating in a highly secure environment. The distribution channel is primarily indirect, moving from brand manufacturer to a central duty-free logistics hub, and then to individual airport stores or cruise ship inventory points. Direct sales, while present in limited brand-operated stores, are less common. This indirect channel requires highly specialized logistics providers accustomed to handling high-value, tax-exempt inventory and complying with strict international movement protocols. This stage focuses heavily on merchandising, in-store experience creation, and ensuring efficient point-of-sale processing.

Downstream analysis centers on the final customer interface and post-purchase interactions. The success of the downstream flow depends on seamless delivery, often involving pre-order collection points, in-flight delivery, or organized pick-up at destination downtown stores. Effective communication regarding duty-free allowances and customs procedures is vital for a positive customer experience. The entire value chain is driven by partnerships and specialized logistics, where the ability to maintain the duty-free status of inventory while moving it across borders is the central operational challenge. Strong digital infrastructure linking manufacturers, concessionaires, and customs authorities is increasingly critical for enhancing efficiency across all stages of the travel retail value delivery system.

Duty Free Travel Retail Market Potential Customers

The primary customers of the Duty Free Travel Retail Market are international travelers, segmented by origin, destination, purpose of travel (leisure vs. business), and spending capacity. The dominant end-users are tourists from emerging economies, particularly those residing in the Asia Pacific region, such as mainland China and South Korea, who exhibit a strong preference for high-end luxury products, cosmetics, and premium alcoholic beverages. These buyers are often driven by the perceived authenticity, exclusivity, and significant price savings offered by duty-free channels compared to their home country’s taxed retail environment. Loyalty programs and pre-travel marketing efforts are heavily targeted towards this high-value demographic, recognizing their disproportionate contribution to overall market revenue.

A secondary, yet crucial, customer segment includes high-frequency business travelers and affluent international leisure seekers from North America and Europe. While often less price-sensitive than emerging market tourists, this group values convenience, curated product selection, and sophisticated in-store experiences. They are frequent purchasers of smaller, high-value items like premium confectionery, unique spirits, and electronic accessories, often utilizing duty-free purchases for gifts or personal indulgences during transit. The effectiveness of capturing this segment relies on rapid transaction processing, personalized service, and a highly efficient store layout that respects the time constraints of busy travelers.

Furthermore, airport personnel, airline crew, and cruise ship passengers represent distinct customer groups with specific purchasing patterns. Cruise ship passengers often prioritize Wines & Spirits and local souvenirs. Crucially, the modernization of duty-free regulations in certain jurisdictions, such as the introduction of expanded downtown duty-free shopping to domestic residents in specific travel zones, broadens the customer base beyond strictly international outbound travelers, introducing complex new dynamics to the end-user profile and requiring adaptive inventory and regulatory compliance systems. Understanding these diverse buyer motivations allows retailers to optimize their product mix and service delivery models effectively.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.4 Billion |

| Market Forecast in 2033 | USD 178.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dufry AG, LVMH Group, Lagardère Travel Retail, DFS Group, Aer Rianta International (ARI), King Power International Group, Heinemann Duty Free, China Duty Free Group (CDFG), The Shilla Duty Free, Lotte Duty Free, Estée Lauder Companies, Diageo plc, Pernod Ricard, Kering SA, Coty Inc., Japan Airport Terminal Co., Ltd., Dubai Duty Free, Istanbul Duty Free, Hellenic Duty Free Shops, Gebr. Heinemann. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Duty Free Travel Retail Market Key Technology Landscape

The Duty Free Travel Retail Market is undergoing a rapid technological transformation, moving beyond basic Electronic Point of Sale (EPOS) systems towards sophisticated retail tech ecosystems designed to maximize passenger engagement and operational efficiency within highly constrained environments. A crucial technological component is the integration of Omnichannel Retail Platforms. These systems unify inventory, customer data, and sales across physical airport stores, pre-order websites, and mobile apps, allowing travelers to browse and purchase products before their flight, collect them conveniently at the gate, or even have them delivered to their destination (where regulations allow). This seamless integration is powered by cloud-based infrastructure and high-speed networking, essential for handling the massive volume of real-time transactional data generated by global travelers and coordinating inventory across multiple international locations with varying regulatory mandates.

Another pivotal technological area is the deployment of Advanced Customer Analytics and Personalization Tools. Utilizing Big Data and Machine Learning, retailers are deploying specialized CRM systems that analyze passenger flow patterns, flight schedules, and loyalty program data to predict purchasing intent. This enables targeted marketing via digital screens, personalized push notifications, and AI-driven recommendations delivered directly to a traveler’s smartphone as they navigate the terminal. Key technologies also include Radio-Frequency Identification (RFID) for high-accuracy inventory tracking, essential for managing high-value luxury items and ensuring compliance with customs documentation. The adoption of biometric identification for loyalty program verification is also gaining traction, further speeding up the transaction process and enhancing the premium feel of the retail experience.

Furthermore, payment technology innovation is a high priority, addressing the diverse international payment preferences of travelers. This includes implementing frictionless checkout solutions such as mobile wallets, QR code payments (especially important for Asian travelers), and accepting various cryptocurrencies in select markets. Robotics and Automation are also beginning to appear, particularly in centralized logistics and warehousing supporting duty-free operations, improving the speed and accuracy of order fulfillment for click-and-collect services. These technologies collectively aim to reduce bottlenecks, maximize the efficiency of sales associates, and transform the physical store into a 'phygital' experience center, cementing technology as a core competitive differentiator in the modern duty-free landscape.

Regional Highlights

The global duty-free travel retail market exhibits pronounced regional variations driven by tourism volumes, infrastructure development, and local regulatory frameworks. Asia Pacific (APAC) currently dominates the market and is projected to maintain the highest growth rate throughout the forecast period. This dominance is intrinsically linked to the immense outbound tourism from China, coupled with the rapid expansion of international air hubs in countries like South Korea, Singapore, and India. The development of large-scale, state-sponsored duty-free zones, such as those on Hainan Island, China, has fundamentally shifted consumer spending patterns, making this region the primary focus for global luxury brands and retail operators seeking growth.

Europe and North America represent mature markets characterized by stable, albeit lower, growth rates compared to APAC. European duty-free sales are strongly supported by intercontinental travel and robust demand for Wines & Spirits and niche luxury items, often tied to historic brand heritage. Modernization efforts in European airports focus on high-quality concessions and elevating the sense of place. North America is experiencing significant investment in refurbishing and expanding airport retail spaces, often integrating strong local branding and highly sophisticated digital platforms to cater to both domestic and international traffic, with cosmetics and electronics being strong performing segments.

The Middle East and Africa (MEA), particularly the Gulf Cooperation Council (GCC) countries, serve as critical global transit hubs (e.g., Dubai, Doha, Istanbul), positioning them as high-volume, high-spend retail environments. These hubs excel in offering vast retail footprints and world-class customer service, attracting long-haul passengers. Latin America is a growing region, constrained by infrastructure but offering significant potential, especially in categories like perfumes and fashion, driven by recovering regional travel and strategic regulatory reforms designed to boost tourism spending in key international gateways. Each region necessitates a tailored retail strategy based on local passenger profile, customs restrictions, and competitive intensity.

- Asia Pacific (APAC): Market leader and highest growth region, driven by Chinese tourism, massive airport expansion projects, and regulatory support for duty-free shopping zones (e.g., Hainan). Focus on Perfumes & Cosmetics and Luxury Goods.

- Europe: Mature market focused on stable growth, strong demand for Wines & Spirits and unique regional products. Driven by intercontinental connectivity and airport experiential upgrades.

- North America: Significant investment in modernizing concessions; growth fueled by rising international traffic and focus on technology integration, targeting electronics and local premium brands.

- Middle East: Critical transit hub region (UAE, Qatar) characterized by extremely high passenger footfall, large retail spaces, and a focus on premium and high-end luxury watch/jewelry segments.

- Latin America: Emerging potential, constrained by regulatory complexity but benefiting from regional travel recovery; key growth in cosmetics and fashion accessories at major gateway airports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Duty Free Travel Retail Market. These companies are instrumental in defining the competitive landscape through strategic alliances, concession bids, and aggressive expansion into high-growth geographies. Their strategies focus heavily on digital transformation and securing long-term contracts in major global travel hubs to consolidate market dominance and ensure resilience against market fluctuations.- Dufry AG

- LVMH Group

- Lagardère Travel Retail

- DFS Group

- Aer Rianta International (ARI)

- King Power International Group

- Heinemann Duty Free

- China Duty Free Group (CDFG)

- The Shilla Duty Free

- Lotte Duty Free

- Estée Lauder Companies

- Diageo plc

- Pernod Ricard

- Kering SA

- Coty Inc.

- Japan Airport Terminal Co., Ltd.

- Dubai Duty Free

- Istanbul Duty Free

- Hellenic Duty Free Shops

- Gebr. Heinemann

Frequently Asked Questions

Analyze common user questions about the Duty Free Travel Retail market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Duty Free Travel Retail Market?

The primary driver is the massive increase in global air traffic and the rising affluence of the middle class, particularly in Asian economies, which fuels high discretionary spending on luxury goods and cosmetics offered at tax-exempt prices in international travel hubs.

How is technology impacting the customer experience in duty-free stores?

Technology is driving seamless Omnichannel integration, allowing for pre-order and mobile collection. AI and advanced analytics are used extensively for hyper-personalization, dynamic pricing, and optimizing inventory based on real-time passenger flow data, transforming the retail journey.

Which product segment holds the largest share in the Duty Free Travel Retail Market?

The Perfumes & Cosmetics segment consistently holds the largest market share. This dominance is attributed to high consumer demand, frequent product innovation, strong brand presence, and the consistent release of travel-exclusive product sets and limited editions.

What are the main regulatory challenges faced by duty-free retailers globally?

The main challenges include regulatory fragmentation across different customs jurisdictions, strict allowances on duty-free quotas, and complex rules governing the sale and movement of restricted items like tobacco and alcohol, requiring significant investment in compliance infrastructure.

Why is the Asia Pacific region considered the most important market for future growth?

APAC is critical due to its vast outbound tourist volumes, government investment in large-scale airport infrastructure, and the establishment of powerful duty-free consumption zones (e.g., Hainan), offering unprecedented scale and continuous growth opportunities for luxury and travel retail brands.

The comprehensive analysis of the Duty Free Travel Retail Market underscores its resilience and potential for innovation, particularly as global travel fully recovers and digital integration becomes standard practice. Retailers and brand owners must continuously invest in data security, personalization technologies, and flexible supply chains to capitalize on the increasing demands of the modern global traveler. The market remains inherently tied to geopolitical stability and economic health, necessitating adaptive business models focused on risk management and strategic regional diversification. Success in this specialized retail environment hinges upon operational excellence within the constrained airport environment and the ability to deliver unparalleled exclusivity and value to international consumers, ensuring the segment remains a critical component of the global luxury and consumer goods economy. Future competitive advantages will be secured by those operators who master the synthesis of physical retail experience with scalable digital engagement.

The transition towards sustainable retail practices is also becoming a non-negotiable factor influencing procurement and brand selection within the duty-free channel. Consumers, particularly younger travelers, are increasingly favoring brands that demonstrate clear commitments to environmental and social governance (ESG) criteria. This shift is compelling retailers to overhaul their product sourcing, store design, and packaging strategies to reduce waste and carbon footprint. Furthermore, the strategic utilization of airport downtime for engaging and informative brand storytelling—often via interactive digital installations—is transforming waiting areas into commercial assets. This experiential focus not only boosts immediate sales but also strengthens brand loyalty, translating directly into higher conversion rates per passenger and sustained revenue growth across core categories.

Regulatory evolution, especially concerning taxation waivers and allowances, continues to be a dynamic force. While some jurisdictions are tightening restrictions on high-volume items like tobacco, others are experimenting with broader tax refund schemes that integrate with duty-free offers, blurring the lines between traditional duty-free and general tax-free shopping. Retailers are actively engaging with policy makers and airport authorities to advocate for streamlined processes that simplify the consumer journey while maintaining regulatory integrity. The robust growth projected through 2033 signifies that despite occasional external shocks, the fundamental appeal of acquiring unique or premium products at a beneficial price point during the emotional high of international travel remains a powerful, durable economic engine for the global retail industry, driving consistent capital investment and strategic innovation across all geographies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager