Dye Transfer Inhibitor Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438833 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Dye Transfer Inhibitor Market Size

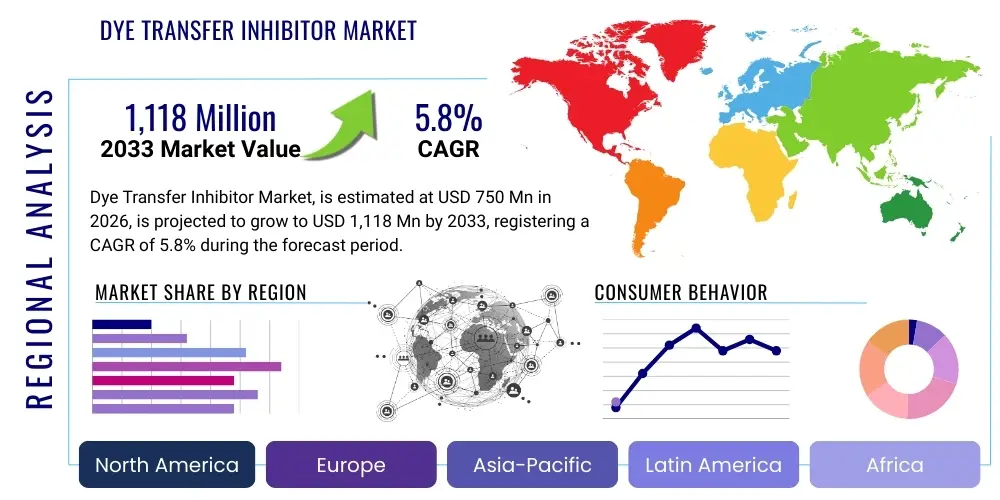

The Dye Transfer Inhibitor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million USD in 2026 and is projected to reach $1,118 Million USD by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global adoption of high-efficiency automatic washing machines and the consumer preference for premium laundry care products that promise fabric protection and color longevity. The expansion of industrial laundering services, particularly within the hospitality and healthcare sectors, further drives the demand for robust dye transfer mitigation solutions, thereby contributing significantly to the overall market valuation.

The market expansion is also intrinsically linked to innovation in polymer chemistry, focusing on developing more effective and environmentally benign inhibitors. Traditional inhibitors are being phased out in favor of advanced polymeric compounds, such as Polyvinylpyrrolidone (PVP) variants and novel polyamine derivatives, which offer superior performance across a wider range of washing temperatures and water hardness levels. Geographically, emerging economies, especially in the Asia Pacific region, are witnessing a substantial uptick in market penetration due to rising disposable incomes and rapid urbanization, translating directly into heightened consumer demand for sophisticated laundry additives. These macroeconomic shifts solidify the projected financial milestones for the 2026-2033 timeline.

Dye Transfer Inhibitor Market introduction

Dye Transfer Inhibitors (DTIs) are specialty chemical additives incorporated into detergent formulations to prevent fugitive dyes from transferring from colored garments to white or lighter-colored fabrics during the washing cycle. These chemicals function primarily by sequestering or solubilizing loose dye molecules in the wash liquor, holding them in suspension until they are rinsed away, thereby maintaining the original color vibrancy and minimizing staining. The primary products include polymeric compounds such as Polyvinylpyrrolidone (PVP), Polyvinylimidazole (PVI), and Polyvinylpyridine N-oxide (PVNO), each possessing unique dye-binding capabilities tailored for specific detergent chemistries and washing conditions.

Major applications of DTIs span household laundry detergents, including liquid, powder, and unit dose formulations, as well as institutional and industrial cleaning agents used in commercial laundries and textile processing. The inherent benefits of using DTIs are numerous: they enable mixed-load washing, conserve water and energy by reducing the need for separate color and white washes, and extend the lifespan and aesthetic quality of textiles. This utility positions DTIs as essential components in modern, convenience-driven laundry products.

The market is primarily driven by the increasing global penetration of automatic washing machines, particularly in developing regions, coupled with stringent consumer expectations regarding fabric care. Furthermore, the trend toward cold-water washing, which inherently increases the risk of dye bleeding, necessitates the use of high-performance DTIs that are effective at lower temperatures. Regulatory shifts favoring greener chemistries and bio-based ingredients also act as a long-term driving factor, pushing manufacturers toward sustainable and readily biodegradable DTI formulations.

Dye Transfer Inhibitor Market Executive Summary

The Dye Transfer Inhibitor market is characterized by robust business trends focusing on sustainable chemistry and formulation efficiency, driven by increasing consumer demand for eco-friendly and high-performance laundry solutions. Key industry players are heavily investing in developing bio-based polymers and encapsulation technologies to enhance inhibitor efficacy at lower concentrations and temperatures, aligning with global trends toward cold-water washing. The adoption of concentrated and unit dose detergent formats is reshaping demand patterns, favoring highly potent DTI variants that offer maximum performance in minimal volumes, alongside strategic acquisitions and partnerships aimed at securing specialized proprietary technology and expanding geographic reach across high-growth markets.

Regionally, the Asia Pacific (APAC) market is poised for the fastest expansion, fueled by burgeoning populations, rising urbanization, and the significant adoption of household appliances, which collectively necessitate increased consumption of sophisticated laundry care products. North America and Europe, while mature markets, emphasize premiumization and sustainability; regulatory frameworks such as REACH in Europe drive continuous innovation toward non-toxic and biodegradable DTI solutions. These regional dynamics create a bifurcated market structure, where volume growth dominates in APAC and innovation/value creation drives the Western markets.

Segment trends indicate that Polyvinylpyrrolidone (PVP) derivatives remain the dominant product type due to their cost-effectiveness and proven efficacy, though Polyvinylpyridine N-oxide (PVNO) is gaining traction owing to superior dye-binding capabilities in demanding detergent environments. The Application segment is heavily skewed toward Household Laundry Detergents, which constitutes the bulk of revenue, but Institutional Laundry is emerging as a significant high-value segment due to stricter hygiene standards and the need for professional-grade stain management. The shift from powder to liquid and unit dose formulations also influences DTI selection, favoring liquid-compatible polymers that maintain stability and solubility in complex surfactant systems.

AI Impact Analysis on Dye Transfer Inhibitor Market

Common user questions regarding AI's impact on the Dye Transfer Inhibitor market center on how artificial intelligence and machine learning (ML) can accelerate the discovery of novel chemical structures, optimize formulation stability, and predict material performance under varying conditions (e.g., water hardness, temperature, pH). Users are keenly interested in whether AI can reduce the time and cost associated with synthesizing new polymers and whether it can enhance supply chain resilience by forecasting raw material volatility. The key themes revolve around AI-driven R&D efficiency, predictive modeling for product quality, and personalized formulation recommendations for specific textile types or regional water profiles, ultimately seeking to understand how AI translates into more effective and sustainable DTI products.

AI is fundamentally transforming the R&D pipeline for DTIs by allowing chemists to screen millions of virtual compounds and predict their dye-binding affinity and compatibility with complex surfactant mixtures much faster than traditional laboratory methods. Generative AI models are being utilized to propose novel polymer architectures with enhanced sequestering capacity and biodegradability, circumventing the lengthy trial-and-error approach common in specialty chemical synthesis. This rapid prototyping significantly shortens the time-to-market for next-generation inhibitors and enables manufacturers to respond swiftly to evolving consumer or regulatory demands.

Furthermore, machine learning algorithms are pivotal in optimizing manufacturing processes and quality control. By analyzing real-time sensor data from polymerization reactors, ML models can predict yield fluctuations, monitor purity, and suggest optimal adjustments to temperature or catalyst concentration, ensuring consistent product quality across large production batches. In downstream applications, AI can analyze geographical water quality data and consumer washing habits to recommend tailored DTI concentrations for regional detergent formulations, ensuring maximum efficacy and minimizing chemical overuse, thereby driving both cost savings and sustainability.

- AI accelerates the discovery and design of novel polymeric structures with superior dye-binding capabilities.

- Machine learning optimizes formulation stability, predicting interactions between DTIs and complex surfactant systems.

- Predictive maintenance models enhance manufacturing efficiency, reducing material waste and energy consumption.

- AI-driven supply chain analytics improve raw material sourcing, mitigating risks associated with geopolitical instability.

- Generative models enable rapid virtual screening of sustainable, bio-based DTI candidates, aligning with green chemistry mandates.

DRO & Impact Forces Of Dye Transfer Inhibitor Market

The Dye Transfer Inhibitor market is propelled by significant drivers, notably the continuous rise in the global penetration of automated washing machines and the associated consumer demand for convenience, specifically the ability to wash mixed loads of colored and white clothing without color bleeding. This convenience factor, coupled with the increasing use of challenging synthetic dyes in textiles that are prone to bleeding, necessitates the incorporation of high-performance DTIs into all premium detergent products. Conversely, the market faces restraints primarily stemming from fluctuating prices of key raw materials derived from petrochemicals, high research costs associated with synthesizing new, highly effective, and non-toxic polymers, and increasingly stringent global regulations demanding higher levels of biodegradability and reduced aquatic toxicity from chemical additives.

Opportunities for market growth are substantial and center around the shift towards sustainability, creating a strong market pull for bio-based Dye Transfer Inhibitors synthesized from renewable resources, such as specialized proteins or cellulosic derivatives, which offer comparable performance profiles to traditional petroleum-based polymers. Furthermore, the expansion of commercial and institutional laundry services in developing nations presents an opportunity for targeted marketing of concentrated, professional-grade DTI products. Technological advancements in encapsulation technology, allowing for targeted release of the inhibitor during the critical washing phase, offer enhanced efficacy and dosage control, presenting another vital growth avenue.

The impact forces within the DTI market are dominated by technological innovation pressure, which compels companies to continuously improve performance while meeting environmental compliance. Supplier power is moderate, influenced by the specialized nature of monomer synthesis, whereas buyer power is high, driven by the large multinational detergent corporations demanding competitive pricing and stringent quality specifications. These interconnected forces dictate the competitive landscape, emphasizing the need for companies to secure intellectual property around novel, high-efficacy, and sustainable DTI chemistries to maintain market relevance and profitability in the face of evolving consumer expectations and regulatory scrutiny.

Segmentation Analysis

The Dye Transfer Inhibitor market is comprehensively segmented based on product type, application, and formulation, providing a granular view of market dynamics and adoption trends. Product segmentation distinguishes between the various polymeric agents used, with Polyvinylpyrrolidone (PVP) derivatives historically dominating the volume, while more specialized, high-performance polymers like Polyvinylpyridine N-oxide (PVNO) command higher prices due to superior efficacy. The complexity of modern detergent matrixes and the demand for performance across varied washing conditions drive continuous differentiation within the product segment.

Application analysis clearly demonstrates the dominance of the Household Laundry segment, reflecting the massive scale of consumer detergent usage globally. However, the Institutional and Industrial segment, encompassing commercial laundries, hospitality, and healthcare sectors, is gaining momentum due to the requirement for rapid, large-scale processing of diverse textiles and the high cost associated with garment replacement due to dye damage. The formulation segment tracks the structural evolution of laundry products, moving away from traditional powders towards concentrated liquids and, most recently, convenient unit dose products (pods or pacs), which influences the physicochemical requirements for the incorporated DTIs, demanding high solubility and stability.

- Product Type

- Polyvinylpyrrolidone (PVP) and Copolymers

- Polyvinylpyridine N-oxide (PVNO)

- Polyvinylimidazole (PVI) and Copolymers

- Others (e.g., Specialty Enzymes, Modified Cellulose Derivatives)

- Application

- Household Laundry Detergents

- Institutional and Industrial Laundry

- Formulation

- Liquid Detergents

- Powder Detergents

- Unit Dose/Pod Detergents

- Auxiliary Laundry Additives (e.g., Fabric Conditioners)

Value Chain Analysis For Dye Transfer Inhibitor Market

The value chain for the Dye Transfer Inhibitor market begins with the upstream segment, which involves the sourcing and production of foundational chemical building blocks, primarily monomers like N-Vinylpyrrolidone (NVP) and Vinylimidazole. These raw materials are predominantly derived from petrochemical processes, making the upstream stage susceptible to volatility in global oil and gas prices. Key suppliers in this stage specialize in high-purity monomer production, operating large-scale chemical plants. The quality and consistent supply of these specialized monomers are critical determinants of the final DTI polymer's molecular weight, purity, and ultimately, its performance in the detergent matrix, demanding stringent quality control measures from chemical manufacturers.

The midstream stage focuses on the core chemical synthesis—the polymerization process. Specialized chemical companies, which are often the DTI market leaders, transform monomers into functional polymers (PVP, PVNO, etc.) using proprietary synthesis methods that control molecular architecture and dispersity. This stage is characterized by high capital investment in polymerization reactors and significant intellectual property surrounding catalyst systems and process engineering. After synthesis, the DTI product undergoes formulation (e.g., liquid solution, granular powder, or encapsulated beads) to ensure compatibility with the final detergent product, adding value through improved handling and dosing precision before distribution.

The downstream segment involves the distribution and final integration of DTIs into consumer products. Distribution channels are typically specialized B2B relationships, involving direct sales from the DTI manufacturer to large multinational Fast-Moving Consumer Goods (FMCG) corporations (e.g., Procter & Gamble, Unilever). Direct channels dominate the high-volume segment, ensuring technical support and tailored solutions. Indirect distribution involves chemical distributors who service smaller regional detergent manufacturers. The final users are the detergent manufacturers who formulate the DTI into their liquid or powder products. The success at this stage hinges on strong technical collaboration to ensure the DTI performs optimally within the complex chemical environment of the final detergent formulation.

Dye Transfer Inhibitor Market Potential Customers

The primary customers for Dye Transfer Inhibitors are multinational and regional manufacturers of laundry care products, forming the largest and most concentrated buyer segment. These customers require high volumes of DTIs that meet rigorous specifications regarding stability, efficacy in cold water, and compliance with local environmental regulations. Large FMCG companies, such as those dominating the household cleaning aisle, dictate purchasing trends, focusing heavily on polymers that offer excellent performance-to-cost ratios and support product claims related to advanced color protection, which is a major driver of consumer choice in premium detergent categories.

A second significant customer base resides within the Institutional and Industrial (I&I) cleaning sector. This includes commercial laundries servicing hotels, hospitals, prisons, and textile rental companies. I&I customers prioritize DTIs that can handle extremely high volumes, diverse loads, and harsh industrial washing cycles, often involving higher temperatures and stronger chemical cocktails than household washing. The need for consistent, professional-grade results and the minimization of textile replacement costs make this segment a crucial, albeit smaller volume, high-value customer base for specialized, highly concentrated DTI formulations.

Emerging potential customers include specialized textile processors and chemical formulators focusing on niche applications, such as fabric pre-treatment sprays or specialized additives sold directly to consumers (e.g., color catcher sheets). Furthermore, the burgeoning market for eco-friendly and natural cleaning products is driving demand among specialized start-ups and manufacturers dedicated to bio-based solutions. These customers are highly sensitive to the environmental profile of the DTI, seeking certifications for biodegradability and low toxicity, thereby driving innovation towards sustainable sourcing and production methods within the polymer supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million USD |

| Market Forecast in 2033 | $1,118 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Ashland Global Holdings Inc., DuPont de Nemours Inc., The Dow Chemical Company, Clariant AG, Nouryon, Evonik Industries AG, Solvay S.A., Kolon Industries Inc., KAO Corporation, Lubrizol Corporation, Croda International Plc, Stepan Company, Galaxy Surfactants Ltd., SNF Group, Akzo Nobel N.V., Wacker Chemie AG, Shandong Head Co. Ltd., Nanjing Bailing Chemical Co. Ltd., Jiangsu Sanyi Technology Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dye Transfer Inhibitor Market Key Technology Landscape

The technological landscape of the Dye Transfer Inhibitor market is rapidly evolving, driven by the imperative to enhance efficacy in challenging washing environments while meeting stricter sustainability criteria. A core technological focus involves the advanced synthesis of specialized copolymers, particularly those based on vinylpyrrolidone and vinylimidazole, where precise control over the molecular weight distribution and functional group placement is paramount. Innovations in molecular engineering allow manufacturers to tailor the polymer's affinity for specific dye chemistries, ensuring maximum sequestering efficiency against a wide spectrum of fugitive dyes, including those derived from synthetic pigments that are notoriously difficult to control in wash water.

Another pivotal technological advancement is the integration of encapsulation and core-shell technologies. By microencapsulating the DTI, manufacturers can protect the active ingredient from degradation or premature interaction within highly concentrated liquid detergent formulations, ensuring that the inhibitor is released only when diluted in the wash water at the optimal time and concentration. This controlled-release mechanism not only boosts overall performance but also enables the use of lower DTI dosages, contributing to both cost efficiency and a reduced environmental footprint. Encapsulation also supports the viability of DTIs in unit dose formats where high concentration stability is critical.

Furthermore, the shift towards green chemistry is driving research into bio-catalysis and fermentation-based DTI production. Novel enzyme-based or bio-derived polymeric inhibitors, sourced from renewable feedstocks, represent a major technological frontier. While traditional petrochemical DTIs like PVP remain dominant, the pursuit of readily biodegradable and non-toxic alternatives is intensifying, utilizing advanced biotechnology platforms to engineer polymers with high dye affinity and rapid environmental breakdown characteristics. This focus on bio-based alternatives is essential for compliance in regulated regions like Western Europe, solidifying its place as a key technology driver for future market growth.

Regional Highlights

The regional dynamics of the Dye Transfer Inhibitor market display significant variance in terms of maturity, growth rate, and regulatory environment. Asia Pacific (APAC) stands out as the highest growth region, primarily due to the rapid urbanization, increasing middle-class disposable income, and the corresponding shift from manual laundry to automatic washing machine usage across countries like China, India, and Southeast Asia. The vast population base and the relatively lower current penetration rates of premium detergents suggest massive untapped potential, driving demand for both effective and cost-efficient DTI solutions to support high-volume detergent production.

North America and Europe represent mature markets characterized by high consumer awareness and a strong focus on high-performance, premium products. In these regions, growth is driven less by volume and more by value, emphasizing specialized DTIs that excel in cold-water washing (a necessity for energy conservation) and comply with stringent sustainability standards. European regulations, particularly those concerning the aquatic toxicity and biodegradability of chemical ingredients, are a major influence, compelling manufacturers to continually innovate and adopt bio-based or readily degradable alternatives.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions that show moderate but steady growth. The LATAM market, influenced by diverse economic conditions, exhibits demand for both mass-market and premium detergents, requiring flexible DTI offerings. The MEA region, particularly the Gulf Cooperation Council (GCC) states, sees demand growth tied to infrastructure development and industrial expansion, including hospitality and healthcare sectors, which require robust institutional laundry solutions. Water scarcity in some MEA regions also makes efficient, mixed-load washing appealing, boosting DTI adoption.

- Asia Pacific (APAC): Dominates market growth due to rising disposable incomes, urbanization, and rapid penetration of automatic washing machines. Key markets include China, India, and Indonesia, focusing on volume and cost-effectiveness.

- North America: Mature market characterized by demand for premium, high-efficacy DTIs optimized for cold-water wash cycles and large-scale industrial laundry applications.

- Europe: Focuses heavily on sustainability and compliance; regulations (e.g., REACH) drive the adoption of biodegradable, non-toxic DTI polymers. Demand is stable, centered on innovation.

- Latin America (LATAM): Emerging market with varied economic conditions, leading to mixed demand for both basic and advanced detergent formulations.

- Middle East and Africa (MEA): Growth driven by institutional sector expansion and increasing household penetration in urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dye Transfer Inhibitor Market.- BASF SE

- Ashland Global Holdings Inc.

- DuPont de Nemours Inc.

- The Dow Chemical Company

- Clariant AG

- Nouryon

- Evonik Industries AG

- Solvay S.A.

- Kolon Industries Inc.

- KAO Corporation

- Lubrizol Corporation

- Croda International Plc

- Stepan Company

- Galaxy Surfactants Ltd.

- SNF Group

- Akzo Nobel N.V.

- Wacker Chemie AG

- Shandong Head Co. Ltd.

- Nanjing Bailing Chemical Co. Ltd.

- Jiangsu Sanyi Technology Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Dye Transfer Inhibitor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Dye Transfer Inhibitor Market?

Market growth is primarily driven by the global increase in automatic washing machine adoption, especially in emerging economies, and the consumer demand for convenience (mixed-load washing) and protection against color bleeding. The efficacy requirement in cold-water washing is also a significant driver forcing innovation.

How do Polyvinylpyrrolidone (PVP) derivatives function as Dye Transfer Inhibitors?

PVP derivatives function by acting as polymeric complexing agents. They possess a high affinity for fugitive dye molecules released into the wash water, binding to them and holding them in suspension. This action prevents the free dyes from redepositing onto other fabrics, ensuring color maintenance.

What is the greatest challenge faced by DTI manufacturers in sustainable formulation?

The greatest challenge is achieving high dye-binding performance and thermal stability using bio-based, biodegradable polymers. Traditional DTIs are petrochemical-derived; developing sustainable alternatives that match the cost-effectiveness and broad-spectrum efficacy of conventional polymers requires intensive research and significant investment in green chemistry technologies.

Which application segment holds the largest share in the Dye Transfer Inhibitor Market?

The Household Laundry Detergents segment holds the largest market share due to the vast volume consumption of consumer washing products worldwide. However, the Institutional and Industrial segment is growing rapidly and represents a high-value opportunity for specialized, professional-grade DTI products.

How does technological advancement in encapsulation influence DTI effectiveness?

Encapsulation technology enhances DTI effectiveness by providing controlled release. This protects the inhibitor from degradation within concentrated detergent liquids and ensures it is delivered at the precise moment and concentration needed in the wash cycle, maximizing dye sequestration efficiency and minimizing dosage requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dye Transfer Inhibitor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Dye Transfer Inhibitor Market Size Report By Type (PVP Polymers, Chromabond Polymers, Others), By Application (Industrial Printing and Dyeing, Daily Washing), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager