Dynamic Fatigue Test Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433192 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Dynamic Fatigue Test Machine Market Size

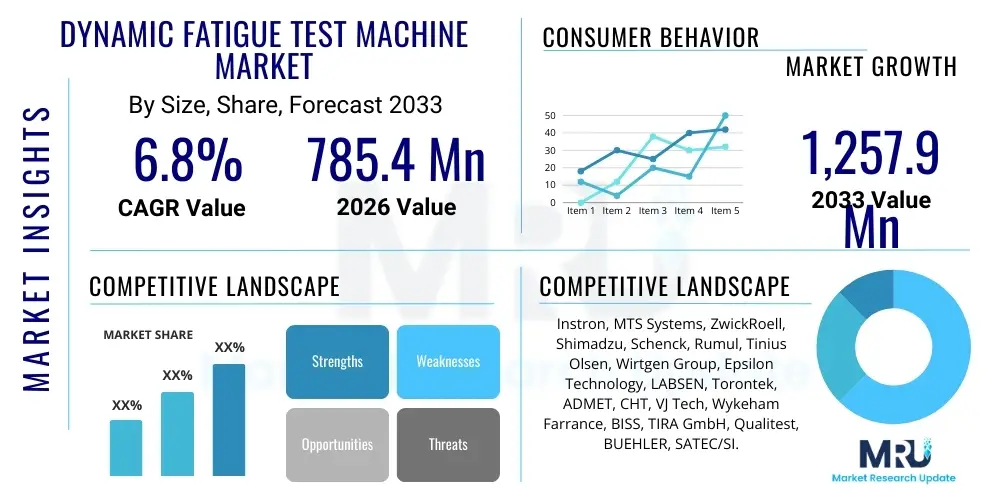

The Dynamic Fatigue Test Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,257.9 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing complexity of materials utilized across critical industries such as aerospace, automotive, and construction, necessitating rigorous quality assurance and structural integrity assessments. Manufacturers are continuously seeking advanced testing solutions that can accurately replicate real-world cyclic loading conditions over extended periods to ensure product safety and longevity.

The valuation reflects robust demand for high-performance testing equipment capable of performing Low Cycle Fatigue (LCF), High Cycle Fatigue (HCF), and Very High Cycle Fatigue (VHCF) testing. Market growth is further augmented by technological advancements, particularly the integration of high-speed digital controllers and improved servo-hydraulic systems that offer superior accuracy and responsiveness. Geographically, emerging economies, particularly in the Asia Pacific region, are contributing significantly to market size expansion due to escalating infrastructure development and the localization of advanced manufacturing facilities that require strict adherence to international material standards.

The increasing utilization of lightweight materials, including advanced composites and high-strength alloys, in transportation sectors mandates comprehensive fatigue testing to validate their long-term durability under dynamic stresses. This need is creating a sustained revenue stream for specialized dynamic testing machine providers. Furthermore, the push towards standardized testing protocols and the incorporation of automated reporting features within these machines contribute to their high value proposition, cementing the market’s positive financial trajectory throughout the forecast period.

Dynamic Fatigue Test Machine Market introduction

The Dynamic Fatigue Test Machine Market encompasses highly specialized instruments designed to evaluate the mechanical properties and life expectancy of materials and components when subjected to repetitive cyclic loading. These machines, critical in materials science and engineering, simulate the cumulative damage and degradation that occurs under operational stresses, crucial for predicting component failure points. Products range from advanced servo-hydraulic systems capable of high force, high frequency, and multi-axial loading, to electromagnetic resonance systems optimized for energy-efficient testing in the VHCF domain. The primary objective is the determination of critical parameters such as fatigue limits, crack initiation points, and crack propagation rates, yielding essential data for design validation and material selection.

Major applications of dynamic fatigue testing machines span the entire engineering ecosystem, predominantly focusing on safety-critical components. In the automotive industry, they are used for testing engine parts, suspension systems, and chassis components. Aerospace manufacturers rely on them extensively for verifying turbine blades, airframe structures, and landing gear materials. Additionally, they are indispensable in the biomedical field for simulating the lifespan of prosthetics and implants under physiological loading conditions. The intrinsic benefit derived from using these machines is the reduction of catastrophic failures, improvement of product reliability, and optimization of material usage, ultimately minimizing recall costs and regulatory liabilities.

Driving factors propelling this market include increasingly stringent safety and regulatory mandates imposed by bodies such as ISO, ASTM, and specific regional safety organizations, compelling manufacturers to invest in verifiable testing infrastructure. Furthermore, the global trend towards ‘lightweighting’ across transportation sectors—requiring the substitution of traditional materials with complex, performance-driven alloys and composites—necessitates meticulous fatigue characterization. The continuous evolution of additive manufacturing (3D printing) also generates demand, as printed components exhibit unique microstructures requiring specialized dynamic verification protocols, further stimulating innovation and market demand for versatile testing solutions.

Dynamic Fatigue Test Machine Market Executive Summary

The Dynamic Fatigue Test Machine Market is characterized by robust growth underpinned by stringent regulatory frameworks and the global pursuit of lightweight, durable engineering solutions. Business trends indicate a significant shift towards integrated testing platforms that combine mechanical testing with advanced digital data acquisition and analysis tools, enhancing testing efficiency and repeatability. Key manufacturers are focusing on miniaturization of test systems and the development of specialized modules for testing new materials like carbon fiber reinforced polymers (CFRPs) and metal matrix composites, thereby diversifying their product portfolios and addressing niche industrial requirements. Strategic collaborations between machine vendors and material science research institutions are emerging as a core strategy to co-develop cutting-edge testing methodologies tailored for next-generation materials and components.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, primarily fueled by massive infrastructural investments, rapid expansion of domestic automotive manufacturing, and escalating defense spending in countries such as China, India, and South Korea. North America and Europe maintain leading positions in terms of technology adoption and R&D spending, driven by strict aerospace safety standards and mature regulatory compliance requirements. These regions show high demand for high-end, multi-axial servo-hydraulic systems. Meanwhile, the Middle East and Africa (MEA) and Latin America (LATAM) are poised for steady, moderate growth, mainly driven by oil and gas industry requirements for pipeline and structural integrity testing under extreme environmental conditions.

Segment trends reveal that the Electro-Hydraulic Servo (EHS) segment retains the largest market share due to its flexibility, high force capacity, and applicability across LCF and HCF testing regimes. However, the Electromagnetic Resonance segment is experiencing the highest CAGR, propelled by its energy efficiency and suitability for very high-cycle fatigue (VHCF) testing, essential for understanding the ultra-long-term endurance of critical metallic components. The automotive application segment remains dominant due to the sheer volume of component testing required for vehicle safety and performance validation, while the aerospace segment demands the most stringent specifications and customized, high-precision solutions, commanding premium pricing.

AI Impact Analysis on Dynamic Fatigue Test Machine Market

Common user inquiries regarding AI in this domain center on how machine learning can accelerate the highly time-consuming process of fatigue limit determination (running stress-life curves often takes weeks or months), whether AI can improve the predictive accuracy of remaining useful life (RUL) estimation, and if automated data interpretation can replace expert human analysis of complex fracture surface patterns. Users are keen to understand the transition from traditional, standardized testing methodologies (like staircase methods) to adaptive, AI-guided testing procedures that minimize unnecessary test points. Concerns also revolve around data security, the quality of training data, and the standardization of AI algorithms across different testing machine platforms to ensure regulatory acceptance of AI-derived fatigue data.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the dynamic fatigue test machine ecosystem by introducing predictive capabilities and optimizing testing efficiency. AI algorithms are being employed to automate the interpretation of high-volume data generated during fatigue cycles, particularly in identifying crack initiation and monitoring propagation rates from digital image correlation (DIC) systems or acoustic emission sensors. This level of automated, real-time analysis drastically reduces the potential for human error and speeds up the extraction of actionable insights, leading to quicker design iterations and material qualification. Furthermore, AI facilitates the development of intelligent control systems, adjusting test parameters dynamically based on the observed material response, optimizing resource utilization, and accelerating the convergence towards precise fatigue limits (endurance strength) determination.

AI’s most profound impact is seen in predictive maintenance and operational efficiency. By analyzing sensor data (pressure, temperature, displacement, frequency) across an array of testing machines, AI models can forecast potential mechanical failures or required calibration events within the test equipment itself, minimizing downtime and maximizing laboratory throughput. For the components under test, AI helps in generating synthetic fatigue data when empirical testing is impractical, bridging the gap between computational modeling and physical testing. This capability is vital for industries dealing with components having extremely long operational lives, enabling engineers to confidently extrapolate test results far beyond the conventionally measurable cycle counts, thus significantly enhancing material performance modeling.

- AI optimizes test matrix design, reducing the number of required specimens for S-N curve determination.

- Machine learning algorithms enhance real-time crack detection and automated fracture analysis from high-resolution imaging.

- Predictive analytics minimizes machine downtime by anticipating maintenance needs for servo-hydraulic components.

- AI supports the development of digital twins for components, allowing virtual fatigue testing under varied simulated loads.

- Advanced pattern recognition improves the accuracy of estimating the Remaining Useful Life (RUL) of tested structures.

DRO & Impact Forces Of Dynamic Fatigue Test Machine Market

The Dynamic Fatigue Test Machine Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly shaped by competitive and external impact forces. Key drivers include the global mandate for enhanced structural safety, particularly within aerospace and civil infrastructure projects, requiring verifiable component life cycle data. The continuous innovation in materials science, focusing on composites and advanced alloys for lightweighting, mandates specialized, versatile testing equipment to accurately characterize performance under dynamic conditions. Opportunities arise from the rapidly expanding additive manufacturing sector, as 3D-printed parts often exhibit anisotropic properties requiring multi-axial fatigue testing not covered by traditional methods. Furthermore, the push towards industry 4.0 integration, emphasizing automated testing, remote monitoring, and comprehensive data analytics, presents significant revenue streams for technologically advanced vendors.

Restraints primarily revolve around the substantial initial capital investment required for high-capacity, sophisticated testing systems, especially servo-hydraulic machines, which can deter smaller research institutions or nascent manufacturing entities. Operational complexities, including the need for highly skilled technicians for precise calibration and maintenance, and the high energy consumption associated with high-frequency fatigue testing, also pose significant barriers. The market is also sensitive to macroeconomic cycles, as capital expenditures on testing equipment are often among the first items curtailed during economic downturns, affecting large-scale procurement decisions by automotive and construction OEMs. Moreover, the standardization challenge—where different industries or regions adopt varied testing standards—can fragment the market, requiring customized machine configurations.

Impact forces, analyzed through a strategic framework, reveal high bargaining power of suppliers for high-precision components (e.g., servo-valves, actuators, proprietary control software), influencing overall machine costs and technological advancement rates. Conversely, the bargaining power of buyers is moderate to high, driven by the specialized and long-term nature of these investments, leading buyers to demand extensive warranty, maintenance, and customization options. Threat of new entrants remains low due to the high technological barriers, rigorous quality certifications required, and the established brand loyalty commanded by incumbent market leaders. The threat of substitutes, while present (e.g., computational simulation/FEA), is mitigated by the regulatory necessity of physical testing validation, ensuring continued demand for physical dynamic fatigue test machines as the final verification step.

Segmentation Analysis

The Dynamic Fatigue Test Machine Market is highly segmented based on the mechanism of operation, force capacity, and end-user application, allowing vendors to cater to distinct industry requirements ranging from high-volume, low-cost testing to specialized, high-precision R&D verification. Analyzing these segments provides critical insights into areas of highest expenditure and fastest technological uptake. Segmentation by product type highlights the core technological trade-offs: servo-hydraulic systems offer unmatched force and flexibility but are resource-intensive, while electromagnetic resonance machines deliver energy efficiency and ultra-high cycle capability but are typically limited to fixed-frequency, uniaxial testing. The force capacity dictates the primary end-user base; lower capacity machines (below 100 kN) often serve biomedical and general material science research, whereas mega-capacity systems (above 500 kN) are essential for infrastructure, rail, and full-scale aerospace structure testing.

The application segmentation reveals the primary revenue drivers. The automotive segment, driven by mandatory safety standards and rapid design cycles for components like engine blocks, axles, and steering systems, remains the largest consumer. The aerospace and defense segment, while smaller in volume, demands the highest level of customization and precision, leading to premium pricing structures for multi-axial and thermal fatigue testing chambers. The biomedical sector, focusing on the longevity of medical devices and implants, requires specialized low-load, high-precision equipment operating under simulated physiological environments (e.g., saline solution), driving demand for materials-compatible systems. This structured segmentation is vital for manufacturers developing targeted marketing strategies and optimizing their production lines for specific market needs.

- By Product Type:

- Electro-Hydraulic Servo (EHS) Dynamic Fatigue Testing Machines

- Electromagnetic Resonance Dynamic Fatigue Testing Machines

- Electrodynamic (High Frequency) Dynamic Fatigue Testing Machines

- Other Specialized Systems (e.g., Torsion, Multi-axial)

- By Capacity:

- Below 100 kN (Low Capacity)

- 100 kN to 500 kN (Medium Capacity)

- Above 500 kN (High Capacity/Structural Testing)

- By Application:

- Automotive

- Aerospace and Defense

- Biomedical and Medical Devices

- Construction and Infrastructure

- Academia and Research Institutions

- Other Industrial Manufacturing (e.g., Rail, Energy)

Value Chain Analysis For Dynamic Fatigue Test Machine Market

The value chain for the Dynamic Fatigue Test Machine Market begins with upstream analysis focusing on the procurement of highly specialized raw materials and subcomponents. This includes sourcing high-grade steel and composite materials for load frames, precision-machined servo-valves, linear actuators, high-resolution sensors (load cells, extensometers), and proprietary digital controllers and data acquisition boards. The complexity and performance requirements of these components mean that suppliers often have significant technological leverage and market influence. Manufacturing, the central stage, involves high precision assembly, rigorous calibration, and the integration of sophisticated proprietary software. Leading OEMs invest heavily in R&D to enhance control loop speed, reduce system noise, and improve user interface intuitiveness, creating strong differentiation within the competitive landscape.

The downstream analysis addresses the crucial aspect of distribution and post-sales support. Due to the high value and technical complexity of the machines, direct sales channels, often utilizing specialized application engineers, are dominant for large structural testing systems. However, indirect channels, involving regional distributors and value-added resellers (VARs), are critical for accessing smaller research laboratories and developing markets. These intermediaries not only facilitate sales but also provide localized installation, commissioning, training, and routine calibration services, which are essential components of the total cost of ownership. The relationship between the manufacturer and the end-user is long-term, heavily reliant on the quality and responsiveness of technical support and ongoing software updates.

A key element distinguishing this value chain is the critical role of software and integration services. Modern fatigue testing is highly reliant on sophisticated software packages that manage test protocols, real-time data logging, and comprehensive reporting tailored to specific industry standards (e.g., ASTM E466). Therefore, the post-installation phase involves continuous interaction, including training users on complex multi-channel analysis and ensuring software compatibility with laboratory information management systems (LIMS). The transition to digital platforms and the offering of subscription-based software services (SaaS) for advanced data analytics represents a growing trend, augmenting the traditional hardware sales model and creating recurring revenue streams across the distribution channels.

Dynamic Fatigue Test Machine Market Potential Customers

The primary customer base for Dynamic Fatigue Test Machines is highly technical and concentrated in sectors where material failure can result in catastrophic outcomes or severe economic loss. End-users fall mainly into two categories: industrial manufacturers conducting quality control and certification, and research institutions focused on material development and advanced engineering studies. Within the industrial sphere, large-scale automotive OEMs and Tier 1 suppliers constitute the largest volume buyers, focusing on validating the cyclic performance of critical vehicle components such as engine mounts, braking systems, and lightweight chassis structures to meet federal safety mandates (FMVSS). These customers require durable, standardized, high-throughput testing systems capable of continuous operation.

The aerospace and defense industry represents the segment with the most exacting specifications, purchasing highly customized, multi-axial fatigue testing rigs integrated with environmental chambers capable of simulating extreme temperature, humidity, and vacuum conditions. Key buyers here include major aerospace prime contractors (e.g., Boeing, Airbus, Lockheed Martin) and their critical subcontractors, who require testing capabilities aligned with stringent military and FAA regulatory frameworks. Furthermore, independent commercial testing laboratories, which provide accredited testing services to multiple smaller firms or outsource their testing requirements, act as significant aggregators of demand, acquiring a diverse range of machines to service varied client needs.

Beyond traditional industrial applications, emerging buyers include additive manufacturing bureaus focused on material parameter development and validation of new 3D-printed alloys, as well as biomedical companies developing next-generation orthopedic implants, stents, and prosthetics that must withstand millions of cycles under simulated human body conditions. Academic and government-funded materials science research centers also remain crucial purchasers, driving demand for technologically advanced, versatile research-grade machines capable of exploring fundamental phenomena like gigacycle fatigue (VHCF) and the mechanical performance of nanoscale materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,257.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Instron, MTS Systems, ZwickRoell, Shimadzu, Schenck, Rumul, Tinius Olsen, Wirtgen Group, Epsilon Technology, LABSEN, Torontek, ADMET, CHT, VJ Tech, Wykeham Farrance, BISS, TIRA GmbH, Qualitest, BUEHLER, SATEC/SI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dynamic Fatigue Test Machine Market Key Technology Landscape

The technological landscape of the Dynamic Fatigue Test Machine Market is rapidly evolving, moving beyond conventional hydraulic systems to incorporate advanced digital control and sensor fusion. The core technology remains the Electro-Hydraulic Servo (EHS) system, which leverages high-performance proportional and servo valves coupled with proprietary hydraulic power units (HPUs) to achieve precise load and displacement control over a wide range of frequencies and forces. Recent advancements in EHS focus on energy efficiency through optimized HPU design and the integration of digital servovalves, which offer faster response times and reduced noise. Crucially, the move towards multi-axis testing systems (biaxial and triaxial) allows for the simulation of complex real-world loading paths encountered in aerospace and automotive applications, requiring sophisticated closed-loop control algorithms to manage simultaneous forces and moments.

A parallel significant technological trend is the rise of electromagnetic resonance testing systems. These machines utilize resonant mechanical frequency to achieve ultra-high cycle fatigue (VHCF) testing, often exceeding 109 cycles, far more efficiently than conventional EHS systems. While resonance testing is typically uniaxial and frequency-limited based on the specimen's natural frequency, its major appeal lies in its extremely low power consumption and high testing speed (up to 200–300 Hz). The market is also seeing increasing adoption of Electrodynamic (or linear motor) testing machines for high-frequency, lower-force applications that require exceptional control linearity and silence, often used in materials research and small component verification, offering a flexible and cleaner alternative to oil-based hydraulics.

Furthermore, the testing environment itself is undergoing digitalization. Key technological innovations include the integration of high-speed Digital Image Correlation (DIC) systems for non-contact, full-field strain and displacement measurement, replacing traditional contact extensometers in many advanced applications. Furthermore, the convergence of testing equipment with Industry 4.0 principles necessitates machines with built-in networking capabilities (IoT connectivity), standardized communication protocols (e.g., OPC UA), and advanced software for automated data processing, remote diagnostics, and standardized report generation. This digital transformation enhances test traceability, improves calibration compliance, and allows for the centralized management of global testing data across large corporate R&D divisions, solidifying the market's trajectory towards smart, automated testing laboratories.

Regional Highlights

The regional dynamics of the Dynamic Fatigue Test Machine Market are defined by varied industrial maturity, regulatory enforcement, and investment levels in R&D infrastructure. North America holds a significant market share, primarily driven by the colossal requirements of its aerospace and defense sectors, which demand specialized, high-precision fatigue testing equipment for materials qualification and structural certification. The region benefits from substantial investments in advanced materials research and a mature, stringent regulatory environment that necessitates exhaustive physical verification testing for new product launches, particularly in the automotive and medical device segments. Key demand drivers include research institutions and major R&D centers located across the U.S. and Canada, focusing on advanced composite structures and lightweighting technologies.

Europe represents another mature and substantial market, characterized by technological leadership, particularly in Germany and the UK. The European market's strength stems from its robust automotive manufacturing base (especially premium segments) and rigorous European Union safety and quality standards (e.g., Euro NCAP requirements). European companies are often at the forefront of developing high-efficiency electromagnetic resonance systems and specialized multi-axial testers. Government initiatives promoting sustainable engineering and material circularity also drive demand for testing systems capable of characterizing recycled and novel bio-based materials, supporting the market for medium-capacity, flexible fatigue testing solutions across various engineering disciplines.

The Asia Pacific (APAC) region is projected to register the fastest growth rate during the forecast period. This rapid expansion is fundamentally fueled by large-scale infrastructural development projects, surging domestic production in the automotive and consumer electronics sectors, and significant government backing for local R&D capabilities in China, India, and Japan. As manufacturing shifts towards higher quality and safety standards across APAC, the demand for reliable, accredited dynamic testing machines is spiking. While price sensitivity remains a factor in certain sub-regions, the focus on developing indigenous aerospace and rail transport sectors is driving premium demand for high-capacity structural testing equipment. Latin America and MEA show moderate growth potential, tied mainly to investment cycles in the oil & gas industry (pipeline integrity) and construction materials verification.

- North America: Dominance in R&D spending; High demand for highly customized systems driven by aerospace safety mandates and stringent medical device certification.

- Europe: Strong focus on high-efficiency, sustainable testing technologies (electromagnetic resonance); Mature automotive and civil engineering testing standards; Germany leads in innovation and manufacturing presence.

- Asia Pacific (APAC): Highest expected growth rate due to rapid industrialization, expansion of domestic automotive and infrastructure projects; Major importers of both high-end and cost-effective testing solutions.

- Latin America (LATAM): Growth linked to infrastructure investments and material testing needs in mining and energy sectors; Preference for robust, reliable servo-hydraulic systems.

- Middle East & Africa (MEA): Demand primarily driven by the oil & gas and construction industries requiring material integrity assessment in harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dynamic Fatigue Test Machine Market.- Instron (ITW Company)

- MTS Systems Corporation

- ZwickRoell GmbH & Co. KG

- Shimadzu Corporation

- Schenck Testing & Simulation

- Rumul AG

- Tinius Olsen Testing Machine Company

- Wirtgen Group (for construction material testers)

- Epsilon Technology Corp.

- LABSEN Test Systems

- Torontek Group

- ADMET Inc.

- CHT Testing Technology Co., Ltd.

- VJ Tech Ltd.

- Wykeham Farrance (Controls Group)

- BISS Pvt. Ltd.

- TIRA GmbH

- Qualitest International Inc.

- BUEHLER (ITW Company)

- SATEC/SI

Frequently Asked Questions

Analyze common user questions about the Dynamic Fatigue Test Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Electro-Hydraulic Servo (EHS) and Electromagnetic Resonance fatigue testing machines?

EHS machines utilize hydraulic power to generate high forces (up to MN) across a broad frequency spectrum (typically 0.1 to 100 Hz), offering maximum flexibility for complex loading profiles like random spectrum or multi-axial tests (LCF/HCF). In contrast, Electromagnetic Resonance machines use the natural resonant frequency of the specimen to achieve ultra-high cycle fatigue (VHCF) testing (>109 cycles) with exceptional energy efficiency and speeds (up to 300 Hz), although they are generally limited to uniaxial, fixed-frequency testing.

How does the integration of Industry 4.0 affect the functionality and cost of dynamic fatigue testing machines?

Industry 4.0 integration significantly enhances machine functionality by enabling real-time remote monitoring, predictive maintenance forecasting, and automated data synchronization with cloud platforms and LIMS. While these features increase the initial software and sensor costs, they drastically reduce operational expenditures and downtime, improve compliance traceability, and allow for centralized, global management of testing protocols, providing a net positive return on investment (ROI) over the machine's lifecycle.

Which application segment drives the highest demand for Dynamic Fatigue Test Machines, and why?

The automotive industry segment drives the highest volumetric demand. This is attributed to the necessity of validating safety-critical components (e.g., suspension, engine components, body welds) across millions of cycles to meet stringent global vehicle safety standards and manufacturer warranty requirements. The rapid introduction of new materials for electric vehicle (EV) structures and lightweighting further compels continuous, high-volume dynamic testing.

What are the key technological advancements expected to shape the future growth of this market?

Future growth will be driven by the wider adoption of Artificial Intelligence (AI) for optimizing test sequences and real-time failure prediction, the development of specialized multi-axial testing systems tailored for anisotropic composite and additive manufactured materials, and the miniaturization of high-frequency electrodynamic systems for smaller, high-precision component testing, offering cleaner and quieter operation than traditional hydraulics.

What role do international standards like ASTM and ISO play in the purchasing decisions for dynamic testing equipment?

International standards are paramount, as end-users—particularly in aerospace and certified testing laboratories—must demonstrate compliance with specific protocols (e.g., ASTM E466, ISO 12107). Purchasing decisions are heavily influenced by a machine's inherent capability to reliably execute and document tests according to these standards, requiring manufacturers to provide traceable calibration certificates and validated software reporting features to ensure regulatory acceptance of the fatigue data generated.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager