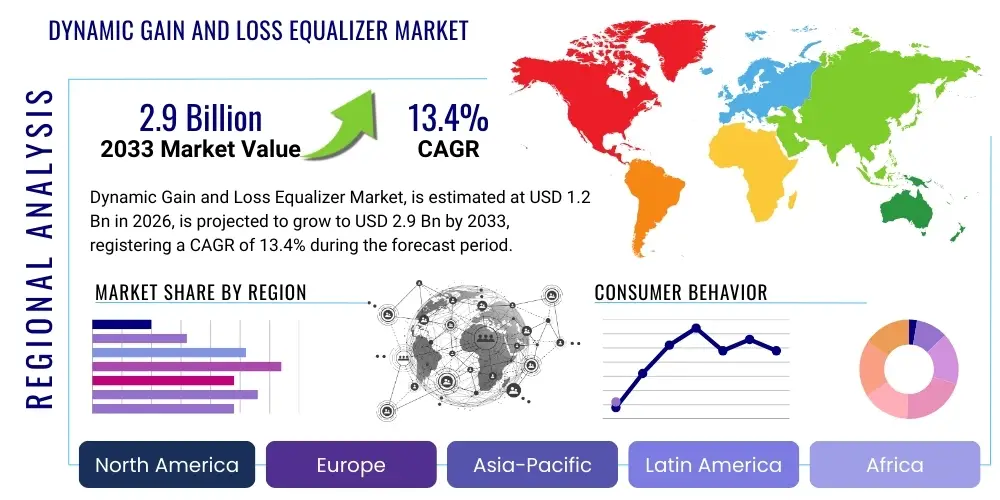

Dynamic Gain and Loss Equalizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436182 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dynamic Gain and Loss Equalizer Market Size

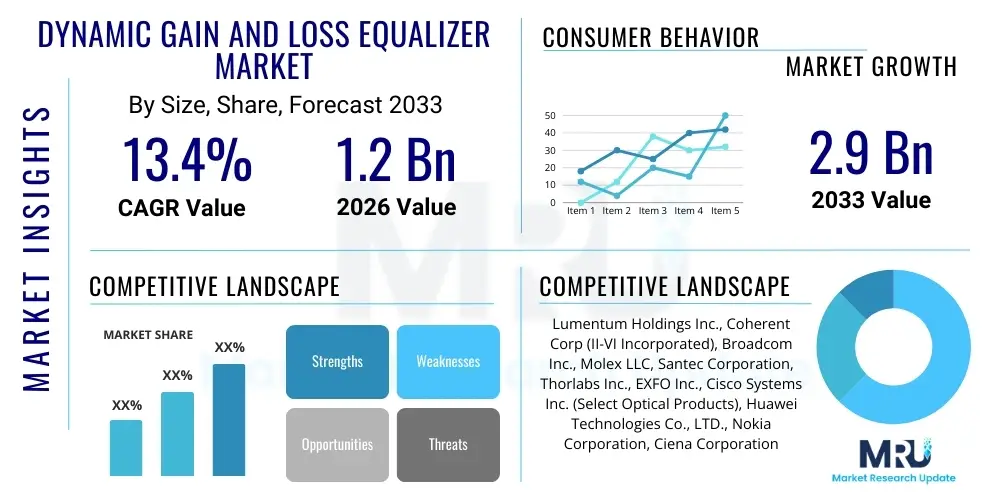

The Dynamic Gain and Loss Equalizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.4% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the relentless demand for higher data transmission capacities in long-haul and ultra-long-haul fiber optic networks, exacerbated by the global rollout of 5G infrastructure and the continuous proliferation of cloud computing services that necessitate robust, low-latency communication backbones.

Dynamic Gain and Loss Equalizer Market introduction

The Dynamic Gain and Loss Equalizer (DGLE) Market encompasses specialized optical components essential for managing power and spectral variations in high-capacity Dense Wavelength Division Multiplexing (DWDM) systems. DGLEs are crucial for maintaining uniform signal quality across all wavelength channels by actively compensating for non-uniform gain spectra introduced by optical amplifiers, particularly Erbium-Doped Fiber Amplifiers (EDFAs), and mitigating channel-dependent losses accumulated over extended transmission distances. Their core function is to flatten the optical power profile, which is paramount for maximizing the system's reach, optimizing spectral efficiency, and ensuring high-fidelity data transmission in modern coherent optical systems.

The primary applications of DGLE technology are concentrated within core telecommunication infrastructure, including terrestrial long-haul networks, regional metro networks, and, increasingly, complex submarine cable systems where manual intervention is impractical and signal integrity is critical. DGLEs offer superior performance compared to static or fixed equalizers by providing real-time, tunable compensation based on dynamic changes in network load, component aging, and ambient temperature fluctuations. This dynamic capability allows network operators to maintain optimal operational margins, facilitating faster deployment of new channels and reducing overall operational expenditure (OPEX) associated with network maintenance and monitoring.

The market growth is substantially fueled by several key factors: the escalating data consumption rates driven by streaming media and enterprise cloud solutions, the global push towards 400G and 800G per wavelength transmission standards requiring precise signal management, and the necessity for flexible grid architectures. Benefits derived from deploying DGLEs include enhanced optical signal-to-noise ratio (OSNR), extended transmission distances without regeneration, and improved channel add/drop flexibility, all contributing to a more resilient and scalable optical network ecosystem capable of handling future traffic demands efficiently and reliably.

Dynamic Gain and Loss Equalizer Market Executive Summary

The Dynamic Gain and Loss Equalizer market is experiencing rapid acceleration, primarily fueled by massive investments in hyperscale data centers and the transition to higher-speed coherent optics (400G/800G). Business trends indicate a shift towards integrated photonics and smaller form factors, enabling manufacturers to embed advanced equalization capabilities directly within transponder units or line cards, thus simplifying network deployment and reducing module costs. Strategic mergers and acquisitions among traditional optical component manufacturers and larger semiconductor firms are defining the competitive landscape, focused on vertical integration to control the supply chain for specialized materials and intellectual property critical to high-performance DGLE fabrication. Furthermore, there is a pronounced focus on software-defined networking (SDN) compatibility, allowing DGLE functions to be managed remotely and dynamically adjusted based on real-time traffic heuristics, enhancing network automation and efficiency.

Geographically, the Asia Pacific (APAC) region stands out as the primary growth engine, driven by extensive investment in fiber infrastructure, particularly in countries like China, India, and Southeast Asia, necessitated by the rapid adoption of 5G and the enormous size of their mobile user bases. North America and Europe remain foundational markets, characterized by high adoption rates of the latest coherent technology standards (e.g., 400G ZR/ZR+) and continuous upgrades to existing long-haul terrestrial networks to support massive cloud exchanges and interconnected data center facilities. Regulatory incentives promoting broadband penetration and the rapid deployment of regional network backbones further stimulate demand across all major geographies, prioritizing components that offer high reliability and minimal spectral distortion.

Segment trends reveal that the application segment focused on long-haul and ultra-long-haul terrestrial and submarine networks continues to dominate revenue share, owing to the critical requirement for sophisticated gain equalization over vast distances. However, the metro network segment is projected to exhibit the fastest CAGR, driven by the increasing complexity of regional interconnection links and the need to manage gain tilt over shorter, but highly variable, distances within metropolitan areas. Technology advancements in Micro-Electro-Mechanical Systems (MEMS) based DGLEs and liquid crystal technology are gaining traction, offering high-speed, low-power consumption solutions that appeal to volume manufacturers seeking optimized performance characteristics for next-generation network equipment.

AI Impact Analysis on Dynamic Gain and Loss Equalizer Market

Common user questions regarding AI’s impact on Dynamic Gain and Loss Equalizers typically revolve around predictive maintenance, optimization of equalization algorithms, and the integration of AI-driven control loops into SDN architectures. Users frequently inquire: "Can AI predict spectral drift and adjust DGLEs proactively?" or "How does machine learning improve OSNR management in complex DWDM routes?" These concerns underscore a strong market expectation for AI to transform DGLE operation from reactive compensation to predictive, autonomous optimization. The key themes summarizing user expectations are increased network autonomy, improved operational efficiency through predictive modeling of optical impairment, and enhanced system longevity by minimizing the stresses caused by rapid or unnecessary physical adjustments to optical components.

The integration of Artificial Intelligence and Machine Learning (AI/ML) algorithms fundamentally changes how Dynamic Gain and Loss Equalizers are managed within large-scale optical networks. Traditionally, DGLEs rely on static monitoring and pre-set thresholds, requiring human intervention or complex manual calibration. AI/ML, however, facilitates the processing of massive datasets—including historical traffic patterns, temperature fluctuations, and real-time component performance metrics—to build highly accurate predictive models. These models allow the Network Management System (NMS) to anticipate potential signal degradations, such as gain tilt or spectral narrowing, hours or even days before they become critical, thereby proactively adjusting the DGLE settings.

This proactive approach significantly enhances network stability and performance. For DGLEs, AI optimizes the compensation profile by considering not just the immediate loss in a fiber span but also the cumulative impact on subsequent spans and the overall system performance across all channels. This level of optimization, previously unattainable manually, ensures maximal utilization of spectral resources and extends the effective reach of the network, reducing the need for costly regeneration sites. Furthermore, AI-driven diagnostics reduce the time required to identify the root cause of performance issues, improving overall network resilience and lowering the total cost of ownership (TCO) for telecommunication carriers and cloud providers.

- AI enables predictive spectral drift compensation, maximizing optical signal-to-noise ratio (OSNR).

- Machine Learning algorithms optimize DGLE settings in real-time based on fluctuating traffic load and environmental variables.

- Integration with Software-Defined Networking (SDN) allows AI to autonomously manage gain profiles across multi-vendor networks.

- AI-powered diagnostics speed up fault isolation related to component degradation or fiber impairments.

- Enhanced automation reduces human error in complex network calibration, lowering OPEX.

- Facilitates optimized power distribution, minimizing non-linear effects over ultra-long distances.

DRO & Impact Forces Of Dynamic Gain and Loss Equalizer Market

The Dynamic Gain and Loss Equalizer market is profoundly influenced by the twin forces of technological necessity and economic efficiency in optical networking. The primary drivers include the exponential growth in global IP traffic, demanding higher spectral efficiency (bits/Hz) and the deployment of coherent transmission technologies operating at 400G and beyond, which inherently require sophisticated gain management to compensate for increased non-linear effects and amplifier gain ripple. Opportunities are largely centered around emerging markets and the critical need for next-generation submarine cables, where highly reliable and remotely adjustable DGLEs are indispensable. However, the market faces significant restraints, including the high initial cost of deploying advanced optical systems and the increasing price pressure exerted by network operators who demand standardized, lower-cost components, pushing manufacturers toward highly integrated, application-specific integrated circuits (ASICs) or photonic integrated circuits (PICs).

Impact forces currently shaping the market trajectory stem from the competitive landscape and technological obsolescence cycle. The rapid pace of innovation in optical amplification (e.g., Raman amplification integration) necessitates constant evolution of DGLE design to remain compatible and effective. Furthermore, the reliance on a limited number of highly specialized component suppliers for core technologies like MEMS mirrors or specialized liquid crystal materials presents supply chain vulnerabilities, which act as a key impact force on pricing and delivery timelines. The market structure dictates that performance requirements—specifically, fast response time and low insertion loss—remain non-negotiable competitive advantages.

The sustained demand from hyperscale cloud providers represents a powerful driver, as these entities require vast, efficient, and flexible optical backbones to connect their global fleet of data centers. Opportunities also arise from the migration of existing 100G networks to 200G/400G infrastructures, which necessitates replacing or upgrading older, static equalization components with dynamic solutions. Conversely, a major restraint is the technical complexity involved in integrating DGLEs with ultra-wideband optical amplifiers (C+L band amplification), demanding intricate engineering to maintain performance across an extremely broad spectral range without introducing unacceptable polarization-dependent losses (PDL).

Segmentation Analysis

The Dynamic Gain and Loss Equalizer market is primarily segmented based on the component type, the underlying technology used for achieving dynamic equalization, the network application, and the geographic region. Analyzing these segments provides strategic insights into the market's evolving demand patterns, revealing where technological advancements are having the most significant commercial impact. The component segmentation, differentiating between stand-alone DGLE modules and integrated solutions embedded within optical line amplifiers or transponders, is critical for understanding vendor strategies regarding size, weight, power consumption (SWaP), and modularity for network deployment.

Technological segmentation highlights the shift from older bulk optic solutions to highly advanced micro-electromechanical systems (MEMS) and liquid crystal-based equalizers, which offer superior performance characteristics, including faster response times and lower optical insertion loss, making them ideal for high-speed, modern coherent systems. The application segment, separating long-haul, metro, and submarine networks, dictates the specific performance specifications required, as ultra-long-haul and submarine environments demand the highest levels of reliability, precision, and environmental stability, driving premium pricing for specialized DGLE variants in these areas.

The increasing sophistication of DWDM networks, particularly those leveraging Flexible Grid architectures, emphasizes the importance of DGLEs capable of managing channel power independent of specific fixed channel spacing. This allows network operators the flexibility to provision bandwidth dynamically, adapting to unpredictable traffic surges. The move towards highly automated networks ensures that DGLEs with sophisticated digital control interfaces and low latency adjustment capabilities will capture the dominant market share over the forecast period, confirming the continuous investment focus on improved system integration and software compatibility across all major segments.

- By Technology:

- MEMS-Based Dynamic Gain Equalizers

- Liquid Crystal-Based Dynamic Gain Equalizers

- Planar Lightwave Circuit (PLC)-Based Equalizers

- Acousto-Optic Tunable Filters (AOTF)

- By Component Type:

- Stand-Alone Modules

- Integrated Line Cards/Sub-Systems (Embedded)

- By Application:

- Long-Haul Networks (Terrestrial)

- Ultra-Long-Haul Networks (Submarine Cables)

- Metro and Regional Networks

- Data Center Interconnect (DCI)

- By Channel Width:

- C-Band Equalizers

- L-Band Equalizers

- C+L Band Equalizers (Broadband)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Dynamic Gain and Loss Equalizer Market

The value chain for the Dynamic Gain and Loss Equalizer market is complex, spanning from highly specialized material production to final network integration. The upstream segment involves the sourcing of critical raw materials, including specialized rare earth elements (like Erbium for optical amplifiers often integrated with DGLEs), high-purity silica glass for fiber optics and Planar Lightwave Circuits (PLCs), and high-precision components required for MEMS fabrication, such as silicon wafers and advanced micro-actuators. This segment is characterized by a limited number of highly specialized suppliers who hold proprietary knowledge and patents, giving them significant leverage. Cost and quality control at this stage are paramount, as the performance of the final DGLE product is directly dependent on the purity and precision of these input materials.

The core manufacturing and assembly stage involves optical component specialists who design, fabricate, and test the DGLE devices. This segment requires substantial capital investment in cleanroom facilities, advanced photolithography equipment (for PLC-based devices), and high-precision alignment and testing tools. Manufacturers often integrate the DGLE with other components like variable optical attenuators (VOAs) and photodiodes to create sophisticated sub-systems. Distribution channels are predominantly indirect, relying heavily on partnerships with original equipment manufacturers (OEMs) such as Cisco, Nokia, Ciena, and Huawei, who incorporate DGLEs into their larger optical transport systems (e.g., line cards and amplifier units) before selling them to network operators. Direct sales are typically limited to high-volume or highly customized orders placed by major hyperscalers or strategic military communication projects.

The downstream segment primarily consists of Tier 1 and Tier 2 telecommunication service providers (Telcos), cable operators, and hyperscale data center operators (DCOs). These end-users integrate the OEM systems into their vast fiber networks. Maintenance and support, often provided either by the OEM or third-party optical network consultants, form a crucial final part of the value chain. As network architectures evolve toward open and disaggregated models, the power balance is subtly shifting downstream, with hyperscalers and major Telcos increasingly influencing component specifications and demanding standardized interfaces and software compatibility, placing pressure on DGLE manufacturers to innovate continuously while maintaining competitive pricing.

Dynamic Gain and Loss Equalizer Market Potential Customers

The primary consumers and end-users of Dynamic Gain and Loss Equalizer technology are large organizations operating high-capacity, mission-critical optical communication networks that demand superior signal integrity over vast distances. Telecommunication service providers (Telcos), including major global carriers like AT&T, Verizon, Deutsche Telekom, China Mobile, and NTT, are foundational buyers, utilizing DGLEs to upgrade their national and international backbone infrastructure to support growing voice, data, and mobile traffic derived from 5G deployments. Their procurement decisions are driven by factors such as system reliability, compatibility with existing DWDM infrastructure, and the ability to minimize operational expenditure through automated signal management.

Hyperscale cloud service providers (CSPs) such as Amazon Web Services (AWS), Google Cloud, and Microsoft Azure represent the fastest-growing customer segment. These entities require immense, ultra-low-latency interconnectivity between their massive global fleet of data centers (DCI). DGLEs are essential for managing the high-density wavelength channels used in DCI networks, ensuring maximum spectral efficiency and minimal power consumption across these crucial links. The demand from CSPs is often focused on compact, integrated DGLE solutions suitable for high-density rack deployment and optimized for 400G and 800G coherent transmission standards.

Furthermore, cable operators, organizations managing vast regional fiber-to-the-home (FTTH) networks, and operators of submarine cable consortiums constitute significant potential customer groups. Submarine cable systems, in particular, necessitate the most robust and highly reliable DGLEs due to the impossibility of on-site repairs and the catastrophic costs associated with signal failure. Governmental and defense organizations, requiring secure and resilient communication links, also represent a specialized, albeit smaller, market segment. In all cases, the decision to purchase DGLEs is tied directly to the need for scalable bandwidth provisioning and the mitigation of accumulated optical noise and non-linear effects over long transmission distances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 13.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lumentum Holdings Inc., Coherent Corp (II-VI Incorporated), Broadcom Inc., Molex LLC, Santec Corporation, Thorlabs Inc., EXFO Inc., Cisco Systems Inc. (Select Optical Products), Huawei Technologies Co., LTD., Nokia Corporation, Ciena Corporation, NEL (NTT Electronics), Fujitsu Optical Components, Optoplex Corporation, Calix, TE Connectivity, Oclaro (Lumentum), Eoptolink Technology Inc., Sumitomo Electric Industries, Accelink Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dynamic Gain and Loss Equalizer Market Key Technology Landscape

The technological landscape of the Dynamic Gain and Loss Equalizer market is characterized by a strong push toward miniaturization, increased spectral coverage, and faster response times, driven by the demands of next-generation optical transmission standards, particularly those utilizing Flexible Grid DWDM. The prevailing technologies utilized include Micro-Electro-Mechanical Systems (MEMS), which use microscopic mirrors or shutters actuated electrostatically to selectively attenuate specific wavelengths. MEMS-based DGLEs are highly valued for their high reliability, low power consumption, and relatively compact size, making them suitable for integration into high-density line cards and transponders in modern telecommunication equipment. Their precise, real-time control capability is critical for optimizing the flattened gain profile across the operational spectrum.

Another significant technology is the use of liquid crystal (LC) devices. Liquid crystal DGLEs operate by leveraging the voltage-dependent birefringence properties of liquid crystals to vary the attenuation applied to specific light paths, effectively shaping the spectral response. While they may sometimes have slightly slower response times compared to some MEMS counterparts, LC technology offers excellent fine-tuning capability and lower cost scalability for certain applications. Furthermore, there is growing interest and investment in Planar Lightwave Circuit (PLC) technology. PLC-based DGLEs integrate the equalization function onto a single chip using silica-on-silicon fabrication processes, offering ultra-compact footprints and the potential for mass production scalability, which aligns perfectly with the cost pressures faced by network operators globally.

The overarching technological trend is the integration of these equalization functions with other necessary optical components, such as multiplexers, demultiplexers, and Variable Optical Attenuators (VOAs), into Photonic Integrated Circuits (PICs). PICs drastically reduce the size and manufacturing complexity, improve thermal stability, and enhance overall system performance by minimizing interconnection losses. Key advancements in proprietary algorithms for controlling the dynamic elements are also vital, often incorporating advanced digital signal processing (DSP) to interpret network telemetry data and execute predictive adjustments, solidifying the role of the DGLE as an intelligent, rather than merely passive, component within the optical transport layer.

Regional Highlights

Geographically, the Dynamic Gain and Loss Equalizer market exhibits distinct adoption patterns correlating directly with fiber infrastructure maturity and investment cycles in 5G and data center expansion. Asia Pacific (APAC) currently dominates the market in terms of volume and growth potential. Countries like China, due to large-scale government-backed fiber rollouts and the fastest global 5G adoption rate, drive immense demand for DGLE components in both terrestrial and new intra-regional submarine networks. India and Southeast Asian nations are also ramping up infrastructure spending to meet rapidly escalating mobile data demands, making APAC the epicenter of future market expansion, focused primarily on cost-effective, high-reliability components.

North America and Europe represent mature markets characterized by the highest adoption rates of cutting-edge technology, particularly 400G and 800G coherent systems used by hyperscale cloud providers and Tier 1 carriers for Data Center Interconnect (DCI) and trans-Atlantic links. Demand in these regions is driven by replacement cycles, network densification, and the need for components that support ultra-wideband (C+L band) amplification and flexible grid architectures. The focus here is less on volume and more on superior performance metrics, such as extremely low Polarization Dependent Loss (PDL) and high spectral resolution for complex modulation schemes.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging regions showing promising growth, primarily supported by government initiatives to improve broadband penetration and new submarine cable projects connecting these regions to global internet backbones. While currently smaller in market share, these areas represent significant long-term opportunities as infrastructure matures. Deployment in these regions emphasizes components capable of handling long distances under challenging environmental conditions, prioritizing durability and remote management capabilities offered by advanced DGLE solutions.

- North America: High early adoption of 400G/800G coherent optics; strong demand from hyperscale Data Center Interconnects (DCI).

- Europe: Focus on high-capacity terrestrial upgrades and stringent regulatory requirements driving technological refinement in components.

- Asia Pacific (APAC): Leading market in terms of volume growth, fueled by extensive 5G rollout and massive fiber infrastructure investment, particularly in China and India.

- Latin America (LATAM): Emerging market driven by fiber-to-the-home (FTTH) expansion and new subsea cable infrastructure connecting major metropolitan hubs.

- Middle East and Africa (MEA): Growth tied to significant government and private investment in regional network backbones and international connectivity projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dynamic Gain and Loss Equalizer Market.- Lumentum Holdings Inc.

- Coherent Corp (II-VI Incorporated)

- Broadcom Inc.

- Molex LLC

- Santec Corporation

- Thorlabs Inc.

- EXFO Inc.

- Cisco Systems Inc. (Select Optical Products)

- Huawei Technologies Co., LTD.

- Nokia Corporation

- Ciena Corporation

- NEL (NTT Electronics)

- Fujitsu Optical Components

- Optoplex Corporation

- Calix

- TE Connectivity

- Sumitomo Electric Industries

- Accelink Technology Co., Ltd.

- Source Photonics

- Photon Technology Co., Ltd.

Frequently Asked Questions

What is the primary function of a Dynamic Gain and Loss Equalizer (DGLE) in optical networks?

The primary function of a Dynamic Gain and Loss Equalizer is to compensate for non-uniform gain variations and spectral tilt introduced by optical amplifiers (like EDFAs) and accumulated losses across various wavelengths in Dense Wavelength Division Multiplexing (DWDM) systems. This ensures uniform power levels for all channels, maximizing the system's optical signal-to-noise ratio (OSNR) and extending the effective transmission distance.

Which technology segment is expected to show the highest growth in the DGLE market?

The MEMS-Based Dynamic Gain Equalizers segment is expected to show robust growth due to their ability to deliver high-speed, precise, and low-power equalization. MEMS technology offers superior integration capabilities, making it ideal for the highly dense, next-generation 400G and 800G coherent optical transport platforms demanded by hyperscale data centers and telecommunication carriers.

How does the rollout of 5G infrastructure impact the demand for DGLEs?

The massive global rollout of 5G infrastructure significantly increases the demand for DGLEs by generating exponential data traffic that must be aggregated and transported over high-capacity fiber backbones. 5G networks necessitate upgrades to core DWDM systems, driving the replacement of older static components with sophisticated dynamic equalizers to manage the complexity and scale of modern optical transmission.

What key operational challenges do DGLEs help network operators solve?

DGLEs address critical operational challenges including mitigating channel power imbalances (gain ripple), compensating for temperature-induced spectral drift, and managing non-linear effects over ultra-long distances. By performing real-time, autonomous equalization, they improve network stability, reduce manual intervention costs, and ensure consistent quality of service (QoS) across all channels.

Which geographical region is currently leading the investment and adoption of DGLE technology?

Asia Pacific (APAC), particularly driven by substantial infrastructure investments in China and India, is currently leading the market in terms of volume and growth. This dominance is attributed to large-scale government fiber initiatives, rapid 5G deployment, and the continuous expansion of high-capacity intra-regional optical networks necessary to support massive mobile user bases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager