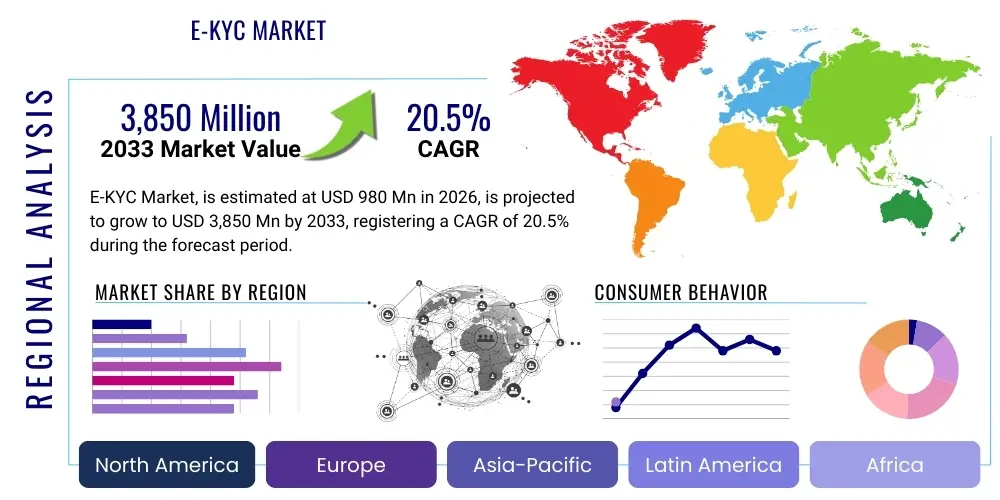

E-KYC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436511 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

E-KYC Market Size

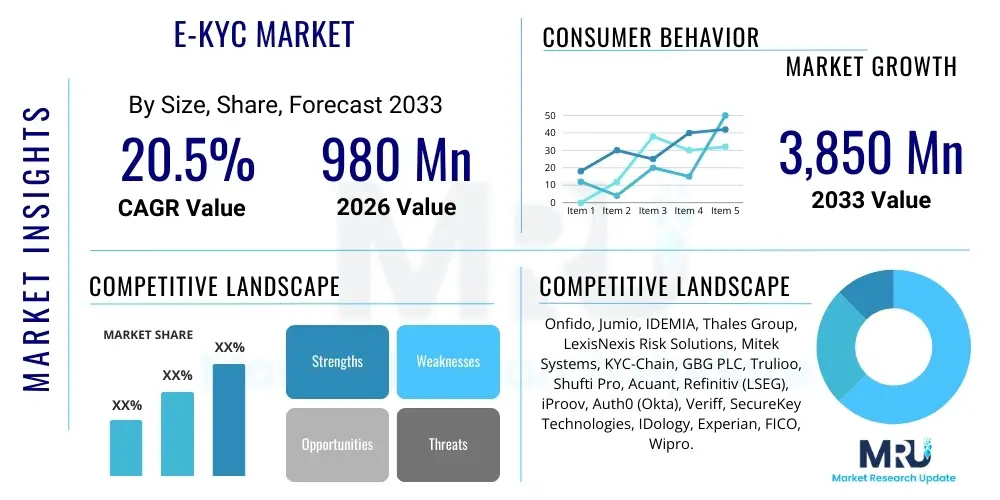

The E-KYC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 980 Million in 2026 and is projected to reach USD 3,850 Million by the end of the forecast period in 2033.

E-KYC Market introduction

The Electronic Know Your Customer (E-KYC) Market encompasses digital solutions designed to verify the identity of customers remotely and securely, fulfilling stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulatory requirements without requiring physical presence. These solutions leverage cutting-edge technologies, including biometric verification, optical character recognition (OCR), and advanced database cross-referencing, to streamline the customer onboarding process. The fundamental product offering revolves around identity proofing and verification services delivered through web portals, mobile applications, or integrated Application Programming Interfaces (APIs). Major applications span across highly regulated sectors such as Banking, Financial Services, and Insurance (BFSI), Telecommunications, Government services, and Healthcare, where establishing trust and compliance is paramount. The primary objective is not only risk mitigation but also enhancing operational efficiency and drastically improving the overall customer experience by reducing friction during initial sign-up.

The core benefits of adopting E-KYC systems are multifaceted, addressing both compliance imperatives and competitive pressures. From a compliance perspective, E-KYC minimizes human error associated with manual document checks, thereby strengthening adherence to complex global regulatory frameworks like GDPR, Basel III, and various national PII protection laws. Operationally, these systems drastically reduce the processing time for onboarding—often from several days to mere minutes—leading to significant cost savings associated with paper handling and physical verification processes. Furthermore, the enhanced security features, particularly liveness detection and sophisticated fraud pattern analysis, provide a robust defense layer against synthetic identity fraud and deepfake attacks, which are increasingly prevalent in the digital domain. These foundational benefits drive widespread adoption across industries striving for comprehensive digital transformation.

Key driving factors accelerating the market’s expansion include the global shift towards digital and mobile-first services, necessitating seamless and remote identity verification. The proliferation of affordable smartphones and ubiquitous internet access has empowered consumers to demand instant service activation, forcing traditional institutions to digitize their legacy verification workflows. Moreover, the increasing global volume of financial transactions and the associated regulatory scrutiny placed upon financial institutions to demonstrate due diligence against illicit activities act as powerful mandates for E-KYC implementation. Governments worldwide are actively supporting digital identity initiatives and introducing regulations that specifically authorize remote verification methods, further validating and legitimizing the E-KYC methodology as the standard for future identity management.

E-KYC Market Executive Summary

The E-KYC market is characterized by robust growth driven fundamentally by global regulatory evolution and the imperative for seamless digital customer journeys. Current business trends indicate a significant convergence of identity verification processes with advanced data analytics and machine learning, moving beyond simple document validation towards continuous and risk-based authentication models. Service providers are increasingly offering comprehensive Identity-as-a-Service (IDaaS) platforms, leveraging cloud deployment models (SaaS) to ensure scalability, rapid updates, and lower total cost of ownership for end-user organizations. A critical trend is the incorporation of decentralized identity (DID) frameworks, often powered by blockchain technology, aimed at giving users greater control over their verifiable credentials while enhancing data security and immutability. This technological shift is reshaping competitive dynamics, favoring companies that can integrate multiple verification layers—biometrics, behavioral analysis, and credential checking—into a unified, compliance-focused solution set.

Regionally, the market exhibits divergent growth trajectories influenced heavily by regulatory maturity and digitalization speed. Asia Pacific (APAC) stands out as the highest growth region, primarily due to large, government-led digital identity programs in countries like India (Aadhaar) and rapidly expanding digital banking penetration across Southeast Asia, where a substantial portion of the population is migrating directly to mobile financial services. Europe demonstrates steady, compliance-driven growth, propelled by robust regulatory harmonization efforts, notably the eIDAS regulation, and strict data protection laws like GDPR, necessitating secure and transparent identity management solutions. Conversely, North America leads in technological innovation and market maturity, with demand fueled by highly sophisticated financial markets and stringent sector-specific regulations, alongside a strong focus on advanced anti-fraud features like passive liveness detection and behavioral biometrics.

Analyzing segment trends reveals that the BFSI sector remains the dominant end-user due to the inherent nature of financial transactions and stringent AML/KYC mandates. However, the fastest-growing segments are projected to be Telecommunications, necessitated by SIM card registration requirements and combating mobile fraud, and Healthcare, driven by the need for secure patient record access and remote telehealth services. Regarding solution type, biometric verification services (facial recognition, fingerprint matching) are experiencing the fastest adoption rates, favored for their high accuracy and non-repudiation capabilities, significantly outpacing traditional methods like simple database checks. The evolution of regulatory technology (RegTech) solutions embedded within E-KYC platforms is also a critical segment trend, enabling automated compliance reporting and real-time risk scoring, moving the industry towards proactive, instead of reactive, verification.

AI Impact Analysis on E-KYC Market

User inquiries regarding the influence of Artificial Intelligence (AI) and Machine Learning (ML) on the E-KYC market frequently center on efficiency gains versus potential ethical and regulatory risks. Common user questions probe the accuracy of AI-powered facial recognition in diverse lighting conditions, the ability of ML models to detect sophisticated synthetic fraud (such as deepfakes or morphing), and the preparedness of systems to handle bias and discrimination embedded within training data, particularly concerning vulnerable demographics. A major concern revolves around the regulatory accountability when an AI system incorrectly rejects a legitimate customer (false negative) or approves a fraudulent one (false positive). Users are intensely interested in how AI facilitates continuous, passive verification throughout the customer lifecycle, moving away from a one-time onboarding check, and how AI can automate compliance audits, reducing the manual burden on compliance officers. These themes highlight a market expectation that AI will be transformative in fighting advanced fraud while simultaneously requiring meticulous governance to ensure fairness, transparency, and regulatory adherence.

AI’s integration into E-KYC platforms is profoundly changing the landscape, transforming processes from manual data entry and visual inspection to highly automated, algorithmic decision-making. Machine learning algorithms are deployed to analyze huge volumes of identity data points, correlating details across documents, biometric scans, and historical risk databases to generate a comprehensive trust score. This capability significantly elevates fraud detection capabilities, allowing systems to recognize subtle discrepancies, patterns of suspicious activity, or inconsistencies that a human reviewer would likely miss. Specifically, supervised and unsupervised ML models are now essential for distinguishing between genuine human presence (liveness detection) and static or dynamic spoofing attempts, drastically increasing the security posture against sophisticated digital attacks. Furthermore, AI automates the initial screening process, ensuring that the majority of low-risk applications are processed instantly, enabling compliance teams to focus their finite resources on high-risk cases flagged by the advanced systems.

The strategic implementation of AI also extends deep into regulatory technology (RegTech) components, where Natural Language Processing (NLP) is used to interpret and categorize complex global regulatory text, automatically mapping institutional verification policies to mandated requirements. This enables E-KYC providers to offer solutions that are automatically updated in response to changing laws, ensuring clients maintain perpetual compliance with minimal operational friction. However, the adoption of AI is not without its challenges; managing model drift, ensuring data sovereignty, and mitigating algorithmic bias are ongoing priorities. Market participants must provide clear auditing trails and explainability (XAI) for all AI-driven decisions to satisfy regulatory requirements for transparency, ensuring that the enhanced efficiency provided by AI does not compromise principles of fairness or legal accountability.

- AI-driven fraud detection significantly improves accuracy against deepfakes and synthetic identities using advanced pattern recognition.

- Machine Learning enhances liveness detection capabilities by analyzing micro-movements and biometric features in real-time.

- Natural Language Processing (NLP) accelerates document verification by automatically extracting, categorizing, and validating textual data across various international formats.

- AI enables continuous monitoring and risk scoring post-onboarding, transitioning verification from a static event to a dynamic process.

- Predictive analytics driven by AI optimizes compliance efforts by prioritizing and flagging potentially suspicious transactions or accounts for human review.

DRO & Impact Forces Of E-KYC Market

The E-KYC market is fundamentally shaped by a powerful confluence of drivers that mandate digitalization, counterbalanced by significant restraints centered on privacy and implementation complexity, while emerging technological opportunities promise future market expansion. The primary driver is the accelerating global mandate for digital transformation across regulated industries, compelling enterprises to replace outdated paper-based, manual verification processes with remote, instantaneous solutions to meet evolving consumer expectations for speed and convenience. Simultaneously, the increasingly stringent global regulatory landscape, exemplified by enhanced AML/CFT directives, necessitates auditable and highly secure identity verification methods, positioning E-KYC as an indispensable compliance tool. These regulatory and market pressures create a potent impact force driving high investment in E-KYC infrastructure, ensuring that compliance requirements are met while competitive advantages in customer experience are gained.

Conversely, the market faces considerable restraints, chief among them being consumer and regulatory concerns regarding data privacy and security, especially in light of mass data breaches and stringent PII protection laws like GDPR and CCPA. The requirement to collect, process, and store sensitive biometric and personal data necessitates high security spending and complex consent management frameworks, raising the barrier to entry for smaller firms. Furthermore, the high initial cost of deploying sophisticated E-KYC infrastructure, which often involves integrating specialized biometric hardware, advanced AI/ML engines, and complex legacy IT systems, presents a financial restraint, particularly in emerging economies or for smaller institutions. Overcoming the public’s skepticism regarding data handling transparency and mitigating the risk of system compromise remain critical obstacles that vendors must address through superior encryption and decentralized solutions.

Despite these challenges, substantial opportunities exist, particularly in leveraging nascent technologies such as blockchain for decentralized identity management (DID), which promises to revolutionize data security and user control by moving away from centralized databases. The expansion of E-KYC applications beyond BFSI into high-growth vertical markets, including telehealth, online education, and governmental social services, presents a vast untapped customer base. Additionally, the development of standardized, interoperable digital identity frameworks on a national or regional scale (e.g., EU Digital Identity Wallet) provides a powerful opportunity for E-KYC vendors to offer compliant, cross-border verification services, accelerating market penetration. The continuous innovation in anti-spoofing technology and passive biometrics further enhances the value proposition, ensuring E-KYC remains the front line defense against escalating cyber fraud methods.

Segmentation Analysis

The E-KYC market is comprehensively segmented based on three primary characteristics: the type of solution offered, the model of deployment utilized, and the end-user industry leveraging the services. Solution segmentation differentiates between the core technological components, ranging from traditional digital identity verification software to advanced biometric authentication and specialized regulatory technology (RegTech) platforms. Deployment models distinguish between highly secure on-premise solutions favored by large, heavily regulated entities, and flexible, scalable cloud-based (SaaS) deployments that dominate the small and medium-sized enterprise (SME) sector and accelerate global adoption. Understanding these segments is crucial as market dynamics vary significantly—for instance, biometric solutions are seeing higher growth rates, while cloud deployment is preferred for its agility and lower capital expenditure, defining specific competitive submarkets.

The segmentation structure reflects the diversity of customer needs, with end-user industries representing the crucial demand side of the market. While the Banking, Financial Services, and Insurance sector remains the largest consumer, driven by mandatory compliance for customer onboarding and transaction monitoring, high-growth opportunities are emerging in niche segments like Gaming and Cryptocurrency exchanges, which face unique challenges in adhering to international AML standards. The selection of solution and deployment model is intrinsically linked to the end-user's size and regulatory environment; for example, large central banks or governmental bodies typically mandate on-premise deployment for maximum data sovereignty, whereas Fintech startups universally adopt the cloud-based IDaaS model for speed-to-market and operational scalability. This hierarchical segmentation allows vendors to tailor their offerings—such as specialized OCR for international passports versus simplified government ID verification for local telecom customers—optimizing their strategic focus.

- By Solution Type:

- Identity Verification Software

- Biometric Verification (Facial Recognition, Fingerprint, Iris)

- Digital Signature Verification

- Regulatory Compliance Services (RegTech)

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS/IDaaS)

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications

- Government and Public Sector

- Healthcare

- Retail and E-commerce

- Gaming and Entertainment

- Cryptocurrency and Blockchain Exchanges

Value Chain Analysis For E-KYC Market

The E-KYC value chain is complex and integrated, starting with upstream technology providers who supply the foundational components necessary for verification systems. Upstream activities involve research and development of core enabling technologies, including advanced optical character recognition (OCR) engines for document parsing, sophisticated AI/ML algorithms for liveness detection and fraud pattern analysis, and specialized hardware manufacturers supplying high-resolution cameras, biometric scanners, and secure cryptographic modules. The quality and sophistication of these upstream inputs directly determine the accuracy, speed, and security capability of the final E-KYC solution. Key players in this stage often specialize in deep technical areas, such as developing proprietary algorithms for synthetic identity detection or securing certifications for biometric template management, forming essential partnerships with solution integrators further down the chain.

Midstream activities are dominated by E-KYC solution providers and system integrators who aggregate the upstream technologies, integrate them with regulatory frameworks, and develop the final configurable platform (whether SaaS or on-premise). This stage involves crucial tasks such as creating user-friendly onboarding interfaces, managing secure data transmission layers (encryption protocols), and building comprehensive case management tools for compliance officers. The distribution channel plays a pivotal role in market reach; solutions are distributed both directly to large enterprise clients (such as global banks requiring customized, complex integrations) and indirectly through strategic partnerships. Indirect distribution involves working with Value-Added Resellers (VARs), Managed Security Service Providers (MSSPs), and core banking software vendors, leveraging their established client bases and integration expertise to penetrate specific regional or vertical markets rapidly.

Downstream deployment and utilization represent the final stage, encompassing the end-users—primarily BFSI, Telecom, and Government entities—who consume the E-KYC service to onboard and manage their customers securely. Success in the downstream market hinges on seamless integration capabilities with existing customer relationship management (CRM) systems and core operational platforms. The ongoing operational services, including maintenance, regulatory updates, and continuous monitoring of risk profiles, are crucial for sustaining the value proposition. Direct distribution often ensures high customization and dedicated support for large accounts, while indirect channels provide wider market accessibility and standardized, easily deployable solutions, particularly for SMEs. The constant regulatory flux mandates continuous updates and service optimization throughout the entire downstream process, emphasizing the strong link between technology deployment and regulatory adherence.

E-KYC Market Potential Customers

The E-KYC market targets any entity subject to stringent regulatory requirements regarding customer identity verification, particularly those undergoing significant digital transformation or managing sensitive customer data. The most prominent end-user segment is the Banking, Financial Services, and Insurance (BFSI) sector, which includes commercial banks, credit unions, investment firms, and insurance carriers. These institutions are compelled by global AML/CTF mandates to verify identities thoroughly, both during account opening and periodically throughout the customer lifecycle. Their critical needs center on reducing customer churn during digital onboarding, ensuring regulatory compliance across jurisdictions, and mitigating sophisticated financial fraud schemes, making them the anchor customers for high-security, biometric-driven E-KYC solutions. Beyond traditional banking, the burgeoning Fintech sector, including mobile payment providers and peer-to-peer lending platforms, represents a high-growth customer base seeking scalable, API-driven IDaaS solutions for rapid, global market entry.

Beyond the BFSI sphere, the Telecommunications sector constitutes a rapidly expanding segment of potential customers, driven by mandatory SIM registration laws in many countries designed to prevent anonymous usage for illicit activities. Telecom operators require efficient, often mobile-based, verification tools to rapidly onboard subscribers while maintaining compliance. Government and Public Sector agencies are also significant potential buyers, utilizing E-KYC for secure access to digital services, identity verification for welfare distribution, and passport issuance processes. Furthermore, the Healthcare sector, specifically hospitals and telehealth platforms, is increasingly adopting E-KYC for securing remote patient records, ensuring compliance with privacy regulations (like HIPAA), and verifying patient identity during remote consultations. The increasing need for secure digital interaction across these diverse sectors solidifies their status as primary target markets, demanding tailored solutions that balance security, regulatory compliance, and user convenience in their specific operational context.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980 Million |

| Market Forecast in 2033 | USD 3,850 Million |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Onfido, Jumio, IDEMIA, Thales Group, LexisNexis Risk Solutions, Mitek Systems, KYC-Chain, GBG PLC, Trulioo, Shufti Pro, Acuant, Refinitiv (LSEG), iProov, Auth0 (Okta), Veriff, SecureKey Technologies, IDology, Experian, FICO, Wipro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

E-KYC Market Key Technology Landscape

The E-KYC market’s technological foundation is built upon a dynamic stack of advanced verification and security tools, central to which is advanced biometric technology, specifically facial recognition and fingerprint scanning, integrated with sophisticated anti-spoofing mechanisms. Facial recognition systems utilize neural networks and deep learning models to map unique facial characteristics from a live feed or uploaded document, cross-referencing this against government-issued IDs. Crucially, these systems employ liveness detection, which can be passive (analyzing texture, micro-movements, and reflections in a single image) or active (requiring the user to perform a specified action, like blinking or turning their head). Liveness detection is paramount in the current fraud landscape, serving as the primary technological defense against deepfake videos, printed photos, and screen replays used to bypass traditional remote verification checks, demanding continuous technological refinement to keep pace with evolving fraud techniques.

Another fundamental technology is Optical Character Recognition (OCR), enhanced by Artificial Intelligence, which automates the extraction and parsing of data from physical documents (passports, driver’s licenses) with high accuracy, regardless of language or document format variations. Modern AI-enhanced OCR goes beyond simple text extraction; it includes tamper detection by analyzing font consistency, watermarks, and security features embedded within the document image. Alongside OCR, the proliferation of digital signature technologies, adhering to standards like eIDAS in Europe, ensures the non-repudiation of transactions initiated after the E-KYC process is complete. These technologies collectively enable fully automated identity workflows, reducing manual intervention and significantly accelerating the processing time, which is a major competitive differentiator for vendors.

The future technology landscape is heavily invested in Decentralized Identity (DID) and blockchain integration. Blockchain technology offers immutable record-keeping and a decentralized verification layer, moving away from centralized databases that are prime targets for large-scale data breaches. DID frameworks empower the user to control their verifiable credentials, sharing only necessary proofs of identity without exposing underlying sensitive data. This shift addresses major privacy restraints and aligns with increasing demands for data sovereignty, representing a crucial opportunity for technology disruption. Furthermore, behavioral biometrics—analyzing typing patterns, mouse movements, and navigation speed—is emerging as a key passive verification technology, providing continuous authentication beyond the initial onboarding step, creating a robust, multi-layered security framework that incorporates machine learning to detect anomalous user behavior in real-time.

Regional Highlights

- North America (NA): North America is characterized by high market maturity, driven by stringent financial regulations (e.g., Bank Secrecy Act, Patriot Act) and rapid technological adoption, particularly within the advanced financial services and technology sectors. The region sees strong demand for AI-driven fraud detection and passive liveness solutions, reflecting the highly sophisticated nature of fraud attempts. The U.S. market is fragmented but highly innovative, with significant investment in enterprise-grade, on-premise solutions from major banks and high-growth IDaaS deployments favored by Silicon Valley fintechs. Regulatory variations across states, particularly concerning privacy legislation (like CCPA), also influence the adoption of flexible, compliant identity orchestration layers. The focus here is on seamless integration, high throughput, and superior accuracy, often leading the market in adopting next-generation verification methods like behavioral biometrics.

- Europe: The European E-KYC market is primarily driven by comprehensive regulatory harmonization, notably the implementation of the Fifth Anti-Money Laundering Directive (5AMLD) and the eIDAS regulation, which mandates mutual recognition of electronic identification across member states. This regulatory environment fosters strong, compliance-focused growth. Europe exhibits high adoption of certified digital signature solutions and robust, GDPR-compliant data processing frameworks, prioritizing user privacy and consent management above all. Countries like Germany and the Nordics lead in digital government services, demanding high-assurance E-KYC solutions integrated with national digital ID schemes. The market is increasingly consolidating around pan-European providers that can guarantee compliance consistency across the diverse national legal landscapes, particularly focusing on remote video identification and secure digital wallets.

- Asia Pacific (APAC): APAC is the fastest-growing and most dynamic market globally, propelled by massive population bases, rapid urbanization, and government-backed initiatives promoting digital inclusion and identity ecosystems (e.g., India's Aadhaar, centralized digital ID programs in Singapore and Malaysia). The region’s growth is fueled by the vast potential of the unbanked or underbanked population migrating directly to mobile-based financial services, creating explosive demand for scalable, mobile-optimized E-KYC solutions. Adoption rates for simple, effective remote verification methods, such as mobile OCR and basic biometrics, are extremely high. Challenges include managing verification across numerous local languages, diverse document types, and ensuring reliable connectivity in rural areas. The focus in APAC is heavily skewed towards accessibility, cost-efficiency, and integration with local telecom and payment infrastructure, positioning it as the key volume market for E-KYC vendors globally.

- Latin America (LATAM): The LATAM market is characterized by high levels of mobile penetration alongside significant challenges related to identity fraud, lack of standardized documentation, and varying regulatory maturity across countries (e.g., Brazil, Mexico, Colombia). E-KYC adoption is rapidly accelerating, primarily driven by fintech innovations seeking to fill gaps left by traditional banking infrastructure and the need to combat high rates of financial crime. The demand is strong for identity solutions that can effectively handle low-quality documentation, provide robust fraud scoring, and integrate with local credit bureaus. The market is showing a preference for cloud-based, easily deployable solutions that support rapid market scaling, with vendors focusing on establishing regional data centers and strong local partnerships to navigate complex jurisdictional requirements and security concerns effectively.

- Middle East and Africa (MEA): The MEA region is emerging, with growth highly concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to ambitious national digitalization agendas (e.g., Saudi Vision 2030) and large government investment in smart city infrastructure and financial regulation. Demand in the GCC is for premium, high-security solutions, often leveraging advanced biometrics and customized, centralized identity registries. In Africa, growth is spurred by the massive expansion of mobile money services and telecommunications, necessitating simple, secure mobile onboarding tools that cater to populations often lacking formal traditional ID documents. Market development is heavily reliant on governmental policies and regulatory frameworks concerning data sovereignty and cross-border financial compliance, demanding flexible solutions adaptable to environments with intermittent internet access and power supply challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the E-KYC Market.- Onfido

- Jumio

- IDEMIA

- Thales Group

- LexisNexis Risk Solutions

- Mitek Systems

- KYC-Chain

- GBG PLC

- Trulioo

- Shufti Pro

- Acuant

- Refinitiv (LSEG)

- iProov

- Auth0 (Okta)

- Veriff

- SecureKey Technologies

- IDology

- Experian

- FICO

- Wipro

Frequently Asked Questions

Analyze common user questions about the E-KYC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is E-KYC and how does it differ from traditional KYC?

E-KYC (Electronic Know Your Customer) is the digital, remote process of verifying a customer's identity using technologies like biometrics and AI, eliminating the need for physical paperwork or in-person verification required by traditional KYC. It offers faster onboarding, reduced cost, and enhanced fraud detection capabilities compared to manual processes.

Which technologies are essential for advanced fraud prevention in E-KYC systems?

Essential technologies include AI/ML algorithms for anomaly detection, advanced liveness detection (both passive and active) to prevent spoofing via deepfakes or masks, and sophisticated Optical Character Recognition (OCR) combined with document security feature analysis to detect tampered IDs.

Is E-KYC mandatory, and which industries are the primary drivers of adoption?

E-KYC is not universally mandatory but is widely adopted due to regulatory mandates (AML/CFT) requiring robust identity verification. The Banking, Financial Services, and Insurance (BFSI) sector is the primary driver, closely followed by Telecommunications, and increasingly, Government and Healthcare sectors seeking digital security.

How does the implementation of Decentralized Identity (DID) impact the future of E-KYC?

DID, often leveraging blockchain, shifts control of identity credentials from centralized organizations to the individual user. This approach enhances data privacy, reduces the risk of mass data breaches, and streamlines verification by allowing users to share cryptographically secure proofs of identity rather than raw personal data.

What is the main concern regarding E-KYC and data privacy regulations like GDPR?

The main concern involves ensuring compliance with strict data protection rules regarding the collection, storage, and processing of sensitive biometric and personal data (PII). Solutions must offer strong encryption, transparent consent management, data minimization, and demonstrable compliance with the right to be forgotten and data sovereignty requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager