E-textiles and Smart Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432988 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

E-textiles and Smart Clothing Market Size

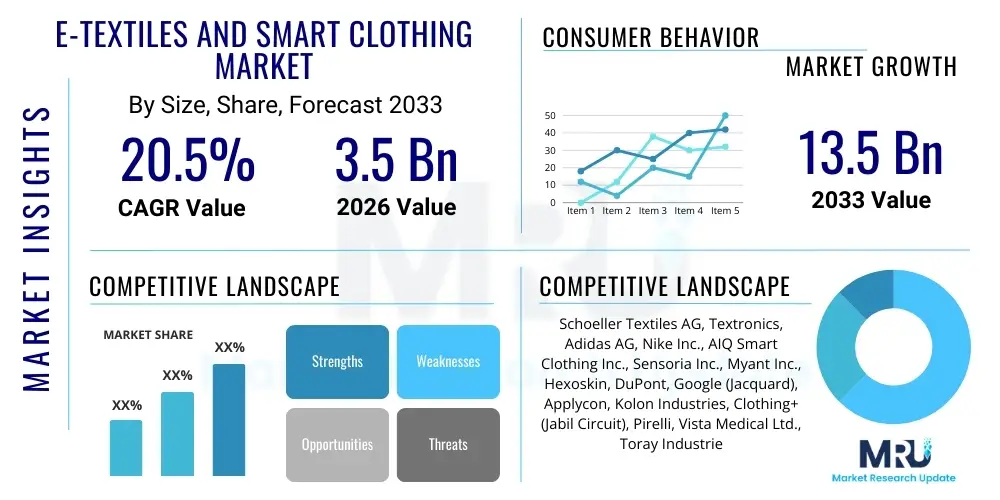

The E-textiles and Smart Clothing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033.

E-textiles and Smart Clothing Market introduction

The E-textiles and Smart Clothing Market encompasses a revolutionary intersection of traditional textile manufacturing and advanced digital technology, producing garments and fabrics capable of sensing, reacting, generating, and transmitting data. These smart fabrics incorporate electronic components—such as sensors, microcontrollers, conductive fibers, and power sources—seamlessly integrated into the textile structure, maintaining the comfort and flexibility of conventional clothing. The primary product goal is to provide continuous, non-invasive physiological and environmental monitoring, moving beyond rigid, specialized wearable devices into everyday attire. Key products range from biometric monitoring shirts and temperature-regulating jackets to interactive athletic wear and safety gear for industrial or military use. The technological evolution has shifted focus from basic conductive yarns to sophisticated systems involving textile transistors and flexible circuits, enabling complex data processing at the edge.

Major applications of smart clothing are predominantly found in the healthcare sector, including remote patient monitoring (RPM), continuous electrocardiogram (ECG) tracking, and sleep analysis, offering crucial data points without requiring clinical settings. In the fitness and sports industry, these textiles measure vital statistics like heart rate variability, muscle activity, and athletic performance metrics with superior accuracy compared to wrist-worn devices. Furthermore, the defense and military sectors utilize smart clothing for tactical applications, integrating global positioning, communication systems, and monitoring soldier readiness and environmental stress levels. The inherent value proposition of E-textiles lies in their ability to offer personalized, real-time insights integrated into a form factor that encourages constant usage, thereby fostering proactive health management and enhancing professional performance.

The core driving factors propelling this market expansion include the increasing global prevalence of chronic diseases requiring continuous monitoring, substantial investments in miniaturization and flexible electronics research, and a growing consumer interest in quantifying wellness and fitness data. Benefits extend beyond data collection to encompass enhanced safety (e.g., heated clothing, integrated alert systems), improved thermal management, and sophisticated human-machine interaction facilitated directly through clothing. However, the market’s realization is heavily reliant on overcoming hurdles related to cost, washability, long-term durability, and establishing standardized data protocols for seamless integration with existing IT infrastructure and mobile platforms. The convergence of 5G networks further promises to enhance the real-time data transmission capabilities crucial for critical applications.

E-textiles and Smart Clothing Market Executive Summary

The E-textiles and Smart Clothing Market is characterized by vigorous growth, driven by technological breakthroughs in material science and increasing demand for remote physiological monitoring solutions across diverse end-use sectors. Key business trends indicate a definitive move toward vertical integration, where traditional apparel companies are partnering extensively with semiconductor and sensor manufacturers to control the quality and scalability of integrated products. Furthermore, strategic alliances are forming around data analytics platforms, as the true value of smart clothing resides not just in the hardware, but in the actionable insights derived from the voluminous data generated. Business models are increasingly focusing on subscription services attached to the data generated, especially in the medical and professional sports markets, shifting revenue streams from a one-time product sale to long-term data service provision. Investment is heavily concentrated in improving the power efficiency of embedded electronics and developing robust encapsulation techniques to enhance product lifespan and user acceptance, particularly addressing the crucial issue of laundering durability.

Regional trends highlight North America as the current market leader, primarily due to high healthcare expenditure, established R&D infrastructure, and early adoption of innovative medical technologies, specifically in chronic disease management and rehabilitation. Europe follows closely, driven by strong regulatory support for worker safety standards (e.g., industrial protective wear) and significant military investment in next-generation soldier systems. Asia Pacific (APAC) is projected to exhibit the fastest growth, underpinned by its dominance in textile manufacturing and electronics production, coupled with rapidly increasing consumer adoption of fitness and lifestyle wearables, particularly in emerging economies where health consciousness is rising alongside disposable incomes. Government initiatives in countries like China and South Korea are actively supporting smart textiles research, positioning APAC as the manufacturing and future high-volume consumer hub.

Segment trends underscore the significant dominance of the healthcare and medical segment, which commands the highest market share due to the high average selling price and critical nature of applications such as continuous glucose monitoring and cardiac diagnostics. The components segment is seeing rapid innovation, particularly in the development of sophisticated biometric sensors and flexible energy harvesting elements that reduce reliance on conventional batteries. Within product segmentation, smart shirts and upper wear remain the most prominent category due to their optimal placement for capturing vital statistics accurately (e.g., chest area for heart and lung functions). Furthermore, specialized niche segments, such as smart insoles for gait analysis and pressure ulcer prevention in elderly care, are demonstrating promising growth trajectories, reflecting the market’s capacity to address highly specific functional requirements across various patient populations.

AI Impact Analysis on E-textiles and Smart Clothing Market

Analysis of common user questions surrounding AI integration in E-textiles reveals primary concerns centered on predictive accuracy, data security, personalization, and operational independence (edge computing). Users frequently inquire about the reliability of AI algorithms in detecting subtle physiological anomalies before symptoms manifest, particularly in long-term health monitoring applications. A significant concern revolves around the proprietary nature and security of the highly sensitive personal biometric data collected, asking whether AI processing is secure and compliant with global health regulations like HIPAA or GDPR. Furthermore, users often seek assurance that AI embedded within the clothing (edge computing) can provide timely, personalized feedback and therapeutic adjustments without constant reliance on cloud connectivity, ensuring functionality during activities like deep-sea diving or remote military operations.

The key themes emerging from this analysis confirm that expectations are high for AI to transform smart clothing from simple data loggers into proactive diagnostic and intervention platforms. Users anticipate that sophisticated machine learning models will enhance sensor calibration, filter out motion artifacts to provide cleaner data, and establish personalized baselines for health metrics, making deviations immediately actionable. This shift necessitates robust, lightweight AI models optimized for resource-constrained textile-embedded processors. The core expectation is that AI will unlock the true potential of E-textiles by enabling highly customized health interventions, predictive maintenance for the garments themselves, and intuitive user interfaces that translate complex physiological data into clear, easy-to-understand feedback. This level of sophistication is crucial for mass market adoption and clinical credibility.

AI’s influence is therefore anticipated to fundamentally restructure product design and data monetization strategies within the market. By providing superior data processing and pattern recognition capabilities, AI enables higher value services beyond mere hardware sales. This capability directly supports the shift towards diagnostic rather than descriptive usage. Furthermore, AI algorithms are vital for managing the complex interplay of hundreds of data points collected simultaneously (e.g., combining temperature, heart rate, respiration, and movement) to paint a comprehensive and reliable picture of the user's status. Ensuring transparency and explainability in these AI systems remains a paramount developmental objective to build trust among both consumers and medical professionals.

- AI algorithms enhance data accuracy by filtering noise, motion artifacts, and sensor drifts inherent in flexible systems.

- Predictive modeling enables early detection of health issues (e.g., cardiac events, impending fatigue) before clinical symptoms appear.

- Machine learning optimizes power consumption protocols, extending the battery life of smart garments through intelligent duty cycling.

- Edge AI processing facilitates real-time personalized feedback and intervention without requiring continuous cloud connection.

- AI supports personalized therapeutic pathways and training regimens based on unique physiological responses.

- Computer vision and machine learning are utilized in the manufacturing phase for quality control and defect detection in textile integration.

- Intelligent data governance systems ensure compliance with privacy regulations (GDPR, HIPAA) for sensitive biometric information.

DRO & Impact Forces Of E-textiles and Smart Clothing Market

The E-textiles and Smart Clothing market is shaped by a powerful matrix of drivers, restraints, and opportunities that dictate its growth trajectory and competitive landscape. The primary driver is the accelerating consumer and clinical demand for continuous, non-invasive health monitoring solutions, moving data collection out of the hospital and into daily life. This is coupled with relentless advancements in material science, particularly in developing highly flexible, washable, and durable conductive polymers, yarns, and miniature sensors that can withstand the rigors of conventional garment use. Opportunities abound in specialized high-value sectors such as military and defense applications, which prioritize reliable, ruggedized performance tracking and physiological status monitoring under extreme conditions. Moreover, the integration of these devices within the burgeoning Internet of Things (IoT) ecosystem provides a significant opportunity for expanding functionality and data synergy with other connected devices, broadening the appeal beyond niche markets.

Despite the strong growth impetus, several critical restraints temper the market's explosive potential. The chief constraint remains the high initial cost associated with specialized materials, complex manufacturing processes, and rigorous quality assurance needed to ensure longevity and functionality, particularly after multiple washes. Current E-textiles still face challenges related to power supply and charging methods; users require solutions that are seamless and minimize the need for frequent manual intervention. Furthermore, the market lacks universally accepted standardization protocols for sensor data output, communication interfaces, and performance metrics, creating interoperability issues and slowing down regulatory approvals for medical applications. These technical hurdles necessitate significant capital investment in R&D before achieving widespread consumer affordability and standardization.

Impact forces currently driving market dynamics are predominantly technological and societal. The rising health consciousness among millennials and Gen Z, coupled with an aging global population requiring constant geriatric care, creates a foundational societal pull for monitoring technologies. Technologically, the rapid scaling of flexible PCB manufacturing and advancements in wireless power transfer are critical forces reducing production barriers. Economically, major strategic acquisitions and partnerships between established apparel brands (e.g., Adidas, Nike) and specialized tech firms (e.g., sensor developers) signify market validation and an accelerated path to commercialization. Regulatory impact is also growing, with bodies like the FDA increasing scrutiny on smart garments used for medical diagnostics, which, while initially slowing market entry, ultimately enforces quality and builds necessary clinical credibility for long-term growth.

Segmentation Analysis

The E-textiles and Smart Clothing market is systematically segmented based on Component, Product Type, Function, and End-User, reflecting the diverse applications and technological requirements inherent in this field. This multifaceted segmentation helps analysts and stakeholders understand where innovation is most impactful and where demand is concentrated. Segmentation by component is crucial, distinguishing between the sophisticated hardware elements like sensors and actuators and the foundational textile elements such as conductive fibers and smart yarns. This view highlights the supply chain complexity, separating semiconductor manufacturing from traditional textile production. The overall market landscape is shaped by the continuous balancing act between integrating robust electronic functionality and maintaining the aesthetic and comfort qualities of traditional garments, which is reflected in the specialized product types developed for specific functions.

Product Type segmentation distinguishes between garments like smart shirts (upper wear), trousers (lower wear), smart socks/footwear, and accessories (gloves, patches). Upper wear currently holds the largest share due to its proximity to the chest, which allows for accurate heart and respiration monitoring, crucial for both medical and fitness applications. Function-based segmentation separates garments optimized for monitoring (e.g., physiological data collection) from those focused on protection (e.g., temperature regulation, hazard detection) and aesthetic or interactive purposes. The End-User segmentation provides insight into market value, with Medical & Healthcare representing the highest-value segment due to the stringent requirements and high pricing of diagnostic-grade devices, followed closely by the fast-growing Sports & Fitness sector driven by high consumer volumes.

Understanding these segments allows market players to tailor their R&D efforts. For instance, companies focusing on the Military & Defense sector prioritize ruggedized durability and secure communication (Function: Protection/Tracking), often incorporating high-cost materials. Conversely, firms targeting the Sports & Fitness segment focus on comfort, integration with mobile apps, and battery longevity (Function: Monitoring). The fastest growing sub-segment is expected to be Function-based sensing technologies, particularly those monitoring biophysical data like muscle activity (EMG) and hydration levels, which are expanding the scope beyond conventional heart rate tracking into highly detailed human performance analytics.

- Component:

- Sensors (Biometric, Environmental, Motion)

- Actuators and Control Units

- Conductive Materials (Fibers, Yarns, Ink)

- Battery and Energy Harvesting Systems

- Communication Modules (Bluetooth, NFC, 5G)

- Product Type:

- Upper Wear (Shirts, Vests, Jackets)

- Lower Wear (Pants, Shorts)

- Foot Wear (Smart Shoes, Insoles, Socks)

- Accessories (Gloves, Headbands, Patches)

- Function:

- Monitoring and Sensing (Heart Rate, Respiration, Temperature, GPS)

- Protection and Safety (Hazard Detection, Thermal Regulation)

- Aesthetics and Fashion (Interactive Lighting)

- Therapeutic/Rehabilitation (Muscle Stimulation, Drug Delivery)

- End-User:

- Healthcare and Medical

- Sports and Fitness

- Military and Defense

- Industrial and Commercial

- Fashion and Entertainment

Value Chain Analysis For E-textiles and Smart Clothing Market

The E-textiles and Smart Clothing value chain is intricate, bridging distinct sectors—textiles, electronics, and software development—which necessitates high levels of collaboration and integration. The upstream segment involves the sourcing and preparation of specialized raw materials. This includes the development and manufacturing of highly conductive and flexible polymers, yarns, and specialized inks for printing circuits directly onto fabrics. It also involves the production of miniature, energy-efficient microcontrollers and sensors by the semiconductor industry. A significant upstream challenge is ensuring the electronic components maintain performance while being pliable enough for textile integration. Innovation at this stage focuses heavily on developing wash-resistant encapsulation and seamless integration techniques, moving beyond simple wiring to complex weaving patterns that incorporate the functionality into the fabric structure itself.

The midstream segment involves the core manufacturing processes: textile creation (weaving/knitting of smart yarns), electronic component integration (embedding sensors and control units), and the assembly of the final garment. This stage requires specialized machinery and highly skilled labor capable of precision engineering within a soft goods environment. Quality control is paramount here, focusing on testing connectivity, resilience to washing, and accuracy of sensor readings. Downstream activities involve distribution, sales, and post-sales service, including data management and analysis services. The distribution channel is bifurcated: direct distribution is common for high-value institutional customers (hospitals, military), ensuring strict quality control and technical support. Indirect channels, involving traditional retail outlets, specialized sports stores, and increasingly, e-commerce platforms, dominate the high-volume consumer market.

The complexity of the downstream distribution is compounded by the need to manage two product streams: the physical garment and the digital data service. Many E-textile solutions rely on associated smartphone applications and cloud services for data visualization and analysis, requiring ongoing software maintenance and updates. Direct distribution models allow companies to retain control over the customer experience and monetize data services more effectively. Indirect distribution channels rely on comprehensive retailer training to explain the complex technical features of smart garments to consumers. Effective management of this integrated value chain, from specialized raw material sourcing (upstream) through complex manufacturing (midstream) to multifaceted sales and service platforms (downstream), is critical for market success and achieving economies of scale.

E-textiles and Smart Clothing Market Potential Customers

The potential customer base for E-textiles and Smart Clothing is broad yet distinct, categorized primarily by their motivation for adopting the technology—ranging from life-critical monitoring to performance enhancement and occupational safety. The most valuable segment comprises professional healthcare organizations, including hospitals, clinics, and remote patient monitoring service providers. These buyers utilize smart clothing for continuous, clinical-grade data collection on patients with chronic conditions (e.g., congestive heart failure, diabetes), reducing readmission rates and allowing for earlier intervention. Their purchasing decisions are driven by regulatory compliance, data accuracy, integration capability with Electronic Health Records (EHR), and evidence of improved patient outcomes. This segment prioritizes reliable, long-lasting, and highly certified products.

The second major customer group is the professional and enthusiast sports and fitness community. This includes elite athletic teams, individual high-performance athletes, and general fitness enthusiasts. These customers seek competitive advantages through precise biomechanical data (gait analysis, muscle strain) and detailed physiological feedback to optimize training intensity and recovery schedules. Their purchasing drivers are related to real-time performance metrics, comfort during strenuous activity, battery life, and seamless connectivity with popular fitness tracking apps. They are often early adopters of new technology and are less price-sensitive than the mass consumer market if performance gains are demonstrable.

A rapidly expanding segment involves governmental and institutional buyers, specifically the Military, Defense, and first responder organizations (firefighters, police). These customers procure smart clothing for critical operational purposes, including tracking soldier readiness, monitoring exposure to hazardous environments, managing thermal stress, and providing integrated communication and navigation capabilities. Their requirements emphasize ruggedness, communication security, high reliability in harsh environments, and the ability to integrate with existing tactical equipment. Furthermore, industrial sector buyers, particularly in manufacturing, construction, and mining, represent a key demographic focused on worker safety, fatigue monitoring, and preventing workplace accidents through proactive biometric alerts, driven primarily by occupational safety regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schoeller Textiles AG, Textronics, Adidas AG, Nike Inc., AIQ Smart Clothing Inc., Sensoria Inc., Myant Inc., Hexoskin, DuPont, Google (Jacquard), Applycon, Kolon Industries, Clothing+ (Jabil Circuit), Pirelli, Vista Medical Ltd., Toray Industries, Lumo BodyTech, Athos, CuteCircuit, Wearable X |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

E-textiles and Smart Clothing Market Key Technology Landscape

The technology landscape for E-textiles and Smart Clothing is highly dynamic, predicated on innovations that solve the fundamental conflict between electronic rigidity and textile flexibility. Central to this landscape are advancements in conductive fiber technology, including the use of silver-coated nylon, carbon nanotubes, and specialized polymers that allow data and power transmission directly through the woven structure of the fabric without compromising drape or comfort. Furthermore, flexible printed electronics (FPE) represent a cornerstone technology, enabling sensors and circuits to be manufactured via printing processes onto substrates or directly onto fabrics, significantly reducing weight and volume compared to traditional rigid PCBs. These printed components are crucial for surface monitoring applications, such as large-area temperature sensing or electrophysiological signal capture (ECG, EMG).

Another crucial area is sensor integration and miniaturization. The market relies heavily on micro-electro-mechanical systems (MEMS) sensors for collecting high-fidelity motion and environmental data, alongside novel biometric sensors that are highly sensitive yet robust enough to be embedded. Significant technological effort is dedicated to encapsulation and packaging technologies, often involving specialized resins or layered polymer coatings, which protect the electronic components from moisture, abrasion, and chemicals, ensuring the garment’s washability—a key determinant of consumer acceptance. Advanced wireless communication protocols, particularly low-power Bluetooth and emerging 5G connectivity, are integrated into micro control units (MCUs) embedded in small, removable 'pods' or directly integrated and protected within the clothing structure, facilitating real-time data transmission to edge devices or cloud platforms.

Furthermore, energy management remains a critical technological frontier. While conventional coin cell batteries and rechargeable packs are standard, there is increasing investment in energy harvesting technologies, such as textile-based solar cells, piezoelectric materials that generate electricity from movement (kinetics), and thermoelectric generators that convert body heat differentials into power. These technologies aim to move towards self-powered or passively charged garments, thereby improving user experience and eliminating the need for frequent charging. Finally, the role of textile computing—where the fabric itself acts as a computational interface, utilizing integrated textile transistors—is a long-term developmental goal that promises the highest level of seamlessness and functionality, effectively making the entire garment a distributed sensor and processing unit.

Regional Highlights

North America maintains market leadership, driven primarily by the United States’ significant investment in medical device technology and a sophisticated healthcare infrastructure that actively adopts remote patient monitoring (RPM) technologies. The region benefits from high consumer disposable income, enabling premium pricing for high-tech sports and fitness apparel, and robust government funding for military and defense-related smart clothing research. Key drivers include regulatory bodies facilitating fast-track approvals for clinically validated smart garments and a high concentration of leading technology developers and research institutions focused on flexible electronics.

Europe represents a mature and highly regulated market, with strong emphasis on industrial and occupational safety applications. Countries like Germany and the UK lead in adopting protective smart clothing for industrial workers, driven by stringent European Union safety directives. Furthermore, Europe possesses a strong traditional textile industry base (e.g., Italy, France) which facilitates the integration of new technologies into high-end fashion and functional apparel. Growth is stable, supported by public sector procurement for health and military uses, but innovation speed can sometimes be moderated by rigorous testing and certification requirements.

The Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This acceleration is fueled by the region's massive manufacturing capacity, particularly in China, South Korea, and Taiwan, which are essential for producing both the electronic components and the textiles at scale. Rising health awareness, coupled with rapidly improving standards of living and increasing prevalence of chronic diseases across countries like India and China, drives consumer adoption of smart fitness and medical wearables. Government support through initiatives aimed at fostering domestic high-tech industries further positions APAC as the future volume leader in the global smart clothing market.

Latin America (LATAM) and the Middle East and Africa (MEA) currently represent smaller but highly promising emerging markets. Growth in LATAM is driven by increasing adoption in sports and professional athletics, while market penetration remains low in the medical segment due to varying healthcare infrastructure quality. In MEA, market growth is primarily concentrated in technologically advanced nations like the UAE and Saudi Arabia, largely driven by large-scale government investments in defense modernization and high-end consumer technology adoption, particularly in the affluent urban centers.

- North America: Dominance in healthcare technology adoption and high R&D spending; strong consumer market for fitness tracking; leading region for investment in flexible circuit manufacturing.

- Europe: Focus on regulated industrial safety standards and military textile innovation; strong existing infrastructure in traditional textile manufacturing; growth driven by government health programs.

- Asia Pacific (APAC): Fastest growing market due to extensive manufacturing capabilities; rapid consumer adoption of fitness wearables; significant investment in component miniaturization and textile research in countries like South Korea and China.

- Latin America (LATAM): Emerging market concentrated in sports technology and niche military applications; growth constrained by economic instability and variable regulatory frameworks.

- Middle East and Africa (MEA): Growth centered in defense procurement and luxury consumer segments in the Gulf Cooperation Council (GCC) countries; market maturity highly fragmented geographically.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the E-textiles and Smart Clothing Market.- Schoeller Textiles AG

- Textronics (DuPont)

- Adidas AG

- Nike Inc.

- AIQ Smart Clothing Inc.

- Sensoria Inc.

- Myant Inc.

- Hexoskin

- Google (Jacquard)

- Applycon

- Kolon Industries

- Clothing+ (Jabil Circuit)

- Pirelli

- Vista Medical Ltd.

- Toray Industries

- Lumo BodyTech

- Athos

- CuteCircuit

- Wearable X

- OMsignal

Frequently Asked Questions

Analyze common user questions about the E-textiles and Smart Clothing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors limiting the widespread adoption of smart clothing?

The main limitations include the high manufacturing cost of integrated electronic components, inadequate long-term durability and washability compared to conventional textiles, and the current absence of universal standardization protocols for data security and interoperability across different brands and devices.

How is AI specifically enhancing the functionality of E-textiles?

AI improves functionality by performing real-time data filtering to eliminate sensor noise, personalizing health baselines for precise anomaly detection, optimizing power consumption, and enabling predictive analytics for early diagnosis and personalized intervention feedback.

Which industry segment currently holds the largest share in the E-textiles and Smart Clothing Market?

The Healthcare and Medical segment holds the largest market share. This is driven by the high demand for continuous, clinical-grade patient monitoring (RPM) and the associated high value and rigorous certification requirements of medical-grade smart garments.

Are smart clothes safe and how are issues like data privacy addressed?

Smart clothing is generally safe as it uses low-voltage, non-invasive technology. Data privacy is a significant concern, addressed through end-to-end encryption, secure communication protocols, and adherence to international regulations such as GDPR and HIPAA when dealing with sensitive biometric and physiological information.

What are the major technological breakthroughs expected in the next five years for smart clothing?

The next five years are expected to see significant advances in self-powered garments utilizing kinetic and solar energy harvesting, increased utilization of flexible textile transistors (moving away from rigid components), and the development of truly therapeutic E-textiles capable of localized drug delivery or advanced rehabilitation stimulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager