Earned Value Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439141 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Earned Value Management Software Market Size

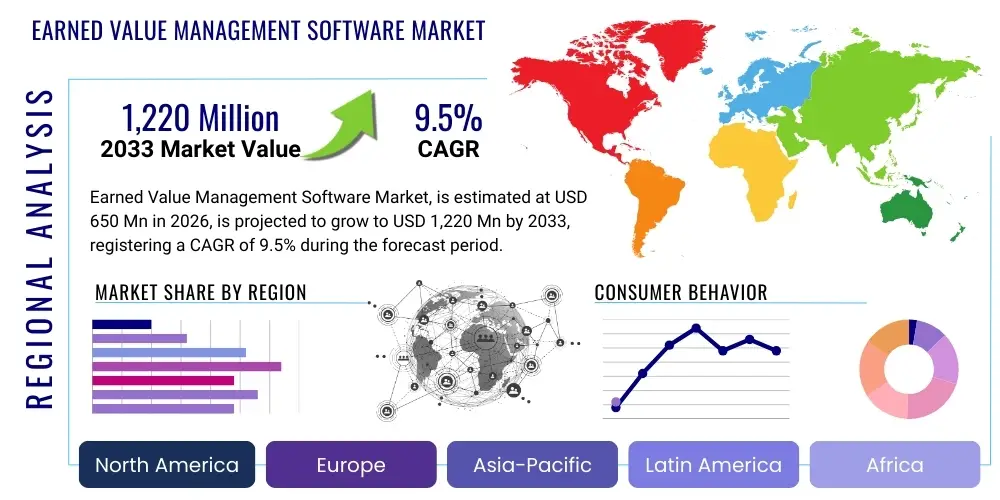

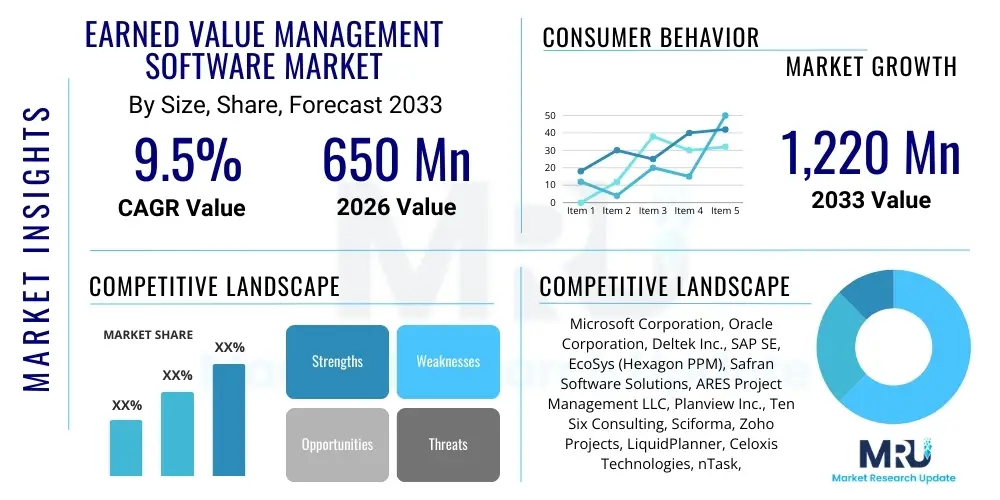

The Earned Value Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,220 Million by the end of the forecast period in 2033.

Earned Value Management Software Market introduction

Earned Value Management (EVM) Software represents specialized tools designed to integrate project scope, schedule, and cost data to measure project performance objectively and quantitatively. This methodology provides stakeholders with a precise, single-system view of project health, answering critical questions regarding cost overrun probabilities and schedule delays early in the project lifecycle. The primary product offering involves robust platforms that facilitate the establishment of a performance measurement baseline (PMB), track actual costs incurred (AC), and measure the value of work performed (EV), thereby calculating key performance indicators (KPIs) such as Schedule Variance (SV), Cost Variance (CV), and various performance indices (SPI and CPI).

Major applications of EVM software span highly complex and mission-critical industries, predominantly including aerospace and defense, engineering and construction (EPC), large-scale IT infrastructure projects, and government contracts where regulatory compliance, such as mandates by the Department of Defense (DoD) or similar global agencies, is stringent. These applications demand high levels of data integrity and traceability, making integrated software solutions indispensable for managing large capital expenditure projects. The software typically integrates modules for resource management, scheduling (Gantt charts, critical path method), risk analysis, and financial reporting, offering comprehensive project control capabilities.

The market growth is fundamentally driven by the escalating complexity and scale of modern capital projects globally, coupled with increased regulatory scrutiny demanding greater accountability and transparency in public and private sector investments. Key benefits include improved forecasting accuracy, enhanced risk mitigation, better resource allocation efficiency, and superior communication among project teams and executive stakeholders. Furthermore, the global push towards digital transformation in project management offices (PMOs) is accelerating the adoption of cloud-based EVM solutions, facilitating real-time data access and collaborative functionalities, which are crucial for distributed project teams operating across various geographical locations.

Earned Value Management Software Market Executive Summary

The Earned Value Management Software market is experiencing significant tailwinds driven by the necessity for advanced project oversight in increasingly complex sectors. Business trends indicate a strong shift towards Software-as-a-Service (SaaS) deployment models, offering scalability, lower upfront costs, and quicker implementation cycles, particularly appealing to medium-sized enterprises moving beyond rudimentary spreadsheet-based project tracking. Furthermore, the integration capabilities of EVM platforms with existing Enterprise Resource Planning (ERP) and Project Portfolio Management (PPM) systems are becoming central competitive differentiators, as enterprises seek unified data ecosystems for end-to-end project financial control and performance governance. Customization and configuration flexibility, allowing tailoring to specific industry standards (e.g., ANSI/EIA-748 in defense), are also fueling market penetration across highly regulated industries.

Regionally, North America maintains the dominant market share, primarily due to the stringent EVM compliance requirements mandated by the U.S. government for large federal contracts, especially within the defense, energy, and infrastructure sectors. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by massive infrastructure development projects, rapid industrialization in countries like China and India, and the subsequent need for sophisticated project management maturity. Europe follows closely, driven by large-scale cross-border infrastructure initiatives and the increasing adoption of best practice project management methodologies across the continent’s manufacturing and construction industries.

Segmentation trends highlight the increasing demand for cloud-based solutions across all enterprise sizes, signaling a gradual phasing out of traditional on-premise deployments, except in highly sensitive environments requiring maximum data control. Enterprise Size segmentation shows that Large Enterprises remain the primary revenue generators due to their involvement in mega-projects, while Small and Medium-sized Enterprises (SMEs) are rapidly adopting scalable cloud offerings. The vertical segmentation confirms that Aerospace & Defense and Construction & Engineering continue to be the foundational application sectors, although IT and Telecommunications are exhibiting accelerated adoption rates as they prioritize agile and hybrid project governance models requiring quantitative performance tracking.

AI Impact Analysis on Earned Value Management Software Market

Users frequently inquire about AI's potential to automate variance analysis, improve baseline forecasting, and integrate predictive risk modeling within EVM frameworks. Common questions center on whether AI can entirely replace traditional variance interpretation by project controllers, how machine learning algorithms handle data anomalies in cost and schedule performance indices, and the accuracy of AI-driven 'Estimate at Completion' (EAC) projections compared to human expert judgment. The primary themes circulating among users and industry stakeholders revolve around leveraging AI to enhance the proactive nature of EVM, moving it beyond historical reporting into a truly predictive control mechanism. There is high expectation that AI will standardize and speed up the labor-intensive processes of root cause analysis for variances, transforming raw EVM metrics into actionable intelligence, thereby democratizing sophisticated project control techniques.

- AI enhances forecasting accuracy by analyzing thousands of historical project data points, leading to more reliable Estimates at Completion (EAC).

- Machine learning algorithms automate variance analysis, identifying patterns and root causes of cost and schedule deviations faster than traditional methods.

- Predictive analytics enables early warning systems, flagging projects at high risk of breaching performance measurement baselines (PMB) before critical thresholds are met.

- Natural Language Processing (NLP) integration improves data quality by automatically extracting performance insights from project narratives and status reports.

- AI facilitates intelligent baseline adjustments and scenario planning by simulating the financial and schedule impacts of proposed changes instantly.

DRO & Impact Forces Of Earned Value Management Software Market

The dynamics of the Earned Value Management Software market are governed by a robust framework of drivers compelling adoption, counterbalanced by significant restraints that challenge widespread deployment, and abundant opportunities stemming from technological evolution. Key market drivers include regulatory mandates, especially in government-contracted sectors (e.g., DoD, NASA, infrastructure agencies), demanding rigorous adherence to EVM standards for cost control accountability. Furthermore, the increasing capital intensity and inherent risks associated with modern mega-projects necessitate sophisticated, integrated tools for objective performance measurement, pushing companies to upgrade from basic scheduling tools to comprehensive EVM platforms. Restraints predominantly involve the complexity of initial implementation, requiring substantial organizational change management, extensive training, and high upfront licensing and integration costs, particularly for large, legacy on-premise systems. The shortage of skilled EVM professionals capable of interpreting and operationalizing the software output also acts as a significant barrier to entry for many potential adopters.

Opportunities lie primarily in the rapid migration towards cloud and SaaS models, which significantly reduce the barrier to entry for Small and Medium-sized Enterprises (SMEs) and offer enhanced scalability and accessibility. The integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) presents substantial opportunities for vendors to offer differentiated predictive and prescriptive analytics functionalities, moving EVM beyond retrospective analysis. Impact forces highlight the critical role of data governance and security standards; as EVM software handles sensitive financial and performance data, robust security protocols are paramount. Moreover, the accelerating convergence of EVM with Agile project management methodologies is forcing software providers to develop hybrid solutions that can seamlessly track both planned value (traditional EVM) and business value delivered (Agile metrics), broadening the addressable market.

Impact forces also encompass the competitive landscape, where established ERP giants and niche project management specialists vie for market share, often through strategic partnerships focused on deep vertical integration within specific industries like defense contracting or heavy construction. The economic cycle exerts a significant force; during periods of economic expansion, capital expenditure on large projects increases, driving demand for EVM tools. Conversely, during downturns, efficiency and cost-saving mandates intensify the need for performance monitoring, maintaining baseline demand but shifting focus towards optimization features rather than new implementations. Overall, the foundational need for accurate project governance amidst increasing complexity ensures sustained long-term market growth.

Segmentation Analysis

The Earned Value Management Software market is comprehensively segmented based on deployment model, enterprise size, and end-user industry, reflecting the diverse requirements of organizations ranging from large governmental agencies to mid-sized technology firms. The deployment model split between On-Premise and Cloud (SaaS) is the most dynamic, with Cloud solutions rapidly capturing market share due to their flexibility, reduced infrastructure overhead, and capability for instantaneous updates and collaborative access. Enterprise size segmentation illustrates that while large corporations remain the key consumers, driven by the size and mandates of their projects, the SME segment offers the highest growth potential for cloud-based, subscription services. End-user segmentation reveals a concentrated demand across highly regulated and capital-intensive sectors, where accurate cost and schedule control is mission-critical, defining the core vertical markets for specialized feature sets and compliance modules.

- Deployment Model:

- On-Premise

- Cloud/SaaS

- Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- End-User Industry:

- Aerospace and Defense

- Construction and Engineering (EPC)

- Government and Public Sector

- IT and Telecommunications

- Energy and Utilities

- Manufacturing

Value Chain Analysis For Earned Value Management Software Market

The value chain for Earned Value Management Software is structured into upstream activities (software development and intellectual property creation), core processing (platform integration and delivery), and downstream activities (implementation, support, and consulting). Upstream activities involve rigorous research and development focused on adhering to international EVM standards (e.g., ANSI/EIA-748) and integrating new technologies like predictive analytics and blockchain for data integrity. Software vendors invest heavily in developing robust APIs to ensure seamless interoperability with core enterprise systems like ERP, human capital management (HCM), and specialized scheduling tools. This stage defines the technical depth and compliance readiness of the final product offering.

The core processing and distribution phase primarily involves licensing, platform hosting (especially for SaaS providers via major cloud infrastructure platforms), and channel management. Direct distribution channels involve vendors selling licenses or subscriptions directly to large enterprise clients, often including bespoke training and support packages. Indirect channels utilize system integrators, value-added resellers (VARs), and specialized project management consulting firms, which play a crucial role in tailoring the generic software solution to the client's unique organizational structure and regulatory environment. These indirect partners often act as critical intermediaries, particularly in complex international markets where localized support is essential.

Downstream activities center on maximizing customer utilization and success, encompassing implementation services (data migration, baseline setup), customized training, and ongoing technical support. Project Management Offices (PMOs) within client organizations are the ultimate recipients of this value, utilizing the software outputs for strategic decision-making and reporting compliance to external stakeholders or regulatory bodies. The long-term profitability of the vendor is heavily dependent on renewal rates and the ability to upsell complementary modules (e.g., risk management, portfolio optimization), underscoring the importance of quality post-sale support and continuous software updates that reflect evolving project management best practices.

Earned Value Management Software Market Potential Customers

Potential customers for Earned Value Management Software are predominantly organizations engaged in complex, long-duration projects characterized by significant financial investment, stringent compliance requirements, and high stakeholder visibility. The primary buyers are governmental entities, particularly defense departments and infrastructure agencies (e.g., transportation, water, energy), which require mandatory EVM reporting to ensure accountability for taxpayer funds and compliance with federal contracting regulations. Secondly, large engineering, procurement, and construction (EPC) firms involved in mega-projects like power plants, oil and gas facilities, and large-scale residential developments are major consumers, using EVM to manage subcontractor performance, control cost escalation, and adhere to tight project deadlines.

A burgeoning customer base includes large enterprises within the IT and telecommunications sector that utilize EVM principles within hybrid or scaled-agile frameworks (e.g., SAFe). These companies use the software to quantify the value delivered by complex software development initiatives, blending traditional cost control with incremental delivery metrics. Furthermore, any organization that manages a significant portfolio of projects (PPM) requiring consistent, objective performance metrics—such as major pharmaceutical companies managing drug development pipelines or manufacturing firms overseeing facility upgrades—constitutes a viable customer segment. The key characteristic tying these diverse potential customers together is the critical need to maintain predictable outcomes and fiscal discipline within their project environments, moving beyond subjective reporting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,220 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft Corporation, Oracle Corporation, Deltek Inc., SAP SE, EcoSys (Hexagon PPM), Safran Software Solutions, ARES Project Management LLC, Planview Inc., Ten Six Consulting, Sciforma, Zoho Projects, LiquidPlanner, Celoxis Technologies, nTask, Mega International, BQE Software. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Earned Value Management Software Market Key Technology Landscape

The technological landscape of the Earned Value Management Software market is rapidly evolving, moving away from monolithic desktop applications towards highly integrated, modular, and cloud-native architectures. A foundational technological requirement remains robust integration capabilities, utilizing APIs and microservices, allowing the EVM software to seamlessly exchange data with core scheduling tools (like Primavera P6 or Microsoft Project), financial systems (ERP platforms), and resource management databases. This integration capacity is paramount, as the accuracy of EVM metrics relies heavily on the timely and precise flow of Actual Cost (AC) data from accounting systems and Planned Value (PV) and Earned Value (EV) data from scheduling systems. Furthermore, modern solutions must offer robust database support and complex calculation engines capable of processing large volumes of transactional data necessary for variance reporting across massive projects, often involving thousands of work packages.

The primary technological differentiator currently shaping the market is the embrace of cloud computing and Software-as-a-Service (SaaS) delivery models. Cloud infrastructure enables real-time collaboration across geographically dispersed project teams, enhances data security through centralized hosting, and facilitates compliance with disaster recovery protocols. Alongside cloud adoption, the utilization of advanced analytics is becoming mandatory. This includes leveraging business intelligence (BI) dashboards for intuitive data visualization and, more crucially, integrating Artificial Intelligence (AI) and Machine Learning (ML) modules. These modules are specifically engineered for predictive forecasting, automatic identification of cost and schedule performance deviations, and prescriptive recommendations for corrective actions, significantly enhancing the intelligence derived from traditional EVM outputs.

Another increasingly relevant technological feature involves support for Agile and hybrid methodologies. EVM software must now accommodate the calculation of Earned Value based on story points or delivered features (often termed 'Earned Value for Agile'), requiring flexible baseline management and metric configurations that align with iterative development cycles. Moreover, the security framework is critical; given the sensitive nature of financial and project performance data, platforms must adhere to industry-leading encryption standards (e.g., AES-256) and provide granular access controls, multi-factor authentication, and robust audit trails to meet strict regulatory and contractual security requirements, particularly in defense and government sectors where cyber resilience is non-negotiable.

Regional Highlights

The regional market for Earned Value Management Software displays distinct maturity and growth patterns influenced by regulatory environments and capital investment cycles.

- North America: This region dominates the global market, largely driven by the mandatory EVM implementation requirements (ANSI/EIA-748 compliance) imposed by the U.S. Department of Defense, Department of Energy, and other federal agencies for large-scale procurement and research projects. The presence of major vendors and a mature professional project management culture contribute to high adoption rates across aerospace, defense, and heavy construction sectors. Demand is shifting rapidly towards highly secure, specialized SaaS platforms tailored for government compliance.

- Europe: Europe represents a mature market with significant adoption in the infrastructure, energy, and manufacturing sectors. Growth is steady, fueled by cross-border infrastructure projects (e.g., railways, energy grids) requiring standardized performance measurement. While regulatory requirements are less centralized than in the US, major European nations and large multinational firms often voluntarily adopt EVM best practices for internal governance and risk mitigation. The focus is increasingly on integrating EVM with sustainability metrics and complex portfolio planning tools.

- Asia Pacific (APAC): APAC is the fastest-growing region, characterized by massive government investment in infrastructure, urbanization, and industrial expansion in countries such as China, India, and Southeast Asia. The rapid escalation of project complexity and scope mandates the use of advanced project control tools. Although EVM maturity is generally lower compared to North America, the lack of deeply embedded legacy systems facilitates quicker adoption of modern, cloud-based EVM solutions, bypassing traditional on-premise deployments.

- Latin America (LATAM): Market adoption is moderate, concentrated primarily within the mining, oil and gas, and infrastructure sectors. Economic instability and fluctuating project cycles pose challenges, but large international EPC firms operating in the region drive demand for compliant EVM software to manage risks associated with volatile local currencies and complex labor environments.

- Middle East and Africa (MEA): This region shows significant potential, driven by major "Vision" projects in the Gulf Cooperation Council (GCC) countries (e.g., NEOM, Dubai Expo projects) requiring immense capital deployment and strict performance oversight. The MEA market is heavily influenced by international contractors and consultants who bring EVM expertise and standardized software platforms into the region, particularly within the energy and mega-construction verticals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Earned Value Management Software Market.- Microsoft Corporation

- Oracle Corporation

- Deltek Inc.

- SAP SE

- EcoSys (Hexagon PPM)

- Safran Software Solutions

- ARES Project Management LLC

- Planview Inc.

- Ten Six Consulting

- Sciforma

- Zoho Projects

- LiquidPlanner

- Celoxis Technologies

- nTask

- Mega International

- BQE Software

- Wrike (A Citrix Company)

- Project Control Tools (PCT)

- PMWeb

- Milestone Consulting Group

Frequently Asked Questions

Analyze common user questions about the Earned Value Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Earned Value Management Software?

The primary function of EVM software is to objectively measure project performance by integrating scope, schedule, and cost data to calculate variances, forecast future performance (Estimate at Completion), and maintain compliance with established project baselines.

Why is the North American region dominant in the EVM Software Market?

North America's dominance is largely due to stringent regulatory mandates, particularly those imposed by U.S. federal agencies like the Department of Defense (DoD), which require mandatory EVM reporting (e.g., ANSI/EIA-748 compliance) for major government contracts, driving high institutional adoption.

How does the cloud deployment model benefit EVM software users?

Cloud deployment (SaaS) benefits users by offering lower initial costs, enhanced scalability, automatic software updates, and facilitating real-time data access and collaboration for geographically dispersed project teams, significantly reducing infrastructure burden.

Can EVM software be used for Agile project management methodologies?

Yes, modern EVM software is increasingly incorporating features to support hybrid methodologies, allowing users to calculate "Earned Value for Agile" by tracking metrics like delivered features or story points alongside traditional cost and schedule variances.

What role does Artificial Intelligence (AI) play in the future of EVM software?

AI's role involves enhancing predictive capabilities, automatically refining Estimates at Completion (EAC), automating complex variance root cause analysis, and providing prescriptive recommendations for corrective action, moving EVM tools toward proactive project control.

Detailed Analysis of Deployment Trends and Implementation Challenges

The transition from on-premise to cloud-based EVM solutions represents a pivotal shift in market dynamics. On-premise installations, while providing maximum control over data security and customization for highly specialized, often classified projects (common in defense), inherently involve high capital expenditure for licenses, dedicated IT infrastructure, and continuous maintenance by internal staff. These legacy systems are increasingly being relegated to organizations with stringent regulatory requirements concerning data sovereignty and air-gapped security protocols. Conversely, the proliferation of robust cloud infrastructure and the maturation of security practices within major cloud providers (AWS, Azure, Google Cloud) have made SaaS EVM highly attractive. SaaS models allow organizations to shift costs from CapEx to OpEx, utilize pay-as-you-go subscription structures, and benefit from rapid feature deployment, which is essential for keeping pace with evolving project management standards.

However, the rapid adoption of cloud EVM introduces unique implementation challenges. Data migration from disparate legacy systems—often consisting of manually tracked spreadsheets or outdated scheduling tools—is complex and highly critical. Ensuring data integrity during migration and maintaining historical traceability are non-trivial tasks that require specialized consulting expertise. Furthermore, integrating the cloud EVM platform with existing on-premise ERP and financial systems necessitates secure, reliable API linkages and robust data synchronization protocols. Organizations must also address internal resistance to change, as adopting integrated EVM software often demands restructuring existing project accounting and control processes, requiring comprehensive training for project managers, control account managers (CAMs), and executive stakeholders to ensure system utilization translates into measurable business value.

Strategic considerations for adopting new EVM solutions must heavily weigh total cost of ownership (TCO) over the forecast period, factoring in licensing, training, integration, and the cost of necessary compliance audits. The sophistication of vendor support, particularly for compliance-driven sectors, is a major selection criterion. Organizations are prioritizing vendors that offer certified consultants and deep domain expertise in specific vertical requirements, such as handling international contract types (e.g., FFP, Cost Plus) and associated reporting deliverables (e.g., Integrated Program Management Report, IPMR). This detailed functional capability, often coupled with built-in audit features and data validation tools, dictates market preference among major capital project stakeholders seeking reduced risk exposure.

Impact of Regulatory Landscape and Compliance Requirements

The regulatory landscape is arguably the single most powerful driver of the Earned Value Management Software market, particularly in North America and, increasingly, globally within international joint ventures. The enforcement of standards such as ANSI/EIA-748 (National Standard for Earned Value Management Systems) ensures that organizations bidding on or executing large government contracts must possess a validated EVM system capable of generating auditable data. This mandatory compliance creates a high entry barrier for organizations using ad-hoc tools, pushing them toward specialized EVM software that offers built-in checks and traceability required for EVMS certification and subsequent surveillance reviews by government contracting officers or auditing bodies. Vendors must continuously update their software to reflect minor changes in these standards, placing significant emphasis on R&D for compliance features.

Beyond defense and government, regulatory pressure in critical infrastructure sectors (nuclear, public transport) and highly regulated industries like pharmaceuticals (for R&D project tracking) also stimulates demand. The increasing focus on accountability and the public transparency of large infrastructure spending globally encourages private sector firms involved in these projects to adopt robust EVM systems voluntarily to demonstrate effective governance. This voluntary adoption is driven by the realization that failure to adequately manage cost and schedule risk can lead to reputational damage, significant financial penalties, and disqualification from future bids. Consequently, EVM software is moving from a niche compliance tool to a foundational strategic asset for managing enterprise risk exposure.

The complexity of managing multi-national projects further complicates the regulatory environment. EVM software must accommodate diverse reporting requirements, currency conversions, and local tax laws while maintaining a unified performance baseline. This necessity drives the market toward solutions that offer highly configurable security and permission layers, ensuring that sensitive data is only accessed by authorized personnel based on regional data governance policies. The ability of the software to produce both detailed, bottom-up work breakdown structure (WBS) data and highly summarized reports required by executive governance boards and external regulators is crucial, positioning integrated reporting capabilities as a core competitive feature.

Market Opportunities in Vertical Integration and Niche Specialization

Significant market growth opportunities exist through deep vertical integration and the specialization of EVM software for specific industry needs that extend beyond generic project tracking. For instance, in the construction and engineering sector, there is growing demand for EVM tools that integrate seamlessly with Building Information Modeling (BIM) software, allowing performance data to be tied directly to physical progress models (4D planning). This integration provides visual performance indicators and enhances the accuracy of physical percent complete calculations, a key metric often challenging to obtain accurately in field operations. Vendors who can bridge the gap between financial control (EVM) and physical progress (BIM/field reporting) are poised for substantial market gains.

Similarly, the IT and telecommunications sector presents opportunities for specialization in hybrid project management. As organizations increasingly adopt scaled Agile frameworks, the need to integrate financial EVM tracking with Agile velocity metrics, backlog management, and release planning becomes critical. This requires EVM software to adapt its measurement calculations to iterative cycles, focusing on business value delivered rather than strict adherence to a fixed, long-term schedule baseline. Specialized modules for risk management, which leverage historical project data to predict the likelihood and impact of common industry risks (e.g., supply chain disruptions in manufacturing, scope creep in IT), also represent a significant area for feature enhancement and market differentiation.

The future trajectory of the EVM software market will also be shaped by its integration into broader Enterprise Performance Management (EPM) suites. Customers are seeking unified platforms that combine project execution data (EVM) with strategic portfolio decision-making (PPM), resource capacity planning, and long-range financial planning. Vendors like Oracle, SAP, and Microsoft are leveraging their extensive EPM footprints to embed advanced EVM functionality, offering a compelling integrated value proposition that is difficult for pure-play EVM specialists to match without strategic partnerships. This competitive dynamic is driving innovation in integration technologies and API openness across the entire ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager