Earthmoving Fasteners Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437796 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Earthmoving Fasteners Market Size

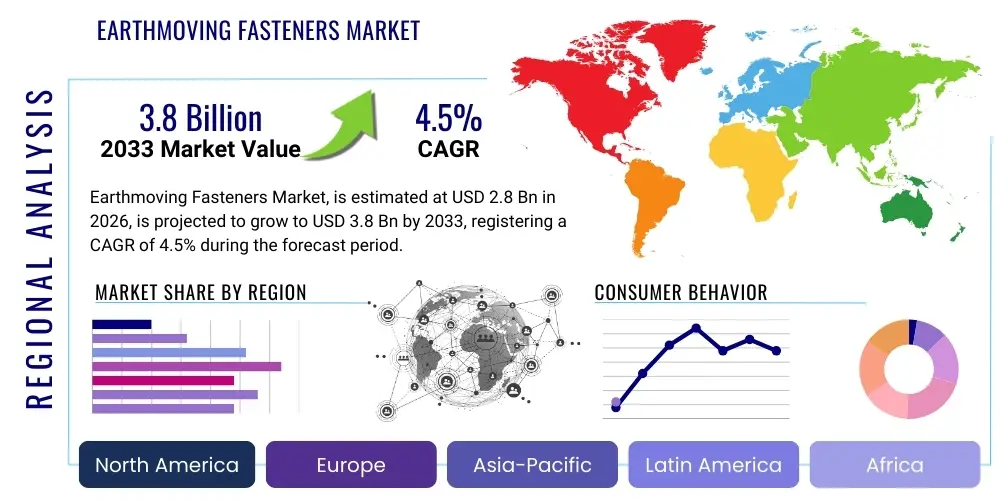

The Earthmoving Fasteners Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

Earthmoving Fasteners Market introduction

Earthmoving fasteners represent critical components essential for the structural integrity, operational safety, and longevity of heavy machinery utilized in construction, mining, agriculture, and infrastructure development. These specialized fasteners, including high-strength bolts, nuts, washers, pins, and sophisticated locking mechanisms, are designed to withstand extreme operational stresses, vibrations, high torque loads, and corrosive environmental conditions characteristic of earthmoving applications. Their primary function is securing major assemblies such as tracks, buckets, booms, engine components, and chassis structures in equipment like excavators, bulldozers, loaders, motor graders, and dump trucks, where failure is not an option due to stringent safety regulations and the high cost of downtime.

The core product description encompasses fasteners manufactured from advanced alloys, high-grade carbon steel, and specialty heat-treated materials, often featuring proprietary coatings for enhanced resistance to rust and abrasion. Key applications span the assembly line integration by Original Equipment Manufacturers (OEMs) and subsequent maintenance, repair, and overhaul (MRO) activities. The inherent benefits derived from high-quality earthmoving fasteners include improved machine reliability, extended service life of critical components, reduced operational noise, and enhanced worker safety, directly contributing to lower total cost of ownership (TCO) for fleet operators.

Driving factors propelling market expansion are fundamentally linked to global infrastructure spending, urbanization trends, and the necessity for resource extraction activities. Specifically, substantial governmental investments in public works, coupled with rapid technological advancements in earthmoving machinery (demanding fasteners with tighter tolerances and higher fatigue resistance), are fueling consistent demand. Furthermore, the robust growth of the Asia Pacific construction sector, particularly in emerging economies, solidifies the foundational market demand for these high-performance securing solutions, while stringent international quality standards for heavy equipment compel manufacturers to adopt certified, premium-grade fasteners.

Earthmoving Fasteners Market Executive Summary

The Earthmoving Fasteners Market is characterized by robust business trends driven primarily by the sustained global demand for heavy construction and mining equipment, which necessitates high-reliability fastening solutions. A key business trend involves the shift towards lightweight, yet higher-strength, materials such as specialized stainless steels and advanced composites, enabling equipment manufacturers to enhance fuel efficiency without compromising structural integrity. Furthermore, inventory management is increasingly reliant on digital supply chain integration, optimizing the delivery of critical MRO components to vast, decentralized operational sites globally. Manufacturers are also heavily focused on developing proprietary thread-locking technologies and anti-vibration coatings to address the extreme dynamics encountered by modern earthmoving equipment, positioning product innovation as a major competitive differentiator.

Regionally, the Asia Pacific (APAC) region dominates the market, largely due to unprecedented levels of infrastructure development and urbanization across China, India, and Southeast Asian nations, leading to massive production and consumption volumes of earthmoving equipment. North America and Europe, while mature, exhibit demand driven by replacement cycles, stringent safety regulations requiring premium-grade components, and significant investments in smart mining technologies that necessitate precision-engineered fasteners for complex sensor mounts and automated systems. Emerging markets in Latin America and the Middle East and Africa (MEA) offer substantial growth opportunities, spurred by burgeoning construction sectors and large-scale mining projects, though these regions present logistical complexities related to distribution and aftermarket support.

Segment trends indicate that the OEM segment remains the largest consumer, benefiting from continuous equipment production, while the MRO segment is expanding rapidly, driven by the increasing average age of operational machinery fleets globally. In terms of product type, high-strength bolts and studs hold the largest market share due to their widespread use in securing major load-bearing assemblies, but specialized segments like pins & clevises and hydraulic tube fasteners are showing accelerated growth due to advancements in hydraulic systems and modular machine design. Materially, treated alloy steel fasteners maintain supremacy, though demand for corrosion-resistant coatings, such as zinc flake and specialized polymer layers, is experiencing significant upward trajectory in coastal and high-humidity operational environments.

AI Impact Analysis on Earthmoving Fasteners Market

Common user questions regarding AI's impact on the Earthmoving Fasteners Market frequently revolve around optimizing supply chain logistics, predicting component failure rates, and enhancing manufacturing precision. Users are primarily concerned with how AI can minimize expensive downtime caused by fastener failures and how it might influence material selection and design through predictive modeling. Key themes emerging from these queries include the potential for AI-driven maintenance scheduling (predictive maintenance), automating quality inspection processes, and optimizing inventory levels for diverse regional MRO requirements. Expectations center on AI enabling the transition from routine, scheduled replacement to condition-based replacement, thereby improving operational efficiency and reducing waste within the construction and mining sectors. Furthermore, users seek clarity on how machine learning algorithms analyzing vibration and stress data gathered by embedded sensors in equipment can inform the next generation of fastener design, requiring components capable of integration with smart monitoring systems.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is beginning to significantly influence the fastener value chain, primarily through optimizing the manufacturing process and revolutionizing aftermarket services. In manufacturing, AI allows for real-time adjustments to forging, heat treatment, and coating processes, ensuring unprecedented levels of dimensional accuracy and material consistency, which is crucial for high-stress applications. For example, ML models analyze sensor data from production machinery to predict tool wear or potential material defects before they manifest, drastically reducing scrap rates and improving overall product quality compliance. This technological integration is pivotal in meeting the stringent quality requirements mandated by Tier 1 earthmoving OEMs.

Furthermore, the most profound impact of AI is observed in the service and maintenance phases. Fasteners, when paired with smart washers or integrated sensors, generate continuous operational data regarding load, vibration, and temperature. AI algorithms process this massive data stream to perform predictive analytics, forecasting the remaining useful life (RUL) of critical joints. This enables fleet managers to schedule the replacement of specific fasteners precisely when necessary, rather than relying on generalized service intervals. Such precision maintenance minimizes catastrophic failures, maximizes machine uptime, and significantly extends the operational lifespan of high-value earthmoving assets, transforming the MRO demand landscape from reactive replacement to proactive structural health management.

- AI-driven Predictive Maintenance (PdM): Algorithms analyze vibration data to predict fastener fatigue life, enabling condition-based replacement.

- Automated Quality Control (AQC): Machine vision systems powered by AI inspect manufactured fasteners for micro-cracks or dimensional deviations at high speed and precision.

- Optimized Supply Chain & Inventory: ML models forecast MRO demand based on regional equipment usage, weather patterns, and operational hours, reducing stockouts and excess inventory.

- Generative Design Optimization: AI assists engineers in designing lighter, stronger fasteners by simulating extreme load conditions and recommending optimal material compositions and geometries.

- Smart Fastener Integration: Facilitating the development of fasteners with integrated sensors (IoT), enhancing structural health monitoring capabilities for autonomous earthmoving equipment.

- Enhanced Manufacturing Efficiency: Use of ML in controlling furnace temperatures and quenching times during heat treatment processes to ensure superior mechanical properties and metallurgical consistency.

DRO & Impact Forces Of Earthmoving Fasteners Market

The market dynamics for earthmoving fasteners are governed by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. The primary Drivers include escalating infrastructure investment globally, especially in emerging economies, and rigorous governmental safety regulations that necessitate the use of high-grade, certified fastening components in heavy machinery. Restraints predominantly involve the volatility of raw material prices, particularly steel and specialized alloys, which directly impacts manufacturing costs and market stability. Additionally, the proliferation of counterfeit and low-quality fasteners, particularly in less regulated aftermarket channels, poses a persistent threat to quality perception and component reliability, necessitating consumer education and stricter supply chain enforcement. Opportunities are significantly present in the burgeoning market for autonomous and electric earthmoving equipment, which require specialized, high-precision fasteners to manage unique vibrational profiles and battery component security. Furthermore, the expansion of advanced coating technologies to enhance corrosion resistance in extreme environments offers a substantial avenue for product differentiation and market premiumization.

Impact Forces are shaping the long-term trajectory of this sector. The rapid pace of technological innovation in earthmoving equipment—suchating larger capacities and higher operating speeds—exerts immense pressure on fastener manufacturers to continuously increase the tensile strength and fatigue resistance of their products. Environmental, Social, and Governance (ESG) criteria are becoming critical; OEMs demand fasteners produced through sustainable, energy-efficient manufacturing processes. Moreover, geopolitical shifts impacting global trade routes and tariffs introduce complexities in sourcing and distribution, necessitating highly resilient and diversified supply chains. The collective effect of these forces pushes the market towards higher standards of material science, manufacturing automation, and supply chain transparency, favoring established players with strong R&D capabilities and robust quality control systems over smaller, less compliant manufacturers.

Segmentation Analysis

The Earthmoving Fasteners Market is rigorously segmented based on product type, material, application, and end-user, reflecting the diverse requirements across the heavy equipment industry. Analyzing these segments is crucial for understanding specific growth pockets and competitive landscapes. Product segmentation typically includes standardized high-load fasteners like bolts and nuts, alongside specialized components such as pins, rivets, and proprietary locking mechanisms unique to heavy machinery assemblies. Material segmentation highlights the dominance of high-strength alloy steels treated to withstand extreme temperatures and dynamic loads, while the application structure differentiates between highly critical structural assemblies (e.g., booms, chassis) and less demanding enclosure or panel applications. The end-user classification is arguably the most critical, distinguishing between the highly specific quality needs of Original Equipment Manufacturers (OEMs) and the price-sensitive, volume-driven demand from the Maintenance, Repair, and Overhaul (MRO) aftermarket sector.

- Product Type:

- High-Strength Bolts and Screws (Hex head, carriage bolts, structural bolts)

- Nuts and Washers (Lock nuts, heavy hex nuts, flat washers)

- Studs and Threaded Rods

- Pins and Clevises (Track pins, pivot pins)

- Rivets and Inserts

- Specialized Fasteners (Hydraulic tube fasteners, structural adhesive systems)

- Material:

- Alloy Steel (Grade 8, Grade 10.9, Grade 12.9)

- Stainless Steel (304, 316 for corrosive environments)

- Carbon Steel (Treated and untreated)

- Non-Ferrous Materials (Aluminum, Brass for specialty applications)

- Application:

- Engine and Drivetrain Assembly

- Chassis and Frame

- Bucket and Attachment Mounting

- Track and Undercarriage Systems

- Hydraulic and Fluid Systems

- End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (Maintenance, Repair, and Overhaul - MRO)

- Coating Type:

- Zinc Plating

- Hot Dip Galvanizing

- Zinc Flake Coatings (Geomet, Dacromet)

- Proprietary Polymer Coatings

Value Chain Analysis For Earthmoving Fasteners Market

The value chain for Earthmoving Fasteners commences with upstream raw material suppliers, predominantly high-grade steel producers and specialized alloy manufacturers. The quality and consistency of these raw inputs—such as high-tensile carbon steel, boron steel, and various stainless steel grades—are paramount, as they directly determine the mechanical properties and fatigue life of the final product. Key activities in the upstream segment involve meticulous alloy formulation, billet casting, and wire drawing, all subject to rigorous metallurgical testing and certification. Fastener manufacturers maintain strong, often long-term, relationships with these suppliers to secure consistent quality and buffer against commodity price volatility. The efficiency of the upstream sector, particularly its ability to deliver materials compliant with demanding international standards (like ISO 898-1 for mechanical properties), profoundly influences the subsequent production processes and overall cost structure of the fasteners.

The midstream phase, dominated by fastener manufacturing, involves several complex processes including cold forming, hot forging, thread rolling, machining, and extensive heat treatment (e.g., quenching and tempering) to achieve specific hardness and strength specifications. This stage is heavily capital-intensive, requiring advanced machinery and sophisticated quality control measures like magnetic particle inspection and ultrasonic testing. Following forming and treatment, protective coatings, such as advanced zinc flake systems or proprietary polymer finishes, are applied to enhance corrosion and abrasion resistance, a critical requirement for fasteners exposed to harsh operating conditions in mining or construction. Manufacturing excellence, characterized by tight tolerance control and efficient energy usage during heat treatment, provides a significant competitive advantage in this specialized industry.

The downstream segment encompasses distribution and ultimate deployment. Distribution channels are bifurcated: direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales via specialized industrial distributors and aftermarket resellers for Maintenance, Repair, and Overhaul (MRO) applications. Direct channels emphasize just-in-time (JIT) delivery and highly customized product requirements, often involving strategic inventory holding by the manufacturer near the OEM assembly plants. Indirect channels rely on established networks of stocking distributors who manage vast inventories of various fastener types and sizes, serving dispersed end-users (fleet operators, maintenance shops). The effectiveness of the downstream logistics, particularly the ability to rapidly deliver specialized fasteners globally, is critical for supporting the high uptime demands of earthmoving operations. Successful companies utilize advanced inventory management systems and robust e-commerce platforms to streamline the aftermarket supply chain, ensuring authenticity and traceability of crucial structural components.

Earthmoving Fasteners Market Potential Customers

The primary consumers, or End-Users, of Earthmoving Fasteners fall distinctly into two major categories: Original Equipment Manufacturers (OEMs) and the vast Aftermarket segment, consisting of heavy equipment fleet owners, independent repair facilities, and MRO service providers. OEMs represent the most technically demanding customer base, requiring high-volume supply of custom-engineered, application-specific fasteners that must adhere strictly to design specifications, material traceability protocols, and advanced quality certifications. These customers, including global giants like Caterpillar, Komatsu, Volvo Construction Equipment, and Hitachi Construction Machinery, integrate fasteners directly into their production lines for constructing new equipment, making procurement decisions based heavily on reliability, supply chain resilience, and the manufacturer's R&D capability to co-develop next-generation fastening solutions for advanced machine designs, such as those used in electric or autonomous vehicles.

The second major group, the Aftermarket (MRO), constitutes a highly diversified customer base focused on the maintenance and repair of existing fleets. These buyers prioritize product availability, standardized fitment, cost-effectiveness, and logistical speed. Fleet operators, ranging from large mining corporations managing hundreds of specialized machines to smaller local construction firms, require replacement fasteners for scheduled maintenance (e.g., track pad replacement) and critical repairs following component failure. For MRO customers, downtime is extremely costly, making fast fulfillment of correctly specified, durable replacement parts a necessity. Consequently, distributors who can provide a wide range of certified replacement fasteners quickly across various geographies hold a competitive edge in serving this segment, often facilitating purchases through specialized parts catalogs and authorized service centers.

Beyond traditional construction and mining, specialized customers include large infrastructure development agencies, government defense departments utilizing heavy engineering vehicles, and specialized industries such as large-scale quarrying, forestry, and waste management. These end-users typically operate machinery under unusually harsh or corrosive conditions, driving specific demand for fasteners with enhanced protective coatings and superior metallurgical composition. Furthermore, the agricultural sector, particularly large-scale industrial farming operations utilizing heavy tillage and harvesting equipment that shares operational similarities with earthmoving machinery, represents an important ancillary customer segment. Fastener manufacturers increasingly tailor product lines and distribution strategies to address the unique logistical and technical challenges presented by each of these distinct groups, ensuring that the critical function of joining structural components remains consistently reliable under diverse operational stresses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fastenal Company, Würth Group, ITW (Illinois Tool Works), Nifco Inc., LISI Group, Bulten AB, Fontana Gruppo, Penn Engineering, Aoyama Seisakusho Co., Ltd., Stanley Black & Decker (Emhart Teknologies), MW Industries Inc., Bifrangi S.p.A., SFS Group AG, ATF Inc., Precision Castparts Corp. (PCC), TATA Steel Fasteners, Kamax Holding GmbH & Co. KG, Dokka Fasteners AS, Nord-Lock Group, and Jiangsu Gemho Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Earthmoving Fasteners Market Key Technology Landscape

The technological landscape of the Earthmoving Fasteners Market is rapidly advancing, focusing on enhancing material durability, precision manufacturing, and system integration. A primary area of innovation involves advanced material sciences, specifically the development of proprietary high-strength steel alloys (often using microalloying techniques involving elements like Vanadium and Niobium) that offer superior tensile strength and resistance to cyclic fatigue without compromising ductility. These new materials are essential for accommodating the increasing power density and operational stresses of modern excavators and loaders. Coupled with material improvements are advancements in heat treatment protocols, utilizing vacuum carburizing and nitriding techniques to create fasteners with extremely hard, wear-resistant surface layers while maintaining a tough core structure, dramatically extending the fastener’s life in highly abrasive environments like rock quarries and mining sites.

Manufacturing precision is being driven by the integration of automation and data analytics. State-of-the-art cold and hot forging processes now incorporate sensor feedback and machine learning to achieve dimensional tolerances measured in microns, critical for ensuring accurate fitment and optimal load distribution in structural joints. Furthermore, thread rolling technology has evolved to produce threads with higher surface quality and improved stress profiles, significantly minimizing stress concentration points where fatigue failure typically initiates. The deployment of advanced non-destructive testing (NDT) methodologies, including eddy current and acoustic emission testing, ensures that every high-criticality fastener leaving the production line is free of internal flaws, moving beyond traditional batch sampling to 100% quality inspection for critical components sold to Tier 1 OEMs.

A burgeoning technological segment involves intelligent and anti-loosening fastening solutions. Intelligent fasteners are emerging as a key technology for predictive maintenance, incorporating miniature strain gauges or piezoelectric sensors directly into the bolt head or under the washer. These integrated systems transmit real-time data on preload tension, vibration levels, and temperature back to the machine’s central monitoring system, providing actionable insights into structural health. Concurrently, anti-loosening technologies, such as proprietary thread interference coatings, wedge-locking washers (e.g., Nord-Lock systems), and chemical thread lockers, are seeing increased adoption, specifically targeting applications prone to extreme transverse vibration (like track joints) where fastener integrity is paramount to operational safety and continuity. The convergence of high-performance materials, precision manufacturing, and smart integration defines the competitive technological edge in the contemporary earthmoving fastener market.

Regional Highlights

The consumption and production dynamics of earthmoving fasteners exhibit significant regional variation, heavily correlated with global construction activity and mining investment cycles.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, fundamentally driven by aggressive infrastructure initiatives across China, India, and Southeast Asia. Massive urbanization projects, coupled with large-scale resource extraction activities in Australia and Indonesia, create immense demand for heavy machinery and, consequently, high volumes of fasteners for both OEM assembly and MRO. The region is also home to major global fastener manufacturers and large localized OEM production hubs, making it a critical strategic center.

- North America: This region is characterized by high demand for premium, high-specification fasteners due to stringent safety regulations and significant investments in modernizing aging infrastructure (roads, bridges, utilities). Demand is stable, focused on replacement parts for mature fleets and innovative fastening solutions for autonomous and electric construction equipment being developed and deployed across the US and Canada.

- Europe: Western European markets are mature, prioritizing quality, material traceability, and adherence to strict environmental and safety standards (e.g., EU machinery directive). Growth is steady, driven by MRO demand and specialized infrastructure projects like high-speed rail and tunnel boring. Eastern Europe offers incremental growth fueled by lower labor costs attracting manufacturing and localized construction expansion.

- Latin America (LATAM): Growth in LATAM is closely tied to commodity cycles, with large-scale mining operations in countries like Chile, Brazil, and Peru fueling demand for heavy-duty, corrosion-resistant fasteners. Construction markets are developing, leading to volatile yet substantial demand, often requiring robust fasteners capable of handling rugged operating environments and varying maintenance practices.

- Middle East and Africa (MEA): The Middle East is a high-growth area propelled by mega-construction projects (e.g., NEOM, Dubai infrastructure), creating concentrated demand for construction machinery and associated fasteners. Africa’s market is dominated by mining and oil & gas infrastructure development, requiring specialized, reliable fasteners for remote operations where logistical challenges necessitate highly durable components with long service intervals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Earthmoving Fasteners Market.- Fastenal Company

- Würth Group

- ITW (Illinois Tool Works)

- Nifco Inc.

- LISI Group

- Bulten AB

- Fontana Gruppo

- Penn Engineering

- Aoyama Seisakusho Co., Ltd.

- Stanley Black & Decker (Emhart Teknologies)

- MW Industries Inc.

- Bifrangi S.p.A.

- SFS Group AG

- ATF Inc.

- Precision Castparts Corp. (PCC)

- TATA Steel Fasteners

- Kamax Holding GmbH & Co. KG

- Dokka Fasteners AS

- Nord-Lock Group

- Jiangsu Gemho Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Earthmoving Fasteners market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for high-strength fasteners in earthmoving equipment?

The primary driver is the global escalation of infrastructure development and urbanization projects, combined with stringent safety regulations that mandate the use of certified, high-tensile fasteners to manage extreme dynamic loads, vibration, and torque in modern heavy machinery, ensuring operational safety and machine integrity.

How do material advances contribute to the longevity of earthmoving fasteners?

Material advances, specifically the use of advanced microalloyed steels and optimized heat treatment protocols (like vacuum carburizing), enhance the fastener's resistance to fatigue, wear, and corrosion. This metallurgical precision ensures the fasteners maintain critical preload tension and structural integrity over extended service intervals in harsh operational environments.

What distinguishes OEM fasteners from MRO fasteners in this market?

OEM fasteners are custom-engineered, application-specific components supplied in high volume for new equipment assembly, demanding the highest levels of quality control and traceability. MRO (Aftermarket) fasteners, while meeting high standards, focus more on standardized sizes, immediate availability, competitive cost, and broad compatibility for repair and maintenance purposes across diverse older fleets.

What role does digitalization play in the Earthmoving Fasteners supply chain?

Digitalization plays a critical role by integrating real-time inventory management systems and e-commerce platforms, optimizing the MRO supply chain to reduce stockouts and delivery times. Furthermore, the development of intelligent fasteners with IoT sensors facilitates predictive maintenance by providing continuous data on joint stress and potential failure points.

Which technology is most critical for preventing fastener loosening in high-vibration earthmoving applications?

The most critical technology involves specialized anti-loosening systems, including mechanical solutions like wedge-locking washers (which utilize tension instead of friction) and chemical solutions like anaerobic thread lockers. These mechanisms counteract the severe transverse vibration inherent in earthmoving operations, preventing catastrophic joint failure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager