Eco-Friendly Bag Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436544 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Eco-Friendly Bag Market Size

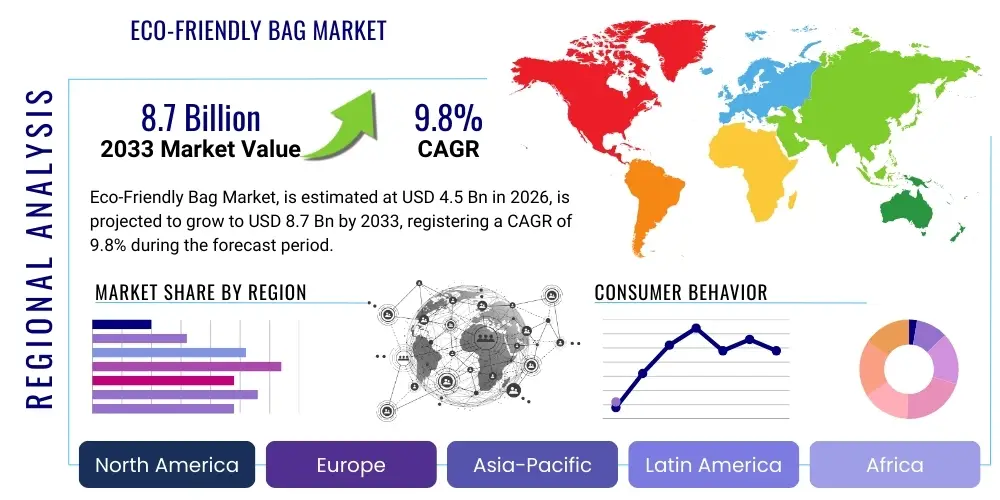

The Eco-Friendly Bag Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

Eco-Friendly Bag Market introduction

The Eco-Friendly Bag Market encompasses the production and distribution of various carrying solutions designed to minimize environmental impact compared to conventional plastic bags. These products utilize materials such as non-woven fabrics (e.g., polypropylene), natural fibers (jute, cotton, canvas), recycled plastics (rPET), and biodegradable polymers (PLA, PHA). The primary objective of these bags is to offer sustainable alternatives for packaging, shopping, and general transport, aligning with global efforts to reduce plastic waste, conserve resources, and mitigate climate change risks associated with petrochemical-based products. This shift is heavily influenced by stringent governmental regulations and escalating consumer environmental awareness, particularly in developed economies across North America and Europe, which are rapidly transitioning toward circular economic models.

Product descriptions within this category vary widely, ranging from durable, reusable shopping totes and messenger bags to compostable trash liners and single-use food packaging films derived from plant sources. Major applications span numerous sectors, including retail grocery, apparel and fashion, pharmaceuticals, quick-service restaurants (QSRs), and institutional waste management. Key benefits include reduced carbon footprint, resource conservation, enhanced corporate social responsibility (CSR) perception for retailers, and compliance with national and international environmental directives banning or taxing single-use conventional plastics. The versatility of eco-friendly materials allows for customization in design, strength, and degradation profile, meeting diverse industry requirements.

Driving factors propelling market expansion are fundamentally linked to legislative action and socio-economic changes. The increasing number of plastic bag bans implemented across states, provinces, and nations acts as the most significant market stimulant. Furthermore, improvements in bio-material science and manufacturing efficiency are steadily reducing the cost differential between sustainable and traditional packaging options. Growing consumer preference for brands demonstrating commitment to sustainability is reshaping purchasing behavior, forcing retailers and manufacturers to prioritize environmentally sound packaging strategies to maintain market relevance and brand loyalty. Investment in recycling infrastructure and chemical recycling technologies further supports the viability of using recycled content in these bag solutions.

Eco-Friendly Bag Market Executive Summary

The Eco-Friendly Bag Market is characterized by robust growth, fueled predominantly by global legislative frameworks restricting single-use plastics and a fundamental shift in corporate sustainability strategies. Current business trends indicate a strong move toward material diversification, with manufacturers investing heavily in developing advanced biodegradable polymers and expanding production capacity for durable, natural fiber bags like jute and cotton. Retailers are integrating these bags into loyalty programs and high-visibility marketing campaigns, cementing their role not just as a compliance necessity but as a consumer engagement tool. Mergers, acquisitions, and strategic partnerships between material suppliers and bag converters are common, aiming to secure sustainable raw material sourcing and streamline the supply chain efficiency necessary to meet high volume demands from large retail chains.

Regionally, Asia Pacific (APAC) represents the fastest-growing market segment, largely driven by regulatory interventions in highly populated nations like India and China, alongside massive industrial expansion and increasing per capita income driving retail spending. While North America and Europe currently hold the largest market share due to early and stringent regulatory adoption and high environmental consciousness, the market dynamic is shifting as African and Latin American nations progressively introduce comprehensive plastic pollution control measures. European markets, particularly, focus on standardized labeling and certification for compostability and recyclability, pushing innovation toward closed-loop systems and certified bio-based content verification across member states.

Segment trends highlight the dominance of the reusable bag category, specifically those made from non-woven polypropylene (PP) and cotton canvas, owing to their durability and effectiveness in replacing multiple single-use transactions. However, the fastest growth is observed in the biodegradable/compostable segment, particularly bags utilized for waste management (bin liners) and fresh produce packaging, addressing short-term, disposable needs without contributing to permanent landfill accumulation. The retail segment remains the largest end-user, but the industrial and construction sectors are emerging as significant users, adopting durable, heavy-duty eco-friendly sacks for materials handling, indicating a comprehensive sustainability integration across all economic activities.

AI Impact Analysis on Eco-Friendly Bag Market

User inquiries regarding AI's influence on the Eco-Friendly Bag Market primarily revolve around optimizing sustainable manufacturing, predicting fluctuating raw material costs (especially bio-feedstocks), and enhancing supply chain transparency to verify environmental claims. Users often ask how AI can improve the sorting and recycling processes for mixed materials, ensuring compliance with strict compostability standards, and managing the complex logistics of reverse vending or bag return schemes. The consensus theme is that AI will not only drive efficiency but also serve as a critical verification and assurance tool, providing data-driven traceability from raw material cultivation or recycling input through to end-of-life processing, thus bolstering consumer trust in 'green' product claims and supporting automated decision-making in inventory management based on real-time environmental impact assessments and legislative risk.

- AI-driven optimization of material formulations: Utilizing machine learning algorithms to predict the optimal blend ratios for bioplastics, minimizing cost while maximizing mechanical strength and ensuring certified degradation timelines under specific environmental conditions.

- Predictive supply chain management: Deploying AI models to forecast volatility in natural fiber commodity prices (e.g., cotton, jute) and bio-feedstock availability, enabling manufacturers to secure contracts and optimize inventory levels proactively, mitigating risk associated with climate-related supply disruptions.

- Quality control and defect detection: Implementing computer vision and AI analytics on production lines to ensure rigorous quality standards, identifying structural flaws in woven and non-woven bags, and verifying material thickness and uniformity crucial for durability and certified reuse cycles.

- Enhanced sorting and recycling infrastructure: Integrating AI-powered robotics and spectral analysis (NIR) in material recovery facilities (MRFs) to accurately identify and separate various types of eco-friendly bags (rPET, PP, PLA, cotton), overcoming the significant challenge posed by the material complexity of the sustainable packaging waste stream.

- Consumer engagement and lifecycle tracking: Using AI to personalize reusable bag programs, optimize store inventory based on local demand and seasonality, and provide traceable digital passports (via QR codes) detailing the bag’s material origins, number of reuse cycles, and appropriate end-of-life disposal instructions, thereby improving consumer participation in circular economy initiatives.

DRO & Impact Forces Of Eco-Friendly Bag Market

The market dynamics of the Eco-Friendly Bag Market are intrinsically linked to legislative mandates, technological advancements, and shifting consumer environmental values. Drivers are predominantly centered on the global pushback against plastic pollution, exemplified by outright bans and taxes on traditional plastic bags implemented by hundreds of municipalities and countries, forcing retailers to adopt sustainable alternatives rapidly. Complementary to regulation are significant technological leaps in polymer science that have made biodegradable and compostable options more viable in terms of performance and cost. These forces are amplified by substantial corporate commitments, where major multinational retailers and fast-moving consumer goods (FMCG) companies pledge to use 100% sustainable packaging by target dates, thus creating guaranteed, high-volume demand for eco-friendly bag manufacturers.

Restraints, however, pose challenges to widespread adoption. The primary restraint is the higher manufacturing cost associated with bio-based polymers and the intensive agricultural requirements for natural fibers (e.g., land, water). Furthermore, the lack of standardized industrial composting infrastructure in many regions limits the effective end-of-life processing for many 'compostable' bags, leading to consumer confusion and potential contamination of conventional recycling streams. Supply chain volatility, particularly concerning the availability and price fluctuation of sustainable raw materials, remains a critical operational barrier. Additionally, the need for consumer education is paramount, as misconceptions about the durability or appropriate disposal methods of different eco-friendly bag types can hinder sustained adoption.

Opportunities for market growth lie in continuous innovation toward marine-degradable bioplastics, offering a solution for leakage into aquatic environments, and the development of cost-effective, high-barrier bio-films suitable for specialized food packaging applications that require extended shelf life. Furthermore, expanding into developing economies that are just beginning to implement anti-plastic legislation presents vast, untapped market potential. The impact forces are overwhelmingly positive, driven by the irreversible global political and social momentum toward environmental responsibility. Policy implementation is the chief impact force, creating immediate market gaps that sustainable solutions must fill, while investment in circular economy solutions (recycling, reuse programs) ensures the long-term viability and growth trajectory of the entire eco-friendly packaging ecosystem.

Segmentation Analysis

Segmentation analysis for the Eco-Friendly Bag Market provides granular insight into the types of materials, applications, and end-users driving demand and innovation. The market is primarily segmented based on Material Type (Paper, Jute/Burlap, Cotton/Canvas, Polypropylene (PP) Non-Woven, Recycled Plastic, and Bioplastics/Compostable Polymers), End-Use Application (Retail, Institutional/Commercial, Food Service, and Industrial), and Distribution Channel. The diversity in segmentation reflects the varied needs of sustainability mandates, ranging from the need for highly durable, multi-use bags (addressed by PP Non-Woven and Canvas) to the requirement for rapid-degrading, food-safe packaging (addressed by Bioplastics and high-grade compostable paper). The market structure is dynamic, with regulatory changes continually influencing the fastest-growing segments, favoring those materials offering verifiable, resource-efficient lifecycles.

Material segmentation reveals that Non-Woven PP bags, despite being derived from petroleum, dominate in volume due to their low cost, high durability, and widespread adoption in large retail chains as the preferred 'bag-for-life' option, maximizing reuse cycles. However, Bioplastics (PLA, PHA, PBAT) are witnessing the fastest revenue growth, driven by investments in agricultural feedstock and technological advancements that enhance performance characteristics, making them suitable for sensitive applications like organic waste collection and fresh produce packaging where compostability is mandated. The distinction between reusable and single-use eco-friendly solutions is critical; while single-use bio-bags solve the immediate waste issue, the global trend strongly favors maximizing the circularity and life span of reusable options to minimize overall material consumption.

The retail sector remains the anchor for market demand, encompassing grocery stores, department stores, and apparel outlets, which are obligated to provide compliant packaging at the point of sale. However, the institutional sector—including hospitals, government offices, and educational bodies—is significantly contributing, particularly through the bulk purchase of compostable liners for cafeteria and waste collection systems. This expansion into commercial and governmental procurement demonstrates the integration of sustainability beyond just consumer-facing retail, solidifying the market’s broad applicability. Future segmentation growth is expected to focus heavily on sophisticated compostable packaging materials that can handle moisture and oil without compromising structural integrity, crucial for the expanding e-commerce and QSR delivery sectors.

- By Material Type:

- Paper (Kraft, Recycled, Specialty)

- Natural Fibers (Cotton, Canvas, Jute, Hemp)

- Woven and Non-Woven Polypropylene (PP)

- Recycled Plastics (rPET, rPP)

- Bioplastics (PLA, PHA, Starch Blends, PBAT)

- By Usage:

- Reusable Bags (Totes, Messengers, Shopping Bags)

- Single-Use/Compostable Bags (Produce Bags, Bin Liners, Carrier Bags)

- By Application/End-User:

- Retail and Consumer Goods (Grocery, Apparel, Convenience Stores)

- Food Service and Hospitality (Restaurants, Hotels, Catering)

- Institutional (Healthcare, Education, Government)

- Industrial and Manufacturing (Bulk Packaging, Construction Sacks)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of LATAM)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Eco-Friendly Bag Market

The value chain for the Eco-Friendly Bag Market begins with the upstream sourcing of sustainable raw materials, which is highly complex and diversified. For natural fibers like cotton and jute, this involves agricultural production, processing, and harvesting, ensuring adherence to organic and ethical farming standards, often requiring certification (e.g., Global Organic Textile Standard - GOTS). For bioplastics, the upstream includes the cultivation and processing of feedstocks such as corn starch, sugarcane, or specialized bacterial cultures (for PHA). Key challenges at this stage include price volatility, ensuring ethical labor practices, and maintaining a consistent supply of certified, high-quality materials free from contaminants, which is crucial for achieving specific degradation profiles.

Midstream activities encompass the manufacturing process, where raw materials are converted into finished bags. This involves specialized processes such as non-woven fabric production, weaving, extrusion and film blowing for bioplastics, cutting, stitching, and high-quality printing (often using water-based, eco-friendly inks). Efficiency in this stage is critical, as manufacturers strive to reduce production costs to compete with conventional plastic alternatives. Investment in automated machinery capable of handling diverse and often delicate materials (like thin bioplastics) efficiently is a major focus. Quality control ensures durability for reusable bags and certified compostability/biodegradability for single-use products, often involving third-party testing.

Downstream distribution channels are extensive and involve both direct and indirect routes. Direct sales are common for large-scale contracts with major retail chains, where manufacturers deliver tailored bag solutions directly to the retailer's central distribution centers. Indirect distribution relies heavily on packaging wholesalers, regional distributors, and specialized e-commerce platforms that cater to small and medium-sized enterprises (SMEs) and specialized institutional buyers. The trend toward digital platforms and business-to-business (B2B) e-commerce is growing, offering manufacturers a way to connect directly with end-users globally, enhancing transparency and reducing logistical layers. The efficiency of the downstream relies heavily on fast, traceable logistics to meet the just-in-time inventory demands of high-volume retail customers seeking to avoid stockouts.

Eco-Friendly Bag Market Potential Customers

The potential customers and end-users of eco-friendly bags span nearly every industry segment that requires carrying, containment, or packaging solutions, driven largely by regulatory necessity and consumer preference for sustainable brands. The largest and most immediate segment comprises Mass Retailers and Grocery Chains, including hypermarkets, supermarket chains, and large specialty grocery retailers. These entities are directly impacted by plastic bag bans and require millions of reusable or compostable bags annually to facilitate customer purchases and maintain operational compliance. Their procurement decisions often hinge on scale, cost-effectiveness, durability, and the supplier's capacity to guarantee sustainable sourcing credentials for marketing purposes.

Another significant group includes the Quick-Service Restaurants (QSR) and Food Delivery Services. As food delivery expands globally, these businesses require specialized eco-friendly bags (often paper or compostable bioplastic) that can handle heat, moisture, and grease while maintaining structural integrity. Compliance here is critical, especially in cities implementing strict compostable requirements for food waste and packaging. The growth of meal kit services further amplifies the need for specialized, sustainable internal and external packaging solutions that communicate freshness and environmental responsibility to the consumer.

The emerging potential customer base includes Institutional and Governmental Bodies, such as hospitals, schools, large corporate campuses, and municipalities. These entities are primary buyers of compostable bin liners for standardized waste management programs, often purchasing based on strict technical specifications for decomposition rates and durability. Furthermore, fashion and apparel retailers represent a high-value customer segment, seeking customized, aesthetically pleasing, and premium eco-friendly packaging (e.g., organic cotton totes or luxury paper bags) that aligns with their brand image and conveys high perceived value to the final consumer, making the bag itself an extension of the brand's sustainability message.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reusable Bag Holdings, Inc., Smurfit Kappa Group, Novolex Holdings, Inc., Shaktimaan Jute, International Paper Company, Hilex Poly Co., LLC, Rutan Poly Industries, Inc., BioBag International AS, Xiamen Ebelee Industry & Trade Co., Ltd., Elif Packaging, Jiangsu Greenery Packaging Co., Ltd., Abena A/S, NatureWorks LLC (Material Supplier), TGR Group, Ltd., Bulldog Bag Ltd., Stellar Exports, Umasree Texplast, Green Team, Inc., PaperWorks Industries, Inc., Enviro-Tote, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eco-Friendly Bag Market Key Technology Landscape

The Eco-Friendly Bag Market is continuously being shaped by innovations across materials science and manufacturing processes, aimed at enhancing sustainability performance while reducing production complexity and cost. A primary technological focus is on advanced polymer engineering, specifically the development of second-generation bioplastics derived from non-food agricultural waste (e.g., cellulosic materials, algae) rather than traditional crops like corn or sugarcane. This shift reduces the ethical conflict between food security and industrial production. Furthermore, research into polyhydroxyalkanoates (PHAs) is accelerating, as these polymers exhibit genuine marine biodegradability, positioning them as a superior solution for mitigating leakage into aquatic environments, addressing a critical pain point in the market.

In the realm of traditional materials, technological advancements focus on maximizing the recycled content and improving the efficiency of the recycling process itself. For paper bags, this includes adopting highly efficient, closed-loop paper manufacturing processes that minimize water usage and chemical inputs, alongside developing stronger, lighter-weight papers (like high-performance Kraft) that reduce overall fiber consumption while maintaining necessary tensile strength. For woven bags, automated, high-speed stitching and precision cutting technologies are standardizing production, ensuring consistent quality and maximizing the number of guaranteed reuse cycles, a key metric for retailers adopting 'bag-for-life' programs.

Manufacturing technologies are also integrating digital tools to enhance transparency and quality control. Robotics and automated production lines are essential for handling the sometimes delicate nature of bioplastic films, preventing tearing and maximizing yield. Additionally, the adoption of specialized printing technologies that utilize low-VOC (volatile organic compound) or water-based inks is becoming standard, ensuring that the decoration and branding elements of the bag do not undermine its eco-friendly credentials. Traceability solutions, such as embedded RFID tags or digitally printed QR codes, leverage cloud-based platforms to track the material origin and verify compliance certifications throughout the entire product lifecycle, a critical component for meeting increasingly strict governmental reporting requirements.

Regional Highlights

The global Eco-Friendly Bag Market demonstrates varying levels of maturity and growth drivers across major geographic regions, primarily influenced by local environmental policies, consumer income levels, and recycling infrastructure development.

- North America (U.S. and Canada): This region is a mature market characterized by fragmented, state-level, and municipal-level plastic bag legislation, creating complex compliance requirements for national retailers. The market is dominated by reusable PP non-woven and rPET bags. Key growth is driven by California, New York, and Canadian provinces which have implemented comprehensive bans and fees. Consumers here display high willingness-to-pay for premium, durable organic cotton and canvas bags, emphasizing high aesthetic value and long-term reuse.

- Europe (Germany, U.K., France): Europe holds the largest market share in terms of revenue, primarily due to the European Union's ambitious Circular Economy Action Plan, which includes directives aimed at drastically reducing single-use plastic consumption. The market exhibits high penetration of paper bags and certified bioplastics, driven by robust industrial composting infrastructure and strict labeling standards (like the EN 13432 compostability standard). The emphasis in Europe is on cradle-to-cradle principles, prioritizing materials that can be effectively recycled or composted in existing systems.

- Asia Pacific (APAC) (China, India, Japan): APAC is projected to be the fastest-growing region, driven by massive regulatory shifts in populous nations and rapid urbanization increasing retail consumption. China's new plastic pollution control policies are creating immense demand for sustainable packaging across its vast manufacturing and retail sectors. India's staggered, state-level implementation of plastic bans, coupled with robust domestic jute and cotton production capabilities, makes natural fiber bags a major growth category.

- Latin America (LATAM): This region is experiencing dynamic growth, particularly in urban centers of Brazil, Argentina, and Chile, which have implemented strict municipal bans. Demand is strong for affordable, durable reusable bags and basic paper packaging. Economic volatility sometimes restrains the adoption of higher-cost bioplastics, favoring solutions based on abundant local raw materials.

- Middle East and Africa (MEA): Growth is accelerating due to rising environmental awareness and several key regulatory actions in the GCC countries and South Africa aimed at plastic reduction. The market favors durable, high-visibility reusable bags for retail, often imported. Challenges include reliance on international supply chains and limited local manufacturing capacity for advanced bio-materials, though local initiatives are gaining momentum.

The United States, particularly, presents a patchwork of regulations where federal involvement is limited, placing the impetus on state and local governments. This regulatory complexity drives demand for suppliers capable of providing a diverse portfolio of compliant materials tailored to different jurisdictions. Canada, showing more centralized efforts, exhibits strong support for centralized recycling and composting programs, thereby accelerating the adoption of certified compostable packaging in municipal waste systems. The high degree of environmental consciousness among the population ensures sustained demand for high-quality, ethically sourced products.

The U.K. pioneered effective market intervention with a widely adopted plastic bag charge, significantly reducing consumption and boosting demand for reusable totes. Germany focuses heavily on material recovery and recycling efficiency, supporting innovation in rPET and recycled fiber bags. France has been particularly aggressive in banning all non-compostable single-use plastic items, creating immediate market opportunities for advanced bioplastic manufacturers. The political environment is highly favorable, ensuring continued regulatory tightening that favors sustainable alternatives.

While infrastructure challenges persist, particularly concerning waste collection and recycling in developing areas, the sheer scale of manufacturing and domestic consumer base in APAC dictates global market trajectory. Japan and South Korea lead in adopting technologically advanced bio-films and sophisticated packaging solutions, reflecting high standards for quality and cleanliness. Regional growth is contingent upon consistent enforcement of anti-plastic legislation and investment in end-of-life processing capabilities across diverse urban and rural settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eco-Friendly Bag Market.- Reusable Bag Holdings, Inc.

- Smurfit Kappa Group

- Novolex Holdings, Inc.

- International Paper Company

- BioBag International AS

- Shaktimaan Jute

- Hilex Poly Co., LLC

- Rutan Poly Industries, Inc.

- Xiamen Ebelee Industry & Trade Co., Ltd.

- Elif Packaging

- Jiangsu Greenery Packaging Co., Ltd.

- Abena A/S

- NatureWorks LLC (Material Supplier)

- TGR Group, Ltd.

- Bulldog Bag Ltd.

- Stellar Exports

- Umasree Texplast

- Green Team, Inc.

- PaperWorks Industries, Inc.

- Enviro-Tote, Inc.

Frequently Asked Questions

Analyze common user questions about the Eco-Friendly Bag market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between biodegradable and compostable bags?

Biodegradable bags break down naturally over time through microbial action but often require specific conditions and can leave behind toxic residues. Compostable bags, conversely, must decompose completely into non-toxic components (humus, water, CO2) within a specified timeframe (usually 90-180 days) under controlled, industrial composting conditions, making them a more environmentally preferred option for organic waste streams.

Which material segment is driving the fastest growth in the eco-friendly bag market?

The Bioplastics segment, specifically materials like PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates), is exhibiting the fastest growth rate. This acceleration is driven by technological advancements making these materials cost-competitive and regulatory pressures in Europe and North America mandating compostable solutions for food and waste applications.

How are government regulations impacting the market size and trajectory?

Government regulations, particularly outright bans and high taxation on traditional single-use plastic bags, are the single most significant driver of market growth. These mandates instantly eliminate conventional options, forcing retailers to procure certified eco-friendly alternatives, thereby stabilizing demand and justifying investments in sustainable manufacturing infrastructure globally.

Are non-woven polypropylene (PP) bags truly considered eco-friendly?

Non-woven PP bags are classified as eco-friendly primarily because of their high durability and ability to be reused hundreds of times, significantly reducing the frequency of disposable bag usage. While derived from petroleum, their superior longevity and recyclability at the end of their useful life position them favorably in circular economy models, outweighing the environmental impact of frequent disposable packaging.

What challenges does the recycling of eco-friendly bags present?

The primary challenge is material complexity and contamination. Different eco-friendly materials (e.g., PLA, cotton, rPET) require separate and distinct recycling or composting streams. Mixing bioplastics with traditional plastics (due to consumer confusion) contaminates conventional recycling, while the lack of widespread industrial composting facilities limits the effective processing of truly compostable bags in many geographic regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager