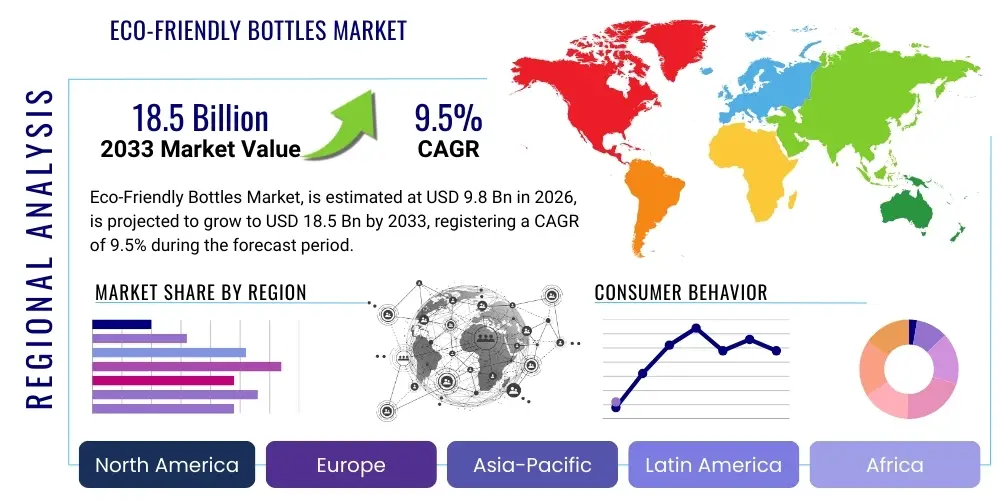

Eco-Friendly Bottles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435242 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Eco-Friendly Bottles Market Size

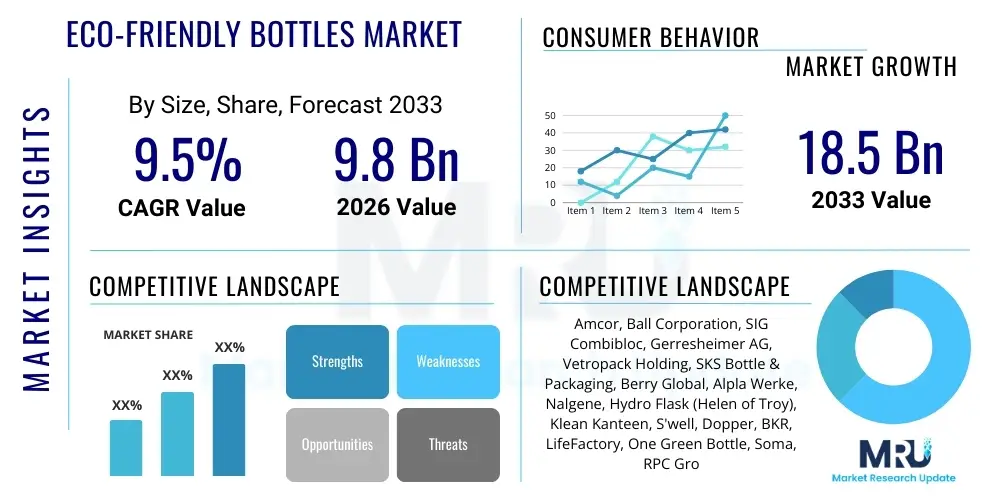

The Eco-Friendly Bottles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 9.8 Billion in 2026 and is projected to reach USD 18.5 Billion by the end of the forecast period in 2033.

Eco-Friendly Bottles Market introduction

The Eco-Friendly Bottles Market encompasses reusable, biodegradable, or highly recyclable packaging solutions designed to minimize environmental impact compared to conventional single-use plastics. These products include containers made from materials such as rPET (recycled polyethylene terephthalate), glass, stainless steel, aluminum, and advanced bio-plastics (like PLA and PHA). The primary objective of these bottles is to offer sustainable alternatives for packaging beverages, food products, personal care items, and pharmaceuticals, thereby reducing plastic waste accumulation and lowering carbon footprints associated with material production and disposal. Major applications span the consumer goods sector, municipal drinking water distribution, and the health and wellness industry, where consumers increasingly demand verifiable sustainable packaging.

The accelerating shift toward eco-consciousness among global consumers and stringent government regulations targeting plastic pollution are the chief driving factors bolstering market expansion. Benefits associated with eco-friendly bottles include enhanced brand image for manufacturers, superior material safety for consumers (especially with glass and stainless steel), and long-term cost savings associated with reusable models. Furthermore, innovations in material science, particularly the development of high-barrier bio-based polymers that maintain product integrity, are critical in broadening the applicability of these sustainable solutions across diverse market segments previously reliant on traditional virgin plastics.

The market is defined by continuous product lifecycle assessment and transparency, pushing manufacturers to invest heavily in circular economy initiatives, ensuring high collection rates, and developing closed-loop recycling systems. The rise in disposable income in emerging economies, coupled with significant public awareness campaigns regarding marine plastic pollution, further catalyzes the demand for readily available and economically viable eco-friendly bottling options. This transition requires substantial infrastructural investment in sorting and recycling facilities globally, which presents both a challenge and a lucrative opportunity for market participants.

Eco-Friendly Bottles Market Executive Summary

The Eco-Friendly Bottles Market is experiencing robust acceleration, driven primarily by evolving consumer preferences favoring sustainability and amplified regulatory pressures across North America and Europe mandating minimum recycled content standards. Business trends highlight a strong movement towards material diversification, with key players heavily investing in advanced materials like PHA and specialized lightweight aluminum, moving beyond rPET dominance. Strategic partnerships between packaging manufacturers and major Fast-Moving Consumer Goods (FMCG) corporations are critical in establishing scalable supply chains for sustainable materials, ensuring that eco-friendly options are integrated into mass-market product lines.

Regionally, Europe leads the adoption, propelled by the European Union’s ambitious Plastic Strategy and specific regulations concerning single-use plastics, fostering innovation in both reusable schemes and advanced recycling technologies. Asia Pacific (APAC), although facing infrastructural challenges, represents the fastest-growing market due to rapid urbanization, increasing middle-class environmental awareness, and significant governmental focus on waste management, particularly in countries like China and India. Segmentation trends reveal that the Reusable segment (driven by stainless steel and glass) holds significant value due to high initial investment and long product life, while the Biodegradable Plastic segment is expected to show the highest volume growth, pending improvements in composting infrastructure and material performance parity with traditional polymers.

Overall, the market landscape is shifting from incremental material changes to systemic circular models, influencing the entire value chain from raw material sourcing (focusing on waste streams) to end-of-life management. Technological advancements, particularly in chemical recycling, are poised to unlock greater supply of high-quality recycled content suitable for food-grade applications. Competitive dynamics emphasize differentiation through material transparency, certifications, and consumer convenience, positioning sustainability not just as a compliance requirement but as a core competitive advantage.

AI Impact Analysis on Eco-Friendly Bottles Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Eco-Friendly Bottles Market frequently center on optimizing the circular economy, predicting material performance, and enhancing smart packaging logistics. Key themes revolve around how AI can improve waste sorting accuracy, thereby increasing the yield of usable recycled content (rPET, aluminum), which directly addresses the major supply constraint facing the market. Users also express interest in AI-driven material discovery—specifically, using machine learning to simulate and accelerate the development of new, high-performance bio-degradable polymers (PLA, PHA) that possess superior barrier properties and lower production costs. Concerns often include the energy footprint of AI systems and the need for standardized data inputs across fragmented global recycling infrastructures to maximize the efficiency gains promised by advanced analytics and computer vision.

- AI-Powered Material Sorting: Utilizing advanced computer vision and machine learning algorithms in Material Recovery Facilities (MRFs) to identify and separate different types of plastics and materials with higher accuracy, significantly boosting the quality and quantity of recycled feedstock for eco-friendly bottle production.

- Predictive Supply Chain Optimization: Implementing AI models to forecast demand for sustainable bottles and optimize raw material procurement (recycled content or biomass), reducing waste in manufacturing processes and minimizing transportation-related carbon emissions.

- Accelerated Bio-material Discovery: Leveraging AI and generative chemistry platforms to simulate molecular structures and test the feasibility and barrier properties of novel bio-plastics (e.g., PHA variations), reducing R&D timelines for next-generation eco-friendly materials.

- Smart Reusable Ecosystems: Integrating AI-driven tracking technologies (IoT and sensors) into reusable bottle programs to monitor usage, optimize cleaning cycles, predict maintenance needs, and manage collection points efficiently, thereby increasing the longevity and viability of circular packaging models.

- Optimized Manufacturing Efficiency: Employing machine learning in bottling lines to predict equipment failures, adjust temperature and pressure for optimal material processing (especially sensitive bio-plastics), and reduce production scrap, contributing to overall resource efficiency.

DRO & Impact Forces Of Eco-Friendly Bottles Market

The core dynamics of the Eco-Friendly Bottles Market are shaped by a complex interplay of stringent environmental regulations (Drivers), high production costs associated with novel materials (Restraints), immense potential for innovation in advanced recycling (Opportunities), and the overarching pressure of shifting consumer behavior (Impact Forces). The accelerating global commitment to achieving net-zero emission targets necessitates a radical overhaul of traditional packaging, positioning sustainable bottles as a mandatory component rather than a niche preference. This shift is highly sensitive to external factors such as fluctuating oil prices (impacting virgin plastic competitiveness) and the pace of investment in dedicated recycling infrastructure.

Drivers: The dominant driver remains the escalating global concern over plastic pollution, particularly marine debris, which compels both regulatory bodies and corporate entities to seek immediate sustainable alternatives. This societal pressure is formalized through policies such as Extended Producer Responsibility (EPR) schemes, plastic taxes, and outright bans on specific single-use items in numerous jurisdictions across Europe and North America. Secondly, technological advancements in material science, particularly the ability to produce food-grade recycled content (rPET and rHDPE) at scale, significantly enhances the economic viability and material performance of eco-friendly bottles, making them suitable for high-demand applications like carbonated beverages and dairy products. Furthermore, corporate sustainability goals, where multinational corporations commit to 100% recyclable or reusable packaging by specific deadlines, create mandatory market demand for these specialized solutions.

Restraints: Significant restraints include the current higher cost and lower availability of high-quality sustainable raw materials compared to inexpensive, readily available virgin plastics derived from fossil fuels. Although prices are narrowing, the capital investment required for establishing dedicated chemical recycling plants or large-scale bio-plastic fermentation facilities remains substantial, posing a financial barrier, particularly for smaller market players. Another critical restraint is the lack of standardized, mature recycling and composting infrastructure globally. Many bio-degradable or compostable plastics require industrial composting facilities, which are scarce, often leading to these materials ending up in landfills and failing to deliver on their environmental promise, which subsequently erodes consumer trust and slows widespread adoption.

Opportunities: The primary opportunity lies in the development and commercialization of next-generation packaging technologies, specifically chemical recycling (depolymerization) which can process mixed, contaminated plastic waste back into virgin-quality feedstocks, drastically increasing the supply of rPET and rPE suitable for bottles. Furthermore, the burgeoning market for smart and active packaging, integrating features like antimicrobial properties or temperature sensors using sustainable materials, presents high-value opportunities in the pharmaceutical and high-end beverage sectors. The emerging economies of APAC and Latin America offer untapped growth potential, provided localized, cost-effective sustainable solutions can be deployed, capitalizing on increasing consumer purchasing power and governmental initiatives aimed at waste modernization.

Impact Forces: Consumer purchasing power is the strongest impact force, as studies consistently show a willingness to pay a premium for certified sustainable products, although this willingness is sensitive to economic downturns. Regulatory impact forces compel rapid corporate compliance and investment, fundamentally reshaping packaging design. Competitive dynamics, particularly the race among large bottling companies to secure exclusive contracts for high-quality recycled input materials, drive vertical integration and strategic mergers. Finally, the environmental impact forces, evidenced by measurable climate change effects and rising pollution metrics, provide non-negotiable external pressure for continued innovation and widespread adoption of eco-friendly packaging solutions.

Segmentation Analysis

The Eco-Friendly Bottles Market is meticulously segmented based on material type, application, and distribution channel, reflecting the diverse needs and technical requirements across various end-user industries. The Material Type segment is particularly dynamic, undergoing rapid shifts from traditional rPET towards more advanced materials like bio-based plastics (PLA, PHA) and durable, non-plastic alternatives such as stainless steel and reusable glass, driven by longevity and consumer perception of safety. Application segmentation highlights the dominance of the Beverage sector, which demands high-volume, high-performance barriers, contrasting with the smaller, high-value personal care and pharmaceutical segments that prioritize aesthetic appeal and material inertness. Geographic segmentation underscores the regulatory influence, with Europe and North America focusing heavily on reusable models, while APAC concentrates on high-volume, lower-cost recyclable solutions.

- By Material:

- Glass

- Metal (Stainless Steel, Aluminum)

- Recycled PET (rPET)

- Bio-degradable/Compostable Plastics (PLA, PHA, Starch-based)

- Plant-based materials (Sugarcane, Bamboo Fiber)

- By Application:

- Beverages (Water, Carbonated Soft Drinks, Juices, Dairy)

- Food Products (Condiments, Sauces, Oils)

- Personal Care and Cosmetics

- Pharmaceuticals and Nutraceuticals

- By Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales (B2B)

- By Usage:

- Reusable

- Single-Use (Recyclable/Compostable)

Value Chain Analysis For Eco-Friendly Bottles Market

The value chain for eco-friendly bottles starts with sustainable raw material sourcing, fundamentally differentiating it from conventional packaging. The upstream analysis focuses heavily on securing reliable, high-quality feedstock, which includes processing post-consumer waste (for rPET and recycled aluminum) or cultivating and processing biomass (for PLA and PHA). Key challenges at this stage involve ensuring the purity and consistent supply of recycled materials, requiring significant investment in advanced sorting and cleaning technologies. Suppliers of bio-resins and specialized recycled metal alloys hold substantial bargaining power due to the technical specifications required for bottling applications. Strategic partnerships or vertical integration into recycling infrastructure become critical for manufacturers seeking to stabilize material costs and secure supply.

The midstream involves the core manufacturing processes: polymerization (for recycled or bio-plastics), glass blowing, or metal forming. This stage requires specialized machinery and energy-efficient operations to maintain the "eco-friendly" integrity of the product. Manufacturers of eco-friendly bottles must invest in blow-molding and injection machinery capable of handling novel materials, which often have different thermal and tensile properties than virgin plastics. The focus is on minimizing scrap rates, optimizing lightweighting techniques to reduce material usage, and achieving necessary barrier performance for product protection. Quality control and certifications (e.g., FSC for wood-based components, food-grade safety standards) are essential elements adding value at this stage.

Downstream analysis involves distribution and end-of-life management, which are crucial for the overall sustainability claim. Distribution channels are bifurcated between B2C channels (online retail and supermarkets for reusable bottles) and B2B channels (direct sales to major FMCG companies for single-use recyclable options). The final stage, the reverse logistics chain (collection, sorting, and recycling), determines the success of the circular economy model. Direct distribution minimizes handling and energy use, while the efficiency of national and local deposit return schemes (DRS) and municipal recycling programs directly influences the recovery rate of the bottles, completing the circular flow and providing essential feedstock back to the upstream suppliers.

Eco-Friendly Bottles Market Potential Customers

Potential customers for eco-friendly bottles are broadly categorized across sectors that require robust, safe, and environmentally compliant liquid containment solutions, with strong emphasis placed on brands committed to achieving their corporate sustainability mandates. The primary buyers include multinational beverage conglomerates, who are under intense public and regulatory scrutiny to eliminate plastic waste and increase their use of recycled content. These companies require bottles in high volumes and depend on suppliers who can guarantee material safety, consistent barrier properties, and reliable large-scale supply chains, often preferring rPET and aluminum due to existing infrastructure compatibility.

A second major customer segment comprises the high-growth niche markets of personal care, cosmetics, and premium wellness brands. These buyers prioritize aesthetic value, brand alignment with sustainability, and often favor premium materials such as high-end reusable glass, bamboo-derived packaging, or novel bio-plastics (PHA). For this segment, the eco-friendly bottle is part of the brand storytelling, emphasizing non-toxicity and luxury presentation. Smaller, independent consumer brands often drive innovation, utilizing less common materials and embracing compostable solutions to differentiate themselves in highly competitive retail environments.

The third substantial segment is the pharmaceutical and nutraceutical industry, where buyers demand extremely high standards of material purity, chemical inertness, and precise barrier functionality, particularly against oxygen and moisture. While slower to adopt complex bio-plastics due to strict regulatory hurdles, this sector is increasingly adopting pharmaceutical-grade recycled HDPE and specialized glass packaging, especially for over-the-counter and nutritional supplements, driven by a desire to align corporate social responsibility with patient-safety requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.8 Billion |

| Market Forecast in 2033 | USD 18.5 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor, Ball Corporation, SIG Combibloc, Gerresheimer AG, Vetropack Holding, SKS Bottle & Packaging, Berry Global, Alpla Werke, Nalgene, Hydro Flask (Helen of Troy), Klean Kanteen, S'well, Dopper, BKR, LifeFactory, One Green Bottle, Soma, RPC Group, Resilux NV, Guala Closures. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eco-Friendly Bottles Market Key Technology Landscape

The technology landscape for the Eco-Friendly Bottles Market is characterized by intense innovation across material processing, barrier enhancement, and end-of-life solutions, moving beyond mechanical recycling limitations. The most transformative technology is advanced (chemical) recycling, which employs methods such as pyrolysis, gasification, and depolymerization to break down mixed or contaminated plastic waste into their original monomers or base chemicals. This output is identical to virgin fossil fuels, allowing for the creation of high-quality, food-grade rPET and other polymers that meet stringent regulatory requirements, thereby dramatically expanding the available supply of recycled content suitable for bottling applications that mechanical recycling cannot achieve due to material degradation.

A second crucial area involves the optimization of bio-plastic production. This includes industrial fermentation technologies for producing Polyhydroxyalkanoates (PHAs), which are naturally occurring polyesters often considered superior to PLA due to their improved marine biodegradability. Research is focused on reducing the high cost of microbial fermentation, increasing yield, and engineering PHA variants with enhanced thermal stability and barrier properties. Concurrently, technological advancements in barrier coatings—such as silicon oxide (SiOx) or plasma coatings applied to rPET or glass—are vital. These ultra-thin layers improve the oxygen and moisture resistance of the bottles, extending shelf life and allowing sustainable materials to be used for sensitive products like beer and carbonated soft drinks, segments traditionally dominated by multi-layer virgin materials.

Finally, the development of lightweighting technologies for glass and aluminum bottles is a continuous focus area, aiming to reduce the energy required for transportation and manufacturing without compromising structural integrity. For reusable systems, the integration of advanced tracking technology, such as RFID or digital watermarking, is essential for implementing efficient reverse logistics and ensuring bottles meet defined usage cycles before retirement. These smart technologies provide transparency and facilitate the scaling of deposit return schemes and container washing facilities, which are vital components of successful circular models.

Regional Highlights

The global Eco-Friendly Bottles Market exhibits significant regional disparities in terms of maturity, regulatory pressure, and adoption rates, largely dictated by local environmental policies and existing waste management infrastructure. Europe and North America currently dominate the market value due to stringent regulatory environments and high consumer awareness, whereas the Asia Pacific region presents the most significant growth trajectory fueled by urbanization and government investment in infrastructure.

- Europe: The leading market region, driven by the EU Single-Use Plastics Directive and ambitious recycling targets. European markets show high adoption of reusable systems (driven by countries like Germany and Scandinavia) and mandates requiring high percentages of recycled content in new packaging. Innovations in chemical recycling and industrial composting are heavily concentrated here, often supported by public-private partnerships focusing on closed-loop systems.

- North America: Characterized by state-level variability in regulation, the U.S. market sees robust demand from major beverage brands adhering to global sustainability commitments. High consumer uptake of premium reusable bottles (stainless steel and glass) is prominent. The primary focus is on expanding rPET supply through improved collection systems and substantial investments in bottle-to-bottle recycling facilities to meet ambitious targets set by state legislations like California’s plastic laws.

- Asia Pacific (APAC): The fastest-growing market, spurred by massive volumes of consumption, accelerating urbanization, and increasing government efforts in countries such as China, Japan, and India to manage overwhelming plastic waste streams. While focused historically on improving basic recycling rates, the region is now emerging as a major manufacturing hub for bio-based plastics (like PLA) and is rapidly adopting aluminum and rPET solutions to mitigate environmental impact.

- Latin America (LATAM): This region is characterized by nascent but rapidly developing regulatory frameworks, particularly in large economies like Brazil and Mexico. Market growth is driven by local initiatives and the entry of global players demanding sustainable packaging. Cost-effectiveness is a major factor, favoring high-volume rPET solutions over premium reusable or complex bio-plastic alternatives.

- Middle East and Africa (MEA): Represents an emerging market with varying degrees of adoption. The Gulf Cooperation Council (GCC) countries show increasing demand for sustainable luxury packaging (glass, aluminum) due to high disposable incomes, while parts of Africa are implementing strict bans on single-use plastics, driving the mandatory shift towards locally sourced, eco-friendly alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eco-Friendly Bottles Market.- Amcor

- Ball Corporation

- SIG Combibloc

- Gerresheimer AG

- Vetropack Holding

- SKS Bottle & Packaging

- Berry Global (formerly RPC Group)

- Alpla Werke Alwin Lehner GmbH & Co KG

- Nalgene (Thermo Fisher Scientific)

- Hydro Flask (Helen of Troy)

- Klean Kanteen

- S'well

- Dopper

- BKR

- LifeFactory

- One Green Bottle

- Soma

- Resilux NV

- Guala Closures

- Corvaglia Group

Frequently Asked Questions

Analyze common user questions about the Eco-Friendly Bottles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material driving growth in the eco-friendly bottles sector?

Recycled PET (rPET) is the primary material driving volume growth, particularly in the beverage industry, due to its cost-effectiveness, established recycling infrastructure, and regulatory pressure demanding increased recycled content. However, reusable materials like stainless steel and durable glass lead the high-value segment, offering superior longevity and perceived consumer safety.

How do governments influence the adoption of eco-friendly bottles?

Governments influence adoption through key regulatory mechanisms, including implementing bans on single-use plastics, establishing mandatory minimum recycled content requirements for packaging, instituting plastic taxes, and funding Extended Producer Responsibility (EPR) schemes that incentivize manufacturers to use easily recyclable or reusable bottle designs.

What are the main challenges facing the mass adoption of bio-degradable bottles?

The main challenges are the lack of widespread industrial composting infrastructure required for proper degradation of many bio-plastics (like PLA), the generally higher production cost compared to traditional plastics, and ongoing technical limitations regarding material performance parity, specifically in terms of barrier properties required for long shelf life.

What role does chemical recycling play in the future of sustainable bottling?

Chemical recycling is critical as it processes mixed or contaminated plastic waste that mechanical recycling cannot handle, yielding virgin-quality monomers. This technology significantly increases the supply of high-purity, food-grade recycled content necessary to meet the high demand from major beverage brands and regulatory mandates.

Which region currently leads the market in terms of regulatory maturity and sustainable innovation?

Europe currently leads the market, propelled by the European Union’s comprehensive Plastic Strategy and specific directives targeting plastic waste reduction. This regulatory environment fosters high investment in advanced recycling, circular economy models, and extensive reusable bottle systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager