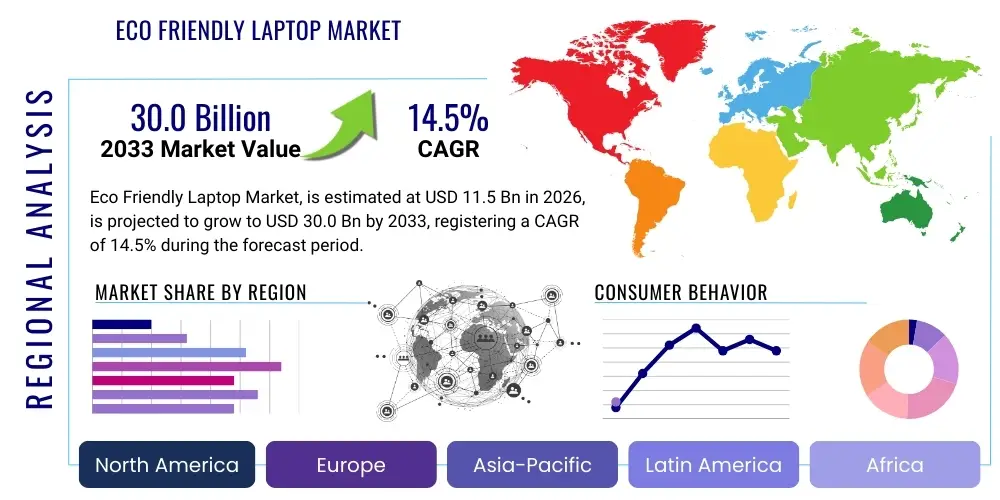

Eco Friendly Laptop Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437551 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Eco Friendly Laptop Market Size

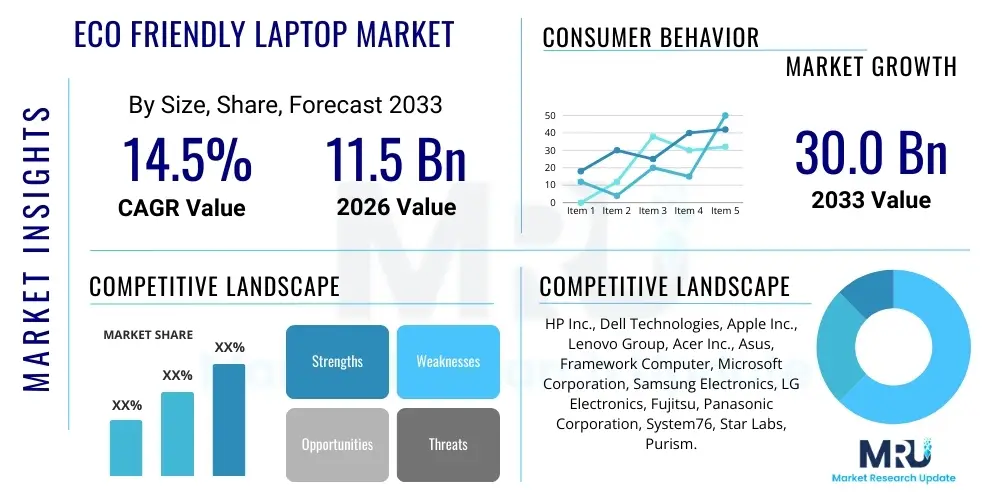

The Eco Friendly Laptop Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $11.5 Billion USD in 2026 and is projected to reach $30.0 Billion USD by the end of the forecast period in 2033.

Eco Friendly Laptop Market introduction

The Eco Friendly Laptop Market encompasses computing devices designed, manufactured, and utilized with a paramount focus on minimizing environmental impact throughout their lifecycle—from raw material extraction to end-of-life disposal. These products prioritize energy efficiency, utilize post-consumer recycled (PCR) plastics and sustainably sourced metals, and incorporate modular designs that facilitate repair, upgrade, and eventual recycling, aligning closely with principles of the circular economy. This specialized segment is fundamentally driven by mounting global regulatory pressure, particularly in the European Union (EU) regarding Ecodesign directives, and increasing consumer and corporate demand for products that support Environmental, Social, and Governance (ESG) initiatives. Major applications span commercial enterprises seeking to reduce Scope 3 emissions, educational institutions integrating sustainability into their procurement, and environmentally conscious consumers prioritizing product longevity and low Total Cost of Ownership (TCO).

Key design attributes for eco friendly laptops include enhanced durability, the use of low-power consumption components such as high-efficiency processors and displays, and the complete elimination or significant reduction of hazardous substances (RoHS compliance, beyond standard). Furthermore, packaging materials are overwhelmingly derived from recycled or sustainably certified sources, often replacing traditional plastic foams with molded pulp or bamboo fiber. The overall benefit proposition extends beyond mere compliance, offering businesses reduced operational costs through lower energy consumption and enhanced brand reputation associated with clear sustainability leadership.

The driving factors accelerating this market include strong governmental incentives and mandates promoting e-waste reduction and extended producer responsibility (EPR) schemes. Furthermore, rapid technological advancements in bio-based and recyclable materials, coupled with innovative manufacturing processes such as closed-loop recycling systems pioneered by major Original Equipment Manufacturers (OEMs), are making sustainable production scalable and economically viable. The confluence of corporate mandates requiring verifiable sustainability claims and maturing technology platforms ensures robust market expansion in the coming years.

Eco Friendly Laptop Market Executive Summary

The Eco Friendly Laptop Market is experiencing rapid expansion, fueled primarily by significant global business trends emphasizing corporate social responsibility and verifiable ESG metrics. Corporations are increasingly adopting "green procurement" policies, driving large-volume orders for sustainable devices to meet stringent internal sustainability goals and external regulatory reporting requirements. Key market trends include the shift toward modular and repairable designs, epitomized by companies offering easily replaceable components, and the growing incorporation of blockchain technology to ensure supply chain traceability of recycled and ethically sourced materials. Technological innovation in battery chemistry focused on longer lifecycles and enhanced recyclability also marks a critical trend impacting product longevity and material circularity.

Regionally, Europe stands as the dominant force, largely due to proactive and mandatory legislation such as the EU Green Deal, Ecodesign regulation for servers and data storage products (which influences component design), and forthcoming Right to Repair directives, creating a robust framework for sustainable hardware adoption. Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by large-scale manufacturing shifts toward sustainable practices in countries like China and Taiwan, coupled with rapidly expanding middle classes prioritizing environmental considerations in purchasing decisions. North America, while having strong consumer awareness, is primarily driven by corporate voluntary sustainability commitments, particularly among technology and finance sectors.

Segment-wise, the commercial application segment dominates the market share due to bulk procurement and the necessity for certified sustainable devices that contribute positively to corporate environmental reporting. In terms of material segmentation, post-consumer recycled plastics currently hold the largest share, but bio-based polymers and innovative closed-loop metal recycling techniques are gaining rapid traction. The proliferation of specialized software tools that monitor energy usage and device health to maximize lifespan further enhances the value proposition across all market segments, solidifying the market’s trajectory toward mainstream adoption.

AI Impact Analysis on Eco Friendly Laptop Market

User inquiries regarding AI's influence on the Eco Friendly Laptop Market primarily center on how artificial intelligence can optimize resource efficiency, improve material selection, and enhance the longevity and reparability of devices. Key concerns revolve around whether AI-powered devices, while having efficient software, compensate for the increased computing power and cooling needs, potentially negating energy savings. Users seek assurance on the role of AI in supply chain transparency—specifically, ensuring that recycled and sustainable materials are tracked effectively from source to finished product. The overarching expectation is that AI will be a critical tool for "Design for Sustainability," identifying material combinations that maximize recyclability while maintaining performance and structural integrity, and optimizing power management to reduce the overall carbon footprint of the device during its operational phase.

- AI algorithms optimize energy consumption settings based on user behavior and application load, significantly extending battery life and reducing power consumption during operation.

- AI-driven predictive maintenance models analyze component health data to flag potential failures early, enabling timely repair and component replacement, thus maximizing device lifespan (Design for Longevity).

- Machine learning models enhance supply chain traceability by analyzing vast datasets regarding material sourcing, ensuring verifiable certification and ethical provenance of recycled and raw materials (e.g., conflict-free minerals).

- AI assists product designers in performing complex Life Cycle Assessments (LCA) instantaneously, optimizing Bill of Materials (BOM) to maximize the percentage of PCR content and modularity.

- In manufacturing, AI optimizes production yields and minimizes waste generation by precisely controlling complex processes involving bio-plastics and recycled alloys.

- AI facilitates the sorting and identification of diverse e-waste streams, dramatically improving the efficiency and purity of materials recovered during the end-of-life recycling phase.

DRO & Impact Forces Of Eco Friendly Laptop Market

The dynamics of the Eco Friendly Laptop Market are predominantly governed by robust drivers, counterbalanced by inherent restraints related to cost and supply chain transition, all of which create significant long-term opportunities. The primary drivers include sweeping legislative actions, especially in mature markets like the EU and Japan, which mandate higher energy efficiency standards and enforceable repairability metrics. Additionally, the increasing financialization of ESG performance means that corporate investment funds and shareholders are actively pushing large enterprises to procure sustainable IT assets, translating sustainability from a peripheral goal into a core procurement requirement. These regulatory and financial pressures collectively act as the major propelling forces.

However, the market faces notable restraints, primarily the higher initial procurement cost associated with eco friendly models compared to conventional counterparts. This cost differential stems from investments in certified recycled materials, specialized manufacturing processes that prioritize low energy use, and the complexity involved in establishing verifiable, fully traceable, and ethical supply chains. Furthermore, standardizing modular components across a highly competitive and fragmented hardware landscape presents a technical and logistical challenge, slowing the immediate adoption rate in price-sensitive emerging markets.

The resulting opportunities are substantial, centered around service innovation and material science breakthroughs. The shift toward Device-as-a-Service (DaaS) and subscription models allows OEMs to retain ownership of hardware, enabling true closed-loop recycling and minimizing upfront costs for consumers and businesses. Furthermore, ongoing research into advanced bio-based polymers, fungi-based packaging, and chemical recycling methods that restore plastic quality to virgin grade promise to overcome current material limitations and significantly enhance the market's long-term sustainability trajectory, ensuring strong future growth.

Segmentation Analysis

The Eco Friendly Laptop Market is segmented across several critical dimensions, providing a comprehensive view of adoption patterns across various user profiles, product specifications, and material compositions. Analysis reveals that segmentation based on application and materials is particularly crucial for market players developing targeted sustainable product strategies. While the commercial segment demands specific enterprise-grade security and longevity certifications (such as EPEAT Gold), the residential segment is driven more by perceived environmental impact and price points. Material segmentation highlights the shift from conventional plastics to advanced, bio-based, and highly recycled alternatives, reflecting technological maturity in sustainable material engineering.

- By Product Type:

- Eco Friendly Laptops (Standard clamshell design)

- Eco Friendly Notebooks (Slimmer, ultraportable designs)

- Eco Friendly Convertibles/2-in-1s

- By Application/End-User:

- Commercial/Enterprise (Corporate bulk purchasing, DaaS models)

- Residential/Personal (Individual consumer purchasing)

- Educational Institutions (K-12 and Higher Education)

- Government and Public Sector

- By Material Used:

- Post-Consumer Recycled (PCR) Plastics (Housing, keycaps)

- Recycled Metals (Aluminum, Magnesium Alloys)

- Bio-based Polymers and Composites (e.g., derived from corn or plant waste)

- By Certification Standard:

- EPEAT Certified (Bronze, Silver, Gold)

- Energy Star Certified

- TCO Certified

Value Chain Analysis For Eco Friendly Laptop Market

The value chain for eco friendly laptops distinguishes itself from conventional electronics manufacturing through rigorous upstream sourcing and optimized downstream operations. Upstream analysis focuses intensely on ethical and sustainable material procurement, prioritizing suppliers who provide verifiable PCR plastics, certified conflict-free minerals, and low-carbon-footprint components. This involves comprehensive auditing to ensure materials meet high environmental and social standards, adding complexity but guaranteeing the product's foundational sustainability claims. Manufacturers invest heavily in due diligence processes, often leveraging third-party certifications like EPEAT and TCO, to vet their tier-one and tier-two suppliers. The integration of advanced tracking technologies, such as blockchain, is increasingly common in this phase to maintain immutable records of material origin and processing.

Midstream activities involve sustainable manufacturing practices, characterized by closed-loop water systems, significant energy consumption reduction in assembly plants, and 'Design for Disassembly' (DfD) protocols on the production line. This phase mandates stringent waste management, minimizing scrap and prioritizing the use of renewable energy sources for assembly. The modular architecture inherent in eco friendly laptops—designed for easy repair and component separation—fundamentally dictates manufacturing precision and the ability to use standardized, non-proprietary fastening methods. This contrasts sharply with traditional manufacturing focused purely on high volume and low assembly cost.

The downstream distribution channel sees a significant preference for direct sales and DaaS models, which allows OEMs to maintain control over the product's entire lifecycle. Indirect channels, such as authorized resellers and large retailers, must increasingly demonstrate competency in handling trade-ins, facilitating warranty repairs, and participating in manufacturer-led take-back programs. Crucially, the end-of-life phase is integrated directly into the value chain through effective reverse logistics, ensuring products are efficiently collected, disassembled, and recycled, thereby feeding materials back into the upstream supply chain to close the loop. This circular mechanism is paramount to the eco friendly market’s success.

Eco Friendly Laptop Market Potential Customers

The primary end-users and potential buyers in the Eco Friendly Laptop Market are diverse but share a common imperative for sustainability, compliance, and long-term cost efficiency. Corporate enterprises, particularly those in regulated sectors like finance, technology, and pharmaceuticals, represent the largest customer segment due to their need to comply with stringent ESG reporting standards and minimize Scope 3 emissions stemming from procured assets. These customers prioritize high EPEAT or TCO certifications, advanced security features, and availability of robust DaaS contracts that simplify asset management and ensure guaranteed recycling.

A second major customer demographic includes educational institutions and governmental bodies, which are increasingly subject to public mandates requiring preferential purchasing of environmentally sound products. These segments look for durability, reparability to reduce fleet replacement cycles, and competitive pricing based on the low TCO offered by energy-efficient devices. The focus here is on fleet management and standardization across thousands of deployed units, making reliability and repair documentation key purchasing criteria.

Finally, environmentally conscious residential consumers represent a rapidly expanding segment. These buyers are often younger, digitally native, and willing to pay a premium for verifiable sustainability claims, ethical sourcing, and modular designs that promise longevity and freedom from proprietary lock-in. Their purchasing decisions are heavily influenced by transparent brand communication regarding carbon footprint and end-of-life options, signaling a fundamental shift in consumer values driving market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $11.5 Billion USD |

| Market Forecast in 2033 | $30.0 Billion USD |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HP Inc., Dell Technologies, Apple Inc., Lenovo Group, Acer Inc., Asus, Framework Computer, Microsoft Corporation, Samsung Electronics, LG Electronics, Fujitsu, Panasonic Corporation, System76, Star Labs, Purism. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eco Friendly Laptop Market Key Technology Landscape

The technology landscape supporting the Eco Friendly Laptop Market is defined by innovations centered around reducing material consumption, extending product utility, and minimizing energy footprints. A foundational technological shift involves the transition to truly modular and repairable architectures, exemplified by designs where components like RAM, storage, battery, and even ports are user-replaceable using standard tools. This "Lego-like" design significantly extends the effective economic life of the device, directly addressing the planned obsolescence model prevalent in traditional consumer electronics. Furthermore, there is a strong emphasis on integrating low-power components, specifically ultra-low voltage processors optimized for efficiency rather than peak performance, and utilizing advanced display technologies that minimize backlighting power draw while maintaining visual quality.

Material science innovation is equally critical, focusing on substituting virgin plastics and metals with high-quality, verified post-consumer recycled (PCR) materials and advanced bio-based polymers derived from sustainable feedstocks. This requires breakthroughs in material purity and durability to ensure the recycled content meets the structural and aesthetic requirements of premium computing devices. Beyond the hardware, the integration of intelligent, adaptive power management firmware and operating system features plays a crucial technological role. These systems dynamically adjust power distribution based on workload, ambient temperature, and user input, ensuring the laptop operates at its highest energy efficiency point throughout its usage cycle, contributing to lower TCO and reduced carbon footprint.

Finally, technology related to the end-of-life infrastructure—reverse logistics platforms, automated disassembly systems, and chemical recycling plants—is rapidly maturing. These technologies enable manufacturers to efficiently recapture high-value materials. The implementation of digital product passports (DPPs), leveraging technologies like NFC and blockchain, is emerging as a critical tool, providing consumers and recyclers with instantaneous access to material composition, repair instructions, and recycling pathways, thereby democratizing the repair process and ensuring proper material handling at end-of-life.

Regional Highlights

- Europe: The undeniable leader in the Eco Friendly Laptop Market, largely due to mandatory regulatory frameworks, including the Ecodesign requirements for ICT products and forthcoming Right to Repair legislation. European consumers demonstrate high environmental awareness and willingness to pay a premium for certified sustainable products (EPEAT, TCO). The region benefits from robust reverse logistics and governmental incentives promoting circular economy initiatives, making it the benchmark for sustainable IT procurement, especially within government and large corporate sectors.

- North America (U.S. and Canada): Characterized by strong corporate voluntary adoption, driven by internal ESG commitments and investor pressure rather than sweeping federal mandates. The U.S. commercial sector is a massive procurement engine for eco friendly models, utilizing DaaS contracts extensively. State-level legislation (e.g., California’s e-waste laws) and strong presence of major technology OEMs pushing sustainability agendas contribute significantly to market growth.

- Asia Pacific (APAC): Expected to register the highest CAGR due to rapid urbanization, increasing disposable incomes, and the dual role of the region as both a massive consumer base and the global manufacturing hub. Countries like Japan and South Korea have mature sustainability policies, while emerging economies like India and China are rapidly scaling up domestic recycling infrastructure and implementing stricter environmental regulations on electronics manufacturing, driving material innovation and localized demand.

- Latin America (LATAM): A nascent but growing market, primarily focused on adopting energy-efficient devices to reduce electricity costs, often prioritized over material sustainability. Growth is driven by multinational corporations implementing global ESG standards locally and increasing awareness campaigns regarding e-waste hazards. Regulatory alignment across the region is fragmented but accelerating, particularly in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Currently the smallest market share, characterized by infrastructure challenges, particularly related to e-waste management and recycling capabilities. Demand growth is concentrated in the Gulf Cooperation Council (GCC) countries, driven by large-scale government digitization projects and smart city initiatives that incorporate sustainability standards into procurement frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eco Friendly Laptop Market.- HP Inc.

- Dell Technologies

- Apple Inc.

- Lenovo Group

- Acer Inc.

- Asus

- Framework Computer

- Microsoft Corporation

- Samsung Electronics

- LG Electronics

- Fujitsu

- Panasonic Corporation

- System76

- Star Labs

- Purism

- Razer Inc.

- Toshiba (Dynabook)

- Gigabyte Technology

- Google (Chromebook initiatives)

- NVIDIA Corporation (Component optimization)

Frequently Asked Questions

Analyze common user questions about the Eco Friendly Laptop market and generate a concise list of summarized FAQs reflecting key topics and concerns.What criteria define an Eco Friendly Laptop?

Eco friendly laptops are defined by a minimized environmental footprint across their entire lifecycle. Key criteria include the use of Post-Consumer Recycled (PCR) materials, high energy efficiency (e.g., Energy Star certification), minimal hazardous substances, sustainable packaging, modular designs that enable repair and upgrades, and participation in established take-back or closed-loop recycling programs.

Are eco friendly laptops more expensive than standard models?

The initial purchase price of eco friendly laptops is often slightly higher due to the costs associated with certified recycled materials, specialized sustainable manufacturing, and robust certifications (EPEAT Gold). However, their Total Cost of Ownership (TCO) is generally lower over the product's lifespan due to superior energy efficiency, longer durability, and the ease and affordability of repair and component upgrades.

How does modular design benefit sustainability in the laptop market?

Modular design significantly boosts sustainability by promoting longevity. By allowing users to easily replace or upgrade specific components—such as RAM, storage, or ports—the need to replace the entire device is eliminated. This reduces e-waste, decreases the demand for virgin raw materials, and empowers consumers with the "Right to Repair," extending the asset's useful life considerably.

What role do certifications like EPEAT and TCO play in this market?

Certifications like EPEAT (Electronic Product Environmental Assessment Tool) and TCO Certified provide independent, verifiable assurance of a laptop's environmental performance. These certifications are crucial for large-scale corporate and government procurement, acting as standardized proof that the product meets stringent criteria for material composition, energy efficiency, lifecycle management, and supply chain social responsibility.

How are manufacturers addressing e-waste associated with eco friendly laptops?

Manufacturers address e-waste through mandatory, formalized take-back schemes, often integrated into Device-as-a-Service (DaaS) contracts or standard sales. They utilize Design for Disassembly (DfD) principles to ensure rapid and efficient material separation, and they are increasingly investing in chemical recycling technologies to recover high-purity plastics and metals for direct reuse in new products, thus closing the material loop.

Is performance compromised when using recycled materials in laptops?

Modern material science has largely overcome performance compromises. OEMs utilize advanced Post-Consumer Recycled (PCR) plastics that are engineered to meet or exceed the structural integrity and durability of virgin polymers. Similarly, recycled metal alloys undergo rigorous refinement processes, ensuring that the final material maintains the necessary thermal and structural properties for high-performance computing devices without sacrificing quality.

What is the significance of "Bio-based Polymers" in sustainable laptop manufacturing?

Bio-based polymers, derived from renewable sources like corn starch, wood pulp, or agricultural waste, are critical for reducing reliance on fossil-fuel-based plastics. Their significance lies in lowering the carbon footprint during material production and offering an alternative that is biodegradable or more easily recyclable than complex traditional plastics, although their adoption is still scaling up across the market.

How do global regulations, specifically the EU's, impact market growth outside Europe?

Global regulations, particularly the EU’s Ecodesign and Right to Repair directives, establish a de facto global standard. Since major OEMs produce singular global SKUs (Stock Keeping Units) to simplify manufacturing and inventory, products designed to meet the rigorous EU standards automatically meet or exceed requirements in other regions. This legislative pressure in Europe effectively forces sustainable innovation worldwide.

What are the primary energy saving features in an eco friendly laptop?

Primary energy-saving features include the use of low-power processors (e.g., specific Intel U-series or ARM architectures), high-efficiency OLED or mini-LED displays, solid-state drives (SSDs) that consume less power than traditional HDDs, and sophisticated firmware optimized for adaptive power management. These features collectively reduce electricity consumption during both active use and standby modes.

What challenges exist in establishing a reliable circular supply chain for eco friendly components?

Key challenges include maintaining the purity and consistent quality of recovered Post-Consumer Recycled (PCR) materials, overcoming the logistical complexity and cost of reverse logistics (collecting used devices), and ensuring full supply chain traceability against ethical sourcing standards (e.g., conflict minerals). Standardization of modular component sizes across different brands also remains a significant hurdle.

How is AI being utilized to enhance the sustainable lifecycle of laptops?

AI is utilized in optimizing the design process (Design for Disassembly), performing instantaneous Life Cycle Assessments (LCA) to choose the best materials, optimizing power consumption through predictive user behavior analysis, and improving the efficiency of e-waste sorting during the end-of-life recycling phase by accurately identifying material composition.

Do warranties differ between eco friendly and standard laptops?

In many cases, warranties on eco friendly laptops are standard, but the service agreements (especially DaaS) often include clauses that guarantee repairability and extended support, reflecting the manufacturer's confidence in the device's durability and modular construction. Some manufacturers even offer explicit longevity guarantees tied to repair service availability for a predetermined number of years.

What specific materials are prioritized for recycling in these devices?

Manufacturers prioritize the recycling of high-value, high-impact materials such as rare earth magnets, precious metals (gold, silver, palladium), copper wiring, and highly pure aluminum and magnesium alloys used in casings. Post-consumer recycled plastics that are structurally integral to the chassis are also a critical focus area for closed-loop recycling.

How do consumers verify a laptop's sustainability claims?

Consumers can verify claims primarily through third-party certifications (EPEAT Gold, TCO Certified). They should also look for clear documentation regarding the percentage of PCR content, published Life Cycle Assessment (LCA) data, and transparent information regarding the manufacturer's energy consumption and carbon neutrality goals, often detailed in the company's annual ESG reports.

What market potential does the Device-as-a-Service (DaaS) model unlock for this segment?

DaaS transforms the market by allowing manufacturers to retain ownership of the hardware. This facilitates true circularity because the OEM is incentivized to maximize the device's lifespan (through repair and upgrades) and ensure mandatory, effective recovery and recycling at the end of the contract, effectively institutionalizing the closed-loop system for commercial clients.

How are battery lifecycles being addressed in eco friendly designs?

Batteries are addressed through two key strategies: design and chemistry. Designs often make batteries easily replaceable, preventing device disposal simply due to battery degradation. Chemically, manufacturers are focusing on longer-lasting cells and materials that are less toxic and more easily recoverable through specialized recycling processes, minimizing lithium-ion waste impact.

Does the packaging of eco friendly laptops also adhere to sustainability standards?

Yes, packaging is a critical component of the eco friendly claim. Packaging standards typically mandate the elimination of EPS foam and non-recyclable plastics, opting instead for 100% recycled or certified sustainable paper/cardboard, molded pulp, bamboo fiber, or mushroom-based packaging, often printed with soy-based or water-based inks.

What are the regulatory trends that are expected to shape the market by 2033?

By 2033, key regulatory trends include mandatory Digital Product Passports (DPPs) across major markets, stricter enforcement of Minimum Energy Performance Standards (MEPS), expansion of Extended Producer Responsibility (EPR) schemes covering full recycling costs, and globally harmonized mandatory minimum repairability scores for electronic devices.

Are smaller component manufacturers also focusing on eco friendly practices?

Yes, driven by demand from large OEMs, smaller component suppliers (e.g., for chipsets, cooling systems, or connectors) are under increasing pressure to meet sustainable sourcing quotas, reduce their own manufacturing carbon footprint, and provide components that adhere to Design for Disassembly (DfD) principles, ensuring that sustainability is integrated deep into the supply chain.

How does the Eco Friendly Laptop Market contribute to the broader Circular Economy?

The market is a foundational pillar of the Circular Economy by shifting the industry paradigm from a linear "take-make-dispose" model to a restorative, closed-loop system. It achieves this by prioritizing resource retention through repair, reuse, refurbishment, and high-quality material recycling, minimizing the extraction of new resources and maximizing asset utilization.

What is the primary factor driving APAC's high CAGR in this market?

APAC's high CAGR is driven by a combination of rapid industrial transition in major manufacturing centers toward greener processes, stringent domestic environmental policies (especially regarding air and water pollution control in manufacturing), and a rapidly expanding middle-class consumer base with increasing awareness and demand for high-quality, ethically sourced electronics.

Do these devices use specialized operating systems for efficiency?

While many utilize standard operating systems (Windows, macOS, Linux), the trend is toward highly optimized operating system kernels and firmware that prioritize power management and efficient resource allocation. Some specialized eco-focused brands utilize lightweight, open-source operating systems specifically tailored to minimize computational overhead and energy draw.

What impact does the material selection have on the carbon footprint of the laptop?

Material selection has a profound impact, as material production often accounts for the largest portion of a laptop's total embodied carbon. By substituting virgin metals and plastics with high-content recycled materials, manufacturers can significantly reduce the manufacturing phase's carbon footprint, sometimes by as much as 50% or more, depending on the material type.

How is the education sector’s adoption different from the commercial sector’s?

The education sector prioritizes extreme durability, resistance to physical damage, and low upfront TCO, often favoring simpler, more rugged designs with guaranteed long-term repair service availability. The commercial sector focuses more on meeting high-level ESG compliance, integration with DaaS models, and advanced security features, making certification status (EPEAT Gold) a non-negotiable requirement.

What are the current limitations of bio-based plastics in laptop chassis manufacturing?

Current limitations include achieving the necessary high mechanical strength and heat resistance required for internal components and ensuring long-term colorfastness and aesthetic durability compared to conventional polymers. While improving rapidly, scaling the supply chain for consistent, high-volume bio-based material remains a logistical challenge.

How important is the "Right to Repair" movement to the success of this market?

The "Right to Repair" movement is fundamentally important. It legislatively validates the core sustainable principle of longevity, forcing manufacturers to design devices that are user-serviceable and ensuring that necessary parts and documentation are available. This legal backing dramatically increases the market viability of modular, eco friendly designs.

What security concerns might arise from easily disassembled modular laptops?

While modularity aids repair, it theoretically increases component accessibility. However, leading eco friendly manufacturers counter this with layered security features, including robust software locks (BIOS, UEFI) and secure component pairing, ensuring that unauthorized component swaps or tampering are detected and prevented, maintaining enterprise-level security standards.

How do manufacturers ensure that recycled materials are ethically sourced?

Manufacturers ensure ethical sourcing by implementing rigorous supply chain audits, often utilizing third-party organizations to verify ethical labor practices and conflict-free mineral sourcing. Increasingly, blockchain technology is employed to create an immutable digital ledger, verifying the complete chain of custody for both virgin and recycled materials.

What is the distinction between energy efficiency and material sustainability in a laptop?

Energy efficiency pertains to the power consumed during the laptop's operational life (reducing utility bills and carbon emissions from electricity generation). Material sustainability relates to the environmental impact of the physical components (reducing virgin material extraction, waste generation, and embodied carbon during manufacturing). Both are essential pillars of an eco friendly design.

How does the rise of remote work affect demand for eco friendly laptops?

The rise of remote work accelerates demand by shifting the consumption model. Businesses purchasing devices for remote employees must adhere strictly to internal ESG mandates, driving bulk procurement of energy-efficient, certified, and easily manageable eco friendly laptops that align with centralized corporate sustainability goals.

Is the use of recycled aluminum better than recycled plastic for sustainability?

Both are beneficial, but their impact differs. Recycling aluminum saves enormous amounts of energy compared to primary aluminum smelting. Recycling plastics reduces landfill waste and reliance on oil feedstocks. The optimal choice depends on the specific component's structural needs, but utilizing high-quality PCR material for both is the key sustainability objective.

What is a Digital Product Passport (DPP) and its relevance?

A Digital Product Passport (DPP) is an electronic record containing all crucial product information, including material composition, repair history, origin, and recycling instructions. Its relevance is to enhance transparency and traceability across the lifecycle, empowering repair technicians and recyclers with necessary data to maximize circularity and ensure compliance with future regulatory frameworks.

How are fanless or advanced cooling systems contributing to eco design?

Fanless designs or advanced passive cooling systems eliminate the power draw associated with fans and reduce the number of moving parts subject to failure, enhancing device longevity. They also allow for tighter integration of efficient processors, contributing to a lower overall operating energy footprint and quieter operation, benefiting both sustainability and user experience.

What financial incentives exist for businesses to purchase eco friendly laptops?

Financial incentives include tax credits and deductions related to energy-efficient equipment procurement in some jurisdictions, lower energy costs over the device lifecycle, reduced regulatory risk, and enhanced eligibility for sustainable investment funds (green bonds), improving the overall financial valuation of the corporation's sustainable asset base.

How do OEMs measure the carbon footprint reduction of their eco models?

OEMs measure carbon footprint reduction primarily through rigorous Life Cycle Assessments (LCA), which quantify all greenhouse gas emissions associated with the product from material extraction through disposal. They use these assessments to compare the environmental impact of a new eco model against a previous generation or conventional benchmark product.

Is the market transitioning towards fully biodegradable components?

While the market is utilizing bio-based components, a transition to *fully* biodegradable components is complex due to the requirement for devices to maintain performance and durability for 5-10 years. The focus remains primarily on modularity, high-recyclability, and non-toxic materials, ensuring that materials that cannot degrade are effectively captured and recycled.

What challenges do emerging markets face in adopting these laptops?

Emerging markets face challenges primarily related to the higher initial price point of certified eco friendly devices, inconsistent local e-waste recycling infrastructure to support circularity, and a lack of standardized regulatory frameworks mandating sustainable procurement, which can slow corporate and governmental adoption rates.

How significant is the impact of packaging on the device's overall sustainability rating?

The impact of packaging is highly significant, even though it is a small portion of the product weight. Using 100% recycled or certified sustainable, plastic-free packaging substantially reduces landfill burden and the carbon emissions associated with virgin material production, making it a visible and easy-to-verify element of the sustainability claim.

What is the market's current trajectory regarding component standardization?

The market is slowly moving towards component standardization, driven by the demands of modular design and regulatory pressure (e.g., EU mandates for standardized charging ports). While full industry standardization remains distant, leading players are adopting universally available components (standard screws, common connector types) instead of proprietary custom parts.

How does the commercial enterprise benefit from certified eco friendly procurement?

Commercial enterprises benefit through improved ESG scoring, reduced exposure to regulatory non-compliance fines, decreased operational costs via energy savings, and enhanced reputation among environmentally conscious customers and investors. This procurement strategy aligns operational expenditures with long-term sustainability mandates.

Are refurbished eco friendly laptops a growing market segment?

Yes, refurbished eco friendly laptops are a rapidly growing segment, supported by the devices' inherently modular and durable nature. High-quality refurbishment and re-sale extend the asset life and offer a lower-cost, highly sustainable option for consumers and small businesses, capitalizing on the DaaS return cycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager