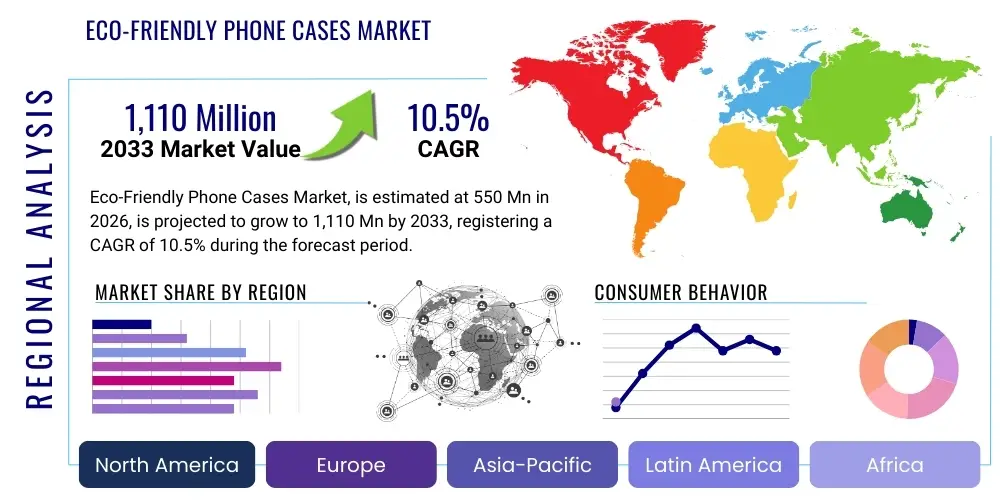

Eco-Friendly Phone Cases Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440068 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Eco-Friendly Phone Cases Market Size

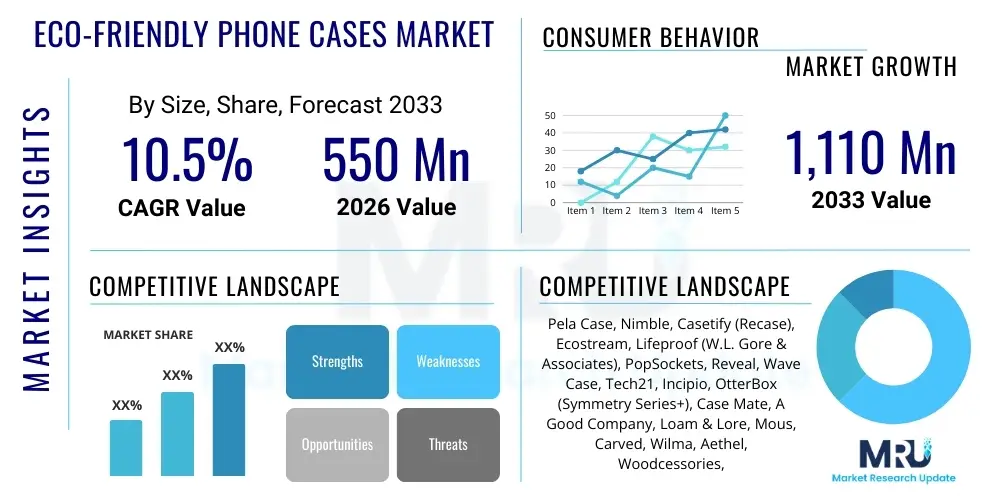

The Eco-Friendly Phone Cases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,110 Million by the end of the forecast period in 2033. This robust expansion is directly linked to increasing global consumer awareness regarding plastic pollution and the accelerated adoption of sustainable consumption practices across North America and Europe. The shift from conventional petroleum-based plastics towards bio-based and recycled materials is a primary revenue driver, establishing this niche sector as a critical component of the wider consumer electronics accessories market.

Market valuation reflects the increasing premium consumers are willing to pay for products that align with their environmental values, particularly among Millennial and Generation Z demographics. Growth forecasts are further supported by corporate social responsibility initiatives undertaken by major smartphone manufacturers who are actively seeking sustainable supply chain solutions. The market size calculation includes revenues generated from the sale of biodegradable, compostable, recycled plastic, and bamboo/wood-based phone cases sold globally across various distribution channels, including e-commerce platforms and specialty retail stores.

Eco-Friendly Phone Cases Market introduction

The Eco-Friendly Phone Cases Market encompasses the manufacturing and distribution of protective coverings for mobile devices made from sustainable, ethically sourced, or recycled materials designed to minimize environmental impact at the end of their lifecycle. These products often utilize innovative materials such as plant-based bioplastics (e.g., PLA, PHA derived from corn starch or sugarcane), certified compostable polymers, recycled polyethylene terephthalate (rPET), or natural components like bamboo, cork, and salvaged wood. The product description highlights essential attributes such as durability, drop protection, and compatibility with wireless charging, while emphasizing their reduced carbon footprint compared to standard polycarbonate or silicone cases.

Major applications for these cases span the entire spectrum of consumer electronics protection, serving smartphones, tablets, and increasingly, specialized protective needs for rugged outdoor use or clinical environments where sustainability certifications are valued. The primary benefit driving adoption is the alleviation of plastic waste contribution, as traditional phone cases often end up in landfills for centuries. Furthermore, these eco-conscious choices offer consumers a tangible way to participate in circular economy initiatives, often supported by brand take-back and recycling programs.

Key driving factors include pervasive media coverage focusing on climate change and ocean plastic pollution, which has spurred significant behavioral changes among consumers. Regulatory pressures, particularly in the European Union, mandating greater product sustainability and recyclability standards, also propel innovation in material science within this sector. The frequent renewal cycle of smartphones necessitates continuous demand for new protective accessories, making the transition to eco-friendly materials both a vital environmental necessity and a significant commercial opportunity.

Eco-Friendly Phone Cases Market Executive Summary

The Eco-Friendly Phone Cases Market is characterized by rapid material innovation and shifting consumer preferences towards transparency and ethical sourcing. Business trends indicate a strong move toward vertical integration, where companies manage the entire product lifecycle from raw material sourcing (e.g., certified sustainable forests or managed waste streams) to end-of-life recycling programs. Strategic partnerships between specialized eco-case manufacturers and large technology original equipment manufacturers (OEMs) are becoming critical, enabling broader market access and standardized product compatibility. Furthermore, successful businesses are leveraging digital marketing heavily to communicate complex sustainability metrics, such as carbon neutrality or compostability certifications, directly to environmentally engaged consumers, positioning sustainability as a key competitive advantage over price.

Regional trends highlight Europe and North America as mature markets demonstrating high per capita spending on sustainable accessories, fueled by established eco-consciousness and high disposable incomes. Europe, particularly the Nordic countries and Germany, leads in regulatory adoption of circular economy principles, driving demand for certified compostable products. Asia Pacific (APAC) represents the fastest-growing region, characterized by massive smartphone penetration and emerging middle classes increasingly aware of environmental issues, especially in countries like China, India, and South Korea. However, market growth in APAC is contingent upon the development of robust composting and recycling infrastructure capable of handling specialized bioplastics.

Segment trends underscore the dominance of the Plant-Based (Compostable) material segment, favored for its clear end-of-life benefits, although the Recycled Plastics segment remains strong due to its cost-efficiency and proven durability. Distribution channel analysis shows that Online Retail continues to capture the largest share, owing to the ease of accessing niche eco-brands and detailed product information that justifies the often higher price point. Within the device segment, products catering to high-end flagship devices (iPhone and Samsung Galaxy series) command premium pricing and drive substantial revenue due to the need to protect expensive technology investments.

AI Impact Analysis on Eco-Friendly Phone Cases Market

User queries regarding AI’s influence on the Eco-Friendly Phone Cases Market often center on how technology can enhance sustainability claims, optimize supply chains, and verify ethical sourcing. Common concerns revolve around whether AI can reliably trace materials from waste stream or agricultural source to finished product, thus combating "greenwashing," and how AI tools might accelerate the discovery of novel, ultra-sustainable materials. Users also frequently ask if AI-driven personalized design and manufacturing (mass customization) could reduce waste by minimizing overproduction and stock surpluses. The consensus suggests high expectations for AI to serve as a pivotal tool for verification, material science acceleration, and demand forecasting, significantly improving the market's environmental integrity and operational efficiency.

The adoption of Artificial Intelligence, particularly in areas like predictive analytics and machine learning, is transforming the lifecycle management of eco-friendly phone cases. AI-powered software can analyze massive datasets related to consumer purchase patterns, regional recycling infrastructure capacity, and material degradation rates. This predictive capability allows manufacturers to optimize raw material procurement, minimizing material waste during production and accurately forecasting demand to prevent costly excess inventory. Furthermore, AI systems are increasingly deployed in quality control processes, ensuring that bioplastic compounds meet stringent criteria for compostability and durability, thereby reinforcing product trustworthiness and compliance with global standards.

AI's strategic impact also extends deeply into marketing and consumer engagement. Machine learning algorithms enable hyper-personalized marketing campaigns that target consumers based on their specific sustainability preferences (e.g., prioritizing vegan materials over recycled content), improving conversion rates. Crucially, AI facilitates the development of sophisticated Circular Economy tracking platforms, utilizing blockchain technology overlaid with AI analysis, to verify that returned or expired eco-cases are genuinely diverted into appropriate recycling or industrial composting facilities, providing the transparency that eco-conscious consumers demand.

- AI-driven supply chain transparency verifies ethical sourcing and combats greenwashing.

- Predictive analytics optimize inventory levels, minimizing manufacturing waste and overproduction.

- Machine learning accelerates the research and development of novel bio-based and recycled polymers.

- AI enhances quality control for composting standards and material strength testing.

- Intelligent tracking systems monitor product end-of-life management for closed-loop initiatives.

- Personalized product recommendations based on consumer sustainability values improve targeted sales efficiency.

DRO & Impact Forces Of Eco-Friendly Phone Cases Market

The Eco-Friendly Phone Cases Market operates under a powerful interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. The primary driver is the accelerating shift in global consumer sentiment, where environmental stewardship is becoming a purchasing determinant rather than a secondary consideration, coupled with robust legislative action, particularly plastic bans and Extended Producer Responsibility (EPR) schemes, compelling brands towards sustainable alternatives. However, this growth is significantly restrained by the perceived and actual trade-offs associated with eco-materials, including the higher production cost compared to conventional plastics, which translates into higher retail prices, and lingering consumer doubts regarding the durability and genuine compostability of some bioplastics, often requiring specific industrial conditions not readily available everywhere. These restraining factors necessitate substantial investment in consumer education and infrastructure development.

Opportunity lies in leveraging advanced material science to overcome durability concerns, specifically through hybrid material development combining the protective qualities of traditional polymers with the sustainability of bio-based inputs. Furthermore, expansive opportunities exist in emerging economies where smartphone penetration is skyrocketing, coupled with public concern over local pollution levels, creating a fertile ground for affordable, entry-level sustainable cases. The impact forces are currently skewed toward accelerating growth, driven primarily by corporate commitment to ESG (Environmental, Social, and Governance) targets. Market participants are finding that sustainability is no longer optional but essential for maintaining brand relevance and accessing capital, thereby positioning eco-friendly case development as a core business function rather than a specialty niche.

The collective impact of these forces dictates that market players must prioritize material innovation and supply chain resilience. Companies that successfully implement transparent, verifiable circular models—offering take-back programs that genuinely close the loop—will gain significant competitive advantages. Conversely, those that fail to substantiate their sustainability claims risk public backlash and regulatory penalties. The market's overall momentum suggests a steady transition from purely petroleum-based accessories to environmentally responsible alternatives, making this sector a high-growth area within the accessories industry, provided infrastructure challenges regarding industrial composting and advanced recycling are effectively addressed by governments and industry consortiums.

Segmentation Analysis

The Eco-Friendly Phone Cases Market is systematically segmented based on material type, distribution channel, case structure, and compatibility with device brands, allowing for precise market targeting and strategic development. The segmentation reflects the diverse ways consumers seek sustainability, ranging from fully compostable solutions favored by dedicated environmentalists to recycled content preferred by budget-conscious buyers seeking durability. Understanding these segments is crucial for manufacturers to tailor their supply chain management and marketing narratives effectively, ensuring products meet specific environmental certifications relevant to target geographic markets, such as ASTM D6400 certification for compostability or Global Recycled Standard (GRS) for recycled content.

- Material Type:

- Plant-Based (Compostable)

- Recycled Plastics (rPET, TPU)

- Bamboo/Wood/Cork

- Bio-degradable Polymers (PLA, PHA)

- Distribution Channel:

- Online Retail (Direct-to-Consumer, E-commerce Marketplaces)

- Offline Retail (Specialty Stores, Supermarkets/Hypermarkets, Carrier Stores)

- Case Type:

- Snap-On/Slim Case

- Wallet Case/Folio

- Bumper Case

- Rugged/Heavy-Duty Case

- Device Type:

- iPhone Series

- Samsung Galaxy Series

- Others (Google Pixel, Huawei, OnePlus)

Value Chain Analysis For Eco-Friendly Phone Cases Market

The value chain for eco-friendly phone cases begins with the upstream segment focusing on the sourcing and preparation of sustainable raw materials, which is significantly more complex and diversified than for conventional plastics. Upstream activities involve agricultural processes for bioplastics (e.g., corn, sugarcane, or algae), ethical harvesting of natural materials (e.g., FSC-certified wood, sustainably grown bamboo), or sophisticated waste management and sorting processes for obtaining high-quality post-consumer recycled (PCR) plastics. Key upstream suppliers include specialized chemical companies focusing on biopolymer research, sustainable farming cooperatives, and advanced recycling facilities. The viability of this segment is highly dependent on scalable and cost-effective conversion technologies to turn sustainable feedstock into usable industrial compounds suitable for injection molding or fabrication.

The midstream process involves manufacturing, where raw materials are transformed into finished case products. This includes compounding, injection molding, precision cutting, and finishing, often requiring specialized, low-energy machinery and processes suitable for bioplastics, which can be sensitive to heat or mechanical stress. Packaging is also critical, demanding the use of recycled or minimal, plastic-free alternatives. Downstream analysis focuses on distribution and sales. The distribution channel is heavily dominated by direct-to-consumer (DTC) models via specialized e-commerce platforms (direct channel), allowing brands to maintain control over messaging and sustainability narrative. Indirect channels include collaborations with major retail chains and carrier stores, essential for reaching mainstream consumer audiences, though these channels often demand competitive pricing and high-volume consistency, posing a challenge for smaller eco-manufacturers.

The entire value chain culminates with crucial post-consumer management: the circularity loop. Unlike traditional accessories, the eco-friendly value chain must include robust take-back and recycling programs designed to handle specialized materials, ensuring products are properly composted or recycled back into the supply stream, thereby closing the loop. The efficiency of the indirect distribution channel depends heavily on retailers’ willingness to participate in reverse logistics for case collection. Transparency and traceability throughout all segments—from the origin of the plant material to the final recycling facility—are paramount, serving not just as a compliance requirement but as a core marketing tool that builds consumer trust and differentiates the product in a crowded market.

Eco-Friendly Phone Cases Market Potential Customers

Potential customers for eco-friendly phone cases span diverse demographics but are unified by a strong preference for sustainable consumption and ethical product sourcing. The primary buyers are often categorized as 'Eco-Conscious Millennials and Gen Z,' highly educated individuals aged 18 to 40 who are digitally native, proactively seek out green products, and are willing to pay a premium for certified sustainable or plastic-free items. These consumers prioritize brand transparency, carbon neutrality claims, and robust end-of-life solutions (e.g., compostability guarantees). They are frequent users of online retail and rely heavily on social media and influencer endorsements to validate their purchasing decisions, making them crucial drivers of the DTC channel.

A secondary, rapidly expanding customer base includes large Corporate and Educational Institutions seeking to align their procurement policies with internal Environmental, Social, and Governance (ESG) mandates. These institutional buyers often purchase cases in bulk for employee or student use, demanding high durability alongside specific environmental certifications, such as utilizing post-consumer recycled content (PCR) to minimize waste contribution. For these buyers, the total cost of ownership, including the social and environmental benefit, often outweighs the initial purchase price, positioning B2B sales as a high-value, high-volume opportunity for established eco-case suppliers.

Furthermore, a third distinct segment consists of Tech Enthusiasts and Early Adopters who appreciate product innovation and material science advancements. These consumers are attracted not just by sustainability, but by the novelty of materials like bio-based polymers or unique salvaged wood, viewing the case as a statement of design and technology convergence. They seek customization and cutting-edge features, such as enhanced bio-based shock absorption, demanding products that do not compromise protection for the sake of sustainability, ensuring that the integration of recycled materials meets or exceeds the performance standards of conventional counterparts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,110 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pela Case, Nimble, Casetify (Recase), Ecostream, Lifeproof (W.L. Gore & Associates), PopSockets, Reveal, Wave Case, Tech21, Incipio, OtterBox (Symmetry Series+), Case Mate, A Good Company, Loam & Lore, Mous, Carved, Wilma, Aethel, Woodcessories, Goal Zero. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eco-Friendly Phone Cases Market Key Technology Landscape

The technology landscape for eco-friendly phone cases is predominantly driven by advancements in material science and specialized manufacturing processes adapted for sustainable compounds. A pivotal technological area is the continuous evolution of Bio-Polymer Synthesis, focusing on increasing the thermal stability, shock resistance, and shelf life of materials like Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA). Researchers are concentrating on creating blended materials that meet industrial compostability standards (e.g., ASTM D6400, EN 13432) while offering comparable drop protection to conventional TPU or polycarbonate. This requires sophisticated polymerization techniques and the incorporation of natural fiber reinforcements to enhance structural integrity without compromising the material's end-of-life breakdown capabilities. Success in this area is critical for mass market acceptance, addressing the fundamental consumer conflict between sustainability and performance.

Another essential technological component involves Precision Injection Molding specifically optimized for recycled and bio-based resins. These materials often exhibit different flow properties, cooling requirements, and shrinkage rates compared to virgin plastics, demanding specialized tooling and temperature control systems to prevent defects, reduce cycle times, and ensure consistent product quality across high-volume production runs. Furthermore, Advanced Waste Sorting and Mechanical/Chemical Recycling technologies form a key upstream technological pillar. Innovations in near-infrared sorting and solvent-based chemical recycling are crucial for generating clean, high-purity post-consumer recycled (PCR) feedstock that can be reliably incorporated into new case production without degradation of mechanical properties, enabling true circularity and adherence to certified recycled content claims.

Finally, Digital Traceability Technologies, integrating solutions like Blockchain and advanced serialization, are fundamentally changing how sustainability is verified and communicated. This technology allows every batch of raw material—whether recycled plastic or agricultural feedstock—to be digitally tracked throughout the entire supply chain, offering immutable proof of origin and processing methods. This technical transparency is vital for combating greenwashing and providing consumers with confidence in the product's environmental claims. These digital platforms often integrate with internal AI analysis tools to monitor energy consumption during manufacturing, driving incremental efficiency improvements across the production line and reducing the embodied carbon of the final product.

Regional Highlights

The global market for eco-friendly phone cases exhibits significant regional disparities in maturity, regulatory environment, and growth dynamics. North America, driven primarily by the high market penetration of premium smartphones and a strong consumer base committed to ethical spending, represents a high-value market. The United States and Canada lead in adopting direct-to-consumer (DTC) models for eco-brands, frequently featuring product innovations from companies like Pela Case. Regulations, while varying by state, are increasingly pushing corporate responsibility, and major retailers require suppliers to meet stringent packaging and material sustainability standards. This region focuses heavily on recycled plastics and innovative plant-based materials that offer uncompromising durability, reflecting the consumer demand for both protection and sustainability without trade-offs.

Europe stands out as the most regulated and arguably the most environmentally advanced region for this market. Policies such as the EU's Circular Economy Action Plan and stringent requirements for packaging and plastic waste heavily favor certified compostable and bio-based products. Germany, the Nordic countries, and the UK are major consumption hubs, with consumers actively seeking products carrying recognized certifications like TÜV Austria OK Compost INDUSTRIAL. The European market focuses intensely on robust end-of-life infrastructure, encouraging manufacturers to design cases specifically for easy disassembly and material recovery. The combination of legislative pressure and high consumer awareness makes Europe a crucial testbed for truly circular business models within the accessories sector.

Asia Pacific (APAC) is forecasted to be the engine of growth, characterized by rapid urbanization, soaring smartphone sales (especially in emerging markets like India and Southeast Asia), and increasing public awareness regarding air and plastic pollution. While infrastructure challenges (e.g., lack of industrial composting facilities) currently restrain the adoption of certain compostable materials, demand for recycled plastic cases is accelerating due to lower price points and high durability. China and South Korea are key manufacturing centers that are rapidly adopting advanced bio-material production capabilities. Latin America and the Middle East and Africa (MEA) remain nascent markets, primarily driven by international brands, but show growing potential as disposable incomes rise and governmental sustainability initiatives gain traction, particularly in urban centers.

- North America: High consumer expenditure on premium eco-products; strong adoption of recycled and durable plant-based materials; market dominance of DTC brands.

- Europe: Driven by stringent EU regulations (Circular Economy mandates); high demand for certified compostable products; focus on integrated waste management solutions.

- Asia Pacific (APAC): Fastest growing region due to mass smartphone adoption; increasing environmental awareness offsetting infrastructure deficits; growth concentrated in recycled plastic solutions.

- Latin America and MEA: Emerging markets with growing environmental consciousness; potential dependent on local infrastructure investment and international brand penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eco-Friendly Phone Cases Market.- Pela Case

- Nimble

- Casetify (Recase)

- Ecostream

- Lifeproof (W.L. Gore & Associates)

- PopSockets

- Reveal

- Wave Case

- Tech21

- Incipio

- OtterBox (Symmetry Series+)

- Case Mate

- A Good Company

- Loam & Lore

- Mous

- Carved

- Wilma

- Aethel

- Woodcessories

- Goal Zero

Frequently Asked Questions

Analyze common user questions about the Eco-Friendly Phone Cases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are primarily used in genuinely eco-friendly phone cases?

The primary materials include plant-based biopolymers (such as PLA and PHA derived from corn starch or cane sugar), certified post-consumer recycled plastics (rPET and TPU), and natural, sustainably harvested resources like bamboo, cork, and FSC-certified wood. Genuinely eco-friendly cases often include certifications validating compostability or recycled content percentage.

Are eco-friendly phone cases as durable and protective as conventional plastic cases?

Modern eco-friendly cases, particularly those using advanced recycled TPU or reinforced biopolymers, offer drop protection comparable to standard cases. Manufacturers use specialized design techniques and material blends to ensure high shock absorption and scratch resistance, mitigating earlier concerns about the fragility of sustainable alternatives.

What is the difference between biodegradable and compostable phone cases?

Biodegradable cases break down naturally over an undefined period, often leaving microplastic residue. Compostable cases, specifically those certified to standards like ASTM D6400 or EN 13432, break down into non-toxic elements (water, CO2, biomass) within a specific timeframe and controlled environment, typically an industrial composting facility.

How does the cost of sustainable phone cases compare to traditional cases?

Eco-friendly phone cases generally carry a higher price point than conventional plastic cases due to the higher cost associated with sourcing sustainable or recycled feedstocks, specialized manufacturing processes for bio-polymers, and the necessary investment in research, development, and supply chain certification for transparency.

Which regions are leading the growth and innovation in the Eco-Friendly Phone Cases Market?

Europe leads in regulatory push and demand for certified compostability due to stringent EU policies. North America is dominant in premium market size and DTC brand innovation. Asia Pacific, driven by volume and increasing environmental awareness, represents the fastest-growing region, focusing heavily on adopting recycled plastic options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager