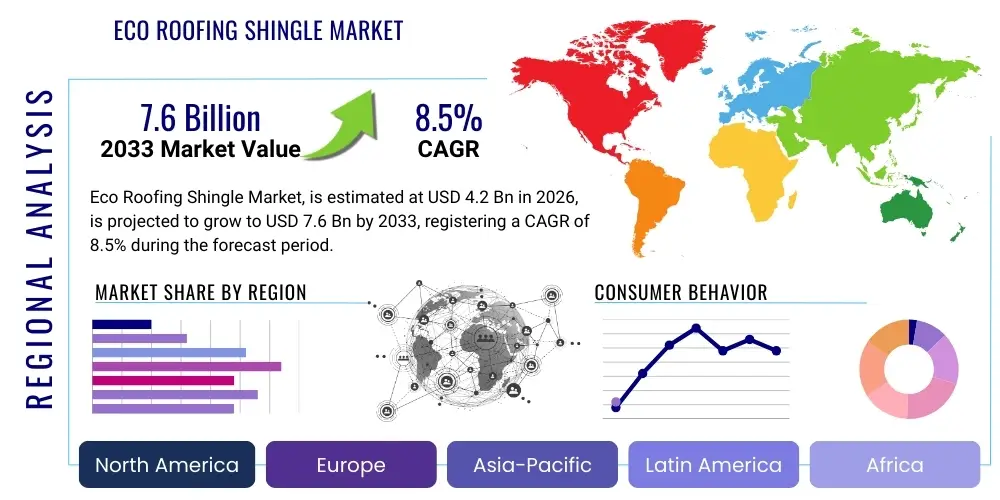

Eco Roofing Shingle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434598 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Eco Roofing Shingle Market Size

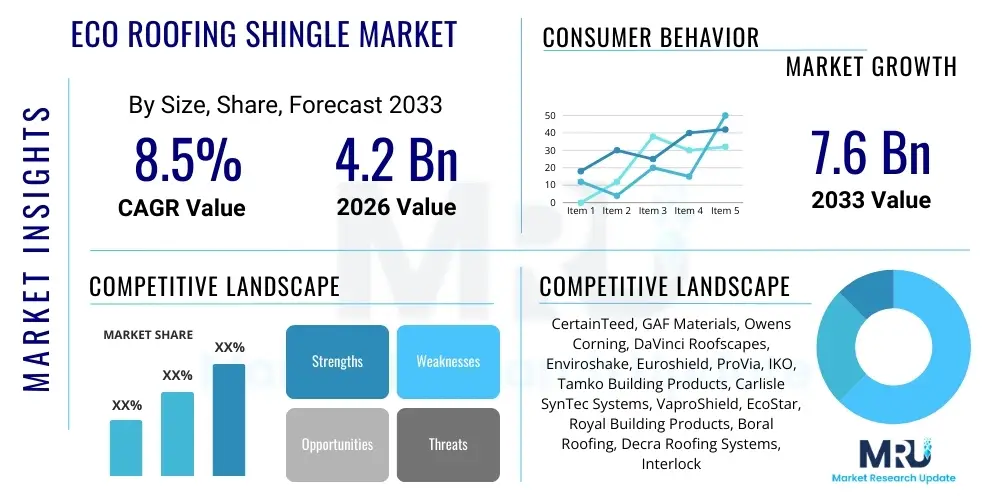

The Eco Roofing Shingle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.2 Billion in 2026 and is projected to reach $7.6 Billion by the end of the forecast period in 2033.

Eco Roofing Shingle Market introduction

The Eco Roofing Shingle Market encompasses sustainable and environmentally responsible roofing solutions designed to minimize ecological impact throughout their lifecycle, from manufacturing and installation to disposal. These products are typically made from recycled materials such as rubber, plastics, wood fiber, and asphalt, or utilize natural, rapidly renewable resources. A fundamental element of eco roofing shingles is their superior performance in energy efficiency, often providing high solar reflectivity (cool roofing properties) and insulation values that significantly reduce a building's heating and cooling demands. This market segment is rapidly expanding due to global mandates promoting green building practices and the increasing consumer preference for low-maintenance, durable, and aesthetically pleasing sustainable construction materials.

Major applications for eco roofing shingles span across residential, commercial, and institutional construction sectors. In residential settings, homeowners seek these shingles for long-term cost savings, enhanced curb appeal, and compliance with local green initiatives. Commercial applications, particularly those aiming for LEED or similar green certifications, rely on eco shingles to meet stringent sustainability criteria, reduce operational costs, and demonstrate corporate social responsibility. The key benefits of these products include exceptional durability, often exceeding 50 years; resistance to extreme weather conditions like hail and high winds; significant reduction in landfill waste through the use of recycled content; and often, lighter weight compared to traditional slate or concrete tiles, simplifying installation and reducing structural load requirements. Furthermore, modern eco shingles are increasingly designed for seamless integration with Building-Integrated Photovoltaics (BIPV), transforming the roof surface into an active energy generator.

Driving factors for sustained market growth are multifaceted, anchored by evolving governmental regulations and attractive financial incentives. Governments globally are implementing stricter energy codes for new construction and renovation projects, compelling developers and builders to adopt certified sustainable materials. Consumer awareness regarding the long-term economic and environmental advantages of sustainable roofing, coupled with advancements in material science that have improved the aesthetic quality and performance parity with traditional materials, further fuel demand. The commitment of manufacturers to achieve net-zero carbon operations and invest in circular economy principles is consistently introducing innovative products, such as bio-based composites and highly recyclable synthetic materials, positioning the eco roofing shingle market as a pivotal component of the global shift towards resilient and sustainable infrastructure.

Eco Roofing Shingle Market Executive Summary

The Eco Roofing Shingle Market is experiencing robust expansion driven primarily by escalating regulatory support for high-performance green buildings and significant technological leaps in sustainable material engineering. Business trends highlight a strong industry focus on vertical integration, particularly involving recycled material sourcing, which enhances supply chain resilience and cost-competitiveness. Manufacturers are heavily investing in proprietary blends of polymers and reclaimed materials to produce shingles that offer superior Class A fire ratings, high impact resistance, and vibrant, fade-resistant color palettes, effectively neutralizing historical aesthetic disadvantages compared to traditional materials. Furthermore, strategic partnerships between roofing material providers and smart home technology companies are becoming commonplace, centering on the development of integrated solar and passive energy management solutions that utilize the roof surface as a sophisticated energy asset, thereby increasing the value proposition for high-end residential and commercial developments.

Regionally, North America remains the dominant market, bolstered by mandatory green building codes in states like California and aggressive incentive programs designed to promote energy-efficient retrofits in the existing housing stock. Europe is exhibiting the fastest growth trajectory, largely attributed to the stringent objectives set forth by the European Green Deal and the comprehensive renovation waves aimed at drastically improving the energy performance of buildings across the bloc. Asia Pacific is emerging as a critical growth engine, characterized by rapid urbanization, significant government spending on sustainable infrastructure development in countries such as China and India, and a growing middle class increasingly prioritizing premium, long-lasting construction materials. The adoption rate in APAC is supported by the necessity for highly durable materials capable of withstanding varied extreme weather patterns, including monsoon seasons and typhoons, where eco shingles often outperform conventional options.

Segment trends confirm that the recycled material segment, particularly recycled rubber and polymer shingles, commands the largest market share due to its excellent impact resistance and low environmental footprint, offering a compelling waste-reduction narrative. The residential segment continues to be the primary consumer base, but the commercial segment is demonstrating accelerated growth as institutional investors and large corporations adhere to environmental, social, and governance (ESG) reporting standards, demanding sustainable solutions for massive roofing projects. Within technology, the shift towards Building-Integrated Photovoltaics (BIPV) is transforming the market, where shingles are not merely protective barriers but active energy harvesting systems. This trend signifies a foundational shift from simple material replacement to holistic energy solution provision, pushing average selling prices upwards but simultaneously delivering substantial long-term value through electricity generation and energy savings.

AI Impact Analysis on Eco Roofing Shingle Market

User inquiries regarding Artificial Intelligence (AI) in the eco roofing shingle sector predominantly revolve around optimizing material science, enhancing supply chain transparency, and improving installation efficiency. Common questions focus on how AI algorithms can accelerate the discovery of new bio-composite materials with enhanced thermal properties, whether machine learning can predict the longevity and failure points of recycled shingles under various climate stressors, and how automated drone inspection utilizing AI image recognition can streamline quality assurance and post-installation maintenance. Users are keenly interested in predictive analytics for managing volatility in recycled input material supply and optimizing manufacturing processes to minimize waste and energy consumption, demonstrating a clear expectation that AI will deliver substantial reductions in both production costs and ecological footprint while significantly boosting product performance and reliability across the entire value chain.

- AI-driven material formulation accelerates R&D for next-generation bio-based polymers and high-performance recycled composite blends, optimizing thermal insulation and structural integrity.

- Predictive maintenance analytics, leveraging sensor data and machine learning, forecast shingle wear and potential failure, extending product lifespan and minimizing the need for premature replacement.

- AI optimizes complex, volatile recycled material supply chains by forecasting raw material availability and pricing, ensuring stable production volumes and reducing purchasing risk.

- Automated quality control systems use computer vision to inspect shingle batches during manufacturing, identifying defects with higher precision and speed than manual inspection.

- Implementation of AI in drone surveys provides detailed, high-resolution damage assessment and energy efficiency analysis post-installation, streamlining repair scheduling and insurance claims.

- Machine learning models enhance factory energy management by optimizing machinery run times and temperature control, significantly lowering the overall energy intensity of shingle production.

- Generative AI tools assist designers in creating optimized shingle patterns and roof layouts that maximize aesthetic appeal and ensure optimal water run-off and snow load management.

DRO & Impact Forces Of Eco Roofing Shingle Market

The dynamics of the Eco Roofing Shingle Market are dictated by a compelling set of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its future trajectory. A principal Driver is the increasing implementation of stringent building codes and energy performance mandates globally, notably across North America and Europe, which effectively penalize the use of less sustainable alternatives and mandate high R-values and cool roof properties for new construction. Further propelling the market is the significant corporate and governmental emphasis on Environmental, Social, and Governance (ESG) criteria and sustainability pledges, which necessitate the selection of certified eco-friendly materials in all new infrastructure and renovation projects. Public awareness regarding climate change vulnerability and the associated demands for resilient building materials that can withstand increasingly severe weather events, such as higher category storms and extreme temperature fluctuations, also acts as a potent driver, pushing consumers toward durable, high-impact rated eco shingles.

Despite strong tailwinds, the market faces significant Restraints, primarily centered on the higher initial capital expenditure often associated with eco roofing solutions compared to conventional asphalt shingles. While the total cost of ownership (TCO) is generally lower over the product's lifespan due to energy savings and longevity, the upfront investment hurdle remains a barrier for budget-sensitive consumers and developers, particularly in emerging markets. Another restraint involves the variability and supply consistency of high-quality recycled input materials, which can complicate large-scale manufacturing and quality standardization, occasionally leading to perceived risks regarding product uniformity and long-term performance guarantees. Furthermore, a lack of widespread installer expertise specific to certain advanced eco materials, such as BIPV integrated shingles or complex polymer composites, can slow adoption rates and increase installation costs, requiring substantial industry investment in specialized training and certification programs.

Opportunities within the sector are vast, fundamentally driven by the ongoing transition toward Building-Integrated Photovoltaics (BIPV), which transforms the roof from a passive shield into an active energy producer, opening new revenue streams and dramatically improving the value proposition of eco shingles. The development of advanced bio-composite materials sourced from agricultural waste and renewable feedstock presents an avenue to further reduce manufacturing emissions and dependence on petrochemical-derived components, simultaneously enhancing the shingle's end-of-life recyclability. Market expansion into the massive global renovation and retrofit sector, particularly in mature economies where aging infrastructure requires performance upgrades to meet modern energy standards, represents a sustained, high-volume Opportunity. Key Impact Forces influencing the market include political stability surrounding carbon taxation policies, economic fluctuations affecting construction financing rates, and technological breakthroughs that drive down the unit cost of recycled polymer processing and thin-film solar integration, making advanced eco options increasingly accessible to the mainstream construction market.

Segmentation Analysis

The Eco Roofing Shingle Market is rigorously segmented based on material composition, application type, technology integration, and distribution channels to facilitate targeted market strategies and accurate assessment of demand drivers. Material segmentation is crucial as it reflects the sustainability profile and performance characteristics of the product, spanning everything from recycled rubber tires and post-consumer plastics to natural slate and advanced fiber cement composites. Application segmentation distinguishes between the high-volume residential sector, which emphasizes aesthetics and cost-effectiveness, and the rapid-growth commercial sector, which prioritizes durability, compliance with green certifications (like LEED), and high fire ratings. Analyzing these segments is essential for manufacturers to tailor their production capabilities and marketing efforts, ensuring that specific product attributes align precisely with end-user requirements, such as impact resistance for regions prone to hail or high solar reflectivity for hot climates.

The segmentation by technology—standard eco shingles versus solar-integrated (BIPV) shingles—is defining the future trajectory of the market. While standard eco materials offer immediate environmental benefits through recycling and energy efficiency, the BIPV segment offers transformative functionality by converting the roof into a power plant, making the total value proposition significantly higher for energy-conscious consumers and commercial entities. Distribution channel analysis further clarifies the sales pipeline, with direct sales often preferred for large commercial BIPV projects requiring technical consultation, whereas the residential market relies heavily on established retail networks and specialized roofing distributors. Understanding the precise demands and growth rates of each sub-segment enables strategic prioritization, allowing companies to allocate resources effectively toward high-potential areas, such as the increasing demand for architectural-grade, heavy-weight shingles that mimic traditional slate or cedar shakes while offering superior eco benefits.

- By Material Type:

- Recycled Rubber/Tire

- Recycled Plastic/Polymer (HDPE, LDPE)

- Recycled Asphalt/Fiber Cement

- Natural/Bio-based Composites (e.g., Wood Fiber/Soy Oil blends)

- Metal (Recycled Aluminum/Steel)

- Fiberglass Reinforced Composites

- By Application:

- Residential (Single-family homes, Multi-family units)

- Commercial (Offices, Retail, Hospitality)

- Industrial/Institutional (Warehouses, Schools, Hospitals)

- By Technology:

- Standard Eco Shingles (Non-Integrated)

- Building-Integrated Photovoltaics (BIPV) Shingles

- Cool Roof Technology Shingles (High Albedo)

- By Distribution Channel:

- Direct Sales (OEMs and Large Contractors)

- Retail and Home Centers (e.g., Lowe's, Home Depot)

- Specialized Distributors (Wholesalers)

- E-commerce Platforms

Value Chain Analysis For Eco Roofing Shingle Market

The value chain for the Eco Roofing Shingle Market begins with meticulous upstream analysis, focusing heavily on the sustainable sourcing and processing of raw materials. Unlike conventional roofing, this stage involves securing consistent, high-quality streams of reclaimed materials, such as end-of-life tires (for rubber shingles) or specific plastic waste streams (for polymer shingles). Key challenges upstream involve establishing robust reverse logistics networks and rigorous quality assurance processes to filter and prepare heterogeneous waste inputs, ensuring that contaminants do not compromise the final product integrity. Manufacturers often need specialized, high-intensity sorting and washing equipment to prepare these materials before compounding, requiring significant capital investment. Successful upstream management is paramount for controlling production costs and maintaining the verifiable sustainability credentials critical to the eco market.

The core manufacturing and distribution phases are characterized by specialized processes. Manufacturing involves compounding the recycled or natural materials with additives (UV stabilizers, fire retardants) and molding or pressing them into shingle forms, often utilizing lower-energy processes compared to cement or asphalt production. Distribution channels are bifurcated into direct and indirect routes. Direct sales are critical for large-scale commercial or institutional projects, where manufacturers deal directly with developers or major contractors, providing technical specifications and warranty support. Indirect distribution, leveraging national retail chains and regional specialized roofing wholesalers, dominates the fragmented residential market. Effective management of these channels requires targeted inventory strategies, ensuring that complex, high-value BIPV products are handled through technically proficient specialty channels, while standard products benefit from the broad reach of big-box retailers.

Downstream analysis focuses on installation, maintenance, and end-of-life management. Specialized installation training is often required for eco shingles, particularly for complex integrated solar systems, driving demand for certified contractor networks. The long lifecycle and low maintenance requirements of premium eco shingles translate into significantly reduced downstream costs for end-users. Crucially, the final step in the eco shingle value chain involves planning for end-of-life recycling. Leading manufacturers provide take-back programs or design products for easy disassembly and reuse, closing the material loop and reinforcing the product's ecological integrity. This circularity not only serves as a competitive differentiator but also addresses regulatory pressures concerning construction and demolition waste, thereby completing the sustainable lifecycle mandate inherent to the eco roofing sector.

Eco Roofing Shingle Market Potential Customers

The primary target demographic for the Eco Roofing Shingle Market includes sustainability-focused homeowners and developers involved in high-end residential and commercial construction who prioritize energy efficiency, long-term durability, and aesthetic excellence. High-net-worth individuals embarking on custom home builds are significant end-users, seeking premium architectural shingles that replicate the look of natural materials like slate or cedar shake but offer superior performance in terms of fire resistance, impact rating, and longevity without the high maintenance. These consumers are typically willing to absorb the higher initial cost in exchange for verifiable environmental benefits, reduced maintenance expenditures, and the prestige associated with certified green residences. Additionally, residential customers in regions prone to severe weather, such as hailstorms or wildfires, constitute a key potential customer base dueishing to superior Class 4 impact ratings and Class A fire resistance commonly achieved by polymer and recycled rubber shingles.

In the commercial sector, the potential customer base consists predominantly of institutional investors, real estate developers managing large portfolios, and public sector entities committed to sustainable infrastructure investment. Companies seeking to achieve green building certifications, such as LEED Platinum or Zero Energy Building status, are compelled to utilize high-albedo (cool roof) and BIPV-integrated eco shingles to maximize points in sustainability assessments. Retail chains, major corporations, and hospitality groups often use these roofing solutions to align their physical assets with ambitious corporate ESG goals, leveraging the roof as a visible demonstration of environmental stewardship. The large scale of commercial roofing projects translates into substantial volume demand, often requiring specialized contractual relationships and technical support from manufacturers, making this segment highly attractive despite longer sales cycles.

Furthermore, government bodies and municipal organizations represent crucial potential customers, particularly in regions enacting ambitious climate action plans. These include public housing authorities, school districts, and military bases undergoing energy modernization initiatives. They often procure eco roofing shingles through large-scale, long-term tenders, driven primarily by mandates for operational efficiency, carbon footprint reduction, and the need for extremely durable materials capable of enduring decades of service life. Retrofit projects targeting historical buildings or existing housing stock to improve energy performance also present a continuous stream of opportunities, where the lightweight and easy-to-install nature of certain eco shingle variants provides a logistical advantage over heavier, traditional materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.2 Billion |

| Market Forecast in 2033 | $7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CertainTeed, GAF Materials, Owens Corning, DaVinci Roofscapes, Enviroshake, Euroshield, ProVia, IKO, Tamko Building Products, Carlisle SynTec Systems, VaproShield, EcoStar, Royal Building Products, Boral Roofing, Decra Roofing Systems, Interlock Roofing, RGS Energy, SunPower, Tesla Energy, Longevity, Axion International, CeDUR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eco Roofing Shingle Market Key Technology Landscape

The technological landscape of the Eco Roofing Shingle Market is rapidly evolving, driven by material science innovations focused on enhancing sustainability without compromising structural integrity or performance characteristics. A core technological area is the development of advanced polymer and composite formulations utilizing high percentages of post-consumer and post-industrial recycled waste. This involves sophisticated compounding and extrusion technologies designed to chemically bind disparate waste materials (e.g., tire rubber, polypropylene, limestone dust) into a monolithic shingle structure. Key innovations include the use of proprietary UV stabilizers and flame retardant additives that are integrated during the molding process, ensuring Class A fire ratings and extreme resistance to long-term solar degradation and fading, effectively making these materials superior to many conventional petroleum-based alternatives in terms of longevity and resistance to environmental stress.

Another dominant technological trend is the seamless integration of energy-generation capabilities through Building-Integrated Photovoltaics (BIPV). BIPV shingles utilize thin-film solar technology (e.g., CIGS or flexible monocrystalline cells) laminated directly onto the eco shingle substrate, allowing the solar cells to function as the primary weatherproofing layer while generating electricity. Technological advancements here focus on increasing the efficiency of the photovoltaic material while maintaining the architectural aesthetics and ease of installation of standard shingles, addressing the historical trade-off between power output and visual appeal. Furthermore, smart roofing technologies, incorporating sensors for temperature, moisture, and potential damage detection, are emerging. These sensors communicate data via integrated mesh networks to building management systems, enabling proactive diagnostics and optimized energy harvesting management, drastically reducing reactive maintenance costs and ensuring peak system performance throughout the roof's extended lifespan.

The manufacturing process itself is undergoing significant technological optimization, primarily through automation and the implementation of circular economy principles. This includes advanced sorting robotics and digital twin technology used in production facilities to model and minimize material waste during compounding and molding. Innovations in cool roof technology are also paramount, utilizing highly reflective pigments and ceramic granules with high Solar Reflectance Index (SRI) values, particularly crucial in warmer climates. These coatings technologically reject solar heat, reducing attic temperatures and subsequently lowering air conditioning demands. The development of bio-based binders and non-toxic, sustainable coloring agents derived from natural sources is a critical technological frontier, further enhancing the eco-friendliness of the final product and reducing dependence on traditional petrochemicals, appealing strongly to a market segment increasingly concerned with indoor air quality and lifecycle toxicity.

Regional Highlights

- North America (United States and Canada): North America dominates the global Eco Roofing Shingle Market, driven by robust governmental support for energy efficiency through tax credits, rebates, and strict adherence to codes such as California's Title 24 and federal ENERGY STAR programs. The region experiences a high frequency of extreme weather events, leading to strong consumer demand for high-impact rated (Class 4) recycled rubber and polymer shingles. The U.S. residential replacement market, spurred by insurance companies recommending or requiring resilient materials, is a major consumption driver. Furthermore, key market players, including major established roofing manufacturers, are headquartered here and are investing heavily in BIPV technology development and localized recycling infrastructure to secure material inputs.

- Europe (Germany, UK, France, Scandinavia): Europe is projected to exhibit the highest CAGR due to the unparalleled regulatory environment established by the European Green Deal and the Renovation Wave strategy, which mandates significant energy performance upgrades for millions of buildings. High energy costs in the region make the energy-saving benefits of cool roofing and integrated solar power compelling for both commercial and residential owners. Government grants for sustainable renovations, particularly in countries like Germany and France, accelerate the adoption of high-performance, aesthetically integrated eco materials. The focus here is strongly on carbon neutrality and documented lifecycle assessment (LCA) compliance, favoring locally sourced, low-emission materials.

- Asia Pacific (China, India, Japan, Australia): APAC represents a high-potential market characterized by rapidly expanding construction activity and a growing emphasis on green urbanization projects, particularly in China and India. While price sensitivity remains a factor, increasing air pollution concerns and government investments in sustainable infrastructure (e.g., smart cities) are driving demand for durable, non-toxic building materials. Japan and Australia, with their advanced regulatory standards and high solar irradiation, are leading the regional uptake of BIPV shingles. The necessity to withstand seismic activity and typhoons also favors high-strength, lightweight composite eco shingles over traditional, heavy alternatives.

- Latin America (Brazil, Mexico): The market growth in Latin America is tied primarily to large-scale commercial and governmental projects targeting energy independence and climate resilience. Adoption is slower in the residential segment due to cost barriers but is accelerating in countries like Brazil, where strong solar resources make BIPV applications highly profitable. The region offers significant opportunity for manufacturers focused on cost-effective, high-albedo cool roof technologies to mitigate severe urban heat island effects.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, driven by massive, high-profile construction projects (e.g., NEOM, Dubai infrastructure) that demand the highest international standards for sustainability and energy efficiency. The intense heat necessitates extensive use of cool roof technology, often utilizing highly reflective polymer coatings or recycled metal shingles. Market expansion is closely linked to national visions prioritizing economic diversification and sustainable energy generation across newly developed urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eco Roofing Shingle Market.- CertainTeed (A Saint-Gobain Company)

- GAF Materials Corporation

- Owens Corning

- DaVinci Roofscapes

- Enviroshake

- Euroshield Roofing

- ProVia

- IKO (Integrated K.O.R.P.)

- Tamko Building Products

- Carlisle SynTec Systems

- VaproShield

- EcoStar LLC

- Royal Building Products

- Boral Roofing

- Decra Roofing Systems

- Interlock Roofing Ltd.

- RGS Energy

- SunPower Corporation

- Tesla Energy

- Longevity Inc.

- Axion International

- CeDUR Shake Roofing

Frequently Asked Questions

Analyze common user questions about the Eco Roofing Shingle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary material types used in Eco Roofing Shingles?

Eco roofing shingles are primarily manufactured using recycled materials such as rubber (sourced from tires), high-density polymers (plastics), reclaimed metal (aluminum and steel), and fiber cement composites blended with recycled content. Increasingly, bio-based materials derived from agricultural waste are also being utilized to enhance sustainability and reduce the reliance on fossil fuels in manufacturing processes.

Are Eco Roofing Shingles more durable and long-lasting than traditional asphalt shingles?

Yes, premium eco roofing shingles, especially those made from advanced polymers or recycled rubber, often offer significantly superior durability. Many carry high Class 4 impact resistance ratings and are warrantied for 50 years or more, easily surpassing the typical 20-30 year lifespan and lower impact resistance of standard asphalt shingles, particularly in extreme weather conditions.

What is the cost comparison between Eco Roofing Shingles and conventional roofing materials?

The initial purchase and installation cost of eco roofing shingles are typically 15% to 50% higher than conventional asphalt options, dependent on material and BIPV integration. However, the total cost of ownership (TCO) is generally lower due to substantial savings realized through reduced energy consumption (via cool roof technology) and minimal replacement costs over the extended lifespan of the material.

How do Eco Roofing Shingles contribute to a building's energy efficiency?

Eco shingles improve energy efficiency primarily through two mechanisms: high thermal insulation properties and high solar reflectivity (cool roof). By reflecting a significant portion of solar radiation and minimizing heat transfer into the attic, these shingles substantially reduce the need for air conditioning, lowering overall peak energy demand and utility costs, contributing positively toward net-zero goals.

What role does Building-Integrated Photovoltaics (BIPV) play in the Eco Roofing Shingle Market?

BIPV is a transformative technology in the eco roofing market, integrating photovoltaic cells directly into the shingle form factor. This allows the roof to not only act as a protective, energy-efficient barrier but also as an active generator of clean electricity, thereby maximizing the environmental and economic value of the roofing system and accelerating the adoption of sustainable construction practices globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager