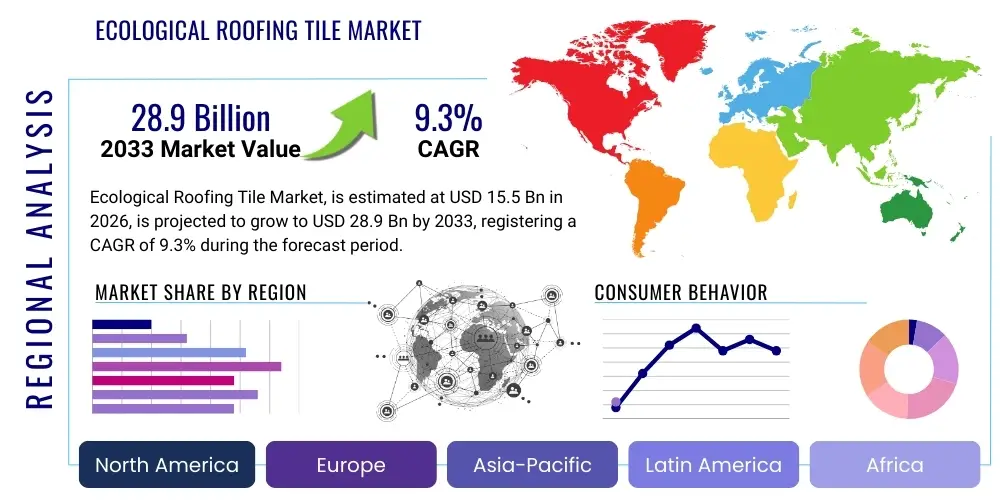

Ecological Roofing Tile Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435496 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Ecological Roofing Tile Market Size

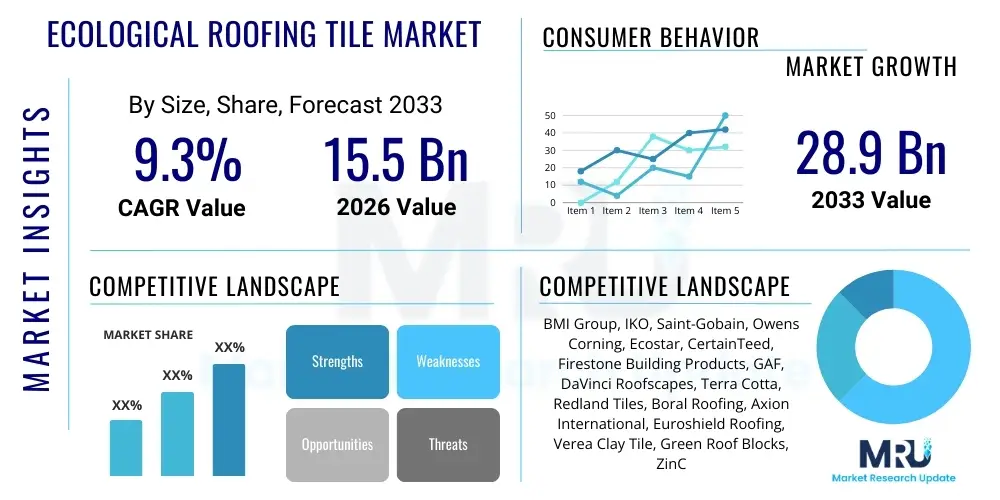

The Ecological Roofing Tile Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.3% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 28.9 Billion by the end of the forecast period in 2033.

Ecological Roofing Tile Market introduction

The Ecological Roofing Tile Market encompasses a sophisticated array of sustainable construction materials specifically engineered for roofing applications, fundamentally driven by the imperative to reduce the construction industry's substantial environmental footprint. These solutions span a technological spectrum, including advanced composites manufactured from post-consumer and industrial waste streams, innovative bio-based polymers, high-performance vegetative roof systems, and low-embodied-energy clay and concrete tiles. The core design principle behind these products is multifunctionality: they must not only provide durable protection against weather elements but also actively contribute to the energy performance and ecological stability of the underlying structure. This dual focus ensures compliance with rapidly evolving global sustainable building mandates and appeals directly to environmentally conscious corporate and individual consumers seeking long-term investment value and verifiable sustainability credentials.

Product categories within this market are highly diversified, reflecting different regional needs and aesthetic preferences. Recycled material tiles, utilizing materials such as plastics, rubber from tires, and salvaged metals, offer exceptional durability, resistance to rot and insects, and often present a cost-effective, low-maintenance alternative to traditional slate or wood shingles. Conversely, living roof systems (green roofs) provide ecological services critical for dense urban environments, including enhanced thermal regulation, improved air quality, noise reduction, and essential stormwater retention capabilities, effectively mitigating the urban heat island effect. Major applications across the residential sector are increasingly focusing on thermal performance and longevity, while large-scale commercial and industrial applications prioritize compliance with rigorous green building certifications such as LEED Platinum or BREEAM Outstanding, often mandating the use of materials with fully disclosed life cycle assessments (LCAs).

The market expansion is robustly underpinned by several critical driving factors, including global commitments under the Paris Agreement demanding sectoral decarbonization, the tangible financial benefits derived from reduced energy bills, and proactive government fiscal policies that incentivize green construction practices through grants, subsidies, and preferential tax treatments for building owners. Technological innovation remains a vital catalyst, particularly in material science, which is constantly improving the aesthetic quality and structural integrity of recycled and bio-based composites, effectively addressing historic concerns about durability and fire resistance. As the cost parity gap narrows between ecological and conventional roofing solutions due to economies of scale and automation, the perceived risk and high initial investment associated with sustainable materials are decreasing, fueling accelerated market adoption across all geographic regions and end-use sectors.

Ecological Roofing Tile Market Executive Summary

The global Ecological Roofing Tile Market is exhibiting accelerated growth, largely steered by global business trends emphasizing supply chain transparency, modular manufacturing, and robust product standardization to facilitate wider adoption. Key manufacturers are strategically investing in vertical integration, particularly securing control over waste input streams to ensure the consistent quality of recycled raw materials, a critical differentiator in this market. The business landscape is rapidly adopting digital tools, including AI-driven inventory management and simulation software for optimizing tile composition and reducing R&D cycles. Furthermore, the development of lightweight, easy-to-install interlocking systems is lowering labor costs and broadening the market appeal to include the extensive residential renovation sector, which demands simplified, rapid deployment solutions without structural reinforcement needs.

Regional dynamics clearly highlight a maturity gradient: Europe and North America maintain market leadership based on established regulatory frameworks and high disposable incomes enabling investment in premium ecological options. European leadership, in particular, focuses on circularity, driving stringent demands for closed-loop recycling guarantees. Meanwhile, the Asia Pacific (APAC) region, led by China and India, is undergoing a transformational phase where massive urban development projects are increasingly integrating sustainable mandates. This region, characterized by its sheer volume of new construction, presents the greatest long-term volume opportunity, contingent on the successful scaling of locally sourced, cost-competitive ecological solutions. Regional variations in climate, ranging from monsoon-prone areas in South Asia to extreme temperature zones in North America, necessitate tailored product development focusing on specific resilience characteristics like wind uplift resistance and high-albedo performance.

Segment analysis underscores the prevailing preference for innovative composite materials, which offer high sustainability metrics coupled with flexibility in design and reduced installation weight. The Vegetal/Green Roof segment continues its exponential growth in metropolitan areas globally, driven by local municipal requirements for permeable surfaces and urban biodiversity enhancement. Within application trends, the Renovation and Retrofitting sector is proving to be a stronger, more consistent driver of demand than new construction in developed markets, spurred by governmental targets requiring existing buildings to dramatically improve energy performance. This focus on improving the efficiency of legacy structures is driving demand for thin, high-insulation ecological over-roofing systems. The convergence of strict environmental legislation, proactive corporate sustainability goals (ESG reporting), and efficiency-driven consumer demand is collectively accelerating the shift away from traditional, high-carbon roofing products toward ecological alternatives.

AI Impact Analysis on Ecological Roofing Tile Market

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally altering the material science and operational efficiency within the Ecological Roofing Tile Market, moving beyond simple automation to sophisticated optimization. User queries frequently center on how ML algorithms can optimize the composition of complex recycled composites. Specifically, AI is employed in simulating the performance of hundreds of material ratios—involving different waste plastics, binding agents, and mineral fillers—to predict outcomes such as thermal conductivity, resistance to accelerated weathering, and long-term mechanical stress without extensive physical prototyping. This drastically reduces the time and cost associated with product development, allowing manufacturers to quickly scale viable, sustainable formulations that guarantee compliance with international building codes and certification standards, significantly lowering the barrier to entry for innovative ecological materials.

AI also plays a critical role in enhancing the sustainability and consistency of the upstream supply chain, a notorious complexity for recycled materials. Machine vision systems, coupled with ML algorithms, are deployed in recycling facilities to accurately sort and grade feedstock materials (e.g., distinguishing high-density polyethylene from polypropylene in mixed plastic waste) far faster and more accurately than human operators. This guarantees the purity and consistency of raw inputs, directly addressing one of the primary restraints in the market: material homogeneity. Furthermore, AI-driven predictive logistics optimizes the collection routes for bulky waste materials, minimizing fuel consumption and carbon emissions associated with the material sourcing phase, thereby reinforcing the ecological credentials of the final roofing product through quantifiable supply chain efficiencies.

In the downstream segment, AI-enabled analytics are transforming quality control and post-installation monitoring. During the manufacturing process, high-speed camera systems using deep learning models inspect every tile, identifying microscopic defects, stress fractures, or inconsistencies in surface finish that could compromise the lifespan or aesthetics of the product. Post-installation, for complex systems like large green roofs or BIPV installations, AI analyzes sensor data (temperature, moisture, power generation) to predict maintenance needs or potential failures before they occur. This predictive maintenance capability maximizes the return on investment for end-users, ensures the sustained performance of the ecological features, and provides manufacturers with invaluable feedback loops for future product iteration, ultimately cementing user trust in high-tech ecological solutions.

- AI optimizes material formulation for enhanced durability and lower embodied carbon by simulating thousands of composite material combinations.

- Machine learning improves predictive quality control, utilizing vision systems to inspect tiles in real-time, reducing manufacturing waste and product defects.

- AI-driven supply chain platforms streamline the sourcing, sorting, and processing of heterogeneous recycled feedstock materials, ensuring consistent input quality.

- Predictive maintenance analytics, powered by IoT sensors, optimize the longevity and performance monitoring of complex installed ecological roofs and BIPV systems.

- AI enhances operational efficiency by optimizing production cycles, including low-energy kiln settings and automated curing times, reducing energy consumption during manufacturing.

DRO & Impact Forces Of Ecological Roofing Tile Market

Drivers: The dominant driving force is the global acceleration toward net-zero building standards and stringent governmental mandates, particularly those focusing on embodied carbon reduction. Regulations such as the European Union’s Energy Performance of Buildings Directive (EPBD) necessitate the adoption of materials with verifiable environmental performance data. Coupled with this, the dramatic increase in extreme weather events globally has amplified the demand for roofing materials that offer superior resilience, including high resistance to wind uplift, hail, and fire. Insurance companies are increasingly offering preferential rates for buildings utilizing certified durable ecological roofing, creating a strong economic incentive that moves beyond mere environmental altruism. This intersection of regulatory obligation and resilience requirements provides a persistent, non-cyclical demand base for ecological tile solutions.

Restraints: The market’s primary constraints revolve around the initial capital outlay and the systemic challenges associated with reliable feedstock supply. Ecological tiles often require higher specialized investment in advanced materials and manufacturing technologies, leading to a higher purchase price compared to conventional clay or asphalt shingles, which can deter cost-sensitive construction projects in developing economies. Furthermore, ensuring a consistent and high-quality supply of specific recycled materials (like specialized plastics or clean wood fibers) can be challenging due to fluctuations in global recycling market prices and varying regional waste management infrastructure quality. The perception, though diminishing, of certain ecological materials lacking long-term performance track records compared to centuries-old traditional materials also requires persistent market education and robust certification programs to overcome.

Opportunities: Significant market opportunities are concentrated in the renovation and retrofit sector, particularly in developed economies where commercial and residential building owners face mounting pressure to upgrade assets to contemporary energy performance standards. The development of high-performance, lightweight ecological overlays that can be installed directly over existing roofing materials without requiring major structural work represents a key technological opportunity. Furthermore, the integration of multi-functional capabilities—such as combining rainwater harvesting mechanisms, air purification coatings, and BIPV into a single roofing system—creates premium product categories with higher margin potential. Emerging economies, as they establish their urban centers, offer vast greenfield opportunities to implement ecological roofing solutions as default building practice.

Impact Forces: The overarching impact force shaping this market is the dramatic shift toward corporate Environmental, Social, and Governance (ESG) reporting requirements. Large corporations and institutional real estate investors are now mandated to quantify and report the sustainability performance of their entire asset portfolio, making the choice of roofing material—which constitutes a significant portion of a building's embodied carbon—a strategic, quantifiable decision. This force shifts procurement from a cost-only perspective to a value-added, risk-mitigation strategy. Simultaneously, the scaling of automated, energy-efficient manufacturing processes is leading to increasing cost parity between ecological and conventional materials, democratizing access to sustainable roofing and acting as a powerful force for mainstream adoption.

- Drivers: Mandatory green building codes targeting net-zero carbon, increasing prevalence of extreme weather requiring resilient materials, strong government subsidies and fiscal incentives for sustainable construction.

- Restraints: Higher initial material cost compared to conventional tiles, volatility and inconsistency in the supply chain for high-quality recycled material feedstock, need for specialized installation and certification knowledge.

- Opportunities: Massive untapped potential in the renovation and retrofit market globally, technological breakthroughs in bio-based and self-healing composite materials, expansion of market through comprehensive BIPV integration and smart features.

- Impact Forces: Dominance of corporate ESG and mandated financial reporting driving sustainable procurement, technological scaling leading to rapid cost reduction and increased accessibility, increasing insurance sector preference for resilient, ecological materials.

Segmentation Analysis

The ecological roofing tile market is dissected along several critical axes to understand varied consumption patterns and technological demands. Segmentation by Material Type is the most fundamental, distinguishing products based on their source and manufacturing process, which directly correlates with embodied energy and performance specifications. The Recycled Plastic and Composite segment offers versatility and low carbon footprint, appealing to budget-conscious projects seeking durability and aesthetics. Meanwhile, the Vegetal/Green Roof segment caters exclusively to projects prioritizing ecological functions like biodiversity and water management, primarily dominating the flat-roof commercial sector in dense urban centers where regulatory pressures for green infrastructure are highest. The segmentation clearly defines the competitive landscape and technological investment pathways for manufacturers.

Segmentation by Application sector—Residential, Commercial, and Industrial—reveals distinct market requirements. Residential users typically require materials that are lightweight, aesthetically diverse (to match diverse architectural styles), and focus on superior thermal insulation to reduce household energy bills. The Commercial segment, encompassing offices, healthcare facilities, and educational campuses, demands high-volume, long-warranty products that demonstrably contribute to achieving third-party green building certifications (LEED, BREEAM). Industrial applications, often involving very large surface areas, prioritize ease of maintenance, extreme durability against operational wear, and cost-effectiveness over aesthetic appeal, often opting for high-albedo recycled metal or specialized durable composite membrane systems on low-slope roofs.

Finally, segmentation by End-Use, contrasting New Construction with Renovation and Replacement, illustrates the evolution of demand across different market maturity levels. The New Construction segment provides large, predictable orders, often driven by new infrastructure planning and urban expansion, particularly prominent in the APAC region. Conversely, the Renovation market, dominant in developed regions like North America and Europe, is characterized by fragmented demand but robust value, fueled by legislative requirements to upgrade existing building stock for energy efficiency. This segment often demands materials suitable for retrofitting, emphasizing lightweight design and quick installation to minimize disruption, representing a high-margin opportunity for specialized ecological roofing solutions designed specifically for overlay applications.

- By Material:

- Recycled Plastic and Composite Tiles: Focus on durability, low maintenance, and highly versatile aesthetic replication.

- Vegetal/Green Roof Systems (Extensive and Intensive): Essential for urban environments, optimizing stormwater management and thermal mass.

- Natural Clay and Concrete (Advanced Low-Carbon Methods): Targeting traditional aesthetics while minimizing carbon footprint via geopolymer or low-temperature firing.

- Recycled Metal and Rubber: Primarily for industrial or commercial flat/low-slope applications requiring extreme durability and high reflectivity.

- By Application:

- Residential: Driven by aesthetics, thermal performance, and long-term utility cost reduction.

- Commercial (Offices, Retail, Healthcare, Education): Focus on compliance with green certifications and maximizing asset value.

- Industrial and Infrastructure: Prioritizing resilience, high-load capacity, and ease of large-scale installation and repair.

- By End-Use:

- New Construction: Large-scale, planned projects driven by developer specifications and foundational green mandates.

- Renovation and Replacement: High-value retrofitting driven by energy efficiency mandates for aging building stock.

Value Chain Analysis For Ecological Roofing Tile Market

The upstream segment of the ecological roofing tile value chain is characterized by complex and highly specialized raw material procurement and processing. Unlike traditional roofing, which relies on readily available mined resources, the ecological segment requires establishing proprietary networks for sustainably harvesting natural materials or, more commonly, creating sophisticated logistics streams for industrial and post-consumer waste. This requires significant investment in advanced sorting and cleaning technologies (often AI-assisted) to transform heterogeneous waste streams into consistent, high-grade feedstock suitable for manufacturing durable tiles. Strategic partnerships with environmental service providers and waste management giants are essential at this stage to secure the necessary volume and quality of recycled plastics, rubber, or metal scrap, ensuring feedstock pricing stability against volatile commodity markets.

The manufacturing phase is defined by innovation in low-energy processes and material engineering. Conversion facilities focus on minimizing energy consumption, frequently integrating renewable energy sources and advanced automation to optimize curing, molding, or pressing processes, thereby achieving low embodied carbon metrics. Quality assurance is exceptionally stringent, involving continuous testing for fire rating, UV resistance, and structural integrity, often relying on digital twin technology for performance validation before mass production. Distribution channels are complex, balancing direct sales for highly technical projects (like integrated BIPV or green roof systems) with indirect sales through traditional construction wholesale networks. Indirect channels rely heavily on distributor training and certification programs to ensure product benefits and installation requirements are accurately conveyed to the local contractor base, maintaining brand reputation and warranty validity.

Downstream activities include specialized installation, maintenance services, and the crucial element of end-of-life material management, which differentiates the ecological market. Due to the unique nature of many ecological systems (especially modular green roofs or interlocking recycled composites), specialized contractor training is mandatory to ensure correct installation maximizes thermal and weather performance. The most critical downstream activity is the commitment to the circular economy: leading manufacturers are establishing robust, often mandatory, take-back programs. These programs ensure that, upon the roof's eventual decommissioning, the material is reclaimed, sorted, and reprocessed into new products, effectively guaranteeing that the material avoids landfill and closes the loop, reinforcing the long-term sustainability promise to the end-user and justifying the initial ecological premium.

Ecological Roofing Tile Market Potential Customers

The market for ecological roofing tiles serves a tri-partite customer base, each with distinct motivational and procurement criteria. Institutional investors and large-scale commercial property developers are highly motivated customers, driven primarily by asset performance, regulatory compliance, and Environmental, Social, and Governance (ESG) mandates. For this segment, roofing is viewed as an active capital asset that influences operational expenditure (via energy savings) and portfolio risk (via climate resilience). They require comprehensive data, including verified Environmental Product Declarations (EPDs), verifiable green certifications, and long-term manufacturer warranties, preferring products like high-albedo coatings, BIPV integration, and extensive green roof systems that directly enhance their building's financial and sustainability ratings.

Residential consumers form a substantial volume segment, characterized by varying levels of environmental awareness and a focus on localized aesthetic appeal and household cost savings. High-end residential buyers are often early adopters of premium, aesthetically superior ecological materials (such as recycled slate-look composites or natural low-carbon clay tiles) who value the ethical sourcing and superior durability. Mid-market homeowners, however, are strongly driven by the renovation sector and are heavily influenced by government incentives, focusing on easy-to-install, cost-competitive recycled options that deliver measurable reductions in heating and cooling bills, viewing the roof upgrade as a prudent energy efficiency investment for their primary asset.

The third major customer segment consists of public sector entities, including federal, state, and municipal governments, alongside major infrastructure developers. These customers are driven by policy objectives, utilizing ecological roofing for large-scale public buildings, affordable housing projects, and essential infrastructure upgrades as part of urban resilience and sustainability master plans. Procurement decisions in the public sector are heavily weighted toward tender specifications that require minimum recycled content, adherence to local stormwater ordinances, and products that offer community benefits, such as supporting urban biodiversity. Architects and engineers, while not the final buyers, act as critical gatekeepers in all three segments, influencing up to 80% of material specifications based on their expertise regarding performance, code compliance, and aesthetic viability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 28.9 Billion |

| Growth Rate | 9.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BMI Group, IKO, Saint-Gobain, Owens Corning, Ecostar, CertainTeed, Firestone Building Products, GAF, DaVinci Roofscapes, Terra Cotta, Redland Tiles, Boral Roofing, Axion International, Euroshield Roofing, Verea Clay Tile, Green Roof Blocks, ZinCo, Tremco, Sika AG, Polyglass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ecological Roofing Tile Market Key Technology Landscape

The technological landscape is undergoing rapid transformation, centered on achieving high performance and verified sustainability across the product lifecycle. In material science, the focus is on developing advanced bio-polymers and high-strength geopolymer cements. Bio-polymers derived from agricultural waste (such as rice husks or hemp fiber) are being refined to serve as durable, fire-resistant substrates for tiles, offering a zero-carbon alternative to traditional petroleum-based materials. Geopolymer technology replaces high-carbon Portland cement with industrial waste byproducts like fly ash and blast furnace slag, drastically cutting the carbon dioxide emissions associated with concrete and clay tile production. These innovations are critical in addressing the embodied carbon crisis in construction and are setting the new benchmark for material acceptability in green building projects globally.

System integration technology is the second pillar of innovation, emphasizing the roof’s transition from a passive cover to an active energy and ecological management system. Building-Integrated Photovoltaics (BIPV) have matured, offering seamless, aesthetically integrated solar tiles that maintain the look of traditional roofing while generating power efficiently. Furthermore, advanced water management systems, particularly relevant for flat-roof commercial applications, utilize porous ecological substrates and smart drainage layers to maximize stormwater retention and slow-release capacity. These integrated systems rely heavily on sophisticated layering and modular design to simplify installation and ensure long-term, verifiable ecological performance, moving the product offering from simple material replacement to comprehensive roofing solutions.

Manufacturing and processing technologies are evolving rapidly to meet the twin demands of scalability and low energy consumption. Continuous process optimization utilizes IoT sensors and automated robotic systems to manage production lines for recycled composite tiles, ensuring consistent density and structural integrity across millions of units while minimizing waste. Furthermore, low-temperature curing and infrared drying techniques are replacing traditional high-heat processes, significantly reducing the energy required for tile production, especially for clay and concrete alternatives. This technological push for process efficiency is directly contributing to closing the cost gap with conventional materials, ensuring that ecological tiles become economically competitive at scale, thereby accelerating mainstream market penetration across all geographic regions.

- Advanced Composite Formulation: Utilizing sophisticated polymer science, often bio-based or derived from difficult waste streams, to create durable, fire-resistant, lightweight roofing materials.

- Low-Carbon Cement and Firing Technologies: Implementation of geopolymer cements, supplementary cementitious materials (SCMs), and energy-optimized kilns for clay and concrete tiles to reduce embodied carbon.

- Building-Integrated Photovoltaics (BIPV): Developing aesthetic and high-performance solar tiles that function both as weather barriers and energy generators.

- Modular and Lightweight Design: Creation of easy-to-install, interlocking roofing systems tailored for the renovation market, minimizing structural impact and labor costs.

- Smart Monitoring and Sensor Integration: Incorporating IoT sensors for continuous data collection on thermal performance, moisture levels (in green roofs), and structural integrity, facilitating predictive maintenance.

Regional Highlights

North America maintains a dominant position in the consumption of high-value ecological roofing, primarily driven by a robust culture of insurance and risk mitigation coupled with strong regulatory action regarding energy efficiency. The U.S. market, particularly in states prone to wildfire (e.g., California) or high-wind events (e.g., Gulf Coast), exhibits high demand for Class A fire-rated and impact-resistant recycled composite tiles, viewing them as essential risk-mitigation tools. Federal and state incentives, notably the Inflation Reduction Act (IRA) and regional clean energy mandates, substantially subsidize BIPV and energy-efficient retrofitting, making the high initial cost of ecological roofing financially feasible for a broad residential and commercial base. The region is also a leader in specialized applications, such as extensive green roof adoption in major metropolitan areas like New York and Toronto to manage local heat island effects and storm runoff.

Europe’s leadership is fundamentally structural, built upon decades of progressive environmental legislation that has made sustainable construction the default standard. The EU’s Circular Economy Action Plan compels manufacturers to take responsibility for product end-of-life, leading to extensive investment in closed-loop recycling infrastructure for roofing materials. This legislative environment ensures the highest market share penetration for products with verified 100% recyclability and transparent EPDs. Countries such as Germany and the Netherlands have extremely high adoption rates of intensive and extensive green roofs, driven by local mandatory ordinances linking planning permission to specified levels of surface permeability and biodiversity enhancement. The European market focuses heavily on technological standardization and cross-border trade of certified low-carbon materials, fostering intense innovation in geopolymer and bio-based tiling.

The Asia Pacific region is poised for explosive growth, transitioning from a nascent market to the primary global growth engine over the forecast period. This acceleration is fueled by immense construction volume in rapidly urbanizing nations like China, India, and Southeast Asian countries. While cost sensitivity remains a factor, governmental sustainability policies in key urban centers are increasingly mirroring Western standards. China's ambitious long-term climate targets necessitate large-scale implementation of energy-efficient building materials, driving significant local manufacturing capacity for advanced low-carbon concrete and recycled composite tiles. The tropical and sub-tropical zones within APAC also drive specific demand for highly reflective (high-albedo) ecological tiles that effectively mitigate heat absorption, addressing the critical challenge of passive cooling in high-density, hot climate cities.

Latin America and the Middle East & Africa (MEA) represent high-potential, emerging markets. In the MEA, demand is heavily concentrated in high-profile, government-funded mega-projects (such as those in the GCC nations) that use ecological roofing to signal global leadership in sustainability and manage intense solar radiation. High-albedo, highly durable tiles are favored here. Latin American growth is more fragmented but is rising alongside increasing public awareness and the introduction of localized green building certifications in metropolitan hubs like São Paulo and Mexico City, focusing on cost-effective, regionally sourced sustainable clay and composite alternatives. These regions face challenges related to supply chain maturity and specialized installation training but offer immense untapped potential as sustainability mandates cascade from high-value projects into general construction.

- North America (NA): Strong demand for high-durability recycled composites; mature market for BIPV integration; focus on resilience against extreme weather; driven by LEED certification and tax incentives.

- Europe: Regulatory dominance through NZEB and circular economy policies; highest penetration of vegetative/green roof systems; technological leadership in low-carbon material production; emphasis on verified EPDs.

- Asia Pacific (APAC): Fastest projected growth driven by rapid urbanization and infrastructure spending; increasing governmental mandates in major economies (China, India); high potential for mass adoption of low-cost, ecological alternatives.

- Latin America (LATAM) & Middle East & Africa (MEA): Emerging markets driven by high-profile sustainable development projects; demand for high-albedo materials in hot climates (MEA); reliance on international investment and standards for market maturity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ecological Roofing Tile Market.- BMI Group

- IKO

- Saint-Gobain

- Owens Corning

- Ecostar

- CertainTeed

- Firestone Building Products

- GAF

- DaVinci Roofscapes

- Terra Cotta

- Redland Tiles

- Boral Roofing

- Axion International

- Euroshield Roofing

- Verea Clay Tile

- Green Roof Blocks

- ZinCo

- Tremco

- Sika AG

- Polyglass

Frequently Asked Questions

Analyze common user questions about the Ecological Roofing Tile market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary cost difference between ecological roofing tiles and traditional materials?

Ecological roofing tiles often have a higher initial purchasing cost, primarily due to specialized manufacturing processes and the cost associated with reliable sourcing and processing of recycled or sustainable inputs. However, this premium is typically offset by significant long-term savings resulting from superior thermal performance, extended lifecycles, reduced maintenance, and potential eligibility for government subsidies or tax credits, leading to a favorable total cost of ownership (TCO).

How do ecological roofing tiles contribute to improved building energy efficiency?

Ecological roofing tiles, particularly green roofs and high-albedo composite materials, inherently possess superior thermal insulation and reflection properties. Green roofs actively cool the building through evapotranspiration, while highly reflective tiles minimize heat absorption, significantly reducing the energy required for mechanical cooling systems and overall operational utility costs throughout the year.

Are recycled plastic roofing tiles durable and safe regarding fire resistance?

Modern recycled plastic and composite roofing tiles are engineered using advanced polymer science and incorporated fire retardants to achieve Class A fire ratings, meeting stringent safety codes. They are highly durable, resistant to impact, freeze-thaw cycles, and UV degradation, often carrying extended warranties that match or surpass those offered for conventional materials like slate or ceramic.

What role do ecological roofing tiles play in urban stormwater management?

Vegetal or green roofing systems are recognized by municipalities as essential tools for urban resilience. They absorb and retain significant volumes of rainwater, delaying and reducing surface runoff by up to 90%. This capability dramatically lowers the burden on municipal drainage systems, mitigates localized flooding risk, and filters pollutants, contributing to cleaner waterways.

What certifications should buyers look for when selecting sustainable roofing products?

Buyers should prioritize materials with third-party verification, including LEED (Leadership in Energy and Environmental Design) compliance, Cradle-to-Cradle certification (ensuring material health and circularity), verified Environmental Product Declarations (EPDs) detailing embodied carbon, and compliance with local energy efficiency standards like ENERGY STAR or the European NZEB mandate, validating the product's environmental claims.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager