Ecommerce Shopping Cart Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438501 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Ecommerce Shopping Cart Software Market Size

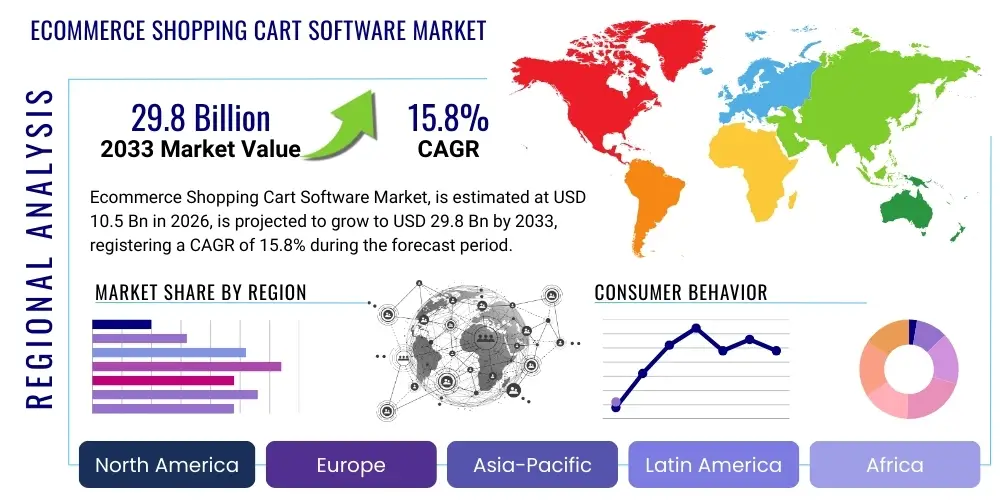

The Ecommerce Shopping Cart Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $10.5 Billion in 2026 and is projected to reach $29.8 Billion by the end of the forecast period in 2033.

Ecommerce Shopping Cart Software Market introduction

The Ecommerce Shopping Cart Software Market encompasses specialized applications and platforms designed to manage the selection, configuration, and purchase of goods or services online. These software solutions form the critical backbone of any digital retail operation, facilitating transactions, managing inventory, calculating taxes and shipping, and securing payment processing. The primary product offering ranges from highly customizable open-source platforms to fully integrated Software-as-a-Service (SaaS) solutions, catering to businesses of all scales, from small and medium enterprises (SMEs) to global large enterprises. Major applications include direct-to-consumer (D2C) retail, business-to-business (B2B) transactions, and cross-border e-commerce, all requiring robust, scalable, and secure transaction handling capabilities.

The core benefit of adopting advanced shopping cart software is the ability to provide a seamless, optimized user experience (UX) across multiple devices and channels, thereby minimizing cart abandonment rates and maximizing conversion. Modern platforms offer features such as multi-currency support, sophisticated product catalog management, integrated CRM capabilities, and extensive API libraries for integration with third-party logistics and marketing tools. The market is heavily driven by the accelerating global digital transformation, particularly the shift toward mobile commerce and the increased consumer expectation for personalized shopping journeys. These driving factors necessitate continuous innovation in features like one-click checkouts and subscription management models, pushing the market valuation upward.

Furthermore, the growing penetration of e-commerce into traditionally offline sectors, such as grocery, healthcare, and industrial parts manufacturing (B2B), significantly broadens the application scope for specialized shopping cart solutions. The demand for flexible deployment options, including headless commerce architectures that decouple the front-end presentation layer from the back-end commerce engine, is also a major driver. This separation allows businesses unparalleled freedom in designing unique front-end experiences while relying on the proven, robust transactional features of the core shopping cart software. This strategic flexibility is vital for enterprises seeking differentiation in highly competitive online retail environments.

Ecommerce Shopping Cart Software Market Executive Summary

The Ecommerce Shopping Cart Software Market is experiencing rapid expansion, characterized primarily by the dominant adoption of SaaS models over traditional on-premise solutions due to superior scalability, lower total cost of ownership (TCO), and automated maintenance. Key business trends include the strong push towards omnichannel retail strategies, forcing software vendors to prioritize unified inventory and customer data management across physical and digital storefronts. The ongoing macroeconomic climate, marked by increased consumer reliance on digital shopping, has accelerated the adoption cycle for advanced platforms capable of handling high transaction volumes securely and efficiently. Innovation in personalized marketing tools integrated directly into the cart software represents a major competitive differentiator among vendors, driving market share gains for feature-rich platforms.

Regionally, North America maintains its position as the largest market, driven by high technology adoption rates and the presence of numerous market leaders and well-established e-commerce ecosystems. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive increases in mobile internet penetration, expanding middle-class populations, and government initiatives supporting digital commerce adoption, particularly in emerging economies like India and Southeast Asia. Europe remains a significant market, focusing heavily on regulatory compliance, data privacy (GDPR), and seamless cross-border e-commerce within the single market, demanding robust localization features from software providers.

In terms of segment trends, the Small and Medium Enterprises (SMEs) segment is a significant revenue generator, predominantly utilizing accessible, low-cost, all-in-one SaaS platforms. Conversely, large enterprises are increasingly investing in highly customized, composable commerce solutions, leveraging headless architectures and microservices to build unique, large-scale applications capable of supporting complex B2B and international operations. The B2B segment is undergoing substantial digital transformation, shifting purchasing processes online and driving demand for specialized features such as tiered pricing, volume discounts, and integration with Enterprise Resource Planning (ERP) systems, thus becoming a pivotal growth segment for specialized shopping cart software.

AI Impact Analysis on Ecommerce Shopping Cart Software Market

Users frequently inquire about AI’s role in optimizing the conversion funnel, securing transactions, and automating inventory management within shopping cart ecosystems. The analysis of these common questions reveals key expectations surrounding AI's capability to deliver enhanced personalization, predictive inventory forecasting, and proactive fraud detection. Users are concerned about how AI can move beyond basic recommendations to truly understand and anticipate buyer behavior, thereby reducing cart abandonment and improving lifetime customer value (LTV). Furthermore, security remains a central theme, with merchants seeking AI-driven tools that can identify and block sophisticated bot attacks and payment fraud attempts in real-time without hindering legitimate customer traffic. The consensus is that AI is transitioning from an auxiliary feature to a foundational component, indispensable for maintaining competitiveness and operational efficiency in high-volume e-commerce environments.

- AI-Powered Personalization: Utilizing machine learning algorithms to analyze real-time browsing and purchasing history, enabling dynamic adjustments to product recommendations, pricing, and promotional offers displayed within the cart environment, significantly boosting conversion rates.

- Predictive Inventory Management: AI models forecast demand volatility and optimal stock levels based on historical sales data, seasonality, and external factors, automatically alerting merchants or adjusting product availability status in the shopping cart interface.

- Enhanced Fraud Detection and Security: Implementing sophisticated AI algorithms (e.g., behavioral biometrics) at the checkout stage to instantly detect anomalous transaction patterns, minimizing chargebacks and protecting sensitive payment data without compromising checkout speed.

- Automated Customer Support Integration: AI-powered chatbots and virtual assistants are integrated directly into the cart and checkout process to resolve common inquiries (shipping costs, product specifications) instantly, improving user experience and reducing operational load.

- Dynamic Pricing Optimization: Using AI to analyze competitor pricing, demand elasticity, and current stock levels to automatically adjust product prices displayed in the cart, maximizing profit margins and maintaining competitive positioning.

- Search and Discovery Optimization: Improving site search relevance within the platform by employing Natural Language Processing (NLP) to understand complex or misspelled search queries, leading customers directly to desired products and enhancing the overall shopping journey.

DRO & Impact Forces Of Ecommerce Shopping Cart Software Market

The market is predominantly driven by the pervasive global digital shift and the relentless expansion of mobile commerce, compelling businesses to adopt robust, mobile-optimized shopping cart solutions. Opportunities are concentrated in the rapid uptake of headless commerce architectures and the deepening penetration into specialized B2B e-commerce sectors, which require complex catalog and pricing management tools. However, the market faces significant restraints, notably the complex integration challenges associated with connecting shopping cart software seamlessly with existing legacy ERP, CRM, and fulfillment systems, particularly for large, established enterprises. Furthermore, escalating concerns regarding data security, compliance with stringent regional data privacy laws (like GDPR and CCPA), and the persistent threat of cyberattacks necessitate substantial ongoing investment in security infrastructure, which can raise the barrier to entry for smaller vendors. These forces collectively dictate the strategic priorities for software development and market expansion.

The core drivers include the exponential growth of cross-border e-commerce, which mandates shopping cart solutions capable of handling multi-currency transactions, localized payment gateways, and intricate international tax calculations. Additionally, the growing consumer expectation for highly flexible fulfillment options, such as Buy Online, Pick Up In Store (BOPIS) and same-day delivery, pushes platforms to offer highly versatile inventory visibility features. These factors create sustained demand for high-performance, feature-rich software. Conversely, the market restraint presented by intense competition from established marketplaces (e.g., Amazon, Alibaba) is significant, as these platforms offer ready-made infrastructure and massive customer bases, posing an alternative to building and maintaining a proprietary e-commerce storefront, especially for new entrants.

Impact forces are currently trending towards opportunities derived from technological innovation. The shift towards composable commerce—utilizing best-of-breed components integrated via APIs rather than monolithic platforms—presents a major opportunity for vendors specializing in specific functionalities, such as advanced personalization or complex subscription management. However, this architectural shift simultaneously acts as an indirect restraint for legacy providers struggling to modernize their systems. The overall market momentum is strongly positive, driven by the fundamental necessity for nearly every modern business to maintain a transactional online presence, ensuring sustained investment in advanced shopping cart technology capable of adapting to future consumer behavior and technological paradigms like Web3 integration.

Segmentation Analysis

The Ecommerce Shopping Cart Software Market is extensively segmented based on deployment model, enterprise size, industry vertical, and specific business model. The segmentation reflects the diverse and often specialized needs across the global digital commerce landscape. The deployment model split—between cloud-based (SaaS) and on-premise solutions—is critical, with cloud deployment dominating due to its scalability, flexibility, and reduced need for capital expenditure on infrastructure. Enterprise size segmentation distinguishes the requirements of Small and Medium Enterprises (SMEs), which prioritize affordability and ease of setup, from Large Enterprises, which demand high customization, dedicated support, and robust integration capabilities with complex corporate systems. These distinct needs drive vendors to tailor their product offerings and pricing strategies specifically for each market segment.

- Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industry Vertical:

- Retail and Consumer Goods

- Electronics and Technology

- Food and Beverage (F&B)

- Healthcare and Pharmaceuticals

- Automotive

- Others (e.g., Media, Education)

- Business Model:

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Consumer-to-Consumer (C2C)

- Direct-to-Consumer (D2C)

Value Chain Analysis For Ecommerce Shopping Cart Software Market

The value chain for Ecommerce Shopping Cart Software is complex, beginning with the upstream component, which involves core software development, technological infrastructure provisioning (dominated by major cloud providers like AWS, Azure, and Google Cloud), and continuous security auditing and patching. This phase is characterized by significant R&D investment aimed at developing modular, API-first architecture, ensuring high uptime, and maintaining compliance with global standards. The midstream involves the crucial phase of system integration and customization, where third-party developers, system integrators (SIs), and implementation partners tailor the core software to meet the specific branding, workflow, and legacy system requirements of the end-client. This integration layer often determines the success and performance of the final deployment, emphasizing the role of robust APIs.

The downstream activities focus on distribution and post-implementation support. Distribution channels are typically bifurcated into direct sales (especially common for large enterprise solutions like Salesforce Commerce Cloud or SAP Commerce Cloud, involving dedicated sales teams and large service contracts) and indirect distribution, primarily utilized by SaaS providers targeting SMEs (e.g., Shopify, Wix). The indirect channel relies heavily on large partner ecosystems, application marketplaces (app stores), and affiliate marketing to reach a broad global user base efficiently. Post-sales support, maintenance, and regular platform updates are critical components of the value chain, ensuring customer retention and maximizing the recurring revenue streams inherent in the SaaS model.

The role of specialized service providers, including payment gateways, logistics aggregators, and marketing automation firms, further enriches the value chain by offering seamless, pre-built integrations into the core shopping cart platform. This ecosystem approach reduces complexity for merchants, allowing them to rapidly deploy sophisticated capabilities. The dominance of the cloud has streamlined infrastructure provisioning, shifting focus and value creation towards sophisticated application layer development and expert integration services, rather than hardware management, making highly skilled implementation partners a valuable intermediary in the modern e-commerce software distribution network.

Ecommerce Shopping Cart Software Market Potential Customers

The primary consumers and end-users of Ecommerce Shopping Cart Software are highly diverse, encompassing virtually every sector engaged in transactional digital commerce. Key customer segments include pure-play online retailers (e-tailers) that rely entirely on the platform for their operations, ranging from niche D2C brands to large digital department stores. A second major segment involves traditional brick-and-mortar retail chains undergoing digital transformation, known as omnichannel retailers. These customers require sophisticated integration capabilities to synchronize physical store inventory, loyalty programs, and point-of-sale (POS) systems with their new online shopping cart infrastructure, ensuring a unified customer experience across all touchpoints.

A rapidly expanding segment consists of B2B enterprises, including manufacturers, wholesalers, and distributors, which are increasingly migrating their complex sales processes online. These buyers require specialized features in shopping cart software, such as customer-specific pricing catalogs, Request for Quote (RFQ) functionalities, complex ordering hierarchies, and deep integration with ERP systems for accurate fulfillment tracking. The shift in B2B purchasing behavior toward self-service digital platforms means these customers prioritize security, scalability, and seamless integration with existing procurement systems over traditional B2C user experience features.

Furthermore, digital service providers, media companies offering subscriptions or digital goods, and educational institutions selling courses also constitute significant buyer groups. For these customers, the shopping cart software needs to excel in managing recurring billing, managing digital product delivery, and handling regulatory compliance specific to digital content sales. Ultimately, any organization aiming to monetize assets or services through an online transactional interface, regardless of industry, represents a potential buyer, provided the software offers the necessary scalability, security, and integration flexibility required by their unique operational demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $10.5 Billion |

| Market Forecast in 2033 | $29.8 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shopify, BigCommerce, WooCommerce, Magento (Adobe), Salesforce Commerce Cloud, PrestaShop, Wix Stores, Squarespace, OpenCart, Ecwid, Oracle NetSuite Commerce, SAP Commerce Cloud, Volusion, 3dcart (Shift4Shop), LemonStand, X-Cart, PinnacleCart, CS-Cart, Shopware. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ecommerce Shopping Cart Software Market Key Technology Landscape

The technology landscape of the Ecommerce Shopping Cart Software Market is rapidly evolving, driven by the need for ultimate flexibility, speed, and scalability. The most pivotal architectural shift is the widespread adoption of MACH architecture—Microservices, API-first, Cloud-native, and Headless—which fundamentally changes how e-commerce sites are built and managed. Headless commerce, which decouples the front-end user interface (the head) from the back-end commerce engine (the body), allows businesses to use the core shopping cart functionality while deploying custom front-ends built using modern frameworks like React or Vue.js. This separation allows for highly optimized, fast-loading, and innovative customer experiences independent of the core transactional system upgrade cycles, addressing the high user expectations for responsiveness and design quality.

Another critical technological trend involves the proliferation of sophisticated Application Programming Interfaces (APIs). Modern shopping cart platforms must be fully API-first, meaning all functionalities—from inventory checks and product configuration to checkout processing—are exposed through robust, well-documented APIs. This allows merchants to create a composable commerce ecosystem, integrating best-of-breed services (e.g., dedicated tax calculators, advanced search engines, specialized PIM systems) seamlessly with the core platform. The reliance on APIs minimizes vendor lock-in and facilitates rapid experimentation and deployment of new features, which is essential for maintaining a competitive edge in fast-moving retail sectors.

Furthermore, cloud-native infrastructure is now the default standard, leveraging the scalability and reliability of hyperscale cloud providers. Security technologies, particularly those related to Payment Card Industry Data Security Standard (PCI DSS) compliance and advanced anti-fraud mechanisms (often AI-driven), are continuously enhanced. The integration of augmented reality (AR) and virtual reality (VR) capabilities, particularly in product visualization within the shopping cart interface, is emerging as a significant feature differentiator, enhancing product immersion and reducing return rates. The foundational technology remains focused on high transactional integrity, low latency, and comprehensive security protocols across all devices, particularly mobile endpoints.

Regional Highlights

- North America: This region holds the largest market share, driven by a mature e-commerce ecosystem, high consumer spending power, and early adoption of advanced technologies like AI, headless commerce, and sophisticated omnichannel retailing strategies. The presence of major vendors and high penetration of SaaS solutions across both large enterprises and SMEs ensure sustained market leadership.

- Europe: Characterized by strong growth, particularly in Western European nations. The market here is highly influenced by rigorous data privacy regulations (GDPR), demanding specialized compliance features in shopping cart software. Cross-border e-commerce within the EU single market drives demand for multi-language, multi-currency, and localized payment solutions.

- Asia Pacific (APAC): Expected to register the fastest CAGR over the forecast period. Growth is fueled by massive mobile commerce adoption, rapidly expanding digital infrastructure, and large, untapped consumer markets in countries like China, India, and Indonesia. This region demands robust, affordable SaaS platforms capable of handling extremely high volume traffic, particularly during localized promotional events.

- Latin America (LATAM): A growing market characterized by increasing internet penetration and a rising consumer comfort level with digital payments. Key market drivers include the need for localized payment methods and solutions that can manage high transaction fraud rates, requiring sophisticated, region-specific security features.

- Middle East and Africa (MEA): An emerging market showing significant potential, particularly in the Gulf Cooperation Council (GCC) countries due to high disposable incomes and government investments in digital infrastructure. The focus is on implementing secure, large-scale systems for both retail and specialized B2B sectors, often utilizing bespoke solutions for logistics challenges unique to the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ecommerce Shopping Cart Software Market.- Shopify

- BigCommerce

- WooCommerce

- Magento (Adobe)

- Salesforce Commerce Cloud

- PrestaShop

- Wix Stores

- Squarespace

- OpenCart

- Ecwid

- Oracle NetSuite Commerce

- SAP Commerce Cloud

- Volusion

- 3dcart (Shift4Shop)

- LemonStand

- X-Cart

- PinnacleCart

- CS-Cart

- Shopware

Frequently Asked Questions

Analyze common user questions about the Ecommerce Shopping Cart Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is headless commerce and why is it crucial for enterprise shopping cart software?

Headless commerce is an architectural approach that separates the customer-facing presentation layer (front-end) from the transactional core (back-end shopping cart software). It is crucial for enterprises because it allows for rapid, flexible deployment of customized user interfaces across new devices (e.g., IoT, VR) without disrupting core business logic, significantly improving speed and scalability.

How does the shift to B2B e-commerce impact shopping cart software requirements?

The shift necessitates specialized features beyond standard B2C functions, including support for complex tiered pricing, customer-specific product catalogs, managing corporate credit limits, enabling Request for Quote (RFQ) workflows, and providing deep, stable integration with Enterprise Resource Planning (ERP) systems for streamlined procurement and invoicing processes.

Which deployment model, SaaS or On-Premise, dominates the current market and why?

The Software-as-a-Service (SaaS) model overwhelmingly dominates the current market. SaaS platforms offer superior benefits such as reduced upfront costs, automatic updates, high availability, intrinsic scalability, and simplified compliance management, making them highly attractive to both SMEs and large enterprises seeking operational efficiency.

What are the primary factors driving cart abandonment, and how does software mitigate this?

Primary factors include unexpected shipping costs, forced account creation, and complex checkout processes. Modern shopping cart software mitigates abandonment through optimized checkout flows (e.g., guest checkout, one-click purchase), real-time transparent shipping and tax calculations, and implementation of recovery tools like automated exit-intent pop-ups and personalized follow-up emails.

How significant is API integration capability in selecting a shopping cart platform?

API integration capability is fundamentally significant, representing a core requirement for modern commerce. Robust APIs ensure the platform can connect seamlessly with essential third-party services—such as payment gateways, logistics providers, PIM systems, and marketing automation tools—creating a flexible, future-proof, composable commerce ecosystem that avoids vendor lock-in.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager