Econometric Analysis Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433071 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Econometric Analysis Software Market Size

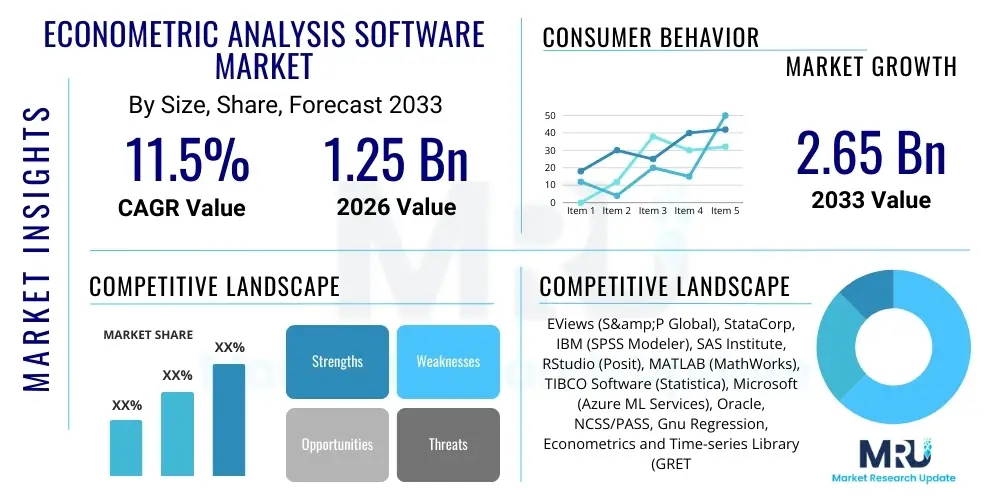

The Econometric Analysis Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.65 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing need across industries, particularly in finance, government, and academia, to derive actionable, statistically rigorous insights from complex, large-scale datasets. Econometric software facilitates sophisticated modeling techniques, such as time-series analysis, panel data regression, and structural equation modeling, which are crucial for precise forecasting, policy evaluation, and risk assessment in volatile economic environments.

Econometric Analysis Software Market introduction

The Econometric Analysis Software Market encompasses specialized computational tools designed to apply statistical methods to economic data, enabling the estimation and testing of economic relationships, hypotheses, and theories. These products are critical for tasks ranging from forecasting macroeconomic indicators and evaluating the efficacy of fiscal policies to optimizing investment strategies and managing credit risk within financial institutions. Key applications include the development of predictive models, the analysis of causal relationships between variables, and the simulation of various economic scenarios. The sophistication of modern software allows users to handle advanced techniques like Generalized Method of Moments (GMM), Vector Autoregression (VAR), and complex volatility modeling (GARCH/ARCH), moving far beyond basic linear regression to address the non-linear complexities inherent in economic data.

Benefits derived from the utilization of advanced econometric software include significantly improved decision-making quality, enhanced risk management capabilities, and increased operational efficiency in data analysis pipelines. These platforms often feature robust data handling capabilities, integration with programming languages like R and Python, and customizable reporting modules, allowing researchers and analysts to translate complex quantitative results into readily understandable business intelligence. The driving factors behind market growth are multifaceted, notably the massive proliferation of digital economic data (Big Data), the urgent requirement for accurate real-time forecasting amidst global economic volatility, and the increasing reliance on evidence-based policy formulation by governmental and international organizations. Furthermore, academic institutions continue to integrate these tools into their core curricula, ensuring a steady stream of trained professionals entering the workforce capable of leveraging these advanced analytical solutions.

Econometric Analysis Software Market Executive Summary

The Econometric Analysis Software Market is experiencing robust expansion, characterized by significant integration of cloud-based deployment models and rising demand from the Banking, Financial Services, and Insurance (BFSI) sector, which uses these tools for advanced risk modeling, portfolio optimization, and regulatory compliance (e.g., Basel requirements). Major business trends include the shift toward subscription-based licensing, enhancing accessibility for small and medium enterprises (SMEs) and individual researchers, and the continuous incorporation of machine learning (ML) algorithms to improve model robustness and predictive accuracy, bridging the gap between traditional econometrics and modern data science. The market is witnessing intensive competition, driving innovation in user interface design, aiming for accessibility even for users without deep programming expertise, while maintaining the capacity for highly technical customization required by professional econometricians.

Regionally, North America maintains market dominance due to high investment in R&D, the presence of major software vendors, and advanced adoption across its financial and governmental sectors. However, the Asia Pacific (APAC) region is poised for the highest growth trajectory, fueled by rapidly digitizing economies, increasing regulatory sophistication in countries like China and India, and expanding academic and corporate investment in quantitative analysis capabilities. Segment trends indicate that the market for complementary services, including consulting, training, and custom model development, is growing faster than the core software segment itself, reflecting the high barriers to entry related to specialized skills required to effectively utilize these powerful tools. Furthermore, solutions specifically tailored for time-series analysis and panel data methods are seeing accelerated adoption, necessitated by the need to analyze longitudinal macroeconomic trends and complex organizational performance metrics over time.

AI Impact Analysis on Econometric Analysis Software Market

User queries regarding the impact of AI on the Econometric Analysis Software Market frequently center on whether AI/ML models will supersede classical econometric methods, how AI integration enhances model specification and prediction, and the potential for AI to automate routine modeling tasks, lowering the skill threshold for usage. Key themes emerging from these concerns include expectations for greater predictive power, the demand for explainable AI (XAI) features to maintain transparency inherent in traditional econometric models, and the perceived potential for AI to handle massive, unstructured datasets that were previously infeasible for classical systems. Users are keenly interested in how AI can assist in the selection of optimal lags in time-series models, identification of structural breaks, and the automated cleaning and preprocessing of economic data, thereby drastically reducing the manual effort involved in model construction and validation.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) on econometric analysis software is transformative, primarily by augmenting existing capabilities rather than replacing core methodologies. AI algorithms, such as neural networks and deep learning, are being integrated to handle non-linearity and high-dimensionality in data, offering more nuanced predictions than conventional linear models, especially in high-frequency trading and risk modeling. Furthermore, AI tools are automating the model selection process, helping analysts efficiently navigate thousands of potential model specifications, and ensuring robustness against overfitting through cross-validation techniques. This synergistic approach allows researchers to leverage the statistical rigor and causal inference strengths of econometrics while benefiting from the predictive accuracy and data handling scale of modern AI, leading to significantly more robust and scalable analytical workflows.

- AI enhances predictive accuracy, particularly for complex, non-linear economic phenomena.

- Machine learning facilitates automated feature selection and model optimization (AutoML), reducing manual specification errors.

- Natural Language Processing (NLP) integration allows for the inclusion of qualitative data (e.g., news sentiment) into quantitative models.

- AI-powered simulation tools enable more sophisticated scenario planning and stress testing.

- Explainable AI (XAI) functionality addresses the "black box" concern, maintaining model transparency crucial for regulatory and policy applications.

DRO & Impact Forces Of Econometric Analysis Software Market

The Econometric Analysis Software Market is propelled by significant drivers, constrained by specific technological and human capital hurdles, and presents substantial growth opportunities arising from technological evolution and geographical expansion. The primary drivers include the global proliferation of economic data requiring sophisticated handling, increasing regulatory demands for rigorous quantitative risk and forecasting models in the BFSI sector, and the competitive necessity for corporations to utilize precise predictive analytics for strategic decision-making. Restraints largely revolve around the high initial cost of enterprise-level software licenses, the dependency on highly specialized personnel proficient in both statistics and programming, and the steep learning curve associated with mastering complex econometric techniques, which limits widespread adoption across smaller organizations. Opportunities lie mainly in the shift towards Software-as-a-Service (SaaS) models, making these tools more accessible, the expansion into emerging economies with rapidly formalizing financial systems, and the continuing technological integration of user-friendly interfaces with advanced modeling capabilities, democratizing access to complex analytical power.

Impact forces within the market are predominantly influenced by technological advancements, regulatory pressures, and shifting customer demand for integration and scalability. The impact of digitalization mandates that econometric software must seamlessly integrate with massive, distributed data architectures, such as Hadoop and Spark ecosystems. Simultaneously, evolving financial regulations (like IFRS 9 or CECL) mandate specific, quantifiable methodologies for risk provisioning, thereby driving mandatory software upgrades and purchases. The competitive landscape is characterized by established statistical software providers continually adding advanced econometric modules and specialized econometric vendors focusing on superior analytical depth in niche areas like panel data or high-frequency finance. The overall impact results in a market prioritizing solutions that are simultaneously powerful, compliant, highly scalable, and user-friendly, pushing vendors toward constant innovation in deployment and analytical features.

Segmentation Analysis

The Econometric Analysis Software Market is comprehensively segmented based on several key criteria, including Component, Deployment Type, Application, and End-User, reflecting the diverse requirements of the global analytical community. Segmentation by Component distinguishes between the core software platform itself and the extensive range of associated services, such as consulting, implementation, and training, which are crucial for optimal utilization of complex tools. Deployment Type is primarily split between on-premise solutions, favored by organizations with stringent data security requirements (like government bodies and large banks), and the increasingly popular cloud-based (SaaS) models, which offer superior flexibility, scalability, and cost efficiency. Analyzing these segments provides vendors with crucial insights into tailoring their offerings, balancing the demand for robust, proprietary desktop tools with the rapid market adoption of flexible, subscription-based cloud environments accessible globally.

- By Component:

- Software (Core Statistical Engines, Modeling Suites)

- Services (Consulting, Implementation, Training, Support)

- By Deployment Type:

- On-Premise (High control and security)

- Cloud-Based (SaaS) (Scalability and accessibility)

- By Application:

- Forecasting and Predictive Modeling

- Policy and Program Evaluation

- Risk Management and Stress Testing

- Causal Inference and Impact Analysis

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Policy Organizations

- Academic and Research Institutions

- Corporate Sector (Retail, Energy, Manufacturing)

Value Chain Analysis For Econometric Analysis Software Market

The value chain for Econometric Analysis Software begins upstream with fundamental research and development, where vendors invest heavily in developing sophisticated statistical algorithms and high-performance computing frameworks capable of processing massive economic datasets efficiently. This phase involves collaboration with academic experts and computer scientists to ensure the algorithms meet the highest standards of econometric rigor, focusing on methodologies like panel data econometrics, spatial econometrics, and complex simulation methods. Key upstream activities include securing intellectual property related to proprietary solvers and ensuring compatibility with prevailing data standards and operating systems. Successful upstream development dictates the fundamental capabilities and competitive differentiation of the final software product, defining its ability to handle modern data challenges like non-stationarity and endogeneity.

The midstream stage focuses on the actual software development, integration, and platform design. This involves building user interfaces, developing programming language interfaces (APIs for R, Python, MATLAB), creating robust data management capabilities, and ensuring the final product is secure and scalable, whether deployed on-premise or via the cloud. Modern value creation emphasizes creating intuitive graphical user interfaces (GUIs) that mask the underlying complexity of the statistical models, thereby broadening the potential user base beyond highly specialized statisticians. Quality assurance, rigorous testing against established econometric benchmarks, and compliance with industry standards (e.g., ISO/IEC 25010) are critical midstream tasks that ensure model reliability and validity across diverse economic applications.

Downstream activities center on distribution, sales, implementation, and post-sale support. Distribution channels are typically a mix of direct sales teams targeting large enterprise and government contracts, and indirect channels relying on value-added resellers (VARs) and academic distributors who often bundle the software with relevant training and customized consulting services. Post-sale support and services are crucial, encompassing technical help, user training, and specialized econometric consulting to help clients correctly apply complex models to their specific economic problems. The final element of the downstream value chain is the continuous collection of user feedback, which feeds directly back into the upstream R&D cycle, ensuring the software evolves in line with emerging econometric needs and technological capabilities, such as advanced cloud integration and the adoption of cutting-edge machine learning techniques.

Econometric Analysis Software Market Potential Customers

The primary end-users and buyers of Econometric Analysis Software are organizations requiring highly reliable, quantitative forecasting and policy evaluation capabilities, where decisions carry significant financial or societal implications. This predominantly includes major institutions within the Banking, Financial Services, and Insurance (BFSI) sector, such as central banks, commercial investment banks, asset management firms, and insurance underwriters, who utilize the software for stress testing portfolios, modeling economic cycles, and ensuring regulatory capital adequacy. Furthermore, Governmental and Public Policy Organizations, including national treasury departments, statistical bureaus, and regulatory agencies, are significant purchasers, relying on these tools for macroeconomic forecasting, evaluating the impact of tax policies, and managing public expenditure programs, demanding solutions that offer high degrees of auditability and transparency in their methodologies.

Beyond these core sectors, Academic and Research Institutions represent a vital customer base, using the software for teaching advanced statistics and econometrics, and conducting cutting-edge economic research that frequently necessitates specialized modeling capabilities like discrete choice or duration models. Increasingly, large Corporate Enterprises across sectors such as energy, retail, and manufacturing are adopting sophisticated econometric software to forecast commodity prices, optimize supply chain logistics based on predicted economic demand shifts, and analyze pricing elasticity. These end-users demand scalable solutions that can integrate massive internal transaction and operational data with external macroeconomic variables to derive competitive strategic advantages, requiring vendors to provide robust APIs and enterprise-level data integration features alongside their analytical power.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EViews (S&P Global), StataCorp, IBM (SPSS Modeler), SAS Institute, RStudio (Posit), MATLAB (MathWorks), TIBCO Software (Statistica), Microsoft (Azure ML Services), Oracle, NCSS/PASS, Gnu Regression, Econometrics and Time-series Library (GRETL), Limdep/NLogit, OxMetrics, GAUSS, SAP |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Econometric Analysis Software Market Key Technology Landscape

The technology landscape of the Econometric Analysis Software Market is defined by a continuous push toward integrating high-performance computing capabilities with user accessibility, allowing analysts to process massive economic datasets swiftly and run complex simulations efficiently. A central technological advancement involves the robust integration capabilities with open-source statistical programming languages, primarily R and Python, via dedicated APIs and integrated development environments (IDEs). This integration allows users to leverage the vast libraries and community-driven innovations within the open-source ecosystem (e.g., packages for specialized time-series analysis or causal inference techniques) while retaining the structured, certified environment provided by commercial software platforms, ensuring both flexibility and statistical reliability in complex modeling workflows.

Another critical technological development is the implementation of distributed and parallel computing architectures, essential for handling Big Data challenges prevalent in high-frequency financial econometrics and large-scale panel data analysis. Modern software utilizes cloud infrastructure (like AWS or Azure) to facilitate scalable, on-demand computational power, enabling the rapid estimation of computationally intensive models, such as Maximum Likelihood Estimation (MLE) or simulation-based methods like Markov Chain Monte Carlo (MCMC). Furthermore, Graphical User Interfaces (GUIs) are becoming significantly more sophisticated, moving beyond simple menu-driven operations to incorporate dynamic visualizations, interactive data exploration tools, and drag-and-drop model building capabilities, specifically designed to lower the barrier to entry for business economists who may not be proficient in traditional command-line scripting.

The landscape is also characterized by substantial innovation in specialized modeling techniques embedded within the software. This includes enhanced modules for structural econometrics, spatial modeling (crucial for regional economic analysis), and advanced discrete choice models (essential for marketing and transportation economics). Furthermore, the security technology underpinning cloud-based econometric solutions is vital, ensuring regulatory compliance regarding data privacy and access control, especially when dealing with sensitive financial or governmental data. Vendors are continually refining proprietary data compression and memory management techniques to optimize performance when dealing with datasets that exceed conventional system memory limitations, solidifying the importance of computational efficiency as a core technology differentiator in this highly specialized market.

Regional Highlights

- North America: North America, particularly the United States, holds the largest share of the Econometric Analysis Software Market. This dominance is attributed to the presence of key industry players, high levels of technological maturity, and the substantial expenditure on advanced analytical tools by the BFSI sector, large corporations, and government agencies (e.g., the Federal Reserve, Bureau of Economic Analysis). The region leads in the adoption of cutting-edge methodologies, including high-frequency econometrics for financial modeling and sophisticated panel data techniques for corporate strategy, driven by a highly competitive business environment and stringent financial regulations requiring transparent and rigorous risk assessment methods.

- Europe: Europe represents a mature market characterized by robust demand driven primarily by stringent regulatory requirements, especially concerning banking stress testing (e.g., the European Banking Authority requirements) and macroeconomic stability monitoring by organizations like the European Central Bank. Countries such as the UK, Germany, and France are major consumers, with a strong focus on using econometric software for policy evaluation, macroeconomic forecasting, and ensuring compliance with complex regulations such as MiFID II. The European market emphasizes software reliability, auditability, and integration with standardized financial reporting frameworks.

- Asia Pacific (APAC): The APAC region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by accelerating digitalization, the formalization of financial sectors in emerging economies (China, India, Southeast Asia), and increasing government investment in economic planning and infrastructure development. The rising adoption of advanced statistical methods in academia and corporate environments, coupled with growing IT infrastructure capabilities, makes APAC a critical growth frontier for cloud-based econometric solutions and localized training services, targeting rapid uptake among new entrants to quantitative analysis.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by central banks and government bodies aiming to manage inflation, stabilize currencies, and improve macroeconomic forecasting accuracy amidst periods of volatility. Brazil and Mexico are key contributors, characterized by a growing need for advanced time-series analysis software to deal with high economic fluctuations. Market penetration is currently lower compared to North America and Europe, presenting substantial opportunities for vendors offering cost-effective and localized training resources.

- Middle East and Africa (MEA): The MEA market is still nascent but shows promising growth, particularly in the Gulf Cooperation Council (GCC) countries, where large-scale government investments in economic diversification, infrastructure projects, and financial sector development necessitate sophisticated economic modeling and projection capabilities. The demand is concentrated in central banks, sovereign wealth funds, and major energy companies seeking reliable predictive models for oil price volatility and future economic scenarios.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Econometric Analysis Software Market.- EViews (S&P Global Market Intelligence)

- StataCorp LLC

- IBM Corporation (SPSS Modeler)

- SAS Institute Inc.

- MathWorks (MATLAB)

- TIBCO Software Inc. (Statistica)

- RStudio (Posit)

- Microsoft Corporation (Azure ML Services)

- Oracle Corporation

- NCSS/PASS Software

- Gnu Regression, Econometrics and Time-series Library (GRETL)

- Limdep/NLogit (Econometric Software, Inc.)

- OxMetrics (Doornik & Hendry)

- GAUSS (Aptech Systems)

- SAP SE

- DataRobot

- Alteryx, Inc.

- RapidMiner (Altair)

- Kutools

- GraphPad Software

Frequently Asked Questions

Analyze common user questions about the Econometric Analysis Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard statistical software and specialized Econometric Analysis Software?

Econometric analysis software is specifically designed to handle the unique complexities of economic and time-series data, such as non-stationarity, endogeneity, simultaneous equations, and structural breaks, which are poorly handled by general statistical packages. It emphasizes robust causal inference, policy evaluation, and financial volatility modeling (e.g., GARCH), providing specialized algorithms and diagnostics tailored to economic theory and forecasting. Standard statistical software often focuses more broadly on experimental data or cross-sectional analysis.

How is cloud deployment transforming the accessibility of advanced econometric tools?

Cloud deployment (SaaS) drastically lowers the barrier to entry by reducing initial capital expenditure associated with purchasing high-cost licenses and powerful on-premise hardware. It allows global accessibility, facilitates collaborative work among geographically dispersed teams, and offers scalable computing power on demand, essential for running large-scale simulations and processing Big Data datasets without local infrastructure limitations. This shift democratizes access to advanced tools for academic users, SMEs, and developing economies.

Which industry sector is the largest end-user of Econometric Analysis Software and why?

The Banking, Financial Services, and Insurance (BFSI) sector is the largest end-user, primarily due to mandatory regulatory requirements (e.g., Basel III, stress testing directives) that necessitate highly accurate risk modeling, credit scoring, and economic forecasting capabilities. Investment banks and asset managers also rely heavily on these tools for portfolio optimization, algorithmic trading strategy development, and real-time market prediction, where the robustness and interpretability of econometric models are critical for managing billions in assets.

What role does the integration of AI/Machine Learning play in the future of econometric software?

AI/ML integration is crucial for augmenting traditional econometrics. It helps automate model specification, handle complex non-linear relationships, and integrate unstructured data (like text) into forecasting models. The future involves hybrid tools that utilize ML for predictive accuracy while retaining the causal inference and interpretability features inherent in classical econometric models, facilitated by robust Explainable AI (XAI) features for regulatory compliance and transparency.

What are the main technical restraints impacting the widespread adoption of advanced econometric software?

The primary technical restraint is the requirement for specialized human capital. Effective utilization of advanced econometric software demands users possess a deep understanding of statistical theory, modeling diagnostics, and programming expertise, leading to a shortage of qualified analysts. Furthermore, software complexity, high licensing fees for proprietary platforms, and challenges related to integrating complex software with proprietary legacy data systems within large organizations also significantly impede broader market adoption, particularly outside of established financial hubs and research institutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager