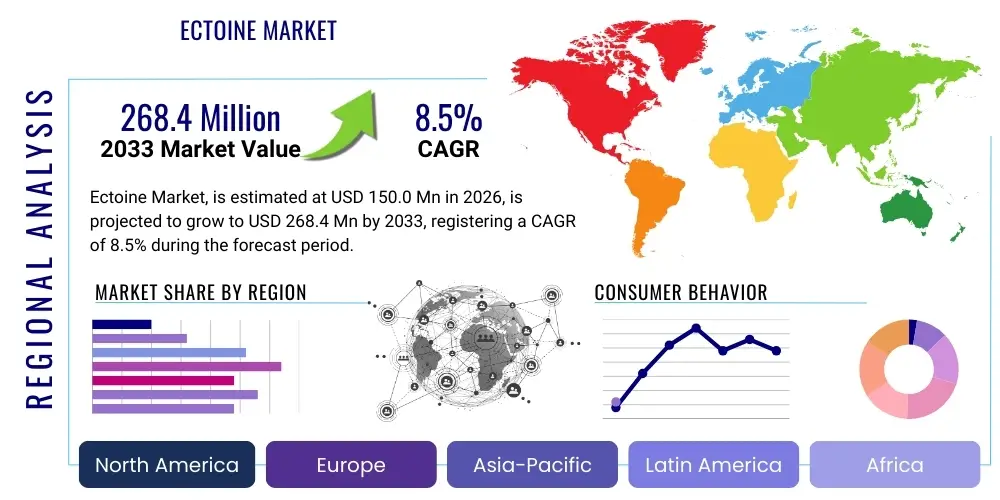

Ectoine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436830 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Ectoine Market Size

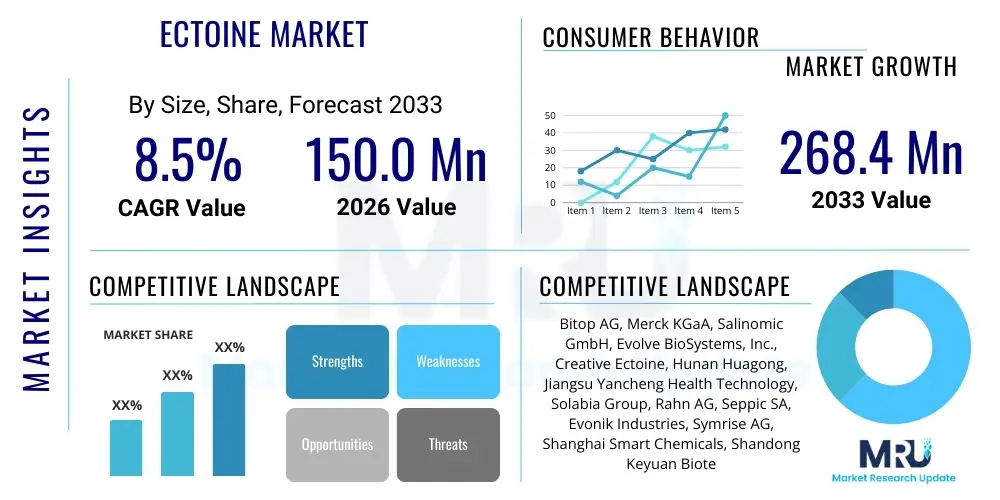

The Ectoine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 150.0 million in 2026 and is projected to reach USD 268.4 million by the end of the forecast period in 2033.

Ectoine Market introduction

The Ectoine market encompasses the global trade and utilization of Ectoine, a natural compatible solute and extremolyte synthesized by halophilic microorganisms, primarily to protect themselves against extreme environmental stress such as high salinity, temperature fluctuations, and desiccation. Functionally, Ectoine stabilizes biological macromolecules, protects cellular membranes, and minimizes external damage, making it highly valuable in applications requiring robust cell protection and hydration. Its unique mechanism of action, often termed the "Ectoine Hydro-Complex," involves forming a protective hydration shell around proteins and DNA without penetrating the cells themselves, offering superior bio-protection compared to conventional humectants.

The primary applications driving market growth include advanced cosmetic formulations, specialized pharmaceutical products, and medical devices, particularly those targeting skin and ocular health. In the cosmetics sector, Ectoine is celebrated for its exceptional anti-aging, pollution-protection, and intense hydrating properties, catering to the rising consumer demand for multifunctional, natural ingredients. It serves as an effective shield against extrinsic aging factors, including blue light and UVA radiation, positioning it as a premium ingredient in dermatological and high-end skincare lines. Furthermore, its non-toxic and biocompatible nature ensures wide regulatory acceptance and high consumer safety profiles.

Key benefits fueling the adoption of Ectoine include its proven efficacy in soothing irritation, repairing damaged skin barriers, and maintaining cellular homeostasis under stress. Major driving factors for the market expansion are the increasing global awareness regarding environmental stressors (such as pollution and climate change), the growing elderly population seeking effective anti-aging solutions, and technological advancements in cost-effective microbial fermentation processes. These technological improvements are essential for scaling up production while maintaining the high purity levels required for medical and pharmaceutical grades, thereby making Ectoine accessible to a broader range of industrial applications globally.

Ectoine Market Executive Summary

The Ectoine market is characterized by robust growth, driven primarily by the escalating demand from the personal care and pharmaceutical industries for high-performance, bio-based ingredients. Current business trends indicate a significant shift towards sustainable sourcing and biotechnology-driven production, as companies seek to optimize purity and yield through advanced microbial fermentation techniques. Key market players are heavily investing in R&D to explore novel applications of Ectoine in areas such as respiratory health (treating dry nasal passages) and veterinary dermatology, diversifying revenue streams beyond traditional cosmetics. Furthermore, strategic partnerships between Ectoine producers and major cosmetic formulators are accelerating product integration and consumer awareness, cementing its status as a cornerstone ingredient in premium formulations.

Regionally, the market exhibits strong expansion across all major geographic segments, though Europe and North America currently dominate in terms of value, owing to stringent regulatory standards that favor natural, evidence-based ingredients and high consumer spending power on specialized personal care. The Asia Pacific (APAC) region, however, is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapidly expanding middle-class populations in China and India, increasing penetration of Western cosmetic trends, and localized investment in fermentation infrastructure. Demand in APAC is largely centered around sun protection and anti-pollution products, capitalizing on Ectoine's unique protective mechanisms.

In terms of segments, the cosmetic application segment holds the largest market share, driven by its versatility in serums, moisturizers, and sunscreens. However, the pharmaceutical grade segment, though smaller in volume, is anticipated to grow at a faster rate due to its critical role in treating conditions like xerophthalmia (dry eye syndrome) and supporting nasal sprays designed for allergen and pollutant protection. Purity levels, specifically the 99% purity grade, command a premium price and are experiencing increased demand, particularly from regulated sectors, reflecting the industry's unwavering focus on ingredient quality and performance validation.

AI Impact Analysis on Ectoine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ectoine market frequently revolve around optimizing production efficiency, accelerating new application discovery, and enhancing quality control. Users often ask: "How can AI reduce the cost of Ectoine production through fermentation?", "Can AI predict the optimal Ectoine concentration for personalized cosmetic formulations?", and "What role does machine learning play in ensuring pharmaceutical-grade purity?". These questions highlight the critical user need for AI to address the current market bottleneck: the high production cost of high-purity Ectoine. Consequently, the key themes summarize that AI is expected to revolutionize upstream processes by modeling complex microbial fermentation kinetics, thereby maximizing yield and minimizing batch variation. Downstream, AI is anticipated to personalize consumer product development and streamline regulatory compliance documentation, accelerating time-to-market for specialized Ectoine applications.

- AI-driven optimization of microbial fermentation parameters (temperature, pH, nutrient feed) to maximize Ectoine yield and purity.

- Predictive modeling using machine learning to forecast demand patterns and optimize inventory management across the specialized supply chain.

- Accelerated discovery of novel Ectoine derivatives or synergistic ingredient combinations through large-scale biological data analysis and virtual screening.

- Enhanced quality control systems using computer vision and sensor data analysis to monitor real-time purity during crystallization and purification processes.

- Development of personalized cosmetic and medical formulations by analyzing individual genomic data and skin microbiome responses to Ectoine.

- Streamlining regulatory affairs by employing Natural Language Processing (NLP) tools to automate compliance checks for regional ingredient listings and safety data sheets.

- Optimization of energy consumption and waste reduction in large-scale bioreactors, contributing to sustainable production goals (Green Ectoine).

DRO & Impact Forces Of Ectoine Market

The dynamics of the Ectoine market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces guiding market trajectory. The primary Driver is the overwhelming consumer preference for natural, high-efficacy cosmetic ingredients, coupled with the proven clinical benefits of Ectoine in treating chronic skin conditions and dry eye disease. This intrinsic demand is further supported by innovations in biotechnology that promise increased production efficiency. Conversely, the market is restrained primarily by the inherently high cost of microbial fermentation and complex purification processes required to achieve pharmaceutical purity levels, creating a pricing barrier compared to synthetic alternatives. However, significant opportunities exist in expanding Ectoine's application scope into veterinary medicine and functional textiles, alongside exploiting emerging markets in Asia Pacific.

The Drivers section highlights the unparalleled biocompatibility and multifunctional capabilities of Ectoine. Unlike many synthetic ingredients, Ectoine offers deep hydration, anti-inflammatory effects, and environmental stress protection simultaneously. The rising geriatric population, especially in developed economies, contributes significantly to demand, as older skin requires advanced protective and reparative agents. Additionally, growing regulatory scrutiny in regions like the European Union favors naturally derived, sustainable ingredients, providing a competitive advantage to Ectoine producers who utilize environmentally sound bioproduction methods. This regulatory push reinforces Ectoine's position as a ‘clean beauty’ staple, driving penetration across premium product lines.

Restraints center on scalability and economic feasibility. While fermentation is the preferred method for high-purity Ectoine, the process is capital-intensive, time-consuming, and highly dependent on specialized bioreactor technology and precise process control. The challenge lies in optimizing yield per batch to lower the unit cost, thereby making Ectoine competitive against cheaper, conventional humectants. Furthermore, intellectual property complexities surrounding specific production strains and purification patents can restrict market entry for smaller players, consolidating manufacturing power among a few large biotechnology firms. This limits supply resilience and maintains high pricing, potentially slowing adoption in mass-market products.

Opportunities are vast, primarily focused on untapped therapeutic and industrial niches. The proven efficacy of Ectoine in mucosal protection presents a strong opportunity in respiratory therapeutics, addressing conditions exacerbated by pollution and dry air. Furthermore, the development of functional textiles infused with Ectoine, designed for sensitive skin or professional exposure to harsh elements, represents a high-growth industrial application. Geographically, the opportunity lies in customizing product offerings for the rapidly growing middle class in APAC, where awareness of pollution-related skin damage is critically high, necessitating specialized, protective skincare ingredients like Ectoine.

Segmentation Analysis

The Ectoine market segmentation provides a comprehensive view of market dynamics based on purity, application, and production method. Purity segmentation (98% vs. 99% grade) dictates the suitability of Ectoine for specific industries, with higher purity grades strictly reserved for regulated pharmaceutical and advanced medical device applications, reflecting stringent safety and efficacy requirements. The application breakdown reveals cosmetics as the dominant segment, leveraging Ectoine’s multi-functional properties, while the burgeoning pharmaceutical segment drives demand for specialized, high-cost variants. Production method analysis shows a clear shift toward advanced biotechnology, as microbial fermentation offers sustainable sourcing and the necessary control for producing enantiomerically pure Ectoine, despite the associated high operational expenses.

- By Purity:

- Ectoine 98% Grade

- Ectoine 99% Grade (Pharmaceutical Grade)

- By Application:

- Cosmetics and Personal Care

- Anti-Aging Products

- Sunscreens and UV Protection

- Moisturizers and Hydrating Serums

- Anti-Pollution Skincare

- Pharmaceuticals and Medical Devices

- Dry Eye Treatments (Ophthalmic Solutions)

- Nasal Sprays (Respiratory Care)

- Dermatological Treatments (Eczema, Psoriasis)

- Nutraceuticals

- Veterinary Applications

- Cosmetics and Personal Care

- By Production Method:

- Microbial Fermentation

- Chemical Synthesis (Limited Use)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Ectoine Market

The Ectoine market value chain begins with the Upstream Analysis, which focuses primarily on the sourcing of microbial strains (halophilic bacteria) and the raw materials necessary for fermentation, chiefly carbon sources (sugars) and specialized nutrient media. Optimization at this stage is crucial for minimizing the cost of goods sold, as media components represent a significant portion of the total production cost. Key activities include strain selection, genetic optimization for high-yield Ectoine secretion, and continuous refinement of bioreactor protocols. The complexity lies in maintaining sterility and controlled environmental conditions necessary for extremophile growth, which requires highly specialized equipment and technical expertise, often proprietary to key manufacturers.

Moving into the Midstream, the primary focus shifts to manufacturing and purification. The core process is fermentation, followed by rigorous downstream processing involving filtration, crystallization, and drying to achieve the required high purity (99% for pharma grade). Effective purification methods are critical as any residual solvents or byproducts can compromise the Ectoine's safety profile, particularly for ophthalmic and medical device applications. The distribution channel is segmented into direct sales, catering to large pharmaceutical manufacturers and established cosmetic brands requiring large, customized batches, and indirect channels, involving specialized chemical distributors who serve smaller formulators and R&D institutions globally.

The Downstream Analysis involves the final formulation and end-user engagement. Direct distribution ensures transparency and quality assurance for highly sensitive applications, while indirect distribution provides market reach and logistical efficiency. End-users—ranging from multinational cosmetic giants formulating anti-aging serums to specialized pharmaceutical companies developing dry eye drops—place high importance on certification, clinical efficacy data, and sustainable sourcing credentials. The value chain is constantly striving for backward integration, where major producers control both fermentation and downstream purification, ensuring maximum quality control and profitability across the entire production lifecycle.

Ectoine Market Potential Customers

The Ectoine market serves a diverse clientele primarily concentrated in regulated and high-value product sectors where ingredient efficacy and safety are paramount. The largest segment of potential customers comprises multinational cosmetic and personal care corporations, including major dermatological brands, seeking advanced, scientifically validated ingredients for premium skincare lines focused on anti-aging, sensitive skin care, and environmental protection. These buyers prioritize clinical evidence supporting claims of blue light protection and pollution defense, integrating Ectoine into high-margin products like specialized serums and daily moisturizers. Their buying decisions are influenced by ingredient trends, consumer demand for 'natural' yet high-tech solutions, and compliance with 'clean beauty' standards.

Another critical customer base resides in the pharmaceutical and medical device industries. These buyers, which include specialized ophthalmic solution manufacturers and respiratory care companies, require Ectoine of the highest purity (99% minimum), often classified as an active pharmaceutical ingredient (API) or a component in regulated medical devices. Their stringent regulatory requirements, adherence to Good Manufacturing Practices (GMP), and need for comprehensive toxicity data necessitate direct sourcing relationships with certified Ectoine producers. Ectoine is crucial here for its osmo-protectant qualities, particularly in non-preservative dry eye drops and nasal sprays that protect the mucosal lining from allergens and irritants.

Emerging potential customers include nutraceutical companies exploring Ectoine's potential in gut health, leveraging its stabilizing properties for probiotics, and specialized textile manufacturers interested in impregnating fabrics for dermatological benefits. Overall, the potential customer base consists of sophisticated buyers who value ingredient origin, rigorous clinical documentation, supply chain integrity, and the ability of Ectoine to deliver unique, protective functionalities that justify a higher premium compared to generic cosmetic raw materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.0 million |

| Market Forecast in 2033 | USD 268.4 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bitop AG, Merck KGaA, Salinomic GmbH, Evolve BioSystems, Inc., Creative Ectoine, Hunan Huagong, Jiangsu Yancheng Health Technology, Solabia Group, Rahn AG, Seppic SA, Evonik Industries, Symrise AG, Shanghai Smart Chemicals, Shandong Keyuan Biotechnology, Zheijiang Ectoine Biotech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ectoine Market Key Technology Landscape

The technological landscape of the Ectoine market is dominated by advancements in industrial biotechnology, particularly concerning high-yield microbial fermentation. The production of Ectoine relies almost exclusively on osmotically induced large-scale fermentation using halo-tolerant microorganisms, such as certain species of Halomonas or Marinococcus. Key technological innovations center on optimizing bioreactor design and process control systems, leveraging sophisticated sensor technology to monitor and maintain the precise salinity, temperature, and nutrient concentrations required to maximize Ectoine production per unit of time and volume. Continuous cultivation techniques, as opposed to traditional batch methods, are increasingly adopted to enhance scalability and reduce overall operational expenditure, directly addressing the restraint of high production costs.

Beyond the core fermentation process, downstream technology—specifically purification—is critically important, particularly for attaining the stringent 99% purity required for pharmaceutical applications. Techniques such as ultrafiltration, diafiltration, and proprietary crystallization methods are employed to efficiently separate Ectoine from biomass and media components. Advanced chromatographic techniques are sometimes utilized for final polishing to remove trace impurities, ensuring the final product meets regulatory standards for use in ophthalmic and injectable formulations. The development of greener, solvent-free purification methods represents a significant R&D focus, aligning with sustainability trends and reducing the environmental footprint of Ectoine manufacturing.

Furthermore, genetic engineering and synthetic biology are emerging technologies with substantial future impact. Researchers are utilizing these methods to genetically modify production strains to boost Ectoine synthesis rates and resilience, potentially allowing for the use of cheaper, non-specialized carbon sources. This move toward enhanced biosynthesis pathways offers the promise of dramatically improving yield and reducing the reliance on complex, high-cost raw materials. The integration of AI and computational biology to model and simulate these genetic modifications and fermentation processes further underscores the market's trajectory toward high-tech, data-driven bioproduction.

Regional Highlights

- Europe: Europe currently maintains market leadership, driven by stringent cosmetic regulations (EU Cosmetics Regulation) favoring natural, safe, and sustainably sourced ingredients. Germany, in particular, hosts major Ectoine producers and key R&D centers. High consumer awareness regarding anti-pollution and 'blue light' defense, coupled with a willingness to pay a premium for certified dermatological products, ensures sustained high demand. The region’s advanced pharmaceutical industry also serves as a crucial consumer of high-purity, medical-grade Ectoine, particularly for dry eye treatments and nasal sprays.

- North America: North America represents a mature and rapidly growing market, characterized by intense innovation in high-end cosmetic formulations and a robust market for dermatological medical devices. Market growth is fueled by strong anti-aging trends and the large presence of multinational personal care companies that integrate Ectoine into their flagship products. Regulatory bodies like the FDA, while cautious, generally accept Ectoine as a safe cosmetic ingredient, supporting its commercial adoption. Consumer preferences lean toward products offering clinically backed benefits and transparent ingredient lists.

- Asia Pacific (APAC): APAC is forecast to be the fastest-growing region, propelled by the rapid urbanization, increased pollution levels, and the expansion of the middle class in economies such as China, Japan, and South Korea. Demand is exceptionally high for anti-pollution and whitening/brightening products. Localized investment in biotechnology and fermentation facilities across China is beginning to challenge the dominance of European suppliers, potentially leading to competitive pricing and greater market penetration, particularly in the mass cosmetic segment.

- Latin America (LATAM): The LATAM market, while smaller, is demonstrating strong upward momentum, driven by increasing consumer expenditure on cosmetics and growing penetration of international brands, especially in Brazil and Mexico. The focus is primarily on basic hydration and sun protection lines, where Ectoine’s UV-protective qualities offer significant value, despite the region's sensitivity to price points compared to North America and Europe.

- Middle East and Africa (MEA): Growth in MEA is specialized, focused on high-end luxury cosmetics, especially in the Gulf Cooperation Council (GCC) countries, and dermatological solutions addressing specific environmental challenges like extreme heat and arid climates. The pharmaceutical application segment is steadily growing, supported by governmental healthcare investments, particularly in treating chronic ocular conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ectoine Market.- Bitop AG

- Merck KGaA

- Salinomic GmbH

- Evolve BioSystems, Inc.

- Creative Ectoine

- Hunan Huagong

- Jiangsu Yancheng Health Technology

- Solabia Group

- Rahn AG

- Seppic SA

- Evonik Industries

- Symrise AG

- Shanghai Smart Chemicals

- Shandong Keyuan Biotechnology

- Zheijiang Ectoine Biotech

- Dr. Straetmans GmbH

- Wacker Chemie AG

- Ginkgo Bioworks

- Lipoid GmbH

- Sinerga S.p.A.

Frequently Asked Questions

Analyze common user questions about the Ectoine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ectoine and why is it used in premium skincare products?

Ectoine is a natural extremolyte molecule derived from halophilic bacteria, utilized for its exceptional cell-protective and osmo-regulatory capabilities. It stabilizes proteins, protects the skin barrier from environmental stressors (like UV, pollution, and blue light), and provides superior, long-lasting hydration, justifying its inclusion in high-efficacy, premium cosmetic formulations.

Which production method dominates the Ectoine market and what are the main challenges?

Microbial fermentation dominates Ectoine production, offering high purity and sustainable sourcing compared to chemical synthesis. The main challenge remains the high operational cost associated with maintaining specialized bioreactor conditions (high salinity, controlled temperature) and the complex downstream purification required to achieve pharmaceutical-grade material.

What are the primary non-cosmetic applications driving market growth?

The primary non-cosmetic applications are in pharmaceuticals and medical devices, particularly for ophthalmic solutions (treating dry eye syndrome, or xerophthalmia) and nasal sprays. Ectoine’s ability to stabilize mucosal membranes and offer protection against allergens and dryness positions it as a key therapeutic ingredient.

Which geographical region exhibits the fastest growth rate for Ectoine?

The Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by increased pollution levels in urban centers, expanding consumer awareness of anti-pollution skincare, and rising disposable incomes fueling demand for advanced, protective cosmetic ingredients.

How does the purity grade (98% vs 99%) influence Ectoine market price and use?

Ectoine 99% purity grade commands a significantly higher price and is mandated for regulated applications such as pharmaceuticals and medical devices due to strict quality and safety standards. The 98% grade is predominantly used in the mass-market and standard cosmetic and personal care formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager