Edge Protection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433656 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Edge Protection System Market Size

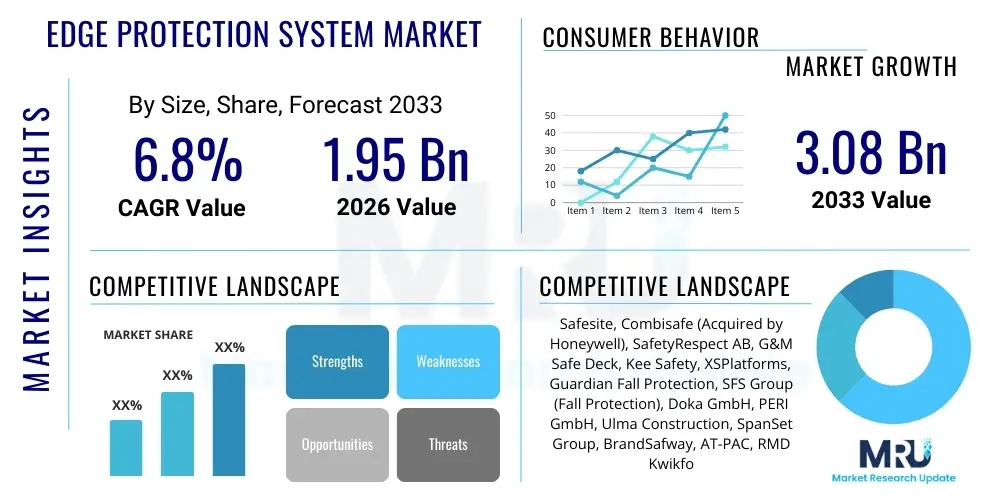

The Edge Protection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.08 Billion by the end of the forecast period in 2033.

Edge Protection System Market introduction

The Edge Protection System (EPS) market encompasses products and solutions designed to prevent personnel and materials from falling from elevated working surfaces, primarily mandated in construction, infrastructure, industrial, and maintenance sectors. These systems include guardrails, temporary fencing, safety nets, and anchor points, adhering strictly to global occupational safety standards set by bodies like OSHA (Occupational Safety and Health Administration) and relevant European norms (e.g., EN 13374). The fundamental objective of EPS is to establish physical barriers around open edges, thereby significantly mitigating workplace hazards and liability risks for project owners and contractors. The continuous global push for stringent worker safety regulations serves as the core underpinning for market demand, especially in rapidly developing economies where large-scale infrastructure projects are proliferating.

The primary products within this market are categorized based on their structural design and duration of use, including permanent systems integrated into building designs (like rooftop guardrails) and temporary modular systems used during the construction phase (like cantilever edge protection or netting). Major applications span high-rise commercial building construction, bridge and highway infrastructure development, industrial plant maintenance (oil & gas, power generation), and residential housing development. The inherent versatility and adaptability of modular EPS solutions allow them to be deployed across various complex geometrical structures, ensuring comprehensive coverage and compliance regardless of the project scale or environment. Adoption is accelerating due to the high cost associated with fall-related incidents, making proactive safety investment economically justifiable.

Key driving factors fueling the market growth include mandatory governmental safety legislation across North America and Europe, technological advancements leading to lighter yet stronger composite materials, and increased public awareness regarding workplace safety best practices. The benefits derived from implementing effective EPS solutions are multifaceted, covering reduction in serious injury rates, minimization of project delays caused by accidents or regulatory halts, improved insurance premiums, and enhanced corporate reputation regarding commitment to safety. Furthermore, the growing trend toward complex architectural designs necessitating customized and specialized protection solutions is also expanding the addressable market for system providers specializing in non-standard installations.

Edge Protection System Market Executive Summary

The Edge Protection System Market is characterized by robust growth driven predominantly by non-negotiable regulatory compliance and a surge in global construction activity, particularly in the infrastructure and residential segments across Asia Pacific and North America. Business trends indicate a strong move towards rental models for temporary systems, offering contractors cost flexibility, while key vendors are focusing on developing lightweight, high-tensile materials (e.g., aluminum and advanced composites) that enhance installation speed and safety compliance. Regional trends show Europe maintaining market leadership due to stringent long-standing EN standards, but Asia Pacific is exhibiting the highest growth trajectory, spurred by rapid urbanization and massive government investments in transport networks, requiring large volumes of temporary EPS solutions.

Segment trends reveal that the temporary edge protection category dominates the market share, corresponding directly to the cyclical nature of construction projects, demanding quick deployment and demobilization. However, the permanent segment, focused on rooftops and maintenance access points, is experiencing steady growth driven by increasing regulatory requirements for safety measures on existing commercial and industrial facilities. Based on material, steel remains the prevalent choice due to cost-effectiveness and durability, yet aluminum is rapidly gaining traction, particularly in applications requiring reduced structural loading or ease of handling. The industrial sector, including energy and manufacturing, presents a stable revenue stream for specialized heavy-duty EPS, contrasting with the high-volume demand from the commercial construction vertical.

Overall, the market remains highly fragmented yet competitive, with major players emphasizing strategic acquisitions to expand geographical reach and product portfolios, especially integrating digital tools for site safety planning and documentation. The shift towards automated and semi-automated installation methods is emerging as a critical efficiency differentiator. The market outlook is overwhelmingly positive, tied inherently to the resilience and expansion of the global construction pipeline, further bolstered by regulatory enforcement mechanisms that ensure consistent demand for compliant, certified edge protection solutions throughout the forecast period.

AI Impact Analysis on Edge Protection System Market

Users frequently inquire about how AI and associated technologies like computer vision and IoT are transforming safety compliance and installation efficiency within the EPS market. Key questions revolve around the use of AI for real-time risk assessment, automated monitoring of barrier integrity, integration of smart sensors into guardrails, and optimizing the logistics of modular system deployment on complex sites. The core theme is the expectation that AI will transition safety management from reactive compliance checks to proactive, predictive failure prevention. Users are keenly interested in solutions that can analyze live construction footage to verify that EPS installations meet required height and strength specifications before regulatory inspections occur, minimizing the potential for costly shutdowns or citations. Furthermore, there is significant anticipation regarding AI's ability to use historical project data to optimize the optimal configuration and quantity of EPS required for a new project, drastically reducing waste and maximizing safety coverage.

- AI-powered site monitoring systems utilize computer vision to verify correct installation and integrity of guardrails, scaffold toe boards, and netting in real-time.

- Predictive risk analytics driven by machine learning identifies high-risk work zones or potential edge breach points based on weather conditions, traffic flow, and worker density.

- Integration of IoT sensors into modular EPS components allows for continuous monitoring of impact stress, unauthorized tampering, or structural compromise, alerting site managers instantly.

- AI algorithms optimize the logistics and inventory management for rental fleets, predicting demand spikes and ensuring timely delivery of certified components to large-scale construction sites.

- Automated drone inspections guided by AI map complex edges and generate precise Bill of Materials (BOM) for customized EPS configurations, reducing manual surveying errors.

DRO & Impact Forces Of Edge Protection System Market

The Edge Protection System market is profoundly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). The paramount driver remains the continuously strengthening and mandated global occupational safety regulations, compelling industries worldwide to adopt certified fall protection measures regardless of cost. This regulatory pressure is amplified by the high financial and human cost associated with workplace fall incidents, motivating proactive investment. However, market growth is often restrained by the high initial capital expenditure required for premium, compliant systems, particularly impacting smaller contractors or projects in developing regions where adherence to standards can be inconsistent. Furthermore, logistical complexity associated with transporting, installing, and managing large inventories of temporary, heavy EPS components presents a tangible operational hurdle.

Opportunities for market expansion are substantial, primarily driven by the increasing application scope beyond traditional construction—extending into solar farm maintenance, wind turbine access, and complex industrial facade repairs, all demanding specialized, lightweight, and durable systems. The development of modular, multi-functional EPS solutions that can adapt quickly to changing site geometries represents a key technological opportunity. Furthermore, the rising adoption of rental services presents a financial opportunity for providers to lower the barrier to entry for smaller users while ensuring consistent product usage and compliance verification. Innovations in material science, focusing on high-strength composites and sustainable materials, also open new avenues for product differentiation and weight reduction.

The primary Impact Forces shaping the competitive landscape are regulatory changes (high impact, high probability), global infrastructure spending cycles (medium impact, medium probability), and the rate of technological adoption, specifically the integration of smart safety features (medium impact, high probability). Regulatory enforcement acts as a powerful external force, creating non-discretionary demand. Economic cycles directly affect construction volume, thus influencing market size. Internal industry forces include competitive pricing pressure, driven by the relative commoditization of basic steel systems, pushing manufacturers to innovate through value-added services such as safety consulting, certified training, and advanced digital integration, ultimately favoring vendors who can offer complete, end-to-end safety ecosystems rather than just physical products.

Segmentation Analysis

The Edge Protection System market is comprehensively segmented based on Type, Material, Application, and End-User, reflecting the diverse requirements across various construction environments and industrial settings. Segmentation by Type, dividing the market into Temporary and Permanent systems, is crucial as it reflects the utilization cycle and installation requirements, with temporary solutions dominating volume but permanent systems offering long-term, stable revenue streams. Material segmentation (Steel, Aluminum, Composite) addresses the need for different strength-to-weight ratios and resistance to environmental factors, directly influencing pricing and application suitability. Geographic segmentation is paramount, demonstrating clear differences in regulatory mandates and construction activity levels between developed economies (high compliance, slow growth) and emerging regions (lower compliance history, high growth potential).

- By Type:

- Temporary Edge Protection Systems

- Permanent Edge Protection Systems

- By Material:

- Steel

- Aluminum

- Composite/Other Materials

- By Application/Structure Type:

- Roofs and Access Points

- Scaffolding and Work Platforms

- Stairwells and Openings

- Bridges and Infrastructure

- By End-User Industry:

- Commercial Construction

- Residential Construction

- Industrial Facilities (Oil & Gas, Energy, Manufacturing)

- Infrastructure & Civil Engineering

Value Chain Analysis For Edge Protection System Market

The value chain for the Edge Protection System market begins with the upstream raw material suppliers, predominantly providers of high-grade steel, aluminum billets, and composite polymers. Given that material costs constitute a significant portion of the final product price, the efficiency and stability of material procurement are critical. Manufacturers focus on specialized fabrication, coating (e.g., galvanization for corrosion resistance), and adhering to precise dimensional tolerances required for modular interconnectivity. Intellectual property often lies in the locking mechanisms, counterweight designs (for freestanding systems), and certified load-bearing calculations, which require rigorous R&D and testing to meet certification standards (e.g., CE marking or OSHA compliance). Efficient manufacturing processes, minimizing scrap and optimizing assembly, are key competitive advantages in this stage.

Downstream analysis highlights the critical role of distribution and installation services. Due to the requirement for expert advice on compliance and site-specific configuration, distribution channels often involve specialized safety equipment wholesalers or direct sales teams from manufacturers who also offer consulting services. The installation phase, particularly for temporary systems, is often managed by specialized rental companies or third-party certified contractors who are responsible for ensuring correct setup and adherence to engineering specifications. This specialized installation service is crucial, as improper setup, even with certified equipment, can lead to fatal accidents, thus liability management flows through this part of the chain.

Distribution channels exhibit both direct and indirect routes. Major national construction firms often engage in direct procurement or long-term rental contracts with manufacturers for standardized systems. Conversely, smaller local contractors typically utilize indirect channels through regional safety equipment distributors or rental houses which provide flexibility and inventory breadth. Rental services have become a major distribution model for temporary EPS, encompassing logistical services, routine maintenance, and inspection services, adding significant value beyond the simple provision of hardware. The shift toward integrated service offerings, where the vendor manages the entire safety lifecycle from design to dismantling, optimizes compliance and operational efficiency for the end-user.

Edge Protection System Market Potential Customers

Potential customers for Edge Protection Systems are broadly categorized by the type of elevated work they undertake and their scale of operation, ranging from large multinational construction conglomerates to local residential builders and industrial maintenance teams. The primary end-users include general contractors involved in high-rise commercial and infrastructure projects, who require vast quantities of temporary, modular EPS for perimeter guarding, shaft openings, and stairwell protection throughout the phased construction timeline. Another significant customer base lies within the industrial sector, including petrochemical facilities, power generation plants, and aerospace manufacturers, which necessitate permanent, heavy-duty guardrail systems for safe rooftop access, machinery maintenance platforms, and elevated walkways, driven by continuous operational safety requirements.

Secondary but rapidly growing customer segments include specialized maintenance and facilities management companies that service existing commercial real estate. These entities require both permanent systems for roof access safety (mandatory compliance in many jurisdictions) and portable, temporary systems for short-term repair work on facades, window washing, and HVAC installation. Furthermore, governmental bodies and public works departments responsible for maintaining civil infrastructure, such as bridges, dams, and highways, are substantial buyers, especially of specialized systems designed for non-standard, curved, or isolated elevated environments. All customers share the fundamental need for certified equipment that minimizes liability risk and ensures compliance with ever-evolving safety mandates, making product certification a non-negotiable purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.08 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safesite, Combisafe (Acquired by Honeywell), SafetyRespect AB, G&M Safe Deck, Kee Safety, XSPlatforms, Guardian Fall Protection, SFS Group (Fall Protection), Doka GmbH, PERI GmbH, Ulma Construction, SpanSet Group, BrandSafway, AT-PAC, RMD Kwikform, Hilti Corporation, Vertemax, Capital Safety Group, Eurosafe Solutions, Protekta |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Edge Protection System Market Key Technology Landscape

The technological landscape of the Edge Protection System market is steadily shifting from basic, purely mechanical structures toward highly engineered, modular, and digitally integrated solutions aimed at maximizing installation efficiency and enhancing real-time safety monitoring. A significant technological advancement involves material science, particularly the increased utilization of high-strength, lightweight aluminum alloys and advanced fiber-reinforced composites. These materials drastically reduce the weight of modular components, simplifying logistics, minimizing manual handling risks, and allowing for faster deployment without compromising structural integrity or load-bearing capacity required by standards like EN 13374 Class A, B, or C. Furthermore, specialized coatings, such as hot-dip galvanization and sophisticated powder coatings, are crucial technologies extending the lifespan and corrosion resistance of systems used in harsh outdoor or marine environments.

Modular and adaptable design innovation represents another core technological area. Manufacturers are investing in proprietary clamping mechanisms, adjustable base plates, and highly adaptable components that can interface with diverse structures, including pre-cast concrete panels, metal decking, and complex roof geometries without the need for extensive structural modification. This modularity reduces the need for custom fabrication on-site, a factor critical for maintaining project timelines and ensuring consistent compliance. The development of specialized freestanding systems utilizing advanced counterweight technology minimizes penetration into sensitive surfaces (like roofing membranes), expanding the applicability of EPS to finished structures and reducing installation time and potential damage costs.

Crucially, the market is beginning to embrace digital integration, establishing 'smart safety' systems. Key technologies include embedding IoT sensors into guardrail bases and anchor points to monitor forces exerted, detect unauthorized removal, or verify continuous component integrity. This digital layer provides real-time data to site safety officers, allowing for proactive intervention. Furthermore, the use of Building Information Modeling (BIM) software integrated with manufacturer component libraries is streamlining the safety planning process, allowing engineers to digitally model and optimize EPS deployment before construction begins, minimizing errors and ensuring AEO (Answer Engine Optimization) for construction safety query resolutions related to certified system placement.

Regional Highlights

The Edge Protection System market exhibits distinct regional dynamics driven by differing regulatory frameworks, construction activity levels, and technological adoption rates. Europe currently holds the largest market share, characterized by mature and highly prescriptive safety standards, such as the comprehensive EN norms, which mandate rigorous testing and certification for all fall protection equipment. The consistent and strict enforcement in countries like the UK, Germany, and the Nordic nations ensures stable, high-value demand, focusing on premium, fully certified modular and permanent systems. The European market is also a leader in the adoption of advanced, lightweight materials and rental services for flexibility.

North America, particularly the United States, represents a significant market size, heavily influenced by OSHA regulations. While robust, the regional focus has historically been on robust, often heavier, steel-based systems. However, the market is rapidly moving towards engineered systems that offer easier installation and meet strict compliance documentation requirements. The strong housing and commercial construction sectors, combined with massive governmental infrastructure investment plans (e.g., in bridges and highways), ensure sustained demand for both temporary and permanent solutions across the continent, driving growth through increased project volume.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This acceleration is attributed to massive urbanization trends, large-scale infrastructure projects in China, India, and Southeast Asia, and, critically, the gradual adoption and enforcement of internationally recognized safety standards. While current market penetration for premium systems may be lower than in the West, the sheer volume of construction activity, coupled with governmental efforts to improve worker safety records, creates immense untapped potential for both local and international EPS providers. Regulatory harmonization is a key factor that will unlock full market potential in this region.

- North America: Strong market driven by strict OSHA compliance; high adoption rate of engineered systems; robust demand from commercial and civil infrastructure projects.

- Europe: Market leader due to stringent and long-standing EN standards (e.g., EN 13374); focus on permanent rooftop safety and high-quality rental services.

- Asia Pacific (APAC): Highest CAGR fueled by rapid infrastructure development (China, India); growing awareness and gradual enforcement of international safety norms; potential for high-volume basic and premium system deployment.

- Latin America (LATAM): Emerging market characterized by fragmented regulatory environments; growth driven by mining and heavy industry safety investment; preference for cost-effective, durable steel solutions.

- Middle East & Africa (MEA): Growth tied to mega-project development (e.g., GCC infrastructure); high demand for heavy-duty systems suited for hot climates and rapid construction schedules; significant reliance on foreign expertise and imported systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edge Protection System Market.- Safesite

- Combisafe (Acquired by Honeywell)

- SafetyRespect AB

- G&M Safe Deck

- Kee Safety

- XSPlatforms

- Guardian Fall Protection

- SFS Group (Fall Protection)

- Doka GmbH

- PERI GmbH

- Ulma Construction

- SpanSet Group

- BrandSafway

- AT-PAC

- RMD Kwikform

- Hilti Corporation

- Vertemax

- Capital Safety Group

- Eurosafe Solutions

- Protekta

Frequently Asked Questions

Analyze common user questions about the Edge Protection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulations governing Edge Protection Systems globally?

The primary global regulatory bodies are the Occupational Safety and Health Administration (OSHA) in North America, focusing on mandatory compliance and guardrail specifications (e.g., 1926.502(b)), and European Norms (EN), particularly EN 13374, which classifies systems based on slope angle and load-bearing capacity. Adherence to these standards is essential for market entry and operation.

What is the key difference between temporary and permanent Edge Protection Systems?

Temporary EPS are modular, reusable systems (guardrails, nets) installed during construction or maintenance and removed upon completion. Permanent EPS are designed for long-term safety on existing structures, typically rooftops or access platforms, often fixed via mechanical anchors to ensure lifelong compliance for facility maintenance personnel.

How does the rental market influence the Edge Protection System industry?

The rental market is a significant growth driver, especially for temporary systems, offering contractors cost flexibility by avoiding large capital expenditures. Rental models often include maintenance, inspection, and logistical support, ensuring that contractors consistently use certified, well-maintained equipment, which is vital for safety compliance.

Which materials are most commonly used in Edge Protection Systems and why?

Steel is widely used due to its high strength, durability, and cost-effectiveness, especially for heavy-duty applications. Aluminum is increasingly preferred for temporary systems as it is lightweight, corrosion-resistant, and significantly reduces installation time and manual handling hazards on construction sites.

How is technology enhancing the reliability of fall protection barriers?

Technology is enhancing reliability through modular, engineered designs that guarantee structural integrity when correctly installed. Furthermore, the integration of IoT sensors and AI-powered computer vision systems allows for continuous, real-time monitoring of barrier integrity, impact forces, and compliance verification, transitioning safety management to a predictive model.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Edge Protection System Market Statistics 2025 Analysis By Application (Commercial Construction, Infrastructure, Industrial), By Type (Concrete Edge Protection System, Steel Edge Protection System, Timber Edge Protection System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Edge Protection System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Concrete Edge Protection System, Steel Edge Protection System, Timber Edge Protection System), By Application (Construction Site, Commercial Roof), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager