Edible Hydrogenated Oils Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433907 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Edible Hydrogenated Oils Market Size

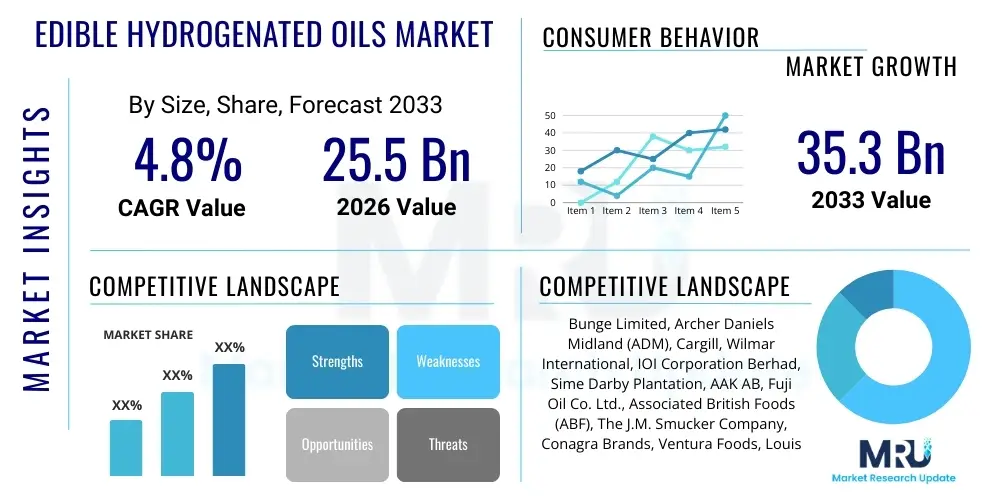

The Edible Hydrogenated Oils Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $25.5 Billion in 2026 and is projected to reach $35.3 Billion by the end of the forecast period in 2033.

Edible Hydrogenated Oils Market introduction

Edible hydrogenated oils, foundational to modern industrial food production, encompass fats and oils that have undergone catalytic hydrogenation to modify their physical and chemical properties. This process converts unsaturated fatty acids into saturated or partially saturated forms, significantly elevating the melting point and enhancing oxidative stability, which translates directly into longer product shelf life and improved performance in high-heat applications like frying. While the traditional utilization of partially hydrogenated oils (PHOs) has dramatically decreased due to regulatory bans targeting industrially produced trans fats (IP-TFA), the market remains robust, pivoting towards fully hydrogenated oils (FHOs) and subsequent functional modification via interesterification. This technical evolution ensures that manufacturers can still access fats offering the essential structural qualities—such as plasticity, crystallization control, and volume retention—required by the bakery and confectionery industries, which are the primary consumers of these specialized lipid products.

The product description mandates a distinction between hydrogenation types. FHOs are produced by saturating almost all double bonds, yielding hard, brittle fats like stearin, which are trans-fat-free. These FHOs are rarely used directly but serve as building blocks. They are often blended with liquid oils or subjected to interesterification to create customized structured lipids with specific solid fat content (SFC) profiles, vital for applications like non-dairy creamer bases, specialized deep-frying shortenings, and tailored industrial margarines. Major applications are concentrated in the production of packaged snacks, where stability is paramount; baked goods, requiring specific fat structures for texture; and confectionery items, where controlled melting characteristics are essential for coatings and fillings. The shift in product focus from PHOs to advanced structured lipids highlights the industry's commitment to compliance and health-conscious innovation.

The market's driving factors are multifaceted, rooted in the continuing global expansion of convenience food consumption, especially in fast-developing economies across Asia and Latin America. Manufacturers in these regions prioritize cost-effective ingredients that guarantee product longevity in often challenging distribution environments. Furthermore, the functional superiority of structured fats in certain high-stress industrial processes, where natural oils fail to deliver the required consistency and stability, continues to drive demand. Conversely, the market faces sustained pressure from consumer trends favoring natural, minimally processed ingredients and saturated fat reduction, compelling continuous research into enzymatic modification and non-hydrogenated alternatives, shaping a dual market structure where high-volume commodity fats coexist with premium, specialized functional lipids.

Edible Hydrogenated Oils Market Executive Summary

The Edible Hydrogenated Oils Market demonstrates resilience and dynamic transformation, projecting steady growth through 2033 despite historical regulatory headwinds against trans fats. Key business trends are characterized by substantial capital expenditure directed towards advanced processing technologies, notably enzymatic interesterification (EIE) and sophisticated oil fractionation units. Global players are securing vertically integrated supply chains, particularly concerning sustainable palm oil and non-GMO soybean oil, to ensure compliance and traceability, which are increasingly demanded by B2B buyers. The competitive landscape is shifting from pure commodity pricing to value-added service, with specialized fat companies offering tailor-made fat systems that meet precise client specifications for specific textural outcomes, shelf life targets, and regulatory adherence globally. This transition emphasizes scientific expertise and proprietary blend formulations over basic refining capacity.

Regional trends delineate a clear division: volume growth is centered in Asia Pacific (APAC), capitalizing on urbanization and mass consumer base expansion. APAC countries, supported by regional supply chains of palm and coconut oil, drive demand for industrial shortenings and margarines. In contrast, North America and Europe lead in value and technological adoption. These regions exhibit market stagnation in volume but high growth in value segments focused on high-performance, non-trans-fat products, low saturated fat blends, and sustainable sourcing certifications. Regulatory consistency across the European Union further incentivizes manufacturers to harmonize their product offerings, whereas North America focuses on innovation to overcome functional challenges posed by the PHO ban. The Middle East and Africa present opportunities for basic commodity hydrogenated fats, catering to nascent industrial food sectors and relying heavily on cost-effective imports for stability and shelf life in hot climates.

Segmentation analysis confirms the persistent dominance of Palm Oil derivatives as the fundamental raw material, owing to their inherent properties that facilitate effective structuring. However, there is burgeoning demand for high-stability hydrogenated alternatives based on rapeseed (canola) and sunflower oil, particularly in regions where non-palm sourcing is preferred for environmental reasons. The application segment sees the Bakery sector maintaining its largest market share, driven by indispensable requirements for plasticity and mouthfeel, though the Prepared Foods and Ready Meals category is showing the fastest rate of expansion, necessitating hydrogenated fats optimized for minimal oil migration and freeze-thaw stability. Overall, the market narrative is one of adaptation: moving away from traditional, less healthy practices toward functionally equivalent, technically superior, and regulatory-compliant fat solutions, securing the industry’s future role in large-scale food manufacturing.

AI Impact Analysis on Edible Hydrogenated Oils Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within the edible hydrogenated oils sector primarily revolutionizes operational efficiency and product development precision. Traditional oil processing involves multiple energy-intensive and time-consuming steps, from refining to hydrogenation and deodorization, each prone to variability based on crude oil input quality. AI addresses this by deploying sophisticated sensor networks and digital twins across production lines. These systems collect and analyze massive datasets related to temperature, pressure, reaction speed, and raw material composition (e.g., free fatty acid levels, iodine value). ML algorithms then predict optimal processing parameters in real-time, allowing for micro-adjustments that maximize yield, reduce utility consumption, and critically, minimize the formation of trans-fat isomers during hydrogenation, ensuring immediate compliance without batch rework.

Beyond process optimization, AI significantly accelerates the research and development pipeline for next-generation fat solutions. The industry is currently seeking non-trans-fat structured lipids that precisely mimic the rheological and crystallization behavior of PHOs, a complex formulation challenge. Computational chemistry, powered by AI, allows researchers to simulate the interactions of various triglyceride molecules and predict the solid fat content (SFC) curve of hundreds of potential fat blends before they are synthesized in a lab. This capability drastically reduces the physical experimentation cycle, cutting costs and accelerating the time-to-market for specialized functional products, such as those required for high-end confectionery coatings or specific emulsified shortenings that demand extreme temperature stability.

Furthermore, supply chain management benefits immensely from AI implementation. The sourcing of primary oils is highly susceptible to climate change, geopolitical events, and commodity price fluctuations. AI utilizes predictive analytics to forecast crop yields, assess risk factors in key production regions (like Southeast Asia for palm oil or the American Midwest for soybean oil), and optimize global inventory placement. This allows manufacturers to secure raw materials at advantageous pricing and manage the continuity of supply, mitigating external volatility. Traceability and sustainability compliance are also enhanced; AI-driven analysis of supply chain data validates sustainable sourcing claims (e.g., verifying RSPO compliance) and detects anomalies, ensuring ethical and transparent procurement practices across the entire value chain.

- Real-time process optimization: AI systems leverage advanced sensor data (e.g., NIR spectroscopy) to control hydrogenation reactor kinetics and thermodynamics, achieving desired saturation levels with minimal energy expenditure.

- Predictive quality control: Machine learning models analyze spectral signatures of oil streams to predict end-product purity, stability, and adherence to specific solid fat content (SFC) targets, reducing reliance on slow laboratory testing.

- Accelerated R&D: Computational simulation and neural networks are used to design and model novel structured lipids and interesterified fats, fast-tracking the development of zero-trans-fat functional alternatives.

- Supply chain resilience: AI integrates global climate, geopolitical, and market data to forecast commodity price movements and optimize procurement, ensuring reliable access to high-quality raw materials.

- Energy and sustainability management: Deep learning algorithms identify operational inefficiencies in refining, bleaching, and deodorization (RBD) processes, contributing to lower carbon footprints and improved catalyst longevity.

- Automated fault detection: Computer vision and AI analyze equipment performance and oil filtration systems, enabling predictive maintenance that minimizes costly downtime in high-volume production facilities.

- Customization and blending optimization: AI algorithms optimize the blending ratios of various fully hydrogenated fractions and liquid oils to precisely match specific customer requirements for specialized shortenings and margarines.

- Enhanced traceability: Blockchain integration managed by AI ensures verifiable sourcing data, supporting consumer and regulatory demands for sustainable and ethical raw material procurement, particularly for palm oil.

DRO & Impact Forces Of Edible Hydrogenated Oils Market

The Edible Hydrogenated Oils Market is experiencing a complex interplay of structural market forces, where significant drivers are simultaneously challenged by profound regulatory restraints, generating distinct opportunities for specialized growth. The primary driver remains the indispensable functional role of structured fats in high-throughput food manufacturing, providing superior textural qualities, aeration, and mouthfeel that are difficult to replicate consistently with natural liquid oils. This functional demand is amplified by the persistent growth in the global population and subsequent urbanization, which exponentially increases the consumer base for packaged, shelf-stable, and convenient foods. Furthermore, in many industrial applications, particularly mass-market baking and frying, hydrogenated oils offer a cost-to-performance ratio that is currently unmatched by most non-hydrogenated alternatives, cementing their essential status in the global commodity ingredients sector.

The paramount restraint remains the global regulatory environment, dominated by the near-universal eradication of industrially produced trans fats (IP-TFA). Regulations enforced by major economies, including the U.S. FDA ban on partially hydrogenated oils (PHOs) and the WHO’s 'Replace' initiative, impose strict limits on trans-fat content, effectively eliminating the easiest and cheapest method of structuring fats. This necessitates costly and extensive reformulation, which involves transitioning to more complex, often patented processes like enzymatic interesterification or the use of specific high-pressure fractionation. Consumer perception further compounds this restraint; even fully hydrogenated oils often face scrutiny due to the association with the hydrogenation process, prompting manufacturers to seek "non-hydrogenated" label claims even when functional equivalents are used.

However, these restraints have paved the way for compelling market opportunities. The need for compliant functional fats has spurred significant investment in low-trans and zero-trans technologies, creating lucrative segments for specialized fat and oil producers who can master these proprietary processes. Furthermore, there is a growing opportunity in leveraging the high stability of fully hydrogenated stearins in non-food applications, such as the production of oleochemicals, surfactants, bioplastics, and bio-lubricants, offering diversified revenue streams. Geographically, emerging markets in Asia and Africa, where food safety and shelf stability are critical priorities and local trans-fat regulations are still evolving, offer substantial growth potential for compliant hydrogenated fat products, provided supply chain logistics can be optimized.

- Drivers:

- Rapid growth of the global packaged food industry and increasing preference for convenient meals and snacks requiring long shelf stability.

- Functional superiority of structured fats in providing essential textural properties (plasticity, crystal structure) necessary for high-quality shortenings and margarines.

- Cost-efficiency and high oxidative stability of hydrogenated oils, making them economically viable for large-scale industrial frying operations.

- Expansion of quick-service restaurants (QSR) and food service sectors globally, demanding durable and high-performance frying media.

- Restraints:

- Global implementation of strict regulations and bans on industrially produced trans fats (IP-TFA), forcing expensive and complex product reformulation.

- Persistent negative consumer perceptions and health consciousness regarding hydrogenated fats (even FHOs) risks.

- Volatile prices and sourcing challenges for key vegetable oil commodities (soybean, palm), impacting manufacturing margins.

- Technological limitations and higher capital costs associated with enzymatic interesterification compared to traditional PHO production.

- Opportunities:

- Commercialization and scaling of advanced zero-trans-fat structuring technologies, specifically enzymatic interesterification and tailored fractional crystallization.

- Development of customized specialty fat blends designed for high-value applications, such as cocoa butter replacers (CBRs) and specialized bakery emulsifiers.

- Market penetration in emerging economies with rapidly industrializing food sectors and high demand for stable, preserved products.

- Utilization of fully hydrogenated oil usage into oleochemicals, cosmetics, and bio-industrial applications, leveraging high purity and saturation.

- Impact Forces:

- Regulatory Impact: Extremely High (mandatory cessation of traditional PHO use).

- Technological Impact: High (necessity for continuous innovation in fat modification chemistry).

- Economic Impact: Moderate (price competition persists due to commodity nature, offset by specialty segment margins).

- Socio-Political Impact: High (driven by strong public health advocacy and sustainability demands).

Segmentation Analysis

The segmentation of the Edible Hydrogenated Oils Market provides a granular view of consumption patterns, technological requirements, and regulatory influences. Segmentation by source is foundational, dictated by the inherent fatty acid profiles and crystallization behaviors of the raw material. Palm oil, rich in palmitic acid, naturally provides high solid fat content and is preferred for hydrogenated products requiring hardness and stability, making it the volume leader. Soybean and rapeseed (canola) oils, being more unsaturated, require more intensive hydrogenation to achieve similar structural profiles but are favored in regions seeking non-palm alternatives or specific functional characteristics, such as lower melting points for specialized spreads. The choice of source material significantly impacts the final product's texture, cost, and adherence to regional sourcing mandates (e.g., sustainability certifications).

The market is critically segmented by the application, reflecting the varying functional demands across the food industry. The Bakery segment requires hydrogenated shortenings and margarines for aeration, volume control, and plasticity, ensuring consistent loaf quality and pastry flakiness. The Confectionery segment relies on these fats for sharp melting profiles, crucial for coatings that melt precisely at body temperature, often utilizing specialized fully hydrogenated fractions or cocoa butter equivalents (CBEs). The Snacks and Savory sector demands highly stable frying oils with minimal foaming and long fry life, often achieved through highly refined, fully hydrogenated blends. The growth rate within each application segment is directly correlated with economic development and shifts in dietary habits, such as the increased consumption of prepared ready-to-eat meals and frozen desserts.

Segmentation also differentiates between the Forms—Solid and Semi-Solid—which is a measure of the oil's structure at ambient temperature. Solid forms (shortenings, block margarines) are essential for industrial baking processes where structure and consistency are critical. Semi-solid or plastic fats are designed for spreadability and use in fillings and creams, requiring complex interesterification to achieve a broad plastic range without incorporating trans fats. Furthermore, the segmentation by the degree of modification (fully hydrogenated, partially hydrogenated, interesterified fats) reveals the technological shift. The decline of the PHO segment is structurally permanent, while the FHO and IE fat segments are experiencing compensatory high growth, driven by their regulatory compliance and successful functional replication of traditional fats. This detailed structural breakdown allows market participants to identify lucrative niches based on technological expertise and regional compliance requirements.

- By Source:

- Soybean Oil: Key source in North America; high hydrogenation requirement; utilized in specialized low-trans blends.

- Palm Oil: Global volume leader; cost-effective; used for high-stability shortenings and tropical margarines.

- Rapeseed Oil (Canola): Preferred in Europe and Canada; used for specialty liquid and soft fats after modification.

- Sunflower Oil: Growing source for high-oleic variants, offering natural stability post-hydrogenation.

- Others (Cottonseed, Corn Oil): Niche applications, often subject to regional availability and cost.

- By Form:

- Solid: Used for block shortenings, requiring high SFC for structural applications in baking.

- Semi-Solid/Plastic: Used for spreads, fillings, and industrial margarines, demanding specific rheological properties over a temperature range.

- By Application:

- Bakery Products (Breads, Cakes, Pastries): Largest consumer; reliance on fat plasticity for texture and volume.

- Confectionery (Chocolate Coatings, Fillings): High demand for fats with sharp melting profiles (CBR/CBEs).

- Snacks & Savory (Potato Chips, Extruded Snacks): Requires high oxidative stability for extended fry life.

- Dairy & Desserts (Ice Cream, Whipped Toppings): Utilized as stabilizers and non-dairy fat bases.

- Prepared Foods & Ready Meals: Requires fats that resist degradation during freeze-thaw cycles and reheating.

Value Chain Analysis For Edible Hydrogenated Oils Market

The Edible Hydrogenated Oils value chain is initiated at the agricultural level, involving the cultivation, harvesting, and initial crushing of oilseeds, a highly localized and weather-dependent upstream process. Major agricultural trading houses and commodity aggregators manage the logistics and supply of crude vegetable oils—the fundamental raw material. The subsequent refining, bleaching, and deodorization (RBD) process transforms crude oil into refined, standardized feedstock. This stage requires significant capital investment and is where initial quality specifications are established. Price volatility at this upstream level is the single largest determinant of profitability throughout the chain, compelling processors to engage in complex hedging and risk management strategies to ensure stable input costs for industrial buyers.

The midstream segment is the core value-addition stage, encompassing the specialized chemical and enzymatic modification processes—hydrogenation and interesterification. This segment is dominated by a few global oleochemical giants who possess the intellectual property and scale required for efficient, compliant processing (zero trans fats). Here, technology is the primary competitive differentiator; proprietary catalysts, advanced reactor designs, and enzymatic protocols enable the creation of high-value functional fats tailored to specific customer needs. These companies focus on precision engineering of the fat crystal structure, moving the product from a commodity to a specialized industrial ingredient.

Downstream activities involve specialized blending, packaging, and distribution. Processed fats are mixed with emulsifiers, colors, and flavorings to create final products like specialized shortenings, industrial margarines, and tailored frying systems, which are then sold to B2B clients. Distribution is highly streamlined: direct sales channels dominate for large-volume customers (major food and beverage multinational corporations), ensuring personalized technical support and guaranteed supply. Indirect channels, utilizing specialized food ingredient distributors, serve smaller bakeries, food service providers, and regional manufacturers. Effective logistics, including managing the temperature-sensitive transport of certain fat blends and maintaining rigorous quality documentation, are crucial for retaining customer trust and market share in this high-specification industrial sector.

Edible Hydrogenated Oils Market Potential Customers

The customer base for edible hydrogenated oils is heavily concentrated in the industrial food processing domain, characterized by large volume purchases and demanding technical requirements. Primary potential customers are integrated commercial bakeries and pastry manufacturers. These entities rely on highly consistent hydrogenated shortenings and specialty margarines to ensure uniformity in mass-produced goods. Key purchasing criteria for these customers include the shortening's creaming capacity (incorporating air), its plasticity profile over varying temperatures, and its guarantee of zero trans-fat content, which directly influences their final product quality and label claims.

A second crucial customer segment is the confectionery and chocolate industry. Manufacturers require fats with sharp melting characteristics—hard at room temperature but melting quickly in the mouth—to produce high-quality chocolate coatings, compound chocolates, and fillings resistant to fat bloom. These customers often purchase fully hydrogenated fractions (like palm kernel stearin) or specialized cocoa butter equivalents (CBEs), prioritizing suppliers who offer precise crystallization kinetics and superior oxidative stability to maintain product quality throughout the global supply chain, often demanding specific traceability and sustainability certifications, especially for ingredients like palm derivatives.

Furthermore, significant volumes are consumed by producers of snacks, savory items, and deep-fried products, alongside the expansive food service sector (QSR chains). These customers require dedicated frying oils that exhibit exceptional thermal stability, reduced gumming, and extended service life under continuous high-heat conditions, crucial for operational cost control and food safety compliance. Beyond food, emerging customer bases include chemical manufacturers seeking oleochemical feedstock for soaps, detergents, and bio-industrial lubricants, leveraging the consistent saturation levels and purity of fully hydrogenated fats for non-edible high-performance applications, broadening the market scope beyond traditional food ingredients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $25.5 Billion |

| Market Forecast in 2033 | $35.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bunge Limited, Archer Daniels Midland (ADM), Cargill, Wilmar International, IOI Corporation Berhad, Sime Darby Plantation, AAK AB, Fuji Oil Co. Ltd., Associated British Foods (ABF), The J.M. Smucker Company, Conagra Brands, Ventura Foods, Louis Dreyfus Company, AG Processing Inc (AGP), Richardson International, CHS Inc., Grupo Nutresa, Upfield, Oleon NV, Mewah Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Edible Hydrogenated Oils Market Key Technology Landscape

The technological evolution within the Edible Hydrogenated Oils market is centered on achieving structural integrity and stability without generating trans fatty acids (TFA). The foundational technology remains catalytic hydrogenation, but the focus has shifted entirely to optimizing selective hydrogenation techniques. This involves using highly specialized nickel-based or noble metal catalysts, coupled with advanced process control systems (often leveraging AI), to carefully manage hydrogen gas flow and temperature profiles. The goal is to maximize the saturation of polyunsaturated fatty acids to achieve the required solid fat curve, while simultaneously minimizing the isomerization that leads to TFA formation, necessitating precise control over reaction intermediates and residence time within the reactor vessel.

The most critical technological pillar driving compliance and innovation is Interesterification (IE). Chemical Interesterification (CIE) involves using chemical catalysts (typically sodium methoxide) to randomly rearrange fatty acids on the triglyceride backbone, creating new fats with desirable plasticity and melting properties. Enzymatic Interesterification (EIE), however, represents the leading edge of technology. EIE utilizes specific lipases (immobilized enzymes) that selectively catalyze the rearrangement, allowing for highly controlled fat structure modification under milder conditions. EIE is highly favored for producing "clean label" products as it avoids chemical catalysts and high heat, yielding fats that mimic PHO functionality while maintaining zero-trans-fat status and often offering better consistency and flavor neutrality.

Furthermore, advanced physical separation techniques are indispensable. Fractional crystallization (fractionation) involves the controlled cooling of oils to separate solid fat fractions (stearins) from liquid ones (oleins) based on their melting points. This process is crucial for refining palm oil derivatives and utilizing fully hydrogenated fats, allowing manufacturers to precisely tailor the stiffness and plasticity of the final fat blend. Dry fractionation, solvent fractionation, and detergent fractionation are employed depending on the required purity and scale. The strategic blending of these highly controlled fractions with liquid oils allows formulators to create bespoke fat systems that perform flawlessly in complex food matrices, representing a significant technological step up from simple traditional hydrogenation.

Regional Highlights

Regional dynamics illustrate a stark divergence between consumption volume and technological sophistication. Asia Pacific (APAC) stands as the undeniable leader in terms of market volume, driven by demographic expansion and the industrialization of the food supply chain across emerging economies like India, Indonesia, and Vietnam. The abundance and cost-competitiveness of palm oil derivatives in this region make them the primary feedstock for hydrogenation processes, fueling the production of massive quantities of industrial margarines and shortenings. While regulatory enforcement regarding trans fats is accelerating across key APAC nations, the rapid expansion of middle-class consumers demanding shelf-stable packaged goods guarantees strong underlying demand. Manufacturers in APAC focus heavily on optimizing logistics and achieving maximum cost efficiency in high-volume, compliant fat production.

Conversely, North America and Europe define the market's value segment and technological trajectory. Following the FDA ban in 2018, North America completed a rapid overhaul of its fat infrastructure, heavily investing in interesterification facilities. The market now values specialty, functionally superior shortenings and oils derived from FHOs and EIE processes, prioritizing non-GMO and clean-label claims. European markets mirror this focus but add a layer of complexity with rigorous sustainability and ethical sourcing requirements, particularly mandating certifications like RSPO for palm oil. Manufacturers here lead in the application of enzymatic technology and specialized high-oleic feedstock, selling premium functional ingredients at high margins to sophisticated food processors dedicated to minimizing saturated fat while eliminating trans fats.

Latin America (LATAM) is characterized by high potential growth, with Brazil and Mexico leading the industrial expansion. The region is transitioning from traditional fat sources to modern, compliant industrial shortenings as international food companies expand their footprint. Supply chain maturity is a key variable; while demand is high, access to advanced processing technologies is often limited, resulting in reliance on specialized imports from global players. In the Middle East and Africa (MEA), the primary driver is the need for enhanced shelf stability in hot, often unstable supply environments. Demand is steady for cost-effective, durable frying and baking fats, making the region crucial for standard, compliant FHO products that maximize stability under extreme heat stress, although the region is catching up on regulatory standards driven by international trade norms.

- Asia Pacific (APAC): Highest volume market; driven by urbanization and processed food consumption; primary focus on mass production, cost management, and regulatory transition regarding palm derivatives.

- North America: Mature, high-value market; leading adoption of zero-trans-fat technologies (EIE, advanced blending) following strict PHO ban; strong focus on non-GMO and clean label attributes.

- Europe: Highly regulated market prioritizing sustainability (RSPO certification) and clean processing; high demand for functional, low-saturated fat, interesterified products used in premium food manufacturing.

- Latin America (LATAM): Rapidly industrializing food sector creating high growth in demand for compliant shortenings; market dynamics influenced by regional trade agreements and commodity price stability.

- Middle East and Africa (MEA): Emerging market focused on fat stability for high-temperature climates; steady growth fueled by expanding food service sector and increasing packaged food imports and production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edible Hydrogenated Oils Market.- Bunge Limited

- Archer Daniels Midland (ADM)

- Cargill

- Wilmar International

- IOI Corporation Berhad

- Sime Darby Plantation

- AAK AB

- Fuji Oil Co. Ltd.

- Associated British Foods (ABF)

- The J.M. Smucker Company

- Conagra Brands

- Ventura Foods

- Louis Dreyfus Company

- AG Processing Inc (AGP)

- Richardson International

- CHS Inc.

- Grupo Nutresa

- Upfield

- Oleon NV

- Mewah Group

Frequently Asked Questions

Analyze common user questions about the Edible Hydrogenated Oils market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between partially and fully hydrogenated oils?

Partially hydrogenated oils (PHOs) contain trans fats, which are generally restricted due to health concerns, and were historically used to create semi-solid consistency. Fully hydrogenated oils (FHOs) contain virtually no trans fats and are highly saturated, waxy solids often used as feedstock for interesterification or blending to create healthier, structured fats compliant with modern food safety regulations.

How do global trans-fat regulations impact the market for hydrogenated oils?

Stringent regulations, notably the WHO's 'Replace' program and regional bans, have mandated a fundamental pivot away from PHOs. This regulatory pressure accelerates the adoption of high-cost, advanced zero-trans-fat technologies, primarily enzymatic interesterification and specialized blending, driving technological investment and reshaping the entire functional fat supply chain to ensure product compliance.

Which oil source dominates the raw material segment in the hydrogenated oil market?

Palm oil derivatives currently dominate the market volume, especially in the Asia Pacific region, owing to their inherent physical properties that simplify structuring, cost-effectiveness, and natural saturation profile. However, non-palm sources like soybean and rapeseed are growing in importance in regions prioritizing specific fatty acid profiles or environmental sustainability concerns.

What are the primary functional benefits of using hydrogenated oils in the bakery industry?

Hydrogenated oils, utilized as shortenings or specialty margarines, provide essential functional benefits including excellent aeration (creaming), structural stability, superior control over dough plasticity and flakiness, and high oxidative resistance, all vital for achieving consistent volume and extended shelf life in mass-produced baked goods.

How is AI being used to improve the production of edible hydrogenated oils?

AI is strategically employed to optimize complex processes like hydrogenation and interesterification. It utilizes machine learning to analyze real-time sensor data, predict input quality variations, minimize energy consumption, and precisely control the formation of saturated fats and crystal structures, thereby ensuring consistent zero-trans-fat output and accelerating the R&D of new lipid blends.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager