EDM Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431723 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

EDM Market Size

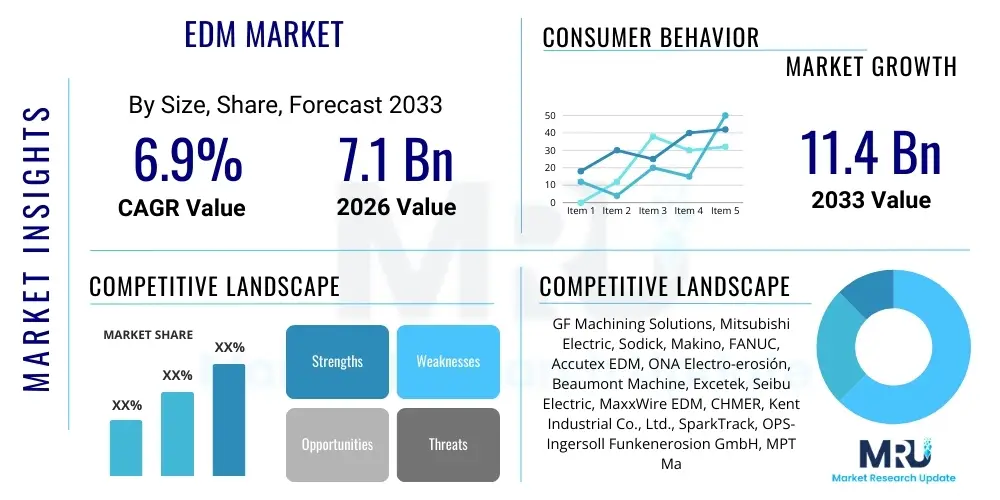

The EDM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at $7.1 Billion in 2026 and is projected to reach $11.4 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing global demand for high-precision components, particularly within the automotive, aerospace, and medical device sectors where traditional machining methods struggle to achieve the required tolerances and surface finishes on advanced materials. The continuous innovation in EDM machine design, focusing on increased automation, faster cutting speeds, and improved process monitoring capabilities, further solidifies its critical role in modern manufacturing landscapes.

EDM Market introduction

The Electrical Discharge Machining (EDM) Market encompasses a range of non-conventional machining processes—primarily Sinker (Die), Wire, and Hole Drilling EDM—that utilize electrical sparks to erode material from a workpiece. This technique is invaluable for manufacturing components with complex geometries, intricate features, and high aspect ratios, particularly when dealing with hard, heat-resistant, or conductive materials that are challenging or impossible to process via conventional cutting tools. The core product offering includes sophisticated CNC-controlled EDM machines, specialized electrodes, dielectric fluids, and ancillary equipment required for precision manufacturing in tool and die making, mold production, and complex part fabrication across demanding industrial applications.

Major applications of EDM technology span critical industries such as aerospace, where it is used for intricate turbine components and engine parts; automotive, for complex mold cavities and precision stamping dies; and medical, for micro-scale instruments and implants. The inherent ability of EDM to machine materials regardless of their hardness—relying only on their electrical conductivity—positions it as an indispensable technology for handling superalloys, titanium, and advanced composites. Key benefits include superior surface finish, minimal mechanical stress on the workpiece, and the capacity to create extremely small features and deep cavities, providing manufacturers with capabilities essential for next-generation product development.

Driving factors for market expansion are multifaceted, including the escalating adoption of lightweight and robust materials in the automotive and aerospace industries to enhance fuel efficiency and performance. Furthermore, the rapid growth of the mold and die industry, especially in Asia Pacific, necessitates high-precision machining solutions like EDM. Technological drivers, such as advanced pulse generators, improved adaptive control systems, and the integration of automation solutions like robotics and automatic wire threading systems, collectively improve the efficiency and applicability of EDM, sustaining its robust market trajectory.

EDM Market Executive Summary

The global EDM market is characterized by robust technological advancements, competitive pricing strategies among key vendors, and a significant shift toward automated and hybrid machining systems. Key business trends indicate a strong move toward industrial IoT integration in EDM machinery, enabling predictive maintenance, remote diagnostics, and real-time process optimization, thereby enhancing overall equipment effectiveness (OEE). Manufacturers are increasingly prioritizing energy-efficient machines and recyclable dielectric fluids to meet rising sustainability mandates. Furthermore, the rise of specialized applications, particularly micro-EDM for MEMS and semiconductor fabrication, is opening up lucrative niche markets globally, necessitating focused R&D investments from market leaders to maintain competitive advantage and intellectual property portfolios.

Regionally, the Asia Pacific (APAC) continues to dominate the EDM market in terms of volume and growth rate, primarily fueled by massive manufacturing bases in China, Japan, and South Korea, particularly in electronics, automotive, and consumer goods production. North America and Europe, while mature, remain crucial markets focused on high-value, high-precision applications, such as medical implants and advanced aerospace components, driving demand for high-end, multi-axis Wire and Sinker EDM machines. Economic stability and robust investment in infrastructure and defense sectors across developed regions ensure sustained demand for premium EDM solutions, while emerging markets in Latin America and MEA show nascent growth potential driven by local industrialization efforts and foreign direct investments.

In terms of segmentation, the Wire EDM segment holds the largest market share due to its versatility, faster cutting speeds, and ability to produce components with tight dimensional accuracy for stamping tools and mold components. However, the Sinker EDM segment is projected to show accelerated growth, particularly driven by demand for complex cavities and deep-hole drilling applications in the mold and die industry. The end-user analysis confirms that the automotive industry remains the largest consumer, but the aerospace and defense segment, driven by the need to machine superalloys like Inconel and titanium for lightweighting initiatives, exhibits the highest value growth rate due to the specialized nature and high unit cost of the components produced.

AI Impact Analysis on EDM Market

User inquiries regarding AI's impact on the EDM market primarily revolve around three critical areas: process optimization, defect prediction, and enhancing the productivity of skilled technicians. Users frequently question how AI algorithms can reduce machining time, particularly in complex Sinker EDM operations where electrode wear is a major variable. There is significant interest in using machine learning (ML) to model the erosion process dynamically, allowing real-time adjustment of pulse parameters (current, duration, frequency) to maintain optimal material removal rates (MRR) while minimizing surface damage (Heat Affected Zone - HAZ). Concerns often surface about data privacy, the cost of retrofitting existing CNC EDM machines with requisite sensors, and the potential displacement of highly skilled EDM programmers and operators by automated intelligence systems. Expectations are high that AI will democratize high-precision EDM by making process setup less reliant on deep experiential knowledge, thereby improving first-pass yield and reducing scrap rates in demanding manufacturing environments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming EDM operations from static, pre-programmed processes into dynamic, self-optimizing systems. AI models can analyze voluminous datasets generated during the machining process—including real-time voltage, current fluctuations, spark gap conditions, and dielectric flow dynamics—to predict and mitigate detrimental events such as arcing or unstable burning conditions before they lead to workpiece damage. This proactive approach significantly increases the reliability of unattended machining, a major goal for high-volume manufacturing facilities. Furthermore, AI contributes substantially to predictive maintenance strategies by analyzing vibration and thermal signatures of critical machine components like servo motors and wire guides, predicting potential failures weeks in advance and allowing for planned downtime rather than costly, unexpected breakdowns, thus maximizing machine uptime and extending the lifecycle of specialized equipment.

Advanced AI applications extend to quality control and design optimization. ML algorithms are being developed to analyze imagery or sensor data post-machining to automatically detect and classify microscopic surface defects, ensuring conformance to stringent quality standards, particularly in medical and aerospace sectors. Moreover, generative AI principles are being explored to optimize toolpath generation and electrode geometry design. By simulating millions of machining scenarios, AI can rapidly identify the most efficient sequence of operations, reducing both material wastage and overall processing time. The resulting optimization allows manufacturers to push the boundaries of achievable geometries and tolerances, cementing AI's role not just as an optimizer, but as an enabler of complex manufacturing breakthroughs in the EDM domain.

- Real-time process optimization (RPO) utilizing ML to dynamically adjust spark parameters (e.g., pulse duration, flushing pressure).

- Predictive maintenance (PdM) analyzing sensor data to forecast failure of critical components, maximizing machine uptime.

- Automated defect detection and classification using computer vision for enhanced quality control and reduced manual inspection time.

- Enhanced electrode wear compensation models that predict material loss based on machining history and adjust toolpath accordingly.

- Optimized dielectric flushing strategy determination via AI simulations to prevent debris accumulation and stabilize the machining gap.

- Assisted programming and simulation, reducing setup time and reliance on extensive operator experience.

DRO & Impact Forces Of EDM Market

The EDM market's trajectory is shaped by a powerful confluence of drivers necessitating high-precision manufacturing, restraints related to operational costs and efficiency, and significant opportunities emerging from technological convergence. EDM drivers center around the material revolution, where the increasing use of advanced, difficult-to-machine alloys (e.g., Inconel, hardened steels, Ti-alloys) across aerospace and power generation sectors makes non-conventional machining indispensable. Restraints include the inherent slow Material Removal Rate (MRR) compared to conventional milling for bulk material removal, the high capital expenditure required for purchasing premium CNC EDM equipment, and the dependence on specialized, highly skilled labor for complex machine programming and operation. Opportunities reside in the development of hybrid machining systems that combine EDM with milling or grinding, the growing demand for micro-EDM in the electronics sector, and the implementation of sophisticated automation and process monitoring tools.

Key drivers include the global push for miniaturization, particularly in the medical and electronics industries, which necessitates the use of micro-EDM to create extremely fine features and precision components that are otherwise impossible to produce. The rigorous quality requirements and safety standards in the aerospace industry mandate components manufactured with minimal residual stress and superior surface integrity, attributes intrinsically offered by the EDM process. Furthermore, the relentless global demand for complex plastic injection molds and stamping dies, essential for high-volume consumer product manufacturing, consistently drives the demand for Sinker and Wire EDM technologies for cavity and contour creation. This continuous demand ensures a steady investment cycle in modern EDM technology, focused on multi-axis capabilities and faster throughput.

Conversely, significant restraints hinder market potential, primarily the energy intensity of the EDM process, leading to higher operational costs compared to traditional subtractive methods. The challenge of efficiently evacuating debris from the spark gap, especially in deep-cavity Sinker EDM, limits the maximum achievable MRR, prolonging cycle times—a major competitive disadvantage in time-sensitive production environments. Furthermore, while EDM can process any conductive material, it is unsuitable for machining non-conductive ceramics and polymers, limiting its total addressable market. The competitive landscape is further complicated by the emergence of highly specialized laser processing technologies, which offer comparable precision in certain micro-machining applications, putting pressure on EDM manufacturers to consistently improve efficiency metrics. Addressing these restraints through innovation in power supply and flushing systems is crucial for sustained market leadership.

Opportunities for growth are concentrated in the development of hybrid EDM systems, such as EDM-Grinding combinations, which leverage the strengths of both processes to achieve rapid bulk material removal followed by high-precision finishing. The rapidly expanding electric vehicle (EV) sector, requiring complex, high-precision cooling plates and battery components, represents a substantial new application field for EDM. Moreover, enhancing the usability and integration of EDM machines with Factory 4.0 infrastructure, including open APIs and robust connectivity options, provides manufacturers with new competitive advantages. Finally, the refinement of dry EDM techniques, which use gas or mist instead of traditional liquid dielectric, presents an opportunity to reduce environmental impact and operational costs while expanding the process's applicability to new material compositions, overcoming material and environmental restrictions.

Segmentation Analysis

The global EDM market is segmented primarily based on the type of technology employed, the end-user industry utilizing the machinery, and the operational complexity (application type). Technology segmentation divides the market into Wire EDM (WEDM), Sinker EDM (SEDM), and Hole Drilling EDM (HDEDM), each catering to specific geometric requirements and material removal needs. WEDM, known for its ability to cut intricate 2D and 3D shapes in plates and blocks, typically dominates revenue due to its versatility in tool and die manufacturing. Application segmentation focuses on mold and die, general machining, and specialized micro-machining, reflecting the diverse scale and precision requirements across the industrial spectrum. The rigorous analysis of these segments is vital for vendors to tailor their product development and marketing strategies towards the most lucrative and fastest-growing market niches, such as the high-precision aerospace component segment.

- By Technology

- Wire EDM (WEDM)

- Sinker EDM (SEDM) / Die-Sinking EDM

- Hole Drilling EDM (HDEDM) / Fast Hole Drilling EDM

- By Application Type

- Tool & Die Manufacturing

- Mold Manufacturing (Injection, Blow, Compression molds)

- General Machining

- Micro-Machining (for medical devices and electronics)

- Aerospace Component Manufacturing

- By End-User Industry

- Automotive

- Aerospace & Defense

- Medical

- Electronics & Semiconductors

- Energy & Power Generation

- Industrial Machinery

- By Operation Type

- CNC EDM Machines

- Conventional EDM Machines

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For EDM Market

The EDM market value chain begins with upstream activities involving raw material suppliers, predominantly focusing on the provision of specialized materials for machine components (e.g., high-grade steel castings, sophisticated electronic components for power generators) and consumables (electrodes made of graphite, copper, and tungsten, along with premium dielectric fluids and wire spools). This upstream segment is characterized by specialized suppliers adhering to stringent quality specifications. Midstream activities involve the primary EDM manufacturers who engage in the research, design, assembly, and testing of CNC EDM machines, focusing heavily on integrating advanced proprietary software and high-precision motion control systems to differentiate their offerings. Intellectual property protection surrounding pulse generator technology and adaptive control algorithms is a critical factor in this phase, determining competitive advantage and market pricing.

Downstream activities are dominated by distribution and after-sales support networks. Distribution channels are bifurcated into direct sales models, often employed for high-value custom machines sold directly to large original equipment manufacturers (OEMs) and Tier 1 suppliers, and indirect channels relying on authorized regional distributors and system integrators. These indirect partners handle sales, installation, commissioning, and localized training for small-to-midsize enterprises (SMEs). A crucial component of the downstream value chain is the provision of continuous technical support, spare parts, and maintenance services, which are significant revenue streams, ensuring the long-term operational efficiency of the installed base and fostering enduring customer relationships, particularly in specialized fields like aerospace where machine reliability is paramount.

The overall efficiency of the value chain is increasingly reliant on seamless supply chain management, ensuring the timely delivery of high-quality consumables like specialized wires and dielectric fluids, which significantly impact machining performance and cost-effectiveness. Direct distribution channels facilitate closer feedback loops between the end-user and the machine manufacturer, enabling faster iteration and customization of machine design based on evolving production requirements, especially concerning new material applications. Conversely, relying on indirect distribution allows manufacturers to leverage local market expertise and expansive service footprints, crucial for penetrating geographically diverse markets like APAC. Maximizing value capture involves strategic partnerships at both the upstream (electrode material innovation) and downstream (integrated software solutions and remote diagnostics) stages, ensuring the highest standards of machine performance and support throughout the product lifecycle.

EDM Market Potential Customers

Potential customers for EDM technology are highly diverse yet consistently require extreme precision, tight tolerances, and the ability to process hard or exotic materials. The primary end-users, or buyers, are organizations involved in high-value, high-complexity manufacturing across core industrial sectors. Tool and die shops constitute a foundational customer base, relying heavily on EDM for producing complex metal stamping dies, extrusion dies, and blanking tools used in mass production. Mold makers, particularly those serving the medical, consumer electronics, and automotive industries, are essential customers, utilizing Sinker EDM to create intricate cavities and textured surfaces in injection molds. These customers prioritize machine accuracy, repeatability, and the quality of surface finish achieved, as mold performance directly impacts product quality and lifespan.

Tier 1 and 2 suppliers to the aerospace and defense industry represent a premium customer segment, demanding advanced multi-axis Wire and Sinker EDM capabilities to manufacture mission-critical components from difficult materials such as nickel-based superalloys (e.g., Inconel) and titanium alloys. Applications here include turbine blades, blisks, and structural components that require deep, precise holes or complex contours. This segment emphasizes reliability, certification compliance, and the machine's ability to minimize recast layer thickness and micro-cracking. Furthermore, medical device manufacturers, particularly those producing surgical instruments, orthopedic implants, and micro-fluidic devices, rely on micro-EDM processes to achieve micron-level precision and bio-compatible surface finishes on materials like stainless steel and cobalt-chrome alloys, demonstrating the critical role of EDM in supporting advanced technological sectors.

Emerging customer segments include manufacturers in the Electric Vehicle (EV) supply chain, utilizing EDM for cutting high-precision copper components for battery cooling systems and intricate parts for power electronics. Semiconductor and electronics manufacturers are also growing customers for micro-EDM, applying the technology for the fabrication of complex micro-electro-mechanical systems (MEMS) and precise wafer dicing where mechanical stress must be avoided. These diverse customer needs underscore the necessity for EDM manufacturers to offer a range of machinery, from entry-level standard models suitable for job shops to highly automated, integrated systems customized for large-scale OEMs and specialized component producers who demand unparalleled process control and high throughput capacity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.1 Billion |

| Market Forecast in 2033 | $11.4 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GF Machining Solutions, Mitsubishi Electric, Sodick, Makino, FANUC, Accutex EDM, ONA Electro-erosión, Beaumont Machine, Excetek, Seibu Electric, MaxxWire EDM, CHMER, Kent Industrial Co., Ltd., SparkTrack, OPS-Ingersoll Funkenerosion GmbH, MPT Machining Systems, MC Machinery Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

EDM Market Key Technology Landscape

The contemporary EDM market is defined by a rapid evolution of core technologies aimed at enhancing speed, precision, and efficiency, coupled with efforts to reduce the environmental footprint. A major technological focus lies in advanced Pulse Generator (PG) design, moving from conventional relaxation circuits to sophisticated transistorized and digital PGs. These modern generators allow for precise control over spark energy, duration, and frequency, enabling operators to optimize the process for achieving ultra-fine surface finishes (Ra values below 0.1 µm) or maximizing Material Removal Rate (MRR) without inducing detrimental thermal damage or excessive recast layers. Furthermore, manufacturers are integrating adaptive control systems directly into the CNC unit, which automatically adjust parameters in real-time based on monitoring spark gap conditions, thereby maintaining stability during high-speed, deep-hole, or high-aspect-ratio machining operations.

Another significant area of innovation revolves around the mechanical and control aspects of the machines. High-precision linear motor drives are increasingly replacing conventional ball screw systems in premium Wire and Sinker EDM machines, offering zero backlash, superior acceleration, and sub-micron positioning accuracy necessary for micro-EDM applications. Concurrently, advances in dielectric fluid technology are shifting towards specialized synthetic oils and deionized water systems that provide enhanced flushing capabilities, improved cooling, and reduced conductivity fluctuations. These fluids, often paired with advanced filtration systems, significantly prolong electrode lifespan, stabilize the cutting process, and minimize the formation of hazardous byproducts, thus improving both operational safety and environmental compliance within manufacturing facilities globally.

The integration of Industry 4.0 principles is fundamentally reshaping the technological landscape, turning EDM machines into smart, connected assets. Key developments include incorporating sophisticated sensor arrays for comprehensive process monitoring, enabling remote diagnostics, and facilitating integration with Manufacturing Execution Systems (MES) via standardized protocols like MTConnect or OPC UA. Furthermore, the push for automation sees increased utilization of automatic tool changers (ATCs) for Sinker EDM electrodes and advanced Automatic Wire Threading (AWT) systems for Wire EDM, significantly reducing manual intervention and enabling extended periods of lights-out, unattended operation. These technological advancements collectively reduce labor costs, improve process reliability, and are crucial for meeting the demands of global supply chains for high-volume, high-quality component manufacturing.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by the massive automotive, electronics manufacturing, and mold and die industries in China, Japan, South Korea, and Taiwan. Government initiatives supporting high-tech manufacturing and extensive investment in precision engineering infrastructure ensure continuous, high demand for both volume production and specialized micro-EDM solutions, making it the epicenter of global EDM consumption and production volume.

- North America: North America represents a mature, high-value market characterized by stringent quality demands from the aerospace, defense, and medical device sectors. The region primarily consumes advanced, high-precision CNC EDM equipment, focusing heavily on automation integration, five-axis capabilities, and specialized machines capable of processing high-performance superalloys. Investment in R&D and advanced materials drives sustained demand for cutting-edge technology.

- Europe: The European market, led by Germany, Switzerland, and Italy, focuses on innovation, premium machine tools, and sustainable manufacturing practices. Demand is fueled by high-end automotive (luxury and performance segments), precision toolmaking, and advanced industrial machinery production. European manufacturers prioritize energy efficiency, precision control, and seamless integration of EDM machines into highly automated production cells, driving adoption of hybrid EDM systems.

- Latin America (LATAM): LATAM is an emerging market with moderate growth potential, driven by developing automotive manufacturing bases (especially in Brazil and Mexico) and increasing local investment in infrastructure and energy production. The market predominantly seeks cost-effective, reliable EDM solutions and is witnessing growing adoption of refurbished or mid-range CNC machines, coupled with rising demand for localized service and support.

- Middle East & Africa (MEA): MEA is the smallest but exhibiting specialized growth, mainly concentrated in energy (oil and gas) and defense sectors requiring complex, specialized components. Demand is often project-based, favoring robust, durable EDM systems for maintenance, repair, and overhaul (MRO) applications, particularly in countries with significant investment in localized defense manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the EDM Market.- GF Machining Solutions

- Mitsubishi Electric Corporation

- Sodick Co., Ltd.

- Makino Milling Machine Co., Ltd.

- FANUC Corporation

- Accutex EDM

- ONA Electro-erosión, S.A.

- Beaumont Machine

- Excetek Technology Co., Ltd.

- Seibu Electric & Machinery Co., Ltd.

- MaxxWire EDM

- CHMER EDM

- Kent Industrial Co., Ltd.

- SparkTrack

- OPS-Ingersoll Funkenerosion GmbH

- AgieCharmilles

- Zimmer & Kreim GmbH & Co. KG

- MC Machinery Systems (Mitsubishi EDM division)

- Novick Manufacturing Company

- Microlution, Inc.

Frequently Asked Questions

Analyze common user questions about the EDM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the EDM Market?

The Electrical Discharge Machining (EDM) Market is projected to experience a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033, driven by increasing demands for high-precision components in aerospace and medical sectors.

Which EDM technology segment holds the largest market share?

Wire EDM (WEDM) technology typically holds the largest market share due to its superior efficiency in cutting intricate 2D/3D contours and its widespread adoption in the high-volume tool and die manufacturing industries globally.

How is AI impacting the productivity and cost-efficiency of EDM operations?

AI integration enhances EDM operations by enabling real-time process optimization, minimizing arcing through dynamic parameter adjustments, and facilitating predictive maintenance, thereby reducing unexpected downtime and improving overall equipment effectiveness (OEE).

Which end-user industry is the largest consumer of EDM machinery?

The Automotive industry remains the largest end-user segment for EDM technology, primarily utilizing the machinery for producing high-precision molds, dies, and intricate components necessary for both traditional and electric vehicle (EV) manufacturing.

What are the primary restraints affecting the EDM market expansion?

Key restraints include the relatively slow Material Removal Rate (MRR) inherent to the spark erosion process, the high capital expenditure required for sophisticated CNC EDM machines, and the operational costs associated with specialized consumables and energy consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- EDM wire (consumable) Market Size Report By Type (No Coated Wire, Coated Wire, Hybrid Wire), By Application (Aerospace, Mechanic, Die & Mold, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Electro-Discharge Machines Market Statistics 2025 Analysis By Application (Mould, Parts, Powder Metallurgy, Other), By Type (Electric Spark Forming Machine, Edm Wire Cutting Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- EDM Cutting Wire Market Size By Regional (Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2025 - 2032

- Linear Guide Rail Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ball Guide, Roller guide, Needle guide), By Application (Wire EDM machines, CNC machines, Deneral machinery drive linear motion, Milling machines, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- EDM Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Dub, Pop and Hip-Hop, Disco, House music, Other), By Application (Recorded Music, Clubs & Festivals, DJs & Live Acts, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager